AIS Transponder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434073 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

AIS Transponder Market Size

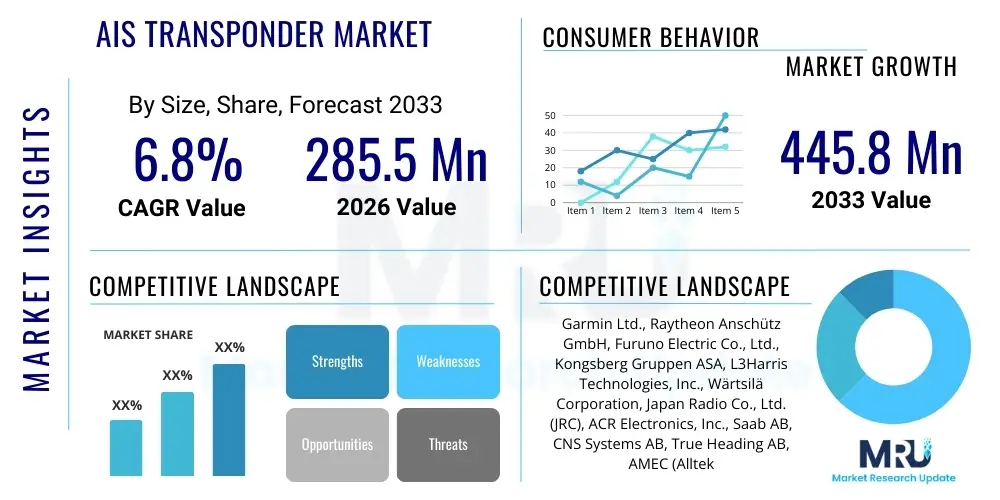

The AIS Transponder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $285.5 Million in 2026 and is projected to reach $445.8 Million by the end of the forecast period in 2033.

AIS Transponder Market introduction

The Automatic Identification System (AIS) Transponder Market is centered around advanced electronic devices that serve as a cornerstone of modern maritime safety and vessel traffic management. These transponders utilize dedicated Very High Frequency (VHF) radio channels to autonomously transmit and receive critical navigational and vessel identity information, a system initially developed to support collision avoidance and aid in maritime security following the mandates established by the International Maritime Organization (IMO). The data exchanged includes dynamic information such as the vessel's precise position derived from an integrated Global Navigation Satellite System (GNSS) receiver, course over ground (COG), speed over ground (SOG), and rate of turn, alongside static details like the vessel’s Maritime Mobile Service Identity (MMSI) number, call sign, vessel type, and dimensions. This constant, bidirectional communication stream ensures that all AIS-equipped vessels and shore stations within VHF range maintain real-time situational awareness, which is paramount for navigating congested shipping lanes and managing port approaches safely.

Product description within this market focuses on two primary regulatory classes: Class A transponders and Class B transponders. Class A units are high-performance systems mandated for all international voyage SOLAS (Safety of Life at Sea) vessels, including large cargo ships, tankers, and passenger vessels. They transmit at a high power output (12.5 Watts) and use the sophisticated Self-Organizing Time Division Multiple Access (SOTDMA) protocol, ensuring the highest reporting priority and most frequent data updates. Conversely, Class B transponders cater to non-SOLAS vessels, encompassing smaller commercial craft, fishing boats, and the rapidly growing recreational boating sector. While historically utilizing the less efficient Carrier Sense Time Division Multiple Access (CSTDMA), the market is now heavily transitioning towards Class B SO (SOTDMA) models, which offer improved performance parameters closer to Class A while adhering to the lower power consumption profile suitable for smaller vessels. The driving factors behind this market growth are the relentless global enforcement of mandatory installation requirements, the sustained expansion of global seaborne trade volumes, and the necessary digitalization of maritime operations.

The major applications of AIS technology extend far beyond simple vessel tracking. AIS data forms the backbone of Vessel Traffic Services (VTS), allowing port authorities and coastal administrations to monitor vessel movements, manage traffic flow, and respond swiftly to potential hazards or emergencies, thereby enhancing port efficiency and regional security. Furthermore, the integration of AIS transponders with specialized navigational displays (ECDIS) provides bridge crews with an immediate visual overlay of surrounding vessel traffic, dramatically lowering the risk of human error-related incidents. The benefits realized from widespread AIS adoption include significant reduction in maritime accidents, optimization of logistical supply chains through enhanced fleet tracking, and streamlined compliance with environmental regulations by monitoring vessel speeds and routes. Technological innovation, particularly in integrating satellite-based AIS (S-AIS) for global coverage, and incorporating advanced cybersecurity features into the hardware itself, are expected to fuel substantial market value appreciation throughout the forecast period, positioning AIS transponders as indispensable components of the future digital ship.

AIS Transponder Market Executive Summary

The global AIS Transponder Market is characterized by robust growth underpinned by non-discretionary regulatory compliance and rapid advances in digital maritime infrastructure. Current business trends indicate a strong market preference for advanced SOTDMA-based transponders across both Class A and Class B segments, reflecting the industry’s demand for high-reliability data transmission in increasingly crowded maritime zones. Manufacturers are focusing heavily on developing integrated solutions, where the AIS unit is seamlessly bundled with other navigational electronics, such as GPS plotters, radars, and bridge management systems, offering plug-and-play simplicity and optimized data flow. A critical trend is the rising significance of the retrofit and aftermarket segment, driven by large-scale compliance deadlines for older vessels to upgrade to current international standards, specifically concerning the requirements for improved data security and integration with new generation e-navigation tools. Furthermore, strategic alliances between hardware manufacturers and Satellite AIS data service providers are becoming commonplace, aimed at offering end-to-end, global vessel tracking capabilities that leverage the strengths of both terrestrial and space-based receivers.

Regional trends clearly highlight the Asia Pacific (APAC) region as the epicenter of market expansion, primarily due to its pivotal role in global manufacturing, extensive coastal fishing activities, and the massive throughput of commercial shipping via critical ports in East and Southeast Asia. Regulatory environments in countries like Indonesia, India, and Vietnam are increasingly enforcing mandatory carriage rules for local fleets, creating substantial new demand pools. Conversely, mature markets in Europe and North America are characterized by replacement cycles and high penetration rates in niche, specialized vessels, such as offshore support and wind farm service vessels, demanding highly customized, robust transponders. Segment trends confirm that while Class A sales are stable and directly tied to new shipbuilding and replacement, the Class B SO segment is experiencing exponential growth, capturing market share from older CSTDMA models and expanding the overall addressable market by attracting smaller, safety-conscious commercial and recreational users who previously lacked affordable, high-performance tracking options. The adoption of dual-band (A and B frequency support) transceivers is also accelerating to ensure optimal performance across diverse operational environments.

The market outlook remains highly positive, driven by the inescapable requirement for transparent maritime domain awareness (MDA) across all jurisdictions. Key stakeholders are responding to the challenge of data volume by investing in cloud-based platforms and data analytics tools that ingest raw AIS signals and transform them into actionable intelligence for logistics, security, and environmental monitoring. This shift is elevating the value proposition of the transponder from a mere safety device to a crucial data node within the maritime IoT ecosystem. Challenges related to cybersecurity, particularly preventing data manipulation (spoofing), necessitate continuous innovation in hardware security modules and firmware updates. Successful companies in this environment will be those that provide not only reliable hardware compliant with stringent IEC and IMO standards but also offer scalable, integrated data services that enhance operational efficiency and regulatory reporting for their diverse global customer base, from governmental agencies to individual boat owners.

AI Impact Analysis on AIS Transponder Market

Common user inquiries concerning the integration of Artificial Intelligence (AI) in the AIS Transponder Market primarily revolve around how AI can enhance the utility of the massive volumes of positioning data generated by AIS networks. Users frequently ask about AI's potential in improving collision avoidance systems, predicting vessel behaviors in congested waters, and automating the monitoring process in VTS centers. Specific concerns include the potential for AI-driven systems to reduce false alarms compared to traditional radar or manual monitoring, and the security implications of using AI to analyze real-time sensitive vessel tracking data. Furthermore, commercial stakeholders are keenly interested in how machine learning algorithms can optimize route planning, forecast port congestion based on arrival patterns derived from AIS data, and improve the efficiency of search and rescue operations by modeling drift and environmental factors. AI's primary impact lies in the intelligence layer that sits atop the existing AIS network infrastructure.

By applying machine learning (ML) algorithms to historical and real-time AIS tracks, AI systems can establish detailed 'normal' operational profiles for various vessel types and routes. Any significant deviation from these learned patterns—be it anomalous speed changes, unusual loitering, or sudden course alterations away from designated shipping corridors—can be instantly flagged as an anomaly, providing maritime authorities with a powerful, automated surveillance capability. This dramatically enhances Maritime Domain Awareness (MDA) by detecting suspicious or non-compliant behavior, often referred to as 'dark vessel' tracking when combined with other sensor inputs. For commercial operators, AI utilizes AIS data for sophisticated predictive maintenance, analyzing speed and position data in conjunction with engine telemetry to forecast optimal transit speeds and minimize fuel consumption, thus delivering significant operational cost reductions. This transition from simple rule-based warnings to sophisticated predictive modeling is critical for high-stakes maritime environments, reducing human error and boosting overall safety.

While the physical transponder hardware itself remains fundamentally a radio transmission device, its evolution is influenced by the need to support the AI data pipeline. Future transponder development is focusing on ensuring high-fidelity data transmission, minimizing latency, and potentially integrating edge computing capabilities to preprocess and filter data before it is sent to shore-based AI platforms. Furthermore, the rising reliance on S-AIS data requires AI to effectively manage the complexities of satellite signal reception, including addressing signal attenuation and intermittent data availability caused by weather or satellite orbital patterns. The ability of AI to validate, clean, and fuse AIS data with inputs from radar, electro-optical systems, and weather models is driving the necessity for new AIS standards that support more comprehensive and secured data outputs, ensuring that the source data is trustworthy for high-stakes, AI-driven decision-making processes. This integration reinforces the transponder's role as a crucial sensor node in the global maritime digitalization ecosystem.

- Predictive Collision Avoidance: AI analyzes historical and real-time movement data, including environmental factors, to predict potential navigational conflicts far more accurately than traditional CPA (Closest Point of Approach) calculations.

- Automated Anomaly Detection: Machine learning identifies unusual speed, course, or location patterns (Deviation from Norm), instantly highlighting potential security threats or non-compliance, such as illegal transshipments or unauthorized intrusions into restricted zones.

- Enhanced VTS Operations: AI algorithms automate the prioritization of thousands of simultaneous monitoring tasks, presenting VTS operators with filtered, high-risk alerts and reducing cognitive overload, thereby improving overall port operational efficiency and responsiveness.

- Route Optimization and Efficiency: Using granular AIS data inputs, AI optimizes fuel consumption, transit times, and adherence to environmental zones by dynamically adjusting routes based on anticipated traffic flow, wave patterns, and port congestion forecasts, delivering tangible economic benefits to fleet managers.

- Data Integrity and Noise Filtering: AI enhances the reliability and usability of S-AIS data by filtering atmospheric or signal interference and compensating for position uncertainties, ensuring continuous, high-quality positional reporting for global tracking and regulatory reporting.

- Maritime Security Intelligence: AI systems classify vessel behavior to distinguish legitimate commercial activities from suspicious or illicit activities, significantly bolstering national maritime security and law enforcement capabilities against smuggling and piracy.

DRO & Impact Forces Of AIS Transponder Market

The core momentum sustaining the AIS Transponder Market stems primarily from stringent international and national safety and security mandates. The regulatory framework established by the IMO, particularly the SOLAS convention, serves as the most powerful Driver, ensuring mandatory installation of Class A systems on all large vessels, creating a constant, inelastic demand curve linked to global fleet size and renewal rates. Complementing this is the pervasive trend of digitalization within the maritime industry; AIS data is foundational to e-navigation and the maritime IoT, driving demand for technologically advanced, integrated systems. Furthermore, global efforts to combat illegal, unreported, and unregulated (IUU) fishing necessitate the adoption of Class B or specialized AIS variants by millions of smaller vessels globally, significantly expanding the market's addressable segment. The necessity for heightened Maritime Domain Awareness (MDA) by governmental and naval bodies also acts as a powerful driver, pushing demand for robust, often encrypted, transponder technologies to safeguard national interests and critical shipping chokepoints. This collective regulatory and technological push fundamentally assures market longevity and stable growth.

Despite these potent drivers, the market faces structural Restraints that temper growth in certain segments. The high initial capital expenditure associated with certified Class A transponder systems and their required installation and calibration (often exceeding $10,000 per unit) poses a financial barrier, particularly for small independent vessel owners and fleets operating in developing economies. Additionally, while the technology is standardized, integration complexity remains a restraint; older vessels often struggle to interface new AIS units seamlessly with legacy navigation displays (ECDIS/Radar), necessitating costly overhauls. A critical technical restraint is the persistent vulnerability to signal spoofing and jamming, which, although rare, creates cybersecurity concerns and requires continuous investment in anti-spoofing countermeasures, driving up R&D costs for manufacturers. Finally, VHF channel limitations and the potential for message collisions in hyper-congested ports also pose an operational restraint, pushing the need for more efficient SOTDMA protocols and potentially new transmission bandwidths.

Significant Opportunities for market expansion reside in the massive, yet currently underpenetrated, segments of inland waterway vessels and coastal commercial craft globally, where regulatory mandates are only just beginning to take effect. The development and commercialization of Satellite AIS (S-AIS) offer a high-growth opportunity, providing continuous global coverage that enhances the commercial viability of AIS data analytics for optimization of long-haul logistics. Furthermore, the integration of AIS with specialized sensor technology, such as Automatic Dependent Surveillance-Broadcast (ADS-B) systems and environmental sensors, positions the AIS transponder as a core node in a broader Maritime IoT platform, enabling services like predictive maintenance and environmental compliance monitoring. The primary impact forces are regulatory adherence (a stabilizing force) and continuous innovation in digital integration and data security (an expansive force). These forces collectively ensure sustained demand, transforming the AIS transponder from a mere safety device into an essential tool for global trade efficiency and security throughout the forecast period.

Segmentation Analysis

Market segmentation provides a detailed map of the AIS transponder industry, distinguishing demand based on regulatory necessity, performance characteristics, operational context, and componentry. The core segmentation by Type—Class A, Class B, and Class B SO (SOTDMA)—is intrinsically linked to IMO and national regulations, determining key operational parameters such as transmission power (2W, 5W, 12.5W) and reporting frequency. Class A systems command the highest average selling price due to stringent certification requirements and robustness, appealing to the mandatory commercial shipping sector. Conversely, the rapidly maturing Class B segment, particularly the Class B SO variant, is critical for market volume growth as governments globally extend tracking requirements to smaller, non-SOLAS vessels, requiring a balance between performance and affordability. This diversification allows manufacturers to tailor marketing and distribution strategies specifically to the technical needs and budgetary constraints of distinct user groups, ranging from multi-billion dollar shipping conglomerates to small independent fishermen.

- By Type:

- Class A Transponders (High-power, SOTDMA protocol, mandatory for large SOLAS vessels, certified to IEC 61993-2 standards)

- Class B Transponders (CSTDMA) (Lower power, basic collision avoidance for non-SOLAS recreational and small craft, being phased out)

- Class B SO Transponders (SOTDMA) (Enhanced performance Class B utilizing SOTDMA for guaranteed transmission slots, driving current aftermarket growth)

- Base Stations (Shore-based units used by VTS systems and coastal authorities for comprehensive traffic monitoring and message relay)

- By Application:

- Commercial Vessels (Demand for Class A and specialized Class A units; includes cargo ships, container ships, cruise liners, oil/gas carriers)

- Fishing Vessels (Significant demand for ruggedized Class B and B SO units driven by fisheries management and safety mandates)

- Leisure Vessels (Volume market for cost-effective, easily installed Class B transponders for improved coastal navigation safety)

- Government/Naval Vessels and Coast Guard (Demand for highly customized, often encrypted Class A systems for surveillance, enforcement, and military operations)

- Port Management and VTS Stations (Primary customers for shore-based transponders, data management software, and integration services)

- By Component:

- Transmitters and Receivers (Core radio modules essential for VHF data exchange; dictates performance and power consumption)

- Antennas (Specialized high-gain VHF and GPS/GNSS antennas crucial for reliable signal transmission and reception)

- GPS/GNSS Modules (High-precision positioning chips that provide the critical location data input for the AIS broadcast)

- Display Units and Interfaces (Integration hardware, including dedicated displays, chart plotter interfaces, and network adaptors for NMEA 2000 compatibility)

- By Frequency:

- VHF (Standard Terrestrial AIS operating on dedicated channels 87B and 88B)

- UHF (Used in specialized military or regional tracking systems outside of the standard international maritime band)

Value Chain Analysis For AIS Transponder Market

The upstream segment of the AIS Transponder value chain is highly dependent on specialized electronics manufacturing, requiring a steady supply of precision components crucial for ensuring compliance with demanding international standards. This includes sourcing high-performance, temperature-stable RF components, advanced System-on-Chip (SoC) microprocessors that handle SOTDMA protocols, and certified multi-constellation GNSS receivers (supporting GPS, GLONASS, Galileo) for accurate positioning. Supply chain resilience, particularly given global semiconductor shortages, is a key risk factor that influences OEM pricing and production schedules. Manufacturers must maintain sophisticated in-house R&D capabilities to handle firmware development, encryption integration, and complex environmental testing required for marine certification (e.g., IEC standards for vibration, temperature, and water ingress). The ability of OEMs to secure reliable, long-term contracts with key component suppliers determines their competitive edge regarding manufacturing cost and innovation speed.

Midstream activities center on the assembly, calibration, and rigorous testing of the transponder units. This manufacturing phase is heavily regulated, requiring adherence to quality management systems and ensuring that every unit complies with type-approval certificates issued by major classification societies and telecommunications authorities. Value addition at this stage is achieved through proprietary firmware that optimizes data handling and network stability, and through the creation of highly durable, ruggedized housings suitable for prolonged exposure to severe marine conditions. Manufacturers often produce a range of products, from integrated 'black box' solutions that feed directly into a vessel’s existing network to standalone units with their own display screens. The transition towards simplified installation procedures and highly reliable performance metrics is a primary objective during this phase to reduce post-sales support requirements and improve customer satisfaction.

The downstream distribution and services segment is complex and multi-layered. Direct sales are crucial for high-value government contracts (VTS systems, naval fleets) and large commercial fleet purchases, often involving customized software integration and long-term service agreements. However, the majority of Class B sales and aftermarket Class A replacements rely on indirect channels, involving a global network of specialized marine electronics distributors, authorized dealers, and certified marine installers. These installers play a non-negotiable role, as correct antenna placement and calibration are essential for regulatory compliance and optimal performance, often requiring professional sign-off. The emergence of Satellite AIS (S-AIS) providers also forms a vital downstream service, transforming raw AIS data into commercial subscriptions for global tracking and analytics, effectively creating a recurring revenue model layered onto the initial hardware sale. Effective training and global availability of certified technical support are paramount for sustaining channel partner confidence and ensuring long-term customer loyalty in this safety-critical sector.

AIS Transponder Market Potential Customers

The core customer segment for AIS transponders is the global commercial shipping fleet, obligated by the IMO’s SOLAS convention to install certified Class A units. This includes owners and operators of massive container ships, Very Large Crude Carriers (VLCCs), bulk carriers, gas carriers, and large passenger vessels. For this segment, procurement is driven by strict regulatory cycles, flag state requirements, and insurance mandates, prioritizing absolute reliability, integration capabilities with advanced bridge systems (ECDIS, Radar), and adherence to the latest security standards. Shipyards constitute a critical B2B customer, purchasing units in bulk for new construction (OEM market), where supply chain efficiency and product consistency are key considerations. The purchasing decisions in this sector are highly technical and often involve complex tenders managed by fleet technical managers and procurement specialists.

A rapidly expanding customer base is found within the smaller commercial and non-SOLAS sector, predominantly comprising fishing vessels, coastal cargo ships, harbor tugs, and utility vessels. Driven by national and regional regulatory expansions aimed at improving safety, fisheries management (combating IUU fishing), and local traffic control, this segment primarily demands robust, cost-effective Class B SO transponders. Procurement decisions here are highly price-sensitive and focused on ease of installation and maintenance, favoring integrated units or those compatible with basic navigational electronics. Furthermore, the recreational boating community—private yacht owners and pleasure craft operators—constitutes a significant volume buyer for Class B systems, driven by personal safety concerns when navigating congested coastal areas, prioritizing user-friendly interfaces and low power consumption features.

Finally, governmental and public sector entities represent a high-value, specialized customer base. This includes naval and defense forces, coast guards, port authorities responsible for Vessel Traffic Services (VTS), and national maritime safety agencies. These customers procure shore-based Class A base stations, high-specification repeaters, and often require customized, military-grade or encrypted AIS transponders for their patrol vessels and surveillance platforms. Procurement in this sector is driven by national security requirements, long-term operational costs, and the need for advanced features such as higher data security, sophisticated data fusion capabilities, and guaranteed long-term hardware support. The demand from VTS centers, in particular, focuses heavily on advanced data processing software that leverages the data generated by shipboard transponders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $285.5 Million |

| Market Forecast in 2033 | $445.8 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Garmin Ltd., Raytheon Anschütz GmbH, Furuno Electric Co., Ltd., Kongsberg Gruppen ASA, L3Harris Technologies, Inc., Wärtsilä Corporation, Japan Radio Co., Ltd. (JRC), ACR Electronics, Inc., Saab AB, CNS Systems AB, True Heading AB, AMEC (Alltek Marine Electronics Corp.), Vesper Marine Ltd., ComNav Technology Ltd., Icom Inc., SRT Marine Systems plc, Digital Yacht Ltd., Transas Marine International (part of Wärtsilä), Sperry Marine (part of Northrop Grumman), Marine Instruments S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

AIS Transponder Market Key Technology Landscape

The core technology sustaining the robustness and reliability of the AIS market is the SOTDMA (Self-Organizing Time Division Multiple Access) protocol, which underpins the operational functionality of both Class A and the advanced Class B SO transponders. SOTDMA represents a significant leap from older CSTDMA methods by employing a time-slotted frame structure that allows transponders to reserve future transmission slots and autonomously manage their communication timing, dramatically reducing the probability of data packet collision, particularly in areas of high vessel density. This technological reliability is non-negotiable for safety-critical systems and requires highly precise synchronization, which is achieved through integrated, high-accuracy multi-constellation GNSS receivers. Modern transponders must incorporate robust chips capable of processing signals from GPS, GLONASS, Galileo, and BeiDou, ensuring positional accuracy (typically better than 10 meters) even under difficult conditions, such as near high structures or in poor weather. Furthermore, the hardware design is increasingly utilizing ruggedized, low-power RF front-ends that maintain high transmission fidelity while minimizing the current draw, crucial for remote and battery-dependent installations.

A second major technological pillar involves seamless digital integration and adherence to standardized communication protocols. All contemporary AIS transponders must be capable of feeding data via the NMEA 2000 (standardized CAN Bus protocol) or NMEA 0183 interfaces into a ship's existing navigation network. This interoperability ensures that the real-time stream of static, dynamic, and voyage-related data is immediately visible on the Electronic Chart Display and Information System (ECDIS), radar, and other multifunction displays (MFDs). The quality of this data integration layer significantly influences the decision-making capabilities of the bridge crew. Beyond vessel integration, the technology landscape is defined by the rapid expansion of Satellite AIS (S-AIS). S-AIS involves specialized space-based receivers in Low Earth Orbit (LEO) constellations, demanding sophisticated filtering algorithms and highly sensitive receivers to capture the relatively weak AIS signals transmitted far offshore. This convergence of space and terrestrial technology is redefining global maritime domain awareness capabilities, pushing manufacturers towards dual-function transponders capable of optimizing signal strength for both local VHF range and distant satellite capture.

Security and software innovation represent the emerging technological battleground. Given the growing threat of AIS data manipulation (spoofing) for illicit purposes, manufacturers are developing hardened transponders that incorporate advanced cryptographic modules and secure boot processes to verify the integrity of transmitted data and prevent unauthorized firmware modification. Future iterations are expected to incorporate more sophisticated, proprietary messaging capabilities—beyond the standard AIS message types (1-27)—to facilitate secure communication for naval and governmental users. Furthermore, the technology is adapting to the broader concept of e-navigation by incorporating features like application-specific messages (ASM), which allow the broadcasting of customized, localized data (e.g., weather warnings, hazard notifications, lock schedules) directly to vessels. This shift requires sophisticated, updated firmware and robust processing power, signaling that the future of the AIS transponder market lies not just in the hardware's reliability, but in its secure, intelligent, and interconnected data processing capabilities within the larger ecosystem of maritime digitalization.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market region due to its central role in global trade, hosting the world's busiest ports and largest shipbuilding hubs. Market growth is structurally guaranteed by the sheer volume of new vessels and the regulatory enforcement aimed at controlling extensive local fishing fleets (e.g., in the South China Sea). Regional demand favors high volumes of Class B SO units for coastal and inland water traffic, supplemented by consistent, high-specification Class A installations in major international ports like Singapore, Shanghai, and Busan, driving significant market expansion through both OEM and aftermarket sales.

- Europe: Characterized by a high-value, mature market with strict regulatory adherence, Europe focuses heavily on high-end Class A systems and specialized applications. Key drivers include rigorous adherence to EU maritime safety directives, the growing fleet of offshore energy support vessels (demanding advanced, ruggedized systems), and high penetration in the affluent leisure boating segment. European markets, particularly in Scandinavia and Northern Europe, also lead in integrating AIS data with advanced VTS systems and autonomous vessel trials.

- North America: The market is stable, driven by the U.S. and Canadian Coast Guard regulations (mandating use in federal waters), commercial traffic through the Great Lakes, and robust demand from the extensive recreational sector. Compliance and safety are paramount, leading to consistent sales of reliable Class A and quality Class B products. A defining feature is the strong emphasis on security, with federal agencies often requiring specific certifications for transponders used for government contracts and coastal monitoring operations.

- Latin America (LATAM): LATAM represents an accelerating growth market, fueled by major port expansions (e.g., Panama Canal operations, Brazilian oil terminals) and a concerted effort by governments to modernize coastal surveillance capabilities. Increased enforcement against illegal fishing in sovereign waters is driving substantial adoption of mandatory Class B systems for local fishing fleets, creating significant opportunities for manufacturers offering robust, competitively priced hardware and reliable distribution networks in countries like Mexico, Argentina, and Peru.

- Middle East and Africa (MEA): Growth in MEA is concentrated around strategic maritime chokepoints and major oil export hubs, where security concerns are paramount. Demand is high for advanced Class A systems for international shipping navigating high-risk areas. African nations are beginning to enforce AIS carriage requirements as part of international agreements to combat piracy and manage fisheries, signaling emerging opportunities in regions previously underserved, particularly for satellite-enabled tracking solutions for expansive coastlines.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AIS Transponder Market.- Garmin Ltd.

- Raytheon Anschütz GmbH

- Furuno Electric Co., Ltd.

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Wärtsilä Corporation

- Japan Radio Co., Ltd. (JRC)

- ACR Electronics, Inc.

- Saab AB

- CNS Systems AB

- True Heading AB

- AMEC (Alltek Marine Electronics Corp.)

- Vesper Marine Ltd.

- ComNav Technology Ltd.

- Icom Inc.

- SRT Marine Systems plc

- Digital Yacht Ltd.

- Transas Marine International (part of Wärtsilä)

- Sperry Marine (part of Northrop Grumman)

- Marine Instruments S.A.

Frequently Asked Questions

Analyze common user questions about the AIS Transponder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an AIS Transponder and why is it mandatory?

The primary function of an AIS Transponder is to continuously broadcast and receive static and dynamic vessel data (position, course, speed) over VHF radio frequencies to enhance maritime situational awareness. It is mandatory for most large commercial vessels under the IMO’s SOLAS convention to prevent collisions, especially in congested waters, thereby drastically improving navigation safety and supporting Vessel Traffic Services (VTS).

What is the difference between Class A, Class B, and Class B SO AIS transponders?

Class A (12.5 W, SOTDMA) is mandatory for large SOLAS vessels, offering the highest power and reporting frequency. Class B (2 W, CSTDMA) is for non-SOLAS vessels, being less performant. Class B SO (SOTDMA) is the latest standard for non-SOLAS craft, utilizing the robust SOTDMA protocol for better slot management and reliability, driving high adoption rates in fishing and leisure segments.

How does Satellite AIS (S-AIS) extend the capabilities of the traditional AIS Transponder network?

Satellite AIS (S-AIS) utilizes receivers mounted on Low Earth Orbit (LEO) satellites to capture AIS signals transmitted by vessels far beyond the line-of-sight range of terrestrial coastal stations (typically 40 nautical miles). This extends global tracking coverage across vast ocean areas, crucial for long-haul fleet management, regulatory enforcement, and global maritime security operations.

What technological advancements are currently driving market growth in AIS Transponders?

Key drivers include the widespread adoption of Class B SO (SOTDMA) for enhanced performance, seamless integration with multi-constellation GNSS receivers (for superior positional accuracy), and the development of robust, secure firmware to mitigate risks associated with signal spoofing, coupled with the ability to handle Application Specific Messages (ASM).

How is Artificial Intelligence (AI) impacting the utility of AIS data for maritime operations?

AI is transforming AIS data into actionable intelligence by enabling predictive collision avoidance, automating anomaly detection to flag suspicious vessel behavior, optimizing complex VTS operations, and enhancing global fleet management systems through route and congestion forecasting, elevating the system's role from passive tracking to proactive security and logistics management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- AIS Transponder Market Statistics 2025 Analysis By Application (Merchant Marine, Recreational Boats, Fishing Vessels), By Type (Class A Marine AIS, Class B Marine AIS), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- AIS Transponder Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Class A (12.5W), Class B (1-3W)), By Application (Shipments, Lighthouse and Beacon, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager