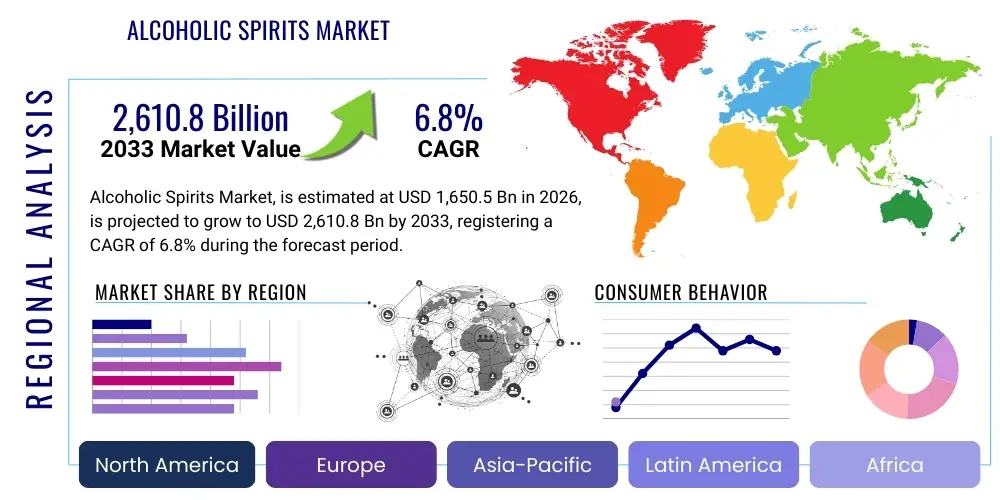

Alcoholic Spirits Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437634 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Alcoholic Spirits Market Size

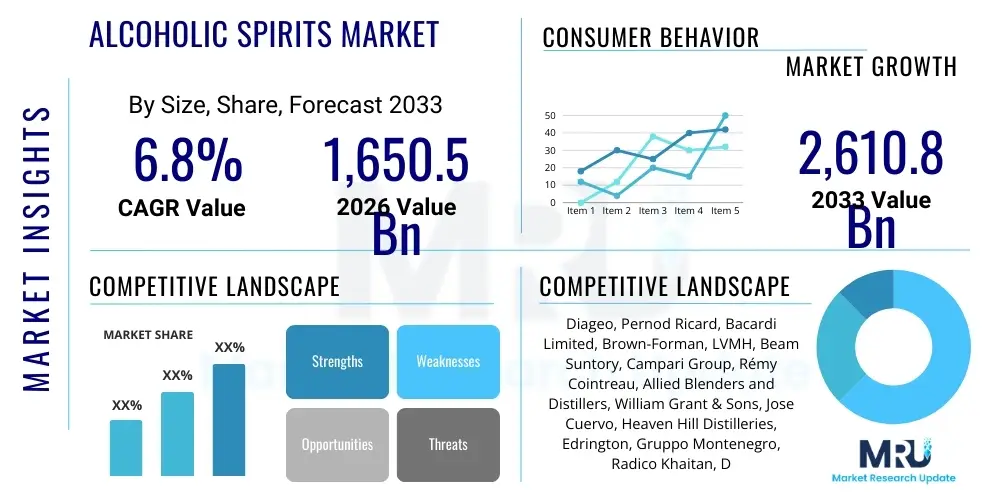

The Alcoholic Spirits Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1,650.5 Billion in 2026 and is projected to reach USD 2,610.8 Billion by the end of the forecast period in 2033.

Alcoholic Spirits Market introduction

The Alcoholic Spirits Market encompasses a wide variety of distilled beverages characterized by high ethanol content, including whiskey, vodka, rum, gin, tequila, and brandy. These products are consumed globally across diverse demographics and occasions, ranging from casual social gatherings to formal celebrations. The product scope extends beyond traditional offerings to include flavored spirits, craft distillates, and ready-to-drink (RTD) spirit cocktails, reflecting evolving consumer preferences for novelty and convenience. Major applications center on direct consumption (neat, on the rocks, or mixed) in both on-trade establishments (bars, restaurants) and off-trade channels (retail stores, e-commerce platforms). The enduring appeal of spirits is rooted in their cultural significance, complexity of flavor profiles, and perception of luxury or quality, particularly within the super-premium segments.

The primary benefits driving market expansion include the premiumization trend, where consumers increasingly opt for higher-priced, higher-quality, and niche products, often associated with specific origins, limited editions, or artisanal production methods. Furthermore, the rising disposable income in emerging economies coupled with growing urbanization is fueling increased consumption. Spirits offer versatility in cocktail creation, which appeals heavily to younger, experimental demographics seeking unique experiences. The shift towards consumption moderation, where quality is prioritized over quantity, also benefits high-end spirits, as consumers seek distinctive and memorable drinking occasions.

Key driving factors supporting the sustained growth of the alcoholic spirits sector include robust innovation in flavor profiles, sustainable packaging initiatives, and effective digital marketing campaigns targeting specific consumer lifestyle segments. The rapid expansion of e-commerce platforms and efficient direct-to-consumer (DTC) models, accelerated by recent global events, has dramatically improved market reach and accessibility. Moreover, the increasing demand for specific categories such as tequila and mezcal, driven by their authenticity and cultural cachet, and the global resurgence of gin, supported by botanical experimentation, continuously inject vitality into the market landscape, ensuring structural expansion across key international territories.

Alcoholic Spirits Market Executive Summary

The Alcoholic Spirits Market is characterized by intense competition and dynamic shifts driven primarily by global premiumization and the rise of niche categories. Current business trends highlight consolidation among major international players who are strategically acquiring successful craft distilleries and smaller regional brands to diversify portfolios and capture localized consumer trends. A significant operational shift involves supply chain modernization, with companies investing heavily in automation and traceability technologies to enhance quality control and meet sustainability mandates, crucial components for maintaining brand equity in the luxury segment. Furthermore, the sustained focus on health and wellness is compelling producers to innovate within the low-alcohol and no-alcohol spirit alternatives, catering to mindful consumption patterns while still engaging consumers with complex flavor profiles.

Regionally, the market exhibits divergent growth trajectories. Asia Pacific (APAC), particularly China and India, represents the fastest-growing region, fueled by massive population growth, expanding middle-class income, and the increasing acceptance of Western spirit types like whiskey and vodka, often displacing traditional local beverages. North America and Europe, while mature, remain critical markets for value growth, dominated by the super-premium and ultra-premium segments. The resurgence of cocktail culture in key metropolitan areas across the globe, coupled with regulatory relaxations concerning alcohol distribution, particularly in emerging markets, dictates regional investment strategies focused on localized production and culturally resonant marketing efforts to maximize market penetration.

Segment trends demonstrate strong performance across specific spirit types, notably Tequila and American Whiskey. Tequila's growth is phenomenal, moving beyond regional identity to become a globally recognized, high-end spirit, driven by celebrity endorsements and strong premium positioning. In terms of distribution, the off-trade segment (especially e-commerce and large retail chains) has gained substantial prominence, outpacing traditional on-trade channels, although on-trade remains vital for brand visibility, experiential marketing, and introducing new premium products. The category split shows relentless migration towards the Premium and Super-Premium tiers, indicating a persistent consumer willingness to spend more for perceived quality, superior ingredients, and authentic brand narratives, thereby significantly enhancing overall market value despite potentially lower volume growth in standard categories.

AI Impact Analysis on Alcoholic Spirits Market

User inquiries concerning AI's impact on the spirits industry frequently center on how technology can enhance personalization, optimize supply chain efficiency, and revolutionize consumer engagement. Common questions revolve around AI-driven flavor development (Can AI create the next best-selling spirit?), predictive analytics for inventory management (How does machine learning minimize waste and overstocking?), and hyper-personalized marketing campaigns (How can AI identify high-value consumer niches?). There is also significant interest in using AI to combat counterfeiting and ensure product authenticity, a crucial issue for high-value aged spirits. The overarching thematic consensus is that AI is moving beyond simple automation to become a strategic tool for innovation, market forecasting, and highly customized customer experience creation, necessitating significant investment in data infrastructure and specialized analytical talent within traditional distilleries and distribution networks.

The spirits industry, traditionally reliant on heritage and artisanal processes, is leveraging AI to introduce scientific rigor into subjective areas like blending and aging. AI algorithms analyze vast datasets related to climate variables, barrel characteristics, and consumer sensory feedback to optimize maturation processes, predict the best time for bottling, and even suggest novel flavor combinations that appeal to specific regional palates. This predictive capability reduces the inherent risks associated with long aging cycles (especially for whiskey and brandy), ensuring consistent quality and maximizing the return on decades-long investments. This application of AI is instrumental in accelerating product development cycles for new ready-to-drink options and flavored spirits, allowing companies to respond rapidly to fleeting market trends.

Furthermore, AI significantly transforms the retail and logistics aspects of alcoholic spirits distribution. Machine learning models predict demand fluctuations with higher accuracy than traditional forecasting methods, optimizing the stock levels required at various points in the distribution chain—from factory warehouse to local liquor store shelves. This efficiency is critical for managing perishable stock (low-alcohol variants) and high-value, limited-supply items (ultra-premium releases). In terms of customer experience, AI powers sophisticated chatbots and personalized recommendation engines on e-commerce platforms, guiding consumers through complex product choices based on past purchases, preference mapping, and real-time behavioral analysis, thereby improving conversion rates and fostering deeper brand loyalty.

- AI-driven Predictive Demand Forecasting and Inventory Optimization.

- Machine Learning applied to optimize spirit maturation and aging processes (e.g., barrel selection, climate control).

- Use of Big Data analytics for hyper-personalized marketing and consumer segment targeting.

- Enhanced Anti-Counterfeiting measures using AI-powered blockchain and image recognition systems for high-end brands.

- Automation of tasting notes analysis and quality control through sensory data processing.

- Development of novel flavor profiles and spirit combinations using generative AI models.

DRO & Impact Forces Of Alcoholic Spirits Market

The Alcoholic Spirits Market operates under a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant impact forces. Key drivers include the global phenomenon of premiumization, coupled with increasing consumer experimentation across different spirit categories, particularly among millennials and Generation Z. The structural shift towards cocktail culture and the continuous stream of product innovations, such as limited-edition releases and bespoke flavor infusions, maintain high consumer engagement and justify premium pricing. Opportunities are largely concentrated in emerging markets where consumption levels are lower but disposable incomes are rapidly rising, presenting significant untapped potential for global brands to establish dominance through targeted distribution and accessible product lines. Additionally, the digital transformation of retail offers a crucial opportunity to bypass traditional distribution hurdles and engage directly with consumers, particularly in areas with strict physical retail limitations.

However, the market faces stringent restraints, most notably the heavy governmental taxation and complex regulatory frameworks that vary significantly by country, affecting pricing strategy, market entry, and advertising rules. Health concerns regarding excessive alcohol consumption and the growing anti-alcohol movement impose significant societal pressure, leading to strict marketing regulations and driving the rise of "dry January" and similar moderation trends, which restrain volume growth. The market is also highly sensitive to commodity price volatility (e.g., grains, agave) and supply chain disruptions, which can impact production costs and the consistency of high-quality ingredients, particularly challenging for categories like whiskey that require long-term planning and storage.

The impact forces are profoundly shaped by consumer behavior shifts toward authenticity and sustainability. Brands that successfully integrate ethical sourcing, transparent production methods, and environmentally friendly packaging gain a competitive edge, driving market momentum toward responsible consumption. The competitive landscape, dominated by a few multinational conglomerates, exerts strong pressure on smaller players, necessitating continuous innovation and highly specialized niche focus for craft distillers to survive and thrive. Overall market direction is dictated by a strategic balancing act between capitalizing on premiumization drivers and mitigating the regulatory and health-related restraints through proactive product diversification into low and non-alcoholic alternatives.

Segmentation Analysis

The Alcoholic Spirits Market segmentation offers granular insights into consumer preference and commercial viability across various product types, distribution models, and pricing tiers. Analyzing these segments is essential for multinational corporations and niche producers alike to tailor their product offerings, optimize supply chain logistics, and implement effective regional marketing strategies. The market is fundamentally segmented by the type of spirit (e.g., whiskey, vodka, gin), reflecting distinct production processes and core consumer demographics. Further critical segmentation occurs across distribution channels, distinguishing between highly regulated on-trade environments (bars, hotels) crucial for brand experience, and high-volume off-trade sales (retail, e-commerce) vital for accessibility and immediate consumption. The economic health of the market is best measured by the Category segmentation, which tracks consumer willingness to trade up from Standard to Premium and Super-Premium price points, confirming the dominance of value-driven growth over mere volume expansion.

- By Type:

- Whiskey (Scotch, Bourbon, Rye, Irish, Japanese, Others)

- Vodka

- Rum

- Gin

- Tequila and Mezcal

- Brandy (Cognac, Armagnac, Others)

- Others (Liqueurs, Shochu, Specialty Spirits)

- By Distribution Channel:

- On-Trade (Bars, Restaurants, Hotels)

- Off-Trade (Retail Stores, Supermarkets, E-commerce)

- By Category/Price Point:

- Standard

- Premium

- Super-Premium/Luxury

Value Chain Analysis For Alcoholic Spirits Market

The value chain for the Alcoholic Spirits Market begins with rigorous upstream activities, primarily involving the sourcing and cultivation of raw materials such as grains (barley, corn, rye), sugarcane, grapes, or agave, depending on the spirit type. This stage requires significant contractual agreements and quality control measures to ensure consistency in feedstock, which directly impacts the final product profile. Upstream analysis also includes the crucial activities of malting, fermentation, and distillation, processes that are increasingly optimized using advanced technology to enhance efficiency and maintain high purity levels. For aged spirits like whiskey and brandy, the procurement and management of high-quality oak barrels and dedicated warehousing facilities form a specialized and capital-intensive component of the upstream supply chain, dictating years of operational commitment before product monetization.

The midstream segment of the value chain focuses on blending, flavoring, and bottling. Blending is an art and science, often involving master blenders who maintain brand consistency across batches, especially for non-vintage or blended products. Packaging design, material sourcing, and bottling operations are critical for both brand perception and regulatory compliance, with high-end spirits demanding intricate and often bespoke packaging to justify their price point. Downstream analysis is concerned with the efficient movement of finished goods through complex distribution channels. Distribution typically involves a three-tier system in key markets like the United States (producer, distributor, retailer), while other markets allow for more direct routes. Navigating customs, duties, and excise taxes across international borders adds significant complexity and cost to the downstream logistics.

Distribution channels are broadly categorized as direct and indirect. Direct distribution, although limited by regulation in many jurisdictions, involves selling directly to consumers via distillery stores or dedicated e-commerce platforms, offering higher margins and direct consumer data acquisition. Indirect distribution dominates the market, relying heavily on wholesale distributors who manage logistics, inventory, and sales to both on-trade and off-trade retailers. The rise of e-commerce as an indirect channel has rapidly transformed the downstream landscape, requiring spirits producers to invest in digital shelf presence and managing complex "last mile" delivery solutions while ensuring strict adherence to age-verification protocols, fundamentally reshaping how products reach the ultimate consumer.

Alcoholic Spirits Market Potential Customers

Potential customers, or end-users and buyers, in the Alcoholic Spirits Market are highly diversified, segmented not only by age and geography but increasingly by psychographic profiles related to consumption occasion, preference for authenticity, and willingness to pay for premium attributes. Historically, key buyers have included established on-trade venues like high-end cocktail bars, nightclubs, and luxury hotels, which are instrumental in driving trial and establishing brand prestige, often purchasing in bulk through specialized procurement contracts. However, the largest volume of sales consistently flows through off-trade buyers, including national supermarket chains, large specialized liquor retailers, and increasingly, subscription box services, which cater to at-home consumption and convenience-seeking consumers who prioritize value and accessibility.

The consumer base itself is rapidly evolving, moving beyond traditional demographics. Millennials and Generation Z represent a critical growth segment, driven by curiosity, a desire for experiential consumption, and high loyalty to brands with compelling ethical and sustainable narratives. These younger consumers are key drivers behind the growth of categories like Tequila and premium Gin, and they are highly engaged through digital channels. Another crucial segment includes the discerning collectors and affluent consumers who target Super-Premium and Ultra-Premium spirits, such as rare Scotch whiskies or high-end Cognacs. These purchases are often investment-driven or reserved for significant gifting occasions, requiring specialized marketing focused on exclusivity, heritage, and limited availability.

Furthermore, the hospitality sector remains a foundational customer segment. Beyond traditional bars, cruise lines, airlines, and corporate event organizers are substantial buyers, requiring customized packaging and distribution solutions. The growing global tourist trade also significantly influences consumption patterns in duty-free zones and international travel retail, creating a specialized customer type focused on unique, travel-exclusive offerings. Understanding these varied end-users—from the mass-market grocery buyer to the high-net-worth collector and the global hospitality procurement manager—is vital for tailoring product size, pricing strategy, and promotional effort across the intricate web of global distribution.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,650.5 Billion |

| Market Forecast in 2033 | USD 2,610.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Diageo, Pernod Ricard, Bacardi Limited, Brown-Forman, LVMH, Beam Suntory, Campari Group, Rémy Cointreau, Allied Blenders and Distillers, William Grant & Sons, Jose Cuervo, Heaven Hill Distilleries, Edrington, Gruppo Montenegro, Radico Khaitan, Distell Group, Patron Spirits International, Suntory Holdings. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Alcoholic Spirits Market Key Technology Landscape

The Alcoholic Spirits Market is increasingly adopting advanced technologies across the entire production and supply chain to improve efficiency, ensure quality, and enhance consumer engagement. In the production phase, the implementation of sophisticated monitoring systems, including automated sensors and IoT devices, allows for precise control over fermentation temperature, distillation cuts, and maturation environmental conditions. This level of precision is critical for maintaining the consistent flavor profile demanded by premium consumers, especially in long-aged categories like Scotch and Bourbon. Furthermore, sustainable production technologies, such as advanced water recycling systems and energy-efficient distilling equipment (like heat recovery units), are becoming standard, driven by corporate social responsibility goals and rising utility costs, fundamentally changing the traditional energy-intensive processes of distilleries.

Technology plays a paramount role in ensuring brand protection and enhancing supply chain transparency for high-value spirits. Blockchain technology is emerging as a critical tool, providing immutable records of a product's journey from grain to glass. This ledger system allows both producers and consumers to verify the authenticity and origin of super-premium bottles, combating the pervasive issue of counterfeiting, which erodes brand trust and market value. Alongside blockchain, advanced track-and-trace solutions utilizing specialized QR codes and near-field communication (NFC) tags are integrated into luxury packaging, offering real-time data on location and handling, thereby ensuring product integrity throughout complex global logistics networks and providing consumers with engaging content about the product's story.

Consumer interaction and marketing are heavily influenced by digital technology. Companies are utilizing Virtual Reality (VR) and Augmented Reality (AR) to offer immersive brand experiences, such as virtual distillery tours or interactive cocktail mixing tutorials, overcoming geographical barriers and enhancing consumer loyalty. E-commerce platforms are leveraging sophisticated customer relationship management (CRM) software integrated with predictive analytics to forecast purchasing behavior and personalize promotions, drastically improving conversion rates in the off-trade channel. The combination of data science for demand forecasting and advanced logistics software for efficient shipping allows companies to manage the volatile regulatory environment surrounding direct-to-consumer sales while meeting high consumer expectations for rapid and reliable delivery of their preferred spirits.

Regional Highlights

Regional dynamics within the Alcoholic Spirits Market are highly diverse, reflecting varying consumer cultures, regulatory environments, and economic growth rates. Asia Pacific (APAC) stands out as the primary growth engine, driven by the sheer scale of the consumer base in countries like China and India, where Western spirit consumption is rapidly mainstreaming, particularly within younger, affluent urban populations. The region shows high demand for imported whiskey (Scotch and American) and premium vodka, though local rice spirits and other traditional beverages still maintain significant cultural relevance. Market penetration in APAC is heavily reliant on effective distribution partnerships and culturally localized marketing campaigns that respect local traditions while introducing new consumption rituals. Regulatory harmonization across ASEAN nations remains a challenge, but the overall economic uplift ensures robust long-term market expansion.

North America (NA), particularly the United States, remains the largest market in terms of value, defined by the relentless drive towards premiumization and category experimentation. American Whiskey (Bourbon, Rye) is experiencing a global renaissance, while Tequila and Mezcal consumption has surged, often displacing traditional white spirits. The U.S. market is characterized by a strong cocktail culture, high disposable incomes, and a highly competitive, innovation-focused craft distillery segment. Regulatory complexities, particularly the three-tier distribution system, shape how products are launched and sold, demanding sophisticated lobbying and distribution strategies. Consumers in NA exhibit high engagement with direct-to-consumer digital channels where permissible, prioritizing convenience and access to specialized, high-end releases.

Europe represents a mature yet dynamic market, anchored by established consumption patterns in Western Europe (e.g., France for Cognac, UK for Scotch and Gin). While volume growth is generally stable or slow, value growth is strong, fueled by premiumization, particularly in the gin category, which continues its botanical and geographical diversification across the continent. Eastern Europe offers volume potential as economies mature, driving demand for affordable, high-quality spirits. Latin America shows significant potential, primarily driven by strong indigenous categories like Tequila (Mexico) and Cachaca (Brazil), alongside rising demand for imported luxury goods. The Middle East and Africa (MEA) remain challenging due to cultural and regulatory restrictions in many nations, yet key tourist destinations and wealthy metropolitan areas drive a niche but valuable market for luxury and travel retail consumption, requiring highly specialized distribution and inventory management.

- North America: Dominant market in value; strong growth in Tequila, Mezcal, and high-end American Whiskey; driven by sophisticated cocktail culture and premiumization.

- Asia Pacific (APAC): Fastest volume and value growth market; immense potential in China and India; increasing acceptance of international spirits like Scotch and Vodka; high reliance on traditional off-trade retail and evolving e-commerce.

- Europe: Mature market characterized by strong premiumization (especially in Gin and Scotch); high regulatory burden; focus on sustainability and craft production across established Western European economies.

- Latin America: Regional stronghold for Tequila, Mezcal, and Rum; high potential driven by increasing middle-class populations and improving economic conditions, particularly in urban centers.

- Middle East and Africa (MEA): Niche, high-value market concentrated in travel retail, expatriate communities, and permissive regulatory zones; highly sensitive to geopolitical stability and religious customs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Alcoholic Spirits Market.- Diageo

- Pernod Ricard

- Bacardi Limited

- Brown-Forman

- LVMH (Moët Hennessy)

- Beam Suntory

- Campari Group

- Rémy Cointreau

- Allied Blenders and Distillers (ABD)

- William Grant & Sons

- Jose Cuervo

- Heaven Hill Distilleries

- Edrington

- Gruppo Montenegro

- Radico Khaitan

- Distell Group

- Patron Spirits International

- Suntory Holdings

- Constellation Brands

- Tito's Handmade Vodka

Frequently Asked Questions

Analyze common user questions about the Alcoholic Spirits market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Super-Premium spirits category globally?

The growth of the Super-Premium category is primarily driven by the 'drink less, drink better' consumer mindset, increasing disposable incomes in emerging markets, and a strong preference for authentic, artisanal products. Premium brands often offer superior ingredient quality, unique packaging, and a compelling heritage narrative that consumers are willing to pay a premium for, especially for gifting and special occasions.

How is e-commerce changing the distribution landscape for alcoholic spirits?

E-commerce is revolutionizing distribution by providing direct-to-consumer (DTC) opportunities where legal, expanding geographic reach, and offering greater selection, particularly for specialty and craft spirits. Digital platforms use advanced analytics for personalized recommendations and efficient fulfillment, shifting purchasing behavior from traditional retail toward convenience and curated online experiences, fundamentally lowering barriers to market entry for new brands.

Which spirit type is currently exhibiting the highest growth rate, and why?

Tequila and Mezcal are currently showing the highest momentum globally. This growth is fueled by strong premiumization—moving beyond low-end mixers to sipping spirits—successful celebrity endorsements, and a growing consumer appreciation for agave's unique terroir and authentic production processes, particularly in North America and Western Europe.

What impact do sustainability and ethical sourcing have on consumer purchasing decisions in the spirits market?

Sustainability and ethical sourcing are becoming critical purchasing factors, particularly for younger consumers. Consumers actively seek brands that demonstrate reduced carbon footprints, responsible water usage, and fair labor practices (e.g., Agave sourcing standards). Brands that offer transparency and align with these values gain significant brand loyalty and competitive advantage over those perceived as environmentally or socially indifferent.

What are the primary regulatory challenges facing international spirits companies?

Primary regulatory challenges include highly disparate excise taxes and tariffs across different countries, complex advertising restrictions that limit digital and traditional marketing, and the requirement to navigate multi-layered distribution systems (like the U.S. three-tier system). Changes in alcohol consumption age limits and governmental health warnings also necessitate continuous legal and operational adjustments for global market access.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager