Aircraft Environmental Control Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431671 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Aircraft Environmental Control Systems Market Size

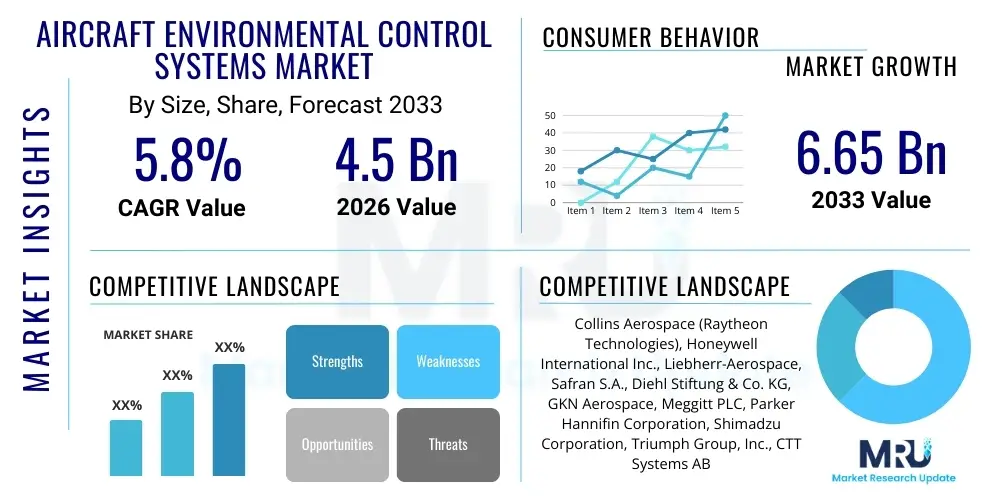

The Aircraft Environmental Control Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.65 billion by the end of the forecast period in 2033.

Aircraft Environmental Control Systems Market introduction

The Aircraft Environmental Control System (ECS) Market encompasses the design, manufacturing, and maintenance of critical systems responsible for ensuring passenger and crew comfort and safety by regulating cabin air temperature, pressure, and humidity. These sophisticated systems manage bleed air tapped from engine compressors or utilize electric compressors in newer, more-electric aircraft architectures. Key components include air cycle machines (ACMs), heat exchangers, bleed air valves, water separators, and cabin air filtration systems. The market scope covers commercial, military, and general aviation sectors, reflecting the stringent performance and reliability requirements demanded by aviation regulators globally. The continuous need for improved fuel efficiency and reduced operational weight drives significant innovation within this sector, pushing manufacturers toward lighter, more efficient components, and the integration of advanced diagnostic capabilities.

The primary function of the ECS extends beyond mere comfort, acting as a crucial safety mechanism, particularly concerning cabin pressurization at high altitudes. Failure of these systems could lead to catastrophic outcomes, necessitating extremely rigorous material selection, redundancy, and maintenance protocols. Major applications span large commercial airliners (wide-body and narrow-body), regional jets, business jets, and various military platforms including fighters, transport aircraft, and helicopters. The increasing global demand for new aircraft, driven by rising passenger traffic in emerging economies and the replacement cycle of older, less efficient fleets, directly stimulates the OEM segment of the ECS market. Furthermore, the mandatory overhaul and repair cycles for existing systems ensure a robust and growing aftermarket segment.

Key benefits derived from advanced ECS include enhanced passenger experience through optimized cabin conditions, improved operational efficiency due to reduced system weight and optimized energy consumption (especially with the shift towards electric ECS), and improved air quality through high-efficiency particulate air (HEPA) filters, which have gained significant prominence post-pandemic. The market is primarily driven by the expansion of global aircraft fleets, stringent aerospace regulations concerning air quality and pressurization, and the technological evolution towards 'More Electric Aircraft' (MEA) architectures. These architectural shifts necessitate the redesign of traditional pneumatic ECS components into high-voltage, electric-driven systems, offering better control and reduced engine workload, ultimately lowering fuel burn.

Aircraft Environmental Control Systems Market Executive Summary

The Aircraft Environmental Control Systems Market is poised for substantial growth, underpinned by fundamental business trends such as aggressive fleet modernization efforts by major airlines and a foundational shift towards electric ECS (e-ECS) architectures in next-generation aircraft programs, including those being developed by Boeing and Airbus. The OEM segment is witnessing intense competition focused on system integration capabilities and lightweight material science, particularly carbon composites and high-strength aluminum alloys, to minimize system weight. Concurrently, the aftermarket segment is expanding rapidly, fueled by the rising Mean Time Between Overhaul (MTBO) requirements and the increased complexity of maintenance, requiring specialized MRO services and advanced digital diagnostic tools for predictive maintenance scheduling. Strategic partnerships between ECS suppliers and airframe manufacturers are critical for securing long-term supply contracts and influencing future design specifications.

Regional trends indicate that North America and Europe remain mature markets characterized by high defense spending and strong R&D investment in advanced systems, particularly those related to military aircraft resilience and stealth capabilities. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, driven by exponential growth in commercial passenger traffic, substantial purchases of new narrow-body aircraft (e.g., A320neo, B737 MAX), and the rapid expansion of localized MRO infrastructure in countries like China and India. The Middle East also represents a critical market, dominated by large flagship carriers investing heavily in long-haul, wide-body aircraft that require sophisticated, high-capacity ECS optimized for extreme temperature variations. Regulatory harmonization efforts across regions, particularly concerning cabin air quality standards set by bodies like EASA and the FAA, influence technological adoption uniformly across global fleets.

Segment trends highlight the dominance of the commercial aircraft segment, driven by large-scale production volumes. Within the components segment, the demand for air cycle machines (ACMs) remains robust, although vapor cycle systems (VCS) are increasingly being integrated, especially in smaller jets and auxiliary cooling applications, due to their independent operation capability. A crucial trend involves the technological shift from traditional bleed-air ECS (which draws pneumatic power directly from the engines) towards electric ECS, which uses engine generators to power electric compressors. This transition significantly impacts engine efficiency and offers architects greater flexibility in aircraft design. The aftermarket services segment is experiencing high growth due specifically to life cycle management, repair, and overhaul (R&O) contracts, focusing heavily on minimizing aircraft ground time through efficient logistics and reliable component supply chains.

AI Impact Analysis on Aircraft Environmental Control Systems Market

Common user questions regarding AI's impact on the Aircraft Environmental Control Systems Market frequently center on predictive maintenance capabilities, optimal energy consumption management, and enhanced fault diagnosis accuracy. Users are keen to understand how machine learning models can process vast amounts of sensor data—temperature, pressure, flow rate, vibration—generated by ECS components in real-time to forecast potential failures well before they occur. There is significant concern about the reliability and certification pathway for AI-driven diagnostic software, particularly regarding airworthiness requirements set by regulatory bodies. Furthermore, users expect AI to play a critical role in dynamic cabin environment management, adjusting airflow and temperature zones based on actual passenger load distribution and metabolic heat output, moving beyond static, pre-set conditions to provide genuine personalized comfort while simultaneously minimizing parasitic drag associated with ECS operation.

The integration of Artificial Intelligence transforms ECS from a reactive system to a proactive, smart component suite. AI algorithms analyze historical performance data and current operational parameters to identify subtle anomalies indicative of wear and impending component failure in parts like air cycle machines, heat exchanger blockage, or compressor degradation. This predictive capability allows airlines and MRO providers to shift from costly, time-based scheduled maintenance to condition-based maintenance (CBM), drastically reducing unscheduled ground time and lowering operational costs. AI also optimizes the control loops within the ECS, dynamically adjusting bleed air extraction or electric compressor speed to meet required cabin conditions with minimal energy expenditure, which directly translates into fuel savings for the operator, fulfilling a critical industry driver for operational efficiency.

Beyond diagnostics and control, AI is significantly impacting the design and manufacturing phases. Generative design tools, powered by AI, are being employed to optimize component geometry, such as fan blades and ducts, for lighter weight and improved thermodynamic performance. Furthermore, during system integration, AI modeling and simulation (e.g., high-fidelity Computational Fluid Dynamics, CFD) can accelerate the certification process by accurately predicting system behavior under extreme flight conditions, reducing reliance on costly physical prototyping and testing cycles. The successful deployment of AI hinges on the secure collection and centralized analysis of high-frequency sensor data (e.g., IoT integration in the ECS), necessitating standardized data formats and strong cybersecurity protocols to protect sensitive operational information from external threats.

- AI enables highly accurate Predictive Maintenance (PdM) for ECS components, minimizing downtime.

- Machine learning optimizes real-time system control, reducing engine bleed air usage and increasing fuel efficiency.

- AI-driven anomaly detection improves fault isolation and reduces diagnostic labor time during maintenance events.

- Generative design tools accelerate the development of lighter, thermodynamically superior ECS heat exchangers and ducts.

- Smart cabin management utilizes AI to personalize zonal temperature and airflow based on passenger density and heat load.

- AI facilitates enhanced system health monitoring by fusing data from diverse sensors (pressure, vibration, temperature).

- Algorithms optimize fleet-wide operational profiles, advising pilots on most efficient ECS settings for specific routes and altitudes.

DRO & Impact Forces Of Aircraft Environmental Control Systems Market

The market dynamics for Aircraft Environmental Control Systems are shaped by a strong interplay of technological advancement, regulatory mandates, and economic pressures within the aviation sector. Key drivers include the massive backlogs of new commercial aircraft orders globally, particularly in the narrow-body segment, which directly increases the demand for OEM-fitted ECS units. Simultaneously, the persistent push for environmental sustainability and noise reduction drives technological opportunities in e-ECS systems, which are quieter and more fuel-efficient than traditional pneumatic systems. Restraints predominantly involve the extremely high cost and long lead times associated with component certification (e.g., FAA/EASA approval), given the critical nature of life support systems. The market is also heavily influenced by the cyclical nature of the aerospace industry, where unexpected events (like global pandemics or oil price volatility) can temporarily halt new purchases and shift focus solely to MRO activities. Nevertheless, the continuous need to upgrade military fleets with advanced, high-performance thermal management systems (especially for high-energy electronic warfare suites) ensures a stable demand floor.

The primary driving force remains the increasing global air traffic, necessitating the expansion and replacement of existing aircraft fleets. This volume-driven demand is compounded by strict and evolving regulatory requirements regarding cabin air quality, including limits on ozone concentration and volatile organic compounds (VOCs), which mandates the incorporation of advanced filtration and catalytic converter technologies into the ECS design. Furthermore, the operational cost pressures faced by airlines push ECS manufacturers to innovate in areas of reliability and weight reduction. A lighter ECS reduces overall aircraft fuel consumption, providing a compelling competitive advantage in sales. Opportunities are particularly rich in the emerging segment of Urban Air Mobility (UAM) and eVTOL aircraft, which require entirely new, scalable, and highly energy-efficient electric thermal management solutions that minimize battery power drain while ensuring stringent thermal compliance in often congested low-altitude airspaces.

Impact forces are centered around high supplier power due to specialized technology and certification barriers, leading to a highly consolidated market landscape dominated by a few major players. The increasing cost of raw materials, particularly specialized aerospace alloys used in heat exchangers and compressors, impacts manufacturing margins. However, customer power (airlines and MROs) is also high, driven by long-term contract negotiations and performance-based logistics requirements. Substitutes for ECS are non-existent due to their essential role as life support systems, making this sector resilient against technological substitution risks. Instead, the rivalry focuses on incremental efficiency gains and integration complexity. The shift toward predictive maintenance and digital twins represents a key opportunity, allowing suppliers to transition from purely component manufacturing to offering comprehensive, high-margin, data-driven service contracts over the full aircraft lifecycle.

Segmentation Analysis

The Aircraft Environmental Control Systems Market is primarily segmented across three key dimensions: Type of System (e.g., Traditional vs. Electric), Component Type (the hardware comprising the system), Aircraft Type (the platform utilizing the system), and Application (OEM versus Aftermarket). This structured segmentation allows for a granular analysis of technological preferences, expenditure patterns across different aviation sectors, and regional market saturation. The Component segment, featuring complex elements like Air Cycle Machines (ACMs), compressors, and various types of valves and sensors, accounts for a significant portion of the market value, driven by high manufacturing complexity and the need for specialized materials capable of handling high pressure and temperature differentials.

Segmentation by aircraft type remains crucial, as wide-body and narrow-body aircraft have vastly different ECS requirements concerning pressurization capacity, air flow rate, and redundancy levels, directly impacting the complexity and cost of the units supplied. For instance, wide-body aircraft often employ multiple redundant ECS packs to service larger cabins and accommodate longer flight durations, driving high unit revenue. Conversely, the high volume of narrow-body aircraft production drives the overall market volume. The growth in the Aftermarket segment, encompassing MRO and spares, reflects the longevity of aircraft fleets, often operating for 25 to 30 years, requiring continuous supply of certified parts and specialized repair services, which provides market stability even during downturns in new aircraft production.

- By System Type:

- Bleed Air ECS (Traditional Pneumatic)

- Vapor Cycle Systems (VCS)

- Electric/Non-Bleed ECS (More Electric Aircraft)

- By Component:

- Air Cycle Machines (ACMs)

- Heat Exchangers

- Compressors and Turbines

- Water Separators and Filters

- Sensors and Controllers (Pressure, Temperature, Flow)

- Ducting and Valves (Shutoff, Flow Control)

- By Aircraft Type:

- Commercial Aircraft (Narrow-body, Wide-body, Regional Jets)

- Military Aircraft (Fighter, Transport, Bomber)

- General Aviation (Business Jets, Helicopters)

- By Application:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Maintenance, Repair, and Overhaul - MRO & Spares)

Value Chain Analysis For Aircraft Environmental Control Systems Market

The value chain for the Aircraft Environmental Control Systems Market is highly integrated and complex, starting with the upstream supply of specialized materials and culminating in the long-term MRO and logistical support provided to end-users. Upstream activities involve the procurement of specialized aerospace-grade raw materials, including nickel-based superalloys (for high-temperature turbine components), specialized aluminum and titanium alloys (for weight-critical ducts and structural elements), and high-performance composites. These suppliers must adhere to extremely tight tolerances and possess rigorous AS9100 quality certifications, resulting in a concentrated supply base characterized by high entry barriers and strong pricing power. ECS manufacturers then focus on complex sub-component manufacturing and system integration, emphasizing R&D related to thermal dynamics, fluid mechanics, and digital control systems.

The core of the value chain is the ECS Original Equipment Manufacturer (OEM), which performs intricate design, engineering, and final assembly, often working in conjunction with the primary airframe manufacturers (like Airbus, Boeing, Lockheed Martin) during the aircraft design phase. This phase requires deep systems integration expertise, as the ECS must interface seamlessly with engine bleed systems, avionics, and structural limitations. Distribution channels for the OEM segment are primarily direct, involving long-term, multi-year contracts secured through competitive bidding processes with airframers. Indirect channels are more prevalent in the downstream aftermarket segment, utilizing authorized distributors, third-party MRO facilities, and parts brokers to ensure rapid availability of certified spare parts (PMA or OEM parts) globally, crucial for minimizing Aircraft on Ground (AOG) situations.

Downstream analysis focuses on the end-users—airlines, military operators, and charter companies—who are responsible for the daily operation and maintenance of the systems. The aftermarket service component is critical, involving repair, overhaul, and predictive maintenance programs. ECS manufacturers increasingly offer comprehensive, performance-based logistics (PBL) support contracts directly to major airlines, thereby extending their control and revenue generation into the operational lifecycle of the product. This shift towards service-oriented business models ensures recurring, high-margin revenue and allows manufacturers to gather crucial operational data needed for continuous product improvement and the deployment of AI-driven diagnostic tools. This full lifecycle management significantly strengthens the supplier's position within the overall aviation ecosystem.

Aircraft Environmental Control Systems Market Potential Customers

The potential customer base for the Aircraft Environmental Control Systems Market is inherently specialized, revolving around entities that own, operate, or maintain large fleets of aircraft across commercial, governmental, and private sectors. The largest and most influential customer group comprises global commercial airlines, including major flag carriers (e.g., Emirates, Lufthansa, United), low-cost carriers (LCCs) like Ryanair and Southwest, and cargo operators. These customers procure ECS primarily through the OEM channel when ordering new airframes, negotiating complex package deals that emphasize initial unit cost, reliability (Mean Time Between Failures), and total cost of ownership (TCO) over a 25-year operational lifecycle. Their buying decisions are heavily influenced by fuel efficiency and MRO support network availability.

A second major customer segment includes military and defense agencies worldwide (such as the US Department of Defense, European Ministry of Defence, and equivalent agencies in APAC). These governmental bodies procure ECS for high-performance military platforms, where requirements emphasize mission capability, resistance to extreme environmental conditions, chemical/biological/radiological (CBRN) filtration capabilities, and thermal management for high-energy directed energy weapons (DEW) or advanced avionics systems. Procurement in this sector is driven less by cost and more by stringent performance specifications, survivability, and security clearances, often involving classified contracts and long-term modernization programs that require bespoke ECS solutions tailored to specific mission profiles.

The third critical customer group encompasses Maintenance, Repair, and Overhaul (MRO) service providers and specialized parts distributors. While not the end-users of the aircraft, these entities are the primary buyers in the high-volume Aftermarket segment, purchasing spare parts, certified components, and overhaul kits. They service the vast existing global fleet on behalf of the airlines and operators. Finally, aircraft manufacturers themselves (Airbus, Boeing, Embraer, Bombardier) are direct customers in the context of system qualification and integration, relying on ECS suppliers to meet strict performance and weight targets for new aircraft programs, thereby determining the initial choice of ECS supplier for decades to come.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.65 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Collins Aerospace (Raytheon Technologies), Honeywell International Inc., Liebherr-Aerospace, Safran S.A., Diehl Stiftung & Co. KG, GKN Aerospace, Meggitt PLC, Parker Hannifin Corporation, Shimadzu Corporation, Triumph Group, Inc., CTT Systems AB, Skurka Aerospace Inc., Air Management Systems (AMS), SEMCO Incorporated, Curtiss-Wright Corporation, Woodward Inc., JBT Corporation, Textron Aviation Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Environmental Control Systems Market Key Technology Landscape

The technological landscape of the Aircraft Environmental Control Systems Market is rapidly evolving, driven primarily by the paradigm shift towards More Electric Aircraft (MEA) and the pervasive demand for enhanced system efficiency and miniaturization. The transition from pneumatic (bleed-air) systems to Electric Environmental Control Systems (e-ECS) represents the most significant technological change. E-ECS replaces the traditional engine bleed air source with electric compressors powered by high-voltage generators, offering superior control precision, reducing engine maintenance costs, and significantly improving fuel efficiency by minimizing engine load. However, this shift necessitates advancements in high-voltage power electronics and thermal management specific to handling the increased heat dissipation generated by high-power electric motors and their associated control units.

Another crucial area of innovation is in material science and component design, specifically targeting weight reduction and improved heat transfer efficiency. Manufacturers are increasingly utilizing advanced composite materials for ducting and housings to replace traditional aluminum, resulting in considerable weight savings that translate directly to fuel efficiency benefits. Furthermore, microchannel heat exchangers and advanced regenerative heat recovery technologies are being adopted to optimize the thermodynamic cycle, enabling the ECS to operate efficiently across a wider range of ambient conditions and flight envelopes. These advancements require sophisticated simulation tools, particularly high-fidelity Computational Fluid Dynamics (CFD), to accurately model complex heat transfer processes within constrained aircraft spaces.

The integration of advanced sensing and digital control systems forms the third pillar of the technological landscape. Modern ECS relies on a dense network of high-precision sensors for pressure, temperature, and contaminant detection. These sensors feed data into highly sophisticated, fault-tolerant digital controllers that manage system redundancy and optimize performance in real-time. Moreover, the implementation of advanced air filtration systems, including third-stage filtration using catalytic converters to manage ozone and advanced HEPA filters (compliant with ISO 29463 standards) to remove particulates and biological contaminants, is becoming standard practice, driven by increased public awareness and regulatory pressure regarding cabin air quality post-COVID-19. Predictive maintenance modules, often integrating AI, are becoming embedded components, allowing the ECS unit itself to communicate its health status wirelessly to ground maintenance crews.

Regional Highlights

Regional dynamics play a significant role in shaping the demand, technology adoption, and competitive intensity of the Aircraft Environmental Control Systems Market. North America holds a dominant market share, primarily due to the presence of major airframe manufacturers (Boeing, Lockheed Martin), key Tier 1 ECS suppliers (Honeywell, Collins Aerospace), and the world’s largest fleet of active commercial and military aircraft. High defense expenditure, particularly focused on upgrading fighter jets and procuring new long-range bombers and transport aircraft, drives demand for highly specialized, resilient ECS and sophisticated thermal management systems for advanced avionics. Furthermore, robust investment in R&D, centered around the rapid development and certification of electric ECS for future domestic platforms, ensures North America maintains its technological leadership.

Europe represents another mature and technologically advanced market. Driven by Airbus’s significant global commercial market share and strong regional defense cooperation (e.g., Eurofighter, Dassault), European ECS manufacturers such as Liebherr and Safran are global leaders. The European region is particularly advanced in implementing strict environmental regulations, spurring innovation in low-noise ECS components and optimized air quality management systems. The market demand here is evenly split between OEM sales (driven by new Airbus production lines) and a highly structured, regulated aftermarket focused on long-term airworthiness maintenance. The establishment of EASA-mandated standards significantly influences how maintenance and upgrade cycles are executed across the continent.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This rapid expansion is fueled by unprecedented growth in air passenger traffic, leading to massive fleet expansion, particularly by budget airlines relying heavily on new narrow-body aircraft. Countries like China and India are not only major consumers of ECS for imported aircraft but are also rapidly developing indigenous aircraft manufacturing and MRO capabilities. The high growth rate is directly linked to the burgeoning middle class, the establishment of new international flight routes, and governmental investments aimed at modernizing regional aviation infrastructure. While initial technological adoption often follows North American and European precedents, there is increasing localized pressure to develop resilient ECS solutions tailored to the diverse and often extreme climatic conditions found throughout Southeast Asia and Australia.

- North America: Dominance driven by large defense procurement budgets, key Tier 1 supplier presence, and aggressive R&D in e-ECS technology for next-generation platforms.

- Europe: Mature market stability provided by Airbus production, strict regulatory environment driving continuous filtration and noise reduction upgrades, and strong MRO service structure.

- Asia Pacific (APAC): Highest growth rate projected, powered by massive narrow-body fleet expansion in China and India, and increasing demand for localized MRO services and spare parts inventory.

- Middle East and Africa (MEA): Significant demand concentrated in the Wide-body segment due to major hub airlines, requiring high-capacity ECS optimized for extreme high ambient temperatures.

- Latin America: Moderate growth, primarily driven by the replacement of aging regional jet fleets and reliance on imported aircraft and international MRO support for complex ECS systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Environmental Control Systems Market.- Collins Aerospace (Raytheon Technologies)

- Honeywell International Inc.

- Liebherr-Aerospace

- Safran S.A.

- Diehl Stiftung & Co. KG

- GKN Aerospace

- Meggitt PLC (now part of Parker Hannifin)

- Parker Hannifin Corporation

- Shimadzu Corporation

- Triumph Group, Inc.

- CTT Systems AB

- Skurka Aerospace Inc.

- Air Management Systems (AMS)

- SEMCO Incorporated

- Curtiss-Wright Corporation

- Woodward Inc.

- JBT Corporation

- Textron Aviation Inc.

- R&D Technical Services

- Intertechnique S.A.

Frequently Asked Questions

Analyze common user questions about the Aircraft Environmental Control Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between bleed-air and electric environmental control systems?

Bleed-air ECS uses hot, compressed pneumatic air directly sourced from the engine compressor stages to drive the cooling and pressurization cycles. Electric ECS (e-ECS) eliminates this dependency, using high-voltage electricity generated by the engines to power electric motors and compressors. E-ECS offers better control, higher fuel efficiency, and reduced engine maintenance but requires more complex electrical power management components.

How do aircraft environmental control systems contribute to aircraft fuel efficiency?

ECS systems contribute to fuel efficiency primarily through weight reduction and optimized energy usage. Modern, lightweight components (e.g., composite ducts, advanced heat exchangers) reduce aircraft mass. More importantly, the transition to e-ECS minimizes the amount of engine power required for cabin pressurization and cooling by reducing parasitic bleed air extraction, directly translating into significant fuel savings over the aircraft's lifecycle.

What role does Artificial Intelligence play in the modern ECS market?

AI is crucial for enhancing predictive maintenance (PdM) capabilities by analyzing real-time sensor data to forecast component failure, allowing airlines to perform condition-based maintenance instead of fixed-interval scheduling. AI also optimizes real-time operational efficiency by dynamically adjusting system parameters based on flight conditions and passenger loads, ensuring energy efficiency and optimal cabin comfort.

Which segment holds the largest share in the Aircraft Environmental Control Systems Market?

The Commercial Aircraft segment, particularly the Narrow-body sector, currently holds the largest market share due to high production volumes (e.g., Airbus A320 and Boeing 737 families). However, the Aftermarket (MRO) application segment is also significantly large, driven by the mandated requirement for long-term repair, overhaul, and certification of high-value ECS components in the aging global fleet.

What are the most critical components within an Aircraft Environmental Control System?

The most critical components are the Air Cycle Machine (ACM) or Electric Compressor, which facilitates the gas expansion and cooling cycle; the Heat Exchangers, which reject heat overboard; and the High-Pressure Shutoff Valves, which regulate the flow of pneumatic power or control the system's operational integrity. Failure of any of these components directly impacts the safety and operability of the cabin environment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager