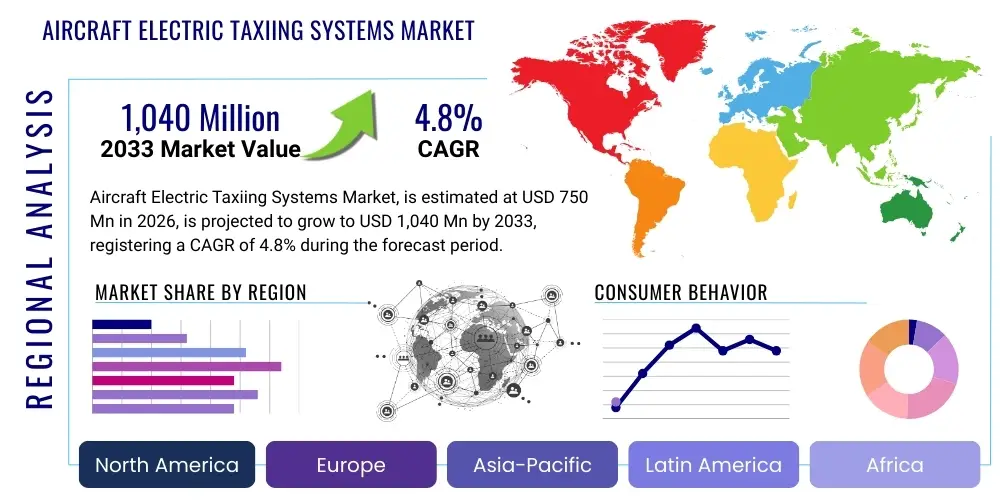

Aircraft Electric Taxiing Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438700 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Aircraft Electric Taxiing Systems Market Size

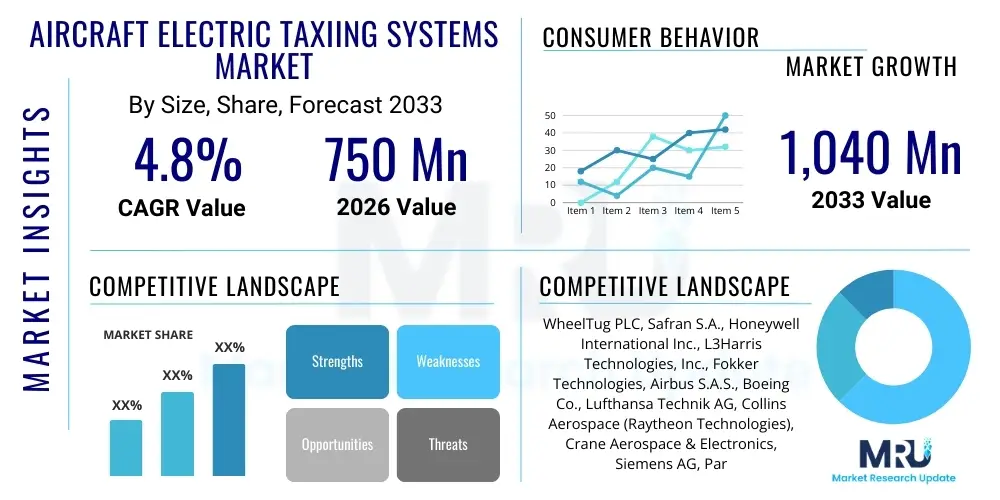

The Aircraft Electric Taxiing Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1,040 Million by the end of the forecast period in 2033.

Aircraft Electric Taxiing Systems Market introduction

The Aircraft Electric Taxiing System (AETS) represents a disruptive technology designed to allow aircraft to maneuver on the ground using their own electric power, eliminating the reliance on jet engines or external tug vehicles during taxi-in and taxi-out operations. This system typically incorporates high-torque electric motors mounted in the main landing gear wheels, powered by the aircraft's Auxiliary Power Unit (APU) or specialized ground power units. The core product provides pilots with precise, independent control over ground movement, leading to significant reductions in fuel consumption, decreased engine wear and tear, and minimized noise and emissions in airport environments. The primary application of AETS is in commercial passenger and cargo aircraft, particularly those operating in high-traffic airports where taxi times can significantly contribute to overall operational costs and environmental footprint. This innovation directly addresses global aviation industry mandates focused on sustainability and efficiency.

Major applications of electric taxiing systems are primarily centered on mitigating the detrimental effects of jet engine usage during ground operations. For instance, long taxi times at hub airports often lead to unnecessary carbon dioxide and nitrogen oxide emissions, directly impacting air quality around urbanized airport areas. AETS systems, by utilizing electric power, offer a solution that is both environmentally compliant and economically attractive. Benefits extend beyond fuel savings; they include reduced foreign object damage (FOD) risk due to lower jet blast, quieter operations contributing to noise abatement initiatives, and improved gate efficiency. The ability to taxi independently also enhances predictability and reduces reliance on ground service infrastructure, streamlining overall airport operations and turnaround times. Furthermore, AETS provides an important step towards fully electric or hybrid aircraft integration, aligning with future aviation powertrain trends.

Driving factors for the adoption of AETS are strongly linked to stringent environmental regulations and the rising cost of aviation fuel. Global bodies and national governments are increasingly pressuring airlines to reduce their carbon emissions, making fuel-saving technologies a necessity rather than an option. The long-term savings generated by minimizing engine use—where one hour of taxiing can consume several hundred kilograms of fuel—provide a compelling return on investment for airlines. Additionally, the proliferation of megacities and the corresponding increase in air traffic density necessitate innovations that enhance airport throughput and minimize ground congestion. AETS contributes to faster gate arrival and departure sequences, acting as a crucial enabler for maintaining schedule integrity in increasingly crowded airspace and tarmac environments. Ongoing technological maturation, particularly in battery density and motor efficiency, further solidifies the market's growth trajectory.

Aircraft Electric Taxiing Systems Market Executive Summary

The Aircraft Electric Taxiing Systems market is positioned for steady expansion, driven primarily by compelling economic incentives related to fuel conservation and pervasive environmental pressures demanding carbon emission reduction across the aviation sector. Current business trends indicate a focused shift toward integrated solutions, where AETS technology is increasingly considered during the manufacturing phase of new aircraft, rather than solely relying on retrofitting existing fleets. Strategic partnerships between airframe manufacturers, landing gear suppliers, and electric motor specialists are defining the competitive landscape, aiming to standardize the technology and reduce installation complexities. The market observes a crucial trend toward lightweight, high-power-density electric motors and sophisticated control software that can seamlessly integrate with existing avionics, ensuring pilot familiarity and minimal training requirements. Operational deployment models, including full ownership and lease-based service models, are being explored by vendors to reduce the initial capital expenditure hurdle for major airlines, thereby accelerating adoption.

Regionally, the market exhibits divergent growth profiles. North America and Europe currently dominate the market share, largely due to the presence of major aerospace OEMs, high-density traffic at primary hub airports, and stringent governmental mandates concerning airport noise and emission control. European Union initiatives, such as the Single European Sky ATM Research (SESAR) program, actively promote greener ground operations, providing regulatory tailwinds for AETS adoption. Asia Pacific (APAC) is projected to register the fastest growth rate, fueled by massive infrastructure investment in new airports and the rapid expansion of air travel across populous nations like China and India. These emerging markets seek advanced solutions to manage anticipated traffic congestion, viewing electric taxiing as a critical component of modern airport design. Conversely, the Middle East and Latin America are seeing gradual uptake, often tied to major carrier modernization programs focusing on long-haul fleet efficiency.

Segment trends highlight the dominance of the OEM segment in terms of future value, driven by the increasing integration of electric taxiing capabilities into next-generation aircraft platforms. The retrofit segment, while smaller, remains vital for extending the lifespan and enhancing the efficiency of current-generation mainline commercial aircraft. By System, the Wheel-Mounted Electric Motor segment holds the largest share due to its established functional efficacy and ease of integration compared to alternative, more complex electric drive systems. Within End-User categorization, the Commercial Aviation sector, particularly narrow-body and wide-body fleets, constitutes the primary demand pool. These aircraft types benefit most from AETS technology due to their high frequency of short-to-medium-haul flights, accumulating significant taxi time savings. Technological advancements are focused on improving the system's ability to operate in diverse weather conditions and optimizing the power source management (APU versus ground charging infrastructure).

AI Impact Analysis on Aircraft Electric Taxiing Systems Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Aircraft Electric Taxiing Systems Market primarily focus on three themes: enhancement of operational safety through predictive maintenance, optimization of complex ground movement paths to reduce taxi time, and the development of autonomous ground operations. Users are keenly interested in how AI algorithms can monitor the health and performance of the high-torque electric motors and associated power electronics in real-time, predicting potential failures before they lead to operational disruptions. Furthermore, there is significant expectation that AI-powered traffic management systems will coordinate aircraft taxi movements more efficiently than human controllers, leveraging machine learning to analyze vast datasets on taxiway congestion, weather conditions, and gate availability, thus minimizing wait times and maximizing AETS benefits. The ultimate concern and future expectation revolve around enabling supervised or fully autonomous taxiing capabilities, fundamentally reshaping the role of the pilot during ground movement, focusing on enhanced reliability and collision avoidance.

- AI-driven Predictive Maintenance: Utilizing sensor data from electric motors and power distribution units to forecast component degradation, maximizing system uptime and reducing unscheduled maintenance costs.

- Optimized Route Planning: Machine Learning algorithms analyze airport layouts, real-time traffic, and regulatory requirements to generate the fastest and most fuel-efficient electric taxi routes, particularly during peak congestion.

- Enhanced Safety and Collision Avoidance: AI vision systems and data processing units provide pilots with improved situational awareness, identifying conflicts with ground vehicles, service equipment, or other aircraft during electric taxi operations.

- Autonomous Ground Navigation: AI serves as the core decision-making element for future autonomous taxiing systems, processing navigational inputs and executing maneuvers with precision, potentially enabling single-pilot operations on the ground.

- Energy Management Optimization: Algorithms dynamically manage power draw from the APU or battery system, optimizing energy consumption based on required taxi speed, incline, and distance to ensure maximum operational efficiency without compromising flight readiness.

DRO & Impact Forces Of Aircraft Electric Taxiing Systems Market

The Aircraft Electric Taxiing Systems market is shaped by a robust combination of favorable drivers (D) and significant constraints (R), balanced by long-term opportunities (O), with the overall trajectory governed by substantial impact forces. The primary driver is the demonstrable cost savings derived from reduced jet fuel burn and decreased engine maintenance (less cycling). This is coupled with regulatory mandates pushing for sustainability, particularly in Europe and North America, accelerating technology adoption. However, key restraints include the high initial capital expenditure (CapEx) required for system installation, the added weight of the system impacting overall aircraft payload capacity, and the certification hurdles imposed by stringent aviation safety regulators (FAA, EASA). Furthermore, concerns surrounding the complexity of integrating AETS into existing aircraft electrical and hydraulic systems pose technical challenges that slow widespread retrofit adoption. These restraints necessitate extensive collaboration and substantial investment in R&D to develop lighter, more affordable systems that minimize disruption to established maintenance procedures.

Opportunities in the market center on the expanding narrow-body fleet segment, which performs the highest number of cycles and stands to gain the most from AETS efficiency improvements. The development of next-generation electric taxi systems powered entirely by batteries, independent of the APU, represents a major technological opportunity, further reducing overall emissions and noise. Moreover, the increasing digitalization of airport infrastructure provides a fertile ground for AETS integration, allowing for centralized traffic control that coordinates electric taxi movements seamlessly with air traffic control. The impact forces defining the market landscape are predominantly environmental and economic. Environmental sustainability has shifted from a desirable feature to a mandatory requirement, compelling airlines to invest. Economically, the volatile price of jet fuel continues to underscore the strategic value of any technology that guarantees operational cost reduction, making AETS an increasingly attractive investment hedge against fuel price instability.

Segmentation Analysis

The Aircraft Electric Taxiing Systems Market is rigorously segmented based on key functional, structural, and application characteristics, providing a detailed view of market demand and technological preferences. The core segmentation includes analysis by Component, System, Type, Technology, Power Source, End-User, and Region. This granular approach helps stakeholders understand which parts of the aviation ecosystem are driving adoption and where technological development is most critical. The primary differentiation lies in whether the system is installed during original equipment manufacturing (OEM) or retrofitted onto existing aircraft. Furthermore, the market differentiates based on the power source used, primarily separating systems reliant on the Auxiliary Power Unit (APU) from those utilizing dedicated on-board batteries or hydrogen fuel cells for taxiing operations. These distinctions are crucial for assessing total cost of ownership, operational flexibility, and environmental impact across different fleet types.

- By Component:

- Electric Motors

- Power Electronics (Inverters, Controllers)

- Power Transfer Units

- System Control and Integration Units

- Landing Gear Modifications

- By System:

- Wheel-Mounted Electric Motors

- Traction-Based Systems

- By Type:

- OEM Installation

- Aftermarket Retrofit

- By Technology:

- Conventional Electric Taxi Systems (APU reliant)

- Autonomous Electric Taxi Systems (Future Integration)

- By Power Source:

- Auxiliary Power Unit (APU)

- On-Board Batteries/Energy Storage Systems

- Hybrid Systems

- By Aircraft Type:

- Narrow-Body Aircraft (e.g., A320 Family, B737 Family)

- Wide-Body Aircraft (e.g., A350, B787, B777)

- Regional Jets

- By End-User:

- Commercial Airlines

- Cargo Airlines

- Military Aircraft

Value Chain Analysis For Aircraft Electric Taxiing Systems Market

The value chain for Aircraft Electric Taxiing Systems is highly intricate, starting with complex upstream suppliers specializing in high-tolerance aerospace materials and specialized power components. Upstream analysis involves manufacturers of critical elements like high-density permanent magnet synchronous motors (PMSM) or induction motors, specialized power electronics (variable frequency drives and inverters), and advanced high-energy storage batteries (in battery-powered designs). These suppliers must adhere to extremely rigorous aerospace certification standards, often requiring AS9100 quality management certification and specific airworthiness approvals. Research and development activities, involving aerodynamic load simulation, thermal management studies, and structural analysis of landing gear modifications, are concentrated at this initial stage. Integration complexity demands close collaboration between component providers and system integrators early in the design phase to ensure seamless performance and weight optimization, as every kilogram added impacts operational efficiency.

Midstream activities are dominated by system integrators and Original Equipment Manufacturers (OEMs). System integrators, often the primary technology developers, focus on the complex task of adapting the electric drive system to specific aircraft landing gear assemblies (a major structural modification) and integrating the control logic with the aircraft's cockpit interfaces and flight management systems. This phase involves extensive ground testing, flight trials, and securing Supplemental Type Certificates (STCs) for retrofit solutions or Type Certificates for OEM installations. Downstream activities involve distribution and maintenance. The distribution channel is primarily direct, involving long-term contracts between the AETS manufacturer and major airlines or aircraft OEMs. For aftermarket retrofit systems, distribution often involves Maintenance, Repair, and Overhaul (MRO) service providers authorized and trained by the AETS vendor to perform the complex mechanical and electrical installation.

The distribution structure is characterized by both direct and indirect routes. Direct sales dominate the OEM segment, where the AETS provider contracts directly with aircraft manufacturers (e.g., Boeing, Airbus) to supply the system as a standard or optional installation on new production lines. Indirect channels predominantly service the aftermarket segment. In this scenario, specialized MRO facilities act as the crucial link, purchasing the systems and installation kits from the vendor and offering the modification service to airline customers globally. Support, training, and spares provision form a critical part of the downstream value, requiring the AETS provider to establish a global network of certified technicians and parts inventories to maintain system reliability across diverse operating environments. This rigorous service ecosystem ensures the long-term viability and operational safety of the installed systems.

Aircraft Electric Taxiing Systems Market Potential Customers

The primary end-users and buyers of Aircraft Electric Taxiing Systems are large commercial airline operators that maintain high fleet utilization rates and operate extensively through congested hub airports. These carriers, including major legacy airlines (e.g., Delta, Lufthansa, Air France-KLM) and rapidly expanding budget carriers (e.g., Ryanair, Southwest), represent the most lucrative customer base. Their continuous focus on reducing operational expenditure, particularly fuel costs, makes them highly receptive to technologies offering proven return on investment. Furthermore, airlines committed to aggressive sustainability targets, often under public and regulatory scrutiny, view AETS as a powerful tool to visibly reduce their ground-based carbon footprint and demonstrate environmental responsibility to investors and consumers. The value proposition is strongest for narrow-body fleets (like the A320 and B737 families) due to their high frequency of short-haul cycles, accumulating significant cumulative taxi time savings over the fleet’s lifespan.

Secondary but significant customers include major cargo operators and military air forces. Cargo airlines, which often operate large wide-body aircraft with frequent movements at major logistics hubs, also face considerable fuel consumption during taxiing. Their business model, focused heavily on operational efficiency and tight scheduling, benefits from the predictable and faster gate access afforded by electric taxiing. Military customers, while less driven by commercial fuel economics, show interest in AETS for tactical advantages, specifically reduced acoustic signature (noise abatement) during stealth operations and decreased dependency on ground support infrastructure in remote or constrained operating environments. For both commercial and military users, the key purchase driver remains a balance between initial investment cost, system weight penalty, and certified reliability and safety across diverse operational theaters and climate zones.

The procurement decision is often centralized within an airline's fleet management or technical operations department. Key decision-making criteria involve detailed life cycle cost analysis, including projected maintenance schedules, anticipated fuel savings, and the warranty and service contracts offered by the AETS vendor. Aircraft OEMs, such as Airbus and Boeing, serve as crucial indirect customers, as they decide whether to factory-fit these systems into new aircraft, influencing the entire market trajectory. MRO providers also act as customers when they invest in the infrastructure and training required to become certified service centers for AETS installations and maintenance, enabling them to capitalize on the lucrative retrofit market. This complex ecosystem requires vendors to tailor sales strategies to address procurement cycles ranging from long-term OEM integration roadmaps to immediate retrofit contracts with individual airlines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1,040 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WheelTug PLC, Safran S.A., Honeywell International Inc., L3Harris Technologies, Inc., Fokker Technologies, Airbus S.A.S., Boeing Co., Lufthansa Technik AG, Collins Aerospace (Raytheon Technologies), Crane Aerospace & Electronics, Siemens AG, Parker Hannifin Corporation, Thales Group, Liebherr Group, TLD Group, Meggitt PLC, Moog Inc., Eaton Corporation, BAE Systems, GE Aviation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Electric Taxiing Systems Market Key Technology Landscape

The technological landscape of the Aircraft Electric Taxiing Systems market is fundamentally defined by the integration of high-power, low-weight electric propulsion with robust landing gear assemblies. The most prevalent technology utilizes direct-drive, high-torque electric motors, typically Permanent Magnet Synchronous Motors (PMSMs), mounted within the hub of the main landing gear wheels. This design is preferred due to its mechanical simplicity and high efficiency, providing the necessary torque to move multi-ton aircraft without utilizing the main engines. Crucially, the system requires sophisticated power electronics, including specialized inverters and controllers, which manage the extremely high current demands, ensure precise speed and directional control, and safely interface with the aircraft's existing electrical generation (APU or engine generator) and battery management systems. The integration challenge lies not only in power management but also in ensuring that the added components withstand the extreme shock loads, temperature fluctuations, and structural fatigue inherent to take-off and landing operations.

A secondary, emerging technological focus involves developing energy storage solutions to power the taxiing system independently of the APU. While most current commercialized systems rely on the APU, which still burns fuel (albeit less than the main engines), next-generation systems are exploring high-density lithium-ion or solid-state battery packs capable of storing enough energy for typical taxi profiles without incurring excessive weight penalties. Furthermore, the development of intelligent control systems and human-machine interfaces (HMI) is critical. These systems must provide pilots with intuitive controls that integrate seamlessly into the cockpit environment, ensuring that the transition between electric taxi mode and engine-powered thrust reverse/braking remains smooth and failsafe under all ground conditions. Continuous technological improvements aim to reduce the system's weight and complexity while enhancing its reliability, particularly in adverse weather conditions like heavy rain or snow, where traction is critical.

Beyond the core mechanical and electrical components, significant investment is being channeled into certification and materials science. New, lightweight alloys and composite materials are being used to construct motor housings and gear components to minimize the weight impact on aircraft performance. From a certification perspective, the technology must meet rigorous standards for electromagnetic compatibility (EMC) to avoid interference with critical flight avionics. The ultimate evolution of this landscape involves connecting the AETS with airport Ground Traffic Management (GTM) systems, potentially utilizing 5G and IoT sensor networks to enable optimized, fully automated routing and taxi speed management, further maximizing fuel savings and minimizing ground delays. This shift towards smart, connected electric taxiing elevates the technology from a simple mechanical substitute to a core component of future airport digitalization strategies.

Regional Highlights

Regional dynamics play a significant role in the adoption and market maturity of Aircraft Electric Taxiing Systems, primarily influenced by air traffic density, environmental policy stringency, and local infrastructure investment capabilities. North America, driven by the presence of major airframe manufacturers and high-traffic airports (e.g., Atlanta, Chicago, Dallas), represents a mature market segment. The region’s focus is dual: maximizing efficiency for major carriers like United and Delta, and responding to localized noise and emissions regulations around key metropolitan hubs. Airlines in the U.S. and Canada are actively evaluating retrofit options for their existing narrow-body fleets, seeking immediate operational cost reductions in an economically competitive domestic market. The market structure is dominated by partnerships between specialized AETS vendors and major MRO facilities to handle large-scale modification programs efficiently.

Europe stands out as a critical growth accelerator, largely due to the aggressive environmental mandates set by the European Union, including targets for aviation decarbonization and noise pollution reduction. Regulatory frameworks, such as the EU Emissions Trading System (ETS) and SESAR initiatives promoting ‘green’ airport operations, create a powerful demand pull for AETS technology. Major European airlines (e.g., Lufthansa, British Airways) and aircraft manufacturers (Airbus) are at the forefront of testing and implementation, often pioneering operational concepts that integrate electric taxiing with enhanced ground control systems. Germany, the UK, and France are the key centers for R&D and manufacturing activity, driven by robust aerospace industrial bases and strong governmental support for sustainable transportation technologies. The operational environment, characterized by dense, short-haul traffic across multiple international borders, maximizes the fuel-saving utility of AETS.

Asia Pacific (APAC) is forecast to be the fastest-growing region, although starting from a smaller base. The market expansion is intrinsically linked to massive aviation infrastructure development, including the construction of mega-hubs in China, India, and Southeast Asia, designed to handle explosive growth in passenger traffic. These new facilities are often designed with sustainability and efficiency as core tenets, making the integration of AETS into new aircraft procurement cycles a strategic decision. While initial adoption may be slower due to localized certification processes and higher upfront cost sensitivity, the long-term potential is enormous, driven by the region's increasing contribution to global air travel and the critical need to manage future airport congestion effectively. The Middle East (MEA) shows targeted adoption, centered around major carriers like Emirates and Qatar Airways, focusing on enhancing the operational efficiency of their vast wide-body fleets operating from world-class transit hubs (e.g., Dubai, Doha). Latin America faces unique challenges related to infrastructure investment but sees gradual adoption linked to fleet modernization programs aimed at improving long-haul flight economics.

- North America: Market leader, driven by high traffic density, competitive airline market, and focused OEM activity (Boeing, major suppliers). Strong demand for retrofit programs.

- Europe: High growth potential mandated by stringent environmental regulations (EU ETS, noise reduction) and governmental support through programs like SESAR. Focus on integrated green ground operations.

- Asia Pacific (APAC): Fastest growing region, fueled by massive new airport infrastructure development and rapidly expanding domestic and international air travel in China and India. Preference for OEM installations.

- Middle East & Africa (MEA): Strategic adoption by major hub carriers to optimize wide-body fleet efficiency and operational throughput at key international transfer points.

- Latin America: Gradual adoption linked to fleet renewal cycles and localized efforts to reduce operational costs amidst fluctuating regional economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Electric Taxiing Systems Market.- WheelTug PLC

- Safran S.A.

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Fokker Technologies

- Airbus S.A.S.

- Boeing Co.

- Lufthansa Technik AG

- Collins Aerospace (Raytheon Technologies)

- Crane Aerospace & Electronics

- Siemens AG

- Parker Hannifin Corporation

- Thales Group

- Liebherr Group

- TLD Group

- Meggitt PLC

- Moog Inc.

- Eaton Corporation

- BAE Systems

- GE Aviation

Frequently Asked Questions

Analyze common user questions about the Aircraft Electric Taxiing Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary economic benefit of implementing Aircraft Electric Taxiing Systems (AETS)?

The primary economic benefit of AETS is substantial reduction in fuel consumption, as aircraft utilize lightweight electric motors instead of high-thrust jet engines for ground maneuvering. This leads directly to lower operational expenditure (OPEX) and decreased engine wear, extending the Mean Time Between Overhaul (MTBO) for main engines.

How does the added weight of AETS impact aircraft payload or range?

The addition of AETS components, including electric motors and power electronics, introduces a weight penalty, which is a major constraint. While manufacturers prioritize lightweight materials, the marginal increase in weight can slightly reduce payload capacity or range, requiring airlines to carefully balance the trade-off against guaranteed fuel savings over frequent taxi cycles.

Are electric taxiing systems powered by the main engines or a separate source?

Most commercially available AETS are primarily powered by the aircraft's Auxiliary Power Unit (APU), which is a small gas turbine that runs on jet fuel but operates far more efficiently than the main engines. Future systems are being developed to utilize dedicated, high-density on-board battery systems to eliminate all fossil fuel consumption during ground operations.

What is the current status of AETS adoption for narrow-body versus wide-body aircraft?

AETS adoption is generally more widespread and economically compelling for narrow-body aircraft (e.g., Boeing 737, Airbus A320 families). These aircraft perform more cycles and spend a higher percentage of their operational time taxiing compared to wide-body, long-haul jets, maximizing the return on investment for the electric taxiing technology.

What are the main regulatory hurdles for commercial adoption of AETS?

The main regulatory hurdles involve securing airworthiness certification from bodies like the FAA and EASA. This process is complex, requiring extensive testing to ensure the added system components do not compromise the structural integrity of the landing gear or interfere with critical aircraft systems, especially under worst-case operational scenarios and heavy environmental loads.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager