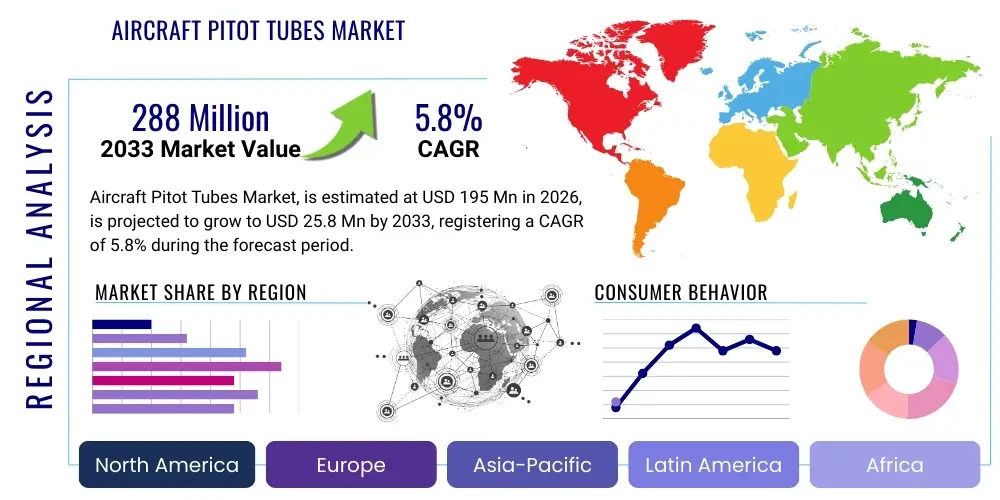

Aircraft Pitot Tubes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436481 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Aircraft Pitot Tubes Market Size

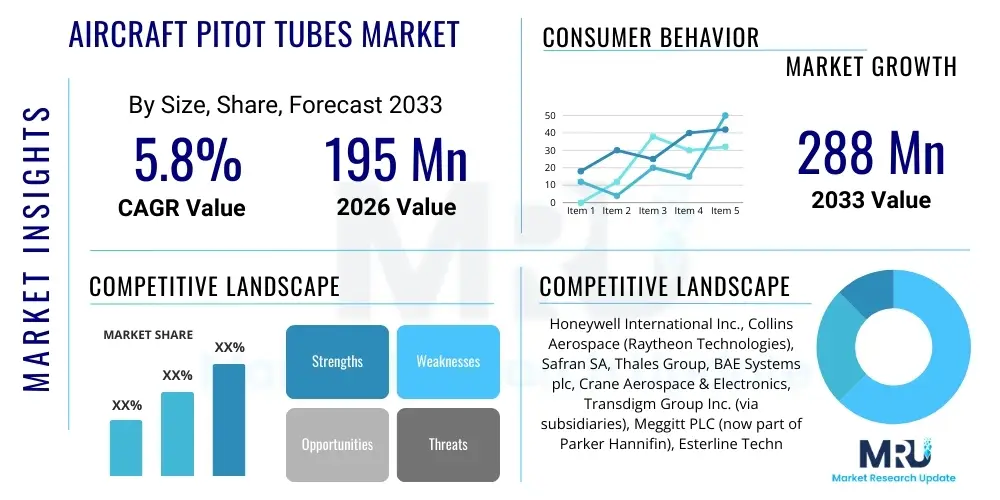

The Aircraft Pitot Tubes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 195 Million in 2026 and is projected to reach USD 288 Million by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the sustained recovery and subsequent growth of the global commercial aviation sector, coupled with ongoing modernization programs within military aviation forces worldwide. The necessity for highly accurate air data measurements across all phases of flight, from takeoff to landing, solidifies the foundational demand for reliable pitot tube technology, particularly those incorporating advanced de-icing and anti-contamination features, which are crucial for operating in diverse environmental conditions.

Aircraft Pitot Tubes Market introduction

The Aircraft Pitot Tubes Market encompasses the manufacturing, supply, and maintenance of specialized aerodynamic pressure sensors designed to measure the total pressure of the airflow surrounding an aircraft, which is subsequently used to calculate airspeed. A pitot tube, named after the French engineer Henri Pitot, functions by facing into the air stream, capturing ram air pressure (total pressure), and relaying this data to the Air Data Computer (ADC) or traditional flight instruments. This information is fundamentally critical for safe navigation, flight management, and compliance with stringent regulatory requirements concerning aircraft performance limits. The core product categories include heated and unheated tubes, catering to different operational environments and aircraft types, ranging from small general aviation planes to large commercial airliners and sophisticated military jets.

Major applications of these components span across various segments of the aviation industry, including fixed-wing commercial transport aircraft, rotary-wing helicopters, business jets, and unmanned aerial vehicles (UAVs). The pitot tube’s reliability directly impacts cockpit avionics, ensuring that flight control systems receive precise inputs for calculating critical parameters such as indicated airspeed, Mach number, and altitude data when integrated with static ports. Benefits derived from advanced pitot tube systems include enhanced safety through improved icing resistance, reduced maintenance requirements due to robust construction materials, and higher data accuracy achieved through miniaturization and digital interfacing capabilities, which are increasingly important for modern, fly-by-wire aircraft systems.

Driving factors for market growth are intrinsically linked to global aircraft delivery schedules, replacement cycles for aging fleets, and the increasing complexity of aerospace regulations that demand redundant and highly accurate air data systems. Furthermore, the rising adoption of sophisticated Anti-Icing Systems (AIS) and innovative material compositions, such as advanced titanium alloys and highly corrosion-resistant steels, contribute significantly to market value. The expansion of air travel, particularly in the Asia Pacific region, necessitates mass production of new-generation aircraft, which, in turn, drives the demand for certified, high-performance pitot tubes compliant with stringent FAA and EASA standards regarding performance under severe weather conditions.

Aircraft Pitot Tubes Market Executive Summary

The Aircraft Pitot Tubes Market is characterized by steady technological advancements, primarily focused on improving reliability, reducing susceptibility to environmental factors like icing and contamination, and enhancing integration capabilities with modern digital avionics suites. Business trends indicate a strong emphasis on strategic partnerships between airframe manufacturers (OEMs) and specialized sensor providers to co-develop integrated air data systems, ensuring seamless certification and reduced system weight. Furthermore, increasing regulatory pressure following high-profile incidents related to air data sensor failures is driving OEMs to invest heavily in redundant systems and sophisticated diagnostic capabilities embedded within the pitot tube assemblies themselves, shifting the market towards higher-value, digitally-enabled products. The market structure remains relatively consolidated, with key players dominating the supply chain due to the high barrier to entry imposed by rigorous certification processes and proprietary aerodynamic designs.

Regional trends highlight that North America and Europe continue to hold significant market share, driven by large established aerospace manufacturing bases, substantial defense spending, and sophisticated maintenance, repair, and overhaul (MRO) infrastructure. However, the Asia Pacific region is demonstrating the highest growth trajectory, fueled by rapid fleet expansion in China and India, alongside emerging domestic aerospace manufacturing capabilities in countries like Japan and South Korea. This shift dictates that suppliers must establish localized service and distribution networks to effectively capture the mounting demand for both new installations and aftermarket replacements in these fast-growing geographies. Simultaneously, geopolitical tensions and sustained investment in military aerial assets globally ensure a resilient demand stream from the defense sector, which often demands specialized, high-velocity pitot designs.

Segmentation trends indicate that the commercial aircraft segment dominates the market in terms of volume, primarily due to the high number of narrow-body and wide-body aircraft deliveries annually. By technology, the trend is moving decidedly towards hybrid and fully digital air data probes, which offer superior signal processing, calibration stability, and direct interface capabilities with centralized flight control computers, surpassing the limitations of older analog systems. The heated pitot tubes sub-segment, essential for preventing ice formation at high altitudes and cold weather operations, maintains its position as the critical revenue generator, undergoing continuous refinement in heating element efficiency and thermal management to minimize power consumption without compromising performance integrity.

AI Impact Analysis on Aircraft Pitot Tubes Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Aircraft Pitot Tubes Market frequently revolve around three core themes: predictive maintenance capabilities, data anomaly detection, and the potential for AI-enhanced air data system redundancy and fusion. Users are keen to understand how AI algorithms can analyze continuous streams of pressure and temperature data from pitot tubes to predict sensor degradation or potential failures before they manifest into critical operational issues, thus minimizing AOG (Aircraft on Ground) events. Concerns also exist about integrating AI processing power seamlessly into existing certified avionics architectures and the regulatory acceptance of AI-driven sensor diagnostics. Overall expectation centers on AI moving pitot tube monitoring from reactive maintenance to proactive health management, optimizing fleet operations and vastly improving air data reliability.

AI's primary influence will not be in the physical design of the pitot tube itself, which remains fundamentally a pneumatic sensor, but rather in the intelligence applied to the data it generates. Advanced AI and machine learning algorithms are being developed to process pitot tube output in real-time, cross-referencing it with static port readings, Angle of Attack (AoA) sensors, and GPS data to identify inconsistencies caused by minor contamination, flow disruption, or heating element malfunction well before traditional fault indicators trigger. This level of granular, continuous monitoring transforms the maintenance paradigm, allowing MRO providers to schedule precise, preventative interventions rather than costly corrective repairs, significantly enhancing the Mean Time Between Failures (MTBF) for critical air data systems.

Furthermore, AI plays a crucial role in sensor fusion systems. In modern aircraft, multiple redundant pitot tubes supply data. AI algorithms are essential for intelligently arbitrating between these sensors, weighing the reliability of each input based on environmental conditions and historical performance, thereby providing the most accurate and fault-tolerant airspeed and altitude references to the flight control systems. This enhanced data integrity is pivotal for autonomous flight technologies and next-generation flight management systems, ensuring that even if one pitot system experiences partial blockage or fault, the aircraft can maintain safe and accurate air data derived from the remaining, validated inputs.

- AI-driven Predictive Maintenance (PdM) reduces unplanned sensor failures by analyzing subtle data drift.

- Enhanced Data Anomaly Detection identifies minor blockages or contamination issues using comparative historical data models.

- Optimized Sensor Fusion algorithms improve the reliability and redundancy of air data references in multi-sensor setups.

- AI facilitates automated, real-time recalibration and health monitoring of de-icing systems within the tube structure.

- Improved diagnostic reporting minimizes troubleshooting time during MRO activities by isolating sensor-specific degradation.

DRO & Impact Forces Of Aircraft Pitot Tubes Market

The dynamics of the Aircraft Pitot Tubes Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively influenced by competitive Impact Forces. Key drivers include mandatory replacement cycles due to component life limits and continuous global fleet expansion, especially in emerging economies. Restraints largely center on the extremely high cost and time required for regulatory certification (e.g., TSO, ETSO) of new designs, which limits market entry and innovation speed. Opportunities emerge from the push towards lighter, more resilient materials and the integration of smart, digitally outputting sensors essential for the next generation of civil and military aircraft. These forces collectively shape the competitive landscape and strategic decision-making for manufacturers.

The primary driver is the fundamental safety requirement mandating accurate airspeed data for all powered flight, coupled with rigorous regulatory oversight (FAA, EASA). Any incident related to air data failure leads to increased scrutiny and accelerated mandates for improved sensor reliability and redundancy across the entire fleet, creating a continuous demand stream for advanced products. Conversely, the market faces significant restraints stemming from the environmental durability challenge; pitot tubes operate under extreme conditions (high velocity, temperature variation, precipitation, and particle impact). Developing materials and de-icing technologies that are highly resistant to erosion and fouling while maintaining precise aerodynamic characteristics is technologically challenging and capital-intensive, slowing the pace of radical product innovation beyond incremental improvements.

Opportunities are significant within the realm of Unmanned Aerial Systems (UAS) and Urban Air Mobility (UAM), sectors demanding miniaturized, lightweight, and highly reliable air data solutions that often incorporate micro-electro-mechanical systems (MEMS) technology. Furthermore, the push towards autonomous and electric aircraft necessitates integrated digital air data solutions that consume less power while offering greater data fidelity. The market impact forces, dominated by the competitive strategies of established OEMs like Honeywell and Collins Aerospace, maintain high barriers to entry. The threat of substitutes is low, as the pitot-static system remains the most globally accepted standard for airspeed measurement, although novel non-intrusive sensor technologies (like optical or laser-based systems) pose a long-term, distant threat. Buyer power is moderate to high, driven by the consolidated nature of the major airframe OEMs who dictate volume and technical specifications.

Segmentation Analysis

The Aircraft Pitot Tubes Market is critically segmented based on criteria such as the type of heating mechanism, the application platform, the output technology used, and the construction material. Understanding these segments is vital for suppliers to target specific market niches—for example, the high-margin military segment often prioritizes durability and speed tolerance, while the commercial segment focuses heavily on Mean Time Between Failures (MTBF) and cost efficiency. The material segmentation reflects advancements in metallurgy aimed at improving resilience against environmental erosion, crucial for extending sensor lifespan and reducing maintenance costs in high-utilization environments. The technology split between analog and digital is rapidly favoring digital solutions for integration benefits.

By application, the commercial aviation segment, encompassing major passenger and cargo transport aircraft, represents the largest volume market due to continuous global fleet growth and mandatory sensor redundancy requirements (typically requiring three or more pitot tubes per large aircraft). The military segment, while lower in volume, commands higher average selling prices (ASPs) due to the need for components certified for supersonic speeds, extreme altitudes, and integration into highly specialized electronic warfare or stealth platforms. General Aviation (GA) and helicopters form smaller but stable segments demanding reliable, often simpler, and more cost-effective solutions tailored for lower speeds and varied operating environments.

The primary differentiation remains the tube type: heated versus unheated. Heated pitot tubes are standard for virtually all jet and turboprop aircraft flying above the freezing level, constituting the overwhelming majority of market revenue, as they incorporate sophisticated internal heating elements and temperature control systems crucial for safe operation. Unheated tubes are generally restricted to light, low-speed, or specialized aircraft that operate exclusively in non-icing conditions. The complexity and maintenance requirements associated with heated systems drive innovation in thermal efficiency and power management, making this segment a focal point for R&D investment across the industry.

- By Type:

- Heated Pitot Tubes (Dominant Segment)

- Unheated Pitot Tubes

- By Application/Platform:

- Commercial Aviation (Passenger and Cargo)

- Military Aircraft (Fighter, Transport, Bomber, Trainer)

- General Aviation (GA)

- Rotary Wing (Helicopters)

- Unmanned Aerial Vehicles (UAVs/Drones)

- By Technology:

- Analog Pitot Tubes

- Digital/Smart Pitot Probes (Growing Segment)

- By Material:

- Stainless Steel (Standard)

- Nickel and Chromium Alloys (High Performance/Erosion Resistance)

- Titanium Alloys (Lightweight, High-Speed Applications)

Value Chain Analysis For Aircraft Pitot Tubes Market

The value chain for Aircraft Pitot Tubes is characterized by intense specialization, starting with the acquisition of high-grade, traceable raw materials—primarily specific alloys of stainless steel and corrosion-resistant metals like Inconel or specific titanium variants. Upstream activities involve material sourcing and precision machining, where tolerances are extremely tight due to the aerodynamic and pressure-sensing requirements. Midstream, the manufacturing phase includes welding, integration of complex heating elements, thermal insulation, and rigorous calibration in specialized wind tunnel or pressure testing facilities. Quality control and regulatory compliance checks (e.g., RTCA DO-160 testing for environmental resilience) are critical bottlenecks in this stage, determining product marketability and certification.

Downstream analysis focuses on two primary routes: direct sales to Original Equipment Manufacturers (OEMs) for new aircraft installation and sales through Maintenance, Repair, and Overhaul (MRO) providers or distributors for the aftermarket segment. Direct channel sales involve long-term agreements with major airframers (e.g., Boeing, Airbus, Lockheed Martin), requiring suppliers to meet stringent quality and volume requirements over multi-year contracts. The aftermarket, serviced predominantly through indirect channels, is crucial for sustaining revenue, as pitot tubes require periodic replacement or repair due to erosion, impact damage, or the natural lifespan of heating elements. Specialized distributors often manage inventory and logistics for MRO facilities globally.

The distribution channel efficiency is paramount, especially in the aftermarket segment, where quick access to certified replacement units is necessary to avoid AOG situations. Direct channels facilitate deep technical collaboration between the sensor manufacturer and the airframe designer, optimizing integration into the aircraft’s Air Data Computer (ADC). Indirect channels leverage a global network of approved aviation parts distributors (like Satair or Aviall) and MRO stations, ensuring global reach for standard replacement parts. The value accretion occurs significantly at the specialized manufacturing and certification stages, where intellectual property related to heating technology and pressure accuracy drives high margins.

Aircraft Pitot Tubes Market Potential Customers

The primary end-users and buyers of Aircraft Pitot Tubes fall into three main categories: large aircraft manufacturers (OEMs), defense departments/military operators, and MRO service providers who cater to commercial airlines and fleet owners. Commercial aircraft OEMs constitute the largest volume buyer group, procuring pitot tubes for initial installation on newly produced narrow-body, wide-body, and regional jet platforms. These customers require highly reliable, standardized products supplied under long-term contracts, prioritizing certification compliance and seamless integration with proprietary avionics architecture.

Military and governmental buyers are highly specific, demanding custom-designed pitot tubes built for extreme performance envelopes (supersonic speeds, high G-loads) and adherence to specialized military specifications (Mil-Specs). These purchases often involve higher security clearance and proprietary technology, leading to higher ASPs. Furthermore, the defense sector regularly initiates upgrade programs for existing fleets, replacing older air data systems with modern, digital equivalents to enhance mission capability and reliability. These buyers prioritize ruggedness, low observability (for stealth platforms), and resistance to electronic interference.

Finally, the aftermarket demand is driven by commercial and private fleet operators who rely on MRO facilities and certified parts distributors. These customers purchase pitot tubes as replacement units, spares inventory, or as part of scheduled maintenance checks. Airlines, cargo carriers, and fractional ownership companies are continuously focused on minimizing operational disruption and seek cost-effective, certified replacement parts that guarantee safety and longevity, making reliable supply and competitive pricing essential for capturing this crucial segment of the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 195 Million |

| Market Forecast in 2033 | USD 288 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Collins Aerospace (Raytheon Technologies), Safran SA, Thales Group, BAE Systems plc, Crane Aerospace & Electronics, Transdigm Group Inc. (via subsidiaries), Meggitt PLC (now part of Parker Hannifin), Esterline Technologies Corporation, United Technologies Corporation (Legacy), General Electric (GE) Aviation, Scientific Research Corporation (SRC), Sensor Systems LLC, Gill Sensors & Controls, Kelvin Hughes Limited, TE Connectivity, Cobham Advanced Electronic Solutions (CAES), Parker Hannifin Corporation, AMETEK, Inc., Potez Aeronautique. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Pitot Tubes Market Key Technology Landscape

The technological landscape of the Aircraft Pitot Tubes Market is undergoing an evolutionary shift characterized by increased digitization, improved material science, and enhanced thermal management systems. Traditionally, pitot tubes were simple metal probes connected via pneumatic lines to an internal pressure transducer. Modern technology integrates the pressure sensor directly into the probe assembly, creating a "smart probe" or "Digital Air Data Probe (DADP)." These DADPs utilize microprocessors to convert pressure readings into digital signals directly at the source, eliminating pneumatic lag and reducing potential signal corruption associated with long tubing runs. This advancement significantly improves data accuracy and simplifies wiring integration with the Air Data Reference (ADR) or Air Data/Inertial Reference Unit (ADIRU).

Material science is another critical area of innovation. Manufacturers are increasingly moving beyond standard stainless steel, particularly for high-performance and high-utilization aircraft. Advanced nickel-chromium alloys and specialized titanium composites are utilized to provide superior resistance to erosion caused by sand, dust, and rain impact, which is a major factor in premature sensor failure, especially in harsh operating environments like the Middle East or developing regions. These materials also offer better thermal properties, enhancing the efficiency of the critical de-icing system and reducing the overall weight of the assembly, which is a key priority for commercial airframe manufacturers seeking fuel efficiency gains.

The most crucial technology remains the anti-icing system. Innovations in heating technology focus on minimizing electrical power consumption while ensuring rapid and uniform heating across the entire probe surface to prevent ice bridge formation. Advanced thermal management systems incorporate embedded temperature sensors and sophisticated digital controllers that modulate heating cycles precisely, preventing overheating while maintaining minimum required surface temperature for de-icing compliance. Furthermore, proprietary probe geometry and advanced computational fluid dynamics (CFD) modeling are continuously used to optimize air flow around the sensor head, ensuring consistent pressure recovery even during high angles of attack or in turbulent conditions, thereby maximizing the reliability of the air data readings provided to critical flight controls.

Regional Highlights

- North America: Market Maturity and Defense Spending. North America, particularly the United States, represents the largest established market for aircraft pitot tubes. This dominance is driven by the presence of major airframe OEMs (Boeing, Lockheed Martin), strong MRO infrastructure, and substantial, sustained defense procurement budgets. The region is a hub for high-technology pitot tube development, focusing heavily on next-generation military applications and the introduction of advanced, digitally integrated probes to replace aging components across commercial fleets. Regulatory alignment with FAA standards ensures a rigorous quality benchmark. The regional focus is increasingly on the integration of these sensors into advanced platforms like the F-35 program and new commercial aircraft types, prioritizing long-life components and superior icing performance, making it a critical revenue driver for high-specification products. The aftermarket revenue stream here is robust due to a large installed base of aircraft requiring certified spare parts and mandatory periodic upgrades to comply with new safety directives. The complexity of manufacturing and certifying these components in the US provides a competitive edge to local suppliers, supported by robust aerospace standards and supply chain management protocols.

- Europe: Regulatory Compliance and OEM Strength. Europe holds the second-largest market share, supported by major aerospace programs (Airbus, Dassault, Leonardo) and adherence to strict EASA certification requirements. The market demand is characterized by a strong emphasis on reliability and compliance with stringent environmental standards, particularly related to component longevity and thermal efficiency. European manufacturers are leading innovation in thermal management systems to reduce the power draw of heated pitot tubes, aligning with the industry's push for greener aviation technologies. The strong presence of MRO centers serving the dense European flight network ensures a steady, high-volume aftermarket demand. Furthermore, joint military initiatives and continued investment in fighter jet platforms (e.g., Eurofighter Typhoon upgrades and future programs) provide a resilient, high-value segment. The region's regulatory environment encourages rapid adoption of safety-enhancing technologies, accelerating the shift from legacy analog systems to smart digital probes across various aircraft types.

- Asia Pacific (APAC): Fastest Growth Trajectory. The APAC region is the fastest-growing market globally, fueled by unprecedented demand for commercial air travel, massive fleet expansion, and emerging indigenous aerospace manufacturing capabilities in countries like China, India, and Japan. This region is undergoing a massive influx of new commercial aircraft, driving huge OEM installation volumes for pitot tubes. While the initial market is driven by foreign imports (US and European suppliers), domestic players are rapidly expanding their capabilities, often focusing on the burgeoning UAV and regional transport segments. Infrastructure limitations and varied operating environments (including high humidity and severe weather) necessitate highly durable and corrosion-resistant pitot tube designs. The increasing domestic MRO capabilities are gradually shifting the aftermarket control, although international suppliers still dominate the certified parts supply for Western-built aircraft. This explosive growth necessitates significant investment in localized support and streamlined supply chains.

- Latin America (LATAM): Modernization and Replacement Needs. The Latin American market exhibits moderate growth, primarily driven by the modernization of commercial airline fleets and sporadic military replacement cycles. Many regional carriers are replacing aging aircraft with modern, more fuel-efficient narrow-body jets, creating a stable demand for new installations. The MRO sector in LATAM is growing, but dependency on international suppliers for high-tech components like digital pitot tubes remains significant. Economic volatility in some countries can occasionally restrain capital investment in upgrades, pushing operators towards certified used parts or maintenance rather than full system replacement. However, the sustained push for improved air safety standards across major carriers provides a fundamental floor for demand growth.

- Middle East and Africa (MEA): Extreme Environment and Defense Focus. The MEA region is characterized by high defense spending and rapid commercial fleet expansion by major Gulf carriers. The unique challenge here is the extreme operating environment—high temperatures, intense solar radiation, and pervasive sand and dust erosion (particulate contamination). This drives demand for pitot tubes made from highly durable, erosion-resistant alloys and those featuring advanced filtration and robust heating elements capable of maintaining functionality in severe dust storms. The defense segment is particularly strong, with significant ongoing procurement of advanced military aircraft, demanding bespoke, rugged air data solutions. The reliance on foreign OEMs and international MRO expertise for sophisticated repairs means the market leans heavily on imports of high-value components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Pitot Tubes Market.- Honeywell International Inc.

- Collins Aerospace (Raytheon Technologies)

- Safran SA

- Thales Group

- BAE Systems plc

- Crane Aerospace & Electronics

- Transdigm Group Inc. (via subsidiaries like Aerosonic)

- Meggitt PLC (now part of Parker Hannifin)

- Esterline Technologies Corporation (acquired by Transdigm/various parties)

- General Electric (GE) Aviation

- Scientific Research Corporation (SRC)

- Sensor Systems LLC

- Gill Sensors & Controls

- Kelvin Hughes Limited

- TE Connectivity

- Cobham Advanced Electronic Solutions (CAES)

- Parker Hannifin Corporation

- AMETEK, Inc.

- Potez Aeronautique

Frequently Asked Questions

Analyze common user questions about the Aircraft Pitot Tubes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an aircraft pitot tube and how is its data used?

The pitot tube measures ram air pressure (total pressure) caused by the aircraft's forward motion. This pressure measurement, combined with static pressure from static ports, allows the Air Data Computer (ADC) to calculate crucial flight parameters, including indicated airspeed, true airspeed, and Mach number, which are essential for navigation and flight control systems.

Why are most modern pitot tubes heated, and what technology is used for anti-icing?

Most modern pitot tubes are heated to prevent ice formation around the sensor opening and on the main body of the tube when the aircraft operates at high altitudes or in freezing conditions. Heating is typically achieved using internal electrical resistance elements (heaters) controlled by sophisticated thermal management systems to ensure compliance with strict regulatory de-icing performance standards (FAA/EASA).

What is the difference between Analog and Digital Air Data Probes (DADP), and which trend dominates the market?

Analog pitot tubes output a raw pressure signal via pneumatic tubing, requiring an external ADC to convert the data. Digital Air Data Probes (DADP) integrate the pressure sensor and microprocessor directly into the probe head, converting readings into a digital signal (e.g., ARINC 429 or CAN bus) at the source. The market trend strongly favors DADPs due to superior accuracy, reduced signal latency, and easier integration with modern digital avionics architectures.

What are the key drivers for the aftermarket segment of the Aircraft Pitot Tubes Market?

The aftermarket is primarily driven by mandatory replacement cycles due to component lifespan limits, scheduled maintenance replacement of heating elements, and required component replacement following foreign object damage (FOD) or erosion from prolonged exposure to harsh environmental conditions. Airlines prioritize certified spares (PMA or OEM parts) to maintain safety and minimize costly Aircraft on Ground (AOG) time.

How is the growth of the UAV/UAS sector influencing pitot tube manufacturing and design?

The UAV/UAS sector demands miniaturized, ultra-lightweight, and highly accurate air data solutions suitable for small platforms and diverse operational profiles. This has spurred innovation in smaller scale manufacturing, leading to the increased use of MEMS (Micro-Electro-Mechanical Systems) technology and highly efficient, low-power digital interfaces, pushing the envelope in sensor integration and size reduction for aerospace sensors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager