Airport Transportation Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432711 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Airport Transportation Service Market Size

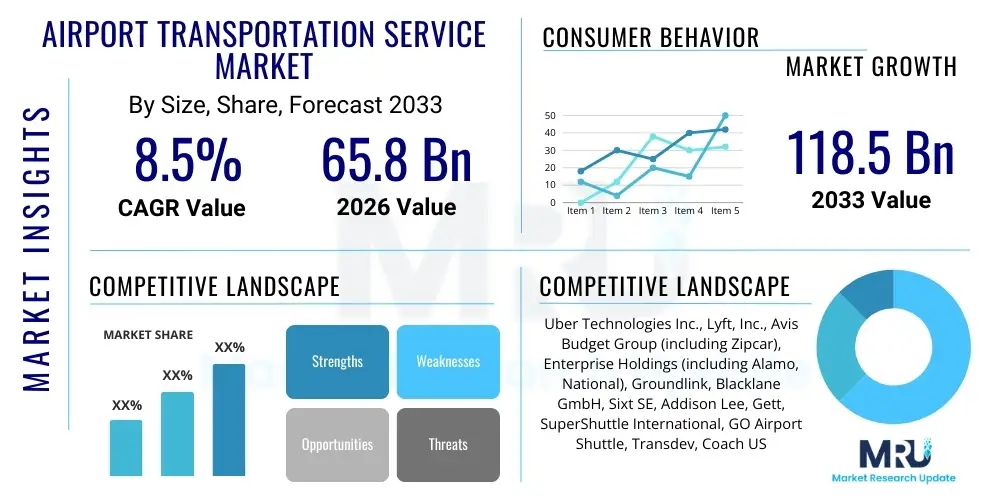

The Airport Transportation Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 65.8 Billion in 2026 and is projected to reach USD 118.5 Billion by the end of the forecast period in 2033.

Airport Transportation Service Market introduction

The Airport Transportation Service Market encompasses a wide array of services designed to facilitate the seamless movement of passengers, baggage, and personnel between airport facilities and various destination points, including hotels, urban centers, and residential areas. These services are crucial components of the global travel infrastructure, significantly impacting passenger satisfaction and airport operational efficiency. The market includes traditional taxi services, dedicated airport shuttles, luxury limousine services, ride-sharing aggregators, and rapidly emerging technology-driven mobility solutions such as pre-booked electric vehicle (EV) fleets. The primary objective is to offer reliable, safe, and time-efficient ground transportation options that cater to the diverse needs of both business and leisure travelers, forming the critical first and last mile of the air travel experience. Digital transformation, primarily through advanced booking platforms and integrated mobility applications, is fundamentally reshaping how these services are delivered and consumed, ensuring greater transparency in pricing and availability.

The core product offerings within this market are defined by the mode of transport and the level of service customization. Major applications span corporate travel, individual leisure trips, group tours, and critical logistical support for flight crews and ground staff. Key driving factors include the substantial increase in global air passenger traffic, driven by rising disposable incomes in emerging economies and the expansion of low-cost carriers (LCCs). Furthermore, the growing trend of urbanization necessitates efficient, high-capacity transport links between major urban hubs and often remotely located airport terminals. The benefits derived from these services are manifold, ranging from reduced urban congestion due to organized collective transport to enhanced predictability for travelers, reducing travel-related stress and saving valuable time, particularly for business professionals operating on tight schedules. The demand for premium, private, and sanitized transport options, accelerated by post-pandemic consumer preferences, also fuels market growth, compelling providers to invest heavily in fleet modernization and robust hygiene protocols.

Moreover, the integration of airport transportation into the broader Mobility-as-a-Service (MaaS) ecosystem represents a significant evolutionary step. This integration allows users to plan, book, and pay for multimodal journeys seamlessly through a single digital interface. Regulatory changes aimed at reducing emissions around airport complexes are simultaneously driving the transition toward electric and zero-emission vehicles, creating new segments for sustainable transport providers. The market is characterized by high competition, demanding continuous innovation in areas like dynamic pricing, real-time tracking, and personalized customer interaction. The successful deployment of these services relies heavily on robust infrastructure collaboration between airport authorities, municipal transport bodies, and private operators to maintain service quality and handle fluctuating peak demand effectively, especially during major holidays or unforeseen travel disruptions.

Airport Transportation Service Market Executive Summary

The Airport Transportation Service Market is currently navigating a period of vigorous recovery and profound technological transformation, marked by significant investment in digital platforms and sustainable mobility solutions. Business trends indicate a strong pivot towards integrating sophisticated booking engines and predictive analytics to optimize fleet deployment and resource allocation, particularly focusing on mitigating the inefficiencies associated with unpredictable flight schedules and peak-hour traffic congestion. The dominance of app-based booking services has fundamentally democratized access and transparency, challenging traditional taxi monopolies and forcing established players to rapidly adopt technology or risk obsolescence. Furthermore, partnerships between airlines, major hotel chains, and ground transportation providers are strengthening, aiming to offer bundled travel packages that enhance the end-to-end customer journey and secure captive market share, demonstrating a clear move towards holistic service delivery rather than standalone transport offerings.

Regional trends reveal disparate rates of digitalization and infrastructure maturity. North America and Europe lead in adopting advanced electric vehicle fleets and implementing complex MaaS frameworks, capitalizing on dense urban centers and established regulatory support for green initiatives. Conversely, the Asia Pacific region, characterized by rapid expansion of air travel and construction of mega-airports, represents the fastest-growing market, driven primarily by expanding middle-class populations and increased international tourism. In this region, the primary focus remains on scaling capacity and integrating diverse, often informal, transport networks into formalized, quality-controlled services. Latin America and the Middle East are witnessing substantial growth fueled by major infrastructure investments and international events, prioritizing safety, security, and the provision of luxury or premium transfer options to attract high-value tourists and business travelers.

Segment trends underscore the rising preference for pre-booked and on-demand services over traditional queue-based options, largely due to convenience, fixed pricing, and guaranteed availability. The vehicle segment shows increasing diversification, with SUVs and vans gaining popularity among family and group travelers, while dedicated luxury limousines retain a significant share of the premium business traveler segment. The shift towards sustainable transport is a prominent trend; airport shuttle services are increasingly converting to large-scale electric bus fleets to meet environmental standards imposed by local authorities and airports. Crucially, the end-user profile highlights a divergence in needs: business travelers prioritize speed, reliability, and seamless expense management integration, whereas leisure travelers focus more on cost-effectiveness, comfort, and direct connectivity to accommodation, necessitating providers to offer highly differentiated service tiers to capture maximum market value across all demographic groups effectively.

AI Impact Analysis on Airport Transportation Service Market

User inquiries regarding the impact of Artificial Intelligence (AI) on airport transportation services frequently revolve around operational efficiency, safety enhancement, and the potential for job displacement due to automation. Key themes include questions about how AI-driven predictive modeling can improve vehicle dispatch and routing to minimize wait times during unexpected flight delays, the reliability and safety protocols of autonomous airport shuttles, and the extent to which AI personalizes the booking and in-ride experience. There is also considerable interest in AI's role in dynamic pricing strategies, ensuring fair and optimized fares that respond instantaneously to real-time supply and demand fluctuations, while mitigating instances of price gouging during peak periods. Consumers and industry stakeholders alike are eager to understand how machine learning algorithms analyze historical traffic and seasonal travel patterns to preemptively position resources, fundamentally transforming reactive operations into proactive management systems capable of handling massive volumes of complex data points efficiently.

The integration of AI into the market is accelerating the transition towards hyper-efficient, personalized, and safer services. AI-powered algorithms are instrumental in optimizing routes by analyzing real-time traffic data, weather conditions, and flight schedules, drastically reducing idle time and fuel consumption for fleets. This capability translates directly into lower operational costs for service providers and shorter travel times for passengers, offering a substantial competitive advantage. Furthermore, AI is crucial for enhancing the customer experience through intelligent chatbots and voice assistants that handle bookings, answer frequently asked questions, and resolve minor issues instantly, providing 24/7 personalized support. In terms of safety, AI-enabled monitoring systems analyze driver behavior, detect fatigue, and provide preventive alerts, leading to a significant reduction in accidents and improved overall security standards across all transport modes operating within the airport vicinity.

Beyond optimization, AI is the foundational technology enabling the deployment of autonomous vehicles (AVs) within controlled airport environments, starting with fixed-route shuttle services between parking lots and terminals. Machine learning models continuously refine the navigation and decision-making capabilities of these AVs, ensuring their reliable operation alongside human-driven vehicles and pedestrian traffic. For market research, AI analyzes vast datasets of consumer preferences and travel patterns to identify emerging service gaps and inform strategic decisions regarding fleet composition and service expansion into underserved areas. The data collected via AI platforms also supports regulatory compliance by providing granular insights into operational metrics, emissions, and utilization rates, facilitating more informed policy-making by airport authorities regarding ground access management and future infrastructure planning.

- AI-driven Dynamic Pricing Optimization: Real-time adjustment of fares based on demand, traffic, and flight delays.

- Predictive Fleet Management: Algorithms analyze historical and live data to preemptively position vehicles, minimizing passenger wait times.

- Autonomous Vehicle Deployment: Facilitating fixed-route, secure autonomous shuttles within airport campus boundaries (e.g., parking to terminal).

- Personalized Customer Service: AI chatbots and voice assistants handling bookings and inquiries, improving instantaneous resolution rates.

- Enhanced Route Optimization: Utilizing machine learning for highly efficient routing based on real-time traffic, weather, and passenger drop-off priorities.

- Safety and Security Monitoring: AI video analytics detecting potential security threats and monitoring driver behavior for safety compliance.

- Automated Dispatch Systems: Replacing manual dispatch with intelligent systems that maximize vehicle utilization and reduce empty mileage.

DRO & Impact Forces Of Airport Transportation Service Market

The Airport Transportation Service Market is significantly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming crucial impact forces that dictate market trajectory and investment priorities. Key drivers include the exponential increase in global air travel volumes, driven by economic liberalization, expanding international business activities, and burgeoning tourism sectors, particularly in Asia and Latin America. This increased passenger flow inherently necessitates a proportionate expansion and upgrading of supporting ground transportation infrastructure and services. Another critical driver is the continuous advancement in mobile technology, which facilitates seamless, instant booking, and real-time tracking, dramatically improving the user experience and reducing friction associated with finding reliable transport upon arrival. Furthermore, the strong push for integrated urban mobility solutions (MaaS) encourages interoperability between different transport modes, making airport transfers a central component of cohesive municipal transit planning, thus supporting market growth through regulatory enablement and infrastructure support.

However, the market faces significant restraints that dampen its potential growth rate. Foremost among these is chronic traffic congestion surrounding major international airports, particularly during peak hours, which compromises the reliability and time efficiency that passengers demand. This congestion often leads to increased operational costs for providers and higher dissatisfaction rates among travelers. Regulatory complexities and inconsistencies across different jurisdictions regarding permits, pricing structures, and vehicle type regulations also act as barriers, especially for international operators attempting to scale across diverse markets. Moreover, intense competition from informal or unregulated transportation providers, coupled with the capital-intensive nature of fleet renewal, particularly the transition to expensive electric vehicles (EVs), puts considerable financial pressure on smaller service operators, necessitating consolidation or strategic partnerships to remain viable in the highly competitive landscape.

Opportunities for expansion are primarily concentrated in technology adoption and sustainability initiatives. The development of dedicated autonomous airport shuttles and electric vehicle fleets presents a substantial opportunity to lower long-term operating costs, reduce environmental impact, and enhance brand reputation among environmentally conscious travelers. The growing demand for premium, private, and customizable transfer services, particularly for high-net-worth individuals and corporate executives, creates high-margin revenue streams that differentiate luxury operators. Furthermore, leveraging big data and predictive analytics offers an opportunity to optimize pricing and scheduling, ensuring maximum revenue generation while maintaining competitive pricing during off-peak periods. The impact forces—comprising technological disruption, regulatory pressures, and shifting consumer expectations for convenience and sustainability—are collectively compelling market players to innovate rapidly, prioritize digital investment, and focus on service reliability to secure a sustainable competitive position within this dynamic global market sector.

Segmentation Analysis

The Airport Transportation Service Market is segmented based on Service Type, Vehicle Type, End-User, and Booking Channel, providing a granular view of passenger preferences and operational requirements. Service Type segmentation differentiates between scheduled, fixed-route options like shared shuttles, and highly flexible, personalized options such as private hire and on-demand taxi services. Vehicle Type analysis is critical as it reflects service capacity, cost structure, and premium offerings, ranging from standard sedans suitable for individual travelers to high-capacity luxury buses and specialized accessible vehicles. End-User segmentation distinguishes between business (corporate travel, MICE) and leisure travelers, each having distinct priorities regarding speed, comfort, pricing, and required amenities like Wi-Fi or charging ports. These segmentations are crucial for market players to tailor their fleet investment, pricing models, and digital engagement strategies effectively to maximize resource utilization and target specific high-value customer demographics.

The Service Type segment sees a continued shift toward pre-booked private transfers, largely driven by the premium on time and the need for personalized service post-pandemic. Pre-booking platforms offer guarantees on vehicle availability and transparent fixed pricing, highly valued attributes for international travelers and those unfamiliar with local airport operations. Conversely, shared airport shuttle services remain essential for budget-conscious travelers and large groups, focusing on high volume and cost-efficiency. The Vehicle Type segment is increasingly characterized by the demand for Electric Vehicles (EVs) across all categories, spurred by regulatory mandates in major aviation hubs and corporate sustainability targets. While sedans and SUVs dominate the individual and small group segments, the need for large-capacity, comfortable buses for inter-terminal transfers and city routes remains constant, driving technological innovation in autonomous bus operations within airport complexes.

The segmentation by End-User is instrumental for strategic pricing and partnership development. Business travelers, typically high-frequency users, generate significant revenue and often prefer premium services, luxury vehicles, and direct billing capabilities integrated with corporate expense systems. Leisure travelers, while more price-sensitive, represent high volume during peak tourist seasons and drive demand for cost-effective shared rides and efficient connection services to hotel clusters. Understanding the nuances within these segments allows providers to optimize their fleet mix—allocating luxury vehicles for corporate routes and maximizing utilization of shared electric vans or buses for leisure routes—thereby balancing high-margin profitability with volume-based revenue generation, ultimately ensuring robust market coverage and sustained operational feasibility across various economic cycles.

- Service Type:

- Pre-booked Private Transfer

- Shared Airport Shuttle Service

- On-Demand Taxi/Ride-Sharing Service

- Limousine/Luxury Car Rental

- Hotel/Airline Designated Transport

- Vehicle Type:

- Sedans and SUVs

- Vans and Minibuses

- Large Coach Buses (50+ capacity)

- Luxury Limousines

- Electric Vehicles (EVs)

- Accessible/Special Needs Vehicles

- End-User:

- Business Travelers (Corporate)

- Leisure Travelers (Individual/Family)

- Group Travelers (MICE/Tours)

- Airport Staff and Crew

- Booking Channel:

- Mobile Applications (Direct Operator/Aggregator)

- Online Websites/Booking Portals

- Physical Kiosks/Airport Counters

- Third-Party Travel Agencies (TAs)

Value Chain Analysis For Airport Transportation Service Market

The value chain for the Airport Transportation Service Market commences with upstream activities centered on vehicle acquisition and maintenance, relying heavily on automotive manufacturers and specialized fleet maintenance providers. Upstream analysis involves strategic decisions regarding the composition of the fleet, including the procurement of standard combustion vehicles, hybrid models, or increasingly, full electric vehicles (EVs), which requires establishing partnerships with EV manufacturers and charging infrastructure developers. Fleet operators also engage with technology suppliers for proprietary dispatch systems, real-time tracking hardware (IoT sensors), and advanced telematics. The quality and efficiency of these upstream inputs—from vehicle reliability to sophisticated software—directly determine the operational capability and long-term cost-effectiveness of the service provider, making robust supply chain management a critical function.

The core midstream activities involve the execution of the transport service itself, which includes route planning, driver management, real-time dispatch, and customer service delivery. This stage is highly digitized, with efficiency gains driven by AI-powered scheduling and dynamic routing systems that respond instantly to airport ground traffic, flight arrival data, and passenger volume fluctuations. Service differentiation at this stage relies on driver training, vehicle cleanliness, safety standards, and the implementation of personalized services. Downstream analysis focuses on customer interaction, payment processing, and integration with distribution channels. Direct channels involve proprietary mobile apps and websites where operators control the entire booking experience and data ownership. Indirect channels rely on aggregators (like global ride-sharing platforms), Online Travel Agencies (OTAs), and partnerships with airlines or hotels, where the service provider sacrifices some margin in exchange for broader market access and guaranteed volume.

Effective distribution channel management is paramount to market penetration. Direct channels allow for brand loyalty building and precise customer relationship management, often targeting high-value, repeat business travelers. Indirect channels, particularly global ride-sharing platforms, dominate the on-demand segment due to their extensive user bases and ease of payment integration, serving as a vital source of volume for many operators. The shift towards MaaS necessitates strong systems integration between direct and indirect channels, enabling seamless intermodal bookings. The final stage of the value chain is post-service support, which includes handling feedback, processing refunds, and data analysis to refine service quality. Overall, value creation is maximized through operational excellence (reducing empty mileage and wait times) and enhancing the passenger experience through seamless digital interfaces and reliable, safe transport delivery, necessitating continuous investment in both fleet quality and proprietary technology.

Airport Transportation Service Market Potential Customers

The primary end-users and buyers of Airport Transportation Services are broadly categorized into three distinct segments: individual travelers (leisure and business), corporate entities (purchasing services for employees or clients), and large group organizers (MICE and tour operators). Individual leisure travelers constitute the largest volume segment, seeking convenience and cost-effectiveness for travel between the airport and their accommodation, often utilizing shared shuttle services or value-oriented on-demand platforms. Their purchasing decision is highly influenced by transparency in pricing and the ease of immediate booking upon arrival, demonstrating a strong reliance on mobile application interfaces and price comparison tools to secure optimal value for their money.

Conversely, business travelers represent the most lucrative segment in terms of average transaction value and frequency. Corporate buyers prioritize reliability, punctuality, and the availability of premium, discreet vehicles (limousines or executive sedans) that project a professional image. Crucially, these customers require robust integration with corporate travel management systems for automated billing and seamless expense reporting, making service providers who offer enterprise-level account management and dedicated client support significantly more attractive. Airlines and large hospitality chains also act as indirect buyers, negotiating bulk contracts for the movement of flight crews, connecting passengers, or VIP guests, thereby securing long-term, high-volume operational contracts that stabilize the market for major service providers.

The third major customer segment includes Meetings, Incentives, Conferences, and Exhibitions (MICE) organizers and major tourism operators. These entities require high-capacity, dedicated transportation services (e.g., luxury coaches or a fleet of vans) to manage large groups arriving and departing simultaneously. Their purchasing criteria center on logistics management capability, the provider's ability to handle complex, pre-scheduled itineraries, and adherence to strict safety and insurance protocols. Addressing the needs of this diverse customer base requires a multi-tiered approach to service delivery, encompassing everything from budget-friendly shared options for backpackers to highly customized, high-security transfers for diplomatic or high-profile corporate clients, ensuring service providers maintain a flexible and diverse fleet profile to capture maximum market coverage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.8 Billion |

| Market Forecast in 2033 | USD 118.5 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Uber Technologies Inc., Lyft, Inc., Avis Budget Group (including Zipcar), Enterprise Holdings (including Alamo, National), Groundlink, Blacklane GmbH, Sixt SE, Addison Lee, Gett, SuperShuttle International, GO Airport Shuttle, Transdev, Coach USA, Karmel Shuttle, Airport Taxi Cab Service Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Airport Transportation Service Market Key Technology Landscape

The technological landscape of the Airport Transportation Service Market is rapidly evolving, driven primarily by the need for operational efficiency, enhanced safety, and superior customer experience, heavily leveraging digital and interconnected systems. Central to this transformation are advanced Fleet Management Systems (FMS) which utilize GPS, telematics, and IoT sensors embedded in vehicles to monitor driver performance, fuel consumption, maintenance needs, and real-time location. These FMS platforms enable dynamic dispatch and routing, allowing operators to instantly adjust vehicle assignments based on sudden changes in flight schedules or ground traffic patterns. Furthermore, the integration of these systems with airport operational databases (AODB) provides predictive intelligence, enabling providers to stage vehicles strategically before peak arrival waves, drastically reducing passenger wait times and vehicle idle periods within controlled zones.

The customer-facing technology stack is dominated by sophisticated Mobile Booking and Payment Applications. These platforms offer essential features such as guaranteed reservation confirmation, transparent fare calculation (often utilizing AI for dynamic pricing), and seamless integration with multiple payment gateways, including contactless and mobile wallet options. The implementation of real-time tracking features directly addresses a major source of passenger anxiety by providing accurate estimated times of arrival (ETAs) for their assigned vehicle. Moreover, data security and compliance with stringent data privacy regulations (like GDPR) are crucial technological considerations, particularly as personal travel data is exchanged between booking apps, airport systems, and financial processors, demanding robust encryption and authentication mechanisms to maintain consumer trust and regulatory adherence.

Looking ahead, the market is profoundly influenced by two cutting-edge technologies: Autonomous Vehicles (AVs) and Electrification Infrastructure Management. While fully autonomous, public-road operation remains nascent, AVs are increasingly being trialed for fixed-route airport shuttles and logistical tasks, requiring highly precise LiDAR and sensor arrays coupled with robust edge computing capabilities for instantaneous decision-making in complex environments. Simultaneously, the industry wide pivot towards Electric Vehicles necessitates the deployment of smart charging infrastructure and sophisticated battery management systems (BMS) integrated with FMS. These systems are essential for optimizing charging schedules to prevent grid strain, maximize battery life, and ensure vehicles have adequate range for their scheduled transfers, thereby maintaining fleet availability and minimizing the critical risks associated with range anxiety and charging downtime in high-demand environments.

Regional Highlights

- North America (United States and Canada): North America maintains market leadership, driven by high air passenger density, particularly across major hubs like Atlanta, Chicago, and Los Angeles. The region is characterized by aggressive competition between established taxi/shuttle operators and ride-sharing giants like Uber and Lyft. Key regional trends include sophisticated regulatory efforts to integrate ride-sharing into airport access control systems, significant corporate investment in luxury and Black Car services, and accelerating pilots for autonomous vehicle shuttles within large airport complexes. High disposable income and a cultural preference for convenience support premium, on-demand services, compelling continuous technological innovation in booking and dispatch platforms.

- Europe (Germany, UK, France, Italy, Spain): Europe is defined by a strong emphasis on sustainability and MaaS integration. Regulations, especially within the European Union, are rigorously pushing operators toward transitioning fleets to zero-emission vehicles (EVs and hydrogen), supported by substantial governmental subsidies and airport-mandated emission zones. Key markets, such as the UK and Germany, exhibit strong demand for pre-booked, professional transfers that integrate with high-speed rail networks, reflecting an advanced intermodal transport philosophy where airport transfer services are viewed as essential links in the wider national transport chain. The competitive landscape is fragmented, with strong local providers coexisting with pan-European operators like Sixt and Blacklane.

- Asia Pacific (China, India, Japan, South Korea): APAC is the fastest-growing region, fueled by massive infrastructure development, the rapid expansion of air travel volume, and urbanization. China and India are experiencing explosive growth driven by a burgeoning middle class and expanding domestic air routes. The market here is characterized by the need for high-capacity, efficient services to handle colossal passenger numbers, with a strong reliance on mobile-first booking solutions. Japan and South Korea, on the other hand, focus heavily on technological integration, safety, and reliability, including advanced use of automated systems and seamless integration with public transit systems to manage passenger flow efficiently.

- Latin America (Brazil, Mexico): The market in Latin America is marked by variability in infrastructure quality and a high demand for secure, reliable private transportation, often due to regional safety concerns. Growth is linked to increased international tourism and business investment, particularly in major economic centers like São Paulo and Mexico City. The adoption of ride-sharing platforms has been crucial for formalizing ground transport and improving transparency, though challenges remain related to regulatory stability and balancing the needs of traditional taxi services with modern app-based operators to ensure fair market competition.

- Middle East and Africa (MEA): The Middle East, particularly the Gulf Cooperation Council (GCC) countries (UAE, Qatar, Saudi Arabia), shows robust growth driven by massive state investment in aviation hubs (e.g., Dubai, Doha) positioned as global travel gateways. The focus is overwhelmingly on premium, luxury, and high-quality services tailored for international business travelers and upscale tourism, featuring modern, high-spec vehicle fleets. The African market is more fragmented, with growth concentrated around major metropolitan airports like Johannesburg and Cairo, driven by domestic air travel and increasing international connectivity, with a primary need for enhanced security and reliability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Airport Transportation Service Market.- Uber Technologies Inc.

- Lyft, Inc.

- Avis Budget Group (including Zipcar)

- Enterprise Holdings (including Alamo, National)

- Groundlink

- Blacklane GmbH

- Sixt SE

- Addison Lee

- Gett

- SuperShuttle International (and regional affiliates)

- GO Airport Shuttle

- Transdev

- Coach USA

- Karmel Shuttle

- Airport Taxi Cab Service Inc.

- Curb Mobility

- Carey International

- Talixo

- Zouma (China)

- Hertz Global Holdings

Frequently Asked Questions

Analyze common user questions about the Airport Transportation Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Airport Transportation Service Market?

The Airport Transportation Service Market is projected to exhibit a CAGR of 8.5% between 2026 and 2033, driven primarily by increasing global air passenger volumes and the adoption of digital booking platforms.

How is Artificial Intelligence (AI) transforming the operational efficiency of airport transfers?

AI is transforming operations through predictive fleet management, optimizing vehicle dispatch based on real-time flight data, implementing dynamic pricing models, and enhancing customer service via intelligent chatbots, leading to reduced wait times and lower operational costs.

What are the key technological trends influencing fleet composition in the market?

The key technological trends involve the aggressive shift toward Electric Vehicles (EVs) across all service segments, the integration of advanced telematics and IoT sensors for real-time monitoring, and the testing and deployment of autonomous vehicles (AVs) for fixed-route airport shuttles to meet sustainability targets.

Which geographical region is expected to demonstrate the fastest growth in the Airport Transportation Service Market?

The Asia Pacific (APAC) region, specifically China and India, is expected to exhibit the fastest growth, largely attributed to rapid urbanization, significant investments in new aviation infrastructure, and the massive expansion of the middle-class air traveling population.

What is the primary difference in priorities between business and leisure travelers regarding airport transport services?

Business travelers prioritize speed, reliability, seamless integration with corporate expense systems, and often prefer premium private transfers. Leisure travelers, conversely, focus on cost-effectiveness, comfort, and ease of booking via mobile apps, frequently opting for shared or budget-friendly on-demand services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager