Airport Dolly Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435447 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Airport Dolly Market Size

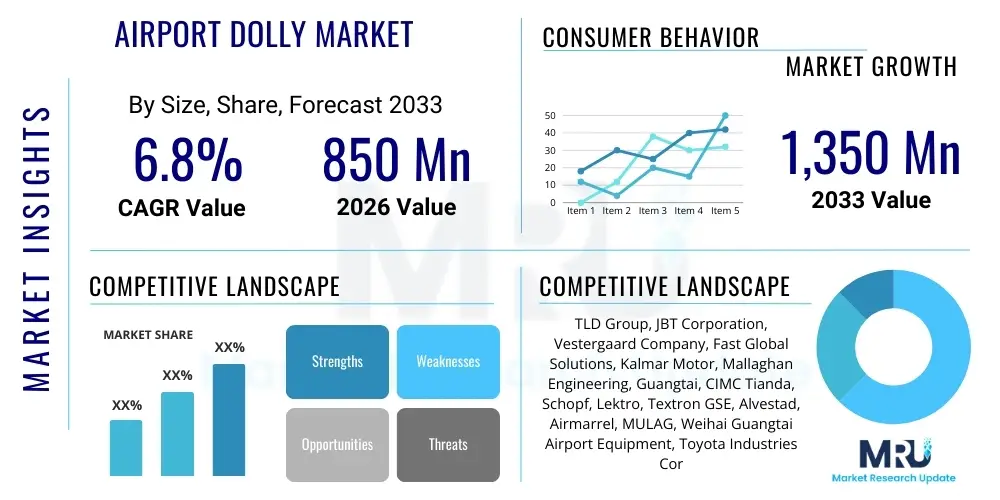

The Airport Dolly Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $850 Million USD in 2026 and is projected to reach $1,350 Million USD by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the relentless increase in global air passenger traffic and the commensurate growth in air cargo volumes, necessitating continual investment in robust and efficient Ground Support Equipment (GSE). As airports worldwide undergo significant infrastructure modernization projects, the demand for specialized, high-capacity dollies capable of safely transporting unit load devices (ULDs) and baggage across extensive aprons has surged. Furthermore, the integration of advanced materials, such as lightweight composites and high-strength steels, is contributing to the longevity and operational efficiency of new dolly fleets, supporting higher replacement rates in mature markets like North America and Europe, while simultaneously equipping burgeoning aviation hubs across the Asia Pacific region.

The valuation reflects the critical role airport dollies play in the core logistics of aviation operations, functioning as the foundational transport medium for both baggage and cargo ULDs between the terminal, cargo warehouses, and parked aircraft. Market growth is further accelerated by regulatory pressures from international bodies, such as IATA, emphasizing safety, security, and minimizing tarmac delays, which requires highly reliable and well-maintained GSE fleets. Geopolitical factors influencing global trade routes, coupled with the exponential rise of e-commerce, have placed unprecedented pressure on air cargo handling facilities, directly correlating to increased procurement of container dollies and pallet dollies designed for heavy-duty, high-throughput environments. The transition towards smarter airport operations, focusing on integrated fleet management systems and the eventual deployment of autonomous towing solutions, promises to sustain this robust CAGR throughout the forecast horizon, making the market highly attractive for innovation and strategic investment by established GSE manufacturers and emerging technology providers alike.

Airport Dolly Market introduction

The Airport Dolly Market encompasses the production, distribution, and utilization of non-motorized rolling platforms specifically designed to transport cargo containers, cargo pallets, and passenger baggage units across the airport apron environment. These crucial pieces of Ground Support Equipment (GSE) are engineered for maximum durability, maneuverability, and load-bearing capacity, typically featuring high-quality casters, towing bars, and integrated braking systems to ensure secure movement when towed by specialized airport tractors. The primary objective of airport dollies is to streamline the turnaround process of aircraft by facilitating the rapid and organized transfer of Unit Load Devices (ULDs) and luggage, thereby mitigating operational bottlenecks and enhancing overall airport efficiency. Product descriptions vary significantly depending on the application; container and pallet dollies are designed with reinforced structures and roller beds for ease of loading and unloading standardized ULDs, while baggage dollies, often equipped with enclosed sides or netting, focus on secure, high-volume transport of individual passenger items, aligning closely with strict aviation safety protocols.

Major applications of airport dollies span the entire spectrum of aviation logistics, prominently featuring in air cargo terminals for the heavy lifting and repositioning of large pallets (like the PMC or PAG types) and containers (such as the LD3 or LD8 models), requiring precise alignment and secure coupling during transit. In the passenger sector, dollies are indispensable for transferring inbound baggage from arriving aircraft to the terminal sorting systems, and conversely, moving outbound baggage from the make-up area to the parked aircraft. Beyond core baggage and cargo operations, specialized dollies are also utilized in maintenance, repair, and overhaul (MRO) operations for transporting heavy components, tools, and aircraft parts across the maintenance facility complex. The versatility and mechanical simplicity of these devices, combined with their critical role in optimizing throughput, solidify their position as essential assets in any modern aviation infrastructure, directly impacting on-time performance metrics and operational cost-effectiveness across global airport hubs and regional facilities.

The inherent benefits derived from utilizing high-quality airport dollies include significantly enhanced operational throughput, minimized manual handling requirements, and substantial improvements in worker safety, especially when dealing with heavy or irregularly shaped ULDs. Driving factors propelling this market include the global expansion of low-cost carriers (LCCs) which necessitates rapid turnaround times, placing greater reliance on optimized GSE utilization. Furthermore, the ongoing digitalization of air freight logistics mandates the use of reliable, standardized equipment that can interface seamlessly with automated warehousing systems and modern fleet management software. The robust construction and typically long lifespan of airport dollies, often spanning over two decades with proper maintenance, offer excellent return on investment for airport authorities and third-party ground handling service providers (GSPs), making their procurement a strategic necessity rather than a mere operational expense in the increasingly competitive landscape of global air travel and air cargo logistics.

Airport Dolly Market Executive Summary

The Airport Dolly Market is currently characterized by vigorous business trends centered around technological integration and sustainability mandates. Key industry players are aggressively focusing on developing lightweight yet durable dollies utilizing aluminum alloys and advanced composite materials to reduce the overall fuel consumption of towing vehicles, thereby addressing environmental regulations and operational cost pressures. A significant business trend involves the shift towards modular designs, allowing dollies to be easily configured for different ULD sizes or applications, improving asset utilization rates for ground handling companies operating across diverse aircraft fleets. Furthermore, consolidation within the GSE manufacturing sector is leading to integrated solutions offerings, where dollies are bundled with complementary equipment like tow tractors and sophisticated telematics systems, optimizing purchasing processes for major global airport groups and streamlining the maintenance protocols for highly dispersed equipment fleets globally.

Regionally, the market exhibits highly differentiated growth patterns. The Asia Pacific (APAC) region stands out as the primary growth engine, fueled by massive investments in new airport construction in India, China, and Southeast Asia, coupled with the rapid urbanization and expansion of middle-class consumerism driving substantial growth in passenger and cargo traffic volumes. Conversely, North America and Europe represent mature markets defined by high replacement demand; here, the focus is less on fleet expansion and more on technological upgrades, particularly the adoption of 'smart' dollies equipped with RFID tags, GPS tracking, and sensors to integrate into comprehensive airport operational databases (AODB) for real-time asset management and anti-misplacement protocols. The Middle East, anchored by major transit hubs in the UAE and Qatar, shows a consistent, high-value demand for premium, high-capacity equipment capable of handling massive transit volumes and extreme climatic conditions efficiently and reliably.

Segmentation trends indicate a strong performance trajectory for the Container Dolly segment, correlating directly with the sustained expansion of global standardized air cargo logistics and containerization, particularly in the e-commerce supply chain requiring standardized LD3 containers. There is also a notable upward trend in the adoption of specialized dollies, including those adapted for handling non-standard equipment or catering to specific maintenance needs, reflecting the increasing complexity of modern airport operations. The material segmentation highlights increasing acceptance of high-grade aluminum and composite construction over traditional heavy steel, driven by the desire for reduced equipment weight and improved maneuverability on congested aprons, contributing positively to reduced wear and tear on towing equipment and lower long-term maintenance costs for the ground handling providers managing extensive fleet inventories. This trend towards lightweight engineering underscores the industry’s commitment to enhanced operational efficiency and sustainable practices.

AI Impact Analysis on Airport Dolly Market

User inquiries regarding AI's influence on the Airport Dolly Market frequently center on the feasibility and immediate timeline for autonomous ground handling, specifically asking about self-driving or Automated Guided Vehicle (AGV) dollies replacing traditional towed systems. Users are also keenly interested in how AI-driven predictive maintenance can reduce costly equipment failure rates and extend the operational lifespan of existing dolly fleets, moving beyond routine scheduled checks to condition-based monitoring. Furthermore, significant concern is expressed about the integration complexity—how seamlessly new AI-enabled GSE can communicate with legacy airport infrastructure and proprietary ground handling systems, and the subsequent cybersecurity risks associated with deploying interconnected, intelligent assets across the tarmac. The core expectation is that AI will primarily optimize routing, minimize idle time, and significantly enhance safety protocols by predicting potential collision risks and managing dynamic, high-density traffic flow across the busy airport environment.

The strategic deployment of Artificial Intelligence, particularly machine learning algorithms analyzing historical operational data, is poised to revolutionize the management and deployment of airport dolly fleets. AI systems are increasingly being used to optimize towing routes based on real-time flight schedules, aircraft gate changes, weather conditions, and predicted tarmac congestion, ensuring that ULDs and baggage reach their destination via the most efficient, least congested path, directly impacting the crucial metric of on-time departure reliability. Beyond routing, computer vision coupled with AI is being trialed for quality control during the loading and unloading process, automatically identifying poorly secured ULDs or misplaced baggage units before they become operational hazards. This transition from manual, reactive decision-making to predictive, data-driven optimization marks a fundamental shift in how ground handlers manage their non-motorized assets, transforming the dolly from a passive transport unit into an integral, intelligent component of the wider airport digital logistics ecosystem, promising unparalleled improvements in operational resilience and resource allocation efficiency across the entire airport complex.

- AI-powered predictive maintenance reduces downtime by forecasting component failure (e.g., wheel bearings, couplings) based on sensor data analysis.

- Machine learning optimizes dolly deployment and storage location, minimizing empty runs and maximizing asset utilization based on forecast demand.

- Autonomous Towed Vehicles (ATV) or AGV Dollies, managed by AI, automate horizontal transport on designated apron routes, enhancing safety and labor efficiency.

- Computer vision systems utilizing AI algorithms ensure proper loading, stacking, and securing of ULDs onto dollies, reducing cargo damage risks.

- Integration with AODB allows AI to provide real-time status and location tracking of every dolly unit, mitigating asset misplacement across large airport properties.

DRO & Impact Forces Of Airport Dolly Market

The Airport Dolly Market is driven primarily by the sustained global expansion of air travel and the continuous modernization requirements of Ground Support Equipment (GSE) fleets across major and minor airports worldwide. The increasing implementation of strict global aviation safety standards, particularly concerning ULD handling and security, mandates the use of reliable, compliant dollies, driving replacement cycles. Simultaneously, the restraints impacting the market include the significant initial capital outlay required for high-quality, specialized dollies, which poses a barrier to entry for smaller ground handling operators, necessitating robust financing solutions. Furthermore, the operational challenges associated with maintaining large fleets across varying and often harsh climatic conditions, coupled with the slow, bureaucratic procurement processes typical of public-private airport partnerships, can inhibit rapid market penetration and technological adoption, creating periods of market stagnation despite underlying growth in traffic volumes globally.

A primary opportunity lies in the burgeoning automation trend, particularly the development and scaled deployment of modular, interoperable AGV dolly systems that can be easily integrated into existing ground handling environments, offering substantial long-term savings in labor costs and providing 24/7 operational capability regardless of staffing constraints or environmental factors. This aligns with the broader industry goal of achieving "Smart Airport" status, where asset tracking via IoT sensors and telematics ensures optimal utilization and proactive maintenance scheduling, mitigating unexpected failures. The key impact forces shaping this market involve economic volatility affecting global trade (directly impacting air cargo demand), fluctuating material costs (especially for steel and aluminum), and regulatory shifts (such as new IATA standards for ground safety), all of which exert significant pressure on manufacturers’ profitability and the overall pricing structure of GSE procurement contracts negotiated by large airport authorities and centralized purchasing groups.

The market also benefits from secondary opportunities rooted in sustainability and lightweighting. The demand for dollies constructed from advanced, lighter materials like composites not only reduces the towing vehicle's energy consumption but also extends the life of the GSE itself due to superior corrosion resistance and reduced stress on moving parts. Manufacturers who can successfully develop and certify highly durable, maintenance-minimal dollies that contribute to airport carbon neutrality goals are poised to capture significant market share, especially in environmentally conscious regions like Europe and North America. The convergence of these opportunities—automation, digitalization, and sustainability—is creating a highly dynamic environment where innovation in component design, power transmission efficiency, and real-time connectivity are becoming essential competitive differentiators among leading GSE suppliers, ensuring that the market trajectory remains robustly positive throughout the projected forecast period despite periodic economic headwinds affecting capital expenditures.

Segmentation Analysis

The segmentation analysis of the Airport Dolly Market provides granular insights into the diverse requirements dictated by varying airport functions and logistics demands. Segmentation is primarily conducted based on the type of load handled (pallets, containers, or baggage), the technology utilized (manual/towed or automated/AGV), and the materials employed in construction (steel, aluminum, composites). This multi-faceted approach is essential because the performance parameters required for a heavy-duty pallet dolly used in a cargo hub are fundamentally different from those required for a lightweight baggage dolly deployed at a regional passenger terminal, necessitating distinct product lines and manufacturing specifications across the competitive landscape, which profoundly affects procurement decision matrices for ground handling service providers and airport operators focused on cost efficiency and optimal fleet composition.

The segmentation by type is arguably the most critical dimension, as it directly addresses the standardization required by IATA ULD regulations. Pallet dollies are built for robust stability and high load distribution, optimized for heavy air freight. Container dollies, while also robust, focus on secure locking and easy rolling mechanisms necessary for rapid transfer of standardized containers like the LD-3, which are ubiquitous in modern passenger aircraft belly holds. Baggage dollies prioritize volume and secure enclosure, often designed to be easily networked into long trains for rapid unloading during peak times. The differentiation between these types allows manufacturers to focus R&D resources on specialized features—for instance, developing enhanced roller bed durability for cargo dollies versus designing improved weather protection features for open-air baggage dollies operating in diverse climates globally.

Further analysis of the material segment indicates a definitive trend towards incorporating high-strength aluminum and advanced composite panels, driven by the compelling economic benefit of weight reduction. Lighter dollies equate to less fuel expenditure for the tow tractors and reduced wear on associated GSE components, offering long-term operational cost savings that outweigh the higher initial unit cost of these advanced materials. Conversely, segmentation by technology highlights the nascent but critical shift towards autonomous or semi-autonomous dollies. While currently representing a smaller share, the AGV segment is expected to exhibit the highest CAGR as global airports begin pilot programs integrating robotics and sensor technology into ground handling operations, recognizing the potential for significantly improved efficiency, reduced labor costs, and enhanced safety compliance, fundamentally reshaping future product development strategies in the core GSE sector.

- By Type:

- Pallet Dolly (PAG, PMC ULDs)

- Container Dolly (LD3, LD8 ULDs)

- Baggage Dolly (Open/Enclosed)

- Specialized Dolly (Engine/Component Handling)

- By Application:

- Air Cargo Handling

- Passenger Baggage Handling

- Maintenance and Overhaul Operations (MRO)

- By Material:

- Steel (Standard and Galvanized)

- Aluminum Alloys (Lightweight solutions)

- Composite Materials (High-durability, anti-corrosion applications)

- By Technology:

- Manual/Towed Dollies (Conventional operation)

- Automated Guided Vehicle (AGV) Dollies (Emerging autonomous solutions)

Value Chain Analysis For Airport Dolly Market

The Value Chain for the Airport Dolly Market begins with the upstream suppliers, primarily focusing on the procurement of raw materials and specialized components, which include high-grade structural steel (often galvanized or coated for corrosion resistance), aluminum extrusions for lightweight frames, durable rubber compounds for tires and casters, and specialized coupling mechanisms and braking systems. The efficiency and quality of this upstream segment are crucial, as fluctuations in global commodity prices for steel and aluminum directly impact the manufacturing cost structure and pricing power of GSE producers. Reputable manufacturers maintain stringent supplier qualification processes to ensure component reliability, given the harsh operating conditions and demanding safety standards placed on airport equipment. The manufacturing phase involves precision engineering, welding, and assembly, requiring specialized factories capable of meeting robust industry certifications (like those related to corrosion testing and load capacity) necessary for global market acceptance and long-term durability of the final product.

The downstream analysis focuses on the end-users and the physical distribution channels. End-users are primarily concentrated in three groups: international airport authorities (who often own centralized GSE fleets), third-party ground handling companies (GSPs) who operate fleets under contract for various airlines, and major airlines themselves (who sometimes maintain proprietary GSE for specialized operations). The distribution channel complexity is high; large, multinational GSE manufacturers often utilize a mix of direct sales teams for major, high-value tenders (Direct Channel), while relying on an extensive network of regional distributors and certified aftermarket service providers for sales to smaller airports, providing localized support, and handling spare parts and maintenance contracts (Indirect Channel). The successful downstream delivery relies heavily on efficient logistics to transport bulky equipment globally and the availability of specialized personnel for installation, testing, and initial operator training.

A critical component of the value chain is the post-sale service and support, particularly in highly regulated environments like airports. Maintenance, repair, and overhaul (MRO) services, along with the provision of certified spare parts, constitute a significant revenue stream and a vital link in the long-term customer relationship. The shift towards telematics and IoT integration further enhances this service offering, allowing manufacturers to provide condition-based monitoring and predictive maintenance contracts, thereby guaranteeing higher operational uptime for the airport authority or GSP. The value chain, therefore, is not linear but circular, heavily relying on continuous feedback loops regarding product performance, material endurance, and evolving regulatory requirements, ensuring that the next generation of airport dollies meets increasingly stringent performance and sustainability benchmarks mandated by global aviation bodies and demanding end-users in major logistical hubs.

Airport Dolly Market Potential Customers

The primary cohort of potential customers for the Airport Dolly Market consists of Ground Handling Service Providers (GSPs), which form the backbone of modern airport operations. Companies such as Swissport, Menzies Aviation, and Dnata, operating across hundreds of airports globally, require vast, standardized fleets of dollies to manage baggage and cargo transfer for multiple client airlines simultaneously. These GSPs prioritize scalability, interchangeability, and robust durability, often procuring equipment in large volumes through centralized contracts that emphasize minimizing the Total Cost of Ownership (TCO) through long-life components and low maintenance requirements. Their purchasing decisions are heavily influenced by the ability of the manufacturer to provide global support networks, quick access to certified spare parts, and integrated fleet management solutions that interface seamlessly with their proprietary scheduling and operational optimization software.

The second major customer group includes Airport Operating Authorities and Government Entities responsible for managing airport infrastructure. In many major international hubs, the airport authority itself owns the core GSE fleet, leasing it out or making it available to all on-tarmac operators, ensuring a high standard of equipment across the facility. These entities prioritize regulatory compliance, long-term asset value retention, and increasingly, equipment aligned with environmental, social, and governance (ESG) standards, seeking lightweight and high-efficiency models that support the airport’s broader sustainability goals. Procurement cycles for this group are typically longer and involve rigorous public tendering processes, placing a premium on certifications, proven track records, and the financial stability of the GSE supplier to guarantee long-term contractual obligations and robust post-warranty support.

Airlines, particularly major cargo carriers like FedEx Express and Lufthansa Cargo, and specialized logistics divisions of passenger airlines, constitute the third significant segment of potential buyers. While passenger airlines often outsource ground handling, specialized cargo operations frequently necessitate proprietary equipment tailored to unique ULD requirements or demanding logistics protocols specific to high-value or temperature-sensitive goods. These customers demand highly specific, robust container and pallet dollies that ensure maximum cargo security and minimal transit time. Furthermore, Maintenance, Repair, and Overhaul (MRO) facilities, both independent and airline-owned, require specialized dollies designed for the safe, precise movement of extremely heavy components like jet engines, landing gear, and tooling, where payload capacity and controlled maneuvering capability supersede general volume considerations, driving demand for bespoke, engineered solutions within the niche segment of the overall market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million USD |

| Market Forecast in 2033 | $1,350 Million USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TLD Group, JBT Corporation, Vestergaard Company, Fast Global Solutions, Kalmar Motor, Mallaghan Engineering, Guangtai, CIMC Tianda, Schopf, Lektro, Textron GSE, Alvestad, Airmarrel, MULAG, Weihai Guangtai Airport Equipment, Toyota Industries Corporation, Global Ground Support, TUG Technologies, HYDRO Systems, ITW GSE. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Airport Dolly Market Key Technology Landscape

The technology landscape in the Airport Dolly Market is rapidly evolving beyond basic mechanical engineering, heavily incorporating advanced material science and digital connectivity solutions to meet contemporary efficiency and environmental mandates. One key technological focus is on lightweighting, driven by the increasing use of high-strength aluminum alloys and aerospace-grade composites in the dolly frame and components. These materials significantly reduce the empty weight of the dolly, resulting in lower fuel consumption for the towing vehicle, reduced emissions, and less wear and tear on tires and chassis components. Furthermore, advanced surface treatments, such as specialized galvanization and highly durable powder coatings, are crucial in extending the equipment lifespan against severe environmental factors like de-icing fluids, saltwater corrosion, and extreme temperature variations common across global operating environments, ensuring long-term asset reliability and mitigating the need for premature replacements due to structural integrity failure.

Another dominant technological trend is the pervasive integration of Internet of Things (IoT) sensors and telematics systems into dolly fleets, transforming previously passive equipment into actively managed, data-reporting assets. These systems utilize GPS and specialized RFID tags to provide real-time location tracking, enabling airport operators and ground handling managers to precisely monitor asset utilization, prevent loss, and optimize the overall flow of cargo and baggage across the apron. The collected data—including route patterns, idle time, coupling cycles, and localized impact monitoring—is fed into cloud-based fleet management software. This allows for sophisticated data analysis, which supports crucial operational decisions, such as identifying bottlenecks in the logistics chain and generating predictive maintenance alerts based on actual usage patterns rather than fixed schedules, significantly enhancing operational responsiveness and minimizing unexpected, costly disruptions to the demanding aircraft turnaround schedule.

The most disruptive technological advancement influencing this market is the shift toward automation and intelligent ground handling, involving the piloting and deployment of Automated Guided Vehicle (AGV) dollies. While full autonomy remains nascent, manufacturers are investing heavily in developing dollies that can communicate with intelligent tow tractors and central traffic control systems via V2X communication protocols. This technological convergence enables highly precise maneuvering, anti-collision capabilities, and the potential for driverless operations in segregated zones, particularly valuable in high-volume cargo complexes or remote baggage sorting areas. The incorporation of advanced braking systems, automatic coupling mechanisms, and sophisticated load distribution sensors ensures safety compliance and optimizes the physical handling of sensitive Unit Load Devices, positioning autonomous and semi-autonomous GSE as the inevitable future trajectory for global airport ground support operations focused on maximizing efficiency and safety simultaneously across the increasingly busy and complex airport environment.

Regional Highlights

North America maintains a highly mature and technologically sophisticated market for airport dollies, driven by significant capital expenditure focused on replacing aging GSE fleets and adopting advanced solutions to enhance efficiency at major hubs like Atlanta, Chicago, and Dallas. The market here is characterized by stringent environmental regulations and a high labor cost environment, which acts as a powerful incentive for ground handlers to invest in high-efficiency, lightweight aluminum and composite dollies to reduce fuel consumption and ultimately minimize operating expenses. Furthermore, North American airports are early adopters of telematics and real-time asset tracking solutions, demanding dollies that are pre-equipped with IoT capabilities for seamless integration into existing airport operational databases (AODB), reinforcing the region's focus on digital optimization and safety compliance across extensive tarmac spaces.

The Asia Pacific (APAC) region represents the fastest-growing market globally, primarily fueled by unprecedented infrastructure development across China, India, and Southeast Asia, responding to booming passenger volumes and the exponential growth of air cargo, particularly e-commerce related logistics flows. Countries like India and Indonesia are launching numerous greenfield airport projects, requiring large-scale procurement of entire GSE fleets, including thousands of dollies, often prioritizing high-capacity, robust steel solutions due to cost constraints, though aluminum is gaining traction. The demand in APAC is volume-driven, necessitating robust local manufacturing and supply chain support. The regional highlight here is the high propensity for new market entrants and domestic manufacturers to compete aggressively with established global players, leveraging lower production costs while rapidly improving product quality to meet international operational standards.

Europe stands as a pivotal market defined by strict regulatory oversight, particularly concerning environmental sustainability and workplace safety standards established by the European Union Aviation Safety Agency (EASA). European airports are leading the global transition towards low-emission and electric GSE, which impacts the dolly market by emphasizing the critical need for lightweight construction (aluminum/composites) to maximize the operational range and battery efficiency of electric tow tractors. Furthermore, Nordic and Central European nations are pioneering the pilot testing of autonomous and semi-autonomous GSE solutions, driven by labor scarcity and the intense focus on operational predictability in challenging weather conditions. This makes Europe a key center for innovation and the early adoption of high-value, digitally integrated dollies, reflecting a strong preference for high-quality, long-life assets over purely cost-driven procurement decisions, maintaining a stable demand trajectory.

- Asia Pacific (APAC): The primary growth driver due to new airport construction, rising air cargo volumes fueled by e-commerce, and high demand for container and pallet dollies in emerging economies like China and India.

- North America: Mature market focused on fleet replacement, technology adoption (telematics/IoT), and high-efficiency, lightweight dollies to meet strict environmental and operational cost targets.

- Europe: Characterized by stringent regulatory standards (EASA/EU), leading adoption of lightweight and composite materials supporting electric tow tractors, and a high focus on automation pilot projects.

- Middle East and Africa (MEA): High-value market focused on heavy-duty, climate-resistant dollies for massive transit hubs (UAE, Qatar), driven by sustained investment in world-class aviation infrastructure.

- Latin America: Stable growth driven by airport privatization and expansion, with purchasing concentrated in major operational hubs like Brazil and Mexico, prioritizing reliable, durable, and cost-effective steel-based solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Airport Dolly Market.- TLD Group

- JBT Corporation

- Vestergaard Company

- Fast Global Solutions

- Kalmar Motor

- Mallaghan Engineering

- Guangtai

- CIMC Tianda

- Schopf

- Lektro

- Textron GSE

- Alvestad

- Airmarrel

- MULAG

- Weihai Guangtai Airport Equipment

- Toyota Industries Corporation

- Global Ground Support

- TUG Technologies

- HYDRO Systems

- ITW GSE

Frequently Asked Questions

Analyze common user questions about the Airport Dolly market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major factors are driving the demand for advanced Airport Dollies?

Demand is primarily driven by the consistent rise in global air passenger and cargo traffic, the necessity for ground handlers to improve aircraft turnaround efficiency, and the increasing investment in airport automation and GSE modernization to meet stringent IATA safety and security regulations globally. The growth of e-commerce also necessitates more robust container handling capabilities.

How is technology, such as IoT and AI, impacting the deployment of dolly fleets?

IoT sensors and telematics are enabling real-time location tracking, utilization monitoring, and integration with Airport Operational Databases (AODB), optimizing routing and deployment. AI is further enhancing this by providing predictive maintenance insights and facilitating the development of semi-autonomous (AGV) dollies to reduce labor costs and increase operational safety.

Which type of Airport Dolly is experiencing the highest growth in the current market?

The Container Dolly segment is exhibiting the highest volume growth, directly correlating with the standardized containerization of both passenger baggage (LD-3s) and air cargo. The Specialized Dolly segment, including those designed for MRO and unique component handling, is also showing high growth in value due to complexity and niche application requirements.

What are the primary restraints affecting the profitability and expansion of the Airport Dolly Market?

Key restraints include the substantial initial capital investment required for purchasing high-quality GSE, the long replacement cycle of equipment (often exceeding 15 years), vulnerability to fluctuating global commodity prices (especially steel and aluminum), and the regulatory hurdles associated with certifying new automated technologies for airport environments.

Which geographical region is expected to lead market growth and why?

The Asia Pacific (APAC) region is projected to lead market growth, driven by extensive new airport infrastructure development, massive capacity expansion projects in countries like India and China, and booming air freight demand, necessitating rapid, large-scale procurement of both cargo and baggage handling equipment to meet soaring regional air traffic volumes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager