Airplane Solenoid Valves Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436244 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Airplane Solenoid Valves Market Size

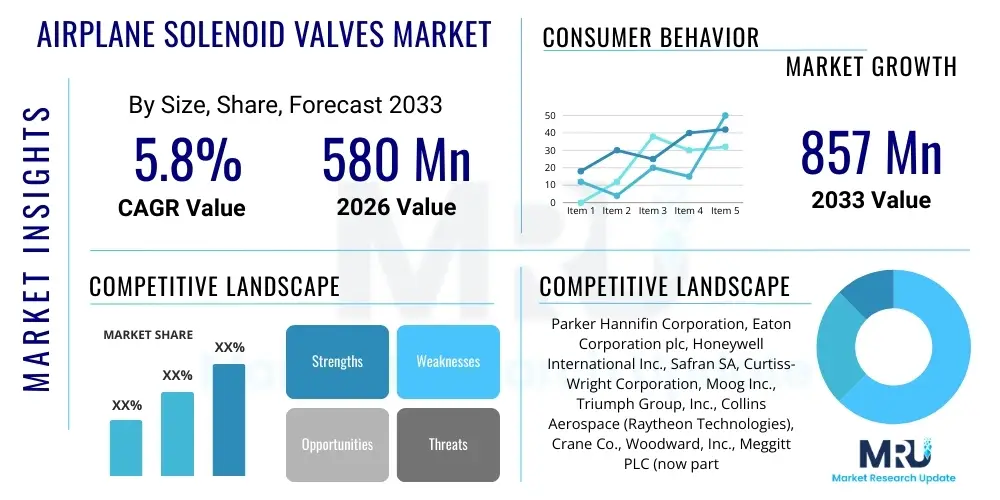

The Airplane Solenoid Valves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $580 Million in 2026 and is projected to reach $857 Million by the end of the forecast period in 2033.

Airplane Solenoid Valves Market introduction

The Airplane Solenoid Valves Market encompasses highly specialized electromechanical components used to control the flow, direction, and pressure of fluids (liquids or gases) within critical aircraft systems. These valves are indispensable in aerospace applications, including hydraulic systems, fuel systems, pneumatic controls, and environmental control systems (ECS). Given the stringent safety and reliability requirements of the aviation sector, these solenoid valves are designed to operate flawlessly under extreme conditions, such as wide temperature ranges, high vibration environments, and significant pressure differentials. They are integral to ensuring the safe and efficient operation of both commercial airliners and military aircraft, facilitating everything from landing gear deployment to precise engine fuel metering.

Major applications of these valves span across thrust reversal systems, cabin pressurization mechanisms, potable water distribution, and auxiliary power units (APUs). The primary benefits of using advanced solenoid valves in aircraft include their rapid response time, high durability, compact size, and reduced weight compared to manual or purely mechanical valve alternatives. Furthermore, the incorporation of smart solenoid valves capable of providing real-time diagnostic feedback is enhancing aircraft maintenance predictability and operational uptime, leading to lower total cost of ownership for airlines and operators.

Driving factors for market expansion include the continuous increase in global air passenger traffic, necessitating large-scale fleet expansion and modernization programs, particularly in the Asia-Pacific region. Additionally, the shift towards more fuel-efficient and environmentally compliant aircraft designs requires sophisticated fluid control mechanisms, propelling demand for technologically advanced, lightweight solenoid valves made from aerospace-grade materials. The steady retirement of older aircraft models and their replacement with newer generation planes, often featuring greater complexity in fluidic systems, further sustains the market growth trajectory.

Airplane Solenoid Valves Market Executive Summary

The Airplane Solenoid Valves Market is characterized by robust growth, driven primarily by favorable macro-level business trends, including escalating global commercial aircraft production rates and increasing expenditure on military modernization programs. The transition toward electric and hybrid-electric aircraft architectures is creating new avenues for specialized solenoid valves capable of managing high-voltage coolants and cryogenic fluids. Business trends indicate a strong emphasis on supply chain resilience and vertical integration among key manufacturers to mitigate component scarcity and maintain intellectual property related to proprietary sealing and actuation technologies. Furthermore, lifecycle management and aftermarket services represent a critical revenue stream, as rigorous maintenance schedules mandate frequent replacement and overhaul of these critical fluid control components across aging fleets globally.

Regionally, the market exhibits dynamic shifts, with North America and Europe maintaining dominant market shares due to the concentration of major aerospace OEMs and robust military aerospace sectors. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by unprecedented demand for new commercial aircraft, infrastructural development supporting Maintenance, Repair, and Overhaul (MRO) activities, and burgeoning domestic aerospace manufacturing capabilities in China and India. Latin America and the Middle East and Africa (MEA) are contributing to growth through expanding low-cost carrier operations and strategic defense procurements, respectively, demanding reliable components for fleet expansion and maintenance.

Segment trends highlight the dominance of the Hydraulic Systems application segment, given the reliance on precise hydraulic pressure management for flight control surfaces and landing systems. Based on Type, direct-acting solenoid valves are widely utilized, but the proportional solenoid valves segment is experiencing rapid adoption due to the need for continuous modulation and highly precise flow control in modern, complex environmental control systems. In terms of platform, the Commercial Aircraft subsegment remains the largest revenue generator, while the Military Aircraft subsegment provides stability through long-term, high-value procurement cycles focused on high-performance and ruggedized component specifications.

AI Impact Analysis on Airplane Solenoid Valves Market

User inquiries regarding AI's impact on the Airplane Solenoid Valves Market commonly center on predictive maintenance, automated quality inspection, and optimization of fluidic system performance. Users are keen to understand how AI algorithms can leverage sensor data collected from installed solenoid valves—such as cycle counts, temperature fluctuations, and response times—to forecast potential failures far in advance of traditional scheduled maintenance intervals. Key themes include the reduction of unscheduled downtime, the viability of integrating AI models into existing Electronic Engine Control (EEC) and flight management systems (FMS), and the necessary standardization of data protocols for successful cross-platform predictive analytics. Concerns often revolve around data security, the high cost of sensor deployment across legacy fleets, and the stringent certification requirements needed for AI-driven maintenance recommendations in highly regulated aerospace environments.

- AI algorithms enable predictive maintenance scheduling, significantly reducing the risk of in-flight failures related to valve component wear.

- Machine learning enhances manufacturing quality control by analyzing high-throughput sensor data during production, optimizing assembly precision.

- AI-driven optimization models refine solenoid valve actuation timing and fluid flow rates, improving overall aircraft system efficiency, particularly in fuel management.

- Integration of AI in onboard diagnostics aids in real-time fault isolation and performance degradation detection within complex hydraulic and pneumatic networks.

- Natural Language Processing (NLP) tools assist maintenance crews by rapidly cross-referencing vast maintenance manuals and historical failure data specific to solenoid valve issues.

DRO & Impact Forces Of Airplane Solenoid Valves Market

The market dynamics for airplane solenoid valves are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), alongside significant internal and external impact forces. Primary drivers include the robust global demand for new commercial aircraft, necessitating high volumes of original equipment manufacturer (OEM) components, coupled with stringent regulatory standards imposed by aviation authorities like the FAA and EASA, which mandate the use of certified, high-reliability solenoid valves. Restraints predominantly involve the extremely long qualification cycles and high barriers to entry for new market participants, driven by the requirement for flawless performance in safety-critical applications. Opportunities are emerging through the development of miniaturized, lightweight valves for Unmanned Aerial Vehicles (UAVs) and the increasing focus on advanced material science to produce corrosion-resistant and highly durable components. These factors are further intensified by the impact forces of technological evolution and shifting geopolitical defense spending.

The core drivers are sustained by the continuous increase in global RPKs (Revenue Passenger Kilometers), which mandates fleet expansion and modernization, particularly targeting fuel efficiency gains. Airlines are increasingly seeking sophisticated solenoid valves that integrate smart diagnostic capabilities, minimizing maintenance downtime and enhancing operational awareness. The military segment also acts as a stable driver, with ongoing global replacement cycles for fighter jets and transport aircraft demanding customized, ruggedized valves engineered to withstand severe operational parameters, including high G-forces and extreme temperatures inherent in defense missions.

Conversely, significant restraints limit explosive growth. The capital-intensive nature of solenoid valve manufacturing, requiring specialized testing facilities and cleanroom environments, coupled with dependency on highly regulated, certified raw materials, creates inertia. Furthermore, the extended service life of aircraft means that long-term support and spare parts provision must be guaranteed, tying manufacturers into extensive contractual obligations. Despite these challenges, opportunities abound in emerging technologies, such as utilizing Additive Manufacturing (AM) for prototyping and producing complex valve bodies, potentially reducing lead times and material waste, and the growing requirement for electrically actuated valves in transitioning towards more-electric aircraft (MEA) architectures, which fundamentally alter the fluid control landscape.

Segmentation Analysis

The Airplane Solenoid Valves Market is meticulously segmented based on critical operational and commercial parameters, allowing for detailed market analysis and strategic planning. The primary segmentation criteria include the valve Type (Direct Acting, Pilot Operated, Proportional), the specific Aircraft Type (Commercial Aircraft, Military Aircraft, General Aviation), and the Application area within the aircraft (Hydraulic Systems, Fuel & Lubrication Systems, Pneumatic Systems, Environmental Control Systems). This multi-dimensional approach helps stakeholders understand which product features and end-use environments are driving revenue generation and technological innovation.

The segmentation by Type is crucial as it reflects varying levels of operational precision and capacity requirements. Direct-acting valves, while simpler and faster, are generally used for lower flow rates, whereas pilot-operated valves leverage line pressure to control larger flow volumes, dominating applications like main hydraulic reservoir control. Proportional valves are gaining traction as they offer continuous modulation capability, essential for fine-tuning fuel flow or cabin temperature management, moving beyond simple on/off switching. Analyzing these distinctions is vital for targeting specific design upgrades and R&D efforts aimed at optimizing performance-to-weight ratios in critical aviation infrastructure.

In terms of application, Hydraulic Systems consistently hold the largest market share due to their necessity in flight control actuation, braking, and landing gear operation, requiring large, robust, and reliable valves. However, the fastest growth is often observed in the Fuel & Lubrication Systems segment, driven by the continuous pressure on aircraft manufacturers to improve engine efficiency and manage complex synthetic lubricant flows. Understanding this segmentation helps companies tailor their component sizing, material selection, and certification efforts to meet the extremely high reliability thresholds mandated for engine proximity applications.

- By Type:

- Direct Acting Solenoid Valves

- Pilot Operated Solenoid Valves

- Proportional Solenoid Valves

- By Aircraft Type:

- Commercial Aircraft (Narrowbody, Widebody, Regional Jets)

- Military Aircraft (Fighter Jets, Transport Aircraft, Helicopters)

- General Aviation and Business Jets

- By Application:

- Hydraulic Systems

- Fuel & Lubrication Systems

- Pneumatic Systems

- Environmental Control Systems (ECS)

- Water and Waste Systems

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (MRO)

Value Chain Analysis For Airplane Solenoid Valves Market

The value chain for airplane solenoid valves is highly structured, beginning with specialized material sourcing and culminating in extensive MRO activities. Upstream analysis highlights reliance on a few critical suppliers for aerospace-grade raw materials, including specialized stainless steel alloys, high-performance plastics (like PEEK), and proprietary sealing compounds necessary to withstand aviation fluid corrosiveness and extreme temperatures. Suppliers must meet rigorous quality controls and traceability standards, often becoming certified partners of major valve manufacturers. This upstream segment is characterized by high material costs and strict regulatory oversight, necessitating long-term supplier relationships and meticulous inventory management to ensure production continuity.

The midstream phase involves complex manufacturing, assembly, and rigorous testing. Solenoid valve manufacturers leverage advanced techniques such as precision machining, laser welding, and automated winding of electromagnetic coils. Qualification testing, which includes endurance cycling, vibration testing, and environmental simulation (altitude, temperature), forms a significant portion of the cost structure. Direct and indirect distribution channels play a pivotal role here; OEM distribution involves long-term contracts delivering valves directly to aircraft production lines (e.g., Boeing, Airbus). Indirect distribution, mainly focused on the aftermarket, involves specialized aerospace distributors and MRO providers who maintain certified stock for replacement and overhaul services globally.

Downstream analysis focuses on the end-users—aircraft manufacturers, major airlines, cargo operators, and defense agencies—and the essential role of the MRO ecosystem. The aftermarket is crucial, representing a stable and often high-margin revenue stream, driven by mandatory component replacement schedules dictated by flight hours or calendar time. The high cost of certification means that components often remain in use for decades, necessitating comprehensive logistics and support networks. The traceability of components and compliance with airworthiness directives are paramount throughout the downstream process, making robust documentation and certified repair capabilities non-negotiable requirements for participants in this part of the value chain.

Airplane Solenoid Valves Market Potential Customers

The primary customer base for the Airplane Solenoid Valves Market is highly concentrated and falls into three main categories: Aircraft Original Equipment Manufacturers (OEMs), Major Airlines and Fleet Operators, and Government/Defense Agencies. OEMs, such as Airbus, Boeing, Embraer, and Bombardier, represent the largest initial point of demand, integrating these valves into newly manufactured aircraft across all system applications—from engine controls to environmental systems. These buyers require high-volume, standardized, yet custom-designed valves with multi-year supply contracts, focusing heavily on weight reduction, reliability, and ease of integration into complex airframes.

Major airlines and cargo operators are the principal customers in the high-volume, highly profitable aftermarket segment. As end-users operating large fleets, their demand is driven by scheduled maintenance, component wear-out, and unscheduled repairs. Buyers in this segment, including carriers like Delta, Lufthansa, FedEx, and Singapore Airlines, prioritize component availability, reliability metrics (Mean Time Between Failures - MTBF), competitive pricing for spare parts, and robust MRO support services globally to minimize Aircraft On Ground (AOG) time. They increasingly seek condition-monitoring capabilities embedded within the valves themselves to enable data-driven predictive maintenance strategies.

The third significant customer segment includes government entities and defense procurement agencies (e.g., the U.S. DoD, NATO forces). These customers procure solenoid valves for military platforms, including fighter jets, heavy lift transports, and specialized surveillance aircraft. Their buying criteria emphasize extreme durability, resistance to harsh operational environments (e.g., nuclear hardening, extreme temperatures), compliance with specialized military standards (MIL-SPECs), and guaranteed long-term logistical support, often resulting in complex, sole-source contracts designed to secure critical national defense capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580 Million |

| Market Forecast in 2033 | $857 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Parker Hannifin Corporation, Eaton Corporation plc, Honeywell International Inc., Safran SA, Curtiss-Wright Corporation, Moog Inc., Triumph Group, Inc., Collins Aerospace (Raytheon Technologies), Crane Co., Woodward, Inc., Meggitt PLC (now part of Parker Hannifin), Liebherr Group, Bosch Rexroth AG, SMC Corporation, Circor International, Inc., Fluid Control Products, Inc., Crissair, Inc., AVIC (Aviation Industry Corporation of China), Hydra-Electric Company, Zotefoams plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Airplane Solenoid Valves Market Key Technology Landscape

The technology landscape for airplane solenoid valves is characterized by relentless innovation focused on achieving higher reliability, reduced size, and optimized power consumption. A key area of development is the transition toward the use of advanced ceramic and composite materials within the valve structure. These materials offer superior resistance to thermal cycling and chemical erosion from aggressive synthetic fluids, extending the Mean Time Between Overhauls (MTBO). Furthermore, advancements in sealing technologies, particularly incorporating highly durable elastomer compounds and metal-to-metal sealing techniques, are crucial for maintaining leak integrity under extreme pressures and vibrations experienced during high-altitude operations and thrust reversal sequences.

The rise of the More-Electric Aircraft (MEA) paradigm is fundamentally influencing valve design, shifting demand towards fully electronic actuation and away from reliance on bleed air or hydraulic power for valve operation. This necessitates the development of sophisticated electronic controllers integrated directly onto the solenoid body (smart valves) that can manage power consumption efficiently and communicate performance diagnostics back to the central aircraft maintenance computer via standardized bus protocols like ARINC 429 or MIL-STD-1553. These smart valves are pivotal for implementing predictive maintenance strategies, enabling operators to move from time-based servicing to condition-based monitoring, optimizing asset utilization.

Miniaturization and modular design are other critical technological trends, especially vital for UAVs and next-generation urban air mobility (UAM) vehicles where weight and space constraints are paramount. Manufacturers are leveraging micro-fluidic principles and highly efficient magnetic circuits to reduce the footprint of the solenoid valve without compromising flow capacity or response speed. This technological push also involves optimizing the electromagnetic coil design to reduce heat generation, which is a significant factor in component degradation, ensuring that the valves maintain peak performance across extended operational cycles in confined aerospace environments.

Regional Highlights

- North America: North America, particularly the United States, holds the largest market share owing to the presence of major global aircraft OEMs (Boeing, Lockheed Martin) and Tier 1 suppliers, alongside the world's largest and most technologically advanced defense sector. The region benefits from substantial government defense spending on fleet upgrades and modernization, driving consistent demand for high-specification solenoid valves for both military and commercial platforms. The mature MRO infrastructure and stringent regulatory environment (FAA mandates) ensure high component replacement rates and a focus on premium, certified products. Technological leadership in aerospace materials and complex systems integration further solidifies North America's dominance, making it the hub for high-value research and development in solenoid valve technology.

- Europe: Europe represents a strong second market, characterized by the manufacturing powerhouse of Airbus and leading suppliers such as Safran and Liebherr. Demand is robust, driven by the replacement cycle for widebody and narrowbody fleets, and strong defense collaborations within NATO, necessitating continuous component updates. European regulations (EASA) align closely with safety mandates, promoting the adoption of certified and high-reliability components. The region is pioneering advancements in sustainable aviation, fostering demand for solenoid valves optimized for future fuels and advanced thermal management systems within more-electric architectures, especially across the UK, France, and Germany.

- Asia Pacific (APAC): APAC is anticipated to exhibit the fastest growth over the forecast period, primarily due to the explosive expansion of air travel and fleet modernization programs in countries like China, India, and Southeast Asian nations. The region is witnessing a major influx of new narrowbody aircraft deliveries to support burgeoning low-cost carriers. While the market historically relied on imports, local aerospace development and assembly capabilities (e.g., COMAC in China) are driving localized demand for components. Significant infrastructure investment in MRO facilities across key regional hubs is further boosting the aftermarket segment, although competitive pricing pressures often influence purchasing decisions in this dynamic area.

- Latin America: The Latin American market exhibits steady, albeit smaller, growth, primarily driven by fleet expansion and replacement cycles among regional carriers such as LATAM and Azul. The demand is often concentrated on aftermarket services and component support for existing fleets, typically procured through international distributors and MRO networks due to limited localized manufacturing. Economic stability remains a key factor influencing capital expenditure on fleet renewal, directing focus towards cost-effective yet certified components for maintenance activities across Brazil and Mexico.

- Middle East and Africa (MEA): The Middle East is a high-growth region characterized by substantial investment in modern, long-haul commercial aircraft by major international carriers (e.g., Emirates, Qatar Airways). This demand focuses on advanced, high-performance solenoid valves suitable for widebody aircraft applications. Africa’s growth is more fragmented, centered on maintaining older fleets, where reliability and cost-efficiency of aftermarket parts are prioritized. Geopolitical factors also drive defense spending in the Middle East, ensuring a consistent market for military-grade solenoid valves tied to strategic defense acquisitions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Airplane Solenoid Valves Market.- Parker Hannifin Corporation

- Eaton Corporation plc

- Honeywell International Inc.

- Safran SA

- Curtiss-Wright Corporation

- Moog Inc.

- Triumph Group, Inc.

- Collins Aerospace (Raytheon Technologies)

- Crane Co.

- Woodward, Inc.

- Meggitt PLC (now part of Parker Hannifin)

- Liebherr Group

- Bosch Rexroth AG

- SMC Corporation

- Circor International, Inc.

- Fluid Control Products, Inc.

- Crissair, Inc.

- AVIC (Aviation Industry Corporation of China)

- Hydra-Electric Company

- Zotefoams plc

Frequently Asked Questions

Analyze common user questions about the Airplane Solenoid Valves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for airplane solenoid valves?

The central driver is the substantial increase in global commercial aircraft production rates, fueled by rising passenger traffic, fleet modernization programs, and the continuous requirement for reliable, certified fluid control components in safety-critical aircraft systems.

Which application segment holds the largest market share for these valves?

The Hydraulic Systems application segment typically holds the largest market share, as solenoid valves are essential for the precise and rapid control of landing gear, flight control surfaces, and braking systems across all commercial and military aircraft.

How is the transition to More-Electric Aircraft (MEA) impacting solenoid valve technology?

The MEA trend is increasing demand for advanced, electrically actuated solenoid valves and integrated smart valves, reducing reliance on hydraulic or pneumatic power, and requiring specialized components capable of efficient thermal management and onboard diagnostics.

What are the main restraints faced by companies entering the Airplane Solenoid Valves Market?

Major restraints include the extremely high cost and long duration required for product certification (FAA/EASA), the capital intensity of manufacturing processes, and the necessity of establishing a proven track record of reliability for safety-critical aerospace applications.

Which region is expected to demonstrate the highest growth rate in the forecast period?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by massive commercial fleet expansion, growing middle-class demand for air travel, and increasing localized manufacturing and MRO activities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager