Airport Document Readers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435952 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Airport Document Readers Market Size

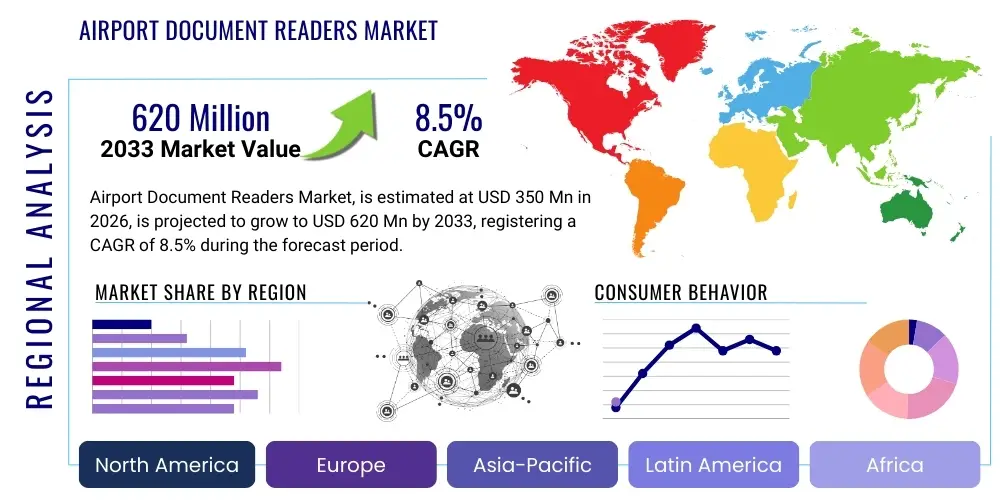

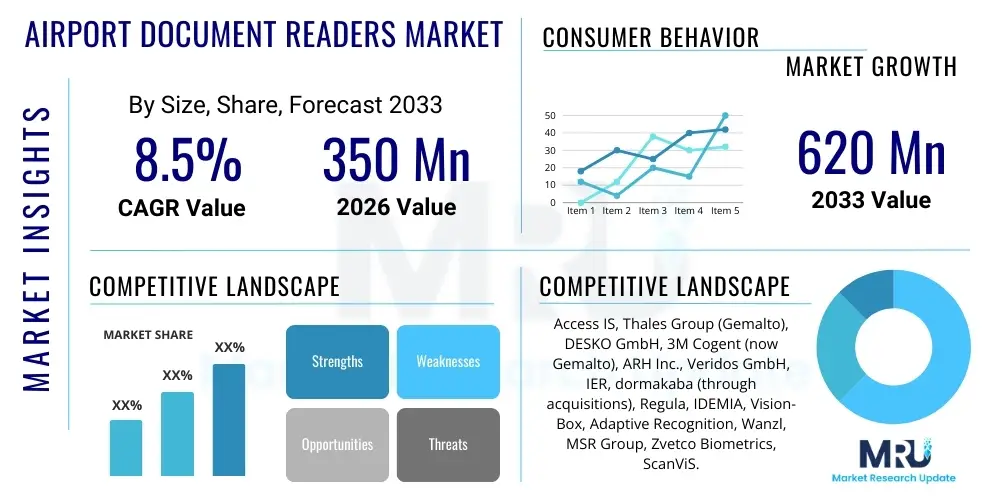

The Airport Document Readers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $350 Million in 2026 and is projected to reach $620 Million by the end of the forecast period in 2033.

Airport Document Readers Market introduction

The Airport Document Readers Market encompasses sophisticated electronic devices designed to capture, authenticate, and verify travel documents, including passports, visas, boarding passes, and ID cards, primarily within the high-security environment of modern airports. These essential tools are integral to critical airport operations such as check-in, self-service kiosks, immigration and border control, and baggage drop-off systems. The primary product offering includes Optical Character Recognition (OCR) readers, biometric-enabled scanners, and multi-functional readers capable of handling various document formats, magnetic stripe reading, and contact/contactless smart card interfacing. These readers enhance security protocols by detecting fraudulent documents and simultaneously improving operational efficiency by automating passenger processing, thereby minimizing wait times.

Major applications of these devices span across passenger processing points, where speed and accuracy are paramount. They are deployed at airline check-in counters to verify passenger identity against flight details, at automated border control (ABC) gates to authenticate travel credentials, and within security checkpoints for seamless verification. The evolution of this market is strongly tied to global aviation security mandates, increased international travel volumes, and the ongoing shift toward seamless travel initiatives championed by organizations like the International Civil Aviation Organization (ICAO) and the International Air Transport Association (IATA).

Key benefits derived from the adoption of advanced airport document readers include enhanced counter-terrorism measures through robust document authentication, significant improvements in passenger throughput during peak hours, and reduced human error associated with manual data entry. Driving factors include the continuous modernization of airport infrastructure globally, the proliferation of e-passports equipped with biometric chips, and the escalating need for rapid, touchless processing technologies, particularly following global health crises that emphasized the need for automated interactions.

Airport Document Readers Market Executive Summary

The Airport Document Readers Market is characterized by robust growth, primarily fueled by stringent international security regulations mandating the use of authenticated travel documents and the sustained expansion of global air passenger traffic. Key business trends indicate a strong move toward integrated solutions that combine OCR, RFID, and advanced biometric verification capabilities (such as facial recognition and iris scanning) into single, unified reader platforms. This integration supports the industry's push for "one-stop verification" and seamless passenger flow management. Technology providers are intensely focused on developing highly durable, tamper-proof, and ergonomic readers suitable for continuous, high-volume operational environments found in major international hubs, often integrating AI for enhanced fraud detection algorithms.

Regional trends highlight that North America and Europe remain mature markets, driven by rigorous regulatory compliance (e.g., EU-wide biometric border control mandates) and significant investment in next-generation automated gates. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market segment, attributed to rapid airport infrastructure development, soaring domestic and international air travel demand, and governmental investments in establishing smart borders, particularly in countries like China, India, and Southeast Asian nations. Latin America and MEA are showing steady uptake, driven by security modernization programs aimed at handling increasing transit traffic.

Segmentation trends reveal that multi-functional readers are dominating the product type segment due to their versatility and ability to handle both legacy paper documents and modern electronic travel documents. In terms of application, border control and immigration checkpoints represent the highest-value segment, given the critical security requirements and large-scale deployment of Automated Border Control (ABC) kiosks. Fixed, integrated readers still hold the largest market share, but mobile and handheld document readers are witnessing accelerated adoption, driven by the need for flexible, off-site verification capabilities during disruptions or remote gate operations. The market competitive landscape is highly consolidated, with established players focusing on strategic partnerships with system integrators and specialized security firms to offer comprehensive end-to-end solutions.

AI Impact Analysis on Airport Document Readers Market

Common user questions regarding AI's impact on airport document readers center on its ability to transcend basic validation and move into predictive security and advanced fraud detection. Users frequently inquire about how AI algorithms improve the authenticity check of complex travel documents, especially those with subtle, sophisticated alterations that traditional OCR readers might miss. There is high interest in AI’s role in automating decision-making at automated border control gates, specifically concerning seamless passenger processing based on pre-vetted data and behavioral analysis linked to the document scanning process. Key expectations revolve around AI enabling faster, more accurate identity verification, reducing false positives, and providing real-time threat intelligence by cross-referencing scanned document data with international watch lists and biometric databases simultaneously.

AI fundamentally transforms the document reader from a passive data capture device into an active, intelligent authentication system. Machine learning models are trained on vast datasets of genuine and fraudulent documents, allowing the readers to identify previously unseen patterns of forgery, manipulation, or synthetic identities that exploit regulatory loopholes. Furthermore, AI facilitates the seamless integration of biometric data extracted from e-passports with live facial or fingerprint scans, ensuring that the presenter is indeed the rightful holder. This deep learning capability significantly elevates the security threshold, moving the industry beyond simple chip reading to complex identity assurance.

The implementation of AI/ML ensures optimization of throughput. By analyzing queuing patterns, peak travel times, and processing speeds, AI-driven systems dynamically adjust the operating parameters of the document readers and the associated gate logic. For instance, in low-risk scenarios identified by AI, the system may expedite the verification process, whereas high-risk documents automatically trigger additional security layers, thereby balancing security needs with passenger experience. This adaptive security approach, powered by cognitive computing, represents the pinnacle of modernization in the aviation security sector.

- Enhanced Fraud Detection: AI algorithms analyze holographic patterns, microprinting, and subtle document deformations to identify sophisticated forgery that surpasses human detection capabilities.

- Biometric Matching Optimization: Machine learning refines the speed and accuracy of matching e-passport biometric data (face/fingerprint) with live capture, minimizing latency.

- Predictive Security Analysis: AI integrates document data with real-time risk scores and behavioral analytics to predict potential security threats before physical inspection.

- Automated Decision Making: Enables faster processing at ABC gates by automatically verifying authenticity and eligibility based on predefined security parameters.

- Adaptive Processing Logic: Optimizes reader sensitivity and verification depth based on real-time operational volume and perceived risk levels.

- Zero-Touch Authentication: Facilitates seamless passenger journey implementation by ensuring continuous, passive verification throughout the airport environment.

DRO & Impact Forces Of Airport Document Readers Market

The Airport Document Readers Market is significantly influenced by a dynamic set of Drivers, Restraints, and Opportunities (DRO). The core driver remains the persistent global mandate for aviation security, enforced by international bodies, requiring rigorous identity verification at all entry and exit points. Coupled with this is the escalating volume of global air travel, pushing airports worldwide to invest in automated solutions to prevent bottlenecks and improve customer satisfaction. Restraints primarily involve the high initial capital expenditure required for deploying and integrating these advanced systems, coupled with ongoing challenges related to data privacy concerns and the necessity of ensuring interoperability between disparate national and international ID systems. Opportunities are centered on the burgeoning market for integrated biometric systems, the shift towards mobile-based document verification (digital identity wallets), and the modernization of infrastructure in emerging economies. These forces collectively shape the investment priorities and technological development trajectories within the document reader ecosystem.

The primary impact forces driving investment are governmental regulation and technological obsolescence. Regulatory bodies frequently introduce new standards for travel documents (e.g., new ICAO standards for e-passports) which necessitate hardware upgrades or replacements, providing continuous market stimulus. Technological advancements, such as the shift from basic optical reading to multi-spectral imaging and the integration of highly sensitive fraud detection firmware, render older equipment obsolete quickly, thereby forcing airports and airlines to continuously refresh their technology infrastructure to maintain security compliance and operational efficiency. The ongoing geopolitical instability and resultant heightened security alerts in several major regions further accelerate the urgency for deploying the most secure and robust document authentication systems available.

Conversely, the lengthy procurement cycles typical in the government and public sector, especially for major infrastructure projects, act as a significant drag on market acceleration. Furthermore, integration complexity poses a hurdle; document readers must seamlessly interface with airport operational databases (AODB), security management systems, and national immigration databases, requiring complex software development and extensive testing. Providers must consistently address these integration challenges while demonstrating clear Return on Investment (ROI) to overcome budgetary restraints and operational resistance to change, positioning robust software platforms as equally critical as the reader hardware itself.

Segmentation Analysis

The Airport Document Readers Market is segmented based on Product Type, Technology, Application, and Region, offering a granulated view of market dynamics and adoption patterns. Product type segmentation distinguishes between single-function readers, primarily used for basic OCR reading, and multi-functional readers, which integrate capabilities like chip reading (RFID), magnetic stripe reading, and advanced biometrics capture. The Technology segmentation focuses on the underlying method of identity assurance, separating traditional OCR scanners from advanced biometric verification systems, including facial and fingerprint readers embedded within the document scanner unit. Application segmentation is crucial, differentiating deployment across various airport operational areas, such as Check-in Kiosks, Automated Border Control (ABC) Gates, Security Screening Points, and Baggage Drop Systems. Understanding these segments is vital for vendors to tailor their solutions to specific end-user requirements and regulatory environments.

The growth trajectory within these segments indicates a clear preference for integrated solutions that minimize passenger touchpoints and maximize data security. Multi-functional readers are expanding their dominance as airports seek hardware consolidation—one device serving multiple security checks. The shift toward biometric technology is accelerating, driven by the global push for seamless travel initiatives (e.g., IATA's One ID concept), where the passenger's face becomes the primary travel token, minimizing reliance on physical documents once initial verification is completed. This biometric integration necessitates high-speed, high-resolution document readers capable of accurately extracting and comparing biometric templates from electronic travel documents in milliseconds.

Geographically, market segmentation provides insight into where regulatory standards and infrastructure maturity are driving the highest investments. While North America and Europe possess the highest density of advanced readers due to early adoption and strict mandates, the fastest future growth is anticipated in the Asia Pacific region, driven by the construction of new mega-airports and substantial governmental investment in smart border technologies. The Middle East and Africa also represent key segments, primarily focused on luxury travel experiences and large transit hubs that demand efficient, high-tech security solutions to manage massive transit volumes effectively.

- By Product Type:

- Single-Function Document Readers (OCR Only)

- Multi-functional Document Readers (OCR, Biometric, RFID, Chip Reading)

- Mobile/Handheld Document Readers

- By Technology:

- Optical Character Recognition (OCR)

- Biometric Document Readers (Fingerprint, Facial Recognition Integrated)

- RFID/NFC Readers

- By Application:

- Check-in and Bag Drop Systems

- Security and Gate Access Control

- Automated Border Control (ABC) and Immigration

- Lounge and Duty-Free Access Verification

- By End-User:

- Airports (Direct Procurement)

- Airlines (Self-Service Kiosks)

- Government/Border Control Agencies

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Airport Document Readers Market

The value chain for the Airport Document Readers Market begins upstream with the suppliers of specialized components, focusing heavily on optical sensors, high-resolution imaging cameras, RFID chip readers, and secure processing units (microcontrollers and GPUs). These foundational technology providers dictate the performance, durability, and cost baseline of the final product. Key activities at this stage involve rigorous quality control of optical components and securing reliable supply chains for specialized security chips. The integration of advanced biometrics requires specialized partnerships with providers of sophisticated biometric algorithms and high-speed matching software, adding complexity and value early in the chain.

Midstream, the value chain involves the original equipment manufacturers (OEMs) and system integrators. OEMs focus on designing rugged, tamper-proof hardware enclosures and integrating the various optical, electronic, and software components into a cohesive reader unit that meets strict ICAO standards (e.g., document placement and illumination requirements). System integrators play a pivotal role downstream, customizing the readers for specific airport environments, ensuring seamless compatibility with legacy airport operational systems (AOS), and managing the complex installation process, often requiring specialized training for airport security and ground staff. Direct distribution channels are typically used for large-volume governmental contracts (e.g., border control), while indirect channels involving specialized IT integrators are prevalent for airline self-service kiosk installations.

Downstream, the chain terminates at the end-user—airports, airlines, and governmental border agencies—who rely on post-sales service, technical support, and continuous software updates, especially concerning fraud detection databases and new document security features. The long operational lifecycle of airport equipment makes maintenance, repair, and overhaul (MRO) services a significant revenue stream. Customer feedback loops at this stage are critical, driving future product innovation, particularly concerning ergonomics, processing speed, and resistance to environmental factors like dust and temperature fluctuations commonly found in operational airport settings.

Airport Document Readers Market Potential Customers

The primary customers and end-users of airport document readers fall into three distinct but often overlapping categories: Airport Authorities, Global Airlines, and National Government/Border Control Agencies. Airport Authorities are major buyers, procuring readers for public-facing infrastructure like self-service common-use kiosks, access gates, and security checkpoint systems to ensure smooth terminal operations and manage flow. Their purchasing decisions are often driven by centralized terminal planning, focusing on durability, ease of maintenance, and compatibility with Common Use Terminal Equipment (CUTE) platforms. The shift toward self-service and contactless processing has cemented airports as key direct consumers of integrated reader solutions.

Airlines represent a significant customer segment, particularly for readers deployed at dedicated check-in desks, premium lounges, and specialized boarding gates. Airlines prioritize efficiency and passenger experience; thus, their purchasing criteria emphasize speed, reliability, and the ability of the reader to quickly process various frequent flyer and loyalty cards alongside mandated travel documents. Furthermore, the adoption of proprietary mobile check-in systems and bag drop solutions necessitates airline investment in specialized, often integrated, reader hardware tailored to their specific operational workflows and branding requirements.

National Government and Border Control Agencies constitute the highest-security, highest-specification customer segment. Their procurement is guided strictly by national security protocols, adherence to international treaties, and the need for rigorous document authentication. These agencies demand the most sophisticated technology, including advanced spectral analysis, AI-driven fraud detection, and robust biometric matching capabilities for deployment at immigration checkpoints and Automated Border Control (ABC) gates. Their focus is purely on preventing illegal entry and ensuring national security, often leading to tenders for highly specialized, bespoke hardware and software solutions integrated directly into national security databases.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350 Million |

| Market Forecast in 2033 | $620 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Access IS, Thales Group (Gemalto), DESKO GmbH, 3M Cogent (now Gemalto), ARH Inc., Veridos GmbH, IER, dormakaba (through acquisitions), Regula, IDEMIA, Vision-Box, Adaptive Recognition, Wanzl, MSR Group, Zvetco Biometrics, ScanViS. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Airport Document Readers Market Key Technology Landscape

The technology landscape for airport document readers is rapidly advancing, moving beyond basic Optical Character Recognition (OCR) toward integrated multi-modal verification systems. The foundation remains high-speed, high-accuracy OCR technology, which is critical for extracting machine-readable zones (MRZ) from passports and IDs, and converting visual information into actionable data. However, modern readers incorporate multi-spectral imaging (visible, UV, IR) capabilities to authenticate security features embedded in documents that are invisible to the naked eye. This multi-spectral approach significantly enhances anti-fraud detection by verifying watermarks, specialized inks, and complex holographic overlays, making forgery far more difficult to execute and detect manually.

The most transformative technology currently deployed is the integration of contactless chip reading (RFID/NFC) compliant with ICAO standard 9303. This technology allows readers to securely communicate with the e-passport chip, extracting encrypted biographical data and high-resolution biometric templates. This process, known as Basic Access Control (BAC) and Extended Access Control (EAC), ensures the chip data has not been tampered with since issuance, thereby providing a superior level of security assurance compared to visual checks alone. Furthermore, the readers must be built with robust processing power to handle cryptographic verification quickly, ensuring minimal latency during high-traffic border control operations.

Looking ahead, the market is characterized by the increasing prevalence of integrated biometric capture devices—specifically high-resolution facial capture cameras and often fingerprint sensors—embedded directly into the document reading unit. This seamless integration allows the reader to simultaneously verify the physical document, authenticate the e-chip data, and confirm the identity of the document holder via live biometric matching, all within a single user interaction lasting only seconds. Future technological developments will focus on utilizing flexible document reading software driven by AI to adapt instantly to new travel document formats and security features implemented by various nations, ensuring future-proofing of hardware investments for airport operators.

Regional Highlights

- North America: This region is a mature market characterized by high regulatory compliance, driven primarily by the U.S. Transportation Security Administration (TSA) and Customs and Border Protection (CBP). Adoption rates for advanced biometric readers are among the highest globally, fueled by initiatives aimed at optimizing passenger processing efficiency at major hubs like JFK, LAX, and Toronto Pearson. The market focuses heavily on integrating readers into existing self-service infrastructure and implementing seamless flow concepts.

- Europe: Europe is a highly regulated market, with growth mandated by EU initiatives such as the Entry/Exit System (EES) and ETIAS (European Travel Information and Authorization System). These mandates require widespread deployment of Automated Border Control (ABC) gates utilizing advanced biometric document readers capable of handling Schengen Area coordination. Replacement cycles are robust due to continuous upgrades required to meet harmonized security standards.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by massive infrastructure expansion in aviation (e.g., new airports in China and India) and a sharp rise in air passenger traffic. Governments in this region are actively investing in "Smart Border" technologies to manage high volumes of intra-regional travel efficiently. Key markets include Singapore (Changi), Hong Kong, and major Chinese metropolitan areas, prioritizing high throughput and advanced AI-driven security features.

- Middle East and Africa (MEA): This region is characterized by significant investment in large transit hubs (e.g., Dubai, Doha), focusing on creating exceptional passenger experiences alongside top-tier security. MEA markets demand high-end, multi-functional readers integrated with luxury services and advanced biometric systems to facilitate rapid transit and high-volume connectivity. South Africa is also a key adopter due to regional security concerns.

- Latin America (LATAM): Growth in LATAM is steady, driven by airport modernization projects in Brazil, Mexico, and Colombia aimed at improving security infrastructure and operational efficiency to handle increasing regional and international tourism. Investment is often tied to large-scale public-private partnerships focused on upgrading decades-old airport facilities with modern, secure document verification systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Airport Document Readers Market.- Access IS (ASL Systems)

- Thales Group (Gemalto)

- DESKO GmbH

- ARH Inc.

- Regula

- IDEMIA

- Vision-Box

- Adaptive Recognition

- IER

- dormakaba

- Veridos GmbH

- Wanzl

- MSR Group

- Zvetco Biometrics

- ScanViS Technology Limited

- Glory Global Solutions

- Shanghai Jing An Instrument Co., Ltd.

- Neurotechnology

- Crossmatch (HID Global)

- Integrated Biometrics

Frequently Asked Questions

Analyze common user questions about the Airport Document Readers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for multi-functional airport document readers?

The primary driver is the necessity for airport operators and airlines to consolidate multiple verification steps (OCR, chip reading, biometrics) into a single, seamless interaction point to meet stringent ICAO standards while significantly accelerating passenger throughput and minimizing physical touchpoints.

How does AI technology enhance fraud detection capabilities in modern document readers?

AI, specifically machine learning models, analyzes complex and subtle forensic security features, such as microscopic patterns and specialized inks, learning to identify sophisticated forgery techniques and synthetic documents that are indistinguishable to the human eye or basic OCR systems, offering real-time threat detection.

Which geographical region is expected to experience the fastest growth in this market?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, driven by massive governmental investments in new airport infrastructure, smart border initiatives, and rapidly expanding air travel volumes necessitating immediate modernization of security processing systems.

What are the main technical restraints affecting the wider adoption of advanced document readers?

Key restraints include the high initial capital investment required for procurement and integration, coupled with complexity challenges related to ensuring seamless interoperability between proprietary airport operational databases and various national and international governmental security databases.

What role does ICAO standard 9303 play in the design of new document readers?

ICAO 9303 provides the essential international technical specification for machine-readable travel documents (MRTDs), including e-passports. Document readers must strictly adhere to this standard to ensure accurate recognition of the Machine Readable Zone (MRZ), secure chip access, and reliable extraction of encrypted biometric data.

What is the difference between OCR readers and Biometric document readers?

OCR readers primarily capture and decode textual data from the document surface (like the MRZ). Biometric document readers include the OCR capability but crucially add features like RFID chip reading to extract encrypted biometric templates (e.g., facial images) for verification against a live scan of the passenger.

How is the market impacted by the global trend toward "contactless" travel?

The shift to contactless travel accelerates demand for integrated readers that can automatically authenticate identity using biometrics and e-passport chips without requiring physical interaction between the passenger and airport staff, supporting IATA's One ID initiative and hygiene concerns.

Who are the primary end-users of specialized high-security document readers?

National Government and Border Control Agencies are the primary end-users for the highest-security readers, utilizing them at immigration and Automated Border Control (ABC) gates where rigorous document authentication and real-time security database checks are non-negotiable requirements.

What is meant by the "seamless travel" concept in relation to document readers?

Seamless travel refers to the use of identity management systems, typically leveraging document readers and biometrics, to create a single identity token that allows passengers to move efficiently through all checkpoints (check-in, security, boarding) without repeatedly presenting physical documents.

Are mobile document readers gaining traction in the airport environment?

Yes, mobile and handheld document readers are increasingly adopted, especially by airlines, for flexible deployment scenarios such as remote gate boarding, mobile check-in during peak periods, and rapid identity verification for lounge access, offering operational flexibility beyond fixed installations.

What role do system integrators play in this market's value chain?

System integrators are crucial mid-to-downstream players, responsible for customizing document reader solutions, ensuring compatibility with complex legacy airport IT infrastructure (CUTE/CUPPS systems), and integrating the readers with centralized security and biometric databases, providing a complete end-to-end solution.

How do data privacy regulations like GDPR affect the use of airport document readers?

GDPR and similar regulations impose strict requirements on how biometric and personal data extracted by the readers are processed, stored, and protected. This necessitates manufacturers to implement enhanced security features, encryption protocols, and clear data governance mechanisms in their reader software.

What is the anticipated impact of e-visas and digital travel credentials (DTC) on the market?

The adoption of e-visas and DTCs requires document readers to evolve into versatile platforms capable of reading and validating digital credentials presented on mobile devices, necessitating advanced optical and near-field communication (NFC) capabilities beyond traditional physical document scanning.

Why is durability a key requirement for airport document reader hardware?

Airport environments require continuous 24/7 operation and high transaction volumes, subjecting hardware to significant wear and tear. Durability ensures a long Mean Time Between Failure (MTBF), low maintenance costs, and reliability critical for maintaining operational efficiency during peak travel periods.

What differentiates fixed readers from integrated readers in terms of deployment?

Fixed readers are standalone units primarily used at counters or desks. Integrated readers are embedded components built directly into self-service kiosks, Automated Border Control gates, or access control turnstiles, offering a more seamless and tamper-resistant installation solution.

How does spectral analysis technology improve security verification?

Spectral analysis utilizes various light wavelengths (UV, IR, visible) to verify unique, document-specific security features, such as fluorescent fibers, latent images, and anti-Stokes inks, making it highly effective at identifying expertly counterfeited documents that appear genuine under normal light.

What is the role of the e-passport chip in the verification process?

The e-passport chip (RFID) stores encrypted biographical data and a digital biometric template. The document reader extracts this data and cryptographically verifies the chip’s integrity, ensuring the document is authentic and has not been altered since issuance by the governing authority.

Are most market revenues derived from hardware sales or software licenses and maintenance?

While initial capital outlay is driven by hardware procurement, a significant and growing portion of long-term market revenue comes from recurring sources, including specialized software licensing (especially for AI/fraud detection databases), continuous firmware updates, and maintenance, repair, and overhaul (MRO) contracts over the device lifecycle.

What impact does the push for self-service systems have on reader design?

The self-service trend dictates reader designs must be highly ergonomic, robust, user-friendly, and capable of guiding the passenger through the scanning and biometric capture process with minimal instruction, ensuring a positive user experience even for non-technical travelers.

Which application segment holds the highest value for document reader deployment?

The Automated Border Control (ABC) and Immigration segment represents the highest value due to the critical security requirements, the need for advanced biometric integration, and large-scale governmental procurement contracts often involving bespoke, highly secure, and durable reader solutions.

How do competitive strategies in this market focus on technology differentiation?

Competitive strategies heavily rely on continuous technological differentiation, specifically through superior AI algorithms for fraud detection, faster biometric matching speeds, integration capabilities with diverse operating systems, and achieving certification for the latest international document standards ahead of competitors.

What is the main challenge faced by manufacturers when designing readers for multiple global markets?

The primary challenge is ensuring technical interoperability and regulatory compliance with the myriad of varying national travel document standards, regional data privacy laws (e.g., GDPR, CCPA), and specific governmental security mandates across different target markets simultaneously.

How is the market addressing the issue of reading damaged or obscured documents?

Advanced readers use sophisticated software algorithms and superior optical imaging techniques, including variable illumination and deep learning correction models, to process documents that are folded, obscured by glare, or partially damaged, ensuring reliable data extraction even in challenging conditions.

What is the expected average lifecycle of an airport document reader?

The operational lifecycle of high-grade airport readers is typically 5 to 8 years, though technological obsolescence driven by new ICAO standards or security mandates often necessitates replacement or significant firmware upgrades sooner, usually within 4 to 6 years in highly regulated environments.

Do airlines or airports hold responsibility for purchasing document readers for check-in counters?

Responsibility varies: readers integrated into Common Use Terminal Equipment (CUTE) kiosks are often procured by the Airport Authority. Readers used at dedicated, staffed airline desks or specific self-bag drop systems are typically procured and managed directly by the respective airline.

Why is the integration of facial recognition technology crucial for next-generation readers?

Facial recognition is critical because it aligns with IATA's "One ID" goal, enabling true seamless travel by verifying the passenger's identity against the biometric template stored on the e-passport, allowing the face to serve as the single, reliable boarding token throughout the journey.

What impact do macroeconomic factors like tourism trends have on the market?

Increased global tourism and recovery from events like pandemics directly stimulate market demand. Higher passenger volumes necessitate faster, more efficient processing, driving airports to invest in automated document readers to mitigate congestion and maintain high service standards.

How do manufacturers ensure the security of data transmitted from the reader?

Manufacturers utilize robust end-to-end encryption (e.g., PKI, TLS) for data transmission and implement tamper-proof hardware modules (TPMs) within the readers to securely handle cryptographic keys and sensitive biometric data, safeguarding information integrity during transfer to airport systems.

What is the role of SDKs (Software Development Kits) in the market?

SDKs are crucial tools provided by hardware manufacturers, allowing system integrators and airport IT departments to rapidly and effectively integrate the document reader's capabilities (data extraction, biometrics capture) into their own customized application software and operational platforms.

Are smaller regional airports adopting advanced document readers at the same pace as major international hubs?

Smaller regional airports are adopting advanced readers, though typically at a slower pace and often focusing on multi-functional, lower-volume, cost-effective solutions rather than the highly specialized, high-throughput ABC gates deployed extensively in major international transit hubs.

What technology is used to ensure the authenticity of the e-passport chip data?

Public Key Infrastructure (PKI) and specialized cryptographic protocols like Basic Access Control (BAC) and Extended Access Control (EAC) are used to authenticate the chip data, verifying that the chip was issued by a legitimate authority and has not been cloned or tampered with.

How do governmental tenders influence the competitive landscape?

Governmental tenders, especially for large-scale border control projects, significantly influence market dominance, favoring established companies that possess the necessary high-level security clearances, proven track record of complex system integration, and financial stability to manage multi-year contracts.

What technological feature provides the highest resistance to future document security changes?

AI-driven, software-defined document analysis platforms provide the highest future-proofing, as they can be instantly updated and retrained via software patches to recognize and authenticate new security features implemented on travel documents without requiring extensive hardware replacement.

What is the current market trend regarding fixed versus mobile deployment?

While fixed readers dominate volume due to permanent installation needs at counters and ABC gates, the trend is toward rapid growth in mobile deployment, fulfilling the need for flexible, on-the-go verification at gate checks, remote stands, or during unexpected operational disruptions.

What challenges arise from integrating document readers into self-service baggage drop systems?

The main challenges involve ensuring that the reader can rapidly process both the passenger's identity document and the airline's baggage tag/boarding pass simultaneously, all while ensuring robust physical integrity against potential accidental damage in a public, automated environment.

How does the quality of the optical sensor affect reader performance?

High-quality optical sensors are crucial as they determine the resolution, clarity, and speed of image capture. This directly affects the accuracy of OCR extraction, the ability to read documents under varying light conditions, and the effective authentication of micro-security features.

What is meant by the term "Common Use Terminal Equipment" (CUTE) platforms?

CUTE platforms are standardized IT environments shared by multiple airlines at an airport. Document readers must be certified CUTE-compatible, meaning their software interface can operate seamlessly across the diverse applications and systems used by all participating airlines.

How do environmental factors impact reader specifications?

Readers must be specified to withstand varying environmental conditions, including temperature extremes, dust, humidity, and constant vibration typical of baggage handling areas or outdoor gate checkpoints, requiring robust sealing and specialized industrial-grade components.

What is the correlation between global security alerts and market investment?

Global security alerts (e.g., counter-terrorism efforts) immediately correlate to increased market investment, as governments and airports prioritize rapid upgrades and deployment of cutting-edge document authentication technology to mitigate heightened risks and comply with updated governmental directives.

What segment of the supply chain benefits most from technological upgrades?

Upstream component suppliers (especially those providing high-resolution optics, ASIC chips, and specialized biometric modules) and midstream technology firms specializing in AI software and firmware updates benefit most, as upgrades necessitate specialized, high-margin components and intellectual property licensing.

What distinguishes an entry-level reader from a premium, high-security reader?

Entry-level readers typically offer basic OCR. Premium, high-security readers include advanced features like full-page document imaging, multi-spectral UV/IR analysis, integrated FAP 60 fingerprint sensors, and AI-driven fraud detection engines, commanding a significantly higher price point.

Why is latency a critical performance metric for document readers?

Latency (the time taken for a full verification cycle) is critical because low latency is required to achieve high passenger throughput, which directly impacts airport operational efficiency, particularly at high-volume checkpoints like immigration and boarding gates.

How is cloud computing being utilized to support document reader operations?

Cloud computing supports centralized management of reader firmware, real-time security updates, centralized storage of audit logs, and scalable processing power for AI-based fraud detection algorithms, particularly for large airport networks utilizing numerous reader units.

What are the key certification requirements for document reader hardware?

Key certifications include ICAO 9303 compliance, various national governmental security approvals, CE/FCC regulatory standards, and often specific approvals for integration with proprietary airport systems (e.g., specific biometric matching software vendor compatibility).

How does the market address outdated or non-e-passports lacking biometric chips?

Modern multi-functional readers are designed to handle both chip-enabled (e-passports) and legacy, non-biometric documents. They utilize advanced OCR and spectral imaging for thorough authentication of legacy documents, ensuring backwards compatibility while facilitating the transition to fully biometric systems.

In the context of the DRO analysis, how does data privacy concern act as a restraint?

Data privacy concerns act as a restraint because they introduce regulatory hurdles (like requiring explicit passenger consent and ensuring anonymization) that increase the complexity and cost of deploying biometric-enabled document readers and associated database infrastructure.

What market segment is most sensitive to price fluctuations and initial investment costs?

Airlines, particularly low-cost carriers, and smaller regional airports tend to be most sensitive to initial investment costs, often opting for more modular or single-function readers over fully integrated, high-cost biometric ABC gate systems preferred by major international hubs.

How does the supply chain manage the secure handling of sensitive chip technology components?

The supply chain employs strict security protocols, often involving chain-of-custody tracking, secure warehousing, and specialized logistics for cryptographic and RFID components to prevent tampering or unauthorized access before final integration into the document reader unit.

What opportunities exist for new entrants in the Airport Document Readers Market?

Opportunities for new entrants lie primarily in specialized software development, particularly AI-driven fraud detection algorithms, secure mobile verification solutions, and providing highly specialized system integration services that bridge legacy systems with new hardware platforms.

How important is ergonomic design for document readers in self-service environments?

Ergonomics is extremely important. The design must be intuitive, featuring clearly marked document placement guides, optimized lighting, and easy cleaning mechanisms to reduce operational friction and minimize staff intervention in automated self-service kiosks and gates.

What is the primary difference between direct and indirect distribution channels in this market?

Direct distribution involves manufacturers selling directly to large end-users (governments/major airport authorities) for large tenders. Indirect distribution relies on Value-Added Resellers (VARs) and system integrators who bundle the readers with other airport IT solutions for sales to smaller airports or individual airline branches.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager