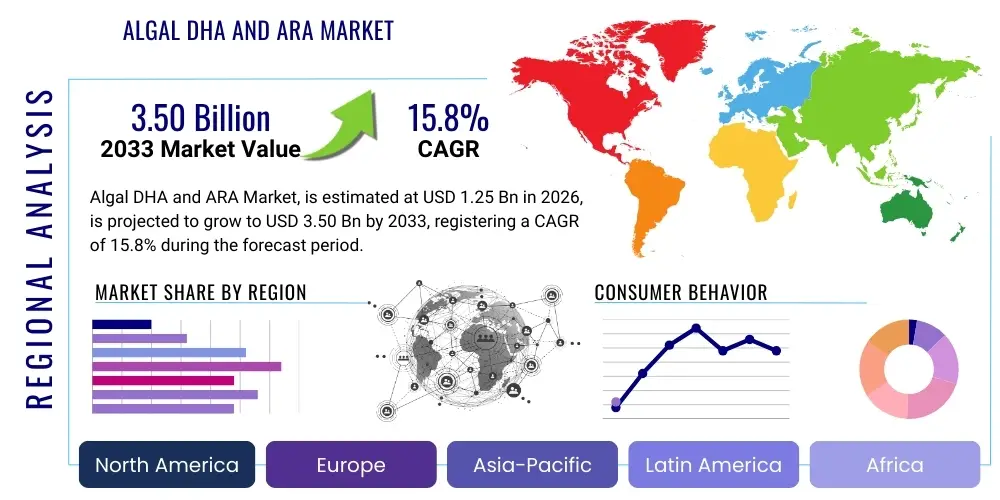

Algal DHA and ARA Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435400 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Algal DHA and ARA Market Size

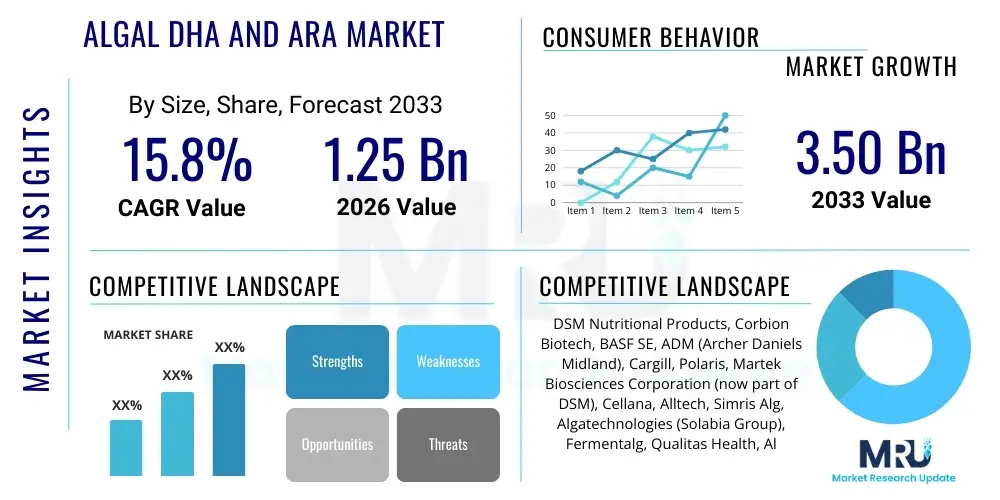

The Algal DHA and ARA Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $3.50 Billion by the end of the forecast period in 2033.

Algal DHA and ARA Market introduction

The Algal DHA (Docosahexaenoic Acid) and ARA (Arachidonic Acid) market encompasses the production and utilization of these essential fatty acids derived from microalgae, primarily replacing traditional fish and poultry egg sources. DHA and ARA are vital polyunsaturated fatty acids (PUFAs) critical for neurological development, visual acuity, and immune function, especially in infants. The use of microalgae as a production platform addresses sustainability concerns associated with marine resources and caters directly to the burgeoning demand for vegan and vegetarian-friendly ingredients. This shift is particularly pronounced in high-value applications such as infant nutrition and advanced dietary supplements, where purity and traceability are paramount consumer requirements.

These algal oils offer superior purity profiles, often lacking the heavy metals, persistent organic pollutants, and oxidation risks associated with fish oil derivatives. The controlled environment of bioreactors or fermenters ensures consistent quality and scalability, positioning microalgae farming as a highly reliable source for pharmaceutical and nutraceutical manufacturers. Key applications driving market expansion include the fortification of infant formula, the development of specialized maternal health supplements, and incorporation into functional foods designed to support cardiovascular and cognitive health across all age groups. Furthermore, the inherent advantage of algae being primary producers in the omega-3 chain allows manufacturers to bypass the complex marine food web, simplifying the supply chain and enhancing product transparency.

The market is predominantly driven by increasing consumer awareness regarding the health benefits of omega-3 and omega-6 fatty acids, regulatory endorsements favoring the inclusion of DHA/ARA in mandatory food products (like infant milk), and aggressive investment in fermentation technology, which allows for cost-effective, high-yield production of specific fatty acid profiles. The ongoing innovation in microalgal strain selection, aimed at maximizing oil yield and minimizing processing costs, further strengthens the market’s positive trajectory. The sustained demand from the geriatric population seeking cognitive health support and the rising global adoption of plant-based diets solidify the long-term growth prospects for algal-derived PUFAs.

Algal DHA and ARA Market Executive Summary

The Algal DHA and ARA market is characterized by robust commercial trends focusing on vertical integration, ensuring end-to-end control from strain cultivation to finished product formulation, driven primarily by the need for quality assurance in sensitive applications like infant nutrition. Business strategies heavily emphasize strategic partnerships between algae biotechnology firms and major food and pharmaceutical companies to secure long-term supply agreements and accelerate product commercialization across diverse geographical markets. Key manufacturing innovations revolve around optimizing high-density fermentation processes to lower the cost of goods sold (COGS), making algal oils more competitive against fish oil alternatives, while simultaneously addressing intellectual property surrounding superior, non-GMO algal strains capable of producing high concentrations of specific fatty acids, thereby acting as a critical differentiator in this specialized ingredient space.

Regionally, the market shows significant momentum, with Asia Pacific (APAC) emerging as the largest and fastest-growing region, fueled by rising disposable incomes, high birth rates, and increasingly stringent governmental regulations in countries like China and India mandating DHA inclusion in infant nutrition products. North America and Europe, however, remain critical hubs for innovation and regulatory standardization, leading the charge in developing advanced dietary supplements and functional food applications, driven by strong consumer health consciousness and proactive regulatory bodies such as the FDA and EFSA. Latin America and the Middle East & Africa are nascent markets, yet they present considerable long-term potential due to expanding access to specialized nutritional products and growing interest in sustainable food ingredients, necessitating localized distribution strategies and market entry focusing on affordability and regional dietary preferences.

In terms of segmentation, the Application segment sees infant formula retaining the dominant market share globally, owing to the high mandated inclusion rates and the non-negotiable status of DHA/ARA in early life nutrition. However, the Dietary Supplements segment is poised for the highest growth rate, fueled by the increasing popularity of standalone vegan omega-3 supplements addressing general health and wellness, prenatal care, and brain health. By type, DHA dominates the market value due to its proven efficacy in cognitive development, while ARA is often co-formulated, reflecting the physiological need for both fatty acids in specific applications. The market is also seeing a trend towards specialized forms, particularly microencapsulated powder formats, which ease incorporation into functional foods and beverages by masking flavor and improving stability against oxidation.

AI Impact Analysis on Algal DHA and ARA Market

User queries regarding AI's impact on the Algal DHA and ARA market frequently center on how these advanced technologies can address the primary industry challenges: yield maximization, cost reduction in fermentation, and ensuring product consistency and purity. Users are highly interested in AI-driven predictive modeling capabilities to optimize the complex biological parameters of microalgae cultivation, asking specifically if machine learning can predict the ideal nutrient mix, light exposure cycles, and temperature controls necessary to maximize the output of high-value fatty acids like DHA and ARA in real-time. A parallel concern relates to supply chain resilience and quality control, questioning AI's role in detecting subtle contamination during large-scale fermentation and ensuring batch-to-batch homogeneity, which is paramount for ingredient buyers in the sensitive infant nutrition sector.

The key themes emerging from user expectations highlight AI as a transformative tool moving beyond simple automation to genuine biological optimization. Manufacturers are leveraging machine learning algorithms to analyze massive datasets generated by bioreactors, including sensor data on pH, dissolved oxygen, biomass density, and nutrient consumption rates, enabling immediate adjustments to cultivation parameters that were previously based on heuristics or delayed lab analysis. This real-time optimization capability translates directly into significantly higher fatty acid yields and reduced energy consumption per unit of DHA/ARA produced, fundamentally improving the economic viability and scalability of algal production facilities globally. Furthermore, advanced vision systems combined with deep learning are being deployed for rapid, non-destructive quality checks, scrutinizing algal morphology and concentration profiles, thereby accelerating release times for ingredients.

The implementation of AI is expected to dramatically lower the entry barrier for high-throughput screening of novel algal strains, utilizing computational biology models to predict the metabolic pathways and genetic modifications required to enhance DHA/ARA synthesis. This predictive R&D significantly reduces the time and cost associated with strain engineering. Ultimately, the integration of AI tools, including predictive maintenance for complex fermentation equipment and intelligent inventory management systems that respond to fluctuating commodity prices and demand forecasts, is establishing a more resilient, cost-effective, and highly traceable supply chain for high-purity algal omega fatty acids, addressing both manufacturer profitability concerns and stringent end-user quality demands across the nutraceutical and food industries.

- AI optimizes real-time fermentation parameters (temperature, pH, nutrient feed) for maximum fatty acid yield.

- Machine Learning models predict optimal microalgae strain performance and assist in high-throughput screening for R&D.

- Advanced sensor integration and AI-driven image analysis ensure rapid quality control and contamination detection in bioreactors.

- Predictive analytics enhance supply chain efficiency, forecasting ingredient demand and optimizing storage conditions to minimize oxidation.

- AI algorithms contribute to sustainable production by minimizing resource consumption (energy, water, nutrients) per unit of oil produced.

DRO & Impact Forces Of Algal DHA and ARA Market

The dynamics of the Algal DHA and ARA market are shaped by powerful Drivers, persistent Restraints, and transformative Opportunities, collectively forming the key Impact Forces influencing market structure and growth trajectory. Primary drivers include the escalating global demand for sustainable and vegetarian sources of omega fatty acids, driven by ethical consumerism and ecological concerns regarding overfishing and marine ecosystem health. This is powerfully complemented by mandatory regulatory frameworks, particularly in major economies, that require the inclusion of DHA and ARA in infant formula, creating a guaranteed, high-volume baseline demand for these ingredients. The proven scientific evidence linking early-life consumption of these PUFAs to superior cognitive and visual development continues to fuel demand across clinical and nutritional sectors, positioning them as non-discretionary health investments.

Conversely, significant restraints impede faster market expansion. The most critical constraint remains the high production cost associated with controlled microalgae fermentation compared to traditional fish oil extraction. While large-scale fermentation technology is advancing, the capital investment required for photobioreactors and downstream processing (extraction, purification) often results in a higher price point for algal oils, affecting competitiveness in commodity ingredient markets. Furthermore, regulatory hurdles, particularly in obtaining novel food status approval in certain jurisdictions, and concerns regarding potential intellectual property disputes related to patented high-yield algal strains can create market entry barriers. The sensitivity of DHA/ARA to oxidation also demands sophisticated, expensive stabilization and microencapsulation technologies, adding to the final cost structure and complexity of handling the ingredients.

The market is rich with opportunities, primarily focused on expanding into new application matrices beyond supplements and infant formula, such as functional beverages, fortified pet nutrition, and clinical enteral feeding solutions, which are less saturated. Technological advancements in genetic engineering and synthetic biology offer the promise of developing super-strains of microalgae with significantly higher yields and purity, potentially overcoming current cost restraints. Furthermore, the global trend towards personalized nutrition and the development of targeted health solutions offer high-margin opportunities for specialized DHA/ARA blends. These driving and restraining forces culminate in a high impact force emphasizing technological efficiency and regulatory agility; companies that can effectively scale fermentation while maintaining the highest purity standards and securing novel food approvals will capture dominant market shares, solidifying the ingredient as a cornerstone of future sustainable nutrition.

Segmentation Analysis

The Algal DHA and ARA market is systematically segmented based on Type, Application, and Form, allowing for targeted analysis of consumer behavior and industrial purchasing patterns. Segmentation by Type differentiates between pure DHA oil, pure ARA oil, and mixtures containing both, reflecting varied requirements across end-use industries, where infant formula typically requires a balanced mixture while certain cognitive health supplements may prioritize higher concentrations of DHA. Analysis of these segments reveals that combined DHA and ARA oils maintain the largest market share due to their biological necessity in human development, especially prenatal and early postnatal stages, necessitating comprehensive production capabilities from ingredient suppliers capable of delivering both crucial fatty acids.

The Application segment is crucial, defining the end-market demand structure, dominated by Infant Formula manufacturers who demand stringent quality controls and consistent supply. The robust growth observed in the Dietary Supplements segment is driven by the aging global population seeking support for cardiovascular health, eye health, and cognitive function, alongside the growing demographic of consumers who explicitly avoid animal-derived omega-3 sources. The smaller, yet rapidly expanding, segments of Functional Food & Beverages and Clinical Nutrition represent future growth vectors where challenges related to flavor masking and formulation stability are being actively addressed through innovative ingredient science, promising diversified revenue streams beyond traditional supplement sales.

Segmentation by Form categorizes the market into Liquid Oil and Powder/Encapsulated forms. While bulk liquid oil is the primary format for immediate incorporation into oil-based products like soft gels and nutritional oils, the powder and microencapsulated forms are increasingly vital for integrating DHA/ARA into dry ingredient mixes, fortified foods, and specialized clinical nutrition products. This powdered format significantly improves shelf stability, masks the inherent algal flavor, and simplifies handling for manufacturers of baked goods, cereals, and dry blend nutritional powders, demonstrating the importance of advanced formulation technology in expanding the ingredient's applicability across the broader food industry and enhancing its market penetration.

- Type

- DHA Oil

- ARA Oil

- DHA & ARA Blend

- Application

- Infant Formula

- Dietary Supplements

- Functional Food & Beverages

- Clinical Nutrition

- Animal Feed

- Form

- Liquid Oil

- Powder/Encapsulated

Value Chain Analysis For Algal DHA and ARA Market

The value chain for Algal DHA and ARA is highly specialized, beginning with intensive upstream activities focused on biological science and high-tech cultivation. The upstream segment involves the critical selection and genetic optimization of specific microalgae strains (e.g., Crypthecodinium cohnii for DHA and Mortierella alpina for ARA, though this is technically fungal, high-purity ARA from heterotrophic organisms is often marketed alongside algal DHA). Manufacturers invest heavily in R&D to enhance productivity and achieve desired fatty acid profiles through techniques like mutation and selective breeding, often securing patents on proprietary strains. This is followed by large-scale cultivation, predominantly through controlled heterotrophic fermentation in massive bioreactors, which is highly capital-intensive and requires precise operational control over temperature, pH, aeration, and nutrient media to maximize biomass and oil accumulation, representing the highest cost center in the entire chain.

The midstream phase centers on processing and purification. Once harvested, the algal biomass undergoes rigorous cell disruption and solvent-based or supercritical CO2 extraction to release the crude oil. Subsequent refinement involves processes such as winterization, deodorization, and molecular distillation to remove impurities, improve stability, and concentrate the desired DHA and ARA content to meet pharmaceutical or infant-grade purity standards. Given the sensitivity of PUFAs to heat and oxygen, sophisticated stabilization techniques, including the addition of antioxidants and subsequent microencapsulation for powder formats, are vital at this stage. This stage requires significant specialized machinery and adherence to stringent GMP (Good Manufacturing Practices) and HACCP standards, guaranteeing the ingredient's safety and quality for sensitive applications.

Distribution channels are categorized into direct and indirect paths. Direct channels involve large-volume B2B sales where ingredient manufacturers supply processed liquid oil or powder directly to major infant formula companies and large nutraceutical firms through long-term contracts, often necessitating specialized storage and transport conditions (e.g., nitrogen blanketing to prevent oxidation). Indirect distribution leverages third-party distributors and specialized ingredient brokers who handle smaller volumes, manage localized inventory, and provide technical application support to smaller functional food producers or supplement brands. The distribution network must prioritize cold chain management and rapid delivery to maintain the ingredient's stability, making logistical expertise a crucial element in downstream success. Furthermore, vertical integration strategies are increasingly common, where producers control the entire chain, from algae growth to the final branded softgel or nutritional product, thus capturing higher profit margins and ensuring end-to-end traceability and quality assurance.

Algal DHA and ARA Market Potential Customers

The primary customers for high-purity Algal DHA and ARA are global Infant Formula manufacturers, who constitute the largest consumer base due to regulatory mandates and consumer expectations linking these essential fatty acids directly to optimal neonatal development. These companies prioritize suppliers capable of delivering certified, non-GMO, contaminant-free ingredients in high volumes with impeccable documentation for traceability. Their procurement demands are highly inelastic, dictated by strict quality specifications, making them the most vital strategic customer segment and driving high-throughput production requirements across the market.

The second major group comprises Dietary Supplement and Nutraceutical companies, ranging from large multinational pharmaceutical firms to agile D2C (Direct-to-Consumer) supplement brands. These buyers utilize algal oils to formulate specialized products targeting specific health outcomes such as prenatal support, adult cognitive enhancement, and general wellness. The shift towards plant-based diets has significantly increased demand from this segment, making them the fastest-growing customer base, particularly favoring encapsulated powder forms for ease of formulation and stability, and often requiring specialized marketing support highlighting the sustainability and vegan benefits of the source material.

Further expansion of the customer base includes Functional Food and Beverage manufacturers, clinical nutrition providers, and increasingly, specialized Pet Food producers. Functional food companies incorporate DHA/ARA into everyday items like juices, baked goods, dairy alternatives, and cereals, presenting challenges regarding flavor masking and processing stability. Clinical nutrition units, particularly those focusing on enteral feeding solutions, require pharmaceutical-grade oils for patients with specific dietary needs or compromised absorption capabilities. Pet food manufacturers, especially those catering to premium and veterinary-prescribed diets, are adopting algal sources to enhance animal cognitive function and skin health, recognizing the high-quality source material appeals directly to health-conscious pet owners.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $3.50 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DSM Nutritional Products, Corbion Biotech, BASF SE, ADM (Archer Daniels Midland), Cargill, Polaris, Martek Biosciences Corporation (now part of DSM), Cellana, Alltech, Simris Alg, Algatechnologies (Solabia Group), Fermentalg, Qualitas Health, Algapharma BioGas, Algae Health Sciences (BGG). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Algal DHA and ARA Market Key Technology Landscape

The technological landscape underpinning the Algal DHA and ARA market is dominated by advanced bioprocess engineering, specifically focusing on controlled heterotrophic fermentation, which allows for consistent, high-yield production independent of weather conditions. Unlike traditional phototrophic cultivation (relying on sunlight), heterotrophic systems utilize large, enclosed bioreactors where microalgae strains are fed glucose or other carbon sources, leading to significantly higher biomass density and fatty acid concentration accumulation in shorter cycles. The continuous innovation in bioreactor design, including scale-up from pilot to industrial size (up to hundreds of thousands of liters), and the optimization of agitation, oxygen transfer, and sterility control, are central to reducing the overall cost of production and meeting the demanding volume requirements of global manufacturers, thereby making this the single most crucial enabling technology.

Following cultivation, the efficiency and selectivity of extraction and purification technologies are paramount for achieving the required grade of DHA and ARA oil, particularly for infant formula applications where solvent residues must be negligible. Supercritical Carbon Dioxide (SC-CO2) extraction technology is gaining prominence as a green, solvent-free alternative to traditional chemical extraction. SC-CO2 allows for the precise separation of target compounds (DHA/ARA) under mild temperatures and high pressure, preserving the integrity of the delicate PUFAs and minimizing thermal degradation or oxidation, resulting in a cleaner, higher-quality oil. This technology not only adheres to stricter environmental regulations but also caters directly to consumer demands for minimally processed, high-purity ingredients, offering a significant competitive advantage over traditional methods.

Furthermore, advanced formulation techniques, specifically microencapsulation, represent a critical technology landscape necessary for expanding application versatility and ensuring product stability. DHA and ARA oils are highly susceptible to oxidation, which can generate off-flavors and reduce nutritional efficacy upon exposure to air, light, or heat. Microencapsulation involves enveloping tiny oil droplets within a protective matrix (usually protein or carbohydrate based), effectively sealing the oil and converting it into a stable powder form. This technology dramatically improves shelf life, masks the inherent algal taste, and facilitates easy incorporation into complex food matrices like functional beverages and bakery products, significantly broadening the ingredient's utility beyond traditional soft gels and liquid supplements. Continuous improvement in encapsulation efficiency and particle size homogeneity remains a major area of technological investment and differentiation among key market players.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally, primarily driven by China and India. This growth is fueled by increasing birth rates, rising middle-class disposable income, and government initiatives and regulatory mandates ensuring the inclusion of DHA in infant nutrition products. The region is also becoming a key manufacturing hub, with local players investing heavily in fermentation infrastructure to meet domestic and international demand, leveraging proximity to key raw material suppliers and rapidly expanding consumer markets.

- North America (NA): North America holds a substantial market share, acting as the epicenter for innovation in dietary supplements and functional foods. Market expansion is driven by strong consumer awareness regarding brain and heart health, coupled with a high prevalence of vegetarian and vegan lifestyles, leading to robust demand for plant-based omega alternatives. The U.S. and Canada are characterized by stringent quality control standards and high adoption rates of premium, high-concentration DHA products aimed at the prenatal and senior populations.

- Europe: Europe is a mature but high-value market, defined by strong regulatory clarity from the European Food Safety Authority (EFSA) and high consumer preference for sustainably sourced ingredients. Growth is concentrated in the supplements and clinical nutrition segments. Key countries like Germany, the UK, and France show high adoption of advanced encapsulated forms for stability and ease of integration into fortified foods, often placing strong emphasis on traceable, non-GMO sourcing credentials.

- Latin America (LATAM): LATAM is an emerging market experiencing steady growth, driven by improvements in healthcare spending and increasing awareness of nutritional deficiencies, particularly concerning early child development. Brazil and Mexico are leading the regional demand, often prioritizing cost-effective production methods and focusing on widespread fortification programs, presenting significant opportunities for volume-based market entry strategies.

- Middle East and Africa (MEA): The MEA region is characterized by slower initial adoption but presents future potential, specifically in developed Gulf Cooperation Council (GCC) countries. Demand is currently concentrated in imported, high-end infant formula and specialized supplements, requiring suppliers to navigate complex local import regulations and halal certifications for market entry and sustained commercial success.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Algal DHA and ARA Market.- DSM Nutritional Products

- Corbion Biotech

- BASF SE

- ADM (Archer Daniels Midland)

- Cargill

- Polaris

- Martek Biosciences Corporation (now part of DSM)

- Cellana

- Alltech

- Simris Alg

- Algatechnologies (Solabia Group)

- Fermentalg

- Qualitas Health

- Algapharma BioGas

- Algae Health Sciences (BGG)

- Fuji Chemical Industry Co., Ltd.

- Tate & Lyle PLC

- Roquette Frères

- Global Algae Innovations

- Evonik Industries AG

Frequently Asked Questions

Analyze common user questions about the Algal DHA and ARA market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Algal DHA and ARA over traditional marine sources?

The primary advantage lies in sustainability and purity. Algal sources are cultivated in controlled environments (bioreactors), eliminating the risk of heavy metal contamination (like mercury) and persistent organic pollutants found in marine fish. Additionally, they offer a sustainable, vegan-friendly alternative, reducing pressure on wild fish stocks, which is crucial for ethical and environmentally conscious consumers seeking high-purity omega fatty acids.

How does the production cost of Algal DHA compare to fish oil, and is it competitively priced?

Algal DHA production is generally more capital-intensive than conventional fish oil extraction due to the sophisticated bioreactor technology and energy required for fermentation and downstream purification. While the cost per unit remains higher, advancements in high-yield strains and large-scale fermentation technology are rapidly narrowing this gap. Competitiveness is achieved in premium segments like infant formula and specialized nutraceuticals where high purity justifies the premium price point.

What are the main applications driving the growth of the Algal DHA and ARA market?

The main application driving market size is Infant Formula, where DHA and ARA inclusion is often mandatory for supporting neonatal brain and visual development. The fastest growth driver, however, is the Dietary Supplements segment, fueled by the increasing demand for plant-based, clean-label omega supplements targeting prenatal care, cognitive health maintenance in adults, and cardiovascular wellness across aging populations globally.

What role does technology, specifically fermentation, play in market scalability?

Heterotrophic fermentation is the cornerstone technology enabling industrial-scale production. By utilizing enclosed bioreactors and controlled nutrient feeding, manufacturers can achieve exceptionally high biomass density and fatty acid yields consistently, independent of geographical or climatic variability. This scalability is essential for meeting the high-volume demand from major B2B clients and driving down the unit cost necessary for broader market acceptance.

Which regional market shows the greatest growth potential for Algal DHA and ARA?

The Asia Pacific (APAC) region demonstrates the greatest growth potential, driven primarily by demographic factors (large population and high birth rates) and rapid economic development, particularly in China and India. Regulatory mandates supporting infant nutrition fortification and a general increase in health-related consumer spending strongly favor the accelerated adoption and local manufacturing of these advanced nutritional ingredients throughout the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager