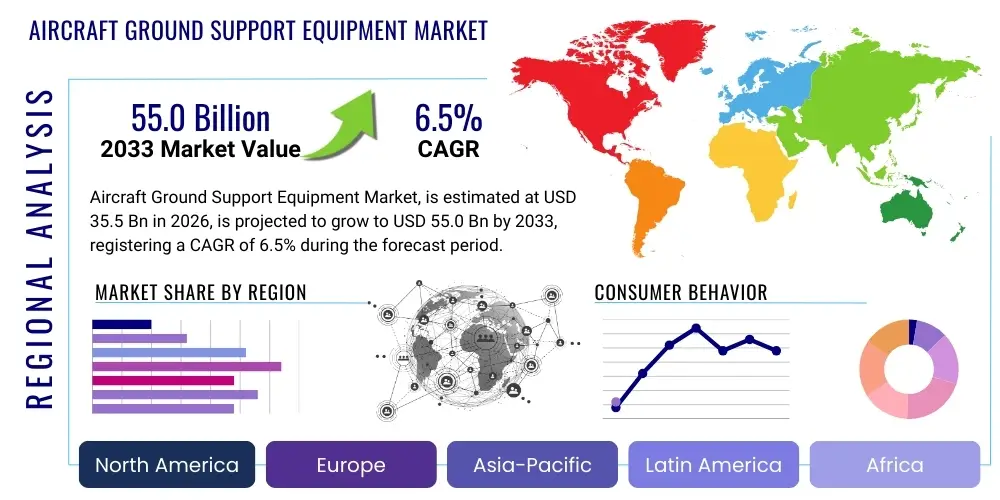

Aircraft Ground Support Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437946 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Aircraft Ground Support Equipment Market Size

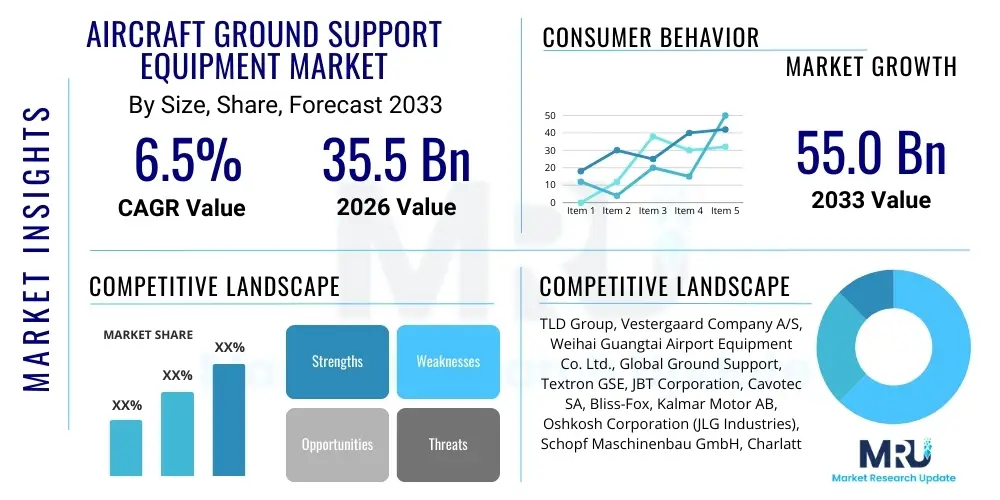

The Aircraft Ground Support Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 55.0 Billion by the end of the forecast period in 2033.

Aircraft Ground Support Equipment Market introduction

The Aircraft Ground Support Equipment (GSE) Market encompasses a diverse range of vehicles, machinery, and apparatus used at airports to service aircraft between flights. This equipment is critical for ensuring efficient, safe, and timely operations on the ramp and apron. GSE includes powered units such as pushback tractors, baggage loaders, passenger stairs, catering trucks, and fuel bowsers, alongside non-powered equipment like dollies, chocks, and specialized maintenance stands. The fundamental function of GSE is to facilitate turnarounds, handling passenger and cargo transfers, aircraft movement, and essential maintenance tasks necessary for airworthiness prior to the next departure. The primary benefit of sophisticated GSE is the reduction in aircraft turnaround time (ATT), which directly impacts airline profitability and overall airport capacity utilization. Furthermore, modern GSE focuses heavily on enhancing safety protocols for both ground personnel and aircraft structures, mitigating risks associated with manual handling and operational inefficiencies. The continuous expansion of global air traffic, coupled with the need for stringent regulatory compliance regarding emissions and noise, serves as a paramount driving factor for innovation and deployment within this market.

Product descriptions within the GSE domain often emphasize durability, operational efficiency, and environmental compliance. Electrified GSE (e-GSE) has emerged as a crucial segment, addressing the industry's commitment to sustainability and reducing reliance on fossil fuels in ground operations. Major applications span commercial airports, military airbases, and private aviation facilities globally. In commercial settings, the deployment is optimized around high-frequency operations requiring robustness and interoperability among various aircraft types, including narrow-body, wide-body, and regional jets. Military applications demand ruggedized equipment designed for extreme conditions and rapid deployment capabilities. The market structure involves specialized manufacturers catering directly to airlines, ground handling companies, and airport authorities, often engaging in long-term service and maintenance contracts to ensure operational readiness and regulatory adherence, reflecting the high capital investment required for modern fleets of ground support assets.

Key benefits derived from investing in advanced Aircraft GSE include significant cost savings realized through lower fuel consumption and reduced maintenance requirements inherent in electric and hybrid models, improved operational predictability through integrated telematics and IoT monitoring, and enhanced safety through automated positioning systems and collision avoidance features. The market is fundamentally driven by the escalating demand for air travel, particularly in emerging economies of the Asia Pacific region, leading to infrastructural expansion and the development of new greenfield airports. Concurrently, strict environmental regulations imposed by international bodies such as the International Civil Aviation Organization (ICAO) and national environmental agencies are compelling rapid modernization of aging GSE fleets, particularly in North America and Europe, thereby sustaining market growth and stimulating research and development in automated and sustainable ground handling solutions.

Aircraft Ground Support Equipment Market Executive Summary

The Aircraft Ground Support Equipment (GSE) market is undergoing a significant transformation, characterized by aggressive electrification, increased automation, and the integration of sophisticated digital technologies aimed at optimizing ramp operations. Current business trends indicate a strong shift towards leasing and subscription models rather than outright purchase, especially among smaller ground handling operators, allowing for flexibility and lower initial capital outlay. Furthermore, manufacturers are increasingly offering holistic solutions encompassing hardware, software, predictive maintenance services, and training, positioning themselves as integrated logistics partners rather than mere equipment providers. Strategic alliances between GSE manufacturers and technology firms specializing in artificial intelligence (AI) and telematics are becoming commonplace, focusing on developing autonomous vehicles and smart asset management platforms to minimize human error and maximize resource utilization during critical turnaround windows. The primary challenge remains the standardization of charging infrastructure across global airports and managing the high initial investment required for transitioning legacy diesel fleets to electric alternatives, despite the compelling long-term operational savings.

Regionally, the market dynamics are polarized. Asia Pacific is the fastest-growing region, driven by massive investments in new airport infrastructure development in China, India, and Southeast Asia, accommodating burgeoning middle-class air travel demand. This region primarily demands new, energy-efficient equipment suitable for high-throughput mega-hubs. North America and Europe, conversely, represent mature markets where growth is sustained primarily through fleet replacement programs, mandated by stringent environmental regulations (such as those promoting zero-emission zones on airside ramps) and a focus on upgrading equipment reliability to handle complex operational challenges presented by increasing air traffic density. Latin America and the Middle East exhibit targeted growth, particularly in hub airports where major carriers are expanding their long-haul routes, necessitating high-capacity and specialized wide-body handling equipment, including advanced cargo loaders and specialized de-icing apparatus.

Segment trends reveal that the Powered GSE segment, particularly the electric variant, is experiencing superior growth rates compared to Non-Powered GSE. Within the GSE type classification, the segment comprising tugs, tractors, and pushback vehicles holds the largest market share due to their indispensable role in every turnaround operation, while passenger stairs and lifts are seeing rapid modernization to accommodate accessibility requirements and safety standards. The maintenance and repair services segment associated with GSE is expanding significantly, driven by the complexity of modern electronic and hydraulic systems which require specialized diagnostic tools and certified technicians. End-user analysis highlights ground handling companies as the dominant buyers, increasingly favoring outsourced handling services from airlines aiming to concentrate on core flight operations, further stimulating demand for efficient, multi-purpose, and interoperable equipment that can service diverse fleets.

AI Impact Analysis on Aircraft Ground Support Equipment Market

Common user questions regarding AI's influence in the Aircraft Ground Support Equipment Market frequently revolve around practical implementation, return on investment, and potential displacement of human labor. Users seek to understand how AI-driven predictive maintenance can genuinely reduce unscheduled downtime, whether autonomous GSE vehicles are safe and reliable in dynamic airport environments, and the necessary infrastructure investment required for such sophisticated integration. Key thematic concerns include data security, interoperability between different equipment manufacturers and airport management systems, and the regulatory pathway for deploying unmanned operations on the tarmac. Users expect AI to fundamentally enhance operational efficiency, speed up aircraft turnarounds by optimizing resource allocation in real-time (especially under adverse weather or congested conditions), and significantly improve safety metrics by minimizing human error through advanced object detection and route planning algorithms. The consensus expectation is that AI will move GSE from scheduled, reactive maintenance towards proactive, condition-based servicing, while simultaneously enabling highly coordinated, multi-vehicle autonomous ramp operations.

- AI-enabled Predictive Maintenance: Utilizes machine learning algorithms on telematics data (vibration, temperature, fluid levels) to forecast equipment failure, dramatically reducing unplanned outages and optimizing repair scheduling.

- Autonomous Ground Handling: Implementation of AI vision systems and sensor fusion enabling self-driving baggage tractors, cargo loaders, and pushback tugs, enhancing precision and minimizing the risk of ramp collisions.

- Resource Optimization and Scheduling: Deployment of AI algorithms to dynamically allocate GSE assets based on real-time flight schedules, gate changes, and personnel availability, thereby shortening aircraft turnaround times (ATT).

- Enhanced Safety and Collision Avoidance: Integration of deep learning models for real-time object recognition and proximity alerts, drastically improving situational awareness for both automated and human-operated equipment, particularly in low visibility conditions.

- Optimization of Charging Infrastructure: AI systems managing the charging and battery health of e-GSE fleets, determining optimal charging times based on grid load and operational needs to maximize battery life and minimize energy costs.

- Streamlined Documentation and Compliance: AI facilitating automated recording of operational data, streamlining regulatory compliance reporting and audit trails related to safety checks and operational limits.

DRO & Impact Forces Of Aircraft Ground Support Equipment Market

The Aircraft Ground Support Equipment market is shaped by a powerful confluence of drivers, restraints, and opportunities, underpinned by significant impact forces from technological acceleration and environmental mandates. The primary driver is the exponential recovery and long-term forecast growth of global air passenger and cargo traffic, necessitating expansion and modernization of airport infrastructure worldwide, particularly the upgrading of ramp handling capabilities to manage larger aircraft volumes and tighter turnaround schedules. Concurrently, the increasing emphasis on operational efficiency among airlines and ground handlers, driven by highly competitive pricing models, mandates the adoption of advanced, integrated, and reliable GSE systems to reduce variable operating costs, primarily fuel and labor. Furthermore, the global regulatory push towards environmental sustainability, championed by international agreements and local government initiatives, is rapidly accelerating the transition from conventional diesel-powered GSE to electric and hybrid alternatives, compelling fleet renewal programs across established markets and creating strong demand for innovative e-GSE solutions.

However, the market faces several significant restraints that challenge its rapid expansion. The most notable restraint is the substantial initial capital expenditure required for purchasing modern, sophisticated GSE, particularly automated and electric variants, which often presents financial barriers for smaller regional airports and independent ground handling companies. Additionally, the operational complexity and high cost associated with maintaining advanced electronic, hydraulic, and telematics systems require specialized training and investment in advanced diagnostic tools, adding to the total cost of ownership. The market also contends with constraints related to infrastructure readiness; while electric GSE is highly desirable, the development of robust, standardized, and scalable charging infrastructure across global airports has been slow and inconsistent, hampering large-scale e-GSE adoption in many locations. Furthermore, the inherent longevity of GSE equipment means that replacement cycles can be extended, occasionally delaying the uptake of newer, more efficient technologies.

Opportunities for market stakeholders primarily lie in leveraging digitalization and automation. The integration of IoT, telematics, and cloud-based fleet management solutions offers manufacturers a pathway to provide value-added services such as predictive maintenance and real-time operational consulting, establishing recurring revenue streams. The burgeoning need for specialized GSE tailored for next-generation aircraft (e.g., A350, B787) and specialized cargo handling equipment, especially for temperature-sensitive pharmaceuticals and e-commerce logistics, represents niche market expansion opportunities. The impact forces are heavily weighted by the accelerating pace of technology, where developments in battery technology (increasing range and reducing charging time) and advancements in sensor technology are continually lowering the barriers to large-scale electrification and full automation of ramp operations. Regulatory mandates, particularly those establishing deadlines for zero-emission zones, act as powerful external forces compelling immediate investment and strategic planning for fleet replacement, ensuring sustained growth in the electric and hybrid segments throughout the forecast period.

Segmentation Analysis

The Aircraft Ground Support Equipment Market is comprehensively segmented based on three critical axes: the type of equipment, the power source utilized, and the specific application or end-user category. This multidimensional segmentation allows for precise market analysis, reflecting the specialized needs of different airport environments and operational contexts globally. The segmentation by type differentiates between Powered GSE, which includes all self-propelled or mechanically operated machinery essential for maneuvering and servicing the aircraft, and Non-Powered GSE, which consists of passive equipment required for safety and basic positioning. The power source segmentation is increasingly vital, highlighting the disruptive shift toward electric and hybrid models away from traditional diesel and fuel-based equipment, driven primarily by sustainability mandates and escalating fuel costs. End-user segmentation focuses on differentiating the demanding requirements of commercial airlines, military logistics operations, and dedicated ground handling service providers, recognizing that each buyer group prioritizes different criteria, such as acquisition cost versus operational efficiency and ruggedness.

- By Equipment Type

- Powered Ground Support Equipment (P-GSE)

- Non-Powered Ground Support Equipment (NP-GSE)

- By Power Source

- Non-Electric (Fuel/Diesel Powered)

- Electric

- Hybrid

- Pneumatic

- By Application/End-User

- Commercial Airports

- Military Bases

- Airlines

- Ground Handling Companies

- By Service Type

- Maintenance & Repair

- Operations & Management

- Leasing

- By Vehicle Type (Within P-GSE)

- Tugs and Tractors (Pushback/Towbarless)

- Cargo Loaders and Conveyors

- Passenger Stairs and Lifts

- De-icing and Anti-icing Vehicles

- Refuelers and Hydrant Dispensers

- Ground Power Units (GPUs) and Air Start Units (ASUs)

- Water and Lavatory Service Vehicles

Value Chain Analysis For Aircraft Ground Support Equipment Market

The value chain of the Aircraft Ground Support Equipment Market is characterized by highly specialized stages, beginning with the complex sourcing of raw materials and sophisticated component manufacturing, extending through final assembly, distribution, and extensive aftermarket services. The upstream analysis involves the procurement of high-grade steel, specialized aluminum alloys, advanced electric motors, high-density battery packs (critical for e-GSE), complex hydraulic systems, and sensitive electronic control units (ECUs). Suppliers of these components often require certifications adhering to stringent aviation industry standards, ensuring the reliability and safety of the final product. Key upstream activities are concentrated geographically in regions possessing advanced manufacturing capabilities, such as parts of Europe, North America, and specialized industrial zones in Asia, where efficiency and quality control in component fabrication directly influence the performance metrics and lifecycle cost of the finished GSE. Negotiations in this stage are complex, driven by factors such as fluctuating commodity prices and the need for long-term supply agreements for proprietary technology, such as specialized battery management systems or advanced sensor arrays for autonomous vehicles.

The core midstream activity is the final assembly and manufacturing of the GSE units, performed by Original Equipment Manufacturers (OEMs) who hold the necessary technical expertise and global distribution networks. This stage involves complex engineering integration, customizing equipment to meet specific regional requirements (e.g., climate, aircraft fleet mix) and incorporating proprietary software for telematics and operational monitoring. Downstream analysis focuses primarily on distribution and deployment. Distribution channels are typically a mix of direct sales from the OEM to large airline groups and major ground handling entities, and indirect distribution through certified regional distributors or specialized leasing companies, particularly for smaller airport operators who prefer capital-light solutions. This phase is heavily influenced by after-sales service requirements, including training, spare parts inventory management, and technical support, which are crucial for maintaining high operational readiness, reflecting the high-stakes environment of airport operations where downtime is extremely costly.

The distinction between direct and indirect channels is critical in determining market penetration and revenue streams. Direct channels facilitate closer customer relationships, enabling manufacturers to receive immediate feedback crucial for product innovation and customization, and are generally utilized for high-value contracts involving large fleet orders or highly specialized equipment like towbarless tractors and advanced de-icers. Indirect channels, often involving local agents or dedicated GSE rental firms, allow manufacturers to reach dispersed and smaller regional customers efficiently, reducing their direct logistical overhead. Regardless of the channel, aftermarket service revenue, encompassing maintenance, spare parts, and digital services (like software subscriptions for telematics), often constitutes a substantial and stable portion of the total market value, emphasizing the importance of robust service networks. The entire value chain is currently being optimized through digital tools, allowing for better inventory tracking, remote diagnostics, and improved efficiency from the component level right up to the end-user operations on the airport ramp.

Aircraft Ground Support Equipment Market Potential Customers

The primary purchasers and end-users of Aircraft Ground Support Equipment are segmented into three distinct categories: Ground Handling Companies, Commercial Airlines, and Airport Operators/Authorities. Ground Handling Companies represent the largest and fastest-growing customer segment. These specialized firms, such as Swissport, Menzies Aviation, and Dnata, contract with multiple airlines to manage passenger, baggage, and aircraft servicing during turnarounds. Their purchasing decisions are heavily influenced by the need for equipment that offers maximum versatility, high reliability across diverse aircraft types, and low total cost of ownership (TCO), making them keen adopters of standardized, multipurpose electric GSE fleets that minimize fuel costs and environmental fees. Their procurement strategies prioritize scalability and interoperability, enabling efficient operations across various airport terminals and sometimes multiple international locations, often leveraging leasing models to manage high capital expenditure and ensure access to the latest technological upgrades swiftly.

Commercial Airlines, while increasingly outsourcing ground handling duties, remain crucial customers, particularly for specialized and strategic GSE, such as equipment customized for specific maintenance procedures or proprietary tools essential for their unique fleet configurations. Major global carriers invest in GSE that directly contributes to the passenger experience, such as premium passenger boarding bridges (where owned by the airline) or specialized catering and cabin service vehicles. Their focus is often on maximizing brand perception and operational control for crucial hub operations. Furthermore, airport authorities and operators constitute another significant customer base, responsible for infrastructure-related GSE, including fire and rescue vehicles, specialized snow removal equipment, and, increasingly, owning and managing centralized GSE pooling systems and common-use charging infrastructure to support all carriers and handling agents operating on their premises. Their purchasing is driven by regulatory compliance, safety mandates, and overall airport operational efficiency goals.

The military and defense sector also represents a stable, albeit distinct, segment of potential customers. Military airbases require GSE designed for extreme environments, rapid deployment, and rugged durability, often purchasing specialized equipment like high-capacity air start units, mobile aircraft heaters/coolers, and specialized fueling systems capable of operating off-grid or in remote locations. Their procurement processes are driven by national defense budgeting cycles and operational readiness criteria, prioritizing robust construction and high performance over strict commercial efficiency metrics. Across all end-user groups, the current purchasing trend is shifting towards suppliers who can not only provide the physical machinery but also integrated data solutions (telematics and fleet management software) that provide actionable insights into utilization rates, maintenance needs, and compliance reporting, reflecting a market where data intelligence is increasingly valued as a core component of the GSE asset itself, driving purchasing decisions toward integrated solution providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 55.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TLD Group, Vestergaard Company A/S, Weihai Guangtai Airport Equipment Co. Ltd., Global Ground Support, Textron GSE, JBT Corporation, Cavotec SA, Bliss-Fox, Kalmar Motor AB, Oshkosh Corporation (JLG Industries), Schopf Maschinenbau GmbH, Charlatte Manutention, Mallaghan Engineering, ISUZU MOTORS LIMITED, Aero Specialties, Inc., Fast Global Solutions, AERO-SERVICE, Alvest Group (SAGE Parts), Guinault, Tronair Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Ground Support Equipment Market Key Technology Landscape

The Aircraft Ground Support Equipment market is heavily influenced by technological advancements focused on three core pillars: electrification, automation, and data connectivity (telematics and IoT). Electrification stands as the single most critical technological shift, driven by mandates for carbon neutrality and noise reduction at airports. Modern e-GSE incorporates advanced lithium-ion battery technology, offering higher energy density, faster charging cycles, and longer operational durations compared to older lead-acid batteries. The technological focus here is on developing modular and swappable battery systems to minimize downtime and standardize the power infrastructure across a diverse fleet of vehicles, tackling one of the major restraints to widespread e-GSE adoption. Manufacturers are also prioritizing high-efficiency powertrains and smart energy management software to maximize battery life and optimize energy consumption during high-load operations, moving beyond simple battery replacement to integrated energy solution design.

Automation and semi-automation technologies are rapidly entering the GSE space, utilizing sophisticated sensor fusion—combining LiDAR, radar, GPS, and high-resolution cameras—to enable functionalities like precision docking, obstacle avoidance, and programmed maneuvering. Towbarless Tractors (TLTs) are increasingly equipped with advanced visualization systems to ensure safe and precise coupling with aircraft landing gear, reducing structural stress. The long-term technological vision involves fully autonomous GSE capable of executing routine tasks, such as baggage delivery or cargo loading, without human intervention, which necessitates the development of robust, AI-driven navigation systems capable of operating reliably in the highly congested and dynamically changing ramp environment, requiring significant advancements in real-time mapping and multi-vehicle coordination algorithms to prevent collisions and ensure regulatory compliance.

Furthermore, the integration of the Internet of Things (IoT) and telematics represents a fundamental shift in how GSE assets are managed and maintained. Every modern piece of GSE is now expected to be equipped with embedded sensors that transmit operational data (engine health, mileage, cycle count, battery charge status) to a centralized cloud platform. This technological infrastructure enables advanced predictive maintenance models, where machine learning algorithms analyze historical data patterns to predict component failure before it occurs, shifting maintenance from reactive to proactive, thereby maximizing asset utilization and minimizing costly operational disruptions. This connectivity also facilitates Generative Engine Optimization (GEO) within the market by providing manufacturers and service providers with extensive data necessary to continually refine equipment design based on real-world usage patterns, making future generations of GSE inherently more reliable and efficient. Security protocols for data transmission and storage remain a crucial technological consideration, given the sensitivity of airport operational data.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate globally, driven by substantial infrastructure investment, particularly the construction of new mega-airports and expansion projects in China, India, and Southeast Asian nations like Vietnam and Indonesia. The burgeoning middle class drives massive air traffic growth, demanding new fleets of GSE. Governments are increasingly incorporating mandatory specifications for greenfield airport projects that favor electric GSE and smart systems, making this region a prime target for new market entrants and technology innovators focused on high-volume, high-density operations.

- North America: North America represents a mature market characterized by stringent operational demands and a rapid push toward sustainable practices. Growth here is primarily driven by fleet replacement cycles, compliance with evolving environmental regulations (e.g., California's zero-emission targets for ground operations), and the high adoption rate of sophisticated automation technologies to mitigate labor costs and enhance safety. The region leads in the adoption of advanced predictive maintenance contracts and the deployment of towbarless tractors for efficiency gains.

- Europe: Europe is a key market defined by high regulatory standards concerning noise and emissions, stimulating strong demand for e-GSE and hybrid solutions across major hubs like Frankfurt, London Heathrow, and Paris CDG. Market expansion is steady, fueled by the modernization of aging fleets and the adoption of specialized equipment, particularly advanced de-icing and anti-icing systems required for extreme winter conditions. European airports are often pioneers in adopting common-use GSE pools managed by airport authorities to enhance operational synergy and reduce redundancy among multiple ground handlers.

- Middle East and Africa (MEA): Growth in the Middle East is centered around major aviation hubs (Dubai, Doha, Abu Dhabi) that serve as critical global transit points. Investments focus on high-capacity and specialized GSE necessary to handle a high volume of wide-body aircraft (A380s, B777s) and complex cargo operations, often requiring heavy-duty, climate-controlled equipment. The African market is characterized by slower, more fragmented growth, focused on basic, rugged, and low-maintenance GSE solutions for regional airports, although major city hubs are starting targeted modernization projects.

- Latin America: This region shows stable, incremental growth, primarily concentrated in the key economic centers of Brazil, Mexico, and Chile. The market is highly cost-sensitive, leading to a strong preference for refurbished GSE or equipment with low acquisition costs. However, major international airports are beginning to adopt modern e-GSE to align with global standards and improve operational efficiency to attract international carriers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Ground Support Equipment Market.- TLD Group

- Vestergaard Company A/S

- Weihai Guangtai Airport Equipment Co. Ltd.

- Global Ground Support

- Textron GSE

- JBT Corporation

- Cavotec SA

- Bliss-Fox

- Kalmar Motor AB

- Oshkosh Corporation (JLG Industries)

- Schopf Maschinenbau GmbH

- Charlatte Manutention

- Mallaghan Engineering

- ISUZU MOTORS LIMITED

- Aero Specialties, Inc.

- Fast Global Solutions

- AERO-SERVICE

- Alvest Group (SAGE Parts)

- Guinault

- Tronair Inc.

- CIMC Tianda

- Diversey

- Power Stow A/S

- EASY MILE

- Treppel Airport Equipment

- ITW GSE

- VOLK Special Vehicles

- Gate Equipment SpA

- HYDRO Systems KG

- SOVAM

- Taylor-Dunn

Frequently Asked Questions

Analyze common user questions about the Aircraft Ground Support Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the electrification of Aircraft GSE fleets?

The primary driver is stringent global environmental regulation, particularly mandates from bodies like ICAO and local governments in Europe and North America, aimed at reducing carbon emissions and minimizing noise pollution on airport ramps, coupled with the long-term operational cost savings associated with lower fuel consumption and reduced maintenance of electric vehicles.

How is predictive maintenance transforming the GSE maintenance service segment?

Predictive maintenance uses IoT sensors and AI analytics to monitor equipment health in real-time, forecasting potential component failures before they cause operational disruptions. This shift from reactive or scheduled maintenance to condition-based servicing maximizes equipment uptime, significantly reduces unplanned maintenance costs, and improves fleet reliability during critical airport turnaround cycles.

What are the main challenges facing the large-scale adoption of autonomous GSE?

The main challenges include establishing standardized charging and communication infrastructure across diverse airport environments, navigating complex regulatory approvals for unmanned vehicles in high-density operational zones, ensuring cyber security for fleet management systems, and guaranteeing interoperability between varied GSE models and airport operational platforms.

Which geographical region exhibits the highest growth potential for Aircraft Ground Support Equipment?

The Asia Pacific (APAC) region displays the highest growth potential, fueled by massive government and private sector investment in new airport construction and capacity expansion, particularly in high-traffic nations like China, India, and rapidly developing Southeast Asian economies, resulting in high demand for modern, new-generation equipment.

What is the difference between Powered GSE and Non-Powered GSE?

Powered GSE (P-GSE) includes self-propelled machinery like tractors, loaders, and GPUs that use an engine or electric motor to operate, facilitating movement and complex tasks. Non-Powered GSE (NP-GSE) refers to passive equipment such as dollies, pallets, chocks, and steps that rely on external power or manual effort for use, primarily serving support and safety functions during aircraft handling.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager