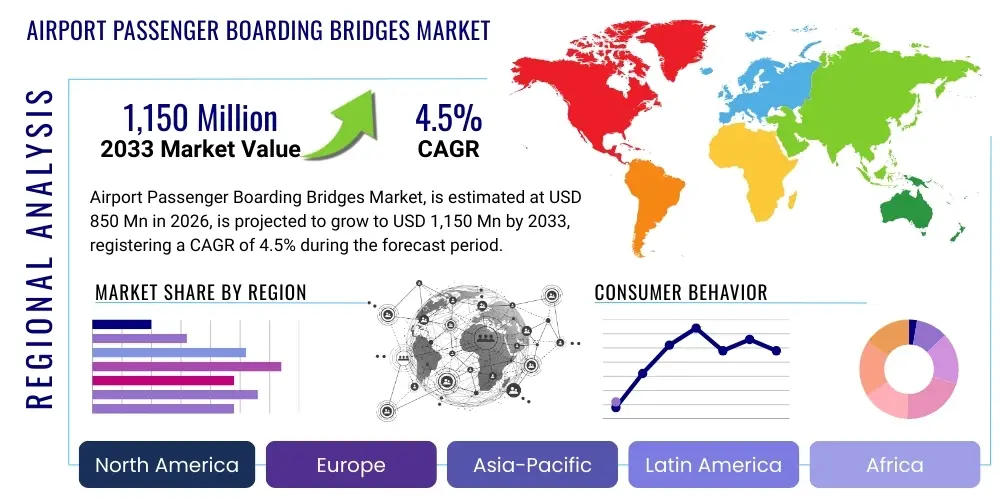

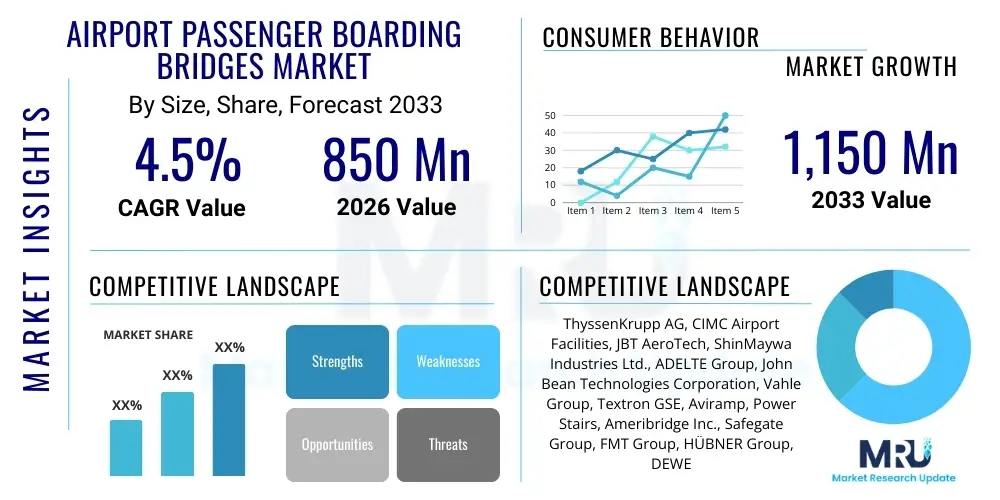

Airport Passenger Boarding Bridges Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439051 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Airport Passenger Boarding Bridges Market Size

The Airport Passenger Boarding Bridges Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1,150 million by the end of the forecast period in 2033.

Airport Passenger Boarding Bridges Market introduction

The Airport Passenger Boarding Bridges (PBB) market encompasses the design, manufacturing, installation, and maintenance of specialized movable walkways connecting airport terminals to aircraft doors. These critical infrastructure components are essential for modernizing airport operations, enhancing passenger safety, and improving overall efficiency in aircraft turnaround times. PBBs facilitate seamless, weather-protected boarding and deplaning processes, crucial for high-volume air travel hubs. The inherent requirement for robust mechanical systems, sophisticated control interfaces, and compliance with stringent international aviation safety standards defines the complexity and value proposition of the PBB industry.

Product diversity within this market is substantial, ranging from apron-drive and fixed-rotunda bridges to specialized T-shape and commuter bridges designed for varying aircraft types (narrow-body vs. wide-body) and gate configurations. Major applications include usage at international airports, domestic hubs, and increasingly, regional airports upgrading their infrastructure to handle larger jets and meet accessibility mandates. The primary benefits of implementing modern PBB systems include enhanced passenger experience, protection from inclement weather, reduced reliance on ground staff and bus transfers, and significant improvements in operational throughput, which is vital for managing air traffic congestion and maintaining flight schedules.

Driving factors for market growth are primarily linked to the aggressive expansion and modernization of airport infrastructure globally, particularly in the Asia Pacific and Middle East regions, necessitated by burgeoning passenger traffic volumes. Furthermore, the stringent enforcement of accessibility standards (such as ADA in the US and similar regulations globally) mandates the use of PBBs over traditional stairways, driving replacement and new installation cycles. Technological advancements focusing on automation, energy efficiency (e.g., LED lighting, optimized motor controls), and enhanced structural materials contributing to longer lifespan and reduced maintenance costs also significantly propel market expansion.

Airport Passenger Boarding Bridges Market Executive Summary

The Airport Passenger Boarding Bridges (PBB) market is characterized by stable growth driven by global infrastructure investment and the critical need for operational efficiency in the aviation sector. Business trends indicate a strong move toward electromechanical PBBs over traditional hydraulic systems due to lower maintenance demands and improved energy consumption profiles. Key manufacturers are focusing on integrating smart technologies, such as automated docking and remote monitoring capabilities, to provide value-added services and secure long-term maintenance contracts. Mergers, acquisitions, and strategic partnerships, particularly between established hardware providers and software integration firms, are shaping the competitive landscape, emphasizing full lifecycle service provision rather than merely equipment sales.

Regionally, Asia Pacific remains the dominant growth engine, fueled by massive government investments in new mega-airports in China, India, and Southeast Asian nations designed to handle unprecedented volumes of air travelers. North America and Europe, while mature, exhibit steady demand driven primarily by replacement cycles, terminal expansions, and the retrofitting of existing infrastructure with energy-efficient and compliant structures. The Middle East continues to see significant investment in world-class hub airports, necessitating the procurement of sophisticated and aesthetically advanced glass-walled PBB systems, often incorporating bespoke features tailored for VIP passenger segments. This dynamic regional demand matrix ensures diversified revenue streams across manufacturers.

Segment trends highlight the dominance of the apron drive bridge type due to its versatility and adaptability to various gate parking procedures. However, the fixed rotunda structure segment is seeing renewed interest in constrained terminal environments where space optimization is paramount. In terms of operation, the transition to electromechanical systems is accelerating, capitalizing on the demand for reduced environmental impact and enhanced precision during docking maneuvers. The long-term outlook remains positive, underpinned by the indispensable nature of PBBs in maintaining secure, efficient, and comfortable air travel experiences across all airport classes, thereby solidifying the market’s resilience against minor economic fluctuations.

AI Impact Analysis on Airport Passenger Boarding Bridges Market

User inquiries regarding AI's influence on the PBB market frequently center on three core themes: the potential for fully autonomous docking operations, the role of predictive maintenance in minimizing downtime, and the optimization of gate utilization management. Users seek assurance that AI integration will enhance safety, reduce human error during critical maneuvering phases, and provide cost savings through preventative measures. There is considerable interest in how machine learning algorithms can process real-time sensor data—including wind speed, aircraft type recognition, and precise distance measurements—to achieve smoother, faster, and more reliable connections, thereby mitigating common causes of aircraft delays and cosmetic damage. The collective expectation is that AI will transform PBBs from complex mechanical devices into intelligent, self-regulating terminal assets.

- Autonomous docking algorithms enhance precision and reduce the time required for PBB positioning, minimizing human error and potential damage to aircraft fuselages.

- Predictive maintenance platforms, powered by machine learning, analyze sensor data (vibration, temperature, current draw) to forecast equipment failure, dramatically extending component lifespan and reducing unscheduled downtime.

- Computer vision systems utilize AI for real-time aircraft type verification and accurate alignment detection, ensuring optimal bridge fit regardless of manual input.

- Optimized gate management software employs AI to dynamically allocate PBB resources based on flight schedules, gate constraints, and passenger flow projections, maximizing terminal throughput.

- AI-driven sensor fusion improves situational awareness, especially in adverse weather conditions, ensuring operational safety and regulatory compliance during maneuvering.

- Enhanced cybersecurity protocols are being integrated into smart PBB control systems, protecting against external threats targeting critical airport ground support infrastructure.

DRO & Impact Forces Of Airport Passenger Boarding Bridges Market

The Airport Passenger Boarding Bridges market dynamics are primarily shaped by a confluence of powerful drivers related to global aviation traffic growth and airport modernization initiatives, balanced against significant restraints imposed by high capital expenditure and complex regulatory environments. The paramount opportunity lies in capitalizing on the shift towards automation and the demand for energy-efficient electromechanical systems, especially in emerging economies requiring rapid infrastructure deployment. These core factors generate impact forces that compel key players to innovate in structural design, materials science, and control system integration, ensuring that PBB technology evolves in lockstep with the demands of new generation aircraft (e.g., Airbus A380 and Boeing 777X) and increasing passenger volumes.

Drivers: Significant growth in global passenger air travel, particularly in the APAC region, necessitates the continuous expansion and construction of new terminals and greenfield airports. Regulatory mandates emphasizing passenger mobility and accessibility (e.g., provisions for disabled passengers) drive the replacement of legacy apron operations with modern PBBs. Furthermore, the imperative for airports to reduce turnaround times—a key performance indicator for airlines—boosts demand for highly reliable and efficient PBB systems that can rapidly and safely connect to diverse aircraft models. The shift towards sustainable airport operations also favors newer, lighter materials and energy-efficient electromechanical drives, accelerating replacement cycles.

Restraints: The primary restraint remains the exceedingly high initial capital investment required for procurement and installation, often delaying adoption in smaller or financially constrained regional airports. PBBs are large, specialized assets that require extensive customized integration into complex terminal architectures, involving significant civil engineering work. Additionally, the stringent and varied international safety and certification standards (e.g., compliance with IATA Airport Handling Manual and local civil aviation authorities) create barriers to entry and increase R&D costs for manufacturers. Maintenance complexity, requiring highly specialized technicians and proprietary parts, also acts as a long-term operational restraint for airport operators.

Opportunities: The greatest potential lies in offering advanced automation features, including remote diagnostics, predictive maintenance contracts, and full lifecycle support, moving the business model from pure hardware sales to integrated service provision. Emerging markets represent substantial greenfield opportunities for new installations. Moreover, the demand for aesthetically pleasing and modern glass-walled PBBs, particularly in luxury hub airports, provides manufacturers an avenue for premium product differentiation. Developing modular, easily deployable PBB systems designed specifically for low-cost carriers or temporary airport expansions presents a niche but growing opportunity segment.

- Drivers:

- Surging global air traffic necessitating airport expansion and new construction.

- Regulatory requirements for enhanced passenger accessibility and safety standards.

- Pressure on airlines and airports to minimize aircraft turnaround times (TAT).

- Trend toward modern, energy-efficient electromechanical PBB systems.

- Restraints:

- High initial capital expenditure and complex installation logistics.

- Strict global and local aviation safety and certification standards.

- Market vulnerability to cyclical slowdowns in the aviation industry and geopolitical instability.

- Dependency on specialized and high-cost maintenance personnel and spare parts.

- Opportunities:

- Integration of AI and automation for fully autonomous docking and remote control.

- Expansion into fast-growing APAC and MEA airport infrastructure projects.

- Demand for robust, low-maintenance electromechanical bridges in replacement markets.

- Offering comprehensive service contracts based on predictive maintenance models.

- Impact Forces:

- Intense competitive pressure drives technological innovation in control systems and structural materials (Force 1: Competition Intensity).

- High barriers to entry due to stringent safety regulations and capital requirements (Force 2: Barriers to Entry).

- Significant buyer power (large airport authorities/consortia) demanding customized, high-quality, long-life assets (Force 3: Buyer Power).

Segmentation Analysis

The Airport Passenger Boarding Bridges market is comprehensively segmented based on product type, operational mechanism, structural material, and the specific application environment (airport type). This multidimensional segmentation allows for precise market sizing and strategic targeting by manufacturers who often specialize in specific bridge designs or operational mechanisms. The predominant segmentation hinges on the bridge structure and the drive system, as these dictate functionality, installation requirements, and long-term operational costs. Analyzing these segments reveals varying growth rates, with advanced electromechanical systems capturing greater market share due to their superior performance metrics compared to legacy hydraulic systems, especially within new construction projects.

In terms of structure, the Apron Drive bridge segment consistently holds the largest share globally, attributed to its flexibility in handling diverse gate configurations and aircraft types, making it the standard choice for major international hubs. However, the operational mechanism segmentation shows the fastest transition, with hydraulic systems steadily losing ground to advanced electromechanical systems. Electromechanical PBBs offer precise control, reduced fluid contamination risk, lower energy consumption, and quieter operation, aligning perfectly with modern airport sustainability goals and maintenance optimization strategies. This transition is a key indicator of the market's technological maturation.

Furthermore, segmentation by material type, specifically the choice between glass-walled and steel-walled structures, impacts both pricing and regional preference. Glass-walled bridges command a premium and are favored in modern, architecturally significant airport projects (common in the Middle East and Asia), enhancing the passenger experience by providing panoramic views. Conversely, steel-walled bridges remain the economical and robust choice for high-traffic, function-oriented environments where durability outweighs aesthetic considerations. Understanding these preference shifts is vital for manufacturers optimizing their product portfolio.

- By Product Type:

- Apron Drive PBBs

- Fixed Pedestal PBBs (T-shape)

- Commuter PBBs (Lower profile for regional aircraft)

- By Operating Mechanism:

- Hydraulic PBBs

- Electromechanical PBBs

- By Structure Type:

- Steel-Walled PBBs

- Glass-Walled PBBs

- Hybrid Structures

- By Application/Airport Type:

- International Airports (Hubs)

- Domestic Airports

- Regional Airports

Value Chain Analysis For Airport Passenger Boarding Bridges Market

The value chain for the Airport Passenger Boarding Bridges market begins with the upstream suppliers providing highly specialized components and raw materials, including high-grade steel and aluminum for structural fabrication, advanced hydraulics or electromechanical drive components (motors, gears, actuators), and sophisticated control system hardware (PLCs, sensors). The bargaining power of these upstream suppliers is moderate to high, especially for niche, certified components such as anti-collision sensors and proprietary control systems, as PBB manufacturing requires adherence to strict aviation standards which limits the pool of approved suppliers. Quality control and material certification at this stage are paramount, heavily influencing the final product's reliability and lifespan.

The midstream stage involves the core manufacturing and integration processes carried out by Original Equipment Manufacturers (OEMs). This phase includes complex structural welding, assembly of the telescopic tunnels, integration of the drive systems, and installation of the control and utility systems (lighting, HVAC). OEMs differentiate themselves through engineering expertise, adherence to safety certifications, customization capabilities, and the provision of long-term service agreements. Distribution channels are typically direct, involving a highly consultative sales process between the OEM and the airport authority, engineering firm, or general contractor responsible for the terminal expansion project. Indirect channels may involve certified regional distributors or integrators for sales of components or maintenance services, but large-scale PBB contracts are almost always direct due to complexity and customization.

Downstream activities include installation, commissioning, training, and, most crucially, post-sale service and maintenance. The maintenance component is a high-margin, long-term revenue stream for manufacturers, often accounting for a significant portion of the total contract value over the PBB's operational life (typically 20-30 years). End-users, the airport operators, prioritize reliability and rapid response times for service, given that PBB failure can directly lead to flight delays. The aftermarket service component dictates customer loyalty and future contract opportunities. The effectiveness of the supply chain in managing complex, global logistics for oversized equipment installation and subsequent spare parts provision is a critical determinant of operational success in this market.

Airport Passenger Boarding Bridges Market Potential Customers

The primary consumers and buyers of Airport Passenger Boarding Bridges are global and regional airport operating authorities, often governmental agencies, private entities, or large airport consortia (e.g., AENA, Fraport, BAA, or specialized local airport trusts). These entities act as the ultimate decision-makers, overseeing major capital expenditure programs for infrastructure expansion and replacement. Their purchasing decisions are driven by long-term strategic needs related to passenger volume projections, compliance with international safety and accessibility regulations, and the overall optimization of airport ground operations. Since PBBs are non-negotiable necessities for modern terminal design, the purchasing cycle is long, involving stringent tendering processes, detailed technical specifications, and significant scrutiny over vendor track records.

Secondary but highly influential potential customers include major General Contractors (GCs) and specialized Engineering, Procurement, and Construction (EPC) firms that are contracted to build or renovate large-scale airport terminals. While the airport authority remains the end-user, GCs/EPCs often manage the procurement process and select the specific PBB manufacturer based on cost, delivery schedules, and technical integration capabilities specified in the project plans. Furthermore, specialized Ground Support Equipment (GSE) leasing companies sometimes procure PBBs for specific regional airports under long-term operational leases, though this model is less common for fixed infrastructure than for mobile GSE. Ultimately, the decision-making unit involves high-level airport management, technical engineering teams, and procurement departments focused on lifecycle costs and operational resilience.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,150 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ThyssenKrupp AG, CIMC Airport Facilities, JBT AeroTech, ShinMaywa Industries Ltd., ADELTE Group, John Bean Technologies Corporation, Vahle Group, Textron GSE, Aviramp, Power Stairs, Ameribridge Inc., Safegate Group, FMT Group, HÜBNER Group, DEWES Group, Dott. Gallina Srl, TAM-EUROPE, Oshkosh Corporation, Mitsubishi Heavy Industries, Wuxi Sunman |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Airport Passenger Boarding Bridges Market Key Technology Landscape

The technological landscape of the Airport Passenger Boarding Bridges market is undergoing rapid evolution, shifting from purely mechanical systems to highly intelligent, interconnected infrastructure components. The most significant advancement lies in the widespread adoption of electromechanical drive systems, which are replacing older, maintenance-intensive hydraulic technologies. These electromechanical systems utilize sophisticated AC motors and precision gearboxes controlled by Programmable Logic Controllers (PLCs), offering superior speed control, highly precise positioning capabilities (crucial for connecting to modern aircraft with tight tolerances), and integrated diagnostics. Furthermore, the incorporation of advanced sensor technology, including laser guidance systems and ultrasonic proximity sensors, ensures safer, faster docking maneuvers while minimizing the risk of collision damage to the aircraft fuselage or wing structure.

Another crucial technological development involves the integration of Building Information Modeling (BIM) and Digital Twin technologies during the design and installation phases. BIM ensures that the PBB seamlessly integrates with the highly complex geometries of the airport terminal and surrounding apron, optimizing placement and maximizing operational flow. Following installation, the concept of the Digital Twin allows airport operators to simulate operational scenarios, test software updates, and conduct comprehensive predictive maintenance analysis using real-time data fed back from the bridge's integrated sensors. This combination of robust physical engineering and advanced digital management tools enhances the lifecycle performance and reliability of these critical assets.

Looking ahead, emerging technologies focus heavily on automation and remote operation capabilities. Research and development are concentrated on developing reliable, fully autonomous docking procedures utilizing AI and computer vision, reducing reliance on manual operator input. Furthermore, advancements in structural materials, particularly high-strength, lightweight composites and specialized corrosion-resistant coatings, are being employed to extend the PBB lifespan and reduce the frequency of heavy maintenance interventions, thereby reducing the Total Cost of Ownership (TCO) for airport authorities over the bridge's decades-long service life. Connectivity via industrial IoT standards allows for standardized communication across a fleet of PBBs and other ground support equipment.

Regional Highlights

The global market for Airport Passenger Boarding Bridges exhibits significant regional variance in terms of growth rates, technology adoption, and project scale, primarily influenced by aviation regulatory frameworks, existing infrastructure age, and economic development cycles. These regional dynamics necessitate tailored market entry strategies and product offerings from key manufacturers.

Asia Pacific (APAC) stands out as the epicenter of growth in the PBB market, characterized by unprecedented investment in aviation infrastructure. Countries like China and India are constructing numerous greenfield airports and expanding existing hubs (e.g., Beijing Daxing, Navi Mumbai, and new airports across Southeast Asia) to accommodate the region's rapidly expanding middle class and resultant exponential growth in air passenger traffic. This region demands high-volume, robust apron-drive bridges, with a growing preference for aesthetically superior, large glass-walled structures in flagship projects. The demand here is not merely for replacement but for entirely new installations, driving volume sales and prioritizing speed of delivery and installation support. The competitive landscape in APAC is intensifying, with local Chinese manufacturers providing stiff competition to traditional Western and Japanese PBB giants, often focusing on cost-effectiveness combined with increasing technological sophistication, particularly in electromechanical systems.

North America represents a mature yet stable market, driven primarily by infrastructure refurbishment and modernization programs. While new airport construction is limited, major hubs across the US and Canada are constantly upgrading terminals to comply with stringent ADA accessibility standards and to replace aging hydraulic bridges installed during the 1980s and 1990s. The emphasis in North America is heavily placed on long-term reliability, low maintenance costs, and integration with complex baggage handling and gate management systems. Electromechanical PBBs are standard requirements, and manufacturers must demonstrate adherence to rigorous safety standards and possess established local service networks. The replacement cycle, mandated by operational efficiency goals and aging infrastructure, ensures continuous, predictable demand.

Europe exhibits similar characteristics to North America, focusing on replacing end-of-life PBBs and optimizing gate efficiency within space-constrained metropolitan airports (such as London Heathrow, Frankfurt, and Amsterdam Schiphol). European airport authorities place a high premium on sustainability, driving demand for the most energy-efficient PBB models, often requiring detailed lifecycle assessment reports from manufacturers. Regulatory compliance, specifically related to EU safety and environmental directives, is a critical purchasing criterion. Furthermore, a unique trend in Europe is the adoption of specialized commuter bridges to service the high volume of regional flights handled by low-cost carriers at secondary terminals, addressing specific narrow-body aircraft requirements efficiently.

The Middle East and Africa (MEA) region is segmented by wildly differing investment levels. The Gulf Cooperation Council (GCC) nations, particularly the UAE, Qatar, and Saudi Arabia, are significant investors, driving demand for state-of-the-art PBB technology, often featuring bespoke luxury finishes, advanced climate control systems, and expansive glass structures to match the high-end architectural design of their mega-hubs (e.g., Dubai, Doha, and Riyadh expansions). These projects require maximum customization and cutting-edge technology integration. Conversely, the African segment is highly nascent, with limited PBB adoption outside major gateway airports (e.g., Johannesburg, Cairo). Growth here is sporadic but shows potential as developing nations invest in modernizing key regional hubs, typically prioritizing cost-effective, durable steel-walled structures.

- Asia Pacific (APAC): Highest growth region fueled by massive greenfield airport construction and terminal expansion projects in China, India, and Southeast Asia; strong demand for high-capacity, apron-drive, and increasingly, glass-walled PBBs.

- North America: Stable market driven by continuous replacement of aging hydraulic systems with modern electromechanical PBBs, focused on compliance with accessibility (ADA) and stringent safety standards, supported by established service networks.

- Europe: Replacement market emphasizing energy efficiency, sustainability, and gate optimization in constrained environments; high demand for specialized commuter bridges for regional traffic and adherence to strict EU regulations.

- Middle East: Major high-value segment characterized by large-scale, luxury airport developments; procurement focuses on advanced, customized, and architecturally integrated glass-walled PBB systems for international transit hubs.

- Latin America (LATAM): Moderate growth driven by selective infrastructure upgrades in key national capital airports (e.g., Mexico City, Sao Paulo); purchases are often constrained by budget, favoring robust, proven technologies over cutting-edge automation.

- Africa: Emerging market with low adoption rates, concentrated in major North and South African gateway cities; future growth tied to stabilization and international investment in commercial air travel infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Airport Passenger Boarding Bridges Market.- ThyssenKrupp AG

- CIMC Airport Facilities

- JBT AeroTech

- ShinMaywa Industries Ltd.

- ADELTE Group

- John Bean Technologies Corporation (JBT)

- Vahle Group

- Textron GSE

- Aviramp Ltd.

- Power Stairs

- Ameribridge Inc.

- Safegate Group (ADB Safegate)

- FMT Group

- HÜBNER Group

- DEWES Group

- Dott. Gallina Srl

- TAM-EUROPE

- Oshkosh Corporation

- Mitsubishi Heavy Industries, Ltd.

- Wuxi Sunman Machinery Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Airport Passenger Boarding Bridges market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the current growth in the PBB market?

The primary driver is the exponential growth in global air passenger traffic, particularly across Asia Pacific and the Middle East, necessitating massive investments in new airport infrastructure and capacity expansion projects, alongside the mandated replacement of obsolete hydraulic systems in mature markets like North America and Europe.

How do electromechanical PBBs differ significantly from hydraulic PBBs?

Electromechanical PBBs utilize AC motors and gearboxes for precise movement, offering superior energy efficiency, quieter operation, and significantly lower maintenance costs compared to hydraulic systems, which rely on pressurized fluid and are prone to leakage and fluid contamination issues.

Which segmentation holds the largest market share by structure type?

Apron Drive PBBs currently hold the largest market share globally due to their high versatility, enabling them to connect seamlessly with a wide range of aircraft types and adapt to various gate layouts, making them the preferred choice for high-volume international hub airports.

What technological advancements are shaping the future of PBB operations?

The future is being shaped by the integration of AI for autonomous docking and guidance, advanced sensor fusion for safety, and the implementation of predictive maintenance systems powered by IoT to maximize uptime and minimize operational downtime through early fault detection.

What is the typical lifespan and critical maintenance cycle of a Passenger Boarding Bridge?

A modern PBB typically has an operational lifespan of 20 to 30 years. Critical maintenance cycles involve mandatory periodic inspections, lubrication of mechanical components, and major overhauls of the electrical or drive systems, usually scheduled every 5 to 7 years, based on operational hours and environmental factors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager