Aircraft Variometers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437490 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Aircraft Variometers Market Size

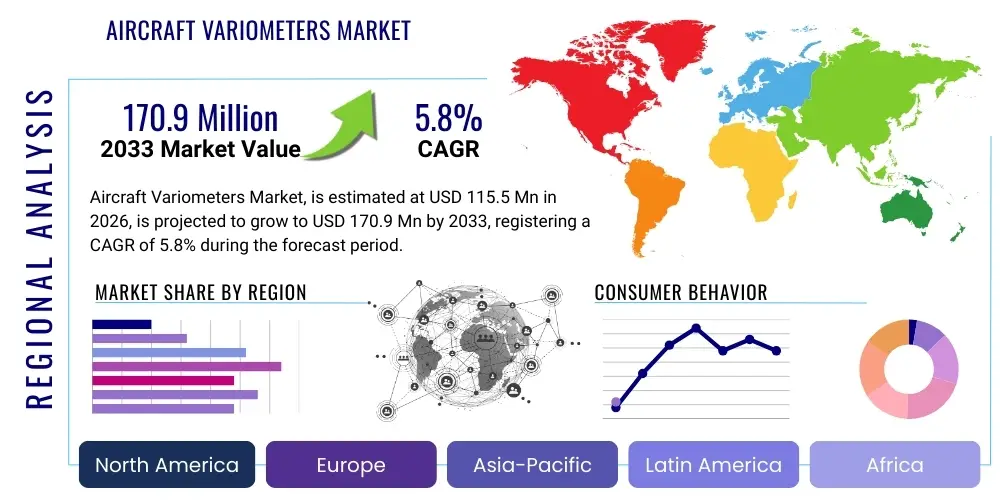

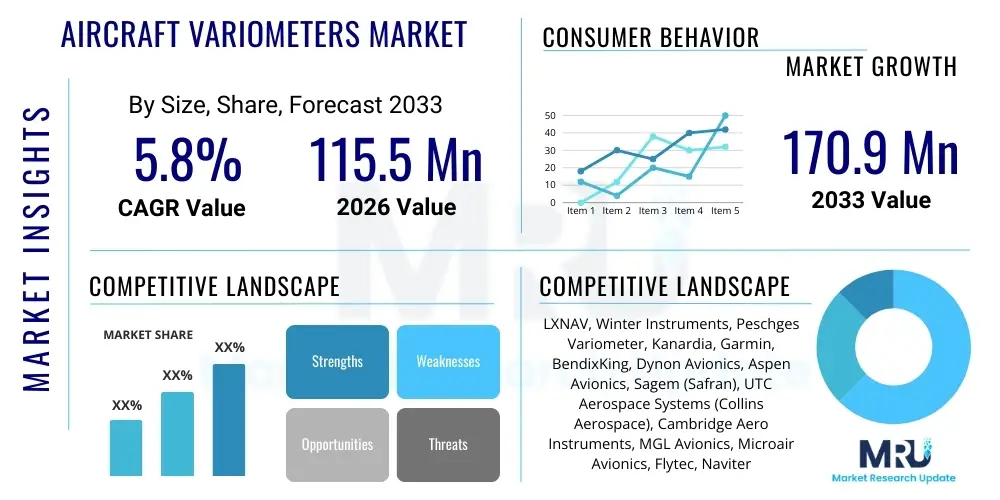

The Aircraft Variometers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 115.5 Million in 2026 and is projected to reach USD 170.9 Million by the end of the forecast period in 2033.

Aircraft Variometers Market introduction

The Aircraft Variometers Market encompasses instruments essential for measuring the rate of climb or descent of an aircraft, providing pilots with crucial information regarding vertical speed. These devices, ranging from traditional mechanical variometers to modern electronic and GPS-integrated systems, are fundamental safety and performance tools, particularly in gliding, sailplanes, and general aviation. Variometers rely on sensing changes in static pressure caused by altitude variations, translating these changes into a discernible rate for the pilot. The primary function is to optimize flight efficiency, ensuring pilots can identify rising air currents (thermals) or measure precise sink rates during descent maneuvers, thereby maximizing flight time and distance.

The primary applications of variometers extend across high-performance soaring aircraft, light sport aircraft, and certain segments of general aviation, where vertical rate indication is critical for flight stability and resource management. Electronic variometers, which often integrate GPS data and sophisticated processing capabilities, offer enhanced accuracy, instantaneous response times, and customizable audio feedback (Netto Variometers). These advancements significantly improve pilot situational awareness, especially in competitive gliding where marginal gains in lift detection translate directly to performance advantages. Furthermore, the increasing adoption of digital cockpits in light aircraft is driving demand for highly integrated, multi-functional variometer systems that seamlessly interface with other avionics.

Key driving factors for market growth include the robust resurgence of recreational and competitive gliding globally, coupled with ongoing mandates for upgrading aging instrumentation in legacy aircraft fleets to modern, reliable digital systems. The benefits provided by advanced variometers, such as precise rate measurement, energy compensation, and integration with flight planning software, ensure their indispensable role in modern aviation safety protocols. Continued innovation in sensor technology, particularly concerning pressure sensing and atmospheric data modeling, is paving the way for variometers that offer even greater precision and reliability across diverse operational environments.

Aircraft Variometers Market Executive Summary

The Aircraft Variometers Market is undergoing a significant transition characterized by the shift from traditional analog and mechanical indicators toward sophisticated electronic and integrated digital display systems. Business trends are dominated by consolidation among specialized avionics manufacturers and the increasing focus on developing comprehensive flight management solutions that incorporate variometry functions alongside navigation and engine monitoring. Key market players are prioritizing modular design and software-defined capabilities to meet diverse regulatory standards and customer preferences across high-performance gliding and general aviation segments. The push for lightweight, energy-efficient components suitable for battery-powered gliders and unmanned aerial systems (UAS) represents a core technological focus, driving substantial investment in miniaturization and enhanced sensor stability.

Regionally, North America and Europe continue to hold the largest market share, fueled by a high density of general aviation activity, established gliding clubs, and stringent airworthiness standards requiring modern instrumentation upgrades. Asia Pacific (APAC) is emerging as the fastest-growing region, primarily driven by expanding private aircraft ownership, rising disposable incomes facilitating recreational aviation activities, and increased military training procurement utilizing modern training aircraft equipped with advanced variometers. Regulatory harmonization efforts across major markets are accelerating the standardization of variometer features, encouraging cross-border trade and facilitating easier entry for innovative manufacturers complying with internationally recognized technical standards orders (TSOs).

Segment trends reveal a rapid increase in the adoption of Electronic Variometers (EVs) and GPS-integrated variometers over traditional Mechanical Variometers. Electronic systems offer superior accuracy, reduced maintenance, and the capability for energy compensation (Total Energy Variometers), which is crucial for optimal soaring performance. The Gliders and Sailplanes application segment remains the foundational revenue driver, but the General Aviation segment, particularly light sport aircraft (LSA) and experimental aircraft, is demonstrating robust growth due to mandates for reliable vertical speed indication in these often-complex operating environments. The integration of variometer data into primary flight displays (PFDs) is a notable trend enhancing cockpit efficiency and reducing clutter for pilots.

AI Impact Analysis on Aircraft Variometers Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) could revolutionize variometer functionality, moving beyond simple rate-of-climb indicators to predictive thermal discovery and flight optimization tools. Key user questions revolve around the potential for AI algorithms to analyze complex atmospheric data in real-time—including ambient temperature, pressure gradients, humidity, and terrain features—to forecast optimal lift zones (thermals) minutes before a pilot might encounter them visually or conventionally. Concerns often surface regarding data reliability, computational latency in safety-critical applications, and the necessary integration standards required to certify AI-driven predictive systems within existing aircraft avionics architecture. The overall expectation is that AI will transform variometers from passive measurement devices into active, decision-support systems, significantly enhancing soaring efficiency and potentially improving overall flight safety by predicting adverse weather or sink conditions more accurately than traditional methods.

- AI-Powered Thermal Prediction: ML algorithms analyze historical and real-time meteorological data to predict the location and strength of thermal lift, guiding glider pilots to optimal soaring paths.

- Adaptive Audio Feedback: AI dynamically adjusts variometer audio tones based on pilot skill, flight phase, and real-time atmospheric complexity, providing personalized and actionable vertical speed alerts.

- Predictive Sink Rate Analysis: Advanced modeling helps aircraft variometers forecast high sink areas based on terrain interaction and localized wind shear, improving safety margins during cross-country flights.

- Sensor Data Fusion and Calibration: AI enhances the accuracy of electronic variometers by fusing data from multiple sensors (GPS, pitot-static, temperature) and automatically compensating for instrument errors or environmental noise.

- Optimized Energy Management: For electric gliders and UAS, AI calculates the most energy-efficient climb/descent profiles based on battery status, optimizing mission endurance.

DRO & Impact Forces Of Aircraft Variometers Market

The Aircraft Variometers Market is fundamentally driven by the stringent necessity for reliable vertical speed instrumentation in all certified aircraft, coupled with the innovation cycle promoting highly accurate electronic systems. Opportunities arise from the global expansion of recreational aviation, including paragliding and hang gliding which increasingly utilize highly accurate, miniature variometers, and the accelerating transition of older general aviation fleets to modern digital cockpits. Restraints primarily include the high cost associated with certifying new avionics systems, particularly complex integrated digital variometers, and the cyclical nature of the light aircraft manufacturing sector, which affects instrumentation procurement volumes. These market dynamics are shaped by regulatory demands for certified vertical speed instruments (Driver), countered by the long lifespan of existing mechanical instruments which delays replacement (Restraint).

The primary impact forces shaping this market include continuous technological advancements (Innovation Force) that introduce features like Netto compensation, thermal assistants, and seamless integration with moving maps and flight computers. This innovation drives obsolescence of older mechanical systems and spurs replacement demand. Secondly, economic conditions significantly influence recreational aviation (Economic Force); periods of high disposable income correlate with increased spending on high-performance variometers and new aircraft purchases. Thirdly, safety regulations and airworthiness directives (Regulatory Force) are critical, mandating periodic calibration or replacement of instrumentation, ensuring sustained market activity, particularly in developed regions like Europe and North America.

The long-term opportunity lies in the burgeoning market for Unmanned Aerial Systems (UAS) and Advanced Air Mobility (AAM) platforms, which require precise, lightweight, and highly reliable vertical navigation instruments, often based on variometer principles adapted for autonomous operation. While the core market remains centered on gliders and general aviation, diversification into the rapidly evolving autonomous flight sector provides a substantial future growth vector. However, the market must navigate challenges related to supply chain volatility for specialized micro-electro-mechanical systems (MEMS) sensors used in the most advanced electronic variometers, maintaining cost-effectiveness while ensuring compliance with aviation-grade reliability standards.

Segmentation Analysis

The Aircraft Variometers Market is comprehensively segmented based on technology type, display method, and primary application, reflecting the diverse requirements across the aviation spectrum, from highly sensitive soaring instruments to robust general aviation indicators. The technological segmentation distinguishes between the legacy, pressure-driven mechanical gauges and the modern electronic systems that leverage advanced pressure sensors, microprocessors, and digital signal processing for improved accuracy and functionality. Application segmentation dictates the required robustness, integration complexity, and specialized features; gliders demand extreme sensitivity for detecting subtle air movements, while general aviation focuses on reliability and integration into multi-function displays. The continuous evolution of display technology, moving from simple analog dials to sophisticated color LCD screens, further differentiates the product offerings across these segments.

- Type:

- Mechanical Variometers (Analog)

- Electronic Variometers (Digital)

- GPS/Flight Computer Integrated Variometers

- Display Technology:

- Analog Displays (Needle/Dial)

- Digital LCD/OLED Displays

- Integrated Cockpit Displays (PFD integration)

- Application:

- Gliders and Sailplanes (High Sensitivity)

- General Aviation Aircraft (GA)

- Commercial and Military Training Aircraft

- Light Sport and Experimental Aircraft

- Technology Feature:

- Total Energy Compensated Variometers

- Netto/MacCready Variometers

- Standard Rate Variometers

Value Chain Analysis For Aircraft Variometers Market

The value chain for the Aircraft Variometers Market begins with upstream activities focused on the procurement and fabrication of specialized components, primarily high-precision pressure sensors (MEMS technology), microprocessors, display modules (LCD/OLED), and robust housing materials capable of enduring harsh flight environments. Manufacturers often rely on specialized semiconductor and sensor companies for their core technology, making supply chain resilience for these critical components a key competitive differentiator. Research and Development (R&D) activities are centralized at this stage, focusing on enhancing sensor response time, reducing weight, and improving software algorithms for features like energy compensation (Netto) and thermal prediction. Quality control and certification processes, adhering to strict aviation standards (e.g., FAA TSO or EASA ETSO), add significant value and cost at the manufacturing level.

Midstream activities involve the final assembly, calibration, and integration of the variometer units. Specialized avionics integrators play a crucial role here, ensuring that the instrument operates accurately across the required altitude and temperature ranges. Distribution channels are bifurcated, involving both direct sales to major Original Equipment Manufacturers (OEMs) of new aircraft (such as glider manufacturers like Schempp-Hirth or Schleicher) and indirect sales through a network of certified avionics dealers and Maintenance, Repair, and Overhaul (MRO) facilities. The indirect channel is vital for the extensive retrofit market, where owners of older aircraft seek to upgrade outdated mechanical instruments to modern electronic versions. Marketing strategies often target specific aviation communities, leveraging performance metrics and integration capabilities.

Downstream activities center on installation, maintenance, and end-user support. Certified avionics shops perform the complex installation and calibration, particularly for integrated flight computer variometers that require interface with GPS and pitot-static systems. The aftermarket service segment provides sustained revenue, covering periodic maintenance checks, software updates, and recalibration services required to maintain airworthiness certifications. Direct distribution is common for high-volume OEM contracts, offering reduced overhead and tailored supply chain logistics. Conversely, the indirect channel, leveraging regional distributors and dedicated aviation parts suppliers, efficiently reaches the fragmented and geographically dispersed population of general aviation pilots and gliding clubs, ensuring global availability and localized technical support.

Aircraft Variometers Market Potential Customers

The primary customer base for Aircraft Variometers is segmented into three major categories: aircraft manufacturers (OEMs), existing aircraft owners engaging in retrofitting, and specialized aviation operators. OEMs, particularly those producing gliders, sailplanes, and light sport aircraft (LSA), represent the largest volume purchasers, integrating these instruments as standard equipment in new aircraft builds, demanding customized form factors and seamless integration with existing panel architecture. These customers prioritize reliability, low weight, and the ability to source compatible units across their production lines. The relationship with OEMs is long-term and often dictates the dominant technology trends in the market.

The second major customer segment consists of individual private aircraft owners and flying clubs, primarily driving the retrofit market. These customers are motivated by safety upgrades, performance enhancement (moving from mechanical to electronic/Netto variometers), and the desire to modernize their cockpit instrumentation. They purchase variometers through certified avionics dealers or MRO shops. This segment is highly sensitive to product features, ease of installation, and total cost of ownership, seeking instruments that offer significant functional improvements over older models without extensive modification requirements.

The third group includes institutional customers such as military and commercial flight training schools, government agencies operating surveillance or specialized utility aircraft, and competitive gliding teams. Training institutions require durable, high-visibility instruments suitable for frequent student use, often opting for robust digital displays integrated into simulator cockpits and primary training aircraft. Competitive gliding customers represent the high-end niche, demanding the most accurate, feature-rich GPS/Netto integrated variometers available, viewing these instruments as critical competitive advantages in performance optimization and flight path planning. Procurement decisions in this segment are highly influenced by performance specifications and cutting-edge features.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.5 Million |

| Market Forecast in 2033 | USD 170.9 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LXNAV, Winter Instruments, Peschges Variometer, Kanardia, Garmin, BendixKing, Dynon Avionics, Aspen Avionics, Sagem (Safran), UTC Aerospace Systems (Collins Aerospace), Cambridge Aero Instruments, MGL Avionics, Microair Avionics, Flytec, Naviter, Volkslogger, Dittel Messtechnik, Funkwerk Avionics, Trig Avionics, L-3Harris Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Variometers Market Key Technology Landscape

The core technology driving the modern Aircraft Variometers Market is the evolution of Micro-Electro-Mechanical Systems (MEMS) pressure sensors, replacing bulkier and less sensitive mechanical bellows systems. MEMS sensors provide highly accurate, rapid-response pressure differential measurements required for instantaneous vertical speed indication. These sensors are integrated with powerful, low-power microprocessors capable of executing complex real-time calculations, such as Total Energy Compensation (TEC). TEC is crucial for high-performance gliding, as it electronically filters out vertical rate changes caused by the aircraft's speed adjustments rather than true air movement (lift/sink), providing the pilot with a "Netto" reading of the surrounding air mass. This technological shift necessitates sophisticated digital signal processing (DSP) capabilities within the instrument itself.

Further technological advancements center on the integration of Global Positioning System (GPS) data directly into the variometer logic, creating highly functional flight computers. GPS integration enables features such as MacCready settings (optimizing cruise speed between thermals), wind calculation, and sophisticated task navigation within soaring competitions. Modern variometers now typically feature color, sunlight-readable liquid crystal displays (LCDs) or Organic Light-Emitting Diode (OLED) screens that present vertical speed data graphically alongside auxiliary information like Glide Ratio, Speed to Fly, and altitude profiles. The shift toward standardized digital communication protocols, such as CAN bus or ARINC 429, ensures seamless integration into modern glass cockpits, allowing variometer data to be displayed on Primary Flight Displays (PFDs).

Future technological development is focusing on enhancing the auditory feedback mechanisms, known as audio variometers, which translate the vertical rate into specific tones, allowing pilots to fly "by ear" while focusing visually on the external environment. This includes developing adaptive audio systems that adjust volume and tone complexity based on ambient noise and flight phase. Furthermore, the incorporation of AI algorithms for predictive thermal assistance, as previously analyzed, relies on leveraging advanced processing power to handle large atmospheric data sets received via telemetry or onboard sensors. The convergence of highly sensitive sensors, powerful processing units, and sophisticated integration software defines the competitive technological landscape in this evolving avionics sector, pushing the boundaries of flight optimization and safety.

Regional Highlights

North America, spearheaded by the United States and Canada, represents a mature and dominant market for Aircraft Variometers. This dominance is attributed to the extremely large installed base of General Aviation (GA) aircraft, the presence of major avionics manufacturers, and a thriving community of recreational pilots and competitive gliding organizations. Regulatory compliance, particularly FAA mandates for instrument reliability and the incentive programs encouraging retrofits to modernize cockpits, sustain consistent demand for high-quality electronic variometers. The region is characterized by early adoption of new avionics technology, particularly integrated GPS-enabled flight computers, and a strong preference for products manufactured by established domestic and international brands with robust technical support networks. Market growth here is largely driven by replacement cycles and upgrades in the extensive existing fleet rather than solely new aircraft production.

Europe constitutes the second largest market, maintaining high demand due to a strong historical tradition in gliding and sailplane manufacturing, particularly in Germany, France, and Poland. European markets are leaders in high-performance variometry, often setting the standards for Total Energy Compensation and Netto functionality, driven by intense competitive soaring requirements. EASA regulations mandate rigorous safety standards, creating sustained demand for certified electronic variometers that adhere to the stringent European Technical Standard Orders (ETSO). Furthermore, the density of specialized glider manufacturers and avionics research institutions within the continent ensures that Europe remains a hub for innovation, often introducing cutting-edge features like AI-assisted thermal prediction before other regions. The retrofit market is also highly active as legacy European aircraft fleets are systematically upgraded to digital instrumentation.

Asia Pacific (APAC) is projected to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period. This accelerated growth is primarily fueled by rapid economic development leading to increased disposable income and greater engagement in luxury and recreational activities, including private and light sport aviation. Countries like China, India, and Australia are witnessing significant expansion in flight training academies and general aviation infrastructure. While the market currently relies heavily on imports from North America and Europe, local assembly and maintenance facilities are beginning to emerge. The demand profile in APAC is mixed, focusing both on cost-effective, reliable digital variometers for training aircraft and high-end integrated systems for the rapidly growing private jet and high-performance recreational segments. Military modernization programs also contribute substantially, as new training aircraft are typically equipped with advanced digital cockpit instrumentation.

Latin America and Middle East & Africa (MEA) represent smaller but evolving markets. Latin America sees demand primarily tied to established gliding clubs in countries like Argentina and Brazil and the need for reliable, robust instrumentation for utility aircraft operating in challenging environments. Market penetration is often slower due to economic volatility and reliance on import tariffs. The MEA region is experiencing gradual growth, driven mainly by investments in modernizing general aviation fleets within stable economies like the UAE and Saudi Arabia, alongside expanding flight schools. The focus in MEA is often on extreme temperature resilience and ruggedized units capable of handling high-dust conditions. These regions predominantly favor electronic variometers that offer minimal maintenance requirements and high reliability under varied operational stresses, frequently sourced from major global suppliers known for their durability.

- North America: Large installed GA base; strong retrofit market; hub for large avionics manufacturers like Garmin and BendixKing.

- Europe: Strong history in gliding manufacturing; high demand for performance-oriented Netto variometers; stringent EASA certification standards.

- Asia Pacific (APAC): Fastest-growing region; driven by rising disposable incomes and expanding flight training infrastructure in China and India.

- Latin America: Demand focused on stability and reliability in utility and recreational aircraft; market growth susceptible to local economic cycles.

- Middle East & Africa (MEA): Emerging growth driven by modernization of private and training fleets; emphasis on rugged, high-temperature-tolerant devices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Variometers Market.- LXNAV

- Winter Instruments

- Peschges Variometer

- Kanardia

- Garmin Ltd.

- BendixKing (a Honeywell brand)

- Dynon Avionics

- Aspen Avionics

- Sagem (Safran Group)

- UTC Aerospace Systems (Collins Aerospace)

- Cambridge Aero Instruments

- MGL Avionics

- Microair Avionics

- Flytec

- Naviter

- Volkslogger

- Dittel Messtechnik

- Funkwerk Avionics

- Trig Avionics

- L-3Harris Technologies

Frequently Asked Questions

Analyze common user questions about the Aircraft Variometers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Total Energy Compensated (TEC) Variometer and a standard variometer?

The primary difference lies in the measurement focus. A standard variometer measures the aircraft's vertical rate relative to the surrounding air, which includes changes caused by pilot inputs (like pushing or pulling the stick). A Total Energy Compensated (TEC) variometer, often referred to as a Netto variometer, uses external pressure sensors (via a TE probe) or internal calculations to filter out altitude changes resulting from changes in airspeed. This provides the pilot, especially in gliders, with an accurate reading of the true vertical movement of the surrounding air mass (lift or sink), independent of control inputs, which is crucial for optimal soaring technique and identifying usable thermals.

How is the growth of the Unmanned Aerial Systems (UAS) sector impacting the demand for Aircraft Variometers?

The UAS sector, particularly for large surveillance and payload delivery drones, is driving increased demand for miniaturized, high-precision electronic variometers. Although UAS operate autonomously, accurate vertical speed and altitude change rate data are essential for stable flight control, optimizing energy consumption, and complying with altitude restrictions. Manufacturers are adapting their sensor technology to create lightweight MEMS-based variometer systems that are robust enough for autonomous operations but small enough to meet the strict size, weight, and power (SWaP) constraints inherent in modern drone platforms, creating a significant new market vertical.

Which regions lead the market in terms of technological innovation for Aircraft Variometers?

Europe, particularly Germany and countries with a strong competitive gliding tradition, currently leads in technological innovation for high-performance variometers. European manufacturers frequently introduce advanced features such as highly sophisticated Netto compensation algorithms, integrated thermal assistants leveraging AI/GPS data, and advanced audio vario systems. North America, however, leads in the market integration and widespread adoption of multifunctional, panel-mounted electronic variometers that seamlessly interface with broader glass cockpit environments, driven by major avionics corporations.

Are mechanical variometers still relevant in the contemporary aviation market, or are they completely replaced by electronic systems?

While electronic variometers dominate new installations and high-performance segments due to their superior accuracy and feature set, mechanical variometers maintain relevance primarily in the legacy aircraft retrofit market and as critical backup instruments. Mechanical units offer inherent simplicity, require no electrical power, and possess excellent reliability, making them a preferred choice for supplemental or emergency vertical speed indication, ensuring redundancy even if the primary electronic system fails. Their continued use is supported by the vast installed base of older aircraft globally.

What role does certification play in the pricing and adoption of new variometer technology?

Certification, specifically attaining approvals like the FAA Technical Standard Order (TSO) or EASA European Technical Standard Order (ETSO), is a major determinant of both pricing and market adoption. The rigorous testing required to demonstrate reliability, accuracy, and airworthiness significantly increases the Research and Development (R&D) and manufacturing overheads, directly influencing the final cost of certified units compared to non-certified options used in experimental aircraft. Certification is mandatory for installation in commercial and most general aviation aircraft, making it the primary gateway to the largest revenue segments of the Aircraft Variometers Market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager