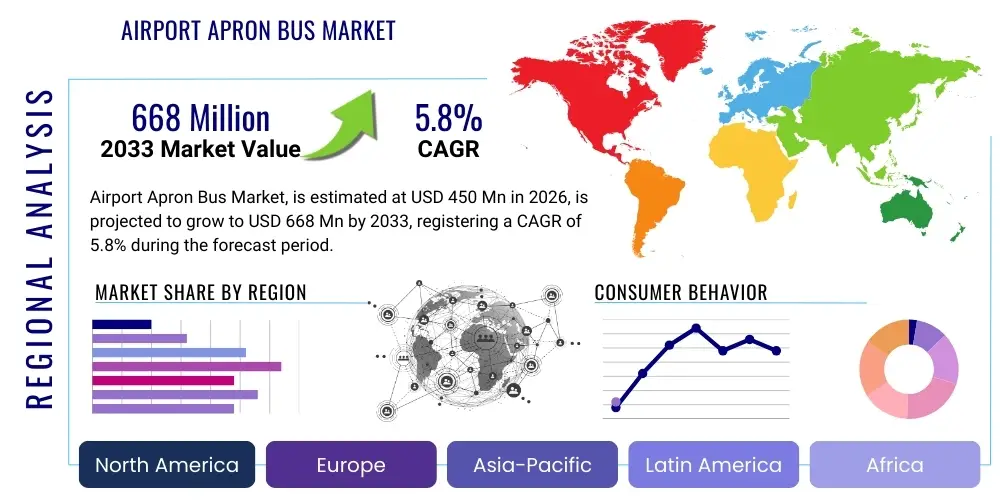

Airport Apron Bus Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437496 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Airport Apron Bus Market Size

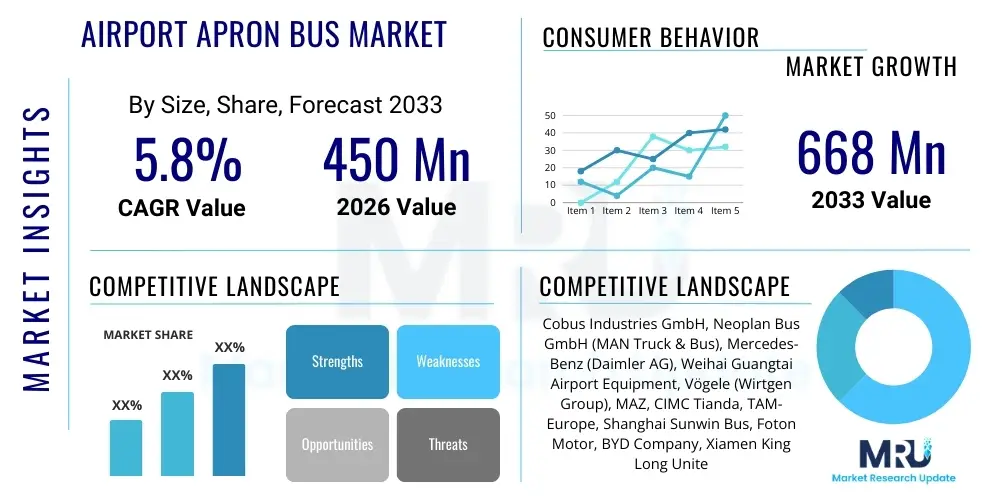

The Airport Apron Bus Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 668 Million by the end of the forecast period in 2033.

Airport Apron Bus Market introduction

The Airport Apron Bus Market encompasses specialized vehicles designed exclusively for transporting passengers between terminal buildings and parked aircraft across the airport apron area. These vehicles, distinct from standard city buses, are characterized by low floors, high passenger capacity, and wide doors to facilitate rapid boarding and disembarking, prioritizing efficiency and safety within the constrained operational environment of an airport tarmac. The core function of these buses is critical for minimizing turnaround times, especially at high-traffic hubs utilizing remote stands or gate-to-gate transfers. As global air travel continues its recovery and subsequent expansion, the demand for reliable and high-capacity apron buses is escalating, driven by infrastructure upgrades and the need for optimized ground handling services.

The primary applications of airport apron buses include airside transfers for international and domestic flights, serving as critical links in the passenger flow management system. Major applications involve ferrying passengers to and from remote parking stands, connecting different terminals, and facilitating swift crew transfers. The benefits offered by these specialized vehicles are manifold: they enhance operational efficiency by reducing aircraft occupancy time at gates, improve passenger comfort through spacious, climate-controlled interiors, and contribute significantly to airport punctuality metrics. Furthermore, modern apron buses, particularly electric models, support airports in meeting stringent environmental compliance targets by minimizing ground emission footprints, aligning with broader sustainability initiatives across the aviation industry.

Key driving factors propelling the market forward include the rapid expansion and modernization of airport infrastructure, particularly in the Asia Pacific and Middle East regions, where massive new hub development projects are underway. The increasing trend of using remote boarding gates due to limited direct gate space at older, capacity-strained airports further necessitates a larger fleet of apron buses. Moreover, technological advancements focusing on electric propulsion systems, enhanced safety features, and integration with Airport Collaborative Decision Making (A-CDM) systems are generating replacement demand, encouraging airport authorities and ground handling firms to upgrade their existing fleets to maximize operational throughput and reduce maintenance overheads in the long term.

Airport Apron Bus Market Executive Summary

The Airport Apron Bus Market is poised for stable growth, fueled primarily by major aviation infrastructure investments globally and the accelerating transition toward electric and hybrid vehicle fleets in ground support equipment (GSE). Business trends indicate a strong competitive focus on technological differentiation, with leading manufacturers investing heavily in modular designs, enhanced battery technology, and smart integration capabilities to offer solutions that reduce total cost of ownership (TCO) for airport operators. Mergers and strategic partnerships between traditional bus manufacturers and specialized GSE providers are becoming prominent strategies to consolidate market share and offer comprehensive maintenance and service packages. Operational sustainability remains a paramount concern, pushing procurement decisions heavily towards zero or low-emission vehicles, which fundamentally alters the supply chain dynamics.

Regionally, the Asia Pacific market is projected to exhibit the highest growth rate, underpinned by surging passenger traffic in China, India, and Southeast Asia, necessitating extensive fleet expansion at newly constructed or significantly expanded international airports. Europe and North America, characterized by mature aviation markets, are focusing primarily on fleet modernization and replacement, driven by stringent emission standards and the implementation of advanced safety protocols. The Middle East remains a critical investment zone, with large-scale projects like new terminals in the UAE and Saudi Arabia demanding high-capacity, climate-resilient apron buses. These regional variations dictate different demand profiles—expansion demand dominates APAC and MEA, while replacement demand leads in the West.

Segmentation trends highlight the increasing dominance of the electric segment. While diesel remains the installed base standard, the electric apron bus segment is anticipated to grow fastest due to regulatory incentives, lower operational noise, and reduced fuel volatility risks. In terms of capacity, the market is favoring high-capacity models (100–150 passengers and above) to handle the growing size of wide-body aircraft passenger loads and maximize vehicle utilization rates at congested airports. Civil airports remain the overwhelming end-user segment, although military applications require specialized, ruggedized variants. Overall, the market trajectory is defined by sustainability, smart operational integration, and capacity optimization.

AI Impact Analysis on Airport Apron Bus Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) will transform ground handling logistics, specifically questioning the timeline for autonomous apron bus deployment and the potential impact on driver jobs. Key concerns revolve around the safety and reliability of AI-driven navigation systems in complex, highly dynamic airport environments, particularly during low visibility conditions or unexpected ground traffic congestion. Furthermore, stakeholders seek clarity on how AI-powered predictive maintenance can optimize fleet uptime, reduce unforeseen failures, and improve scheduling efficiency for ground operations managers. The overarching expectation is that AI will move the market beyond simple electric propulsion towards a fully integrated, self-optimizing ground transportation ecosystem, prioritizing efficiency and reducing human error in vehicle routing and operational decision-making.

The integration of AI into the Airport Apron Bus market is currently focused less on full autonomy and more on enhancing operational intelligence and safety. Advanced driver-assistance systems (ADAS) utilizing machine vision, object recognition, and predictive pathfinding algorithms are being deployed to mitigate collision risks on crowded aprons. AI algorithms are also crucial in optimizing charging cycles for electric fleets, dynamically balancing grid load, and ensuring buses are charged efficiently based on real-time flight schedules and anticipated passenger loads, thereby maximizing vehicle availability and extending battery life.

Furthermore, AI-driven predictive maintenance represents a significant shift in fleet management strategy. By analyzing continuous sensor data regarding battery health, motor performance, tire wear, and HVAC system efficiency, ML models can predict potential failures long before they occur, scheduling maintenance proactively rather than reactively. This capability drastically reduces downtime, lowers maintenance costs, and ensures compliance with strict airport safety regulations. The eventual goal is to integrate these smart buses seamlessly into an airport's overall smart mobility platform, using AI to synchronize apron movements with aircraft arrival/departure protocols, minimizing waiting times for passengers and improving overall airport flow.

- AI-powered Predictive Maintenance: Minimizes bus downtime and reduces operational expenses by forecasting equipment failure.

- Optimized Routing and Scheduling: Utilizes ML algorithms for real-time traffic analysis, reducing vehicle idle time and fuel/energy consumption.

- Enhanced Safety (ADAS): Implementation of machine vision and sensor fusion for collision avoidance and precise docking.

- Autonomous Operation Trials: Pilot programs focused on self-driving capabilities in controlled environments for streamlined shuttle services.

- Dynamic Charging Management: AI systems optimize electric bus charging schedules based on demand forecasting and energy costs.

DRO & Impact Forces Of Airport Apron Bus Market

The market dynamics are significantly shaped by a confluence of accelerating aviation traffic (Driver), strict regulatory hurdles related to safety and certification (Restraint), and the immense opportunities presented by the global shift towards electrification and smart airport integration (Opportunity). These forces create a high-impact environment where manufacturers must balance high capital expenditure requirements with the growing operational need for sustainable and efficient passenger transfer solutions. The overall impact force is strongly positive, driven by long-term airport infrastructure development cycles and mandated environmental upgrades, overshadowing short-term capital constraints faced by some smaller airport operators.

The primary driver is the sheer increase in global air passenger volumes, which necessitates higher frequency and greater capacity in ground transportation systems. This is amplified by the expansion of existing airports and the construction of new mega-hubs, particularly in emerging economies. However, this growth is restrained by the incredibly stringent regulatory environment governing airport ground support equipment. Apron buses must meet specialized aviation standards for fire safety, electromagnetic compatibility, and operational reliability within the sensitive airside domain. The lengthy certification and procurement processes, coupled with the high initial investment cost for electric fleets, act as substantial barriers, especially for smaller market participants or low-budget regional airports.

The most compelling opportunities lie in the wholesale transition to zero-emission mobility. Governments and airport authorities are offering significant incentives and setting aggressive deadlines for replacing diesel fleets, creating a robust, mandated replacement cycle. Furthermore, the integration of apron buses into the Internet of Things (IoT) ecosystems of smart airports offers opportunities for value-added services, data analytics, and operational synchronization. The key impact forces, which include technological change and environmental regulation, are fundamentally reshaping the competitive landscape, rewarding innovative manufacturers who can deliver integrated, sustainable, and highly reliable transportation platforms.

Segmentation Analysis

The Airport Apron Bus Market is meticulously segmented based on Type (Propulsion System), Passenger Capacity, and End-User, reflecting the diverse operational needs across the global aviation ecosystem. The segmentation by Type—Diesel, Electric, and Hybrid—is the most dynamic, showing a clear migration away from traditional diesel platforms toward environmentally superior electric solutions, which are becoming technologically mature and economically viable due to falling battery costs and increasing efficiency. Capacity segmentation mirrors airport throughput, with high-volume international hubs primarily demanding larger buses to minimize turnaround times and optimize passenger flow, while smaller regional airports maintain demand for medium-capacity vehicles.

The detailed analysis of these segments is crucial for strategic market positioning. Manufacturers must tailor their product portfolios to address the specific performance requirements of each segment. For instance, electric bus offerings must address concerns related to range anxiety and charging infrastructure compatibility, particularly in high-temperature environments or where rapid turnaround is non-negotiable. Capacity models, on the other hand, require robust chassis design and ergonomic interior layouts to maximize passenger safety and comfort during heavy loading and unloading cycles on the apron. Understanding these nuances allows suppliers to target specific regional and operational needs effectively.

This granular segmentation also provides insight into future investment priorities. As airports evolve into complex logistical hubs, demand is rising not only for the hardware (the bus itself) but for integrated software and fleet management solutions compatible with the specific propulsion type and capacity requirements. The long-term profitability within this market will increasingly depend on the ability of manufacturers to transition successfully into holistic solution providers, offering both advanced vehicles and the requisite charging/maintenance infrastructure tailored to distinct segments like Civil Airports, which dominate the market demand landscape.

- Type

- Diesel

- Electric

- Hybrid

- Capacity

- Less than 100 Passengers

- 100–150 Passengers

- More than 150 Passengers

- End-User

- Civil Airports

- Military Airports

Value Chain Analysis For Airport Apron Bus Market

The value chain for the Airport Apron Bus Market is characterized by a high degree of specialization and complexity, starting with upstream component suppliers, moving through sophisticated vehicle manufacturing and customization, and culminating in airport-specific deployment and long-term maintenance services. Upstream analysis highlights key suppliers providing specialized components such as low-floor chassis, advanced battery systems (for electric variants), climate control units engineered for high thermal loads, and highly specialized door mechanisms essential for rapid passenger flow. The reliance on a few key global suppliers for proprietary components, especially battery packs and specialized axles, introduces supply chain risks that manufacturers must actively manage through dual-sourcing strategies.

In the middle segment of the value chain, vehicle assembly and customization are paramount. Major OEMs often source standard truck chassis components but integrate unique body structures compliant with airside regulations (e.g., maximum height and width restrictions). Direct manufacturing processes focus on welding, painting, interior fitting (prioritizing durability and ease of cleaning), and the installation of complex electronic systems for vehicle management and communications. Distribution channels are predominantly direct, involving sales teams engaging directly with airport authorities, governmental procurement bodies, or large third-party ground handling companies. Indirect channels, primarily specialized GSE distributors, are utilized in smaller regional markets where direct OEM presence is less established.

Downstream analysis focuses heavily on maintenance, repair, and overhaul (MRO) services, which represent a significant portion of the total lifetime value proposition. Because apron buses operate under demanding, high-utilization cycles, rapid and reliable after-sales support is non-negotiable. Manufacturers that offer comprehensive, technologically advanced MRO packages, including predictive maintenance agreements and local parts stocking, gain a competitive edge. This downstream activity also involves continuous technological updates, such as battery replacements or software upgrades, ensuring the vehicles comply with evolving aviation and environmental standards throughout their extended operational lives of 15-20 years. Effective management of this chain ensures timely delivery, operational reliability, and competitive pricing for the end-users.

Airport Apron Bus Market Potential Customers

The core customer base for Airport Apron Buses consists overwhelmingly of two primary end-user groups: airport operating authorities and large, multinational ground handling service providers. Airport operating authorities, which include both government-owned entities and privately managed organizations (e.g., Aéroports de Paris, Fraport), are often the direct purchasers, particularly when the fleet is considered a core part of the airport's public infrastructure or a mandated service. Their procurement decisions are heavily influenced by regulatory compliance, long-term capital budgeting, and sustainability targets, focusing on durability and emission standards rather than immediate cost minimization.

The second major group, ground handling companies such as Swissport, Menzies Aviation, and Dnata, purchase or lease these buses to fulfill contracts signed with airlines or airport operators. For these buyers, the primary concern is operational efficiency, reliability, and maximizing utilization rates, as bus downtime directly impacts their service level agreements (SLAs). They prioritize vehicles with robust build quality, ease of maintenance, and compatibility with standardized airport communication systems. Increasingly, smaller, regional airports also constitute a growing, though lower-volume, customer segment, often favoring reliable, less technologically complex models or used equipment to manage constrained budgets.

Furthermore, defense ministries and military bases globally represent a niche but stable customer segment (Military Airports). Although volume is lower, their demand is for highly reliable, often custom-built buses that can operate effectively in extreme conditions and meet unique military transport security requirements. In emerging markets, governmental aviation bodies often act as consolidated buyers, purchasing large volumes of buses in multi-year contracts as part of national infrastructure investment plans. Addressing the needs of these diverse customer profiles requires manufacturers to maintain flexible production capabilities and adaptive service models tailored to varying levels of technical sophistication and budget constraints.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 668 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cobus Industries GmbH, Neoplan Bus GmbH (MAN Truck & Bus), Mercedes-Benz (Daimler AG), Weihai Guangtai Airport Equipment, Vögele (Wirtgen Group), MAZ, CIMC Tianda, TAM-Europe, Shanghai Sunwin Bus, Foton Motor, BYD Company, Xiamen King Long United Automotive Industry, Zhejiang Zhongtong Bus, Yutong Bus, Ashok Leyland, Scania AB, Blue Bird Corporation, Gillig LLC, E-Z-GO (Textron), Mototok International GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Airport Apron Bus Market Key Technology Landscape

The technology landscape of the Airport Apron Bus Market is undergoing a radical transformation, moving from traditional mechanical engineering to integrated electric and digital platforms. The most significant technological shift is the adoption of advanced battery-electric propulsion systems. These systems utilize high-density lithium-ion batteries and highly efficient permanent magnet synchronous motors, replacing conventional internal combustion engines. Key technological challenges addressed by modern electric buses include rapid charging capability (often utilizing pantograph or inductive charging systems on the apron), thermal management systems necessary to maintain battery performance in extreme climates, and weight optimization to compensate for heavy battery packs while maintaining high passenger capacity and strict axle load limits required for airside operations.

Beyond electrification, the integration of telematics and Internet of Things (IoT) solutions is redefining fleet management. Modern apron buses are equipped with a suite of sensors that monitor vehicle diagnostics, operational status, passenger load, and precise GPS location. This data is transmitted in real-time to centralized airport ground operations control centers, enabling sophisticated fleet tracking, utilization analysis, and proactive maintenance scheduling through cloud-based platforms. This connectivity is essential for implementing Airport Collaborative Decision Making (A-CDM) programs, ensuring that bus movements are perfectly synchronized with flight events, thereby minimizing delays and maximizing ground efficiency. The development of robust, secure communication protocols tailored for the airside environment is a primary focus area for technology providers.

Furthermore, safety and operational efficiency technologies are continuously evolving. Low-floor designs, already a standard, are being optimized with advanced air suspension systems to ensure stable loading and unloading regardless of passenger numbers. Manufacturers are also incorporating advanced driver-assistance systems (ADAS), featuring high-resolution cameras, LiDAR, and radar to provide 360-degree awareness and automatic emergency braking, critical in the busy, confined space of the apron. Looking forward, the development of Vehicle-to-Infrastructure (V2I) communication is expected to allow buses to communicate directly with airport traffic control systems and charging stations, paving the way for semi-autonomous or fully autonomous operational capability within dedicated airside corridors, significantly improving safety and predictability.

Regional Highlights

The global demand for Airport Apron Buses exhibits distinct patterns based on regional aviation maturity, infrastructure investment levels, and environmental regulatory pressures. Asia Pacific (APAC) stands out as the epicenter of market growth, driven by substantial infrastructure development projects across China, India, and Southeast Asia. Countries like Vietnam, Indonesia, and the Philippines are witnessing massive increases in passenger traffic, necessitating the construction of new terminals and international hubs, leading to high-volume procurement of new fleet units. The APAC market shows a growing preference for both high-capacity models and newly introduced domestic electric variants from regional manufacturers, aiming for both capacity and sustainability.

Europe represents a mature but highly regulatory-driven market. Growth here is primarily focused on fleet replacement, specifically the accelerated phase-out of diesel models in favor of electric and hydrogen-powered buses, stimulated by strict EU emissions mandates and local government incentives (e.g., in Germany, France, and the Netherlands). European procurement demands stringent quality control, durability, and a focus on operational integration with complex airport digital systems. Similarly, North America focuses on modernization, driven by aging infrastructure and the need to improve passenger experience at major hubs. Procurement cycles in the US often involve large contracts for robust, reliable electric models that can withstand varying climate conditions.

The Middle East and Africa (MEA) region is characterized by high-value, large-scale projects, particularly in the UAE, Saudi Arabia, and Qatar. These markets demand specialized, high-performance buses designed to operate efficiently under extremely high ambient temperatures, requiring robust air conditioning and powertrain thermal management systems. Investment is often tied directly to national economic diversification and tourism strategies, leading to procurement of the latest, high-end electric and luxury apron bus models. Latin America presents a moderately growing market, constrained somewhat by economic volatility, yet exhibiting steady demand for reliable, cost-effective buses to serve expanding regional hubs in countries like Brazil and Mexico.

- Asia Pacific (APAC): Highest growth potential, driven by new airport construction and modernization in China and India; strong adoption of domestic electric bus manufacturers.

- Europe: Focus on mandatory fleet replacement with zero-emission (Electric/Hybrid) vehicles due to stringent environmental regulations and established airside operations standards.

- North America: Stable replacement market concentrating on advanced safety features, connectivity, and maximizing operational efficiency at capacity-constrained hubs.

- Middle East & Africa (MEA): Demand for heavy-duty, climate-resilient apron buses for new mega-airports; high-value contracts focused on premium specifications and reliability.

- Latin America: Moderate, steady growth, focused on cost-effective, reliable models for expanding regional airport networks and improving passenger throughput.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Airport Apron Bus Market.- Cobus Industries GmbH

- Neoplan Bus GmbH (MAN Truck & Bus)

- Mercedes-Benz (Daimler AG)

- Weihai Guangtai Airport Equipment

- Vögele (Wirtgen Group)

- MAZ

- CIMC Tianda

- TAM-Europe

- Shanghai Sunwin Bus

- Foton Motor

- BYD Company

- Xiamen King Long United Automotive Industry

- Zhejiang Zhongtong Bus

- Yutong Bus

- Ashok Leyland

- Scania AB

- Blue Bird Corporation

- Gillig LLC

- E-Z-GO (Textron)

- Mototok International GmbH

Frequently Asked Questions

Analyze common user questions about the Airport Apron Bus market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Airport Apron Bus Market through 2033?

The Airport Apron Bus Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% from 2026 to 2033, driven by global air traffic expansion and essential fleet modernization efforts.

What major segment is driving the market and why?

The Electric propulsion segment is the primary growth driver. This acceleration is due to increasing global emphasis on airport sustainability, stringent governmental emission regulations, and the long-term cost benefits of lower operational and maintenance expenses associated with electric vehicles (EVs).

Which geographic region is expected to lead market expansion?

The Asia Pacific (APAC) region is forecasted to exhibit the highest market expansion, fueled by massive investments in new airport infrastructure development, particularly in countries like China, India, and across Southeast Asia to accommodate surging passenger volumes.

How is AI impacting the operational safety and efficiency of apron buses?

AI is primarily impacting the market through the implementation of Advanced Driver-Assistance Systems (ADAS) for collision avoidance and machine learning-based predictive maintenance systems. This integration enhances operational safety on the crowded apron and maximizes fleet uptime by scheduling maintenance proactively.

Who are the primary end-users or potential customers for airport apron buses?

The core end-users are Civil Airport Operating Authorities, who purchase buses for infrastructure needs, and large multinational Ground Handling Service Providers, who require high-capacity, reliable fleets to meet stringent service level agreements with airlines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager