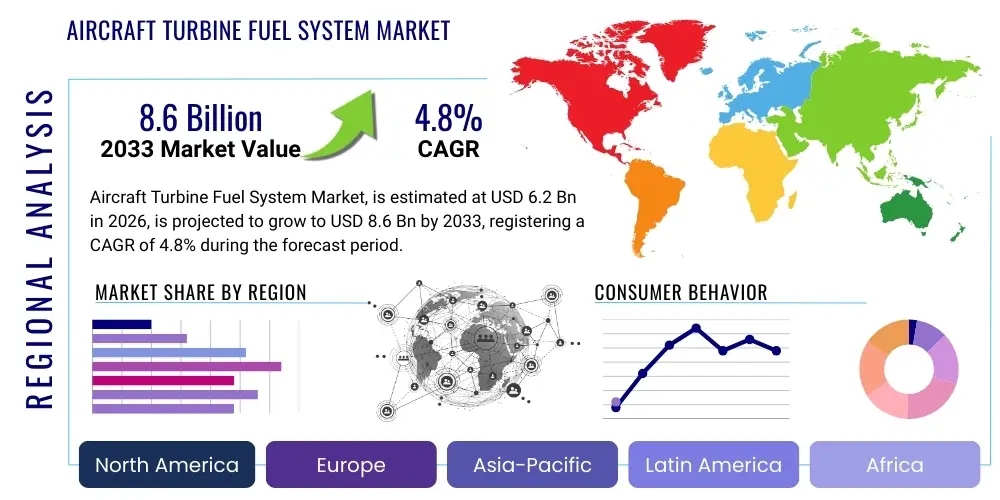

Aircraft Turbine Fuel System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438527 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Aircraft Turbine Fuel System Market Size

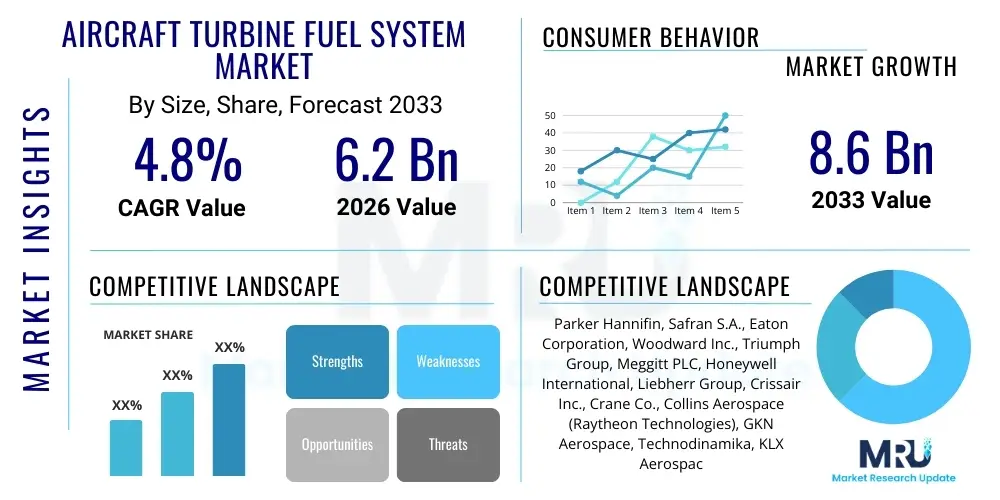

The Aircraft Turbine Fuel System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 8.6 Billion by the end of the forecast period in 2033.

Aircraft Turbine Fuel System Market introduction

The Aircraft Turbine Fuel System Market encompasses the design, manufacturing, and maintenance of complex subsystems responsible for storing, conditioning, metering, and delivering fuel efficiently and safely from the aircraft tanks to the turbine engines. These critical systems include components such as fuel pumps, valves, filters, heat exchangers, flow meters, sensors, and inerting systems, all engineered to operate reliably under extreme temperature and pressure variations encountered during flight. The core function is not only delivery but also ensuring fuel integrity, preventing contamination, managing thermal loads, and providing precise flow measurement for optimal engine performance and range calculation.

Key applications of these systems span across commercial airliners, military jets, general aviation, and rotorcraft, each requiring specialized fuel system architectures tailored to specific mission profiles, redundancy requirements, and operational environments. The increasing global air traffic, coupled with stringent airworthiness directives focused on fire safety and emissions reduction, acts as a primary catalyst for market expansion. Furthermore, the push for next-generation aircraft designs utilizing sustainable aviation fuels (SAF) is compelling manufacturers to innovate materials and sealants compatible with these new fuel chemistries, driving significant research and development investments in sophisticated fuel conditioning technologies.

The primary benefits derived from advanced fuel systems include enhanced operational safety through improved leak detection and inerting capabilities, increased fuel efficiency translating directly into lower operating costs for airlines, and reduced maintenance burden due to the adoption of more durable and condition-monitoring components. Driving factors include mandatory fleet modernization cycles, the development of new, highly efficient turbofan engines requiring greater fuel pressure and precise metering, and the strategic importance of aerial refueling capabilities in the military sector, necessitating robust and high-throughput systems.

Aircraft Turbine Fuel System Market Executive Summary

The Aircraft Turbine Fuel System Market is characterized by intense focus on safety, efficiency, and integration of smart technologies, reflecting fundamental shifts in the global aerospace landscape. Business trends are heavily influenced by long-term procurement cycles in both commercial and defense sectors, favoring established Tier 1 suppliers capable of delivering fully integrated fuel management solutions that comply with strict regulatory frameworks such as FAA, EASA, and military specifications. The ongoing recovery of global air travel, coupled with a significant backlog of new aircraft orders, sustains demand for OEM components, while the increasing age of existing fleets drives a parallel robust market for high-margin aftermarket service, repair, and overhaul (MRO) activities, particularly in components prone to wear like pumps and valves.

Regional trends indicate that North America and Europe currently dominate the market due to the presence of major aircraft manufacturers and robust defense budgets supporting military procurement, alongside high utilization rates of commercial fleets. However, the Asia Pacific region is forecast to exhibit the highest growth rate, propelled by rapid fleet expansion in China and India, substantial investments in regional connectivity aircraft, and emerging localized MRO capabilities. This dynamic shift necessitates that market participants localize production, establish strategic partnerships, and adapt component specifications to meet diverse regulatory requirements and extreme operating climates found across the region, especially regarding thermal management in high-temperature environments.

In terms of segment trends, the Component segment, particularly advanced Fuel Quantity Indicating Systems (FQIS) and inerting systems (such as On-Board Inert Gas Generation Systems - OBIGGS), is experiencing rapid innovation driven by safety mandates to mitigate fuel tank explosions. Furthermore, the Platform segment sees the Commercial Aircraft category holding the largest market share, while the Military Aircraft segment remains critical, focusing on highly customized, durable, and stealth-compatible fuel transfer mechanisms, including high-flow aerial refueling systems. The integration of advanced diagnostics and predictive maintenance capabilities, leveraging sensor fusion and data analytics, is a key segment trend transforming component design and maintenance protocols across the board.

AI Impact Analysis on Aircraft Turbine Fuel System Market

Common user questions regarding AI's impact on the Aircraft Turbine Fuel System Market frequently center on predictive maintenance capabilities, optimization of fuel consumption, and enhancement of system safety diagnostics. Users inquire how AI algorithms can predict component failure in high-stress components like boost pumps or fuel metering units before catastrophic failure occurs, thereby reducing costly unscheduled downtime. Furthermore, there is significant interest in utilizing machine learning (ML) to process complex flight parameters—such as altitude, temperature, air density, and mission profile—to dynamically adjust fuel metering and mixing, achieving optimal combustion efficiency and minimal emissions in real-time. Safety concerns focus on AI’s role in rapidly identifying subtle anomalies or leaks within the tank integrity system, significantly reducing human error associated with manual inspections and data interpretation during MRO procedures.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the operational paradigm of aircraft fuel systems, shifting maintenance practices from time-based scheduling to condition-based monitoring. AI systems analyze vast streams of sensor data—including pressure, temperature, vibration, and flow rates—collected from fuel pumps, valves, and flow meters, identifying deviation patterns that correlate with impending component degradation. This capability ensures that maintenance interventions are highly targeted, maximizing component lifespan, minimizing labor costs, and significantly improving overall fleet availability, which is crucial for maximizing commercial airline profitability and military readiness.

Moreover, AI contributes substantially to enhanced design and certification processes. Generative design tools, powered by AI, are used to optimize the geometry of fuel system components, such as manifolds and structural components within the fuel tank, leading to weight reduction and improved flow dynamics. AI also plays a crucial role in simulating complex scenarios, including fuel sloshing dynamics during turbulence or emergency maneuvers, providing engineers with rapid, high-fidelity insights necessary for designing inherently safer and more stable fuel containment and transfer systems, far surpassing the complexity achievable through traditional analytical methods.

- AI drives predictive maintenance scheduling for high-wear fuel system components (pumps, valves).

- Machine learning algorithms optimize fuel metering unit calibration based on real-time environmental and engine conditions.

- AI enhances safety diagnostics by processing sensor data for rapid, early leak detection and anomaly identification.

- Generative design tools, leveraging AI, optimize fuel manifold geometry for weight reduction and improved fluid dynamics.

- AI models support the simulation of complex fuel sloshing and thermal management dynamics within aircraft tanks.

- Automated data analytics improve the efficiency and accuracy of regulatory compliance reporting related to fuel safety and emissions.

DRO & Impact Forces Of Aircraft Turbine Fuel System Market

The Aircraft Turbine Fuel System Market is shaped by a confluence of powerful Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that dictate market direction and investment priorities. Primary drivers include the massive global demand for new commercial aircraft, particularly in the narrow-body segment, necessitating high-volume production of reliable fuel systems, alongside strict governmental and international regulations mandating enhanced fuel system fire safety, prominently the requirement for fuel tank inerting systems. These drivers create a stable, long-term demand curve for innovative, compliant components.

Restraints primarily involve the extremely high cost and long lead times associated with the research, development, testing, and certification of new fuel system components, which must meet decades-long operational lifecycles and operate flawlessly under severe conditions. Furthermore, the inherent complexity and precision required in manufacturing fuel system components, coupled with supply chain vulnerabilities for specialized materials (e.g., aerospace-grade titanium, high-performance composites, and specialized sealants), can hinder rapid market scaling. The integration challenges posed by varying aircraft architectures and the need for backward compatibility with existing ground infrastructure also serve as structural impediments.

Opportunities are robust, driven by the aerospace industry’s commitment to sustainability, particularly the transition toward Sustainable Aviation Fuels (SAF), which requires fuel system component re-engineering to ensure material compatibility and manage different energy densities. Other major opportunities include the rapid deployment of Condition-Based Monitoring (CBM) technologies utilizing advanced sensors and data analytics for predictive maintenance, thereby reducing operational costs. The growing market for unmanned aerial vehicles (UAVs) and advanced air mobility (AAM) platforms also represents a niche opportunity requiring lightweight, modular, and highly customized micro-turbine fuel systems.

Impact Forces are predominantly exerted by regulatory bodies (FAA, EASA) and Original Equipment Manufacturers (OEMs). Safety mandates instantly accelerate the adoption of new technologies (e.g., OBIGGS), while OEM specifications on weight, durability, and integration complexity force suppliers into continuous innovation. Economic cycles affecting airline profitability influence MRO spending, whereas geopolitical stability and defense spending directly impact military platform procurement, maintaining the dual demand structure of the market.

Segmentation Analysis

The Aircraft Turbine Fuel System Market is comprehensively segmented based on several critical parameters: Component, System Type, Platform, and End-User. This multi-dimensional segmentation allows for a precise understanding of market dynamics, revealing where technological innovation is most rapid and where demand is concentrated. The Component segmentation highlights the criticality of active flow control and measurement devices, while the System Type focuses on the operational method of fuel transfer, crucial for efficiency and safety during ground and in-flight operations.

The Platform segmentation, differentiating between commercial, military, and general aviation, is vital as each category imposes vastly different requirements concerning system redundancy, performance under extreme conditions, and material specifications. For instance, military aircraft require highly robust and potentially self-sealing systems, whereas commercial aircraft prioritize weight reduction and fuel efficiency over long ranges. Finally, the End-User segmentation clearly delineates between the demand driven by new aircraft manufacturing (OEM) and the continuous service and replacement requirements of the global fleet (Aftermarket), reflecting divergent business models and margin structures.

- By Component:

- Pumps (Boost Pumps, Scavenge Pumps)

- Valves (Shutoff Valves, Refueling Valves, Flow Control Valves)

- Fuel Quantity Sensors (Capacitive Probes, Ultrasonic Sensors)

- Filters and Strainers

- Flow Meters and Indicators

- Hoses and Piping Systems

- Fuel Inerting Systems (OBIGGS)

- Thermal Management Systems (Heat Exchangers)

- By System Type:

- Pressure Refueling System

- Gravity Refueling System

- In-flight Refueling System

- By Platform:

- Commercial Aircraft (Narrow-Body, Wide-Body, Regional Jets)

- Military Aircraft (Fighter Jets, Transport Aircraft, Bombers)

- General Aviation (Business Jets, Piston Aircraft)

- Rotorcraft (Civil Helicopters, Military Helicopters)

- By End-User:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Maintenance, Repair, and Overhaul - MRO)

Value Chain Analysis For Aircraft Turbine Fuel System Market

The value chain for the Aircraft Turbine Fuel System Market is highly specialized and structured, commencing with upstream activities focused on the procurement of highly certified raw materials such as aerospace-grade alloys (aluminum, titanium), specialized composite materials, and high-performance elastomers for seals and hoses. Upstream suppliers are characterized by rigorous quality control and often lengthy qualification processes mandated by OEMs. Key upstream activities also involve the development of highly accurate sensor technology and specialized fluid mechanics expertise, forming the foundation of sophisticated fuel system design.

Midstream activities encompass the core manufacturing, assembly, and rigorous testing of integrated fuel system modules, including fuel metering units, pumps, and inerting systems, predominantly handled by Tier 1 and Tier 2 aerospace component specialists. This stage is capital-intensive, requiring advanced manufacturing techniques, clean room environments, and comprehensive system integration testing to ensure compliance with stringent safety and performance specifications. The integration of complex electronics and software for Fuel Quantity Indicating Systems (FQIS) and system diagnostics marks a critical element of this midstream process.

Downstream activities involve the distribution channel, which is highly controlled. Direct distribution dominates the OEM sector, where Tier 1 suppliers deliver integrated systems directly to aircraft manufacturers (e.g., Boeing, Airbus) for line fitment under long-term agreements. Indirect distribution channels primarily serve the aftermarket (MRO), utilizing authorized distributors, specialized repair stations, and airline MRO operations for replacement components, repair services, and system upgrades. The tight control over intellectual property and certified repair procedures ensures that the aftermarket segment often commands high profitability, driven by regulatory requirements for using certified parts.

Aircraft Turbine Fuel System Market Potential Customers

Potential customers and end-users of the Aircraft Turbine Fuel System Market fall into three primary categories, each with distinct purchasing criteria and volume requirements. The largest and most influential customer group comprises global Original Equipment Manufacturers (OEMs) of commercial, military, and general aviation platforms, including giants like Boeing, Airbus, Lockheed Martin, Embraer, and Bombardier. These customers require highly reliable, certified, lightweight, and custom-designed systems for integration into new aircraft programs, prioritizing long-term partnerships and life cycle cost effectiveness.

The second major customer base is the Maintenance, Repair, and Overhaul (MRO) sector, which includes major airlines (operating their own MRO facilities), independent third-party MRO providers, and dedicated component repair specialists. These customers represent the aftermarket demand, requiring replacement parts (e.g., consumable filters, seals, hoses) and overhaul services for capital components (pumps, valves) on existing operational fleets. Their purchasing decisions are driven by component lifespan, lead time, regulatory compliance (PMA vs. OEM parts), and overall total cost of ownership (TCO).

Finally, governmental defense and military organizations globally serve as critical end-users, either procuring new military platforms or maintaining existing fleets. Defense customers require highly durable, performance-optimized, and survivability-focused fuel systems, often incorporating advanced features like self-sealing technology and high-flow refueling capabilities. These contracts are generally non-cyclical and driven by geopolitical needs and strategic defense spending, often requiring higher security clearance and highly specific technical specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 8.6 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Parker Hannifin, Safran S.A., Eaton Corporation, Woodward Inc., Triumph Group, Meggitt PLC, Honeywell International, Liebherr Group, Crissair Inc., Crane Co., Collins Aerospace (Raytheon Technologies), GKN Aerospace, Technodinamika, KLX Aerospace Solutions, Moog Inc., Skurka Aerospace, Senior Aerospace, Curtiss-Wright Corporation, Circor Aerospace & Defense, Hexcel Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Turbine Fuel System Market Key Technology Landscape

The technological landscape of the Aircraft Turbine Fuel System Market is rapidly evolving, driven primarily by the need for weight reduction, improved fire safety, and compatibility with new generation fuels. A core technological focus is the implementation and optimization of inerting systems, particularly the On-Board Inert Gas Generation System (OBIGGS), which reduces the oxygen concentration in the fuel tank ullage space to prevent combustion. Modern OBIGGS utilize advanced membrane separation technology, demanding high-efficiency compressors and specialized filters to maintain system performance across varying altitudes and atmospheric conditions, ensuring compliance with mandates like the FAA's Fuel Tank Safety (FTS) rule.

Another crucial area of technological advancement lies in enhancing the precision and reliability of Fuel Quantity Indicating Systems (FQIS). Traditional capacitive sensing technology is being augmented or replaced by next-generation systems incorporating ultrasonic or frequency-based techniques, which offer better accuracy, especially when dealing with sloshing fuel or irregular tank geometries. Furthermore, the integration of smart sensors (IoT capabilities) within pumps and valves facilitates Condition-Based Monitoring (CBM), providing real-time operational data that feeds into predictive maintenance algorithms, significantly improving Mean Time Between Failure (MTBF) rates.

Material science innovation also plays a vital role. The drive for lightweight components utilizes advanced composite materials and additive manufacturing (3D printing) techniques for producing complex, optimized geometries for fuel manifolds and internal tank structures. Additive manufacturing allows for the creation of components that are structurally stronger yet substantially lighter than conventionally machined parts, reducing the aircraft's overall empty weight. Moreover, new elastomer and sealing technologies are being developed to ensure long-term compatibility and chemical resistance against Sustainable Aviation Fuels (SAF), which often possess different aromatic content and solvent properties compared to traditional Jet A/A-1 fuel, demanding material integrity over long operational cycles.

Regional Highlights

North America maintains market dominance, primarily due to the presence of global aerospace giants such as Boeing and Lockheed Martin, driving substantial demand for both commercial and military fuel system components. The U.S. defense budget consistently supports investments in high-tech military platforms requiring sophisticated aerial refueling and fuel inerting systems. Additionally, the region benefits from highly mature MRO infrastructure and rapid adoption of safety mandates, leading to frequent system upgrades and replacements in the existing large commercial fleet.

- North America: Market leader driven by major OEMs (Boeing, Lockheed Martin) and robust military spending; focus on FTS compliance and advanced sensor integration.

- Europe: Strong market presence anchored by Airbus and key Tier 1 suppliers (Safran, Liebherr); emphasis on environmental compliance, fuel efficiency, and the development of high-performance fuel metering for new engine platforms.

- Asia Pacific (APAC): Highest projected growth rate fueled by massive commercial fleet expansion in China, India, and Southeast Asia; increasing local MRO capabilities and government investments in indigenous aerospace manufacturing programs are key accelerators.

- Latin America (LATAM): Moderate growth, influenced by regional airline fleet renewal cycles and the presence of regional jet manufacturers (Embraer); market relies heavily on imports and international MRO support.

- Middle East and Africa (MEA): Growth driven by state-owned mega-carriers investing in wide-body aircraft and the strategic importance of defense spending; strong demand for high-reliability systems to withstand harsh desert operating conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Turbine Fuel System Market.- Parker Hannifin Corporation

- Safran S.A.

- Eaton Corporation plc

- Woodward Inc.

- Triumph Group, Inc.

- Meggitt PLC (now part of Parker Hannifin)

- Honeywell International Inc.

- Liebherr Group

- Crissair Inc.

- Crane Co.

- Collins Aerospace (Raytheon Technologies)

- GKN Aerospace (Melrose Industries)

- Technodinamika (Rostec)

- KLX Aerospace Solutions

- Moog Inc.

- Skurka Aerospace Inc.

- Senior Aerospace

- Curtiss-Wright Corporation

- Circor Aerospace & Defense

- Hexion Inc. (Specialty materials for sealants)

Frequently Asked Questions

Analyze common user questions about the Aircraft Turbine Fuel System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for new fuel system technologies?

The primary factor driving demand is stringent airworthiness regulations, particularly the FAA and EASA mandates concerning Fuel Tank Safety (FTS), necessitating the widespread adoption of technologies like On-Board Inert Gas Generation Systems (OBIGGS) to mitigate fire risk and explosions.

How are Sustainable Aviation Fuels (SAF) impacting aircraft fuel system design?

SAF introduces challenges related to material compatibility, requiring manufacturers to develop new elastomer seals, coatings, and piping materials resistant to potential changes in fuel density and chemical composition, ensuring system integrity and longevity without costly modifications.

Which component segment is expected to exhibit the highest technological growth?

The Fuel Quantity Indicating Systems (FQIS) and Inerting Systems segments are expected to show the highest technological growth, driven by the shift towards high-precision sensing technologies (ultrasonic) and the continuous optimization of OBIGGS for efficiency, weight reduction, and reliability.

What role does predictive maintenance play in the fuel system aftermarket?

Predictive maintenance, enabled by IoT sensors and AI analysis, transforms the aftermarket by shifting from reactive or time-based maintenance to condition-based servicing. This reduces unscheduled maintenance, maximizes component lifespan (especially pumps and valves), and lowers airline operational costs significantly.

Which geographical region is anticipated to be the fastest-growing market?

The Asia Pacific (APAC) region is anticipated to be the fastest-growing market, propelled by aggressive fleet expansion across major commercial carriers, substantial infrastructure investments, and governmental focus on building local aerospace manufacturing and MRO capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager