Airplane Compass Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433633 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Airplane Compass Market Size

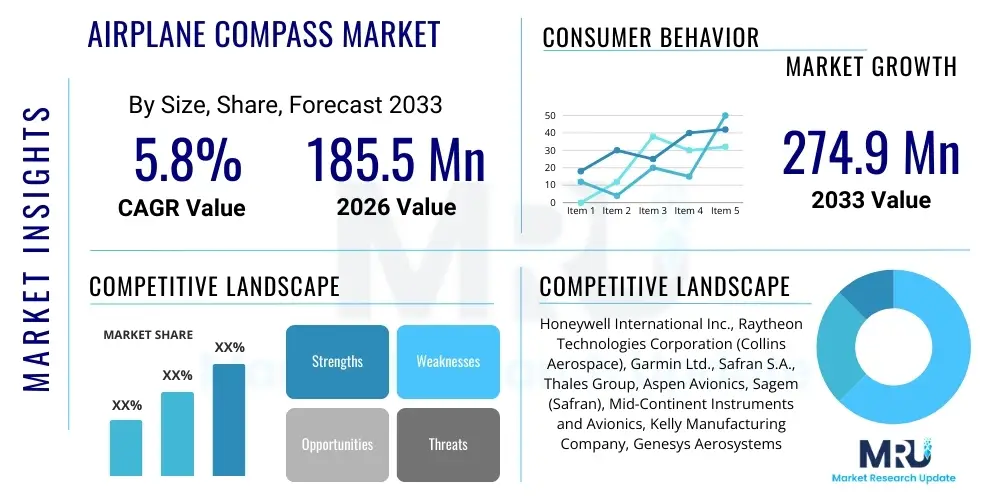

The Airplane Compass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 185.5 million in 2026 and is projected to reach USD 274.9 million by the end of the forecast period in 2033.

Airplane Compass Market introduction

The Airplane Compass Market encompasses devices crucial for indicating the direction of flight relative to the Earth’s magnetic or true north, serving as a fundamental component within the overall avionics suite. These devices range from traditional magnetic compasses, which operate based on geomagnetism, to advanced digital and gyro-stabilized systems that offer superior accuracy and integration capabilities with Flight Management Systems (FMS). Product sophistication has increased dramatically, shifting from simple wet compasses toward sophisticated fluxgate magnetometers and Attitude and Heading Reference Systems (AHRS).

Major applications of airplane compass systems span the entire aviation sector, including large commercial airliners, military reconnaissance and transport aircraft, general aviation (GA) aircraft, and specialized rotary-wing platforms. The compass remains an essential navigational backup system, mandated by regulatory bodies like the FAA and EASA, ensuring operational safety even in the event of primary electronic system failure. Furthermore, modern digital compasses contribute data utilized for calculating wind drift, approach guidance, and overall positional awareness, making them integral to contemporary Required Navigation Performance (RNP) standards.

The market is primarily driven by the continuous global growth in air travel, necessitating the expansion and modernization of existing aircraft fleets, particularly in emerging economies. Benefits include enhanced navigational reliability, redundancy in critical flight systems, and compliance with increasingly rigorous international safety standards. Key driving factors involve the adoption of glass cockpits, which require seamless integration of heading data, and the need to replace older, less accurate magnetic indicators with digital alternatives that reduce pilot workload and improve situational awareness.

Airplane Compass Market Executive Summary

The Airplane Compass Market is characterized by a steady transition from traditional magnetic indicators to integrated digital and solid-state heading reference systems, propelled by the demand for higher accuracy and system redundancy within modern cockpits. Business trends highlight significant investment in Research and Development focused on miniaturization and improved electromagnetic interference (EMI) shielding for fluxgate technology. Key manufacturers are focusing on aftermarket solutions offering plug-and-play compatibility to facilitate the replacement of legacy hardware in general aviation and older commercial aircraft, capitalizing on the long lifecycle of aerospace assets. Strategic partnerships between avionics providers and airframe manufacturers are critical for securing original equipment manufacturer (OEM) installations in new production lines.

Regional trends indicate North America and Europe retaining leadership due to the presence of major aerospace OEMs and stringent airworthiness standards mandating high-reliability navigational systems. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, driven by rapid fleet expansion—especially in China and India—and significant defense modernization programs. This shift is creating substantial opportunities for both OEM suppliers targeting high-volume production and aftermarket service providers catering to diverse fleet demographics across the region. Latin America and the Middle East & Africa (MEA) are also seeing focused growth, largely attributed to increasing domestic air connectivity and military procurement cycles.

Segment trends emphasize the dominance of the Digital Compass Systems segment, primarily fluxgate magnetometers integrated into AHRS units, due to their superior performance, minimal maintenance, and ease of data sharing across the avionics bus (e.g., ARINC 429). The Commercial Aircraft application segment remains the largest revenue contributor, sustained by large-scale aircraft deliveries and mandatory system upgrades. The Aftermarket sales channel is proving resilient, particularly in the General Aviation sector, where aircraft owners frequently upgrade existing panels to meet performance and regulatory requirements, ensuring sustained demand for advanced retrofit heading solutions.

AI Impact Analysis on Airplane Compass Market

User queries regarding the impact of Artificial Intelligence on the Airplane Compass Market often revolve around the obsolescence of traditional compass functions, the integration of AI-driven sensor fusion for enhanced heading accuracy, and the role of machine learning in predictive maintenance for electromechanical components. Users are keen to understand if AI-powered sensor arrays, combining data from GPS, INS (Inertial Navigation Systems), and fluxgate compasses, can eliminate reliance on single-source directional data, thereby increasing system robustness and redundancy. Furthermore, there is significant interest in how AI algorithms might process subtle magnetic anomalies or environmental noise to provide exceptionally clean and reliable heading outputs under challenging operational conditions, such as high-latitude flying or deep-urban environments. The core concern remains balancing AI-driven complexity against the fundamental simplicity and reliability required of backup navigational instruments, which must function independently of complex computing systems.

While AI is unlikely to replace the fundamental physical principle of magnetic sensing, it is profoundly influencing the data processing and system integration aspects of the compass market, especially within advanced avionics architectures. AI algorithms are being employed in sophisticated sensor fusion frameworks, wherein data from the traditional compass (or fluxgate magnetometer) is continuously cross-referenced, weighted, and filtered alongside inputs from GPS, gyroscopes, and accelerometers. This integration allows for real-time error correction, drift compensation, and enhanced navigational accuracy, particularly during maneuvers or in environments where single sensor types might fail or become unreliable. AI thus elevates the compass from a basic indicator to a contributing element in a highly resilient, multi-source navigation solution, optimizing the integrity and availability of heading information.

The application of AI extends significantly into the realm of system health monitoring and predictive maintenance for modern digital compass units, which often incorporate complex electronics and stabilization mechanisms. Machine learning models analyze sensor performance data, temperature fluctuations, and subtle changes in output linearity over thousands of flight hours. By identifying patterns indicative of impending component degradation or calibration drift long before critical failure occurs, AI enables proactive maintenance scheduling, minimizing unscheduled downtime and improving operational safety margins. This transition towards condition-based monitoring, supported by AI analysis, enhances the reliability of the compass system, justifying the continued investment in high-fidelity digital compass hardware.

- AI enhances sensor fusion by intelligently weighting magnetic, inertial, and GPS data for superior heading accuracy.

- Predictive maintenance algorithms analyze fluxgate sensor data to anticipate calibration drift and component failures.

- AI-driven noise reduction and signal processing filter electromagnetic interference (EMI) specific to the aircraft structure.

- Optimization of compass calibration procedures using machine learning minimizes time and maximizes precision during ground checks.

- Development of highly autonomous systems where AI manages sensor redundancy and failover logic related to heading information integrity.

DRO & Impact Forces Of Airplane Compass Market

The Airplane Compass Market is shaped by a robust interplay of driving forces centered on regulatory mandates and technological evolution, while simultaneously facing constraints related to the ascendancy of alternative navigation technologies and high system integration costs. The primary driver is the pervasive requirement for navigational redundancy in aviation safety standards globally, ensuring that even under complete electrical failure scenarios, a basic, reliable heading reference remains available. Opportunities are abundant in the rapid expansion of emerging aviation platforms, such as Unmanned Aerial Vehicles (UAVs) and the burgeoning Electric Vertical Take-Off and Landing (eVTOL) sector, both requiring lightweight, highly accurate, and durable heading sensors optimized for autonomous operations. These factors collectively push manufacturers toward producing smaller, lighter, and more electrically efficient compass systems.

Restraints largely stem from the competitive threat posed by highly sophisticated Inertial Navigation Systems (INS) and Global Positioning System (GPS) receivers, which often provide heading data with higher initial accuracy than magnetic systems, reducing the reliance on the compass as a primary navigational tool in modern airliners. Furthermore, the complexity and cost associated with integrating advanced digital fluxgate systems into older aircraft models can deter operators, favoring minimal compliance or basic component replacement. Impact forces include the fluctuating prices of raw materials, the cyclical nature of aircraft procurement (both commercial and defense), and the increasing threat of electromagnetic jamming or cyberattacks, which paradoxically reinforces the need for resilient, standalone magnetic compass backups.

The impact forces drive a bifurcation in the market: on one hand, manufacturers focus on ultra-low-cost, highly durable standby magnetic compasses (SMC) for redundancy, and on the other, they invest heavily in high-precision, digital fluxgate sensors integrated into complex AHRS/INS units for primary navigation. The overarching impact is a continuous pressure on innovation to maintain relevance in an avionics landscape increasingly dominated by satellite and inertial systems. Regulatory bodies, acting as a major external force, continue to reinforce the mandatory nature of the compass, ensuring sustained market demand despite technological shifts, prioritizing safety over complete reliance on electronic aids.

Segmentation Analysis

The Airplane Compass Market segmentation provides a granular view of demand across various product types, aircraft applications, platform configurations, and sales channels, reflecting the diverse operational requirements within the global aerospace industry. The market is primarily segmented based on the underlying technology utilized, distinguishing between mechanical, electromechanical, and solid-state systems, which directly impacts accuracy, reliability, and integration complexity. Understanding these segments is crucial for strategic planning, as distinct operational environments (e.g., military versus commercial) necessitate fundamentally different product features, from ruggedization to data bus protocols.

Technological differentiation is the most critical axis, with the shift from traditional magnetic compasses, used primarily for regulatory backup, towards sophisticated digital compass systems. These digital systems, often utilizing fluxgate magnetometers, are integrated seamlessly into the aircraft’s primary navigational suite, offering stabilized, corrected heading information. This transition dictates investment priorities for manufacturers, focusing on miniaturization, power consumption reduction, and enhanced compensation algorithms to mitigate the effects of aircraft magnetism and local electromagnetic interference.

Application-based segmentation reveals that commercial aviation represents the largest volume segment, driven by high aircraft production rates, whereas military aviation typically demands the highest performance specifications and specialized ruggedization against extreme operating conditions. The aftermarket segment, supported by the prolonged operational life of most aircraft, plays a vital role by addressing retrofit and mandatory upgrade cycles, especially for general aviation platforms adopting modern digital cockpits.

- Type: Magnetic Compass (Wet Compass, Standby Compass), Gyro Compass (Gyrosyn Compass), Fluxgate Compass (Digital Magnetometer), Digital Compass Systems (Integrated AHRS/INS).

- Application: Commercial Aircraft (Airliners, Cargo), Military Aircraft (Fighters, Transport, Surveillance), General Aviation (Private Jets, Piston Aircraft), Helicopters.

- Platform: Fixed-Wing Aircraft, Rotary-Wing Aircraft, UAV/Drones.

- Sales Channel: Original Equipment Manufacturer (OEM), Aftermarket.

Value Chain Analysis For Airplane Compass Market

The value chain for the Airplane Compass Market begins upstream with the procurement of highly specialized raw materials, including high-permeability magnetic alloys for sensor core construction, precision electronics (ASICs, microprocessors), and robust housing materials compliant with aerospace environmental standards. Key upstream activities involve the design and testing of magnetic sensors and micro-electromechanical systems (MEMS) used in fluxgate and digital compass units. Suppliers in this segment focus heavily on quality control and traceability, given the critical safety role of the final product. A key challenge upstream is securing reliable, high-grade components that can withstand extreme temperature variations and vibration profiles typical of airborne platforms, necessitating specialized aerospace-certified component suppliers.

Midstream activities involve the complex manufacturing, assembly, and rigorous testing of the compass units. This includes calibration procedures—often a manual or semi-automated process to correct for magnetic deviation—and integration with electronic interfaces (like ARINC 429 or MIL-STD-1553 bus standards) necessary for connecting to the cockpit display or FMS. Manufacturers, such as major avionics suppliers, invest heavily in highly controlled manufacturing environments to ensure magnetic cleanliness and precise sensor alignment. The final product undergoes extensive flight qualification testing to meet strict airworthiness standards (e.g., DO-160).

Downstream analysis focuses on distribution channels, which are typically bifurcated into direct sales to OEMs for new aircraft production and sales through certified MRO (Maintenance, Repair, and Overhaul) facilities and authorized distributors for the aftermarket. Direct sales to major OEMs (like Boeing, Airbus, Lockheed Martin) require long-term contracting and adherence to strict production timelines. Indirect channels rely on a global network of specialized aviation parts distributors who manage inventory and deliver calibrated units to general aviation operators and smaller airlines for replacement or upgrade purposes. The certification and installation process, performed by licensed technicians, forms the final crucial step in the value chain, ensuring operational compliance and air safety.

Airplane Compass Market Potential Customers

Potential customers in the Airplane Compass Market are fundamentally segmented based on their operational size and regulatory environment, broadly categorized into airframe manufacturers, fleet operators, and maintenance service providers. Airframe OEMs, including manufacturers of commercial jets, military platforms, and general aviation aircraft, represent the largest customers in the OEM channel, purchasing compass units in high volume for integration into new aircraft builds. These customers prioritize long-term supply agreements, minimal unit weight, system reliability, and seamless integration capabilities with proprietary avionics suites. Their buying decisions are heavily influenced by performance guarantees and compliance with certification standards like TSO (Technical Standard Order).

Fleet operators, ranging from large international airlines (Lufthansa, FedEx Express) to smaller regional carriers and charter companies, constitute the major consumer base in the aftermarket channel. These customers purchase replacement units or upgrade kits either directly from the manufacturer or through authorized MRO providers. For these end-users, system Mean Time Between Failure (MTBF), cost-effectiveness, ease of maintenance, and minimal installation downtime are critical purchasing criteria. Given the necessity of continuous operation, inventory management of critical spares, including compass components, is a significant part of their procurement strategy.

Furthermore, military and defense organizations globally represent a specialized customer segment requiring highly ruggedized, specialized compass systems capable of operating under extreme G-loads and harsh environmental conditions, often demanding adherence to specific military standards. The growing segment of UAV and eVTOL developers also emerges as a high-potential customer group, demanding innovative, miniature, and highly power-efficient fluxgate compass solutions optimized for autonomous flight control systems where size, weight, and power (SWaP) constraints are paramount. These buyers seek suppliers capable of customizing form factors and integrating proprietary data outputs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 million |

| Market Forecast in 2033 | USD 274.9 million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Raytheon Technologies Corporation (Collins Aerospace), Garmin Ltd., Safran S.A., Thales Group, Aspen Avionics, Sagem (Safran), Mid-Continent Instruments and Avionics, Kelly Manufacturing Company, Genesys Aerosystems, FreeFlight Systems, True North Technologies, Northrop Grumman Corporation, Universal Avionics Systems Corporation, L3Harris Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Airplane Compass Market Key Technology Landscape

The technological landscape of the Airplane Compass Market is defined by a dichotomy between highly reliable, passive magnetic systems and advanced, solid-state electronic systems. Traditional magnetic compasses, mandated as the absolute emergency backup, utilize dampened magnets and a fluid-filled bowl to display heading, requiring no electrical power. While inherently simple and robust, they suffer from magnetic deviation errors and inertia effects. The ongoing technological challenge in this segment is maintaining stability and readability under turbulence while minimizing weight and maximizing magnetic shielding effectiveness against cockpit electronics.

The cutting edge of the market is dominated by fluxgate compass technology. A fluxgate sensor, or magnetometer, measures the direction and strength of the magnetic field electronically by using a core material that is repeatedly saturated by an alternating current, inducing a voltage proportional to the external magnetic field component aligned with the sensor. This output is processed digitally, allowing for automatic compensation of deviation, tilt correction, and seamless integration with other aircraft systems via digital data buses. Fluxgate systems offer significantly higher accuracy and dynamic response compared to mechanical wet compasses, making them the standard for primary heading references in modern general aviation and increasingly integrated into commercial aircraft AHRS units.

Another crucial technological development involves the integration of compass functionality within sophisticated Attitude and Heading Reference Systems (AHRS) and Inertial Reference Systems (IRS). These systems fuse fluxgate magnetometer data with data from ring laser gyros or solid-state MEMS gyroscopes and accelerometers. The benefit is highly accurate, stable, and drift-free heading information, regardless of the aircraft's maneuver or geographic position. The technological evolution is focused on miniaturizing these integrated systems (achieving high performance in smaller form factors) and improving the algorithms used for sensor fusion, enhancing overall navigational integrity and reducing reliance on any single sensor type.

Regional Highlights

Regional dynamics significantly influence the Airplane Compass Market, reflecting differences in aircraft fleet age, military spending, and regulatory adoption rates of advanced avionics.

- North America: This region holds the largest market share, driven by the presence of major aerospace manufacturers (e.g., Boeing, Lockheed Martin) and a vast General Aviation (GA) fleet requiring consistent upgrades and replacements. Stringent FAA regulations mandate high standards for both primary and standby navigational systems, sustaining robust demand for high-reliability digital fluxgate compasses and AHRS units. The retrofit market, fueled by thousands of older GA aircraft updating to glass cockpits, is a major revenue contributor.

- Europe: Europe represents a mature market characterized by strong defense expenditures and a high density of commercial air traffic. The market is regulated by EASA, pushing demand for certified components. Key growth is focused on R&D for next-generation integrated navigation systems, particularly those developed by key European players like Safran and Thales, ensuring localized supply chain strength and technological leadership in certain niche areas, such as high-precision military compasses.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR due to unprecedented fleet expansion driven by burgeoning economies like China and India, coupled with significant military modernization efforts across the region. As new aircraft are delivered and older fleets undergo forced regulatory upgrades, the demand for both OEM-installed advanced digital compasses and aftermarket magnetic backups surges. Localized manufacturing partnerships are increasingly important for market penetration in this highly cost-sensitive yet rapidly growing region.

- Latin America (LATAM): The LATAM market is primarily driven by the replacement cycle in existing commercial and regional airline fleets. Economic volatility can sometimes delay major modernization programs, favoring cost-effective, durable magnetic standby compasses and phased upgrades to digital systems in larger carriers. The market relies heavily on imports and certified distribution channels based in North America and Europe.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated around major defense procurements, particularly in the Gulf Cooperation Council (GCC) countries, requiring high-spec military aircraft compass systems. Commercial market growth is steady, supported by major international hub airlines undergoing continuous fleet renewal and expansion. The region also acts as a significant MRO hub, boosting aftermarket sales opportunities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Airplane Compass Market.- Honeywell International Inc.

- Raytheon Technologies Corporation (Collins Aerospace)

- Garmin Ltd.

- Safran S.A.

- Thales Group

- Aspen Avionics

- Sagem (Safran)

- Mid-Continent Instruments and Avionics

- Kelly Manufacturing Company

- Genesys Aerosystems

- FreeFlight Systems

- True North Technologies

- Northrop Grumman Corporation

- Universal Avionics Systems Corporation

- L3Harris Technologies

- Esterline Technologies Corporation (now part of TransDigm Group)

- BendixKing (a division of Honeywell)

- Meggitt PLC

- Diehl Stiftung & Co. KG

- Rockwell Automation

Frequently Asked Questions

Analyze common user questions about the Airplane Compass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a magnetic compass and a fluxgate compass in aviation?

The primary difference lies in the mechanism and output: A magnetic compass is a mechanical, passive device providing visual heading relative to magnetic North, primarily used for standby reference. A fluxgate compass is an electronic, active sensor that digitally measures the magnetic field and transmits highly accurate, corrected heading data directly to the avionics bus (FMS or AHRS).

Why are magnetic compasses still mandatory in modern glass cockpit aircraft?

Magnetic compasses are mandatory because they function entirely independently of the aircraft's electrical power system, acting as a crucial, reliable backup in the event of total electrical or primary avionics failure, ensuring minimum required navigational redundancy as dictated by international air safety regulations.

How does the growth of UAVs and eVTOL platforms affect the demand for airplane compass systems?

The growth of UAVs and eVTOLs significantly boosts demand for miniature, lightweight, and highly reliable digital fluxgate compasses and magnetometers. These platforms require extremely accurate heading information for autonomous flight control and stabilization, emphasizing systems with low Size, Weight, and Power (SWaP) consumption.

Which technology segment is experiencing the fastest growth rate in the market?

The Digital Compass Systems segment, particularly those integrated into modern Attitude and Heading Reference Systems (AHRS), is experiencing the fastest growth. This is due to the rising adoption of glass cockpits, which require the high accuracy, dynamic response, and digital data interface capabilities offered by solid-state fluxgate technology over older analog or mechanical systems.

What major regulatory factors influence the replacement cycle for airplane compasses?

Major regulatory factors include mandates from the FAA, EASA, and ICAO concerning minimum navigational performance standards and system redundancy requirements (e.g., TSO compliance). These regulations periodically force fleet operators, especially in General Aviation, to replace older, less accurate magnetic indicators with certified digital or integrated systems capable of meeting modern performance criteria.

This report has been generated to provide a detailed overview of the Airplane Compass Market, analyzing key technological shifts, regional growth vectors, and the critical influence of safety regulations. The market is undergoing a fundamental evolution driven by the integration of advanced sensors and computational capabilities within the broader framework of flight deck digitalization. Future success in this market relies heavily on manufacturing lightweight, highly reliable, and easily integrated digital heading solutions that simultaneously maintain the legacy robustness of magnetic backups. Manufacturers must focus on addressing the specialized needs of high-growth sectors such as UAVs and eVTOLs while navigating the complex regulatory environment governing airworthiness and component certification globally. The projected growth indicates sustained momentum, underpinned by mandatory safety provisions and the continuous expansion of commercial and military aviation fleets worldwide. Strategic investment in fluxgate technology and AI-enhanced sensor fusion will be paramount for securing market share and maintaining competitive advantage in the forecast period.

Further analysis reveals that supply chain resilience, especially for high-grade magnetic materials and specialized microelectronics, is a key vulnerability that must be managed by leading market participants. Geopolitical stability and defense spending directly impact military segment procurement cycles, which demand rigorous specification adherence and secure supply lines. In the commercial aviation sector, longevity and maintenance simplicity drive purchasing decisions, favoring suppliers who offer comprehensive support and extended warranty programs. The aftermarket remains a lucrative avenue, often necessitating backward compatibility and tailored solutions for diverse aircraft models, ranging from vintage pistons to older regional jets. The transition towards standardized data buses and modular avionics architecture simplifies the integration of new compass technologies, accelerating the replacement rate of obsolete systems and thus supporting the market CAGR.

In summary, the Airplane Compass Market, while traditional in its core function, is undergoing significant technological modernization. The market is highly regulated, ensuring its persistent necessity within the avionics ecosystem. North America and APAC will continue to define market dynamics, with manufacturers prioritizing research into solid-state sensing and improved error correction algorithms. Addressing the challenges posed by high levels of electromagnetic interference in densely packed modern cockpits and optimizing sensors for high-latitude operations are critical technical objectives that will determine leadership in the next decade. The fundamental objective remains providing absolutely trustworthy heading information, making the compass, in whatever technological form, an indispensable component of flight safety and navigational accuracy.

The strategic imperatives for market participants include aggressive investment in securing OEM contracts for new generation aircraft, such as the next generation of narrow-body jets and advanced military trainers, which guarantees long-term volume stability. Concurrently, developing cost-effective, high-performance retrofit kits for the vast global fleet of general aviation and legacy commercial aircraft will unlock significant revenue streams in the aftermarket. Furthermore, collaboration with major INS/GPS providers to ensure seamless, compliant integration of heading data within comprehensive navigation solutions is mandatory. As autonomous flight systems mature, the market will increasingly reward suppliers capable of delivering highly accurate, low-SWaP magnetometers optimized for redundant control systems, positioning the fluxgate compass as a vital sensory input beyond simple directional indication.

The complexity of securing TSO (Technical Standard Order) and other international airworthiness certifications acts as a substantial barrier to entry for new competitors, consolidating market leadership among established avionics giants. These large corporations leverage their extensive certification experience and existing relationships with regulatory bodies (FAA, EASA) to maintain a dominant position. Smaller, specialized firms often focus on innovative components or niche aftermarket solutions, particularly in the General Aviation and experimental sectors, utilizing flexible design and faster innovation cycles to gain a foothold. Intellectual property surrounding magnetic sensing technology, error compensation algorithms, and data bus integration protocols is fiercely protected and forms a significant competitive advantage in this highly specialized field.

Future growth will also be influenced by the global sustainability movement in aviation. Manufacturers are increasingly tasked with designing lighter components that contribute minimally to overall aircraft weight, indirectly supporting fuel efficiency goals. For compass systems, this translates into a demand for smaller, lighter electronic packages and advanced materials that offer high magnetic shielding without excessive mass. The lifecycle management of these components is also crucial, with operators seeking products that offer high reliability and minimal maintenance intervention, further favoring solid-state digital systems over mechanical counterparts requiring periodic fluid replacement or intricate calibration procedures. This focus on lifecycle cost and sustainability reinforces the trend toward highly integrated and durable digital systems.

The final element impacting the market is the training and skill set required for installation and maintenance personnel. As systems transition from analog dials to complex digital sensors communicating via high-speed data buses, maintenance technicians require specialized training in digital avionics troubleshooting and precise magnetic calibration techniques. Suppliers who offer comprehensive training and support packages alongside their hardware gain a significant competitive edge, particularly in regions with developing aerospace infrastructure. Ensuring that the technological complexity does not compromise the fundamental ease of use for the pilot—especially concerning the mandatory standby magnetic compass—remains a core design priority for manufacturers serving this safety-critical industry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager