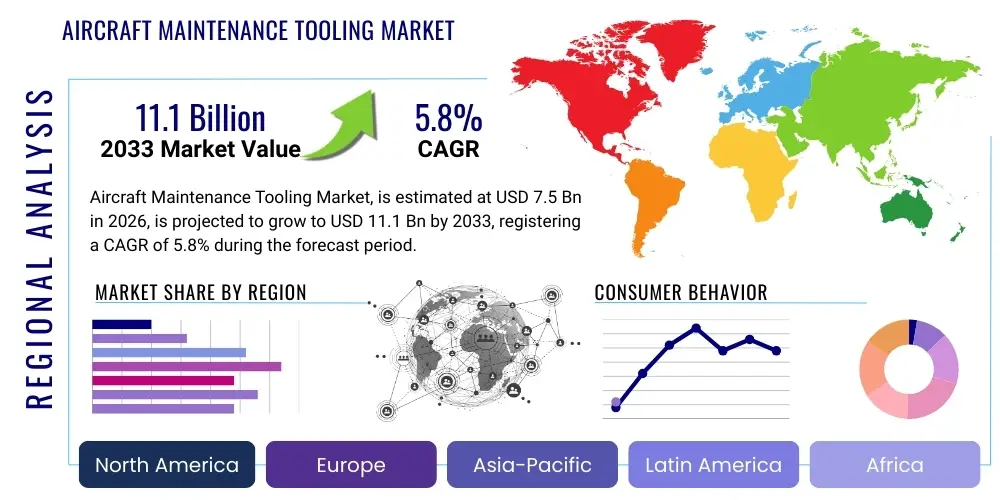

Aircraft Maintenance Tooling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438647 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Aircraft Maintenance Tooling Market Size

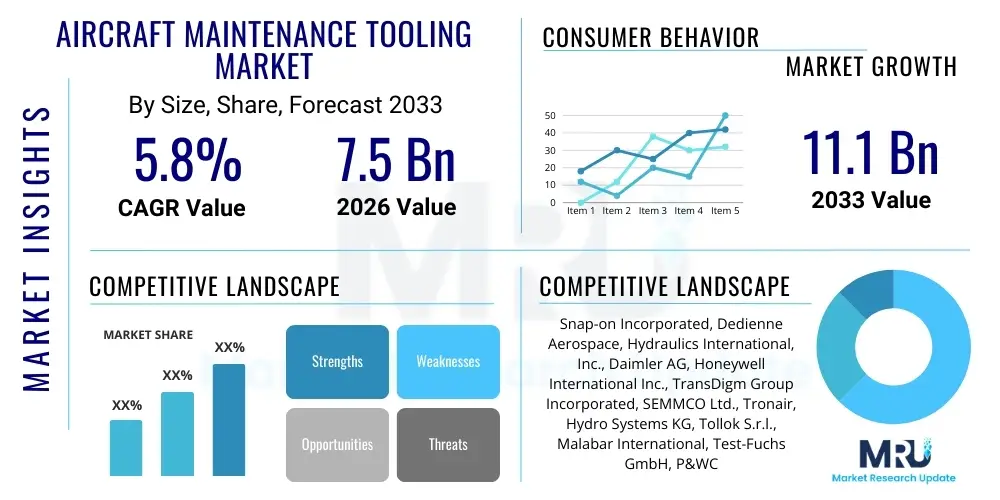

The Aircraft Maintenance Tooling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $11.1 Billion by the end of the forecast period in 2033.

Aircraft Maintenance Tooling Market introduction

The Aircraft Maintenance Tooling Market encompasses a wide array of specialized equipment essential for the comprehensive upkeep, repair, and overhaul (MRO) of commercial, military, and general aviation aircraft. This tooling ranges significantly from standard hand tools and precision measurement devices to highly complex, specialized ground support equipment (GSE) and engine specific tools designed for intricate operations on critical components like landing gear, hydraulics, avionics, and powerplants. The products covered are crucial for ensuring aviation safety, operational efficiency, and strict compliance with global airworthiness directives imposed by regulatory bodies such as the FAA and EASA. The market’s primary focus is on delivering tools that enhance technician productivity, minimize aircraft downtime, and maintain the structural integrity of high-value aerospace assets.

Major applications of aircraft maintenance tooling span across line maintenance (quick turnarounds), base maintenance (scheduled heavy checks, structural repairs), and component MRO shops. Specialized tooling, often developed in collaboration with Original Equipment Manufacturers (OEMs), is mandatory for tasks that require precise tolerances, such as rigging control surfaces, installing high-bypass turbofan engine modules, or performing non-destructive testing (NDT). The inherent complexity and diversity of modern aircraft fleets, coupled with the introduction of new materials like carbon fiber composites, necessitate continuous innovation in tooling design, focusing on ergonomics, durability, and integration with digital maintenance records.

The market is fundamentally driven by the expansion of the global commercial aircraft fleet, the rising average age of in-service aircraft requiring more intensive maintenance cycles, and the increasing trend towards MRO outsourcing. Key benefits derived from robust and certified tooling include reduced human error, accelerated repair times, and verifiable compliance, which collectively contribute to the economic viability and safety record of aviation operators globally. Furthermore, the stringent regulatory environment mandates the use of calibrated and certified tools, ensuring a stable demand for high-quality, professional-grade equipment necessary for the long-term sustainability of aviation operations.

Aircraft Maintenance Tooling Market Executive Summary

The Aircraft Maintenance Tooling Market is poised for significant expansion, driven primarily by strong underlying growth in air passenger traffic and the subsequent need for expanded global MRO capacity. Business trends indicate a marked shift towards smart tooling and digitalization, where tools are increasingly integrated with maintenance execution systems (MES) and enterprise resource planning (ERP) platforms to provide real-time data on usage, calibration status, and workflow progression. This integration is crucial for MRO providers seeking to maximize efficiency and transition toward predictive maintenance models. Geographically, while North America and Europe remain mature, high-value markets characterized by strict regulatory adherence and high-tech tool adoption, the Asia Pacific region is demonstrating the highest growth trajectory, fueled by rapid fleet expansion and the establishment of new, large-scale MRO centers in emerging economies like China and India.

Segment trends highlight the growing importance of specialized and customized tooling over generic standard tools. The introduction of advanced aircraft platforms, such as the Boeing 787 and Airbus A350, built with composite materials and advanced avionics, requires specific, manufacturer-approved tools that cannot be substituted. Consequently, the segment focused on specialized engine tooling and airframe assembly and repair kits is experiencing accelerated demand. Furthermore, the End-User segment shows commercial airlines and independent MRO organizations as the dominant consumers, with military aviation maintaining a consistent demand for highly durable, platform-specific ground support equipment and military-grade measurement tools.

Strategically, market participants are focusing on vertical integration, offering integrated tooling services, including leasing, calibration, and tool management programs, rather than just selling physical equipment. This service-oriented approach provides recurring revenue streams and strengthens customer relationships, particularly with major global airlines and MRO networks. The competitive landscape is characterized by established global players who invest heavily in R&D to meet evolving OEM specifications and smaller specialized companies offering niche, technologically advanced solutions, particularly in non-destructive testing and precision measurement domains. The overall market momentum is strong, underpinned by mandatory regulatory compliance and the non-negotiable requirement for aviation safety.

AI Impact Analysis on Aircraft Maintenance Tooling Market

User inquiries regarding AI's influence in the Aircraft Maintenance Tooling Market frequently center on three main themes: the optimization of tool inventory and logistics, the enhancement of predictive tool maintenance schedules, and the role of AI in quality control and procedural guidance for complex tasks. Users are keen to understand how AI algorithms, coupled with smart tooling data, can reduce 'tool search time' and improve 'first-time fix' rates. Key concerns revolve around the cybersecurity risks associated with networked smart tools and the necessary investment in training technicians to interact effectively with AI-driven guidance systems, such as augmented reality overlays that integrate tooling data directly into the repair environment. The core expectation is that AI will transform tooling from a static asset into an intelligent component of the overall maintenance ecosystem.

AI's primary impact involves leveraging vast datasets generated by smart tools—including torque readings, cycle counts, and calibration history—to establish predictive models for tool failure and calibration drift. By analyzing patterns, AI can automatically trigger preventative maintenance or replacement notifications, significantly reducing the risk of using non-compliant equipment, which is a critical safety and compliance issue in aviation MRO. Furthermore, AI-powered computer vision and machine learning algorithms are being integrated into NDT equipment to enhance defect detection accuracy, especially in composite structures, where human interpretation can be inconsistent. This shift enhances the reliability of maintenance outputs.

The logistical application of AI is also transformative. By processing real-time demand signals, scheduled maintenance requirements, and historical usage patterns, AI-driven systems can optimize tool room operations. This includes dynamically adjusting inventory levels, automating the distribution of tools to hangar locations right before they are needed (Tool-as-a-Service model), and ensuring that all necessary specialized equipment is readily available, thereby minimizing expensive aircraft ground time. This intelligent orchestration elevates the efficiency of MRO operations and maximizes the utilization rates of high-capital-cost specialized tooling, directly impacting airline profitability and operational flow.

- Enhanced Predictive Maintenance Scheduling for Tool Calibration and Replacement.

- AI-Driven Optimization of Tool Room Inventory and Logistics Management.

- Integration of Machine Learning into NDT Equipment for Improved Defect Detection Accuracy.

- Real-Time Quality Control and Procedural Verification via AI-Augmented Smart Tools.

- Automation of Complex Tooling Assignments and Workflow Generation.

- Reduced Tool Search Time and Misplacement Incidents through Digital Tracking and Geofencing.

DRO & Impact Forces Of Aircraft Maintenance Tooling Market

The dynamics of the Aircraft Maintenance Tooling Market are complex, influenced by strong regulatory drivers and technological advancements, yet constrained by high initial investment costs and the specialized nature of the equipment. Key drivers include the mandatory increase in the global commercial aircraft fleet, necessitating proportional growth in MRO activities, and the increasingly stringent global aviation safety standards, which mandate the use of calibrated, certified, and specialized tools for every maintenance task. Furthermore, the trend toward outsourcing heavy maintenance checks to independent MRO providers worldwide creates a continuous, high-volume demand for comprehensive tooling packages. These drivers ensure a stable and expanding market foundation.

Restraints primarily revolve around the significant capital expenditure required to acquire specialized maintenance tooling, particularly those designed for new-generation aircraft. The economic cycles affecting the airline industry can lead to deferred maintenance and reduced investment in new tooling technologies during downturns. Moreover, the necessity for frequent, often mandatory, recalibration and recertification of precision tools adds ongoing operational costs and complexity for MRO providers. The lack of standardized interfaces across different aircraft OEMs also creates a barrier, forcing MROs to maintain redundant, platform-specific tool sets, increasing inventory management burden and storage requirements.

Opportunities for growth are concentrated in the rapid adoption of Industry 4.0 technologies, including the integration of IoT sensors into tools (smart tools) and the application of Additive Manufacturing (3D printing) for creating custom, non-critical tooling parts rapidly and affordably. There is a significant market opportunity in providing integrated digital tool management solutions and data analytics services that leverage tooling usage data for efficiency improvements. Impact forces, analyzed through the lens of Porter’s Five Forces, indicate high bargaining power of buyers (major MRO groups and airlines) due to the fragmented supply side, coupled with moderate competitive rivalry driven by product differentiation (OEM-licensed vs. aftermarket tools) and strong barriers to entry due set by intellectual property and required certifications.

Segmentation Analysis

The Aircraft Maintenance Tooling Market is comprehensively segmented across several critical dimensions, including the type of tool, the application area within the aircraft structure, the specific end-user category, and the type of aircraft being serviced. This detailed segmentation allows market participants and analysts to accurately gauge demand patterns and technological requirements across the diverse aviation landscape. The market for general maintenance tools, such as wrenches and measuring equipment, represents the volume component, while the specialized tooling segment, including engine specific stands and complex rigging tools, represents the high-value segment due to their proprietary nature and higher unit cost. Understanding these divisions is crucial for strategic market positioning and product development tailored to specific MRO needs.

Further granularity in segmentation highlights the critical division between tools used for airframe maintenance, focusing on structural integrity and control systems, and those dedicated to component MRO, particularly engines, landing gear, and avionics. Engine tooling, being highly proprietary and extremely costly, remains a dominant sub-segment, driven by the increasing complexity and size of modern turbofan engines. The end-user perspective clearly differentiates demand patterns: commercial carriers seek scalable, high-durability tools for frequent use, whereas military entities prioritize ruggedness and field-deployable solutions. This structural complexity mandates that tooling providers offer highly specialized solutions that adhere strictly to aerospace standards.

The analysis demonstrates that the fastest-growing segment is likely to be specialized tooling for new-generation, composite aircraft (e.g., A350, 787), as these platforms require unique methods and dedicated tools for repair and inspection that conventional methods cannot accommodate. Segmentation also facilitates understanding regional variances; for instance, regions with older fleets (parts of Latin America and MEA) exhibit higher demand for legacy aircraft tooling, while APAC, with its rapidly growing modern fleet, shows accelerated adoption of smart and digital tooling solutions. This diversity underscores the necessity for flexible manufacturing and distribution strategies within the competitive environment.

- By Tool Type:

- Standard Tools (General Hand Tools, Measurement Devices)

- Specialized Tools (Engine Turning Tools, Jig and Fixtures, Hydraulic Tools, Landing Gear Tools)

- Ground Support Equipment (GSE) Tooling (Towbars, Jacks, Maintenance Stands)

- Test & Measurement Equipment (Avionics Testers, NDT Equipment, Calibration Tools)

- By Application:

- Airframe Maintenance Tooling

- Engine Maintenance Tooling

- Landing Gear Maintenance Tooling

- Component and System MRO Tooling (Hydraulics, Electrical, Fuel Systems)

- By End-User:

- Commercial Airlines

- Independent MRO Organizations

- Military Aviation

- Original Equipment Manufacturers (OEMs)

- By Aircraft Type:

- Narrow-Body Aircraft Tooling

- Wide-Body Aircraft Tooling

- Regional Jet Aircraft Tooling

- General Aviation Aircraft Tooling

Value Chain Analysis For Aircraft Maintenance Tooling Market

The value chain of the Aircraft Maintenance Tooling Market begins with the upstream suppliers responsible for raw material procurement, encompassing high-grade specialty steels, advanced alloys, composites, and specialized electronic components required for smart tooling. This upstream segment is highly quality-sensitive, as the durability and precision of the final tools depend heavily on material integrity. Tooling manufacturers then undertake complex precision engineering and manufacturing processes, often requiring specialized certifications (e.g., AS9100) and intellectual property agreements, particularly when producing OEM-licensed or proprietary tools. Strategic relationships with raw material suppliers and technology component providers (for IoT sensors, calibration modules) are crucial at this stage to maintain cost control and assure product quality.

The distribution channel forms the crucial link between manufacturers and end-users. Direct distribution channels involve major tooling manufacturers selling directly to large commercial airlines, global MRO networks, or aircraft OEMs, often facilitated through long-term service contracts that include maintenance, calibration, and lease agreements. These direct relationships offer better control over inventory and service quality. Conversely, indirect distribution utilizes authorized distributors, third-party tooling service providers, and specialized MRO supply chain aggregators, who cater more effectively to smaller airlines, regional MRO shops, and general aviation segments. The robustness of the distribution network is vital, as rapid tool replacement or delivery is often critical to avoid AOG (Aircraft on Ground) situations.

Downstream, the end-users—primarily MRO organizations and airlines—are the final consumers. Their high demands for tool reliability, calibration accuracy, and traceability drive purchasing decisions. Furthermore, specialized leasing services and integrated tool management programs (Tool-as-a-Service or TaaS) represent a growing trend in the downstream market, where end-users prefer operational expenditure models over large capital outlays. The efficiency of the entire value chain is determined by the seamless flow of high-precision products and associated calibration data from the manufacturer through the channel to the point of maintenance, ensuring regulatory compliance at every step and significantly influencing MRO efficiency and aircraft turnaround time.

Aircraft Maintenance Tooling Market Potential Customers

The primary customers in the Aircraft Maintenance Tooling Market are large commercial airlines and dedicated independent Maintenance, Repair, and Overhaul (MRO) service providers. Commercial airlines, especially major flag carriers and large low-cost carriers (LCCs) with substantial in-house MRO capabilities, require extensive inventories of both general and highly specialized tools to support their operational fleets. Their demand profile emphasizes high utilization, durability, and mandatory certification traceability, as tooling directly impacts their core operational metrics, such as dispatch reliability and safety compliance. These customers often enter into long-term procurement and tool leasing contracts to manage capital expenditure and ensure the immediate availability of mission-critical equipment.

Independent MRO providers, ranging from large, multi-site global operations to specialized component repair shops, represent the highest growth potential customer segment. As airlines increasingly outsource heavy maintenance checks, MRO organizations need to rapidly acquire comprehensive tooling packages compatible with diverse aircraft types (e.g., Airbus, Boeing, Embraer). Their purchasing decisions are heavily influenced by tool compatibility, efficiency metrics (tooling setup time), and the ability to integrate smart tooling data into their facility-wide maintenance management systems. Specialized MROs focusing on engines or landing gear are particularly significant buyers of proprietary, high-cost specialized jigs, fixtures, and calibration equipment.

Other key potential customer groups include military aviation branches globally, which require ruggedized, field-operable tooling often manufactured to stricter military specifications, and aircraft Original Equipment Manufacturers (OEMs). OEMs not only use the tools in their final assembly and production lines but also drive the demand for specific, often patented, tooling designs necessary for authorized maintenance procedures throughout the aircraft's lifecycle. Additionally, smaller regional and general aviation operators, though purchasing lower volumes, contribute steady demand for essential general and standard-grade maintenance tools, often sourcing them through indirect distribution channels and local suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $11.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Snap-on Incorporated, Dedienne Aerospace, Hydraulics International, Inc., Daimler AG, Honeywell International Inc., TransDigm Group Incorporated, SEMMCO Ltd., Tronair, Hydro Systems KG, Tollok S.r.l., Malabar International, Test-Fuchs GmbH, P&WC Tool, GSE Tech, TLD Group, Airbus S.E., Boeing Co., Safran S.A., AAR Corp., General Electric Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Maintenance Tooling Market Key Technology Landscape

The technology landscape within the Aircraft Maintenance Tooling Market is undergoing a rapid evolution, primarily driven by the principles of Industry 4.0 and the need for higher precision and traceability in maintenance procedures. The most significant advancement is the proliferation of smart tooling, which integrates IoT sensors, Bluetooth connectivity, and internal memory modules directly into standard equipment like torque wrenches, multimeters, and hydraulic calibration units. These smart tools automatically record usage data, torque application profiles, and calibration status in real-time. This capability not only ensures regulatory compliance by providing an immutable record of maintenance activity but also feeds into predictive analytics systems to schedule tool maintenance before performance degradation occurs, preventing potential errors that could jeopardize flight safety.

Another crucial technological development is the adoption of Augmented Reality (AR) and Virtual Reality (VR) solutions integrated with maintenance tooling workflows. AR head-mounted displays guide technicians through complex, multi-step maintenance tasks by overlaying digital instructions, schematics, and even specific tool usage parameters directly onto the physical component being serviced. This technology significantly reduces training time, minimizes cognitive load, and decreases the dependency on cumbersome paper manuals. By linking AR guidance systems to digitally managed smart tools, MRO facilities can achieve unprecedented levels of accuracy and standardization, which is paramount when working with sensitive systems like avionics or flight controls.

Furthermore, additive manufacturing (3D printing) is rapidly gaining traction, particularly for on-demand production of highly specialized, non-load-bearing tools, jigs, fixtures, and custom inserts. This allows MRO shops to quickly produce niche tooling that might otherwise have long lead times if sourced conventionally from an OEM, thereby significantly reducing Aircraft on Ground (AOG) time. Digital calibration systems, replacing traditional manual methods, also constitute a key technology. These systems offer faster, more accurate calibration checks, often remotely managed, ensuring that the critical precision required for specialized aerospace tooling is constantly maintained and verifiable via a digital thread, enhancing operational efficiency and lowering the logistical burden associated with mandatory recalibration cycles.

Regional Highlights

- North America: North America, led by the United States, represents a mature, high-value market characterized by robust regulatory oversight, high technological adoption rates, and a vast installed base of aircraft. The region is home to major aerospace OEMs and global MRO service providers who are early adopters of smart tooling, digital inventory management, and high-precision NDT equipment. Demand is stable, driven by the replacement cycle of aging fleets and significant military aviation requirements. The emphasis here is on efficiency gains through automation and data integration, often utilizing Tool-as-a-Service models.

- Europe: Europe is another key market, driven by powerful regulatory bodies (EASA) and a concentration of major aerospace players (Airbus, Safran). The market features strong demand for engine tooling and specialized structural repair equipment, especially for composite materials, reflecting the region's focus on advanced aircraft platforms. The market is highly competitive, emphasizing tool certification, ergonomics, and sustainable manufacturing practices, with significant R&D investment directed towards integrated digital maintenance solutions across countries like Germany, France, and the UK.

- Asia Pacific (APAC): APAC is the fastest-growing regional market globally, propelled by exponential growth in air traffic, massive fleet expansions (particularly narrow-body jets), and the establishment of new MRO hubs in China, India, and Southeast Asia. The demand is characterized by high volume requirements for both standard and specialized tools to equip new facilities. Governments and major carriers in the region are making substantial investments in MRO infrastructure, focusing on acquiring complete tooling sets and modern ground support equipment necessary to service a primarily modern fleet.

- Latin America: This region presents a market with moderate growth, characterized by significant usage of legacy aircraft alongside a slow introduction of newer models. The primary demand centers on cost-effective, durable general maintenance tooling and MRO services for older airframes and engines. Economic instability often leads to a preference for tool leasing and refurbished equipment, requiring suppliers to offer flexible financing and robust regional support networks.

- Middle East and Africa (MEA): The MEA region is expanding, fueled by significant investments in major hub airlines (e.g., Emirates, Qatar Airways) and the development of large, world-class MRO facilities, especially in the UAE and Qatar. Demand is high for advanced, highly reliable specialized tools to maintain long-haul wide-body aircraft. African markets, while fragmented, show increasing need for standard tooling to support regional carriers and general aviation growth, often relying on global distributors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Maintenance Tooling Market.- Snap-on Incorporated

- Dedienne Aerospace

- Hydraulics International, Inc.

- Daimler AG (Through subsidiaries providing GSE)

- Honeywell International Inc. (Focus on test equipment)

- TransDigm Group Incorporated (Acquisition heavy, various GSE/tooling)

- SEMMCO Ltd.

- Tronair

- Hydro Systems KG

- Tollok S.r.l.

- Malabar International

- Test-Fuchs GmbH

- P&WC Tool (Pratt & Whitney Canada Tooling)

- GSE Tech

- TLD Group

- Airbus S.E. (Internal Tooling & Licensing)

- Boeing Co. (Internal Tooling & Licensing)

- Safran S.A. (Engine Tooling Focus)

- AAR Corp. (MRO and Supply Chain services)

- General Electric Company (Engine specific tooling)

Frequently Asked Questions

Analyze common user questions about the Aircraft Maintenance Tooling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for specialized aircraft maintenance tooling?

Demand is driven primarily by the mandatory increase in the global commercial aircraft fleet, stringent international safety regulations requiring certified tools, and the increasing complexity of new-generation aircraft built with composite materials that necessitate proprietary repair and inspection methods.

How is Industry 4.0 influencing the design of aircraft maintenance tools?

Industry 4.0 is leading to the adoption of "smart tooling," which integrates IoT sensors and connectivity. These tools capture real-time data on torque, usage, and calibration status, facilitating automated record-keeping, predictive maintenance, and seamless integration with MRO execution systems for higher traceability.

Which segment of the Aircraft Maintenance Tooling Market is expected to grow the fastest?

The specialized tooling segment, particularly tools required for engine MRO and advanced airframe maintenance (especially for wide-body and composite aircraft), is projected to exhibit the highest growth rate due to proprietary requirements and the high replacement value of these critical components.

What role does 3D printing play in the aircraft maintenance tooling sector?

Additive Manufacturing (3D printing) enables MRO providers to rapidly create customized, non-critical jigs, fixtures, and specialized maintenance aids on-demand. This significantly reduces lead times and inventory costs associated with acquiring unique or obsolete OEM tools, minimizing aircraft ground time.

What are the primary challenges restraining the growth of this market?

Key restraints include the high initial capital investment required for specialized equipment, the complexities and operational costs associated with mandatory frequent tool calibration and certification, and economic fluctuations within the global airline industry impacting MRO budgets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager