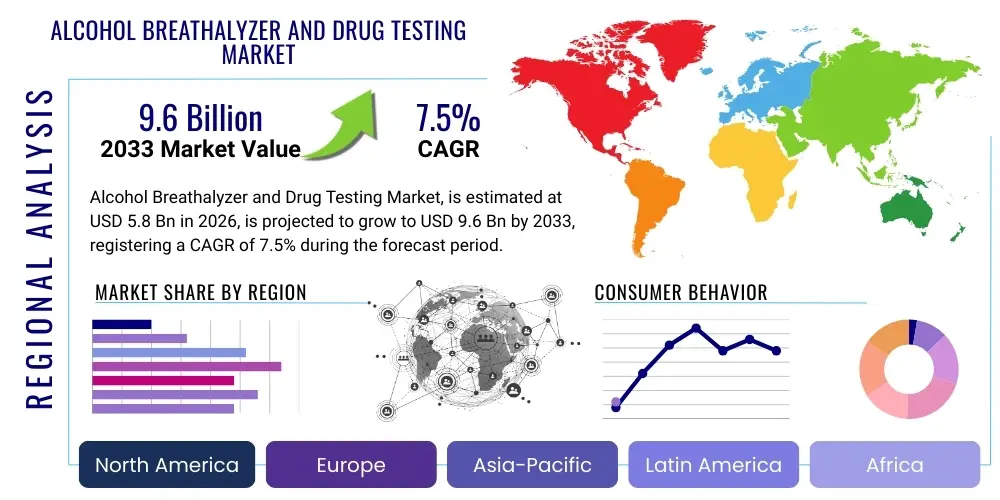

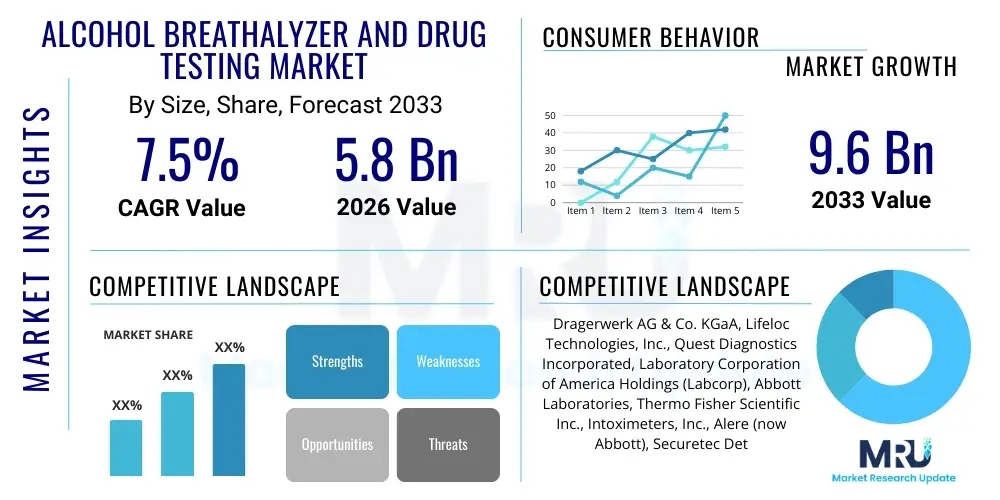

Alcohol Breathalyzer and Drug Testing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437128 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Alcohol Breathalyzer and Drug Testing Market Size

The Alcohol Breathalyzer and Drug Testing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 9.6 Billion by the end of the forecast period in 2033.

Alcohol Breathalyzer and Drug Testing Market introduction

The Alcohol Breathalyzer and Drug Testing Market encompasses a sophisticated range of products designed for the quantitative and qualitative detection of alcohol and illicit substances in biological samples, primarily breath, urine, saliva, and hair. These devices, ranging from portable, handheld breathalyzers utilizing fuel cell technology to advanced laboratory-grade chromatography and immunoassay systems, serve a critical function in ensuring public safety, maintaining workplace security, and supporting forensic investigations. The market is fundamentally driven by global regulatory mandates that necessitate routine testing in high-risk sectors such as transportation, construction, and government services, coupled with increasing concerns regarding substance abuse and impaired driving.

Major applications for these technologies span across law enforcement agencies, clinical settings, corporate environments for pre-employment and random drug screening, and personal use. Products include non-invasive screening tools like disposable breath indicators and digital electrochemical breathalyzers, alongside confirmatory laboratory instruments such as Gas Chromatography-Mass Spectrometry (GC-MS) and Liquid Chromatography-Mass Spectrometry (LC-MS/MS). The primary benefits derived from these technologies include immediate detection capabilities, reduced accident rates, improved compliance with occupational health standards, and the provision of legally defensible evidence for judicial proceedings, which collectively support broader societal goals of harm reduction and safety.

Driving factors propelling market expansion include the increasing stringency of traffic safety laws across developed and emerging economies, the rising prevalence of polysubstance abuse demanding more complex testing panels, and technological advancements focusing on non-invasive and rapid point-of-care (POC) testing devices. Furthermore, the integration of connectivity features, enabling real-time data logging and remote monitoring, is enhancing the efficiency and accountability of large-scale testing programs, particularly within governmental and major corporate drug screening initiatives globally.

Alcohol Breathalyzer and Drug Testing Market Executive Summary

The global Alcohol Breathalyzer and Drug Testing Market is characterized by robust expansion, primarily fueled by legislative mandates and the proactive adoption of testing technologies in professional environments. Key business trends include the consolidation of testing services by major clinical laboratories, a significant shift toward automated, high-throughput systems in clinical toxicology, and the rapid commercialization of highly sensitive, miniaturized devices suitable for remote and on-site testing. These market dynamics are also influenced by evolving synthetic drug chemistries, which continuously necessitate the development of broader and more adaptable testing panels to maintain efficacy and relevance in public safety applications.

Regionally, North America remains the dominant revenue contributor, largely due to stringent Department of Transportation (DOT) regulations, established infrastructure for drug testing, and high public awareness campaigns targeting impaired driving. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by increasing industrialization, rising incidence of alcohol-related traffic accidents, and the subsequent implementation of preventative workplace policies in rapidly developing economies like India and China. Europe maintains a steady growth trajectory, supported by pan-European initiatives to standardize enforcement practices and subsidized public health testing programs.

Segment trends highlight the strong performance of the consumables segment, which is inherently linked to the volume of testing conducted, ensuring recurring revenue streams for manufacturers. Within technology, advanced breathalyzers utilizing fuel cell sensors are gaining significant traction over semiconductor variants due to their superior accuracy, reliability, and specificity, particularly favored by law enforcement. The end-user analysis confirms that Law Enforcement Agencies constitute the largest purchasing segment, although the Workplace segment is experiencing accelerated growth driven by comprehensive corporate safety protocols and insurance mandates.

AI Impact Analysis on Alcohol Breathalyzer and Drug Testing Market

User inquiries regarding the integration of Artificial Intelligence (AI) in alcohol and drug testing frequently center on improving diagnostic accuracy, predicting substance abuse patterns, and streamlining workflow efficiency in clinical and forensic settings. Common questions explore how AI algorithms can interpret complex mass spectrometry data more rapidly and reliably than human analysts, the potential for AI-driven mobile applications to provide personalized risk assessments, and the ethical implications of using predictive policing models based on testing data. Users also express interest in how machine learning (ML) can optimize inventory management for testing consumables and enhance the forensic integrity of results through automated chain-of-custody verification. The core expectation is that AI will minimize interpretation ambiguity, accelerate confirmation processes, and provide valuable public health insights through large-scale data aggregation and pattern recognition.

The implementation of AI and machine learning techniques is poised to revolutionize the operational efficiency and analytical power within the Alcohol Breathalyzer and Drug Testing market. In laboratory settings, AI algorithms are being trained on vast datasets of chromatograms and mass spectra, enabling rapid, precise identification and quantification of both known and novel psychoactive substances, dramatically reducing the time required for confirmation testing. This enhanced automation accelerates toxicology reports, critical for time-sensitive legal and clinical decisions. Furthermore, AI contributes significantly to quality control by autonomously flagging anomalous results or potential instrument calibration drift, ensuring high standards of data integrity and forensic robustness across testing platforms.

Beyond analytical improvements, AI is instrumental in developing sophisticated risk assessment models for workplace and judicial monitoring programs. By analyzing historical test results, demographic data, and geographical incidence rates, machine learning models can identify populations at high risk of substance use disorder relapse or impaired driving, allowing for targeted intervention and resource allocation. This shift towards predictive and preventative strategies, rather than purely reactive testing, significantly increases the societal benefit derived from alcohol and drug testing initiatives, transforming data into actionable public health intelligence and optimizing resource deployment for law enforcement agencies.

- AI-driven predictive toxicology for identifying new designer drugs and metabolites.

- Machine learning optimization of confirmation testing workflows (e.g., GC-MS/MS data interpretation).

- Automated quality control and calibration verification for portable breathalyzers.

- Development of personalized risk stratification models for workplace drug testing programs.

- Enhanced data correlation across testing platforms for forensic case management.

DRO & Impact Forces Of Alcohol Breathalyzer and Drug Testing Market

The market trajectory is significantly shaped by a confluence of influential factors encapsulated by Drivers, Restraints, and Opportunities (DRO). A primary driver is the global escalation in road safety regulations, particularly the enforcement of stricter Blood Alcohol Content (BAC) limits and the mandatory testing for illicit drug presence in commercial drivers and critical infrastructure personnel. Conversely, the high capital investment required for sophisticated laboratory equipment, coupled with persistent concerns regarding privacy issues related to mandatory testing, particularly in private sector environments, act as significant restraints. Opportunities lie predominantly in developing highly portable, non-invasive testing modalities—such as sweat and oral fluid testing—and expanding market penetration into emerging economies where regulatory infrastructure is maturing rapidly, thus requiring substantial quantities of testing equipment and associated consumables.

Impact forces on this market are multidimensional, ranging from technological breakthroughs in sensor development to regulatory shifts in acceptable testing methodologies. Technology acts as a high-impact force, driving the shift from legacy immunoassay screening toward highly specific, often instrument-free, rapid molecular testing methods. Regulatory forces are also profoundly impactful; mandatory zero-tolerance policies in industries like aviation or energy ensure sustained demand, while legal challenges to the admissibility of certain test results can temporarily constrain market growth for specific device types. Socio-economic forces, particularly the increasing public awareness concerning the devastating consequences of impaired operation, contribute to the acceptance and institutionalization of broad testing programs.

The market also faces strong internal competitive forces, characterized by intense efforts to achieve superior sensor reliability and faster turnaround times. Manufacturers are continually vying to produce devices that minimize false positives and false negatives, crucial criteria for law enforcement adoption. Furthermore, the impact of COVID-19 accelerated the need for decentralized and remote testing solutions, pushing innovation toward telehealth-integrated monitoring and fully automated sampling processes, creating new vectors for market expansion previously constrained by traditional in-person testing requirements. Regulatory bodies like the FDA and European Medicines Agency (EMA) exert significant influence through the approval processes, setting benchmarks for clinical accuracy and operational reliability.

Segmentation Analysis

The Alcohol Breathalyzer and Drug Testing Market is rigorously segmented to cater to diverse regulatory, technical, and end-user requirements across the globe. The segmentation is primarily delineated by Product Type, Technology, Application, and End-User, reflecting the specialized needs of different market verticals, from roadside sobriety checkpoints to clinical toxicology laboratories. The inherent complexity of testing substances, which requires varying levels of accuracy and speed, dictates the dominant technology adopted within each segment, influencing purchasing patterns and long-term investment strategies among end-users. This structured categorization allows market participants to tailor their offerings—whether high-volume consumables or technologically advanced analytical instruments—to optimize penetration in specific, high-growth niche areas like personal consumption monitoring or highly regulated workplace environments.

The segmentation by Product Type, distinguishing between Breathalyzers (devices and consumables), and Drug Testing Equipment (analyzers, rapid test kits, and consumables), is critical because consumables represent a high-margin, repetitive revenue stream essential for market stability. Technology segmentation showcases the shift towards non-invasive and high-precision methods, with Electrochemical (Fuel Cell) technology dominating breath analysis due to its superior ethanol specificity, while immunoassay kits dominate rapid screening for drugs, complemented by sophisticated chromatographic methods for confirmation. The application segmentation, spanning from Criminal Justice (law enforcement, corrections) to Medical (hospitals, clinics), highlights the disparate regulatory burdens and accuracy thresholds required, reinforcing the market's specialized nature and the necessity for certified, purpose-built devices tailored to each environment.

End-user segmentation reveals where the highest volume and value lie, demonstrating the dominance of governmental bodies (police, military) versus private entities (workplaces, schools). This structured view confirms the dependency of the market on government spending and regulatory enforcement, while simultaneously acknowledging the rapidly growing role of private enterprise in proactive safety management. The continual introduction of new synthetic drugs and the emphasis on non-invasive sampling are forcing continuous realignment within these segments, prioritizing flexibility and adaptability in testing solutions to maintain effectiveness against a constantly evolving threat landscape.

- Product Type:

- Breathalyzers

- Semiconductor Based

- Electrochemical (Fuel Cell) Based

- Infrared Spectroscopy Based

- Drug Testing Devices and Supplies

- Drug Testing Devices (Analyzers)

- Consumables (Kits, Reagents, Calibrators)

- Breathalyzers

- Technology:

- Immunoassay

- Chromatography (LC-MS/MS, GC-MS)

- Infrared Spectroscopy

- Rapid Diagnostic Testing (RDT)

- Application:

- Workplace Testing

- Law Enforcement (Roadside and Correctional Facilities)

- Hospitals and Clinics (Clinical Toxicology)

- Personal Use

- Sample Type:

- Breath

- Urine

- Saliva/Oral Fluid

- Hair and Sweat

Value Chain Analysis For Alcohol Breathalyzer and Drug Testing Market

The value chain for the Alcohol Breathalyzer and Drug Testing Market initiates with upstream activities focused heavily on the research and procurement of high-precision chemical sensors and specialized raw materials, such as platinum black for fuel cells or highly purified reagents for immunoassay kits. This stage is dominated by specialized chemical and electronic component suppliers who provide critical technological inputs, including microprocessors, advanced optics, and highly sensitive membranes. Success at this stage relies heavily on intellectual property protection and proprietary manufacturing processes to ensure sensor longevity, accuracy, and specificity—parameters that are crucial for legally admissible results.

Midstream activities involve the complex manufacturing, assembly, and rigorous calibration of testing devices and the formulation of consumable kits, often under strict quality control standards mandated by regulatory bodies like ISO 13485. This phase includes the integration of advanced software for data processing and analysis, especially for high-throughput laboratory instruments. Downstream activities focus on marketing, sales, distribution, and critical after-sales support, encompassing maintenance, calibration services, and training for specialized end-users such as police academies and clinical laboratory technicians. The integrity of the distribution channel is paramount, ensuring that sensitive consumables are handled correctly and that devices maintain their certification status.

Distribution channels are bifurcated into direct and indirect routes. Direct sales are common for high-value contracts with governmental agencies (law enforcement, military) or large clinical laboratory networks, allowing manufacturers to manage implementation and service contracts closely. Indirect channels utilize specialized medical device distributors and regional partners to penetrate smaller hospitals, private workplaces, and international markets. The shift toward e-commerce is also noticeable for personal-use breathalyzers and rapid screening kits, although regulated sales still dominate the professional segment. The entire chain emphasizes reliability, security (data handling), and compliance, as the failure of any link can compromise the legal and medical validity of the test results.

Alcohol Breathalyzer and Drug Testing Market Potential Customers

The primary customer base for alcohol breathalyzers and drug testing solutions is expansive and highly segmented, comprising institutions and organizations where safety, compliance, and legal integrity are paramount operational requirements. Law Enforcement Agencies (LEAs), including national police forces, state highway patrols, and customs/border protection units, represent the largest and most consistent demand segment for roadside breathalyzers, portable drug analyzers, and certified consumables used in evidence collection. These customers prioritize robustness, rapid results, and legally admissible accuracy above all else, often procuring equipment through multi-year government tenders and contracts.

The second major consumer cluster is the Workplace segment, encompassing companies across safety-sensitive industries such as transportation, mining, construction, and manufacturing, which implement pre-employment, random, and post-accident drug and alcohol screening. These corporate clients seek efficient, cost-effective testing solutions that minimize operational downtime while maximizing regulatory compliance, often relying on third-party testing service providers and certified occupational health clinics to manage their programs. The shift towards instantaneous oral fluid testing is particularly appealing in this segment due to its non-invasiveness and speed.

Finally, the Healthcare sector, specifically hospitals, emergency departments, and specialized addiction treatment centers, utilizes clinical toxicology analyzers and confirmation equipment to support diagnosis and patient management. Governmental correctional facilities and probation services also represent significant potential customers, requiring frequent, scalable, and secure testing for inmate and parolee populations to monitor compliance with court-ordered restrictions. The growing consumer segment, driven by safety consciousness and the desire for personal BAC monitoring, also contributes meaningfully, albeit mainly focused on lower-cost, semiconductor-based breathalyzer technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dragerwerk AG & Co. KGaA, Lifeloc Technologies, Inc., Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings (Labcorp), Abbott Laboratories, Thermo Fisher Scientific Inc., Intoximeters, Inc., Alere (now Abbott), Securetec Detektions-Systeme AG, Mettler-Toledo International Inc., Premier Biotech, Inc., Express Diagnostics International, Inc., Orasure Technologies, Inc., Alcohol Countermeasure Systems (ACS) Corp., BACTRACK, Inc., RMD Technology, MPD, Inc., Cofain SAS, Hanwell Solutions Ltd, and Smart Start, LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Alcohol Breathalyzer and Drug Testing Market Key Technology Landscape

The technology landscape of the Alcohol Breathalyzer and Drug Testing Market is currently defined by a dual focus: enhancing portability and connectivity for screening tools, and maximizing specificity and throughput for confirmatory laboratory systems. Within breath analysis, electrochemical fuel cell technology remains the gold standard for high-accuracy, evidential breath testing due to its specific reaction to ethanol and immunity to common interfering substances found on the breath, which is essential for police use. However, newer portable infrared spectroscopy devices are emerging, offering rapid, non-contact testing capabilities, particularly useful in high-volume traffic stop scenarios or mandatory entry screening points.

In the drug testing domain, Immunoassay techniques, utilizing technologies like Enzyme Multiplied Immunoassay Technique (EMIT) and Fluorescence Polarization Immunoassay (FPIA), continue to dominate rapid, low-cost screening due to their speed and scalability for multi-panel testing. These screening methods are increasingly supplemented or replaced by sophisticated confirmatory technologies like Liquid Chromatography-Tandem Mass Spectrometry (LC-MS/MS) and Gas Chromatography-Mass Spectrometry (GC-MS/MS). The latter systems offer unparalleled sensitivity and specificity, critical for quantifying drug concentrations and detecting low-level metabolites, and are mandatory for all legally challenged or federally regulated positive screening results, thereby maintaining a high capital investment cycle in forensic laboratories.

A significant technological advancement is the widespread adoption of non-invasive sampling techniques, specifically Oral Fluid (Saliva) testing. Oral fluid testing offers a direct correlation to recent drug use impairment, circumventing the collection challenges and privacy concerns associated with urine testing. Furthermore, advancements in sensor miniaturization and microfluidics are paving the way for highly integrated, multi-analyte portable drug testers capable of simultaneous detection of numerous drugs and alcohol from a single small sample. The convergence of IoT (Internet of Things) with these devices facilitates real-time data transmission, geolocation tagging, and automated calibration checks, significantly bolstering the reliability and forensic integrity of field-collected data.

Regional Highlights

The global Alcohol Breathalyzer and Drug Testing Market exhibits distinct regional dynamics driven by varying legislative frameworks, socio-economic development, and public health priorities. North America (NA), particularly the United States, holds the largest market share due to highly mature regulatory environments, robust enforcement by federal agencies (such as the Federal Motor Carrier Safety Administration - FMCSA), and widespread adoption of mandatory workplace testing protocols. The high volume of clinical toxicology testing, coupled with the frequent use of evidential breath testing devices by state police forces, underpins this dominance. The region also benefits from a strong presence of leading diagnostic and testing service providers, ensuring continuous investment in advanced technology and comprehensive service coverage, including intricate chain-of-custody procedures essential for legal admissibility.

Europe represents a highly fragmented yet significant market, characterized by stringent national regulations, often adhering to European Union guidelines concerning workplace safety and traffic control. Countries like Germany and the UK are major consumers of high-precision fuel cell breathalyzers for law enforcement, while Scandinavian countries lead in the adoption of interconnected, vehicle-based ignition interlock devices (IIDs). Growth in Europe is steady, supported by public procurement of screening equipment and increasing governmental funding for addressing opioid and poly-drug abuse through clinical testing programs. The emphasis here is often on harm reduction strategies alongside strict enforcement, leading to demand for both clinical-grade and preventative monitoring devices.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, driven by rapid urbanization, significant increases in vehicle populations, and subsequent governmental responses to escalating traffic accidents and industrial fatalities linked to impairment. Key drivers include the implementation of new traffic laws in populous nations such as China and India, alongside the professionalization of occupational health and safety standards in manufacturing and infrastructure sectors. While historical reliance on low-cost devices was common, the current trend shows a substantial shift towards adopting certified, high-accuracy instruments—such as advanced chromatographic systems in new forensic labs—supported by international collaboration and technological transfer from North American and European manufacturers.

Latin America and the Middle East & Africa (MEA) are emerging markets offering substantial long-term growth potential. In Latin America, economic development coupled with international pressure to curb corruption and improve safety standards is stimulating demand, particularly within mining and transportation sectors. Government investment remains erratic but targeted initiatives in major economies like Brazil and Mexico are creating specific pockets of opportunity for law enforcement equipment. The MEA region, particularly the Gulf Cooperation Council (GCC) states, shows high-value demand for advanced clinical testing services due to high-income populations and specialized healthcare infrastructure, although the cultural and religious context imposes unique constraints on certain types of mandatory testing compared to Western jurisdictions.

- North America: Dominant market share; driven by stringent DOT regulations, widespread workplace testing, and high adoption of fuel cell technology. Key countries: United States, Canada.

- Europe: Mature market with steady growth; focused on standardizing pan-European traffic safety measures and high implementation of ignition interlock devices. Key countries: Germany, UK, France.

- Asia Pacific (APAC): Fastest growing region; propelled by infrastructure development, rising traffic fatalities, and increasing corporate adoption of HSE standards. Key countries: China, India, Japan.

- Latin America (LATAM): Emerging demand primarily from mining and transportation sectors, with increasing governmental focus on public security initiatives.

- Middle East & Africa (MEA): Growing clinical toxicology demand in GCC; challenging regulatory environment but high-value niche segments in specialized testing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Alcohol Breathalyzer and Drug Testing Market, highlighting their strategic focus on product innovation, regulatory compliance, and geographic expansion to maintain competitive advantage in a highly regulated industry. These companies are continually investing in R&D to enhance sensor specificity and miniaturization of testing platforms.- Dragerwerk AG & Co. KGaA

- Lifeloc Technologies, Inc.

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings (Labcorp)

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Intoximeters, Inc.

- Securetec Detektions-Systeme AG

- Mettler-Toledo International Inc.

- Premier Biotech, Inc.

- Express Diagnostics International, Inc.

- Orasure Technologies, Inc.

- Alcohol Countermeasure Systems (ACS) Corp.

- BACTRACK, Inc.

- RMD Technology

- MPD, Inc.

- Cofain SAS

- Hanwell Solutions Ltd

- Smart Start, LLC

- Medline Industries, Inc.

Frequently Asked Questions

Analyze common user questions about the Alcohol Breathalyzer and Drug Testing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technology driving accuracy in professional breathalyzers?

The gold standard for high-accuracy, evidential breathalyzers, particularly those used by law enforcement, is Electrochemical Fuel Cell technology. These sensors are highly specific to ethanol and provide superior accuracy and long-term stability compared to less reliable semiconductor oxide sensors.

How are new synthetic drugs being detected in current testing protocols?

The detection of novel synthetic drugs (e.g., designer opioids, synthetic cannabinoids) primarily relies on advanced confirmatory methods such as Liquid Chromatography-Mass Spectrometry (LC-MS/MS). Laboratories continually update their testing panels and utilize AI-driven predictive toxicology to rapidly identify and incorporate new metabolites into testing workflows.

Which application segment accounts for the highest revenue share in the market?

The Law Enforcement segment, encompassing roadside testing, correctional facilities, and judicial monitoring, currently accounts for the largest revenue share. This is due to large-scale, mandatory governmental procurement of certified, high-volume testing devices and associated consumables necessary for public safety and evidence collection.

What are the main advantages of oral fluid (saliva) testing over traditional urine testing?

Oral fluid testing offers significant advantages, including non-invasiveness, observed collection (reducing tampering risk), and the ability to detect recent drug use more effectively, which is critical for measuring impairment in the workplace and roadside settings.

What regulatory factors are primarily influencing market growth in the Asia Pacific region?

Market growth in the APAC region is largely influenced by new governmental mandates for occupational safety and health (OSH) in rapidly industrializing sectors, coupled with stricter enforcement of traffic laws designed to reduce fatalities linked to alcohol and substance impaired driving.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager