Aircraft Interiors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434643 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Aircraft Interiors Market Size

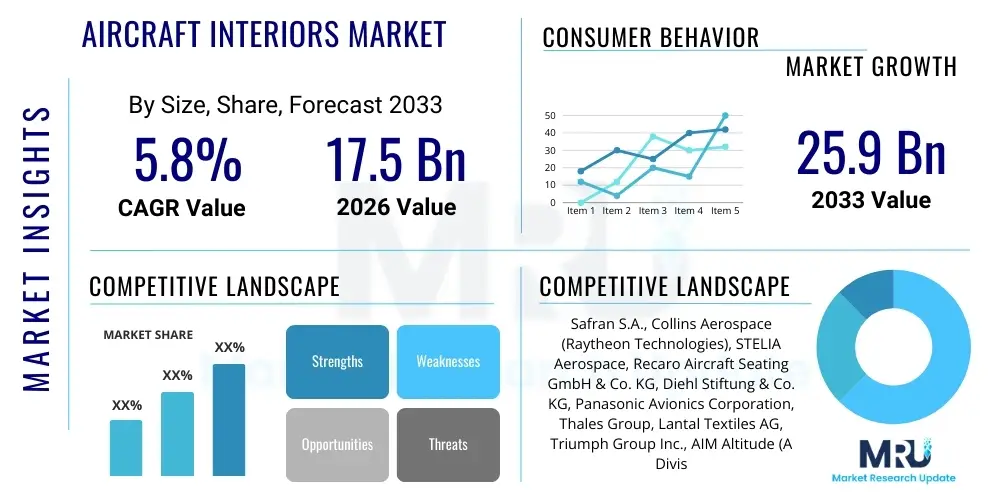

The Aircraft Interiors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 17.5 Billion in 2026 and is projected to reach USD 25.9 Billion by the end of the forecast period in 2033.

Aircraft Interiors Market introduction

The Aircraft Interiors Market encompasses all components and systems within the cabin, crucial for passenger comfort, operational safety, and aesthetic appeal. Key products include seating, galleys, lavatories, in-flight entertainment and connectivity (IFEC) systems, lighting, and advanced cabin management systems. This market is intrinsically linked to the global aviation industry's performance, driven primarily by increasing passenger traffic, the expansion of low-cost carriers (LCCs), and substantial investments in fleet modernization and cabin retrofitting programs by major airlines worldwide. The primary goal of innovations in this sector is to enhance the passenger experience while simultaneously reducing aircraft weight to improve fuel efficiency and lower operational costs, making materials science and smart design central to product development.

Major applications of aircraft interiors span commercial aviation, including narrow-body and wide-body aircraft, as well as business and private jets, and regional aircraft. The market is highly differentiated based on aircraft class, with First Class and Business Class demanding bespoke, luxurious, and technologically integrated solutions, while Economy Class focuses on density optimization and ergonomic seating designs. Benefits derived from advanced aircraft interiors include improved hygiene and sanitization capabilities, personalized in-flight experiences through sophisticated IFEC systems, and reduced maintenance downtime due to enhanced durability and modular design of components. Furthermore, the integration of ambient lighting and ergonomic structures significantly contributes to reducing passenger fatigue on long-haul flights.

Driving factors propelling market expansion include a robust replacement cycle spurred by aging fleets and intense competition among airlines to differentiate their service offerings. Regulatory mandates regarding safety certifications and fire resistance also necessitate continuous innovation and material upgrades. Additionally, the rapid evolution of digital technologies, particularly in connectivity and personalized entertainment, compels airlines to invest in high-specification cabin upgrades. The shift towards sustainable aviation also drives demand for lightweight, composite materials and eco-friendly cabin finishes, aligning market growth with environmental responsibility goals.

Aircraft Interiors Market Executive Summary

The global Aircraft Interiors Market is characterized by intense competition centered on innovation in lightweight materials, digitalization of cabin services, and customization capabilities. Business trends highlight a strong emphasis on aftermarket services (MRO), which constitute a significant revenue stream as airlines prioritize cabin retrofitting and refurbishment over complete replacements to extend the life of existing assets and align with contemporary passenger expectations. Furthermore, partnerships between interior suppliers and aircraft OEMs are critical for establishing long-term supply agreements and integrating new technologies seamlessly into next-generation aircraft platforms. Supply chain resilience, particularly concerning advanced composites and electronic components for IFEC, remains a key strategic focus area for major market participants.

Regional trends indicate that North America and Europe currently dominate the market due to the presence of major aircraft manufacturers, established MRO infrastructure, and high passenger propensity for premium travel experiences requiring advanced cabin amenities. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by rapid expansion of air travel, significant fleet procurement activities by carriers in China and India, and increasing disposable incomes leading to higher demand for enhanced cabin comfort. The Middle East remains a crucial market, dominated by flagship carriers investing heavily in luxurious, custom-designed First and Business Class cabins to maintain their premium global positioning.

Segmentation trends reveal that the Seating segment holds the largest market share, driven by continuous optimization efforts across all classes for weight reduction and comfort improvement. The In-Flight Entertainment and Connectivity (IFEC) segment is witnessing the fastest growth, propelled by the transition from seat-back screens to personalized device integration and the implementation of robust Wi-Fi capabilities for real-time connectivity. From an end-user perspective, while OEM demand is steady, the Aftermarket segment is showing robust acceleration, reflecting the operational strategy of airlines to perform mid-life cabin overhauls to refresh their brand image and technology offerings without purchasing new airframes.

AI Impact Analysis on Aircraft Interiors Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Aircraft Interiors Market frequently center on predictive maintenance capabilities, personalized passenger experiences, and optimized cabin operations. Users are keen to understand how AI can move beyond simple automation to create truly intelligent cabin environments. Key concerns revolve around data security associated with personalized passenger profiles and the integration complexity of AI algorithms with existing cabin hardware, particularly legacy IFEC systems. Expectations focus on AI driving efficiency gains in resource allocation, minimizing crew workload through automated monitoring, and enabling highly granular personalization of comfort settings (lighting, temperature, entertainment) based on real-time biometric and behavioral data collected within the cabin.

AI's influence is transforming the aircraft interior from a static physical space into a dynamic, responsive environment. In design, generative AI tools are assisting engineers in optimizing seat structures and component placement for maximum strength and minimum weight, leading to faster design iterations and superior material efficiency. Operationally, AI algorithms analyze sensor data from seats, lavatories, and galleys to predict component failure, scheduling maintenance preemptively during planned layovers rather than reacting to failures mid-flight. This transition from corrective to predictive maintenance significantly boosts aircraft availability and reduces operational expenditures for airlines.

Furthermore, AI-driven cabin management systems are revolutionizing the passenger experience. These systems can dynamically adjust ambient settings—such as light intensity, color temperature, and ventilation levels—to mitigate jet lag and enhance relaxation, based on flight path, time zones crossed, and individual passenger preferences stored securely. In the IFEC domain, AI powers highly accurate recommendation engines for entertainment and personalized service alerts, enhancing perceived value and customer loyalty. For cabin crew, AI can automate inventory management for catering and duty-free items, streamlining workflows and allowing crew members to focus more on direct passenger interaction and service quality.

- AI-enabled Predictive Maintenance: Utilizes sensor data from seats, motors, and IFEC systems to forecast component failure, minimizing unexpected grounding of aircraft.

- Personalized Cabin Environment: AI algorithms adjust lighting, temperature, and audio zones based on individual passenger profiles and physiological data for optimal comfort.

- Generative Design Optimization: AI tools accelerate the development of lightweight, complex interior structures (e.g., seat frames, partition walls) improving fuel efficiency.

- Enhanced IFEC Recommendations: AI drives personalized content suggestions and tailored advertising based on real-time passenger interaction and historical preferences.

- Automated Inventory and Workflow Management: AI assists cabin crew by automating tasks like stocking levels for galleys and optimizing service routes within the cabin.

- Real-time Biometric Monitoring: Future applications may involve AI analyzing passenger distress signals (e.g., vital signs via smart seats) to alert crew to potential medical issues.

DRO & Impact Forces Of Aircraft Interiors Market

The Aircraft Interiors Market dynamics are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and structural Impact Forces, which collectively influence investment decisions and technological trajectories within the sector. Key drivers include the robust demand for new aircraft deliveries globally, intense airline competition necessitating continuous cabin upgrades for differentiation, and the mandatory requirement for weight reduction to improve fuel efficiency and meet stringent environmental targets. These positive forces compel suppliers to invest heavily in R&D focusing on composite materials and advanced electronics, ensuring a constantly evolving product lifecycle.

Conversely, significant restraints hinder market potential. The primary restraint is the extremely high cost and long lead times associated with the certification process for new interior components, particularly seating and IFEC systems, which must comply with rigorous aviation safety standards (e.g., FAA, EASA). Furthermore, the cyclical nature of the aviation industry, heavily influenced by global economic downturns and geopolitical instability, introduces volatility in airline investment spending on non-essential cabin enhancements. The complexity of integrating new digital systems with existing aircraft infrastructure also poses a substantial technical and financial challenge for airlines and MRO providers.

Opportunities for growth are abundant, particularly in the aftermarket segment, where the focus on cabin retrofitting for extending asset utility remains strong. The rise of connectivity solutions (cabin Wi-Fi) and the integration of Internet of Things (IoT) sensors into cabin components offer vast potential for developing intelligent, data-driven interiors. Furthermore, the burgeoning demand for premium and tailored experiences in business jets and luxury wide-body refits provides lucrative niches for specialized interior designers and manufacturers capable of handling complex, low-volume, high-value projects. The impact forces acting on the market are predominantly technological disruption (AI, composites, flexible displays), regulatory pressures (safety, accessibility, sustainability), and shifting customer expectations towards seamless, personalized digital experiences.

Segmentation Analysis

The Aircraft Interiors Market is highly diversified, segmented based on product type, aircraft type, class, and end-user. This segmentation allows for precise market sizing and strategic targeting, reflecting the varied requirements across the aviation ecosystem. Product segmentation highlights the critical functions of cabin components, from structural elements like galleys and lavatories to experience-enhancing systems such as IFEC and lighting. Aircraft type segmentation addresses the distinct design and durability requirements of high-cycle narrow-body aircraft versus long-haul wide-body jets. The distinction between First, Business, Premium Economy, and Economy classes is crucial as it determines material quality, complexity of features, and pricing structures.

The segmentation by end-user—Original Equipment Manufacturer (OEM) versus Aftermarket (MRO)—is pivotal for understanding revenue streams. The OEM segment is driven by new aircraft orders and initial component installation, demanding large volumes and stringent weight specifications. Conversely, the Aftermarket segment is characterized by frequent refurbishment cycles, offering opportunities for customization, component upgrades, and technology insertions. The growth trajectory of the aftermarket is often more stable, providing consistent revenue streams irrespective of short-term fluctuations in new aircraft delivery schedules.

Analyzing these segments reveals that IFEC and Seating are the most dynamic segments. Seating demands perpetual innovation in lightweight ergonomics, while IFEC is rapidly transitioning towards high-bandwidth connectivity and integration with passenger personal electronic devices (PEDs). The market is also seeing specialization within segments, such as suppliers focusing exclusively on lightweight composite materials for monuments (galleys and lavatories) to capitalize on the industry’s relentless pursuit of reduced operational weight.

- By Product Type:

- Seats (Economy, Premium Economy, Business, First Class)

- Galleys

- Lavatories

- Windows & Windshields

- Lighting (Ambient, Reading, Specialty)

- In-Flight Entertainment & Connectivity (IFEC)

- Others (e.g., Stowage Bins, Linings, Floor Coverings)

- By Aircraft Type:

- Narrow-body Aircraft (NBA)

- Wide-body Aircraft (WBA)

- Business Jets

- Regional Aircraft

- By Class:

- Economy Class

- Premium Economy Class

- Business Class

- First Class

- By End-User:

- Original Equipment Manufacturer (OEM)

- Aftermarket (MRO and Retrofit)

Value Chain Analysis For Aircraft Interiors Market

The value chain of the Aircraft Interiors Market begins with the upstream suppliers providing raw materials, which include specialized high-performance materials such as carbon fiber composites, aerospace-grade polymers, flame-retardant textiles, and advanced electronic components for IFEC systems. These material suppliers, often highly specialized chemical and composite companies, are critical as material choice directly impacts component weight, durability, and certification viability. Upstream activities also include R&D focusing on miniaturization, lightweighting, and digital integration. Supplier relationships are long-term and often involve co-development to meet strict OEM specifications regarding safety and performance.

The midstream comprises the core activities of design, manufacturing, and assembly, carried out by specialized interior manufacturers. These players transform raw materials into complex finished components like seats, galleys, and IFEC hardware. Manufacturing processes involve intricate engineering, rigorous testing, and compliance checks. Distribution channels are segmented: direct sales dominate the OEM market, where major suppliers deliver components directly to aircraft final assembly lines (FALs) under long-term contracts with companies like Boeing, Airbus, and Bombardier. This direct channel requires deep integration into the OEM's logistics and quality control systems.

The downstream segment involves installation, maintenance, repair, and overhaul (MRO). For new aircraft, interiors are installed at the OEM's FAL. In the aftermarket, interiors are installed and maintained by airline in-house MRO facilities or third-party MRO providers during scheduled maintenance checks and retrofits. Indirect distribution channels, such as specialized distributors and brokers, often play a role in supplying smaller, non-major components, spare parts, and specialized materials to the aftermarket MRO segment. Customer service, component certification support, and life-cycle management form the final crucial stages of the value chain, ensuring compliance and operational continuity for the end-user airlines.

Aircraft Interiors Market Potential Customers

The primary customers in the Aircraft Interiors Market are organizations requiring flight-ready, certified cabin components and systems, spanning commercial, regional, and private aviation sectors. The largest customer segment consists of global commercial airlines, ranging from full-service carriers (FSCs) that prioritize premium, luxurious, and technologically advanced cabins (e.g., Emirates, Singapore Airlines) to low-cost carriers (LCCs) that emphasize high-density seating configurations, standardization, and extreme durability to minimize operational costs. These airlines purchase components either directly from OEMs as part of new aircraft packages or through aftermarket channels for refurbishment and upgrades.

A second major customer group includes Original Equipment Manufacturers (OEMs) such as Airbus, Boeing, Embraer, and COMAC. These manufacturers act as direct buyers of major interior systems (seats, monuments, IFEC) which are integrated into the airframes during the production phase. Suppliers compete vigorously for these high-volume, standardized contracts. The relationships with OEMs are strategic and often dictate market share and technological direction. Furthermore, specialized charter and fractional ownership operators focused on business aviation represent a crucial, albeit smaller, segment demanding high levels of customization, luxury finishes, and bespoke cabin layouts not typically seen in commercial aviation.

Finally, Maintenance, Repair, and Overhaul (MRO) providers, both independent and airline-affiliated, represent the core of the aftermarket demand. MROs purchase replacement parts, repair kits, and new upgrade systems (e.g., IFEC retrofits, new seat covers, or minor monument repairs) to service existing fleets. Government and military fleets also constitute a specialized customer base, requiring highly ruggedized interiors optimized for functionality over comfort, often procured through defense contractors and specific government purchasing channels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 25.9 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Safran S.A., Collins Aerospace (Raytheon Technologies), STELIA Aerospace, Recaro Aircraft Seating GmbH & Co. KG, Diehl Stiftung & Co. KG, Panasonic Avionics Corporation, Thales Group, Lantal Textiles AG, Triumph Group Inc., AIM Altitude (A Division of AVIC), Bucher Group, Geven S.p.A., HAECO Group, TSI Aviation Seats, FACC AG, Jamco Corporation, Sogerma (Zodiac Seats), Aviointeriors S.p.A., EnCore Interiors, Ltd., Thompson Aero Seating. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Interiors Market Key Technology Landscape

The technology landscape of the Aircraft Interiors Market is dominated by innovations aimed at achieving weight reduction, enhancing digital connectivity, and improving hygiene and durability. Key advancements center on material science, particularly the deployment of advanced composites such as carbon fiber and high-performance thermoplastics. These materials are essential for manufacturing lighter seating structures and monuments (galleys and lavatories) that maintain superior structural integrity and fire resistance. The pursuit of lightweight components directly translates into reduced fuel burn, providing a crucial competitive advantage for both suppliers and airlines. Furthermore, 3D printing (Additive Manufacturing) is gaining traction, allowing for the rapid prototyping of complex parts and the production of highly customized, optimized components with minimal material waste, especially valuable in the MRO segment for small-volume part fabrication.

Digitalization and connectivity represent the fastest-growing technological area. The migration towards high-bandwidth In-Flight Entertainment and Connectivity (IFEC) systems, leveraging Ka-band and Ku-band satellite technology, is crucial for offering passengers high-speed internet access comparable to ground services. New IFEC systems are increasingly moving away from bulky seat-back boxes towards cloud-based solutions, integrated with fiber optics and wireless distribution networks throughout the cabin. This trend not only saves weight but also facilitates real-time data exchange, supporting predictive maintenance and enabling the delivery of personalized, streaming content.

Another significant technological theme is the development of Smart Cabin systems, incorporating Internet of Things (IoT) sensors into various components. These sensors monitor everything from seat occupancy and passenger comfort metrics (temperature, vibration) to the operational status of galley equipment and lavatory components. The data gathered is processed by Artificial Intelligence (AI) algorithms to provide cabin crews with actionable insights, optimize maintenance schedules, and improve passenger service delivery. Additionally, advancements in cabin lighting, specifically sophisticated LED systems capable of dynamic color shifts and brightness adjustments, are being utilized to influence circadian rhythms, thereby minimizing jet lag and enhancing the overall onboard ambiance.

Regional Highlights

Regional dynamics heavily influence the Aircraft Interiors Market, driven by factors such as fleet size, economic development, airline investment cycles, and regulatory environments.

- North America: This region holds a leading position, characterized by major aircraft OEMs (Boeing) and large airline groups engaged in continuous fleet modernization and cabin retrofit programs. The market here is highly mature, with a strong focus on advanced connectivity (IFEC) and the utilization of third-party MRO services. Innovation often targets premium cabin optimization and compliance with stringent FAA regulations.

- Europe: Europe is a dominant hub, housing Airbus and major interior suppliers (e.g., Safran, Diehl). The market is driven by sustainability goals, pushing demand for lightweight materials and efficient designs. European carriers are aggressive in retrofitting older aircraft to meet modern passenger expectations, leading to robust activity in the MRO segment. Regulatory standards from EASA ensure high safety and design thresholds.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market globally. This exponential growth is fueled by massive fleet expansion, particularly in emerging economies like China and India, where rising middle classes are demanding increased air travel capacity. Airlines in this region are investing heavily in new aircraft equipped with the latest IFEC and comfortable seating to compete globally, driving high OEM demand.

- Middle East: The region is known for its flag carriers (e.g., Emirates, Qatar Airways) that set global benchmarks for luxury and bespoke first-class and business-class interiors. Market activity is concentrated on high-value, highly customized projects involving specialized seating, luxurious finishes, and cutting-edge IFEC technology, often requiring unique supplier capabilities.

- Latin America and Africa (LAMEA): These regions represent emerging markets characterized by low-cost carrier expansion and the operational necessity for durable, low-maintenance interiors. Growth is gradual, primarily driven by fleet renewal and modest cabin upgrades focused on economy-class density optimization and regional connectivity requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Interiors Market.- Safran S.A.

- Collins Aerospace (Raytheon Technologies)

- STELIA Aerospace

- Recaro Aircraft Seating GmbH & Co. KG

- Diehl Stiftung & Co. KG

- Panasonic Avionics Corporation

- Thales Group

- Lantal Textiles AG

- Triumph Group Inc.

- AIM Altitude (A Division of AVIC)

- Bucher Group

- Geven S.p.A.

- HAECO Group

- TSI Aviation Seats

- FACC AG

- Jamco Corporation

- Sogerma (Zodiac Seats)

- Aviointeriors S.p.A.

- EnCore Interiors, Ltd.

- Thompson Aero Seating

Frequently Asked Questions

Analyze common user questions about the Aircraft Interiors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major trends are driving innovation in aircraft seating?

Innovation in aircraft seating is primarily driven by the need for extreme lightweighting (using composites and advanced polymers to save fuel), enhanced passenger personalization (ergonomics, integrated charging, and connectivity ports), and increased density optimization, particularly within the Premium Economy and Economy Class segments.

How significant is the role of IFEC in the market growth?

The In-Flight Entertainment and Connectivity (IFEC) segment is critical, experiencing high growth due to the shift towards high-speed, satellite-based Wi-Fi (Ka-band/Ku-band) and the development of lightweight, streaming-capable systems. Airlines view IFEC as a non-negotiable factor for passenger satisfaction and competitive differentiation.

Which segment, OEM or Aftermarket, offers greater growth potential?

While the OEM segment provides large, stable contracts linked to new aircraft deliveries, the Aftermarket (MRO and Retrofit) segment is expected to show faster growth. Airlines are increasingly retrofitting existing fleets with new interiors to extend asset life, adopt new technology, and align with brand requirements, offering robust and flexible opportunities for suppliers.

What is the primary material focus in the aircraft interiors industry?

The primary material focus is on advanced composite materials (like carbon fiber reinforced plastics) and high-performance thermoplastics. These materials are essential for meeting stringent flammability and structural safety standards while drastically reducing component weight, directly impacting the operational efficiency of the aircraft.

How does sustainability influence the design of aircraft interiors?

Sustainability mandates are pushing designers toward utilizing recycled, ethically sourced, and durable eco-friendly textiles and finishes. Furthermore, the core drive for sustainability is weight reduction through lightweight materials, as minimizing aircraft mass is the most direct method to reduce carbon emissions associated with fuel consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager