Alcoholic Infused Sparkling Water Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434323 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Alcoholic Infused Sparkling Water Market Size

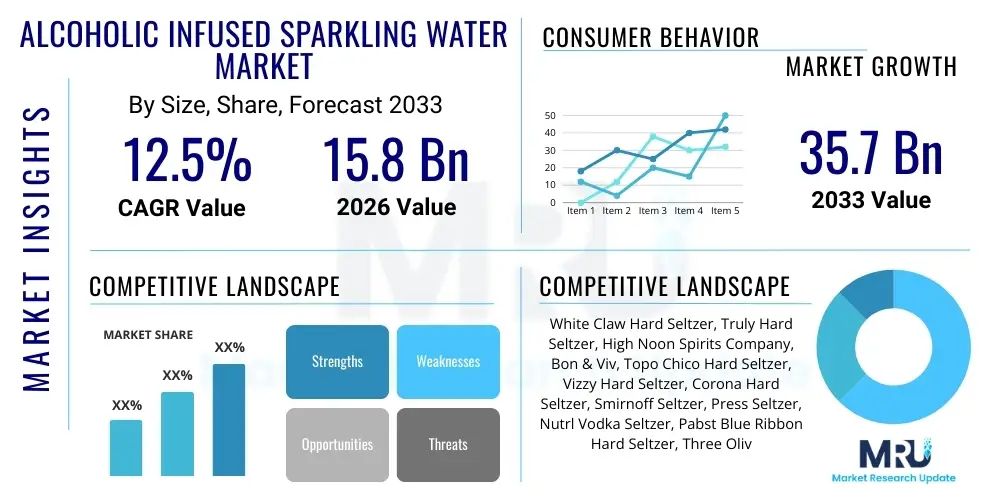

The Alcoholic Infused Sparkling Water Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 15.8 Billion in 2026 and is projected to reach USD 35.7 Billion by the end of the forecast period in 2033.

Alcoholic Infused Sparkling Water Market introduction

The Alcoholic Infused Sparkling Water Market, commonly referred to as the Hard Seltzer market, represents a rapidly evolving segment within the broader alcoholic beverage industry. These products are characterized by their low calorie count, low sugar content, and moderate alcohol by volume (ABV), typically derived from fermented cane sugar, malted barley, or sometimes neutral spirits. The core appeal lies in positioning these beverages as a healthier, more refreshing alternative to traditional beers, ready-to-drink (RTD) cocktails, and heavy mixed drinks. This innovation targets health-conscious consumers, particularly Millennials and Gen Z, who prioritize transparent ingredient labeling and lighter consumption patterns. The convenience of pre-packaged, single-serve cans further bolsters their popularity, making them ideal for social gatherings, outdoor activities, and casual consumption.

The product description centers on highly carbonated water infused with natural fruit flavors and a relatively small amount of alcohol, usually ranging from 4% to 6% ABV. Major applications include social drinking, casual occasions, and as a low-calorie substitute during fitness or wellness-focused activities where consumers seek moderate indulgence without the perceived heavy impact of traditional alcohol. The primary benefits driving market penetration include enhanced portability, gluten-free options, and alignment with modern dietary trends that favor clean labels and reduced sugar intake. The perceived transparency and simplicity of the product formulation contrast sharply with complex flavored malt beverages (FMBs) of the past, reinforcing its modern, health-oriented image.

Driving factors for this market are multifaceted, anchored by the shifting consumer preference toward moderation and well-being. Increased disposable incomes in developed economies, coupled with extensive marketing campaigns positioning hard seltzers as a lifestyle choice, significantly contribute to expansion. Furthermore, continuous innovation in flavor profiles—ranging from tropical fruits to botanical infusions—helps maintain consumer interest and prevents market stagnation. The strategic entry of major established alcohol players and beverage conglomerates, leveraging their extensive distribution networks and brand recognition, has rapidly mainstreamed the category, transforming it from a niche offering into a staple beverage choice globally, particularly in North America and Western Europe.

Alcoholic Infused Sparkling Water Market Executive Summary

The Alcoholic Infused Sparkling Water Market is defined by aggressive growth and dynamic shifts in consumer preferences, emphasizing health and convenience. Key business trends indicate intensified competition, characterized by frequent new product launches and diversification beyond traditional malt-based formulations towards spirit-based and functional seltzers incorporating elements like electrolytes or adaptogens. Major beverage corporations are heavily investing in this segment, often through acquisitions or rapid internal brand development, seeking to capture market share from established beer and FMB categories. The market is also experiencing a premiumization trend, where specialized flavors and unique alcohol bases command higher prices, driving overall market value growth despite regulatory challenges in certain jurisdictions regarding classification and taxation.

Regional trends highlight the continued dominance of North America, particularly the United States, which serves as the epicenter of innovation and consumption. However, rapid acceleration is observed in Western Europe, led by the UK and Germany, where younger demographics are quickly adopting hard seltzers as alternatives to traditional lager. The Asia Pacific region, though nascent, presents significant long-term opportunities, driven by urbanization and rising disposable incomes, with key growth focused on Australia and Japan, markets known for their receptivity to imported and novel beverage formats. Emerging markets in Latin America and MEA are beginning to see introductory launches, but market penetration remains contingent on overcoming distribution complexities and establishing regulatory frameworks favorable to new alcoholic product categories.

Segmentation trends reveal a critical shift towards the Sugar/Fruit-Fermented segment due to its clean profile and easy adherence to gluten-free demands, contrasting with the heavier regulatory burden and flavor constraints often associated with malt bases. The Canned Packaging segment maintains undisputed dominance, driven by portability and sustainability initiatives, as aluminum cans are widely recognized for their high recyclability rates. Distribution channels are seeing significant expansion in the Off-Trade sector, including grocery stores, mass merchandisers, and e-commerce platforms, reflecting the product's suitability for home consumption and casual convenience purchases. Future growth is anticipated in specialized functional hard seltzers, merging the low-calorie alcohol trend with the rapidly expanding functional beverage market.

AI Impact Analysis on Alcoholic Infused Sparkling Water Market

User queries regarding AI’s impact on the Alcoholic Infused Sparkling Water Market frequently revolve around personalization, supply chain efficiency, and demand forecasting specific to highly seasonal and volatile product lines like hard seltzers. Consumers are concerned about how AI-driven marketing might target them based on consumption habits, while businesses prioritize understanding how AI can optimize production schedules, manage complex global flavor sourcing, and accurately predict sudden shifts in local market demand, which is crucial given the rapid flavor cycle turnover inherent in the category. There is significant interest in using predictive analytics to identify emerging flavor combinations and ingredient trends (e.g., exotic fruit pairings or botanical extracts) before they become mainstream, thus gaining a critical competitive edge in product development.

Furthermore, operational inquiries often focus on leveraging AI and machine learning (ML) for enhanced quality control in the fermentation process, ensuring consistency across vast production batches necessary for market leaders. AI is critical in analyzing complex consumer feedback across social media platforms, reviews, and e-commerce data to refine marketing strategies in real-time and tailor regional promotions. This rapid feedback loop is essential for seltzer brands, which rely heavily on digital engagement and viral trends. The expectation is that AI will ultimately minimize waste, optimize inventory levels—reducing spoilage risk—and create highly personalized digital storefronts, improving the overall consumer experience from discovery to purchase.

The future application of AI is expected to extend into packaging design and sustainability tracking, optimizing material usage and tracing ingredients back to sustainable sources. As the market matures, differentiation becomes increasingly difficult based purely on taste or ABV, making the efficiency and personalization provided by AI a core strategic differentiator. Companies successfully integrating AI into their flavor R&D and supply chain logistics are projected to achieve superior margins and faster time-to-market for innovative products, solidifying AI as a necessary tool for maintaining competitive relevance in this fast-paced beverage category.

- AI optimizes flavor profile development by analyzing vast sensory data and consumer reviews, predicting successful flavor combinations.

- Predictive analytics enhance demand forecasting, particularly for highly seasonal and trend-driven seltzer lines, minimizing inventory risk.

- AI-driven supply chain management streamlines global sourcing of specialized fruit purees and flavor compounds, improving resilience.

- Machine learning algorithms enable hyper-personalized digital marketing campaigns, targeting specific demographic segments based on localized consumption data.

- Automation and quality control systems driven by AI monitor fermentation batches to ensure consistent ABV, sweetness, and clarity across production runs.

DRO & Impact Forces Of Alcoholic Infused Sparkling Water Market

The Alcoholic Infused Sparkling Water Market is characterized by robust Drivers, significant Restraints, and numerous Opportunities, all influenced by powerful Impact Forces shaping its trajectory. The primary driver is the pervasive global health and wellness trend, pushing consumers away from high-calorie, sugary beverages toward lighter alcohol options that align with 'better-for-you' positioning. Coupled with this is the convenience factor, as the product is primarily sold in portable cans, catering to modern lifestyles that prioritize ease of consumption and mobility. The opportunity landscape is vast, centered on product innovation, particularly the integration of functional benefits, such as vitamins, probiotics, or performance-enhancing ingredients, transforming the beverage into a hybrid product occupying the space between alcohol and wellness drinks. This market is highly sensitive to regulatory changes concerning alcohol advertising, taxation, and ingredient classification, which act as primary restraints. Intense competition from both established global brewers and nimble craft producers further pressurizes pricing and necessitates constant, expensive innovation cycles.

Key impact forces include shifts in demographic consumption patterns, particularly the preference of younger generations (Gen Z) for moderate, flavorful, and low-ABV drinks over traditional beer. Technological advancements in fermentation science allow producers to create cleaner, more natural-tasting alcohol bases without relying solely on malt, thereby expanding the market's technological feasibility and flavor diversity. Regulatory pressure is a constant impact force; for instance, differing regulations between states or countries regarding whether a seltzer must be taxed as a beer, wine, or spirit significantly impacts pricing and profitability. Economically, the market benefits from stable consumer spending on premium leisure goods but is vulnerable to inflationary pressures impacting aluminum can costs and raw material sourcing.

The competitive rivalry within this market is extremely high, driving down the profit potential for smaller entrants but forcing major players to continuously invest in aggressive marketing and extensive distribution. The threat of substitutes remains moderate but persistent, mainly coming from low-ABV beers, non-alcoholic functional beverages, and premium mixers designed for low-calorie cocktails. However, the high brand loyalty established by early market leaders, coupled with the unique flavor profile and perceived lightness of hard seltzers, provides a strong barrier against these substitutes. Suppliers wield limited power due to the standardized nature of core ingredients (water, sugar, flavorings), yet specialized flavor houses and unique extract providers for premium products may exert moderate influence on innovation costs. Buyers possess high power due to the wide array of competing brands and price sensitivity, demanding constant value addition and variety from manufacturers.

Segmentation Analysis

The Alcoholic Infused Sparkling Water Market is comprehensively segmented based on Type, ABV Level, Packaging, and Distribution Channel, reflecting the diverse consumer preferences and varied operational strategies within the industry. Understanding these segments is crucial for manufacturers to tailor their product offerings, marketing efforts, and distribution logistics effectively. The segmentation by Type, distinguishing between Malt-Based, Sugar/Fruit-Fermented, and Spirit-Based seltzers, highlights the regulatory and technical distinctions in production, directly influencing taste profiles and tax structures. The growing consumer demand for lighter, cleaner tastes has pushed the fermented sugar and spirit-based segments to the forefront of growth, challenging the traditional dominance of malt-based products.

Further granularity is achieved through segmentation by ABV Level, ranging from low (under 4%) to standard (4%-6%) and high (above 6%). The standard ABV range commands the majority market share, aligning with typical consumer expectations for a sessionable beverage. However, the high ABV segment is rapidly expanding, catering to consumers seeking stronger alcoholic alternatives that still retain the seltzer's characteristic low-calorie profile. Segmentation by Packaging underscores the importance of convenience and sustainability, with aluminum cans overwhelmingly dominating the market due to their lightweight nature, quick chilling capability, and strong recycling credentials, essential features for the target demographic.

Finally, distribution channel analysis separates On-Trade (bars, restaurants) and Off-Trade (retail, e-commerce) sales. The Off-Trade channel holds the largest volume share, driven by bulk purchases for home consumption and social gatherings. However, On-Trade locations are vital for brand discovery and image building, providing critical consumer trial opportunities. Manufacturers are increasingly focused on optimizing their e-commerce strategy within the Off-Trade channel, utilizing data analytics to forecast local demand and manage temperature-sensitive logistics, maximizing market reach and ensuring competitive pricing across all relevant purchasing points.

- Type

- Malt-Based

- Sugar/Fruit-Fermented

- Spirit-Based

- ABV Level

- Low (Under 4% ABV)

- Standard (4% - 6% ABV)

- High (Above 6% ABV)

- Packaging

- Cans (Standard 12oz/355ml)

- Bottles (Less common, usually for premium or specialty lines)

- Other (Kegs for On-Trade)

- Distribution Channel

- On-Trade (Bars, Restaurants, Hotels)

- Off-Trade (Retail Stores, Supermarkets, E-commerce, Liquor Stores)

- Flavor Category

- Citrus

- Berry

- Tropical

- Variety/Mixed Packs

Value Chain Analysis For Alcoholic Infused Sparkling Water Market

The value chain for the Alcoholic Infused Sparkling Water Market is characterized by a relatively straightforward production process but complex distribution networks due to the perishable nature and highly regulated sale of alcoholic beverages. Upstream activities primarily involve sourcing core ingredients: high-purity water, cane sugar or malt, yeast strains for fermentation, and natural fruit flavorings or extracts. The initial production phase, whether fermentation or blending with a neutral spirit, is critical for achieving the desired clean taste and consistency. Efficiency in sourcing and ingredient preparation directly impacts the final product quality and cost competitiveness. Suppliers of specialized extracts, particularly natural, high-quality flavor houses, hold a moderate amount of power due to the importance of unique flavor differentiation in this crowded market.

Midstream processes focus on manufacturing, including fermentation, filtration, carbonation, blending, and crucially, canning. This stage demands significant capital investment in high-speed canning lines, which are necessary to meet the enormous volume demands of major brands. Strict quality control, including testing for ABV accuracy and microbiological purity, is paramount. Downstream activities are dominated by distribution. The alcoholic beverage industry relies on three-tier systems in many key markets (like the US), necessitating careful management of wholesalers and distributors. Direct-to-consumer (DTC) channels, though growing through e-commerce, face regulatory barriers that limit full implementation, pushing most volume through established Off-Trade retailers like grocery chains and liquor stores.

Distribution channels are multifaceted, utilizing both direct sales to large retailers (where permitted) and indirect methods through authorized distributors. Direct sales offer higher margins and greater control over inventory and shelf placement but are often limited geographically. Indirect channels, managed by specialized alcohol wholesalers, are essential for reaching disparate On-Trade locations and smaller independent retailers. The heavy reliance on Off-Trade retailers means that brand visibility, strategic shelving (e.g., adjacent to beer or soft drinks), and competitive pricing determined by efficient supply chain logistics are crucial factors driving purchasing decisions by the end consumer.

Alcoholic Infused Sparkling Water Market Potential Customers

The core customer base for Alcoholic Infused Sparkling Water is predominantly the young adult demographic, specifically Millennials (28-43 years old) and Gen Z (18-27 years old). These groups prioritize lifestyle choices that balance indulgence with health consciousness, seeking beverages that are sessionable, low in sugar, and transparently labeled. They are generally experimental with flavors and highly responsive to digital marketing and social media trends, viewing hard seltzers as a modern, sophisticated, and less heavy alternative to traditional beer or sugary cocktails. These buyers value convenience, often purchasing multi-packs for immediate consumption at casual social events, outdoor activities, or while entertaining at home.

A secondary, but rapidly growing, segment includes older consumers (Gen X and early Boomers) who are increasingly adopting healthier consumption habits and appreciate the low-calorie nature of the product. This segment often purchases hard seltzers as a daytime or early evening drink replacement for wine or light beer. They are motivated less by trendy flavors and more by established brand trust and consistent quality. This group often utilizes the Off-Trade channel, particularly large grocery stores, and responds well to promotions focused on value and health attributes rather than trendiness or social cachet.

In terms of purchasing behavior, potential customers are highly price elastic within the category but loyal to specific leading brands that maintain consistent flavor profiles and messaging. They are sensitive to ingredient sourcing, favoring brands that emphasize natural flavorings and clean alcohol bases. Key end-users include individual consumers buying for personal consumption (the largest segment), hosts purchasing beverages for gatherings, and establishments within the On-Trade sector (bars, restaurants, and event venues) that need light, refreshing options that are easy to stock and serve quickly, catering to a broad array of patron preferences.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 Billion |

| Market Forecast in 2033 | USD 35.7 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | White Claw Hard Seltzer, Truly Hard Seltzer, High Noon Spirits Company, Bon & Viv, Topo Chico Hard Seltzer, Vizzy Hard Seltzer, Corona Hard Seltzer, Smirnoff Seltzer, Press Seltzer, Nutrl Vodka Seltzer, Pabst Blue Ribbon Hard Seltzer, Three Olives Vodka Seltzer, Loverboy, San Juan Seltzer, Crook & Marker, Sercy Spiked & Sparkling, Fick's Hard Seltzer, Wild Basin Hard Seltzer, Willie's Superbrew. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Alcoholic Infused Sparkling Water Market Key Technology Landscape

The technology landscape underpinning the Alcoholic Infused Sparkling Water Market is characterized by advancements in fermentation science, specialized filtration processes, and high-speed packaging automation. A critical technological development involves the use of specialized, clean-fermenting yeast strains and specific nutrient protocols that allow producers to ferment cane sugar or similar substrates efficiently, yielding a clean, neutral-tasting alcohol base with minimal off-flavors. This "clean fermentation" technology is essential because the low sugar and flavor content of the final product offers little masking for residual fermentation byproducts. Sophisticated reverse osmosis and multi-stage filtration systems are subsequently employed to ensure the water purity is maximized and any residual particulates or color are removed before the final blending and carbonation stages, guaranteeing product clarity and consistency.

Another crucial area is the high-precision blending and carbonation equipment required to achieve the perfect balance of flavor, sweetness (often managed with non-caloric sweeteners), and effervescence. Brands are investing in precise dosing technologies to ensure that the delicate natural flavorings are accurately incorporated and consistent across billions of cans. Furthermore, the reliance on aluminum cans necessitates high-speed, aseptic canning lines capable of managing the high carbonation levels inherent in sparkling water products. These lines must also integrate advanced quality assurance technologies, such as fill-level inspection systems and seam integrity checks, crucial for maintaining product quality and shelf stability throughout the complex distribution cycle, especially given the rapid turnover and high volume expected in the market.

Beyond the physical manufacturing process, information technology plays a foundational role in market success. Advanced Enterprise Resource Planning (ERP) systems and Supply Chain Management (SCM) platforms are necessary to handle the volatile demand and complex inventory requirements associated with multiple flavor SKUs and seasonal trends. The incorporation of IoT sensors within manufacturing facilities allows for real-time monitoring of fermentation tanks and packaging lines, optimizing operational efficiency and minimizing waste. Furthermore, proprietary data analytics tools are being developed by market leaders to analyze consumer point-of-sale data, social media sentiment, and flavor trends, providing a technological feedback loop that directly informs new product development, enabling manufacturers to rapidly pivot their flavor offerings to meet rapidly shifting consumer demand signals.

Regional Highlights

- North America: North America, particularly the United States, remains the undisputed global leader in consumption and innovation for alcoholic infused sparkling water. The market is highly saturated and competitive, driven by aggressive marketing from major brewers like Mark Anthony Brands (White Claw) and Boston Beer Company (Truly). High consumer acceptance stems from strong health and wellness trends, leading to a shift away from traditional beer. The region is characterized by continuous product diversification, including the rapid expansion of spirit-based seltzers (vodka, tequila) and functional seltzers, commanding premium price points.

- Europe: Europe represents the fastest-growing emerging market for hard seltzers, though starting from a lower base than North America. Key growth countries are the UK, Ireland, and Germany. Adoption is driven by younger consumers seeking low-calorie, low-ABV options for social occasions. Market expansion is challenged by varying regulatory frameworks regarding alcohol taxation and classification (beer vs. FMB vs. spirit), which can complicate cross-border distribution and brand standardization. Local European brands are emerging, often focusing on premium ingredients and organic certification to differentiate themselves.

- Asia Pacific (APAC): The APAC market is fragmented but holds significant future potential, with Australia and Japan being the most mature segments due to existing high-consumption rates of RTDs and novel alcoholic beverages. South East Asia and China are nascent, with growth tied to rising middle-class disposable income and increasing Westernization of drinking culture. The challenge lies in adapting flavor profiles to local preferences and overcoming complex import duties and distribution limitations in mainland regions. Canned packaging is especially favored due to convenience in dense urban environments.

- Latin America (LATAM): Growth is gradual but steady, concentrated primarily in Mexico and Brazil. Market penetration is closely linked to the success of imported US brands establishing initial consumer awareness. Local production is beginning to emerge, often utilizing indigenous fruit flavors. The market faces constraints related to high taxation on imported goods and a strong existing cultural preference for beer and traditional spirits, requiring targeted marketing efforts focused on the refreshing and light characteristics of seltzers.

- Middle East and Africa (MEA): This region exhibits the slowest adoption rate due to strong cultural and religious restrictions on alcohol consumption in many territories. The growth is confined almost entirely to cosmopolitan centers and expatriate communities in countries like the UAE and South Africa, where international beverage trends have a foothold. Products are typically positioned as premium imports, focusing on quality and specific targeting of the tourist and high-end hospitality sectors, with limited mass-market appeal expected in the near term.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Alcoholic Infused Sparkling Water Market.- White Claw Hard Seltzer (Mark Anthony Brands International)

- Truly Hard Seltzer (The Boston Beer Company)

- High Noon Spirits Company (E. & J. Gallo Winery)

- Bon & Viv (Anheuser-Busch InBev)

- Topo Chico Hard Seltzer (Molson Coors Beverage Company)

- Vizzy Hard Seltzer (Molson Coors Beverage Company)

- Corona Hard Seltzer (Constellation Brands)

- Smirnoff Seltzer (Diageo PLC)

- Nutrl Vodka Seltzer (Anheuser-Busch InBev)

- Press Seltzer

- Pabst Blue Ribbon Hard Seltzer

- Three Olives Vodka Seltzer (Proximo Spirits)

- San Juan Seltzer

- Loverboy

- Crook & Marker

- Fick's Hard Seltzer

- Wild Basin Hard Seltzer (Oskar Blues Brewery)

- Sercy Spiked & Sparkling

- Nude Beverages

- Arctic Summer Hard Seltzer

Frequently Asked Questions

Analyze common user questions about the Alcoholic Infused Sparkling Water market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of the Alcoholic Infused Sparkling Water market growth?

The market is primarily driven by the increasing global demand for low-sugar, low-calorie alcoholic alternatives, aligning with prevailing health and wellness consumer trends. Convenience, portability, and the strong preference among Millennials and Gen Z for transparent ingredient labeling also significantly contribute to rapid expansion.

How do spirit-based seltzers compare to malt-based seltzers?

Spirit-based seltzers (often utilizing vodka or tequila) generally offer a cleaner, purer flavor profile compared to malt-based seltzers, which can sometimes retain residual beer-like notes. Spirit-based products often command a premium price and are subject to different regulatory and taxation classifications than FMBs (Flavored Malt Beverages).

Which geographical region dominates the consumption of hard seltzers?

North America, specifically the United States, holds the largest market share and drives global innovation. However, Europe, particularly the United Kingdom, is projected to exhibit the highest future growth rate as the category gains mainstream acceptance outside of its initial key market.

What is the current trend regarding flavor innovation in the hard seltzer market?

Current flavor innovation focuses on sophisticated, complex, and exotic combinations beyond simple fruits, including botanical infusions (e.g., cucumber, basil), spicy notes, and increasingly, functional ingredients like electrolytes or caffeine, blurring the lines between alcohol and health-focused beverages.

What role does e-commerce play in the distribution of alcoholic infused sparkling water?

E-commerce is a rapidly growing distribution channel, especially within the Off-Trade segment, providing essential convenience and reach. While regulatory hurdles exist for direct-to-consumer sales in many regions, online platforms are vital for personalized marketing and efficient inventory management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager