Aircraft Engine Gearbox Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433679 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Aircraft Engine Gearbox Market Size

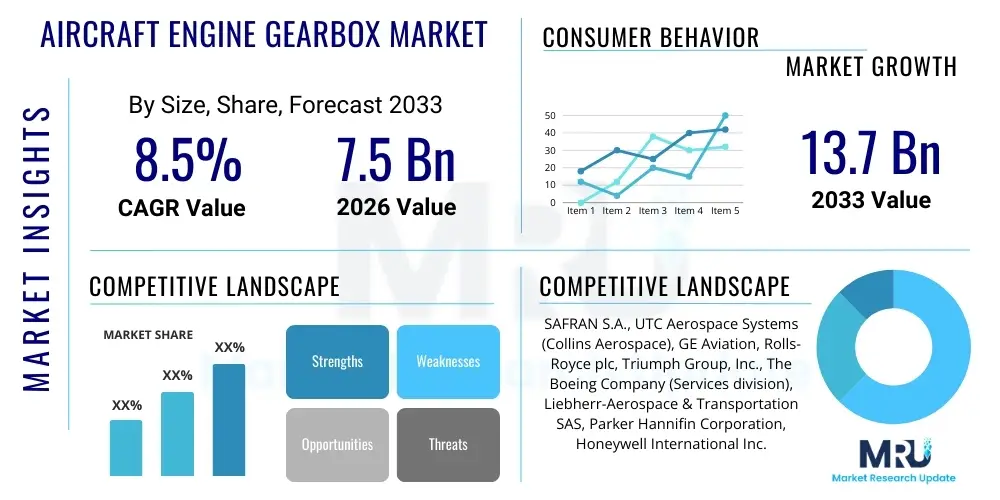

The Aircraft Engine Gearbox Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $13.7 Billion by the end of the forecast period in 2033.

Aircraft Engine Gearbox Market introduction

The Aircraft Engine Gearbox Market encompasses the design, manufacturing, and maintenance of specialized mechanical systems integral to transferring power and managing accessory drives within turbofan, turboprop, and turboshaft engines. These gearboxes, primarily categorized as Accessory Gearboxes (AGBs) or Power Gearboxes, are critical components ensuring the safe and efficient operation of aircraft propulsion systems. AGBs drive essential engine accessories such as fuel pumps, hydraulic pumps, and generators, while power gearboxes manage the torque output required for propellers or rotors. The market’s primary applications span across commercial aviation, military aircraft, and general aviation, driven fundamentally by increasing passenger traffic, modernization of global air fleets, and stringent safety regulations demanding high reliability and extended operational lifetimes for these components. Benefits derived from advanced gearbox technology include enhanced fuel efficiency, reduced noise signature, and higher power density, crucial factors in next-generation engine design.

The core product offerings within this market involve highly engineered solutions utilizing advanced materials like specialty steels, titanium alloys, and composites to withstand extreme operational environments characterized by high speeds, significant thermal loads, and vibrational stress. The complexity of these gearboxes stems from the precision manufacturing tolerances required, often involving sophisticated subtractive manufacturing techniques complemented by emerging additive processes. Major applications reside in narrow-body and wide-body commercial jets undergoing significant ramp-ups in production, necessitated by fleet replacement cycles and growth in emerging markets. Furthermore, military platforms, including fighter jets, transport aircraft, and helicopters, require robust gearboxes tailored for high performance and durability in demanding combat conditions. The market environment is highly regulated, placing emphasis on certification standards mandated by global aviation authorities.

Driving factors propelling market growth include the substantial order backlog for new commercial aircraft, particularly those featuring modern, highly efficient geared turbofan architectures which inherently require complex and large power transmission systems. Simultaneously, the global focus on reducing carbon emissions is accelerating the development and adoption of lighter, more efficient gearbox designs, integrating technologies like magnetic bearings and advanced lubrication systems. The robust demand for Maintenance, Repair, and Overhaul (MRO) services, stemming from the long operational life of in-service fleets, contributes significantly to sustaining market revenue. Geopolitical tensions and subsequent increases in defense spending worldwide also fuel demand for military aircraft engine gearboxes, characterized by rapid replacement and enhancement cycles.

Aircraft Engine Gearbox Market Executive Summary

The Aircraft Engine Gearbox Market is characterized by resilient business trends driven by the cyclical nature of commercial aviation and sustained growth in defense modernization programs. Key business dynamics include strategic partnerships between major engine manufacturers and specialized gearbox suppliers (Tier 1 vendors), focused investment in R&D aimed at material science and noise reduction, and a shift towards predictive maintenance protocols utilizing sensor technology embedded within the gearbox systems. The competitive landscape is oligopolistic, dominated by a few major players with deep technological expertise and stringent certification heritage. Regional trends indicate North America and Europe retaining leadership due to the presence of primary OEMs (Original Equipment Manufacturers) and advanced MRO capabilities. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, fueled by massive fleet expansion, particularly in China and India, and increasing localized manufacturing and assembly operations.

Segment trends reveal that the Accessory Gearbox (AGB) segment remains dominant in terms of volume and application diversity, being essential across almost all types of propulsion systems. Nevertheless, the Power Gearbox segment is witnessing a surge in value growth, directly correlating with the adoption of advanced geared turbofan engines (GTF) in the commercial narrow-body sector. By application, the Commercial Aviation segment holds the largest market share, directly benefiting from high utilization rates and the introduction of next-generation aircraft models designed for greater efficiency. The aftermarket segment (MRO) continues to provide a stable, recurring revenue stream, insulated somewhat from new aircraft delivery fluctuations, and is becoming increasingly specialized, focusing on complex component repair and life extension techniques.

Overall, the market trajectory is positive, underpinned by macroeconomic recovery in air travel and continuous governmental investment in aerospace capabilities. Manufacturers are focused on scaling production efficiently while navigating supply chain complexities, especially concerning high-precision machining and material procurement. Technology migration towards electrification and hybrid propulsion systems presents both an opportunity and a future challenge, necessitating the redesign of traditional power extraction and distribution mechanisms within the engine architecture. Successful market participants are those integrating digital manufacturing processes (Industry 4.0), optimizing lead times, and achieving superior power-to-weight ratios in their certified products, thereby locking in long-term supply agreements with major engine integrators.

AI Impact Analysis on Aircraft Engine Gearbox Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Aircraft Engine Gearbox Market reveals core themes centered on maintenance reliability, design optimization, and manufacturing efficiency. Users frequently inquire about how AI-driven predictive maintenance (PdM) can extend the Time Between Overhaul (TBO) and reduce unscheduled maintenance events. There is significant interest in understanding AI’s role in simulating complex load profiles and thermal dynamics during the design phase to accelerate certification and improve component lifespan. Concerns often revolve around data security, the high cost of implementing sensor technology for data collection, and the integration challenges of new AI software platforms with existing MRO enterprise resource planning (ERP) systems. Expectations are high regarding AI's potential to revolutionize supply chain management for spare parts, ensuring faster response times and minimizing Aircraft on Ground (AOG) situations.

AI is fundamentally transforming the lifecycle management of aircraft engine gearboxes, moving maintenance philosophies from time-based scheduling to condition-based monitoring. Machine learning algorithms, trained on vast datasets of vibration, temperature, oil debris, and operational parameters, are highly effective in identifying minute anomalies indicative of incipient gear wear, bearing fatigue, or lubrication system failures long before they lead to catastrophic failure. This shift optimizes resource allocation, reduces unnecessary component replacement, and drastically enhances fleet operational readiness, particularly crucial for high-utilization commercial carriers and critical military assets. The data generated by sensors within the gearboxes, combined with external flight parameters, forms the basis for sophisticated diagnostic and prognostic models, enhancing the overall safety framework of the propulsion system.

In the manufacturing and design domains, Generative Design coupled with AI optimization tools allows engineers to explore thousands of design iterations simultaneously, optimizing for complex criteria such as weight minimization, structural rigidity, and thermal dissipation, often resulting in topologies unattainable through traditional methods. AI also plays a crucial role in quality control on the production floor, utilizing computer vision systems to inspect precision-machined gears for micro-cracks or surface defects with greater speed and accuracy than human inspection. This integration of AI across design, production, and service drastically compresses the development cycle and elevates the quality and durability standards of the final gearbox product, contributing directly to lower total cost of ownership for operators.

- AI facilitates Predictive Maintenance (PdM) through real-time sensor data analysis, anticipating component failure and maximizing Time Between Overhaul (TBO).

- Generative Design algorithms optimize gearbox topology for maximum strength-to-weight ratios and improved thermal management.

- Machine learning enhances MRO logistics by forecasting spare part demand and optimizing inventory levels across global service networks.

- AI-driven simulation tools significantly reduce physical prototyping and accelerate the rigorous certification and testing phases of new gearbox designs.

- Automated Quality Control (AQC) systems utilizing AI vision improve manufacturing precision, detecting microscopic defects in gear teeth and housing components.

- Integration of AI systems improves operational efficiency by correlating gearbox performance data with overall engine health management programs.

- Data monetization opportunities arise from selling highly valuable operational insights and prognostic reports back to airline operators.

DRO & Impact Forces Of Aircraft Engine Gearbox Market

The dynamics of the Aircraft Engine Gearbox Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively influenced by potent Impact Forces originating from technology, economics, and regulation. The market is primarily driven by the robust recovery and expansion of commercial air travel post-global disruptions, necessitating large-scale fleet renewal programs focused on fuel-efficient, next-generation aircraft, which utilize sophisticated gearbox technology for both power extraction and propulsion management. Further acceleration comes from modernization programs within the defense sector, where militaries globally are upgrading or replacing aging rotary-wing and fixed-wing assets, requiring bespoke, high-performance gearboxes capable of extreme operational demands. Opportunities are heavily concentrated in developing advanced materials (e.g., Powder Metallurgy, high-performance composites) to reduce weight and increase thermal resilience, and the rapid maturation of MRO capabilities in high-growth regions like APAC to service the expanding fleet effectively.

Restraints largely center on the prohibitively high cost and extended timelines associated with Research, Development, Testing, and Certification (RDTC). Achieving airworthiness certification for a new gearbox design is a multi-year, multi-million-dollar process demanding extremely rigorous testing under simulated flight conditions, which limits the pace of innovation and market entry for new players. Furthermore, the supply chain for high-precision components, including specialized bearings and ultra-clean steel alloys, is delicate and vulnerable to geopolitical disruption and raw material price volatility. The necessity of maintaining incredibly tight manufacturing tolerances (often measured in microns) further complicates scaling production, acting as a structural restraint on rapid market expansion, particularly during periods of high demand for new aircraft deliveries.

Impact forces currently shaping the market include technological pressure towards engine electrification, where future hybrid-electric or fully electric propulsion systems will fundamentally alter the requirements for power transmission and accessory driving mechanisms, potentially reducing the reliance on traditional mechanical AGBs. Economic instability and fluctuating fuel prices influence airline purchasing decisions, favoring aircraft with gearboxes that contribute demonstrably to lower fuel burn and maintenance costs. Regulatory forces, particularly stricter noise and emission standards (e.g., FAA, EASA mandates), compel manufacturers to continuously refine gear geometry and housing materials to minimize acoustic output. Ultimately, the market is highly sensitive to the geopolitical climate, where defense budgets and international trade relationships directly impact export controls and the flow of critical aerospace components and technologies.

- Drivers:

- High global commercial aircraft order backlog and subsequent production rate increase.

- Growing adoption of highly efficient Geared Turbofan (GTF) engine architectures.

- Increased global defense spending and modernization of military rotorcraft and fighter fleets.

- Strict regulatory mandates emphasizing fuel efficiency and noise reduction in new aircraft designs.

- Expansion and maturity of the global Maintenance, Repair, and Overhaul (MRO) network.

- Restraints:

- Extremely high cost and long, complex cycles for R&D, testing, and airworthiness certification.

- Vulnerability and complexity of the global high-precision aerospace component supply chain.

- Requirement for ultra-high manufacturing tolerances leading to high production costs.

- Risk of catastrophic failure leading to zero tolerance for defects in performance.

- Opportunities:

- Integration of Additive Manufacturing (3D printing) for lighter, complex gearbox components.

- Development of advanced lubrication and cooling systems (e.g., oil-free designs).

- Emergence of hybrid-electric and fully electric propulsion concepts requiring new power distribution gear systems.

- Expansion into lucrative regional markets requiring specialized MRO centers for localized support.

- Impact Forces:

- Technological Force: Accelerated shift towards electrification and digital twin integration for lifecycle management.

- Economic Force: Fluctuations in global crude oil prices directly influencing airline profitability and capital expenditure.

- Regulatory Force: Increasing stringency of global safety and environmental (noise/emissions) standards.

- Competitive Force: Intense competition among Tier 1 suppliers to secure long-term, exclusive OEM contracts.

Segmentation Analysis

The Aircraft Engine Gearbox Market is systematically segmented based on various technical and commercial criteria, allowing for precise market sizing and strategic targeting. Key segmentation approaches include categorization by component type, which addresses the specific mechanical parts manufactured; by application, detailing the end-use platform; and by end-user type, distinguishing between civil operators and military entities. This multi-faceted analysis provides deep insights into demand heterogeneity. The component segment highlights the distinct market dynamics for gears, bearings, and housing units, each facing unique technological challenges and material requirements. The application split between commercial, military, and general aviation is fundamental, as commercial aviation typically demands high volume and long Mean Time Between Failures (MTBF), while military applications prioritize extreme performance and redundancy. Segmentation is critical for specialized manufacturers defining their core competencies, whether in high-volume accessory gearbox manufacturing or niche power gearbox systems for rotorcraft.

Further granularity is achieved through segmenting based on the type of gearbox, distinguishing between Accessory Gearboxes (AGB) and Power Take Off (PTO) gearboxes, and the primary application within the engine architecture. The AGB segment is foundational, ensuring the functionality of non-propulsive systems essential for flight safety and engine operation, such as generators and hydraulic pumps. The Power Gearbox segment, while smaller in unit volume, represents high value due to its critical role in transferring core engine power to propulsion units, particularly significant in turboprop and turboshaft engines, and increasingly critical in the geared turbofan architectures utilized by modern narrow-body jets, impacting the overall thrust efficiency. Understanding these segments helps track investment flow into advanced design materials and manufacturing optimization efforts.

The aftermarket (MRO) segmentation is also vital, separating the market into OEM-provided services and independent MRO providers. The MRO segment is characterized by specialized services focused on extending the life of high-value, long-lead components through sophisticated repair processes like blending, welding, and surface treatments, requiring specialized certifications. The inherent longevity of aircraft assets ensures that the MRO market provides continuous, stable growth, acting as a crucial revenue buffer against fluctuating new aircraft delivery schedules. Strategic emphasis is placed on digitalization and condition monitoring within MRO operations to reduce turnaround times and enhance predictive capabilities, particularly for the gearbox, which is a major contributor to engine removal events.

- By Application:

- Commercial Aviation

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Regional Jets

- Military Aviation

- Fighter Jets

- Transport Aircraft

- Rotorcraft (Helicopters)

- General Aviation

- Commercial Aviation

- By Component:

- Gears (Spur, Helical, Bevel, Planetary)

- Bearings (Roller, Ball, Fluid Film)

- Housings and Casing

- Shafts and Couplings

- Control Systems (Sensors, Valves)

- By Gearbox Type:

- Accessory Gearbox (AGB)

- Power Gearbox (PG) / Reduction Gearbox (RGB)

- Power Take-Off (PTO) Gearbox

- By End User:

- OEM (Original Equipment Manufacturers)

- Aftermarket (MRO)

- By Aircraft Type:

- Fixed-Wing Aircraft

- Rotary-Wing Aircraft

Value Chain Analysis For Aircraft Engine Gearbox Market

The value chain for the Aircraft Engine Gearbox Market is characterized by high integration and rigorous qualification processes, spanning from specialized raw material procurement to final operational support. The upstream analysis begins with highly specialized suppliers providing aerospace-grade materials, including ultra-clean, high-strength steels (e.g., Maraging steel), titanium, and composite prepregs for casings. These material suppliers must meet stringent quality assurance standards (e.g., AS9100) and are often subject to long qualification periods. Following material production, the intermediate stage involves Tier 2 and Tier 3 suppliers specializing in precise component manufacturing, such as forging, casting, and high-precision gear cutting and grinding. This manufacturing tier is crucial, as component integrity dictates the lifespan and safety of the final gearbox assembly.

The core of the value chain is dominated by Tier 1 gearbox manufacturers who handle the complex design, integration, assembly, and rigorous testing required for certification. These manufacturers often operate in tight collaboration with the major engine OEMs (Pratt & Whitney, Rolls-Royce, GE Aerospace) under long-term supply agreements. The gearbox is then delivered to the engine OEM (the immediate downstream partner) for integration into the complete engine system, which is subsequently sold to aircraft manufacturers (Airbus, Boeing, etc.). This step involves complex logistics and just-in-time delivery protocols, necessitating close coordination to match aircraft production rates.

The distribution channel primarily involves direct sales from the Tier 1 gearbox manufacturer to the Engine OEM (Direct). Once the engine is in service, the aftermarket distribution (MRO) kicks in. This includes direct provision of spare parts and specialized repair services by the OEM/Tier 1 supplier, or through authorized independent MRO facilities (Indirect). The MRO segment is vital, requiring a global network of approved repair shops capable of handling complex gearbox overhauls, which often involve non-destructive testing, precise parts replacement, and re-certification before the component re-enters service. Efficiency in this downstream segment directly impacts aircraft dispatch reliability and operational cost for airlines and military operators, making rapid global service capability a major competitive differentiator.

Aircraft Engine Gearbox Market Potential Customers

The potential customer base for the Aircraft Engine Gearbox Market is segmented primarily into two major categories: Original Equipment Manufacturers (OEMs) and Aircraft Operators/Maintainers (End-Users). The Engine OEMs (e.g., GE Aerospace, Rolls-Royce, Pratt & Whitney) are the immediate and largest buyers, as they integrate the gearboxes into the engine assembly before delivery to the airframer. Securing a long-term contract with a major engine platform represents substantial, stable, and multi-decade revenue for a gearbox supplier. These OEMs demand the highest quality, reliability, and technological integration, essentially dictating design specifications and certification requirements based on their engine architecture.

The second category, the operational end-users, consists of global Commercial Airlines (both passenger and cargo carriers), Military Forces (Air Forces, Navies, Army Aviation), and General Aviation operators. While these entities do not purchase new gearboxes directly from the Tier 1 suppliers for installation into new engines, they constitute the critical aftermarket segment. They are the principal buyers of replacement units, spare parts, and specialized Maintenance, Repair, and Overhaul (MRO) services required throughout the operational life of the aircraft. For commercial operators, the focus is on maximizing component life and minimizing Aircraft on Ground (AOG) time, making predictive maintenance solutions and efficient MRO turnaround times highly attractive procurement criteria. Military customers, in contrast, prioritize reliability under extreme conditions and guaranteed parts availability for operational readiness.

Furthermore, specialized MRO providers and third-party logistics firms also act as important indirect customers within the value chain. Independent MRO shops procure standardized spare parts and utilize specialized tools and repair kits for serving smaller airlines or older fleets, expanding the reach of the original manufacturers' components. Government and defense procurement agencies represent a distinct sub-segment of military end-users, managing procurement contracts that prioritize long-term technical support, intellectual property rights, and guaranteed domestic manufacturing capacity for national security reasons. The market strategy must therefore address both the stringent technological demands of the OEMs and the operational efficiency and cost pressures of the final aircraft operators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $13.7 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAFRAN S.A., UTC Aerospace Systems (Collins Aerospace), GE Aviation, Rolls-Royce plc, Triumph Group, Inc., The Boeing Company (Services division), Liebherr-Aerospace & Transportation SAS, Parker Hannifin Corporation, Honeywell International Inc., BAE Systems plc, Bauer Gear Motor GmbH, Arrow Gear Company, GKN Aerospace, Kawasaki Heavy Industries, Ltd., Avio Aero (A GE Aviation Business), Microtecnica (part of Safran), P.S.M. Gears & Drives Pvt. Ltd., ZOLLERN GmbH & Co. KG, Aerazur (Safran). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Engine Gearbox Market Key Technology Landscape

The technology landscape of the Aircraft Engine Gearbox Market is defined by continuous innovation aimed at achieving higher power density, reduced weight, and improved durability under increasingly harsh operating conditions. A primary focus area is the advancement in gear material science, moving towards specialized materials like high-strength, high-purity aerospace steel alloys (e.g., Pyrowear 53) and carburizing steels designed for extreme contact fatigue resistance and thermal stability. Complementary to materials, sophisticated surface treatments, including advanced case hardening, shot peening, and specialized coatings (e.g., Diamond-Like Carbon, DLC), are employed to minimize friction, reduce wear, and enhance the overall efficiency of the gear mesh. The geometric design of gears is continuously optimized using computational fluid dynamics (CFD) and finite element analysis (FEA) to minimize stress concentrations and acoustic emissions, a critical factor in certification for commercial aviation.

Another pivotal technological shift involves the integration of Additive Manufacturing (AM), or 3D printing, especially for complex gearbox housings and non-load-bearing components. AM allows for highly organic, light-weight designs that incorporate internal features, such as optimized oil passages and cooling channels, which are impossible to achieve through traditional casting or machining. This technology significantly reduces component weight, an essential metric for aerospace applications, and shortens the lead time for prototypes. Furthermore, advancements in bearing technology, including the exploration of hybrid ceramic bearings and actively controlled magnetic bearings, are vital for managing high speeds and reducing the necessity for traditional lubrication systems, paving the way for potential oil-free gearbox architectures, although this remains a highly challenging technological frontier.

Digital technologies form a crucial layer, with integrated health monitoring systems becoming standard. These systems utilize arrays of sensors—vibration accelerometers, acoustic emission sensors, temperature probes, and oil debris monitors—to gather real-time operational data. This data feeds into sophisticated Engine Health Management (EHM) systems, often utilizing AI/ML, to perform condition monitoring and prognostics, enabling predictive maintenance. This shift from preventive to predictive maintenance is the single most significant technological driver impacting MRO services. Future developments are heavily focused on accommodating the shift towards more electric aircraft (MEA), where the gearbox must efficiently manage higher electrical loads and integrate with electric motors and generators, fundamentally reshaping the role and design of the Accessory Gearbox (AGB).

Regional Highlights

The global Aircraft Engine Gearbox Market demonstrates distinct geographical dominance and growth patterns, heavily correlated with the locations of major aerospace manufacturing hubs and high-growth air travel markets.

- North America: This region holds the largest market share due to the presence of primary engine OEMs (GE Aviation, Pratt & Whitney) and major airframe manufacturers (Boeing). The U.S. benefits from extensive R&D capabilities, high defense spending, and a mature MRO infrastructure. Investment is heavily directed towards advanced manufacturing techniques and military gearbox modernization programs, maintaining technological leadership in both fixed-wing and rotary-wing segments.

- Europe: Europe represents the second-largest market, anchored by key players like Rolls-Royce, SAFRAN, and Liebherr. This region excels in highly integrated systems design and specialty component manufacturing. Strong drivers include the production ramp-up for Airbus programs and significant joint European defense initiatives (e.g., Future Combat Air System), ensuring continuous high-value demand for complex power and accessory gearboxes.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This growth is fueled by explosive air passenger traffic growth in China, India, and Southeast Asia, leading to massive fleet expansion and the establishment of local MRO capabilities. While local manufacturing is increasing, the region remains a net importer of high-technology gearbox components, creating substantial market opportunities for international Tier 1 suppliers seeking partnerships.

- Middle East and Africa (MEA): Growth in MEA is primarily driven by large-scale defense procurements and the strategic location of major Gulf carriers acting as international travel hubs. High utilization rates of modern fleets require sophisticated and efficient MRO services, often facilitated through joint ventures with European and North American suppliers. Demand is typically skewed towards wide-body aircraft gearbox components and military rotorcraft systems.

- Latin America: This region maintains a relatively smaller, yet steady, market characterized primarily by fleet replacement cycles and MRO demand focused on regional jets and older commercial aircraft. Economic stability remains a factor influencing capital expenditure, keeping the market focused on cost-effective maintenance solutions and life extension services rather than new procurement.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Engine Gearbox Market.- SAFRAN S.A. (Safran Transmission Systems)

- Collins Aerospace (A Raytheon Technologies Company)

- GE Aviation (including Avio Aero)

- Rolls-Royce plc

- Triumph Group, Inc.

- Parker Hannifin Corporation (Parker Aerospace)

- Honeywell International Inc.

- Liebherr-Aerospace & Transportation SAS

- GKN Aerospace (A division of Melrose Industries)

- Kawasaki Heavy Industries, Ltd.

- BAE Systems plc

- The Boeing Company (MRO and Services division)

- P.S.M. Gears & Drives Pvt. Ltd.

- ZOLLERN GmbH & Co. KG

- Arrow Gear Company

- Bauer Gear Motor GmbH

- Kamatics Corporation (A Kaman Company)

- Aernnova Aerospace S.A.

- Cubic Corporation (Defense Systems)

- Microtecnica (part of Safran)

Frequently Asked Questions

Analyze common user questions about the Aircraft Engine Gearbox market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Accessory Gearbox (AGB) in a modern jet engine?

The primary function of an Accessory Gearbox (AGB) is to extract mechanical power from the main engine shaft (core engine) and transmit it at varying speeds to drive essential engine accessories. These accessories include generators (electrical power), hydraulic pumps (flight controls), fuel pumps, and oil pumps, all critical for flight safety and engine operation.

How is the adoption of Geared Turbofan (GTF) technology influencing the gearbox market?

The adoption of Geared Turbofan (GTF) technology significantly expands the Power Gearbox segment. GTF engines utilize a large Reduction Gearbox (RGB) to allow the fan and the low-pressure turbine to rotate at their respective optimal speeds, improving fuel efficiency and reducing noise. This complexity drives high-value demand for advanced, large-scale reduction gearboxes, increasing market value.

What role does Additive Manufacturing (AM) play in the production of engine gearboxes?

Additive Manufacturing (AM) is increasingly utilized for producing light-weight, complex, non-rotating components, primarily gearbox housings and casings. AM allows for optimized internal cooling passages and reduced material waste, contributing to significant weight reduction and enhanced thermal performance, although rotating, critical load-bearing parts still primarily rely on traditional forging and machining.

Which geographical region exhibits the fastest growth rate in the Aircraft Engine Gearbox Market?

The Asia Pacific (APAC) region is projected to register the fastest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapid commercial fleet expansion, driven by surging passenger demand in developing economies like China and India, necessitating substantial procurement of new aircraft equipped with modern engine gearboxes and the subsequent growth in regional MRO services.

What are the main technological challenges in designing next-generation aircraft engine gearboxes?

Key technological challenges include minimizing component weight while maintaining structural integrity under extreme thermal and speed loads, reducing acoustic emissions to meet strict environmental regulations, and developing advanced lubrication systems capable of operating reliably at higher temperatures and pressures, especially critical for integrating with future hybrid-electric propulsion architectures.

How do certification requirements impact innovation in the gearbox sector?

Certification requirements, mandated by bodies such as the FAA and EASA, impose long, multi-year testing cycles and substantial costs, acting as a significant barrier to rapid innovation. Every material change or design modification requires exhaustive testing to ensure airworthiness, leading manufacturers to prioritize incremental, safety-focused improvements over revolutionary changes, constraining market entry for non-established players.

What is the current trend regarding gearbox maintenance strategies?

The market is rapidly shifting from time-based or scheduled maintenance (Preventive) to Condition-Based Monitoring (CBM) and Predictive Maintenance (PdM). This shift relies heavily on sensor technology (vibration, oil debris) and AI-driven analytics (prognostics) to predict component failure with high accuracy, optimizing maintenance schedules and maximizing the Time Between Overhaul (TBO).

Which component segment holds the highest value share in the gearbox market?

While gear components (due to precision machining and high-grade materials) are highly valuable, the overall Gearbox Housing and Casing segment, particularly when manufactured using complex techniques like Additive Manufacturing or specialized forgings, holds a high value share due to its complexity, size, and critical role in structural and thermal management of the entire system.

How does the military sector's demand differ from commercial aviation for gearboxes?

Military demand prioritizes extreme durability, operational redundancy, and performance under rigorous combat conditions, often requiring bespoke designs for specific rotorcraft or fighter platforms. Commercial aviation, conversely, prioritizes operational efficiency, fuel economy, high reliability over long cycles (MTBF), and lower overall life-cycle maintenance costs.

What is the expected long-term impact of engine electrification on AGB design?

Engine electrification (More Electric Aircraft, MEA) will fundamentally challenge traditional AGB design by requiring the gearbox to handle significantly higher electrical loads and integrate powerful electric starter/generators. Future AGBs will need enhanced thermal management and potentially eliminate some hydraulic/pneumatic accessory drives, requiring substantial design changes focused on electrical power extraction and distribution.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager