Airtight Tape Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433888 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Airtight Tape Market Size

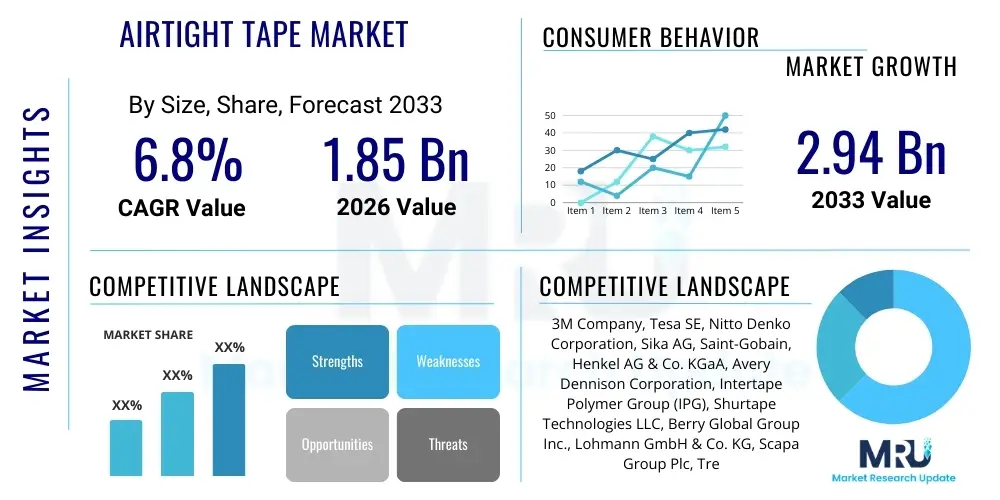

The Airtight Tape Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $2.94 Billion by the end of the forecast period in 2033.

Airtight Tape Market introduction

The Airtight Tape Market encompasses specialized adhesive products designed primarily to create a continuous, impermeable seal against air and moisture penetration in various structural and non-structural applications. These tapes are crucial components in modern energy-efficient building envelopes, transportation systems, and industrial assemblies where stringent requirements for thermal performance, acoustic dampening, and durability are mandated. The tapes utilize advanced backing materials such as specialized polyethylene (PE) foams, PVC films, butyl rubbers, and highly durable acrylic carriers, coupled with high-tack, pressure-sensitive adhesives (PSAs) optimized for long-term adhesion to challenging substrates like wood, concrete, metal, and various membranes.

Airtight tapes are distinguished from standard adhesive tapes by their superior longevity, resistance to extreme temperature fluctuations, UV radiation, and chemical exposure, ensuring the integrity of the seal over the lifespan of the structure or product. The major applications span residential and commercial construction, particularly in passive house standards and zero-energy buildings, where minimizing air leakage is paramount for achieving mandated energy performance targets. Furthermore, the tapes find extensive use in the sealing of HVAC ductwork, automotive body panels (for noise reduction and moisture barrier), and in the electronics industry for environmental protection of sensitive components. The demand is intrinsically linked to global regulatory efforts aimed at enhancing building energy efficiency and reducing carbon emissions.

The core benefits derived from the utilization of airtight tapes include significant reductions in energy consumption by preventing conditioned air loss, improved indoor air quality (by mitigating mold and mildew growth resulting from moisture ingress), and enhanced structural integrity by protecting insulation materials from condensation damage. Driving factors include stringent global building codes like those in the European Union (EU) and North America requiring superior air barrier systems, the rising adoption of prefabricated and modular construction methods which necessitate reliable sealing solutions for joints, and continuous innovation in adhesive chemistry leading to tapes with broader application temperatures and enhanced substrate compatibility. The market's future trajectory is characterized by a shift towards sustainable, solvent-free adhesive formulations and multilayered tapes offering combined air and vapor control.

Airtight Tape Market Executive Summary

The Airtight Tape Market is experiencing robust growth fueled primarily by global regulatory shifts mandating higher energy efficiency in the construction sector, particularly in developed economies. Business trends indicate a strong focus on sustainable product development, with leading manufacturers investing heavily in bio-based and recyclable adhesive formulations to meet green building standards. The increasing adoption of Building Information Modeling (BIM) is also streamlining the integration of specialized sealing solutions into early design phases, driving demand for technologically advanced tapes. Furthermore, the market is becoming highly competitive, characterized by strategic mergers and acquisitions aimed at expanding geographical footprints and acquiring proprietary adhesive technologies, especially those offering extreme weather resilience and rapid installation capabilities.

Regionally, Europe stands as the dominant market, driven by the widespread implementation of the Energy Performance of Buildings Directive (EPBD) and the proliferation of passive house construction standards across Germany, Austria, and Scandinavia, creating a highly mature demand environment for premium airtight sealing systems. The Asia Pacific region, led by rapid urbanization and infrastructure development in China and India, represents the fastest-growing market, although pricing sensitivity remains a factor. North America is characterized by increasing compliance with blower door testing requirements and a growing retrofit market focused on improving the energy efficiency of existing commercial properties, demanding specialized tapes that adhere effectively to older, potentially degraded substrates.

Segment trends reveal that the Building & Construction application segment continues to hold the largest market share, with a notable surge in demand for tapes utilized in sealing timber frame structures and mass timber projects. Material segmentation highlights the increasing preference for advanced acrylic adhesive tapes due to their exceptional UV stability, long-term adhesion performance, and reduced volatile organic compound (VOC) emissions compared to traditional butyl or asphalt-based alternatives. The residential end-use sector is seeing a proportional increase in adoption driven by homeowners seeking to minimize utility costs and improve home comfort, while the industrial sector focuses on high-performance tapes for demanding environments such as cryogenic pipelines and cleanroom sealing applications, prioritizing durability and resistance to extreme temperatures and chemicals.

AI Impact Analysis on Airtight Tape Market

User inquiries regarding AI's impact on the Airtight Tape Market primarily revolve around operational efficiency, quality control, and predictive maintenance within manufacturing and application processes. Common questions center on how AI can optimize adhesive mixing ratios, automate complex tape application in robotic construction, and predict material failure points under various environmental stresses. Users are concerned about whether AI-driven quality checks can replace traditional manual inspections and how machine learning (ML) models can be used to analyze large datasets from building performance monitoring systems to fine-tune the specifications of airtight products for specific climatic zones. The consensus expectation is that AI will predominantly revolutionize the manufacturing supply chain and enhance application precision, rather than directly influencing the chemical composition of the tapes themselves, focusing on speed, waste reduction, and ensuring regulatory compliance through automated documentation.

- AI-powered predictive maintenance minimizes downtime in high-speed tape manufacturing lines by anticipating equipment failure based on sensor data analysis.

- Machine Vision Systems (MVS) utilizing deep learning algorithms ensure stringent quality control by detecting microscopic flaws or inconsistencies in adhesive coating thickness during production.

- Optimization algorithms aid in supply chain management, forecasting demand fluctuations for specialized raw materials (e.g., specific polymers or tackifiers) crucial for tape formulation.

- Robotic application guided by AI and computer vision enhances precision sealing in modular construction, ensuring perfect alignment and continuous bead application, thereby reducing human error in complex joints.

- AI analyzes long-term performance data from smart buildings (IoT sensors) to provide manufacturers with real-world feedback on tape degradation, informing future product development for improved lifespan and climate resilience.

DRO & Impact Forces Of Airtight Tape Market

The Airtight Tape Market is powerfully driven by legislative requirements and the global movement towards energy conservation, countered by challenges related to application complexity and raw material volatility, while simultaneously benefiting from opportunities presented by technological advancements in green building practices. Regulatory forces, particularly the implementation of near-zero energy building (NZEB) mandates across major economies, create a non-negotiable demand floor for high-performance sealing materials. The market is also highly sensitive to the cost and availability of petroleum-derived raw materials, which form the base for many adhesives and backings, leading to price volatility and potential supply chain disruptions, especially during periods of geopolitical instability or pandemic-related logistical constraints. The overarching impact forces compel manufacturers to innovate rapidly, offering solutions that simplify installation for contractors while delivering verifiable, long-term performance metrics essential for achieving stringent building certifications like LEED and Passive House.

Key drivers include the demonstrable energy savings achieved through effective air sealing, making the return on investment compelling for property owners and developers; the increasing trend of healthy building initiatives which require superior moisture and air control to prevent indoor air quality issues; and the expansion of modern methods of construction (MMC), such as offsite manufacturing, which demand standardized, reliable, and durable joint sealing solutions. Restraints primarily involve the high upfront cost of premium airtight systems compared to conventional sealing methods, requiring significant contractor training and a cultural shift in construction practices, particularly in developing markets. Furthermore, the variability in contractor installation quality, if not properly managed, can compromise the performance of even the highest quality tapes, leading to post-installation performance gaps.

Opportunities for market expansion are abundant in the retrofitting segment, targeting older buildings that require significant energy efficiency improvements, and in the development of specialized tapes compatible with emerging construction materials like cross-laminated timber (CLT) and recycled concrete aggregates. The push for sustainability also opens avenues for innovation in solvent-free and biodegradable adhesive systems. Impact forces dictate that product evolution must focus on user-friendliness—specifically, enhanced tack at low temperatures and better conformability to irregular surfaces—to ensure widespread contractor adoption and minimize installation time. The competitive landscape is increasingly defined by offering complete system solutions (tapes, membranes, and sealants) rather than standalone products, positioning manufacturers as partners in achieving verifiable building performance metrics.

Segmentation Analysis

The Airtight Tape Market is broadly segmented based on the type of backing material utilized, the specific adhesive formulation employed, the primary application area, and the eventual end-use sector. This segmentation highlights the diverse technical requirements across different industries, reflecting the need for tailored products that perform optimally under specific environmental and mechanical stresses. The primary distinction arises from the choice of backing material, which dictates the tape's flexibility, vapor permeability, UV resistance, and overall tensile strength, ranging from highly conformable butyl rubber to rigid, durable polyethylene or specialized non-woven carriers. Understanding these segments is critical for manufacturers aiming to target niche markets, such as high-temperature automotive sealing versus low-temperature external building envelope applications.

Adhesive segmentation is perhaps the most critical technical differentiator, with acrylic, butyl, silicone, and asphalt-based systems each offering unique advantages in terms of initial tack, longevity, temperature performance, and substrate compatibility. Acrylic adhesives, known for their superior UV stability and long-term sheer strength, dominate high-performance construction segments, while butyl tapes offer excellent conformability and immediate sealing properties, often favored in roofing and temporary sealing. The application analysis clearly shows the dominance of the Building & Construction sector, requiring tapes that integrate seamlessly with air and vapor barrier systems, followed by the HVAC segment, which prioritizes tapes resistant to mold growth and temperature cycling for duct sealing.

- By Backing Material:

- Polyethylene (PE) Film

- Polyvinyl Chloride (PVC) Film

- Butyl Rubber

- Foam (e.g., EPDM, Polyurethane)

- Acrylic/Non-woven Carriers

- Aluminum Foil/Metalized Films

- By Adhesive Type:

- Acrylic (Water-based, Solvent-based, Pure)

- Butyl

- Silicone

- Asphalt/Bitumen

- By Application:

- Building & Construction (Wall Assemblies, Roofs, Foundations)

- HVAC (Duct Sealing and Insulation)

- Automotive (Noise Damping, Sealing)

- Industrial Sealing (Cleanrooms, Equipment Housings)

- Packaging and Logistics (Specialty Sealing)

- By End-Use Sector:

- Residential

- Commercial

- Industrial

Value Chain Analysis For Airtight Tape Market

The value chain for the Airtight Tape Market begins with the highly specialized procurement and processing of fundamental raw materials, encompassing polymers for backing films (such as PE and PVC), synthetic rubbers, and various petrochemical derivatives essential for adhesive formulation (resins, tackifiers, plasticizers). Upstream activities are dominated by large chemical and polymer manufacturers who supply these specialized ingredients. Fluctuations in crude oil prices and the capacity constraints of specialty chemical suppliers significantly impact the manufacturing costs and lead times for tape producers. A critical aspect of the upstream analysis involves the intellectual property associated with advanced adhesive chemistry, which is often proprietary and forms a key competitive differentiator among tape manufacturers.

The midstream segment involves the core manufacturing process, where raw materials are converted into finished airtight tapes. This stage includes sophisticated processes such as compounding the pressure-sensitive adhesives (PSAs), precision coating onto the backing material, slitting, and final packaging. Manufacturers in this segment focus heavily on process efficiency, minimizing waste, and maintaining stringent quality control over coating weight and adhesive properties to ensure compliance with demanding building standards. Integration between adhesive formulation and coating technology is vital, often requiring significant capital expenditure in specialized machinery. The successful execution of the midstream relies on proprietary techniques that allow for solvent-free processes and the production of multi-layered, functional tapes.

Downstream analysis focuses on distribution channels and end-user engagement. Distribution is primarily handled through a mix of direct sales channels, targeting large commercial contractors and OEMs (Original Equipment Manufacturers, particularly in automotive and modular construction), and indirect channels, utilizing established networks of specialized construction supply distributors and wholesale home improvement centers. Direct technical support and applicator training are crucial components of the distribution strategy, especially for high-performance building applications where correct installation is paramount. The proximity of the distributor to the final construction site is important for timely delivery, emphasizing the regional nature of the construction material distribution network. Furthermore, e-commerce platforms are increasingly utilized for smaller contractors and specialized niche products.

Airtight Tape Market Potential Customers

Potential customers for the Airtight Tape Market are diverse, stemming from sectors where controlled air permeability and long-term durability are critical for operational efficiency, safety, and regulatory compliance. The primary cohort consists of residential and commercial building developers and construction firms, particularly those specializing in high-performance construction like Passive House, LEED-certified buildings, and Net-Zero energy projects. These entities require verifiable, standardized sealing solutions to meet stringent envelope airtightness tests (e.g., blower door tests) mandated by local building codes and certification bodies, focusing heavily on integrating tapes with external membranes and insulation layers.

A secondary, highly technical customer base includes HVAC system installation contractors and engineering firms responsible for ductwork design and installation. For this group, tapes must offer superior adhesion to aluminum, galvanized steel, and fiberglass insulation while possessing characteristics that resist mold and mildew in humid environments, ensuring the efficiency and cleanliness of the air distribution system. The automotive and transportation industries also represent significant customers, utilizing airtight and water-resistant tapes for noise, vibration, and harshness (NVH) damping, sealing battery enclosures in electric vehicles (EVs), and moisture barriers within vehicle bodies.

Additionally, industrial manufacturers, especially those involved in producing sensitive electronic equipment, cleanrooms, or specialized cold storage facilities, constitute another key segment. These buyers prioritize tapes that offer chemical resistance, static dissipation properties, and exceptional sealing integrity under extreme temperature variations. The ultimate buyers, the property owners (both residential and institutional), drive the market indirectly by demanding energy-efficient, durable structures that minimize operational costs and maximize occupant comfort and health, placing continued pressure on designers and contractors to adopt best-in-class airtight sealing methodologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $2.94 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Tesa SE, Nitto Denko Corporation, Sika AG, Saint-Gobain, Henkel AG & Co. KGaA, Avery Dennison Corporation, Intertape Polymer Group (IPG), Shurtape Technologies LLC, Berry Global Group Inc., Lohmann GmbH & Co. KG, Scapa Group Plc, Tremco CPG (RPM International), Covalence (A Berkshire Hathaway Company), H.B. Fuller Company, Pro Clima, W. R. Meadows Inc., Seal King Industrial Co. Ltd., Mapei S.p.A., Deltec Tape. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Airtight Tape Market Key Technology Landscape

The technology landscape of the Airtight Tape Market is continuously evolving, driven by the demand for products that offer superior performance, easier application, and enhanced sustainability. A primary technological focus lies in advanced adhesive chemistry, particularly the development of high-performance acrylic Pressure Sensitive Adhesives (PSAs). These next-generation acrylic systems offer exceptional sheer strength, resistance to plasticizers migrating from building materials, and significantly extended service life compared to traditional rubber or asphalt-based adhesives. Key innovations include pure acrylic adhesive technologies that eliminate the need for solvents, aligning with stricter VOC (Volatile Organic Compound) regulations and promoting healthier indoor environments, making them ideal for green building certifications.

Another crucial technological advancement involves the engineering of backing materials. Multi-layered films and non-woven carriers are being developed to optimize vapor permeability—creating "smart" tapes that can adapt their resistance based on ambient humidity levels. This technology is critical for managing moisture within the building envelope, preventing interstitial condensation while maintaining the necessary air barrier. Furthermore, the integration of specialized pigments and additives enhances UV stability, allowing certain tapes to be exposed for extended periods during construction without degradation. The manufacturing process itself is adopting advanced coating techniques, such as hot melt coating and precision extrusion coating, to ensure highly consistent and controlled adhesive thickness and width, essential for reliable sealing.

In terms of application technology, there is a strong emphasis on cold-weather application solutions. Manufacturers are developing tapes specifically formulated with low-temperature tack properties, allowing contractors to maintain productivity and ensure seal integrity even in freezing conditions, a significant challenge in northern climates. Furthermore, specialized primer-less systems and split-release liner designs simplify the installation process, reducing installation time and mitigating common application errors. This focus on ease of use, combined with materials engineered for compatibility with modern composite building materials like OSB, CLT, and rigid foam insulation, defines the cutting edge of tape technology, ensuring that the physical product supports the high-speed requirements of modern construction methods.

Regional Highlights

- Europe: Europe dominates the airtight tape market, propelled by stringent regulatory frameworks, notably the European Energy Performance of Buildings Directive (EPBD) and the widespread adoption of the Passive House Standard. Countries such as Germany, Austria, and Scandinavia exhibit high market maturity and demand for premium, certified tapes. The region's focus on deep energy retrofitting of existing building stock further drives sustained demand for high-performance sealing solutions compatible with diverse construction types.

- North America (US and Canada): North America represents a highly growth-oriented market, driven by evolving national and state-level energy codes (e.g., IECC) that increasingly require verified air barrier systems. The adoption of blower door testing as a mandatory quality control measure boosts demand for reliable tapes. The US market shows strong growth in both residential new construction and the commercial retrofit segment, with a growing emphasis on high-tack acrylic tapes suitable for wide temperature ranges and high humidity areas.

- Asia Pacific (APAC): APAC is the fastest-growing region, stimulated by massive urbanization, infrastructure investment, and rising awareness of energy efficiency in commercial real estate across China, Japan, and Australia. While the market remains price-sensitive in emerging economies, the introduction of international green building standards is rapidly increasing the uptake of higher quality, certified airtight tapes, particularly in high-value commercial and data center construction projects.

- Latin America (LATAM): The LATAM market is nascent but shows potential, with growth centered around industrial and large-scale commercial developments, particularly in Brazil and Mexico. Demand is generally driven by multinational companies requiring international standard compliance rather than extensive domestic regulation, leading to a fragmented market relying on imported high-performance products.

- Middle East and Africa (MEA): The MEA region presents unique challenges and opportunities. Demand in the GCC nations (Saudi Arabia, UAE) is driven by the need for tapes highly resistant to extreme heat, UV radiation, and sand abrasion, primarily focused on large infrastructure projects and luxury residential developments requiring exceptional HVAC efficiency. The market emphasizes specialized tapes designed for thermal performance under severe climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Airtight Tape Market.- 3M Company

- Tesa SE

- Nitto Denko Corporation

- Sika AG

- Saint-Gobain

- Henkel AG & Co. KGaA

- Avery Dennison Corporation

- Intertape Polymer Group (IPG)

- Shurtape Technologies LLC

- Berry Global Group Inc.

- Lohmann GmbH & Co. KG

- Scapa Group Plc

- Tremco CPG (RPM International)

- Covalence (A Berkshire Hathaway Company)

- H.B. Fuller Company

- Pro Clima

- W. R. Meadows Inc.

- Seal King Industrial Co. Ltd.

- Mapei S.p.A.

- Deltec Tape

Frequently Asked Questions

Analyze common user questions about the Airtight Tape market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of acrylic airtight tapes over butyl tapes?

Acrylic airtight tapes typically offer superior UV resistance, better long-term cohesive strength, and greater tolerance to temperature cycling and environmental degradation, making them the preferred choice for exposed construction joints and permanent seals, whereas butyl tapes excel in conformability and immediate high tack for irregular or challenging surfaces.

How do global energy efficiency standards influence the demand for airtight tape?

Global standards, such as the EU's NZEB mandates and stringent IECC requirements in North America, directly mandate improved building envelope performance, making verifiable airtightness a legal requirement. This legislative pressure forces construction professionals to adopt high-quality sealing solutions like airtight tapes to minimize air leakage and pass required blower door tests.

What factors determine the proper selection of an airtight tape for construction projects?

Tape selection is primarily determined by the substrate compatibility (e.g., adherence to wood, concrete, membrane type), the temperature range of the application, the required duration of exposure (UV stability), the necessary vapor permeability rating (to manage moisture), and project-specific requirements like low-VOC compliance or extreme mechanical resistance.

Is the integration of airtight tapes complicated in modular or prefabricated construction?

No, airtight tapes are highly advantageous in modular construction. Their standardized, adhesive-based application method ensures reliable, repeatable seals on factory-assembled panels. This consistency is crucial for maintaining quality control and accelerating the on-site assembly process compared to traditional liquid sealants.

What is the current trend regarding sustainable materials in the airtight tape sector?

The key sustainability trend involves a shift towards solvent-free, pure acrylic adhesives and bio-based raw materials derived from renewable sources. Manufacturers are also focusing on designing tapes and liners that are easily recyclable and comply with stringent environmental product declarations (EPDs) required for green building projects.

The airtight tape market is fundamentally driven by the convergence of legislative action towards energy conservation and technological advancements in polymer and adhesive science, catering to increasingly sophisticated demands across building envelopes, HVAC systems, and specialized industrial sealing applications. The core trajectory of innovation involves improving application performance under adverse conditions, extending product lifespan, and ensuring environmental stewardship through sustainable material compositions, thereby cementing the tape's role as a critical component in achieving global sustainability and energy efficiency goals.

Future market growth will be heavily influenced by the speed of adoption in developing economies and the success of manufacturers in providing comprehensive, user-friendly sealing systems. Furthermore, the increasing integration of digital tools and AI into construction quality assurance will place higher demands on product documentation and verifiable performance data, pushing manufacturers to standardize testing methods and provide transparent performance metrics. The industry must continue to address the training deficit among contractors to ensure optimal installation, which remains the single largest variable impacting the realized performance of airtight tapes in the field.

The competitive landscape suggests that consolidation is likely, with major players aiming to secure proprietary adhesive technologies and enhance global distribution networks. Small and medium-sized enterprises (SMEs) will thrive by focusing on niche applications, such as specialized repair or retrofitting tapes, or by pioneering highly sustainable, localized product lines. Ultimately, the market trajectory is resilient, underpinned by irreversible global policy movements favoring energy-efficient and sustainable infrastructure development, ensuring continued strong growth throughout the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager