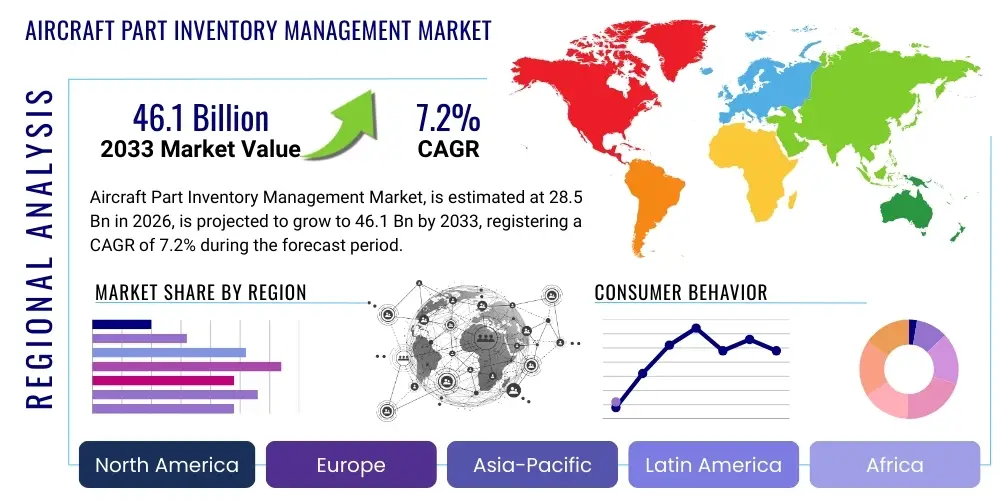

Aircraft Part Inventory Management Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440663 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Aircraft Part Inventory Management Market Size

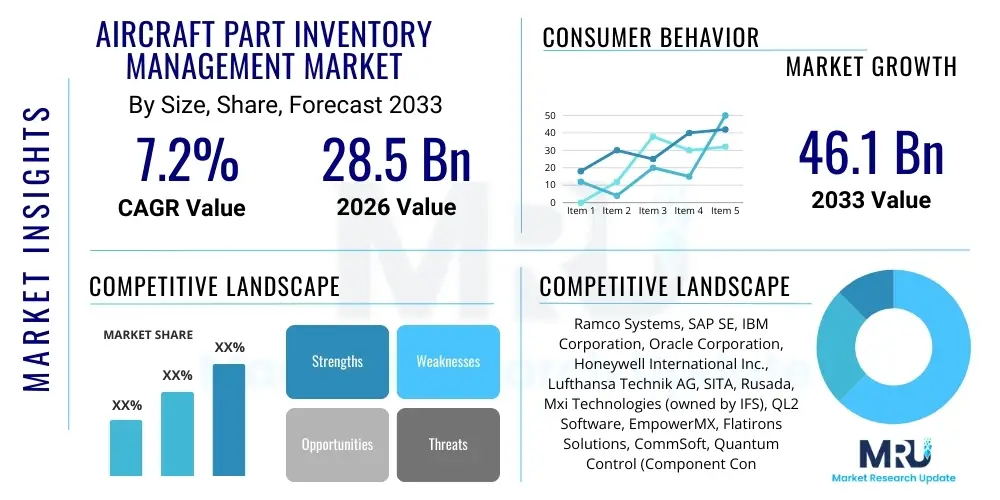

The Aircraft Part Inventory Management Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 28.5 Billion in 2026 and is projected to reach USD 46.1 Billion by the end of the forecast period in 2033.

Aircraft Part Inventory Management Market introduction

The Aircraft Part Inventory Management Market encompasses the systems, software, and services dedicated to optimizing the storage, tracking, and availability of components essential for aircraft maintenance, repair, and overhaul (MRO) operations. This critical domain addresses the complexities of managing a vast array of parts, from rotables and expendables to consumables, ensuring that the right part is available at the right time and place to minimize aircraft downtime and operational costs. Product descriptions within this market often include sophisticated MRO software suites, enterprise resource planning (ERP) modules tailored for aviation, and specialized inventory tracking solutions leveraging advanced analytics and automation. Major applications span commercial airlines, military aviation, general aviation, and third-party MRO providers, all striving for enhanced operational efficiency and compliance with stringent aviation regulations.

The primary benefits of robust aircraft part inventory management include significant reductions in holding costs, improved supply chain visibility, minimized stock-outs, and accelerated maintenance turnaround times. Effective inventory management directly contributes to flight safety by ensuring certified parts are readily accessible for scheduled and unscheduled repairs. Key driving factors propelling market growth involve the continuous expansion of global aircraft fleets, an increasing demand for MRO services driven by aging aircraft and higher flight hours, and a growing emphasis on predictive maintenance strategies. Furthermore, the imperative to reduce operational expenditures, coupled with technological advancements in digitalization and automation, continues to underscore the critical importance of sophisticated inventory solutions across the aviation sector.

Aircraft Part Inventory Management Market Executive Summary

The Aircraft Part Inventory Management Market is undergoing significant transformation, primarily driven by accelerating digital adoption and the strategic imperative for cost optimization across the aviation industry. Business trends indicate a strong shift towards integrated MRO software platforms that offer end-to-end visibility and automation, moving away from disparate systems. Airlines and MRO providers are increasingly investing in solutions that leverage advanced analytics, artificial intelligence, and machine learning to predict part demand, optimize stocking levels, and streamline procurement processes. The focus is on creating resilient and agile supply chains capable of responding to both routine maintenance schedules and unforeseen operational disruptions with minimal impact on fleet availability. Furthermore, sustainability concerns are influencing inventory strategies, pushing for better part utilization and repair capabilities to extend component lifespans.

Regional trends reveal robust growth in the Asia Pacific (APAC) market, fueled by expanding airline fleets, increasing passenger traffic, and the establishment of new MRO facilities. North America and Europe continue to be mature markets characterized by high adoption rates of advanced inventory management solutions and significant investment in R&D for next-generation technologies. Latin America, the Middle East, and Africa are also witnessing steady growth, driven by fleet modernizations and the development of local MRO capabilities, albeit with varying levels of technological integration. These regions often prioritize cost-effective solutions while also seeking to enhance operational efficiencies and compliance with international standards.

In terms of segment trends, the software segment is experiencing substantial expansion, with a particular demand for cloud-based solutions offering scalability and remote access. Services, including consulting, implementation, and maintenance, are also witnessing strong growth as organizations seek expert guidance in navigating complex system integrations and data migration. By aircraft type, the commercial aircraft segment dominates due to the sheer volume of global passenger and cargo fleets, necessitating extensive part inventories. However, the military aircraft segment also shows consistent demand, driven by stringent maintenance requirements and the need for specialized, often unique, components. End-user segments, particularly airlines and independent MROs, are the primary drivers of demand, constantly seeking to optimize their inventory holdings and improve overall operational performance.

AI Impact Analysis on Aircraft Part Inventory Management Market

User inquiries about AI's impact on Aircraft Part Inventory Management frequently revolve around its potential to enhance predictive capabilities, automate mundane tasks, and improve overall supply chain efficiency. Common questions probe how AI can forecast demand more accurately, reduce inventory holding costs, minimize stock-outs, and identify optimal stocking locations. Users are keen to understand the practical applications of machine learning algorithms in failure prediction, real-time inventory tracking, and dynamic pricing strategies for parts. Concerns often include data integration challenges, the need for robust data governance, the reliability of AI predictions in highly variable operational environments, and the initial investment required to implement such sophisticated systems. Expectations are high for AI to revolutionize traditional inventory practices, moving from reactive to highly proactive and intelligent management.

- Enhanced Demand Forecasting: AI algorithms analyze historical data, flight schedules, weather patterns, and MRO events to predict part demand with unprecedented accuracy, minimizing overstocking and stock-outs.

- Predictive Maintenance Integration: AI-driven predictive maintenance systems can signal potential part failures before they occur, allowing inventory managers to proactively procure and position necessary components, significantly reducing unscheduled downtime.

- Optimized Stock Levels and Locations: Machine learning models determine optimal inventory levels for various parts across different storage locations, considering usage rates, lead times, and criticality, thereby lowering carrying costs and improving availability.

- Automated Reordering and Procurement: AI can automate the reordering process by triggering procurement requests based on predicted demand and current stock levels, streamlining the supply chain and reducing manual effort.

- Dynamic Pricing and Supplier Management: AI analyzes market trends, supplier performance, and pricing data to inform more strategic purchasing decisions, negotiate better deals, and manage supplier relationships more effectively.

- Improved Obsolescence Management: AI identifies parts at risk of obsolescence or nearing end-of-life, enabling timely disposition or strategic stocking to avoid financial losses and maintain operational readiness.

- Enhanced Data Analytics and Reporting: AI tools provide deeper insights into inventory performance, identifying inefficiencies, bottlenecks, and trends that would be difficult to spot through traditional analysis, supporting data-driven decision-making.

DRO & Impact Forces Of Aircraft Part Inventory Management Market

The Aircraft Part Inventory Management Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, shaping its growth trajectory and adoption patterns. A primary driver is the relentless growth of global air traffic and the subsequent expansion of commercial and cargo aircraft fleets, which inherently escalates the demand for MRO services and, by extension, parts. Concurrently, the aging of existing aircraft fleets necessitates more frequent and complex maintenance activities, increasing the volume and criticality of part inventory management. The imperative for airlines and MROs to minimize aircraft downtime and improve operational efficiency also acts as a powerful driver, pushing for advanced inventory solutions that promise greater availability and reduced costs. Furthermore, the increasing adoption of digital transformation initiatives, including the integration of IoT, AI, and big data analytics, provides the technological backbone for more sophisticated inventory systems, making these solutions more attractive and capable.

However, the market faces notable restraints. The substantial upfront investment required for implementing advanced inventory management software and integrating it with existing legacy systems can be a significant barrier for many organizations, particularly smaller MROs or regional airlines with limited capital. The inherent complexity of the aviation supply chain, characterized by a vast number of unique parts, stringent regulatory requirements, and global distribution networks, poses significant challenges for data standardization and interoperability. Additionally, the shortage of skilled personnel capable of effectively managing and leveraging these sophisticated systems, coupled with resistance to change within organizations, can hinder widespread adoption. The volatility in global economic conditions and geopolitical tensions can also disrupt supply chains and impact maintenance budgets, thereby restraining market growth.

Despite these challenges, the market is rich with opportunities. The increasing sophistication of AI and machine learning offers unprecedented potential for predictive maintenance and highly accurate demand forecasting, revolutionizing traditional inventory practices. The proliferation of blockchain technology presents an opportunity to enhance transparency, traceability, and authenticity across the complex aircraft part supply chain, mitigating issues of counterfeit parts. The growing trend towards MRO outsourcing by airlines provides independent MRO providers with an impetus to invest in cutting-edge inventory management solutions to enhance their competitiveness and service offerings. Furthermore, the development of cloud-based inventory management solutions offers greater scalability, flexibility, and cost-effectiveness, making advanced tools accessible to a broader range of market participants. The emphasis on sustainable aviation practices also opens avenues for solutions that promote part repairability, reuse, and efficient lifecycle management, aligning with environmental goals.

Segmentation Analysis

The Aircraft Part Inventory Management Market is meticulously segmented to provide a comprehensive understanding of its diverse components and drivers. This segmentation allows for targeted analysis of market dynamics, competitive landscapes, and growth opportunities across various dimensions. Key segments include those based on the type of part managed, the aircraft type, the end-user leveraging these solutions, and the specific solution or service offered. Each segment presents unique challenges and opportunities, influencing technology adoption rates and strategic investments within the aviation maintenance ecosystem. Understanding these distinctions is crucial for market participants to tailor their offerings effectively and for stakeholders to identify areas of significant growth or concentrated demand.

- By Part Type

- Rotables

- Expendables

- Consumables

- By Aircraft Type

- Commercial Aircraft

- Military Aircraft

- General Aviation Aircraft

- By End-User

- Airlines

- MRO Service Providers

- OEMs (Original Equipment Manufacturers)

- Defense & Government Entities

- By Solution

- Software

- On-Premise

- Cloud-Based

- Services

- Consulting & Implementation

- Maintenance & Support

- Training

- Software

- By Application

- Line Maintenance

- Base Maintenance

- Component Maintenance

Value Chain Analysis For Aircraft Part Inventory Management Market

The value chain for the Aircraft Part Inventory Management Market is complex, beginning with upstream activities involving component manufacturing and supply, progressing through inventory management and MRO operations, and culminating in downstream support for aircraft operators. Upstream analysis focuses on the manufacturers of aircraft parts (OEMs) and their network of authorized distributors, who play a crucial role in ensuring the availability and quality of components. This segment also includes raw material suppliers and sub-component manufacturers who feed into the primary part production process. Effective inventory management at this stage involves forecasting demand for new aircraft production and spare parts, managing lead times, and maintaining quality control, often necessitating robust supplier relationship management and sophisticated procurement systems.

Downstream analysis in the value chain primarily involves the end-users of aircraft parts and inventory management solutions, such as commercial airlines, military operators, and independent MRO service providers. These entities are responsible for the actual utilization of parts in maintenance operations, requiring sophisticated systems to track, store, and retrieve components efficiently. The distribution channel is multifaceted, encompassing direct sales from OEMs to major airlines or MROs, as well as indirect channels through third-party distributors, brokers, and logistics providers who specialize in aviation parts. Direct distribution offers greater control over the supply chain and direct customer relationships, often preferred for critical or high-value components. Indirect distribution, leveraging a network of specialized partners, provides broader reach and flexibility, particularly for less critical or widely used parts, and allows for efficient management of diverse regional requirements.

Both direct and indirect channels are critical in ensuring global availability and rapid deployment of parts. Inventory management software and services providers integrate into this chain by offering tools that optimize operations at every stage, from tracking part authenticity and provenance at the supplier level to forecasting demand at the airline or MRO level. The efficacy of the entire value chain hinges on seamless data exchange, robust logistics, and strict adherence to regulatory compliance, all of which are directly supported by advanced aircraft part inventory management solutions. Digitalization and real-time visibility across these stages are becoming paramount for enhancing efficiency, reducing costs, and improving overall operational resilience in the highly demanding aviation sector.

Aircraft Part Inventory Management Market Potential Customers

The primary potential customers and end-users of aircraft part inventory management solutions are diverse yet critically interconnected segments within the global aviation ecosystem. Commercial airlines, ranging from large flag carriers to regional operators, represent a significant customer base. These entities possess vast fleets and require extensive inventories of rotables, expendables, and consumables to support their scheduled maintenance and ensure operational continuity. Their need for efficient inventory management is driven by the imperative to minimize aircraft on ground (AOG) time, reduce carrying costs, and comply with stringent regulatory maintenance schedules. Effective inventory solutions enable them to optimize their internal MRO operations or facilitate smooth interactions with external MRO providers, ensuring parts are available precisely when needed.

Independent MRO (Maintenance, Repair, and Overhaul) service providers constitute another crucial segment of potential customers. These organizations specialize in providing maintenance services to multiple airlines, aircraft owners, and lessors, managing a wide array of parts across various aircraft types. Their business model heavily relies on the ability to efficiently manage inventory for a diverse client base, offering competitive turnaround times and cost-effective solutions. Advanced inventory management systems allow MROs to optimize their stock levels, streamline logistics, and enhance their service delivery, thereby strengthening their market position. The growing trend of MRO outsourcing further accentuates the demand from this segment, as MRO providers seek to improve operational efficiency and expand their service offerings to meet increasing client demands.

Furthermore, Original Equipment Manufacturers (OEMs) of aircraft and aircraft components are significant end-users, especially concerning their aftermarket services and warranty support. OEMs need robust inventory management systems to ensure the availability of spare parts for their manufactured aircraft, supporting their global customer base and fulfilling contractual obligations. Defense and government entities, including military aviation branches and national aerospace agencies, also represent a substantial customer segment. Their unique requirements often involve managing highly specialized, mission-critical parts with extended lifespans, necessitating highly secure and reliable inventory systems. Lastly, aircraft leasing companies, while not directly involved in maintenance, benefit indirectly from efficient inventory management as it contributes to the overall asset value and operational readiness of their leased fleets, impacting their profitability and residual values.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 28.5 Billion |

| Market Forecast in 2033 | USD 46.1 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ramco Systems, SAP SE, IBM Corporation, Oracle Corporation, Honeywell International Inc., Lufthansa Technik AG, SITA, Rusada, Mxi Technologies (owned by IFS), QL2 Software, EmpowerMX, Flatirons Solutions, CommSoft, Quantum Control (Component Control), Epicor Software Corporation, Trax, Cojali S.L., Swiss-AS, CAE Inc., Boeing Global Services |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Part Inventory Management Market Key Technology Landscape

The Aircraft Part Inventory Management Market is increasingly shaped by the integration of sophisticated technologies designed to enhance efficiency, accuracy, and predictability across the aviation supply chain. Central to this landscape are Enterprise Resource Planning (ERP) systems, specifically MRO ERP modules, which provide a centralized platform for managing all aspects of maintenance operations, including inventory, procurement, and labor. These systems offer comprehensive functionalities, enabling real-time visibility into stock levels, part movements, and maintenance schedules, thereby optimizing resource allocation and reducing manual errors. The shift towards cloud-based ERP solutions is prominent, offering greater scalability, reduced infrastructure costs, and enhanced accessibility for geographically dispersed operations, alongside improved data security measures crucial for the aviation sector.

Beyond core ERP, a suite of advanced technologies is transforming inventory practices. The Internet of Things (IoT) plays a vital role through sensor-based tracking of parts and equipment, enabling real-time monitoring of component health, location, and environmental conditions. This data feeds into predictive analytics models, often powered by Artificial Intelligence (AI) and Machine Learning (ML), which forecast part failures, optimize inventory stocking levels, and automate reordering processes. AI/ML algorithms analyze vast datasets, including historical usage, flight data, maintenance logs, and even weather patterns, to predict demand with high accuracy, moving from reactive to proactive inventory management. This capability significantly reduces excess inventory, minimizes stock-outs, and optimizes logistics.

Furthermore, blockchain technology is emerging as a critical tool for enhancing transparency and traceability throughout the aircraft part supply chain. By providing an immutable and distributed ledger, blockchain can track the entire lifecycle of a part, from manufacturing to installation and eventual disposal, verifying authenticity and preventing the introduction of counterfeit components. Robotic Process Automation (RPA) is also being deployed to automate repetitive administrative tasks such as data entry, invoice processing, and report generation, freeing up human resources for more complex decision-making. These integrated technologies collectively contribute to a more resilient, efficient, and secure aircraft part inventory management ecosystem, addressing the complex demands of modern aviation operations and ensuring the highest levels of safety and operational readiness.

Regional Highlights

- North America: This region stands as a dominant force in the Aircraft Part Inventory Management Market, characterized by early adoption of advanced technologies, a high concentration of major airlines, military bases, and leading MRO service providers. The presence of key market players and a strong focus on digital transformation, predictive maintenance, and robust supply chain resilience drives continuous innovation and investment.

- Europe: A mature market with a well-established aviation industry and stringent regulatory frameworks. European countries demonstrate high demand for sophisticated inventory management solutions due to a large existing aircraft fleet, significant MRO activities, and a strong emphasis on sustainability and operational efficiency. Investments in AI-driven solutions and cloud platforms are steadily increasing.

- Asia Pacific (APAC): The fastest-growing market, propelled by rapid expansion of airline fleets, increasing air passenger traffic, and the establishment of numerous new MRO facilities, particularly in China, India, and Southeast Asian countries. Government initiatives to develop local aviation capabilities and a growing acceptance of digital solutions are key growth drivers, though cost-effectiveness remains a significant consideration.

- Latin America: This region is experiencing steady growth, driven by fleet modernization efforts, increased air travel, and the development of regional MRO capabilities. While still relatively nascent compared to North America and Europe, there's a growing recognition of the need for efficient inventory management to optimize operational costs and enhance maintenance reliability.

- Middle East and Africa (MEA): Marked by significant investments in new aircraft and the development of world-class aviation hubs, particularly in the UAE and Qatar. These regions are witnessing a surge in demand for advanced inventory management solutions to support expanding fleets and MRO operations. Africa, while slower, is gradually adopting modern solutions to improve airline efficiencies and safety standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Part Inventory Management Market.- Ramco Systems

- SAP SE

- IBM Corporation

- Oracle Corporation

- Honeywell International Inc.

- Lufthansa Technik AG

- SITA

- Rusada

- Mxi Technologies (owned by IFS)

- QL2 Software

- EmpowerMX

- Flatirons Solutions

- CommSoft

- Quantum Control (Component Control)

- Epicor Software Corporation

- Trax

- Cojali S.L.

- Swiss-AS

- CAE Inc.

- Boeing Global Services

Frequently Asked Questions

What is Aircraft Part Inventory Management?

Aircraft Part Inventory Management (APIM) involves the strategic process of tracking, storing, and controlling the various components, consumables, and expendables required for the maintenance, repair, and overhaul (MRO) of aircraft. Its primary goal is to ensure the availability of the right part at the right time and place, minimizing aircraft downtime and optimizing operational costs.

Why is efficient Aircraft Part Inventory Management crucial?

Efficient APIM is crucial because it directly impacts flight safety, operational efficiency, and financial performance. It helps minimize aircraft on ground (AOG) situations, reduces inventory holding costs, prevents stock-outs, streamlines MRO processes, and ensures compliance with strict aviation regulations, ultimately contributing to a more reliable and cost-effective operation.

How does AI impact Aircraft Part Inventory Management?

AI significantly impacts APIM by enabling highly accurate demand forecasting, powering predictive maintenance, optimizing stock levels across multiple locations, and automating procurement processes. It analyzes vast datasets to identify patterns, predict failures, and streamline decision-making, leading to substantial cost savings and improved operational readiness.

What are the main challenges in Aircraft Part Inventory Management?

Key challenges include the high cost of implementing advanced systems, integrating new solutions with legacy infrastructure, the complexity of managing a diverse range of parts with varying lifespans and criticality, ensuring data accuracy and standardization across the supply chain, and navigating stringent regulatory compliance requirements.

What are the future trends in Aircraft Part Inventory Management?

Future trends include increased adoption of cloud-based MRO and inventory management software, greater integration of AI/ML for predictive analytics and automation, leveraging blockchain for enhanced part traceability and authenticity, utilizing IoT for real-time asset monitoring, and a growing emphasis on sustainable practices such as part repairability and reuse.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager