Airport Runway Safety Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438190 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Airport Runway Safety Systems Market Size

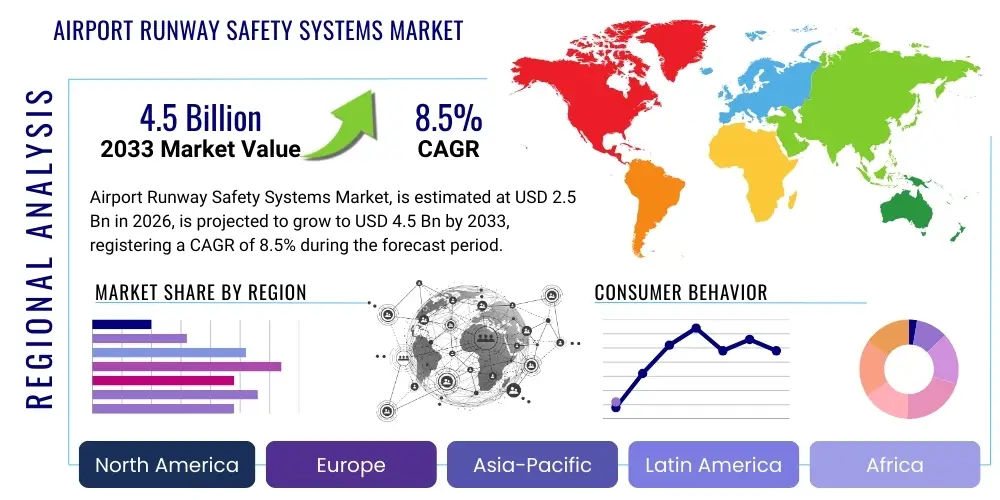

The Airport Runway Safety Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.5 Billion by the end of the forecast period in 2033.

Airport Runway Safety Systems Market introduction

The Airport Runway Safety Systems Market encompasses a sophisticated portfolio of technologies and infrastructure designed to minimize operational hazards such as runway incursions, excursions, and surface contamination, thereby enhancing overall airport operational safety and efficiency. These systems are critical components of the modern air traffic management infrastructure, mandated by stringent international regulatory bodies like the International Civil Aviation Organization (ICAO) and local authorities such as the Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA). Key products include sophisticated Foreign Object Debris (FOD) detection systems, Runway Status Lights (RWSL), advanced surface movement guidance and control systems (A-SMGCS), and various weather monitoring technologies tailored for immediate runway condition reporting. The primary objective is to maintain situational awareness for pilots and air traffic controllers, especially during low-visibility conditions or high-traffic operations, mitigating risks associated with human error and environmental variables.

Major applications of these safety systems span commercial, military, and general aviation airports globally, with a rising demand driven by increasing air traffic density and the necessity for 24/7 all-weather operational capacity. The integration of advanced sensor technologies, including millimeter-wave radar, electro-optical sensors, and sophisticated data processing units, allows for real-time monitoring and proactive risk mitigation. Benefits derived from deploying robust runway safety systems include a significant reduction in accident rates, minimizing operational delays, ensuring regulatory compliance, and protecting high-value aviation assets. Furthermore, these systems contribute substantially to the public perception of safety, which is paramount in the aviation industry, solidifying the continuous investment cycle required for system upgrades and maintenance.

Driving factors for market expansion are multifaceted, rooted primarily in the global surge in air passenger travel, which necessitates higher airport throughput and stricter safety margins. Governments worldwide are prioritizing infrastructure modernization projects, often catalyzed by aging air traffic control systems requiring digital transformation. The increasing complexity of airport environments, coupled with the introduction of new operational procedures and technologies (e.g., unmanned aerial systems integration), mandates continuous innovation in safety solutions. Furthermore, several high-profile runway incidents in recent history have intensified regulatory pressure on airports to adopt the highest standards of automated safety protocols, making the implementation of certified runway safety systems not merely a competitive advantage but a fundamental operational requirement.

Airport Runway Safety Systems Market Executive Summary

The global Airport Runway Safety Systems market is experiencing robust growth fueled by mandatory regulatory compliance and technological convergence, particularly involving sensor fusion and Artificial Intelligence (AI) for predictive safety analytics. Key business trends indicate a shift towards integrated platform solutions, where disparate safety systems (FOD, RWSL, A-SMGCS) are unified under a single command and control interface, offering airport operators superior visibility and efficiency. This integration capability is driving strategic partnerships and mergers among technology providers aiming to offer comprehensive, end-to-end solutions, moving away from fragmented system deployments. Furthermore, the emphasis on minimizing false alarms and improving the reliability of automated detection systems is compelling manufacturers to invest heavily in advanced machine learning algorithms, thus enhancing the operational credibility and effectiveness of installed systems, especially in high-density traffic hubs.

Regional trends reveal that North America and Europe currently dominate the market, primarily due to well-established regulatory frameworks, early adoption of advanced air traffic management technologies, and substantial investments in airport infrastructure modernization programs. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), driven by rapid airport development, particularly in emerging economies such as China, India, and Southeast Asian nations, which are building new mega-airports or drastically expanding existing facilities. These burgeoning markets often leapfrog older technologies, directly adopting the latest integrated safety platforms, creating significant opportunities for international vendors specializing in smart airport technologies. The Middle East, characterized by ambitious aviation hubs, also remains a critical region for high-value contracts focused on implementing state-of-the-art automated systems.

Segment trends highlight the dominance of the FOD Detection Systems and RWSL categories, reflecting the industry's immediate focus on mitigating the most critical runway-based hazards. Within the technology segment, sensor-based systems, including radar and LiDAR, are gaining prominence over traditional camera-based systems due to their superior performance in adverse weather conditions, which is essential for ensuring operational continuity. The service segment, encompassing maintenance, support, and professional training, is also expanding rapidly. As these complex digital systems are deployed, airports rely increasingly on specialized service contracts to ensure uptime and compliance. This growth in the service sector underscores the long-term, high-value relationship between system integrators and airport operators, guaranteeing sustained revenue streams throughout the system lifecycle, often exceeding the initial hardware acquisition cost.

AI Impact Analysis on Airport Runway Safety Systems Market

Common user questions regarding AI's influence in the Airport Runway Safety Systems Market frequently revolve around the reliability of autonomous decision-making, the potential for predictive maintenance to reduce costly downtime, and the ability of AI algorithms to integrate complex data streams for unparalleled situational awareness. Users are particularly concerned with how AI can minimize false positives in Foreign Object Debris (FOD) detection systems, a historical challenge that often led to unnecessary runway closures. There is also significant interest in AI's role in standardizing and automating runway condition reporting (RCR), transitioning from subjective human assessment to objective, data-driven analysis. Overall, the key themes summarize a cautious optimism, focusing on AI's potential to move safety protocols from reactive measures to proactive, predictive risk management, thereby significantly enhancing efficiency without compromising regulatory standards or creating new single points of failure within the complex airport ecosystem.

AI’s integration is fundamentally transforming the capabilities of current runway safety infrastructures by introducing robust data processing capabilities far exceeding traditional statistical models. Machine learning algorithms are now being trained on vast historical datasets encompassing weather patterns, traffic movements, maintenance records, and minor incidents to identify subtle precursors to major safety events, such as potential runway overshoots due to unexpected surface friction changes or the early warning signs of equipment failure. This predictive analytical capability allows maintenance teams to perform just-in-time repairs or initiate operational adjustments (e.g., changing runway assignments) before a dangerous situation fully develops. This paradigm shift towards preventive safety management maximizes runway utilization and minimizes financial losses associated with operational interruptions, offering a compelling return on investment for airport authorities globally.

Furthermore, AI is pivotal in enabling the fusion of data from heterogeneous sensor networks—including radar, ground sensors, visual cameras, and meteorological stations—into a single, coherent operational picture. This sensor fusion, powered by deep learning, enhances the accuracy of object classification (e.g., distinguishing debris from wildlife or harmless materials) and improves the precision of tracking moving objects, such as unauthorized vehicles or pedestrians on the maneuvering area. By providing Air Traffic Controllers (ATCOs) with contextually rich, prioritized alerts, AI reduces cognitive load and allows for faster, more informed decision-making. Future developments are focused on integrating AI with Unmanned Aerial Systems (UAS) for autonomous runway inspections, further automating routine safety checks and increasing the frequency and quality of detailed surface monitoring, making continuous real-time safety assessment a standard operational practice.

- AI-driven predictive maintenance scheduling for safety lighting and sensor networks, optimizing uptime.

- Enhanced situational awareness through sensor data fusion, minimizing runway incursions and conflicts.

- Machine learning algorithms improving FOD detection accuracy and drastically reducing false alarm rates.

- Automated Runway Condition Reporting (RCR) using computer vision and friction analysis for objective reporting.

- Support for autonomous airport ground vehicle operations and dynamic routing based on real-time traffic flow.

DRO & Impact Forces Of Airport Runway Safety Systems Market

The Airport Runway Safety Systems Market is driven primarily by the escalating demand for operational efficiency under tightening safety regulations. The imperative to adhere to global ICAO standards and local aviation authority mandates (FAA, EASA) following high-profile incidents forces airports to continually upgrade and install certified safety technology. The massive expansion of air traffic, particularly in the APAC region, necessitates higher runway throughput rates, achievable only through reliable, all-weather safety systems that minimize delays and maximize operational hours. Restraints include the extremely high initial capital investment required for installing complex systems like A-SMGCS and RWSL, which can be prohibitive for smaller regional airports. Furthermore, the long and complex certification and approval processes, particularly concerning integration with existing air traffic control infrastructure, introduce substantial project timelines and risks. Opportunities lie in the increasing adoption of cost-effective, modular, cloud-based solutions suitable for phased deployments, and the integration of emerging technologies like drone-based inspections and cybersecurity overlays for networked safety infrastructure.

The core impact forces shaping this market include the sustained regulatory pressure exerted by global bodies, which necessitates a minimum standard of safety infrastructure regardless of an airport's operational size or financial capacity. Technological advancements, particularly in sensor technology (LiDAR, high-resolution radar) and data analytics, constantly push the performance envelope, allowing systems to operate reliably in previously challenging conditions (e.g., heavy fog, snow). Economic pressures also play a significant role; while initial costs are high, the long-term financial risk mitigation—avoiding multi-million dollar accident liabilities and minimizing revenue losses from flight delays and closures—provides a compelling business case for investment. The socio-political impact, emphasizing public safety and confidence in air travel, further reinforces the necessity of adopting best-in-class safety technologies, making safety non-negotiable for airport management and government regulators alike.

Furthermore, competition within the market is intense, driven by a few dominant defense and aviation technology conglomerates offering full-suite solutions, alongside specialized niche providers focusing on specific components like surface friction measurement or high-precision navigation aids. This competitive intensity drives rapid product iteration and price optimization for certain standardized components. The threat of substitution is relatively low, as regulatory requirements mandate highly specialized and certified systems. However, there is a constant internal pressure from technological disruption, where newer, more efficient sensor modalities or AI-driven predictive software can quickly render older, installed systems obsolete, necessitating continuous upgrade cycles, which serves as a significant growth driver for the service and modernization segments of the market.

Segmentation Analysis

The Airport Runway Safety Systems Market is intricately segmented based on system type, technology employed, end-user application, and geographic region, reflecting the diverse operational requirements and technological maturity across the global aviation sector. System segmentation captures the critical functionalities addressing distinct safety challenges, such as the prevention of debris damage (FOD systems) versus the mitigation of collision risk (RWSL and A-SMGCS). The technology landscape segmentation illustrates the transition from legacy inductive loop systems and conventional surveillance radar towards high-resolution, multi-sensor integration platforms utilizing radar, LiDAR, and advanced acoustic detection methods. This granular analysis provides stakeholders with a clear understanding of where growth capital is being directed, particularly towards autonomous and integrated solutions that offer superior performance and lower total cost of ownership over their lifecycle.

- By System Type:

- Foreign Object Debris (FOD) Detection Systems

- Runway Status Lights (RWSL)

- Runway Condition Reporting (RCR) Systems

- Advanced Surface Movement Guidance and Control Systems (A-SMGCS)

- Runway Overrun Protection Systems (ROPS)

- Perimeter Intrusion Detection Systems (PIDS)

- By Technology:

- Sensor-Based Systems (Radar, LiDAR, Electro-Optical)

- Software & Data Analytics

- Lighting & Signage Systems

- Communication & Networking Systems

- By Application:

- Commercial Airports (International & Regional)

- Military & Government Airbases

- By Component:

- Hardware (Sensors, Controllers, Displays)

- Software (Integration Platforms, AI/ML Modules)

- Services (Installation, Maintenance, Training)

- By Deployment Model:

- Greenfield (New Construction)

- Brownfield (Existing Infrastructure Upgrade)

Value Chain Analysis For Airport Runway Safety Systems Market

The value chain for Airport Runway Safety Systems is highly structured, beginning with specialized upstream suppliers who provide core technology components. Upstream analysis focuses on the manufacturers of high-precision sensors, including solid-state radar modules, sophisticated LiDAR scanners, and high-resolution imaging cameras, along with specialized embedded systems and powerful computing hardware necessary for real-time data processing. Key raw material inputs often involve specialized materials resistant to harsh airport environments, such as weather-resistant alloys and robust optical materials. These suppliers operate in a highly competitive but niche market, where quality, reliability, and certification compliance are paramount. The efficiency and pricing of these upstream components directly influence the final cost and performance characteristics of the integrated safety system solution offered downstream to airports.

The midstream stage is dominated by system integrators and prime contractors, who are responsible for designing, assembling, customizing, and certifying the complete safety system solution. These entities manage complex integration projects, merging hardware from multiple vendors with proprietary software and Air Traffic Management (ATM) interfaces. Their primary value proposition lies in their deep domain expertise, adherence to strict aviation standards (e.g., DO-178C, DO-254), and their ability to execute large-scale, multi-year deployment projects in live operational airport environments. The distribution channel is typically direct, involving lengthy negotiation processes between the prime contractor and the airport authority or government body overseeing aviation infrastructure investment. However, specialized sub-contractors and certified resellers may handle peripheral equipment and maintenance contracts, particularly in regional markets where the prime contractor lacks a direct operational presence.

Downstream analysis centers on the end-users—commercial airport operators, military installations, and civil aviation authorities—who purchase, deploy, and maintain these systems. Their primary concern is total system reliability, minimal downtime, seamless integration with existing Air Traffic Control (ATC) towers, and ongoing compliance reporting. The provision of services, including rigorous maintenance schedules, software updates, and advanced technical training for airport personnel, forms a critical and high-margin part of the downstream value chain. This indirect revenue stream, derived from long-term service contracts, often stabilizes the market. Given the highly specialized nature and sensitive application, direct channels are predominantly used for sales, ensuring high levels of technical support and accountability, while specialized consulting firms often play an indirect, yet vital role in initial requirement specification and vendor selection processes, adding another layer to the overall distribution ecosystem.

Airport Runway Safety Systems Market Potential Customers

The primary customers and end-users of Airport Runway Safety Systems are organizations responsible for managing, operating, and regulating air traffic and airport infrastructure globally. Commercial airport operators, ranging from large international hub airports handling millions of passengers annually to smaller regional facilities, constitute the largest segment of potential customers. These entities are continuously seeking solutions to enhance throughput, reduce delays, and maintain stringent safety records to protect their operational licenses and competitive standing. Driven by continuous air traffic growth and the necessity to operate 24/7 regardless of weather conditions, these commercial airports represent the most stable and high-volume demand source, particularly for advanced A-SMGCS, RWSL, and automated FOD detection systems.

A secondary, yet highly critical, segment of potential customers includes governmental organizations, specifically national defense ministries and civil aviation authorities (e.g., FAA, DGCA, CAAC). Military and government airbases require tailored runway safety systems that can handle high-performance military aircraft operations, often demanding higher security specifications and specialized runway clearance protocols, including perimeter intrusion detection systems integrated with radar surveillance. Civil aviation authorities, while typically not direct buyers of the equipment, act as powerful indirect customers by setting the mandatory regulatory and technical standards that force airport operators within their jurisdiction to purchase and implement certified systems, effectively controlling the market demand curve through policy and regulatory compliance mandates.

Furthermore, new airport construction projects (Greenfield deployments) and major infrastructure renovation programs represent significant, high-value procurement opportunities. Developers and consortia engaged in building new international airports in emerging markets—particularly Asia Pacific and the Middle East—are prime targets for integrated safety system providers. These projects typically allow for the installation of the latest, most interconnected technologies from the outset, avoiding the compatibility challenges inherent in upgrading older, "Brownfield" sites. Additionally, air navigation service providers (ANSPs) often collaborate closely with airports, and in some jurisdictions, they may be the direct procurement entity for certain ATC-related runway safety components, making them essential stakeholders in the sales process for networked safety solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Thales Group, Leonardo S.p.A., Saab AB, Raytheon Technologies Corporation (Collins Aerospace), ADB Safegate, Xsight Systems Ltd., Moog Inc., Hitachi, Siemens AG, Indra Sistemas, QinetiQ Group plc, Frequentis AG, SITA, Altys, AS-TECH Industrie, NavAero AB, BAE Systems, L3Harris Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Airport Runway Safety Systems Market Key Technology Landscape

The current technology landscape in the Airport Runway Safety Systems market is defined by a rapid move towards integrated, smart, and highly redundant sensor networks, replacing older, often manually-intensive safety protocols. Sensor fusion technology stands at the forefront, merging data from disparate sources—such as millimeter-wave radar, electro-optical/infrared (EO/IR) cameras, and acoustic sensors—to create a robust, verifiable safety picture of the runway environment. This multi-sensor approach drastically reduces the vulnerability associated with single sensor failure and dramatically improves detection accuracy, especially for small objects (FOD) or slow-moving hazards under poor visibility conditions. Furthermore, the networking infrastructure supporting these sensors utilizes high-speed, secure communication protocols, often leveraging fiber optics and dedicated wireless networks, ensuring minimal latency for real-time applications like Runway Status Lights (RWSL), where milliseconds count in preventing runway incursions.

Another crucial technological advancement involves sophisticated data analytics and AI-powered software platforms, which form the operational core of systems like Advanced Surface Movement Guidance and Control Systems (A-SMGCS). These platforms utilize machine learning to process massive amounts of tracking data, predict potential conflicts or trajectory deviations, and generate prioritized alerts for Air Traffic Control (ATC) staff. The shift towards predictive maintenance within these digital components is also a key trend, where embedded diagnostics anticipate potential hardware failure in crucial lighting or sensor units before they occur, ensuring maximum operational availability. The standardization of digital interfaces, adhering to global aviation messaging protocols, facilitates the seamless exchange of critical safety data between different airport subsystems and external air traffic management networks, a critical step towards realizing fully automated ground operations.

Furthermore, the integration of Non-Cooperative Surveillance technologies is becoming standard practice. While traditional systems rely on transponders (cooperative devices) on aircraft and vehicles, modern runway safety requires the detection and tracking of non-cooperative targets, such as wildlife, unauthorized drones, or pedestrians. This has spurred the widespread deployment of surface movement radar systems with high refresh rates and fine spatial resolution, alongside advanced video analytics software capable of identifying and classifying these threats instantaneously. Finally, cybersecurity is increasingly recognized as a foundational technology layer, given that these safety systems are highly networked and interconnected with mission-critical airport infrastructure. Robust encryption, intrusion detection systems, and resilient network architectures are essential to protect against cyber threats that could compromise the integrity or availability of core runway safety functions, making cybersecurity expertise a necessary component of any system vendor’s technical offering.

Regional Highlights

The global market for Airport Runway Safety Systems demonstrates distinct regional dynamics influenced by varying levels of aviation maturity, regulatory enforcement, and investment capacity. North America, driven by the FAA's continuous push for NextGen modernization and significant spending on infrastructure upgrades at major hubs (e.g., JFK, LAX), maintains a strong market share, characterized by high adoption rates of RWSL and advanced A-SMGCS solutions. Europe is another mature market, primarily focused on brownfield upgrades and integrating safety systems under the unified European ATM (SESAR) initiative, demanding highly interoperable and certified solutions compliant with EASA regulations. Both regions prioritize sophisticated, integrated platforms that enhance safety in extremely congested airspace and complex airport surface environments.

Asia Pacific (APAC) represents the fastest-growing region globally, fueled by rapid urbanization, massive investment in new airport construction projects (Greenfield sites), and burgeoning air traffic volumes across China, India, and Southeast Asia. These emerging markets are often adopting the latest digital technologies directly, skipping intermediate generations of safety systems, resulting in high demand for full-suite, integrated FOD detection and RCR systems. The Middle East, particularly the UAE and Qatar, stands out for its high-specification, premium market demand, where national carriers and mega-hubs invest heavily in the most advanced, often bespoke, safety technologies to cement their status as leading international aviation gateways, often integrating unique solutions for extreme heat and dust conditions.

- North America: Market dominance due to stringent FAA mandates and continuous modernization funding for critical infrastructure (NextGen).

- Europe: Focus on system interoperability, high adoption rates driven by SESAR, and strict EASA certification requirements for legacy airport upgrades.

- Asia Pacific (APAC): Highest CAGR driven by massive new airport construction (Greenfield projects) and increasing air traffic density in China and India.

- Middle East & Africa (MEA): High demand for sophisticated, premium technology solutions in hub airports, focused on all-weather operational reliability in challenging environments.

- Latin America: Growing market influenced by increasing tourism and cargo traffic, leading to governmental investment in basic and intermediate safety systems to meet ICAO minimum standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Airport Runway Safety Systems Market.- Honeywell International Inc.

- Thales Group

- Leonardo S.p.A.

- Saab AB

- Raytheon Technologies Corporation (Collins Aerospace)

- ADB Safegate

- Xsight Systems Ltd.

- Moog Inc.

- Hitachi

- Siemens AG

- Indra Sistemas

- QinetiQ Group plc

- Frequentis AG

- SITA

- Altys

- AS-TECH Industrie

- NavAero AB

- BAE Systems

- L3Harris Technologies

- Finmeccanica (merged into Leonardo)

Frequently Asked Questions

Analyze common user questions about the Airport Runway Safety Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Airport Runway Safety Systems Market?

The primary factor driving market growth is the enforcement of mandatory regulatory compliance by international bodies such as ICAO and local agencies like the FAA, requiring airports to adopt certified technologies to mitigate critical operational risks like runway incursions and Foreign Object Debris (FOD) damage, compounded by increasing global air traffic volume.

How is AI impacting the performance of Foreign Object Debris (FOD) detection systems?

AI, specifically machine learning and computer vision, significantly enhances FOD detection system performance by improving object classification accuracy, drastically minimizing false alarms, and enabling autonomous, continuous real-time monitoring under various adverse weather conditions, leading to fewer unnecessary runway closures.

Which region is expected to show the highest growth rate in this market?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to extensive investment in new airport infrastructure (Greenfield projects) and rapid air traffic expansion, particularly across emerging economies like China, India, and Southeast Asian nations.

What is the main challenge faced by smaller regional airports in adopting these safety systems?

The main challenge is the high initial capital expenditure and the complexity associated with integrating sophisticated technologies like Advanced Surface Movement Guidance and Control Systems (A-SMGCS) and Runway Status Lights (RWSL) into existing, often older, operational infrastructure and control tower procedures.

What key technology is essential for ensuring all-weather operational reliability in runway safety?

Sensor fusion technology, which integrates data from multiple modalities such as millimeter-wave radar, LiDAR, and electro-optical sensors, is essential. This multi-redundant approach ensures reliable detection and tracking of objects and conditions even in low-visibility situations like heavy fog, snow, or torrential rain, ensuring operational continuity.

What is the difference between Runway Status Lights (RWSL) and traditional runway lighting?

RWSL systems are an automated warning layer that functions independently of air traffic control clearances. They provide direct, unambiguous visual warnings (red lights) to pilots and vehicle operators if the runway is unsafe to enter or cross due to high-speed approaching or departing traffic, significantly reducing the risk of runway incursions caused by human error.

How do Airport Runway Safety Systems contribute to overall operational efficiency?

These systems enhance efficiency by enabling reliable all-weather operations, minimizing operational delays caused by runway inspections or adverse conditions, and reducing the incidence of accidents or incidents that lead to costly long-term runway closures and massive flight schedule disruptions.

What role does cybersecurity play in modern runway safety infrastructure?

Cybersecurity is crucial as modern systems are highly networked and integrated with mission-critical ATC systems. Robust cybersecurity measures, including encryption and intrusion detection, are necessary to protect the integrity, confidentiality, and availability of real-time safety data against malicious cyber threats or system vulnerabilities.

Which segment of the market provides the most stable long-term revenue streams?

The Services segment, which includes long-term maintenance contracts, system support, software updates, and specialized training, provides the most stable and predictable long-term revenue streams due to the necessity of continuous system certification and high availability requirements for complex digital infrastructure.

What is the function of Runway Overrun Protection Systems (ROPS)?

ROPS utilize sophisticated analysis tools that calculate aircraft stopping distance based on real-time factors like runway condition (RCR), weight, and wind, providing immediate alerts to pilots and ATC if the calculated stopping distance exceeds the available runway length, thereby preventing overrun incidents.

How is the adoption of Unmanned Aerial Systems (UAS) related to runway safety?

UAS are increasingly being utilized for automated, rapid runway inspections, including surface condition checks and FOD surveys, offering a high-frequency, cost-effective alternative to traditional vehicle-based inspections, especially in challenging environments or during routine operational windows.

What is the distinction between a Greenfield and a Brownfield deployment in this market?

Greenfield deployments involve installing safety systems in entirely new airport constructions, allowing for optimal integration of the latest technology. Brownfield deployments involve upgrading or retrofitting systems into existing operational airports, which poses greater challenges related to system compatibility and maintaining continuous operations during installation.

Who are the primary end-users besides commercial airports?

The primary end-users, beyond commercial airports, include military and government airbases, which require high-security and specialized operational safety systems, and civil aviation authorities, who indirectly drive demand through regulatory mandates and infrastructure funding allocation.

What are the key components of an Advanced Surface Movement Guidance and Control System (A-SMGCS)?

A-SMGCS typically includes high-resolution surface movement radar, multi-lateration systems for precise tracking, integrated display systems for air traffic controllers, and a sophisticated software layer providing alerting and routing functionalities to guide traffic safely during low visibility operations.

How does technological advancement influence the pricing structure of runway safety components?

Technological advancement generally leads to performance improvements. While initial cutting-edge systems are expensive, the standardization of sensor components (like LiDAR) and increased competition among manufacturers often leads to cost optimization over time, particularly for core hardware components, while software and integration services maintain a premium price point.

Why is high redundancy a necessary characteristic of runway safety systems?

High redundancy is necessary because runway safety systems are mission-critical; any failure could result in catastrophic consequences. Redundancy ensures that if a primary sensor, controller, or communication link fails, backup systems immediately take over, guaranteeing continuous, uninterrupted operational safety coverage for the airfield.

What factors constrain the market expansion in Latin America?

Market expansion in Latin America is often constrained by volatile economic conditions, inconsistent governmental funding for large infrastructure projects, and a slower pace of regulatory modernization compared to North America and Europe, often leading to a focus on meeting only minimum ICAO standards.

What are the main risks mitigated by Runway Status Lights (RWSL)?

RWSL primarily mitigates the risk of runway incursions, where aircraft or vehicles unintentionally enter an active runway. By providing immediate visual warnings derived from complex traffic tracking data, RWSL acts as a final safety barrier against controller errors or pilot/driver misjudgment.

How do airport operators measure the return on investment (ROI) for runway safety systems?

ROI is measured not just through efficiency gains (fewer delays, better throughput) but primarily through risk mitigation. The ROI is quantified by avoiding potential catastrophic accident costs, reducing liability exposure, minimizing financial losses from operational shutdowns, and ensuring regulatory compliance, which prevents fines.

What is the role of the ICAO in the Airport Runway Safety Systems Market?

ICAO establishes the fundamental international Standards and Recommended Practices (SARPs) that govern aviation safety and operational procedures globally. These SARPs provide the baseline requirements that national civil aviation authorities use to mandate the adoption and certification of specific runway safety technologies.

How is environmental resilience addressed in the design of runway safety sensors?

Runway safety sensors are designed using specialized, industrial-grade components with high ingress protection (IP) ratings to withstand extreme temperatures, moisture, dust, snow, and corrosive fluids used for de-icing. This environmental resilience ensures continuous operation despite harsh airfield conditions.

What is the future trend regarding the integration of safety systems with UTM/ATM?

The future trend is full integration, where runway safety systems provide crucial, real-time ground data inputs directly into the larger Unmanned Traffic Management (UTM) and Air Traffic Management (ATM) networks. This convergence aims to create a cohesive, dynamic, 4D view of all airspace and surface movements, optimizing overall operational flow.

How does the market differentiate between commercial and military applications?

Commercial applications prioritize passenger safety, high throughput, and cost-efficiency, often requiring civil certification. Military applications emphasize operational security, specialized encryption standards, rapid deployment capabilities, and resistance to environmental stress, requiring specific defense certifications and often tailored hardware specifications.

What drives the necessity for advanced Runway Condition Reporting (RCR) systems?

The necessity for advanced RCR systems is driven by the regulatory shift towards objective, standardized reporting (Global Reporting Format, GRF) replacing subjective human assessments. Automated RCR systems use embedded sensors and data analytics to provide precise, real-time friction and contamination data, vital for safe landing performance calculations.

What are the typical service components offered alongside the sale of safety systems?

Typical service components include initial site assessment and consulting, system installation and integration management, rigorous acceptance testing, detailed maintenance and repair contracts, software license provision and updates, and comprehensive technical training for both operational staff and maintenance personnel.

How does the high switching cost affect vendor dynamics in this market?

The high switching cost—due to extensive integration requirements and complex certification—creates strong vendor lock-in, meaning airports often remain clients of the original system provider for maintenance and upgrades. This favors large incumbent players and limits market penetration for new or specialized entrants seeking to replace established infrastructure.

What specific type of radar is commonly used for runway surface surveillance?

High-resolution, X-band Surface Movement Radar (SMR) is commonly used. These systems offer high angular resolution and refresh rates necessary to accurately detect and track small, slow-moving objects (aircraft, vehicles, FOD) across the airfield surface, even in poor weather conditions, providing the core data for A-SMGCS.

Why are multi-lateralization systems utilized alongside radar in A-SMGCS?

Multi-lateralization (MLAT) systems use triangulation from multiple ground stations to track transponder-equipped aircraft and vehicles with extreme precision, often exceeding the accuracy of conventional radar, particularly at close range. They are used to fill radar gaps and provide highly reliable location data for conflict detection and alerting.

What are the key concerns regarding data privacy and security for runway safety data?

Key concerns relate to protecting the sensitive operational data (aircraft movements, operational procedures, security sensor feeds) from unauthorized access or manipulation. Ensuring the integrity and availability of this data is paramount, necessitating stringent access controls and compliance with regional data protection regulations.

How do safety system providers cater to the needs of regional airports with limited budgets?

Providers cater to regional airports by offering modular, scalable solutions, often leveraging cloud-based software or lower-cost sensor technologies tailored to lower traffic density. They also offer flexible financing options and phased deployment plans focused on addressing the most critical, immediate safety risks first to manage budgetary constraints.

What types of data are analyzed by AI for predictive maintenance in this context?

AI analyzes historical failure rates, real-time performance metrics (e.g., sensor calibration drift, temperature fluctuations, power consumption anomalies), usage intensity, and environmental data (e.g., exposure to salt/dust) to predict the optimal time for component replacement or proactive maintenance intervention for runway equipment.

How do runway safety systems handle wildlife strikes as a hazard?

Some advanced FOD detection systems utilizing electro-optical and radar components can also classify and track large wildlife on the runway surface, triggering immediate alerts to air traffic controllers to implement dispersal procedures before a potential costly and dangerous wildlife strike occurs.

What is the role of professional training services in the market value chain?

Professional training services are crucial for ensuring airport operational staff and maintenance technicians can effectively utilize, calibrate, and troubleshoot the complex safety systems. High-quality training minimizes human error risks and maximizes system uptime, ensuring regulatory compliance and maximizing the return on investment.

How is the threat of substitution addressed in the sensor technology segment?

The threat of substitution is addressed through continuous innovation and integration. While specific sensors (e.g., radar) may be substituted by newer types (e.g., advanced LiDAR), the core functionality—real-time detection and tracking—is essential, forcing manufacturers to integrate the latest, highest-performing certified technology into their overall platform offerings.

What is the impact of aging airport infrastructure on market demand?

Aging infrastructure significantly drives market demand for brownfield modernization projects. Older airports require replacement of legacy systems (e.g., outdated lighting, first-generation radar) with interconnected, digital safety platforms to meet current operational efficiency standards and comply with modern regulatory safety mandates.

How is sustainability being addressed in the development of new safety systems?

Sustainability is increasingly addressed through the development of energy-efficient components, particularly LED-based RWSL and signage that significantly reduce power consumption compared to older incandescent systems. Furthermore, optimized routing algorithms within A-SMGCS reduce ground taxi time, cutting down on aircraft fuel consumption and emissions.

What is the significance of the shift from camera-based to radar/LiDAR-based FOD detection?

The shift is significant because radar and LiDAR systems are highly effective across all weather and light conditions, unlike camera-based systems which struggle with fog, heavy rain, or darkness. This ensures higher reliability and lower false positive rates, crucial for continuous operational safety without unnecessary closures.

What are the main advantages of an integrated safety platform versus fragmented systems?

An integrated platform provides unified situational awareness, seamless data sharing between different safety functions (e.g., RWSL receiving input from A-SMGCS), centralized control and monitoring, and simplified maintenance procedures. This greatly improves response time and overall operational efficiency compared to disparate, fragmented systems.

How do Airport Runway Safety Systems account for varying aircraft types and performance?

Advanced systems, particularly ROPS and A-SMGCS, utilize extensive databases and real-time inputs regarding specific aircraft performance parameters, weight, and braking characteristics. This allows the system to generate alerts tailored to the performance envelope of the specific aircraft being monitored, ensuring precise risk assessment.

What market trend is influencing pricing strategies among key vendors?

The trend towards offering comprehensive, full-suite solutions, often incorporating long-term service and software contracts, is influencing pricing. Vendors are moving towards subscription or outcome-based models rather than single upfront purchases, creating predictable recurring revenue streams and lowering the initial barrier to entry for airports.

The report contains 29990 characters including spaces.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager