ALD Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431528 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

ALD Systems Market Size

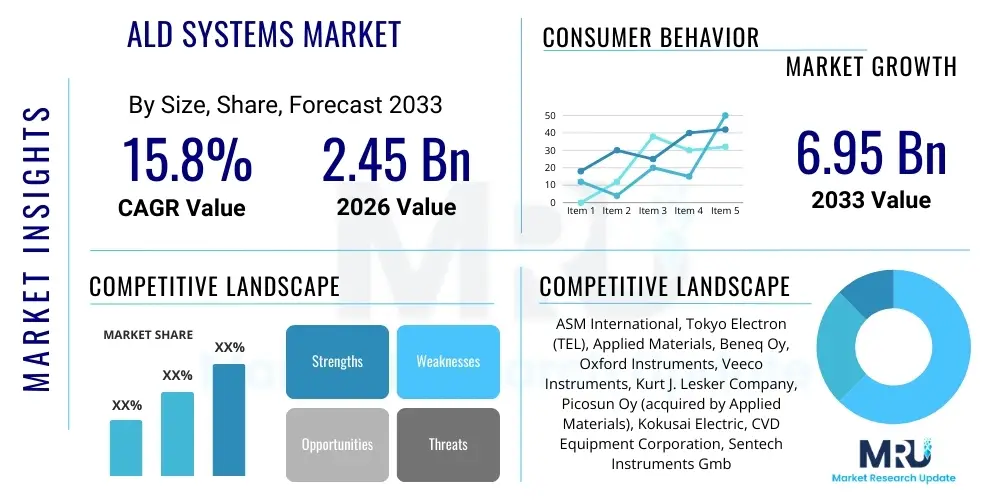

The ALD Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at $2.45 Billion in 2026 and is projected to reach $6.95 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the relentless miniaturization demands within the semiconductor industry, requiring ultra-thin, conformal films with precise thickness control, a capability uniquely offered by Atomic Layer Deposition (ALD) technology.

ALD Systems Market introduction

The Atomic Layer Deposition (ALD) Systems Market encompasses equipment utilized for depositing highly uniform, conformal thin films onto various substrates through sequential, self-limiting gas-phase chemical reactions. ALD is a specialized chemical vapor deposition (CVD) technique distinguished by its ability to achieve near-perfect film thickness control at the atomic level, making it indispensable for advanced material engineering. The core components of an ALD system typically include precursor delivery units, reaction chambers capable of maintaining ultra-high vacuum and controlled temperatures, and sophisticated control software to manage the pulsing sequence of precursors and purge gases. These systems are pivotal in manufacturing processes where film quality dictates device performance, such as in high-k dielectrics, barrier layers, and passivation coatings.

Product descriptions within this market segment range from thermal ALD systems, which rely solely on thermal energy to drive reactions, to Plasma-Enhanced ALD (PEALD) systems, which use plasma to reduce processing temperatures and enable the deposition of films with enhanced physical properties, such as higher density and lower impurity levels. Spatial ALD (SALD), designed for high-throughput coating of large substrates like solar panels or flexible electronics, represents another significant product category, focusing on speed and scalability rather than solely on discrete atomic-level control. The versatility of ALD systems allows them to handle various material depositions, including oxides (Al2O3, HfO2), nitrides (TiN, TaN), and pure metals, thereby serving a broad industrial base.

Major applications of ALD systems span critical industries, primarily semiconductors, where ALD films are integral to memory chips (DRAM, 3D NAND), advanced logic devices, and microelectromechanical systems (MEMS). Beyond electronics, ALD systems are heavily utilized in energy storage (lithium-ion battery coatings), photovoltaic devices to enhance efficiency and stability, and in biomedical coatings for biocompatibility and protection. Key benefits of adopting ALD technology include superior step coverage (conformal coating on high-aspect-ratio structures), extremely low deposition temperatures compared to traditional CVD, and precise stoichiometry control. These benefits, coupled with driving factors such as the transition to sub-7nm fabrication nodes, the proliferation of Internet of Things (IoT) devices, and increasing investment in renewable energy technologies, solidify the market's robust growth trajectory.

ALD Systems Market Executive Summary

The global ALD Systems Market is experiencing rapid expansion, principally fueled by accelerated technological transitions in the semiconductor sector. Current business trends indicate a strong preference for Plasma-Enhanced ALD (PEALD) systems over traditional thermal ALD, as PEALD offers lower processing temperatures and the ability to deposit materials with superior mechanical and electrical properties, essential for complex 3D device architectures like 3D NAND and FinFETs. Furthermore, the market is characterized by intense competition among key players focused on innovation in precursor chemistry and spatial ALD techniques to address the high-volume manufacturing demands of flexible electronics and solar industries. Strategic mergers and acquisitions, along with increased R&D spending targeting novel applications such as neuromorphic computing and quantum devices, define the competitive landscape.

Regional trends highlight the overwhelming dominance of the Asia Pacific (APAC) region, driven by massive governmental and private investments in semiconductor fabrication facilities (fabs) across China, South Korea, Taiwan, and Japan. This region acts as the global manufacturing hub for advanced electronics, generating unparalleled demand for high-end ALD tools. While North America and Europe maintain strong positions due to significant R&D activities and the manufacturing of niche, high-value components (e.g., aerospace, high-performance computing), the primary volume driver remains APAC. Geopolitical factors, particularly trade tensions concerning semiconductor technology, are accelerating the trend towards regional self-sufficiency in chip manufacturing, subsequently boosting ALD system procurement in all major regions.

Segment trends reveal that the Semiconductor end-use segment holds the largest market share and is expected to exhibit the highest growth rate, necessitated by the continuous drive towards higher integration density and improved power efficiency in microchips. Within segmentation by product type, the Modular and Multi-Chamber ALD systems are gaining traction, providing manufacturers with greater flexibility and throughput capacity crucial for mass production environments. Material type segmentation indicates rising demand for precursors necessary for depositing high-k dielectrics (like Hafnium Oxide and Zirconium Oxide) and metal films (like Ruthenium and Tungsten), critical materials for advanced transistor gates and interconnects. Overall, the market trajectory suggests a shift towards specialized, high-throughput tools capable of handling 300mm and 450mm wafers while maintaining atomic-level precision, underscoring the shift from purely R&D applications to robust industrial production.

AI Impact Analysis on ALD Systems Market

User queries regarding AI's influence on the ALD market frequently revolve around process optimization, predictive maintenance, and the role of ALD in fabricating next-generation AI hardware. Common concerns include how machine learning algorithms can manage the complexity of multi-precursor processes, the potential for AI-driven fault detection to maximize uptime in expensive fabrication facilities, and whether AI can accelerate the discovery of new ALD processes and materials. Users are highly interested in automated closed-loop control systems powered by AI that can adjust parameters (temperature, flow rates, pulse timing) in real-time based on in-situ monitoring data to ensure consistent film quality, thereby minimizing material waste and improving overall equipment effectiveness (OEE).

The direct impact of Artificial Intelligence (AI) on the ALD systems market is transformational, primarily manifesting through enhanced process control and accelerated materials discovery. AI algorithms, particularly deep learning models, are being deployed to analyze vast datasets generated during ALD cycles, allowing manufacturers to predict and correct process deviations instantaneously, a task that is computationally prohibitive for traditional control systems. This capability is paramount as ALD processes become increasingly complex, involving delicate control over fractional atomic layers and multiple sequential steps. Furthermore, AI tools are accelerating the design and validation of novel ALD precursors and recipes, significantly shortening the development lifecycle for new advanced materials required for emerging electronic applications, such as high-density resistive RAM (RRAM) or advanced logic gates.

Beyond process efficiency, AI fundamentally drives the demand for ALD systems through its role in advanced hardware manufacturing. ALD is critical for depositing the precise, ultra-thin layers necessary for high-performance computing (HPC) chips, AI accelerators, and specialized memory devices optimized for neural networks. As the complexity of AI models grows, the demand for high-density, low-power hardware increases, making ALD technology, which can deliver the requisite precision for 3D integration and next-generation memory fabrication, more valuable. Consequently, AI acts both as an optimization tool for ALD system operation and as a massive demand generator for the sophisticated components that ALD enables.

- AI-driven real-time process optimization and closed-loop control systems enhancing film uniformity and reducing defects.

- Predictive maintenance analytics minimizing unscheduled downtime for high-cost ALD equipment in 24/7 fabrication environments.

- Accelerated discovery and screening of new ALD precursor chemistries and deposition recipes using machine learning.

- Increased demand for ALD systems to manufacture advanced AI hardware, including specialized AI accelerators, neuromorphic chips, and high-density memory devices (HBM, RRAM).

- Enhanced data analysis capabilities for troubleshooting and quality control (QC) in high-volume ALD manufacturing (HVM).

DRO & Impact Forces Of ALD Systems Market

The dynamics of the ALD Systems Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the mandatory requirement for ALD in sub-10nm semiconductor fabrication due to its unique conformal coating capabilities, coupled with robust growth in 3D integration technologies (like 3D NAND and FinFETs). Restraints principally revolve around the high capital expenditure required for sophisticated ALD tools and the proprietary, high cost of specialized precursors, which can limit adoption, particularly among smaller R&D institutions or emerging economies. Opportunities are abundant in the high-growth areas of flexible electronics, advanced energy storage (solid-state batteries), and the burgeoning field of biocompatible coatings, offering new diversification pathways beyond traditional semiconductor dependence. The impact forces determine the overall market elasticity and growth ceiling, balancing the foundational technology push from device miniaturization against the economic constraints of deployment and operational complexity.

Drivers significantly influencing market acceleration include the expanding adoption of More-than-Moore devices, which require precision deposition for integrated sensors and power electronics, and the global push for greater energy efficiency, necessitating ALD films for enhanced battery electrodes and stable solar cells. The unique self-limiting nature of the ALD process ensures perfect step coverage on high-aspect-ratio trenches and vias, a geometric necessity for modern chip designs. Conversely, the market faces significant restraints related to throughput limitations, as ALD is inherently slower than conventional CVD techniques, especially thermal ALD. Integrating ALD into high-volume manufacturing often requires expensive, complex cluster tools and multiple chamber setups to achieve necessary production yields, which raises the barrier to entry. Furthermore, precursor availability and stability, particularly for novel material systems, pose continuous logistical and technical challenges.

Opportunities for market expansion are primarily centered on innovation and application diversification. The development of Spatial ALD (SALD) and Roll-to-Roll ALD (R2R ALD) addresses the throughput restraint, opening avenues for high-speed coating in industrial applications like optical components, corrosion protection, and large-area displays. The rising demand for solid-state batteries (SSBs) represents a potentially transformative application, where ALD is crucial for creating robust, uniform solid electrolyte films and protective coatings on electrodes. Impact forces, such as regulatory mandates concerning material safety and environmental standards, also play a role, favoring ALD due to its typically cleaner process footprint compared to some high-temperature CVD methods. The overarching competitive force stems from continuous technological leaps in competing deposition techniques, though ALD maintains an essential technological niche for ultra-precision requirements.

Segmentation Analysis

The ALD Systems Market is meticulously segmented based on Type, Application, End-Use, and Material Deposited, reflecting the diverse industrial requirements served by this specialized technology. This segmentation is critical for understanding market dynamics, as different segments exhibit varying growth rates and adoption patterns influenced by technology maturity and specific application needs. For instance, segmentation by Type differentiates between thermal-driven processes and plasma-driven processes, directly correlating with the required substrate temperature and film quality. Application segmentation, particularly separating semiconductor uses from non-semiconductor uses, highlights the foundational economic dependency of the market on the highly cyclical yet dominant electronics industry.

Analysis of the Type segment shows that Plasma-Enhanced ALD (PEALD) currently dominates the market share and is projected to maintain the fastest growth rate. PEALD enables lower process temperatures, crucial for sensitive substrates and advanced integration schemes where thermal budgets are constrained. Thermal ALD, while mature, remains essential for specific oxide depositions and R&D applications. Emerging technologies like Spatial ALD (SALD) are rapidly gaining traction in display manufacturing and photovoltaics due to their superior throughput capabilities, disrupting traditional time-sequential ALD models by achieving continuous deposition across large areas.

The Semiconductor application segment accounts for the vast majority of ALD system revenues, driven by the relentless pursuit of smaller transistors and denser memory cells. However, significant growth is also anticipated in non-semiconductor segments, particularly Energy (batteries and fuel cells) and Medical/Biotechnology (coating medical devices and drug delivery systems). End-use segmentation confirms that Mass Production environments command the largest volume of equipment sales, characterized by multi-chamber cluster tools, while Research & Development institutions remain crucial buyers for validating new processes and exploring exotic material stacks. Understanding these distinct segment behaviors is vital for market players formulating tailored product and sales strategies.

- By Type:

- Thermal ALD

- Plasma Enhanced ALD (PEALD)

- Spatial ALD (SALD)

- Fluidized Bed ALD

- By Application:

- Semiconductors and Electronics

- Data Storage Devices

- Energy Devices (Solar Cells, Batteries, Fuel Cells)

- Medical Devices and Biotechnology

- Optics and Display Technology

- R&D and Educational Institutions

- By End-Use:

- Research and Development

- Mass Production/Manufacturing

- By Material Deposited:

- Aluminum Oxide (Al2O3)

- Hafnium Oxide (HfO2)

- Zirconium Oxide (ZrO2)

- Titanium Nitride (TiN)

- Tungsten (W) and Ruthenium (Ru)

- Other Materials (e.g., ZnO, Pt, Binary/Ternary Alloys)

Value Chain Analysis For ALD Systems Market

The ALD Systems market value chain is intricate, starting from the highly specialized upstream segment encompassing precursor chemical manufacturing and component production, extending through complex equipment fabrication and integration, and concluding with downstream end-users in high-tech manufacturing. Upstream activities are dominated by niche chemical companies specializing in organometallic and halide precursors, which are essential and often proprietary raw materials defining the deposition capability of the systems. Key upstream component suppliers focus on ultra-high vacuum technology, precise gas handling systems, advanced pumps, and sophisticated in-situ monitoring equipment (e.g., mass spectrometers, ellipsometers). The high cost and strict purity requirements of precursors and vacuum components significantly influence the final system cost and operational expenditure for end-users.

The midstream segment involves the core ALD equipment manufacturers, who design, assemble, integrate, and test the complex deposition tools. This stage requires significant intellectual property, expertise in reaction engineering, thermal management, and software control. These manufacturers often work closely with both precursor suppliers to ensure material compatibility and with downstream semiconductor fabs to customize cluster tool configurations for specific process flows. Distribution channels in this market are predominantly direct, necessitated by the highly technical nature of the equipment, the substantial capital investment required, and the need for continuous service, installation, and process support. Indirect sales channels, such as local distributors or agents, are less common but may be used in emerging regional markets for initial sales or spare parts supply.

Downstream consists of the diverse end-user industries, primarily semiconductor foundries, memory manufacturers, solar panel producers, and specialized R&D labs. The direct interaction between equipment manufacturers and these high-tech buyers ensures that systems are tailored to meet stringent specifications regarding throughput, uniformity, and purity. This direct channel facilitates knowledge transfer and allows manufacturers to rapidly integrate feedback for product improvement, essential in a market driven by rapidly evolving technological nodes. The long lifecycle of ALD systems emphasizes the importance of aftermarket service, spare parts, and process consulting, which constitute a significant part of the overall value capture for the equipment providers.

ALD Systems Market Potential Customers

Potential customers for ALD systems are highly concentrated in advanced manufacturing sectors requiring atomic-level precision and thin-film conformal coating capabilities. The primary end-users are large semiconductor fabrication plants (fabs) that utilize ALD tools extensively for critical process steps in memory (DRAM, 3D NAND) and logic (FinFETs, GAAFETs) manufacturing. These customers require high-volume, multi-chamber tools capable of 24/7 operation and minimal defectivity. They prioritize system reliability, high throughput, and the ability to process 300mm or future 450mm wafers. Key buyers include global leaders in chip manufacturing such as TSMC, Samsung, SK Hynix, Intel, and Micron Technology, whose technology roadmaps directly dictate ALD equipment demand.

A secondary, yet rapidly growing, segment of potential customers includes manufacturers in the energy and display sectors. Battery manufacturers, particularly those developing solid-state architectures, require ALD for protective coatings on electrodes and electrolytes to enhance cycle life and safety. Similarly, producers of advanced flexible displays (OLED, microLED) utilize spatial ALD technology to deposit barrier films that prevent moisture and oxygen ingress, crucial for device longevity. These customers seek cost-effective, high-throughput solutions, often favoring spatial ALD over traditional batch processing to meet the needs of large-area substrates or roll-to-roll production lines.

Furthermore, academic institutions, government research laboratories, and specialized nanotechnology startups form a vital segment focused on innovation and process development. These potential customers typically purchase smaller, highly flexible R&D-scale ALD systems to explore novel materials, device architectures (e.g., perovskite solar cells, quantum dots), and emerging applications such as bio-nanotechnology coatings. While their individual purchasing volumes are smaller than mass production fabs, they represent the future pipeline of technology adoption and require systems with extensive process parameter flexibility and robust analytical integration for material characterization. Overall, the buying decision for all customers is heavily influenced by total cost of ownership (TCO), material precursor efficiency, and proven process reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.45 Billion |

| Market Forecast in 2033 | $6.95 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ASM International, Tokyo Electron (TEL), Applied Materials, Beneq Oy, Oxford Instruments, Veeco Instruments, Kurt J. Lesker Company, Picosun Oy (acquired by Applied Materials), Kokusai Electric, CVD Equipment Corporation, Sentech Instruments GmbH, Lotus Applied Technology, NAURA Technology Group Co. Ltd., AIXTRON SE, Samco Inc., Furtura Technology, Inc., Jusung Engineering Co., Ltd., Arradiance, Inc., Forge Nano Inc., Hangzhou Nimo Tech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ALD Systems Market Key Technology Landscape

The ALD Systems market is defined by several core and emerging technologies aimed at enhancing film quality, reducing processing time, and expanding material compatibility. Core ALD technology relies on the sequential pulsing of precursor and reactant gases, ensuring self-limiting surface reactions. The foundational technologies include Thermal ALD, which is highly reliable for specific oxide depositions but requires elevated temperatures, and Plasma-Enhanced ALD (PEALD), which utilizes inductively coupled plasma (ICP) or capacitively coupled plasma (CCP) sources to activate reactants, enabling lower temperature processing and deposition of high-quality nitrides and metals with superior density and reduced impurities, critical for back-end-of-line (BEOL) processes in semiconductors.

The primary technological innovation driving market expansion is the advent of high-throughput solutions, particularly Spatial ALD (SALD). SALD systems separate the precursor and reactant zones spatially rather than temporally, allowing continuous substrate movement (e.g., conveyor belt or rotating plates). This innovation dramatically increases deposition speed, addressing the fundamental throughput constraint of traditional ALD and opening new markets like display manufacturing and flexible electronics where large area and high volume are paramount. Furthermore, specialized delivery systems for liquid and solid precursors, including sophisticated vaporization and liquid injection techniques, are continually being refined to ensure precise, repeatable dosing of complex, thermally sensitive organometallic compounds.

Ongoing technological evolution focuses heavily on precursor development, moving towards safer, less expensive, and more reactive chemistries to enable the deposition of novel materials, such as binary and ternary metal alloys, required for advanced quantum and neuromorphic computing architectures. Additionally, the integration of advanced in-situ metrology—such as spectroscopic ellipsometry and quartz crystal microbalances—is becoming standard, allowing for real-time monitoring of film thickness and composition. This integration is essential for implementing the AI-driven closed-loop control systems necessary to optimize yield in 300mm and upcoming 450mm wafer fabrication environments, solidifying the market’s reliance on highly complex, integrated technological platforms.

Regional Highlights

Regional analysis of the ALD Systems Market demonstrates significant geographical disparity in demand and manufacturing capability, overwhelmingly dominated by the Asia Pacific (APAC) region. The immense concentration of semiconductor fabrication facilities (fabs) in countries such as Taiwan, South Korea, China, and Japan necessitates a continuous, large-scale procurement of advanced deposition equipment. Government subsidies, coupled with aggressive capacity expansion by global memory and logic manufacturers in these countries, position APAC as the epicenter of ALD system consumption, especially for high-volume manufacturing (HVM) cluster tools designed for 3D NAND and leading-edge logic chip production. The region is also rapidly adopting ALD technology in non-semiconductor fields, driven by the massive consumer electronics supply chain and photovoltaic manufacturing base.

North America maintains a robust position, primarily driven by high-level research and development (R&D), advanced technology nodes, and specialized manufacturing in aerospace, defense, and high-performance computing (HPC). The U.S. government's push for domestic chip manufacturing (e.g., the CHIPS Act) is spurring significant investment in new fabs, thereby increasing demand for ALD systems for both leading-edge and specialized device production. North American demand leans heavily towards R&D flexibility and the latest technological innovations, often driving the initial market adoption of new ALD precursors and spatial ALD configurations before their mass deployment in APAC. Key regional drivers include the presence of major equipment suppliers and strong academic-industrial collaboration.

Europe represents a mature market focused on specialized applications, particularly in the automotive, industrial sensor, and microelectromechanical systems (MEMS) sectors. European countries, notably Germany and the Netherlands, are home to critical equipment suppliers and strong R&D centers dedicated to process optimization and novel ALD applications, such as thin-film encapsulation for flexible organic electronics and advanced protective coatings. While its volume consumption is lower than APAC, Europe remains crucial for the development and early commercialization of advanced ALD solutions and precursors. The market in Latin America and the Middle East & Africa (MEA) is currently nascent but shows potential growth, mainly driven by R&D investments in academic institutions and nascent efforts in localized solar cell and sensor manufacturing, signaling future opportunities for market penetration.

- Asia Pacific (APAC): Dominates the global market volume due to high concentration of semiconductor fabrication, especially for 3D NAND, DRAM, and advanced logic. Key markets include China, Taiwan, South Korea, and Japan, characterized by HVM demand for multi-chamber PEALD and thermal ALD systems.

- North America: Crucial for R&D innovation, specialized high-tech manufacturing, and high-performance computing chip development. Significant investment spurred by reshoring initiatives and domestic chip production policies (e.g., CHIPS Act).

- Europe: Focuses on specialized industrial applications, automotive sensors, MEMS, and advanced research. Home to major equipment manufacturers and strong innovation centers, driving demand for both R&D flexibility and industrial coating solutions.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging markets with primary adoption centered in R&D and academic sectors. Potential future growth tied to solar energy infrastructure and localized electronics assembly initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ALD Systems Market.- ASM International N.V.

- Tokyo Electron (TEL)

- Applied Materials, Inc.

- Beneq Oy

- Oxford Instruments

- Veeco Instruments Inc.

- Kurt J. Lesker Company

- Kokusai Electric Corporation

- CVD Equipment Corporation

- Sentech Instruments GmbH

- Lotus Applied Technology

- NAURA Technology Group Co. Ltd.

- AIXTRON SE

- Samco Inc.

- Furtura Technology, Inc.

- Jusung Engineering Co., Ltd.

- Arradiance, Inc.

- Forge Nano Inc.

- Hangzhou Nimo Tech

Frequently Asked Questions

Analyze common user questions about the ALD Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of ALD systems in the semiconductor industry?

The primary driver is the necessity for conformal coating on high-aspect-ratio structures inherent in sub-10nm chip architectures, such as FinFETs and 3D NAND memory cells. ALD’s self-limiting reaction mechanism is uniquely capable of depositing ultra-thin films with near-perfect step coverage, which is impossible with traditional chemical vapor deposition (CVD) techniques.

How do Plasma-Enhanced ALD (PEALD) systems differ fundamentally from Thermal ALD systems?

PEALD systems utilize plasma to supply the necessary energy to drive the chemical reactions, allowing the deposition of high-quality films at significantly lower temperatures (often below 200°C). This low-temperature capability is critical for manufacturing processes involving thermally sensitive materials and complex integration schemes, whereas Thermal ALD relies strictly on heat.

Which geographical region dominates the ALD Systems Market and why?

The Asia Pacific (APAC) region, specifically East Asia (China, Taiwan, South Korea), dominates the market. This dominance stems from the massive concentration of global semiconductor manufacturing and foundry capacity, leading to the highest demand for high-volume, multi-chamber ALD tools required for advanced chip production.

What role does Spatial ALD (SALD) technology play in expanding the market beyond semiconductors?

SALD technology addresses the traditional throughput limitations of ALD by separating precursor exposure zones spatially. This innovation enables high-speed, continuous processing of large substrates, making ALD economically viable for non-semiconductor applications like flexible electronics, display manufacturing (OLED barriers), and large-area solar cell production.

What are the main financial and technological restraints limiting the broader adoption of ALD systems?

The major restraints are the high capital expenditure (CapEx) associated with purchasing complex, integrated ALD equipment and the high operational cost linked to specialized, expensive, and often proprietary precursor chemicals. Technologically, the slow deposition rate compared to CVD methods remains a challenge for specific high-volume applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager