Aircraft Freight System Sales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432303 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Aircraft Freight System Sales Market Size

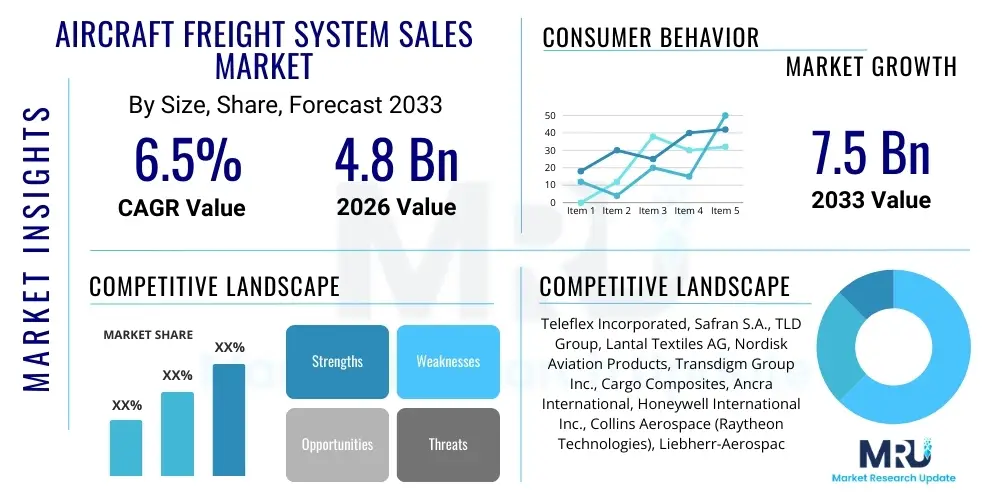

The Aircraft Freight System Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Aircraft Freight System Sales Market introduction

The Aircraft Freight System Sales Market encompasses a highly specialized sector dedicated to the provision of essential equipment for the systematic loading, securing, movement, and preservation of commercial cargo within various airframes. These systems are paramount to the functional capacity of global air logistics, addressing challenges related to weight distribution, safety compliance, and efficient ground turnaround times. The core products include Unit Load Devices (ULDs)—standardized containers and pallets—as well as the sophisticated, motorized Cargo Handling Systems (CHS) integrated into the aircraft floor, designed to move cargo quickly and precisely within confined spaces. The rapid proliferation of e-commerce, demanding just-in-time delivery and complex international shipping routes, has significantly amplified the necessity for highly reliable and advanced freight systems that minimize operational friction and maximize aircraft utility. Furthermore, material science innovation is a key focus, with manufacturers progressively shifting from traditional aluminum structures to advanced lightweight composite materials, such as carbon fiber and high-performance polymers, which offer superior durability, corrosion resistance, and, most critically, substantial weight reduction, directly contributing to airline fuel efficiency targets and lowered operational costs, a major competitive factor in the modern aviation industry. The integration of digital tracking and monitoring capabilities into ULDs represents the technological evolution from passive hardware to active, data-generating assets crucial for modern supply chain visibility.

Product description highlights the divergence between standard, high-volume ULDs used for general freight, and highly specialized systems addressing niche market demands. Specialized systems include active temperature-controlled containers for pharmaceuticals, insulated units for perishables, and specialized handling mechanisms for out-of-gauge or hazardous materials (HAZMAT). Major applications span the entire spectrum of aviation logistics, from dedicated all-cargo carriers and integrated express freight companies to commercial passenger airlines utilizing belly capacity, and specialized military and humanitarian aid operations. Each application imposes unique demands: commercial passenger airlines prioritize lightweight, lower-deck compatibility, while dedicated freighter operators focus on robust, high-throughput systems. The benefits derived from these systems are profound, including significant reductions in ground handling time achieved through automation, enhanced cargo security via integrated locking and monitoring features, and superior preservation of high-value or temperature-sensitive goods, thereby reducing financial liability and ensuring compliance with stringent sector-specific regulations, such as GDP (Good Distribution Practices) for medical products. The global complexity of interconnected logistics networks makes standardization—driven by entities like IATA and ISO—a fundamental pillar of successful system deployment and interlining operations.

The market is overwhelmingly driven by the confluence of fleet renewal cycles, global trade liberalization, and the increasing sophistication of cargo requirements. The ongoing replacement of older cargo fleets with new-generation freighters, alongside the increasing number of Passenger-to-Freighter (P2F) conversions globally, creates a consistent baseline demand for new installations. Furthermore, the imperative for efficiency pushes operators toward investing in automated loading systems and smart ULDs capable of real-time diagnostics and condition monitoring. However, the market’s stability is highly susceptible to external macroeconomic variables, including global GDP growth, geopolitical tensions impacting trade routes, and fluctuations in aviation fuel prices, which directly influence airlines' propensity for capital expenditure on non-core assets like freight systems. The market requires high barriers to entry due to the extensive certification requirements (FAA, EASA approval) needed for any component installed within an aircraft, ensuring that quality, safety, and regulatory compliance remain the definitive criteria for market participation and sales success rather than purely cost-driven procurement decisions. This regulatory environment mandates that manufacturers maintain rigorous quality control and traceability throughout the entire supply chain, fostering long-term relationships between system providers and air carriers.

Aircraft Freight System Sales Market Executive Summary

The Aircraft Freight System Sales Market forecast demonstrates resilience, underpinned by foundational shifts in global consumer behavior and industrial supply chain strategies, specifically the exponential growth of cross-border e-commerce. Business trends indicate a marked acceleration in the adoption of digitalization, moving beyond basic tracking to integrating sensor technology, known as the 'smart fleet' concept, where every ULD transmits actionable data. This shift compels manufacturers to transition from selling mere hardware to providing integrated solutions that include data services, predictive maintenance packages, and cloud-based fleet management platforms. The competitive landscape is characterized by strategic alliances between ULD manufacturers, MRO providers, and technology firms specializing in IoT and AI, aimed at creating end-to-end cargo visibility solutions. Furthermore, pricing pressure remains acute in the standard ULD segment due to the necessity for high volumes and intense competition, whereas premium segments, such as active temperature control systems, continue to command high margins due to specialized technology and certification complexity. Sustainability is rapidly emerging as a core investment trend, with airlines prioritizing suppliers who can demonstrate reduced environmental impact through material selection and efficient system design, influencing future procurement decisions significantly.

Regional trends clearly delineate a bifurcation in growth dynamics. The Asia Pacific region is the primary engine of new demand, driven by fleet expansion, new infrastructure projects, and the maturation of massive logistics networks requiring robust, high-volume capacity solutions. This demand is largely concentrated in standard freight systems and necessary ground support equipment interface points. Conversely, North America and Europe, while demonstrating slower volume growth, lead in technological advancement and replacement demand. Carriers in these mature markets prioritize automation, lightweighting, and sophisticated systems that maximize efficiency in high-cost labor environments and meet stringent environmental and security mandates. The Middle East is solidifying its strategic position as a global cargo transfer hub, fueling significant capital investment in advanced cargo terminals where integration between aircraft handling systems and ground logistics is paramount. These regional hubs often deploy the most cutting-edge, fully automated handling systems to minimize transfer times and maximize throughput capacity for connecting flights, necessitating specialized, high-performance interface solutions from system vendors.

Segmentation analysis reveals nuanced shifts in value contribution. While the foundational Unit Load Devices (ULDs) segment drives the highest market volume and base revenue due to replacement cycles, the highest revenue growth rate is concentrated within the specialized systems categories, specifically Temperature Control Systems and advanced Security Monitoring Systems. This accelerated growth reflects the increasing proportion of high-value, sensitive cargo—such as pharmaceuticals, biologicals, and premium electronics—which demands guaranteed environmental stability throughout transit. Within applications, the sustained increase in Passenger-to-Freighter (P2F) conversions, driven by strong cargo yields post-pandemic, is creating a temporary surge in demand for complete freight deck system installations on previously passenger-configured aircraft. Successful manufacturers are those who strategically diversify their offerings to capture both the high-volume replacement market (standard ULDs) and the high-value specialized systems market, integrating digital services across both segments to maintain competitive differentiation and long-term customer loyalty through superior data analytics and system reliability.

AI Impact Analysis on Aircraft Freight System Sales Market

The pervasive discussion around Artificial Intelligence's influence centers on optimizing resource allocation, enhancing the reliability of critical aviation components, and automating the high-risk environment of cargo handling. Users seek confirmation that AI can transition freight management from reactive maintenance schedules to proactive, predictive models, particularly concerning the structural integrity and operational life of expensive Unit Load Devices (ULDs) and complex in-aircraft handling systems. A major concern is how AI can be leveraged to address the critical industry challenge of aircraft loading optimization, ensuring compliance with strict center-of-gravity and weight limitations, which traditionally requires highly skilled manual input. Furthermore, the role of AI in processing vast amounts of sensor data generated by smart ULDs, turning raw temperature, shock, and location metrics into immediate, actionable insights for logistics managers, is a frequent point of inquiry. The expectation is that AI will introduce unprecedented levels of precision and safety to operations while drastically cutting down on cargo damage and associated insurance liabilities, fundamentally transforming the value proposition of modern freight systems.

AI's primary impact on the manufacturing and sales of aircraft freight systems lies in product lifecycle optimization and enhanced system performance. Manufacturers are employing AI and machine learning (ML) models during the design phase to simulate stress tolerance, material fatigue, and aerodynamic properties of new ULDs and handling system components under diverse operational loads and environmental conditions, significantly shortening the development cycle and ensuring first-time compliance with regulatory standards. In production, AI-powered quality control systems use computer vision and deep learning algorithms to inspect welds, composite layups, and assembly tolerances with accuracy far exceeding human capabilities, ensuring a higher quality final product and reducing manufacturing defects. Furthermore, AI contributes significantly to the aftermarket segment; by analyzing real-world usage data streamed from smart ULDs across an airline’s fleet, AI predictive analytics forecast component failure probability, allowing manufacturers and MRO providers to schedule maintenance precisely when needed, thereby maximizing asset utilization and offering airlines quantifiable cost-saving metrics as part of the sales pitch, moving beyond traditional sales arguments centered solely on material properties.

Operationally, AI is revolutionizing how aircraft cargo is managed on the ground and in the air. Sophisticated AI loading optimization software now integrates directly with the aircraft's weight and balance systems and the dimensions of the freight systems being used. This software rapidly calculates the optimal placement of hundreds of ULDs, factoring in priority, destination, weight, and hazardous material segregation rules, often achieving loading densities and efficiencies unattainable manually. This capability is a significant selling point for automated handling systems. Looking forward, AI-driven automation extends to autonomous ground support equipment (e.g., automated loaders and transports) that use advanced sensor fusion and computer vision to navigate the congested apron environment and interface flawlessly with the aircraft's cargo door and roller systems. This increased automation reduces reliance on manual labor, improves safety margins by minimizing interaction between personnel and heavy machinery, and significantly speeds up the highly time-sensitive process of aircraft turnaround, reinforcing the investment case for high-automation freight systems in major global hubs.

- AI optimizes ULD lifespan through predictive maintenance scheduling, significantly reducing unplanned operational disruptions and enhancing asset utilization across airline fleets.

- Integration of machine learning algorithms drastically improves cargo load planning and spatial utilization, maximizing payload density while strictly adhering to complex aircraft center-of-gravity constraints and weight limitations, contributing directly to fuel efficiency.

- AI-powered sensor data analysis enhances temperature control reliability and integrity for pharmaceuticals and sensitive cargo systems, ensuring GDP compliance and minimizing high-value cargo spoilage risk.

- Autonomous ground handling equipment utilizes AI vision and sensor fusion for precise docking and safe, rapid interaction with aircraft cargo interfaces, minimizing ground handling damage and enhancing safety protocols in a busy environment.

- Demand forecasting and production scheduling are refined using AI models, allowing freight system manufacturers to align production capacity precisely with volatile global trade cycles and geopolitical trends, reducing inventory costs.

- Advanced security screening systems leverage AI and pattern recognition for faster, non-invasive, and more accurate anomaly detection in freight contents within ULDs, meeting increasingly stringent international security standards without impeding throughput.

- AI enables comprehensive digital twin simulations of new freight systems, allowing virtual stress testing and rapid component iteration, accelerating the time-to-market for certified innovations in lightweight composites and structural designs.

DRO & Impact Forces Of Aircraft Freight System Sales Market

The strategic direction of the Aircraft Freight System Sales Market is fundamentally dictated by the tension between market expansion needs and operational challenges. A primary driver is the accelerating fleet modernization trend globally, encompassing the retirement of older, less efficient wide-body aircraft and their replacement with new generation airframes that demand new, custom-fit, and highly efficient freight systems compatible with modern automated ground equipment. Furthermore, the persistent growth in global air freight capacity, particularly in niche high-value sectors like temperature-controlled pharmaceuticals, mandates constant investment in specialized ULDs, creating a high-margin sub-market opportunity. The economic viability of these systems is further reinforced by global security mandates, which continually require upgrades to integrated security features within ULDs and handling systems, ensuring a non-discretionary procurement cycle for essential safety components. The drive towards interconnected, smart supply chains makes the data-generating capabilities of modern freight systems an attractive, value-added feature for logistics providers seeking enhanced end-to-end visibility, thereby accelerating adoption rates for IoT-enabled products.

Restraints primarily revolve around the significant financial burden associated with capital investment and adherence to complex global regulations. The high procurement cost of advanced, automated cargo handling systems can be prohibitive for smaller or regional carriers, forcing reliance on older, manual processes or basic equipment. Compounding this, the stringent regulatory environment of the aerospace sector necessitates lengthy and expensive certification processes (e.g., TSO/ETSO authorization) for every new design or material change, which significantly delays market entry for innovative products and creates substantial operational overhead for manufacturers. Moreover, the long lifespan of aircraft means that fleet replacement cycles are infrequent, leading to cyclical procurement patterns rather than sustained, linear growth, making long-term production planning challenging for system vendors. External macroeconomic risks, specifically persistent volatility in global trade relations and energy prices, can cause airlines to defer non-essential capital expenditures, directly impacting the replacement segment of the market and creating demand uncertainty that manufacturers must navigate carefully.

Key impact forces shape the competitive dynamics and structural necessity of the market. Regulatory pressure from organizations like IATA (through ULD standardization requirements) and national safety agencies (FAA, EASA) acts as a powerful, non-negotiable force, compelling airlines to regularly inspect, repair, and replace systems that show wear or do not meet updated safety standards, thus stabilizing the aftermarket MRO segment. Competition intensity is moderate to high, characterized by a few global system providers holding crucial certifications and proprietary technology, allowing them to exert strong influence over product standards. However, cost competition is fierce in the high-volume standard ULD market, often leading to fierce bidding wars for major airline contracts. The bargaining power of major airlines and integrated express carriers is substantial; as primary buyers with massive fleets, they often dictate system customization specifications and demand comprehensive, multi-year maintenance service level agreements, thereby squeezing manufacturers' margins on initial equipment sales but simultaneously guaranteeing long-term service revenue. Technological innovation, specifically in material science and digitalization, acts as a disruptive impact force, rewarding manufacturers who prioritize R&D into lighter, smarter, and more integrated system architectures.

Segmentation Analysis

The granular analysis of the Aircraft Freight System Sales Market by segmentation provides profound insights into areas of maximum growth, technological divergence, and consumer preference dynamics. The segmentation by Type, specifically distinguishing between fixed Cargo Handling Systems (CHS) and flexible systems like ULDs and specialized units, is crucial. The CHS segment, which includes the permanent, heavy-duty features like roller flooring, rail systems, and power drive units installed directly in the aircraft belly or main deck, is intrinsically tied to new aircraft deliveries and P2F conversion activity, experiencing large, infrequent capital purchases. Conversely, the Temperature Control Systems segment, encompassing both active (e.g., self-powered cooling containers) and passive (e.g., insulated boxes, thermal blankets) units, reflects the high-value, rapid growth in the cold chain logistics market, particularly post-2020, demonstrating a demand independent of basic airframe cycles but highly correlated with pharmaceutical sector outputs. This requires manufacturers in this segment to focus on thermal efficiency, compliance certification, and real-time monitoring software integration rather than just physical durability.

The Component segmentation highlights the recurring revenue stream generated by Unit Load Devices (ULDs) and their ancillary components (nets, straps). ULDs, as the most frequently handled and exposed assets, suffer constant wear and tear, necessitating a predictable and large-scale replacement market—this forms the foundational revenue base for many suppliers. The shift here is towards composite ULDs that offer extended life and lower maintenance costs compared to aluminum, appealing to airlines focused on TCO (Total Cost of Ownership). The Application segmentation reveals a significant divergence in required specifications. Civilian Aircraft systems prioritize efficiency, lightweight construction, and rapid turnaround capability, driven by competitive commercial pressures. Military Logistics systems, conversely, prioritize ruggedization, standardization for multi-platform use (e.g., air, sea, and ground compatibility), and rapid deployment features, often requiring specialized designs for unique military cargo like oversized equipment or munitions, leading to specialized, higher-margin contracts, albeit lower volume.

The Aircraft Type segmentation—Wide-body vs. Narrow-body—is increasingly relevant due to the growth of narrow-body freighters (e.g., Boeing 737 F, Airbus A321 F). Wide-body aircraft, dominating long-haul and high-volume cargo, require complex, multi-level cargo handling systems and specialized lower-deck ULDs (e.g., LD-3). Narrow-body freighters, popular for regional and shorter-haul express logistics, utilize simpler, often customized pallet positions and handling systems that maximize volumetric efficiency in smaller fuselages. Analyzing segment growth forecasts that while wide-body installations will continue to dominate revenue value, the narrow-body freighter segment is set to experience accelerating growth due to its operational flexibility and lower operating costs for express networks. This necessitates manufacturers offering scalable and modular solutions that can be adapted efficiently across both fleet categories, maintaining a strong focus on certification across multiple Supplemental Type Certificates (STCs) to serve the P2F conversion market effectively and broaden their market reach across diverse carrier operational profiles.

- Type:

- Cargo Handling Systems (Roller Beds, Winches, Power Drive Units, Restraint Systems)

- Temperature Control Systems (Active Containers with Integrated Cooling/Heating, Passive Containers, Thermal Blankets, Cryogenic Systems)

- Security and Monitoring Systems (Integrated Sensors, Tamper-Evident Locking Mechanisms, Digital Surveillance and Tracking Hardware)

- Component:

- Unit Load Devices (ULDs) (Standard Pallets, Customized Containers/Igloos, Specialized Heavy-Duty Boxes, Composite ULDs)

- Nets and Tie-Down Systems (Cargo Nets, Straps, Restraint Assemblies, Quick-Release Mechanisms)

- Cargo Linings and Barriers (Fire-Resistant Liners, Partition Walls, Smoke Barriers)

- Application:

- Civilian Aircraft (Passenger Aircraft Belly Cargo, Dedicated Freighters, Charter Operations)

- Military Logistics and Government Operations (Specialized Deployment Systems, High-G Tolerance Systems)

- Aircraft Type:

- Narrow-body Aircraft (e.g., A320F, B737F conversions)

- Wide-body Aircraft (e.g., B777F, A350F)

- Regional Jets and Turboprops (Smaller ULDs and non-motorized systems)

Value Chain Analysis For Aircraft Freight System Sales Market

The value chain begins with highly specialized upstream suppliers providing aerospace-grade materials, including complex aluminum alloys (e.g., 7075 series) and sophisticated high-performance composites like carbon fiber reinforced polymers and aramid fibers. These materials must meet stringent fireworthiness (FAR 25.853) and structural integrity standards, meaning procurement is often locked into long-term contracts with certified aerospace material producers. Suppliers of critical electronic components, such as microprocessors, long-life batteries, and sensor technology for smart ULDs, form the other essential upstream pillar. Given the specialized nature and high regulatory barrier, material sourcing often involves proprietary formulations and tight supply controls, granting these certified suppliers significant, albeit negotiated, pricing power, particularly for niche composite materials designed for weight reduction and high mechanical stress tolerance. The efficiency of this upstream segment is critical, as material shortages or compliance failures can halt high-value aircraft assembly lines, emphasizing reliability over marginal cost savings.

The core manufacturing stage (midstream) involves system design, precision machining, and complex assembly, often requiring vertically integrated facilities capable of handling both large-scale metal fabrication for pallets and advanced composite molding for containers. Key manufacturers invest heavily in R&D to obtain patents on proprietary locking mechanisms, motorized roller bed designs, and thermal management systems for active containers. Certification and compliance testing—a major value-add at this stage—involves securing airworthiness approvals (TSO/ETSO) for components, a process that validates the system's safety and performance for flight use, which acts as a powerful barrier to entry for non-certified competitors. Distribution predominantly flows through two primary channels: direct sales to major aircraft Original Equipment Manufacturers (OEMs) like Boeing and Airbus for line-fit installations on new aircraft, and direct negotiation with major global cargo carriers and leasing companies for large-scale fleet replacement or expansion contracts. The focus during sales is on proving Total Cost of Ownership (TCO) benefits derived from lightweight materials and low maintenance requirements over the system’s long operational life.

Downstream activities are dominated by comprehensive after-sales support and the critical Maintenance, Repair, and Overhaul (MRO) network. Because ULDs are frequently damaged and require periodic recertification (typically every one to five years), the MRO segment generates substantial, predictable service revenue, often exceeding the initial equipment sale value over the life cycle of the system. Manufacturers either operate their own global network of certified MRO stations or license authorized third-party repair organizations, ensuring that system integrity is maintained globally, a vital requirement for carriers operating across multiple continents. Indirect distribution, though smaller in value, includes authorized specialized freight system dealers and leasing companies, which provide flexible inventory solutions to smaller airlines, often maintaining pools of general-purpose ULDs. Customer loyalty and retention are heavily influenced by the speed, geographical coverage, and quality of the MRO services offered, making robust service level agreements and global spare parts availability key competitive differentiators in the overall customer value perception of the aircraft freight system provider.

Aircraft Freight System Sales Market Potential Customers

The customer ecosystem is multi-layered, beginning with large-scale, international Cargo Airlines who rely entirely on the efficiency and reliability of these systems to maintain their core business model. Companies like Qatar Airways Cargo, Emirates SkyCargo, and Lufthansa Cargo, alongside the dominant integrated carriers (FedEx, UPS, DHL), represent the largest volume buyers, prioritizing bespoke, heavy-duty cargo handling solutions and highly specialized Unit Load Devices (ULDs) that withstand continuous operational stress and maximize cubic capacity utilization within their wide-body freighter fleets. These customers engage in highly technical procurement processes, often requiring deep collaboration with manufacturers to ensure seamless integration with proprietary automated warehouse systems and specialized ground handling interfaces. Their massive procurement volume grants them significant negotiating leverage, often resulting in complex supply contracts that incorporate stringent performance guarantees, emphasizing product reliability and long-term MRO support availability as non-negotiable requirements.

A secondary, but rapidly expanding, customer base comprises Commercial Passenger Airlines utilizing the lower deck of their fleet for additional revenue, a sector sometimes referred to as 'belly freight'. While typically procuring standard, certified lower-deck containers (LD-3s), this segment’s demand is driven by the rapid growth in global passenger fleet capacity and the necessity for lightweight solutions that minimize fuel penalties while maximizing cargo revenue potential. A crucial emerging segment is Aircraft Leasing Companies and specialized modification houses focusing on Passenger-to-Freighter (P2F) conversions. These companies act as significant interim buyers, requiring full-deck installations of cargo handling systems, rigid barriers, and associated safety features, often demanding rapid delivery schedules and certified installation kits to meet the tight timelines of conversion projects, reflecting the current high demand for freighter capacity. Their purchasing strategy centers on standardized, widely certified systems that can easily be remarketed or deployed across various customer airlines globally.

Finally, specialized end-users generate high-value, niche demand. This includes leading global Pharmaceutical Companies and specialized Cold Chain Logistics Providers (often 3PLs), who invest in or lease high-specification active temperature-controlled containers directly. Their demand is driven not by fleet size but by the extreme necessity for temperature integrity and compliance with Good Distribution Practices (GDP), resulting in a willingness to pay premium prices for systems that guarantee thermal stability and real-time monitoring capabilities, making them highly profitable targets for specialized system manufacturers. Government and Military organizations constitute a consistent customer stream, procuring extremely durable, often customized, and highly secure freight systems for logistics in tactical and non-standard operating environments, prioritizing system robustness, rapid interchangeability across diverse military airframes, and adherence to specific national defense standards, often necessitating secure domestic sourcing and supply chain resilience guarantees.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Teleflex Incorporated, Safran S.A., TLD Group, Lantal Textiles AG, Nordisk Aviation Products, Transdigm Group Inc., Cargo Composites, Ancra International, Honeywell International Inc., Collins Aerospace (Raytheon Technologies), Liebherr-Aerospace, GKN Aerospace, ACL Airshop, Zodiac Aerospace (now part of Safran), Satco, Inc., C.M.F. Srl, VRR Aviation, PalNet GmbH, Pactec S.A., AeroSafe Global, Dokasch GmbH, Envirotainer, Sonoco ThermoSafe, CSafe Global. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Freight System Sales Market Key Technology Landscape

The foundational technology driving innovation in this market is the relentless pursuit of reduced weight through advanced material substitution. Manufacturers are moving decisively away from traditional aluminum structures toward high-performance aerospace composites, including carbon fiber, specialized fiberglass, and high-strength aramid fibers, often utilizing proprietary matrix resins. This technological shift is not merely about weight reduction but also about improving durability, resistance to corrosion from cleaning agents and moisture, and enhancing resistance to impact damage frequently sustained during ground handling operations. Precision engineering techniques, such as additive manufacturing (3D printing) for complex, low-volume components like locking mechanisms and specialized structural brackets, are beginning to gain traction, offering faster prototyping and optimized weight profiles that cannot be achieved through traditional machining processes. The focus on composite technology requires significant capital investment in advanced molding and curing facilities, further raising the technological barrier to entry and strengthening the position of established aerospace suppliers capable of handling such complex material certification.

Digital integration, specifically the widespread adoption of IoT (Internet of Things) and sophisticated sensor technology, constitutes the most transformative change in the current technology landscape. Smart ULDs incorporate embedded sensors to monitor and transmit critical environmental and handling data, including precise GPS location, internal and external temperature profiles, shock events (G-force), door status, and humidity levels. This data transmission relies on certified avionics-compatible hardware and robust wireless communication protocols (e.g., LoRaWAN, cellular gateways) that can function reliably in airport environments and during flight. Cyber security for these smart systems is rapidly becoming a key technological concern; manufacturers must ensure the integrity and security of the transmitted data, protecting against unauthorized access or manipulation, particularly for high-value or highly sensitive cargo. The ability to offer a secure, end-to-end data platform integrated with airline or logistics providers’ enterprise resource planning (ERP) systems is now a crucial competitive technological advantage, moving system sales toward a subscription-based data service model alongside the hardware component.

Further technological advancements center on the automation and mechanization of the cargo hold. Modern Cargo Handling Systems (CHS) feature electronically controlled roller beds, multi-directional ball mats, and synchronized power drive units (PDUs) guided by complex integrated controllers. The technology employed here aims for high reliability, minimal maintenance intervention, and energy efficiency, often utilizing brushless DC motors and redundant control systems to ensure fault tolerance. Standardization technology, driven by IATA’s ULD Management (ULD CARE) guidelines, ensures interoperability across different carrier fleets and MRO providers globally. Future development is focusing on advanced anti-collision systems utilizing radar and lidar within automated ground handling environments to ensure perfect alignment and safe transfer of ULDs between ground transport and the aircraft cargo deck. This fusion of advanced robotics, sensor technology, and composite material science positions the market at the forefront of aviation logistics innovation, continually raising efficiency standards and necessitating high technical competency among all key market participants.

Regional Highlights

- Asia Pacific (APAC): Characterized by explosive growth, APAC is driven by substantial investments in new airport infrastructure across key economies and the rapid expansion of intra-Asian and intercontinental freight traffic fueled by massive e-commerce platforms. The primary focus is on establishing foundational high-capacity cargo hubs, leading to significant volume demand for standard pallets, containers, and initial installations of highly automated handling systems. Government support for logistics sector development in regions like Singapore, Shanghai, and Dubai (as a gateway) accelerates system deployment.

- North America: A dominant and mature market focusing on technological differentiation, fleet replacement, and optimization due to high operational costs. The demand is heavily skewed towards high-margin smart ULDs, advanced integrated security features, and automated handling systems designed to maximize efficiency and minimize labor dependency. Regulations imposed by the Transportation Security Administration (TSA) frequently drive non-discretionary system upgrades related to security and screening compatibility, ensuring continuous demand for specialized technology.

- Europe: Strong demand anchored by highly sophisticated cold chain logistics requirements, driven by the concentration of pharmaceutical manufacturing and distribution centers. The market prioritizes active temperature control systems (refrigerated ULDs) and adherence to strict EU and GDP guidelines, demanding high-specification systems with robust certification documentation. Geopolitical factors and the need for seamless cross-border freight movement within the EU drive the adoption of highly standardized and digitally tracked systems across various European national carriers and specialized logistics providers.

- Latin America (LATAM): Experiencing moderate, albeit variable, growth, predominantly driven by the export of perishable goods (fruits, flowers, seafood) requiring reliable, medium-specification temperature-controlled solutions. Market expansion is correlated with economic stability and trade liberalization. Carriers are focused on upgrading aging ULD fleets and establishing more reliable regional maintenance centers (MROs) to reduce dependence on external repair services, creating opportunities for durable, easy-to-maintain system sales.

- Middle East and Africa (MEA): Critical due to its strategic geographical position linking Asia, Europe, and Africa. The region sees massive infrastructural investment focused on creating global transit mega-hubs, demanding state-of-the-art, high-throughput automated handling systems capable of rapid transshipment volumes. Gulf carriers are leading the adoption of cutting-edge technology, including fully integrated smart ULD systems and highly secure cargo handling solutions, to solidify their position as premium global cargo gateways, resulting in high value-per-system procurement.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Freight System Sales Market.- Teleflex Incorporated

- Safran S.A.

- TLD Group

- Lantal Textiles AG

- Nordisk Aviation Products

- Transdigm Group Inc.

- Cargo Composites

- Ancra International

- Honeywell International Inc.

- Collins Aerospace (Raytheon Technologies)

- Liebherr-Aerospace

- GKN Aerospace

- ACL Airshop

- Zodiac Aerospace (now part of Safran)

- Satco, Inc.

- C.M.F. Srl

- VRR Aviation

- PalNet GmbH

- Pactec S.A.

- AeroSafe Global

- Dokasch GmbH

- Envirotainer

- Sonoco ThermoSafe

- CSafe Global

Frequently Asked Questions

Analyze common user questions about the Aircraft Freight System Sales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Aircraft Freight System Sales Market?

The primary driver is the accelerating global e-commerce volume, which necessitates faster, more reliable, and higher-capacity air cargo logistics, pushing airlines and logistics providers to invest in new, automated, and lightweight freight handling systems and Unit Load Devices (ULDs).

How are 'Smart ULDs' impacting the air cargo supply chain?

Smart ULDs, equipped with IoT sensors and GPS, provide real-time data on cargo location, temperature, and integrity. This capability is critical for optimizing cold chain compliance, enhancing security, and enabling predictive maintenance, drastically improving supply chain transparency and reliability.

Which geographical region is expected to show the highest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid fleet expansion, massive infrastructure development, and booming domestic and international e-commerce sectors, particularly in developing economies.

What is the biggest restraint affecting market expansion?

The most significant restraint is the extremely high initial capital expenditure required for purchasing and installing certified automated Cargo Handling Systems and specialized ULDs, alongside lengthy and rigorous regulatory certification processes mandated by global aviation authorities.

How does the market address the need for sustainable air freight solutions?

Manufacturers address sustainability by focusing on advanced lightweight composite materials for ULDs and handling systems, which significantly reduce the overall operating weight of the aircraft, directly contributing to substantial fuel savings and lower carbon emissions over the operational life of the equipment.

What role does the MRO segment play in the value chain?

The Maintenance, Repair, and Overhaul (MRO) segment is critical as it handles the mandatory periodic recertification and repair of high-stress components like ULDs and roller systems. It represents a large, predictable, and highly stable revenue stream for system manufacturers throughout the system's operational lifespan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager