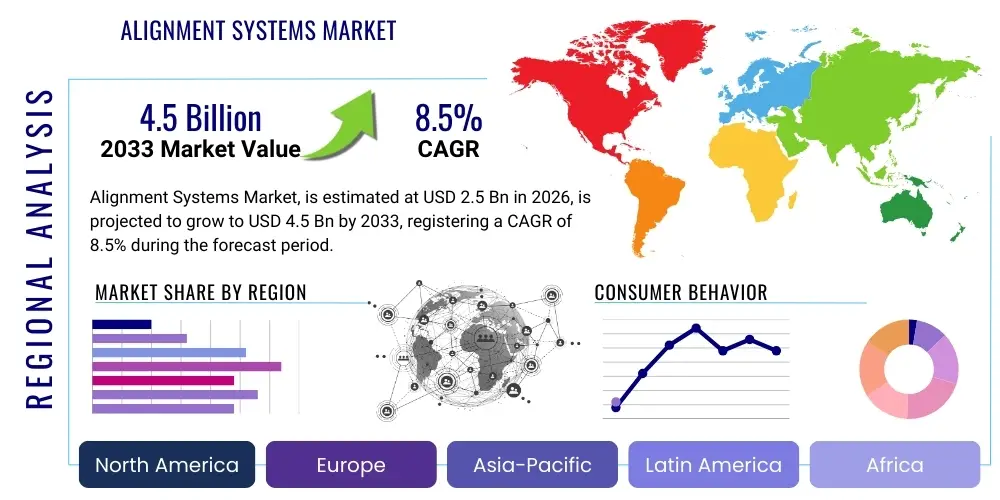

Alignment Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436132 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Alignment Systems Market Size

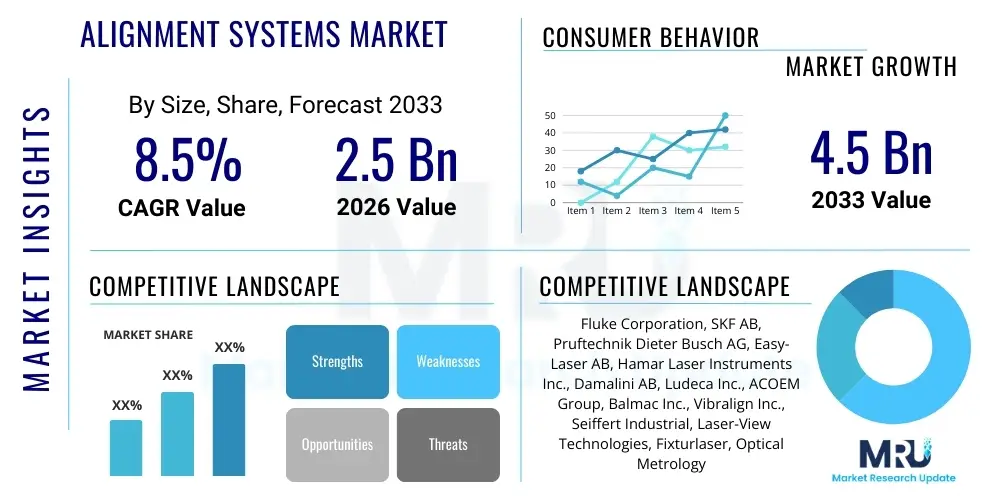

The Alignment Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.5 Billion by the end of the forecast period in 2033.

Alignment Systems Market introduction

The Alignment Systems Market encompasses sophisticated measurement and diagnostic tools designed to ensure the precise spatial positioning of mechanical components, particularly in rotating machinery and large industrial structures. These systems utilize advanced technologies such as laser, optical, and inertial sensors combined with specialized software for real-time data processing and correction guidance. Accurate alignment is critical for optimizing operational efficiency, minimizing energy consumption, and significantly extending the lifespan of industrial assets like pumps, motors, turbines, and compressors. The primary objective is to eliminate misalignment, which is a leading cause of vibration, excessive wear, and catastrophic failure in rotating equipment across various heavy industries. Market participants offer solutions ranging from handheld laser alignment devices for shaft coupling to complex three-dimensional measurement systems used in aerospace tooling and shipbuilding. The increasing demand for predictive maintenance strategies and the rigorous implementation of ISO standards related to machinery vibration further cement the necessity of these precise alignment solutions, driving consistent market expansion.

Product descriptions within this market segment are diverse, covering systems for shaft alignment, belt alignment, bore alignment, and geometric alignment. Shaft alignment systems, typically utilizing dual-laser technology, are paramount in ensuring that coupled machinery operates on the same axis of rotation, thereby preventing undue stress on bearings and seals. Geometric alignment systems, often based on total stations or laser trackers, address flatness, straightness, and perpendicularity issues in large structures. Major applications span high-precision manufacturing, where machine tool calibration is essential; automotive production, focusing on robotics and assembly line accuracy; and critical infrastructure, including power generation and oil and gas operations where unscheduled downtime is financially crippling. The inherent benefits of utilizing these systems include reduced maintenance costs, improved equipment reliability (Mean Time Between Failures, MTBF), enhanced safety protocols, and a substantial reduction in operational energy waste resulting from frictional losses caused by misalignment.

The market is currently being driven by several macroeconomic and technological factors. Technologically, the integration of wireless connectivity, cloud-based data storage, and intuitive tablet interfaces has significantly simplified the alignment process, making high-precision tools accessible to a broader user base. Economically, the global push toward Industry 4.0 and smart factory concepts mandates the collection and analysis of continuous operational data, positioning alignment systems as essential components of comprehensive Condition Monitoring (CM) programs. Furthermore, the stringent regulatory environment in sectors like nuclear power and aerospace necessitates absolute precision in component installation and maintenance, creating sustained demand for certified and traceable alignment tools. The ongoing digital transformation of maintenance practices worldwide serves as a fundamental catalyst for adoption.

Alignment Systems Market Executive Summary

The Alignment Systems Market demonstrates robust growth propelled by the global industrial shift towards predictive maintenance methodologies and the pervasive integration of IoT within manufacturing environments. Key business trends include aggressive mergers and acquisitions aimed at consolidating software and hardware capabilities, particularly in sensor fusion and data analytics platforms. Major players are strategically focusing on developing hybrid alignment solutions that combine laser accuracy with inertial measurement units (IMU) for enhanced functionality in challenging industrial settings where line of sight might be obstructed. Furthermore, the emphasis is shifting from simply providing measurement tools to offering comprehensive, subscription-based Condition Monitoring services that incorporate alignment data seamlessly, thereby maximizing customer retention and recurring revenue streams. This evolution requires substantial investment in robust, cybersecurity-compliant cloud infrastructure to handle the massive influx of industrial data generated by continuous monitoring equipment.

Regional trends indicate that Asia Pacific (APAC) is emerging as the fastest-growing market, primarily fueled by massive infrastructure development, rapid industrialization in countries like China and India, and the subsequent expansion of high-speed rail, power generation facilities, and automotive manufacturing bases. North America and Europe, characterized by mature industrial landscapes, focus heavily on replacing older, dial-indicator-based alignment methods with advanced laser systems to comply with increasingly stringent efficiency and environmental standards. These regions prioritize sophisticated solutions integrating vibration analysis alongside alignment diagnostics. Segment trends highlight significant growth in the software and services segment, as end-users seek integrated solutions for asset management rather than standalone hardware purchases. Demand for non-contact optical and 3D scanning alignment systems is also accelerating, particularly in large structure alignment where traditional contact methods are impractical or time-consuming. The laser-based segment, however, remains the foundational revenue driver due to its established reliability and ease of use in standard shaft coupling applications.

In summary, the market is characterized by technological innovation focused on automation and connectivity. Strategic alignment involves integrating proprietary software with existing Enterprise Asset Management (EAM) and Computerized Maintenance Management Systems (CMMS). The shift from reactive to proactive maintenance schedules across heavy industries provides a guaranteed long-term demand foundation. Companies are investing heavily in R&D to improve sensor resolution, enhance battery life, and develop more ergonomic, field-ready instruments. Competitive strategies revolve around providing superior customer training and support, optimizing user interfaces for complex data interpretation, and ensuring compatibility with diverse machinery types and operating environments. The overall market outlook is exceptionally positive, driven by the inescapable economic benefits associated with minimizing equipment downtime and maximizing asset performance.

AI Impact Analysis on Alignment Systems Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Alignment Systems Market predominantly center on automated decision-making, predictive drift analysis, and the integration of machine learning (ML) into asset performance management (APM) platforms. Users are keen to understand how AI can move alignment systems beyond simple measurement tools to proactive, self-optimizing solutions. Key themes reveal expectations that AI will analyze historical alignment corrections, vibration signatures, thermal expansion data, and operational load profiles to predict precisely when and how misalignment is likely to occur, allowing for ultra-precise, condition-based maintenance scheduling rather than time-based intervention. Concerns often revolve around data privacy, the trustworthiness of automated recommendations (i.e., the need for human validation), and the costs associated with upgrading existing infrastructure to handle advanced AI processing at the edge or in the cloud. There is a strong consensus that AI will fundamentally transform precision maintenance from a diagnostic task into a prescriptive function.

The integration of AI algorithms facilitates a paradigm shift in how alignment data is interpreted. Machine learning models can process massive datasets—including operational parameters, historical repair logs, and sensor outputs—far faster and more accurately than traditional statistical methods. This enables the detection of subtle patterns indicative of impending alignment degradation, such as minor changes in coupling temperature or fluctuations in operational speed that correlate with incipient misalignment. Furthermore, AI is crucial for optimizing the alignment procedure itself. By simulating various correction scenarios based on the machinery's foundation stiffness and bolt patterns, AI-driven software can guide technicians through the fastest, most effective series of adjustments, significantly reducing the time required for successful alignment, a critical factor in minimizing plant downtime.

The future application of AI includes the development of autonomous alignment systems, particularly relevant for remote or hazardous locations. While fully autonomous systems are still nascent, AI is already powering sophisticated monitoring units that alert operators to alignment issues the moment they exceed predefined or AI-determined tolerance limits, effectively turning fixed-interval inspections into continuous, intelligent surveillance. This prescriptive capability ensures that maintenance resources are deployed only when and where they are absolutely necessary, optimizing labor costs and extending asset useful life. The convergence of 5G connectivity, advanced sensing, and AI processing power is the primary technological accelerant for this transformation, ensuring the Alignment Systems Market remains at the forefront of industrial maintenance innovation.

- AI-driven predictive modeling forecasts misalignment occurrences based on operational and environmental variables.

- Machine Learning enhances diagnostic accuracy by correlating subtle sensor data anomalies with alignment status changes.

- Automated prescriptive guidance optimizes correction steps, minimizing technician time and error during maintenance routines.

- AI facilitates the creation of self-optimizing machinery, adjusting tolerances dynamically based on real-time load conditions.

- Enhanced data fusion capabilities integrate alignment data seamlessly with vibration, thermal, and oil analysis for holistic asset health reports.

DRO & Impact Forces Of Alignment Systems Market

The Alignment Systems Market is fundamentally influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), underpinned by powerful market impact forces. Key drivers include the overwhelming global demand for improved operational efficiency and energy conservation across asset-intensive industries. Misalignment accounts for a significant portion of industrial energy consumption and maintenance expenditure; thus, precise alignment systems offer immediate and quantifiable ROI, compelling adoption. Furthermore, strict safety regulations and the corporate drive towards zero unplanned downtime necessitate the adoption of reliable condition monitoring tools, of which alignment systems are an integral component. The technological driver is the continuous miniaturization and increased accuracy of sensors, coupled with the user-friendliness of modern software interfaces, lowering the barrier to entry for maintenance personnel lacking specialized training.

Conversely, the market faces several notable restraints. The initial high capital expenditure required for sophisticated laser and 3D alignment systems, especially for Small and Medium Enterprises (SMEs), can be prohibitive, often leading to reliance on older, less efficient methods. Another significant restraint is the prevalent lack of skilled technicians capable of not only operating the advanced equipment but also accurately interpreting the complex data outputs and translating them into effective corrective actions. Cultural resistance to change within traditional industrial environments, where established mechanical practices are deeply rooted, also slows the adoption of digital alignment technologies. The technical challenge of ensuring reliable alignment measurements in harsh environments characterized by extreme temperatures, dust, and vibration also poses a restraint that requires constant R&D investment.

Opportunities for market expansion are abundant, particularly in the realm of integrated service models. The shift towards "Alignment-as-a-Service" (AaaS), where providers offer alignment, condition monitoring, and predictive analysis under a single subscription, presents a massive growth avenue. Furthermore, the burgeoning demand for geometric alignment solutions in specialized sectors like wind energy (turbine rotor alignment) and civil engineering (precision machine installation on large foundations) represents untapped potential. The largest opportunity lies in leveraging IIoT connectivity to facilitate remote diagnostics and support, enabling system vendors to manage global fleets of alignment tools and provide real-time expert assistance, further optimizing resource utilization for end-users. These factors collectively shape a market where technological sophistication is both the primary driver and the source of implementation challenges.

Segmentation Analysis

The Alignment Systems Market is highly segmented based on technology, component, application, and end-use industry, reflecting the diverse requirements of industrial users worldwide. This detailed segmentation allows manufacturers to tailor their product offerings, focusing on specialized niches such as high-speed turbomachinery alignment versus standard motor-pump setups. Segmentation by technology is critical, distinguishing between the dominant laser-based systems, traditional mechanical (dial indicator) methods, and advanced optical and inertial measurement technologies. The trend shows a rapid decline in mechanical methods usage and corresponding high growth in portable, wireless laser systems. The segmentation also clarifies the market size of key enabling technologies, such as dedicated alignment software, sensor hardware, and peripheral devices like shims and measurement fixtures, ensuring that strategic marketing efforts are precisely targeted.

The application-based segmentation, covering shaft, belt, bore, and geometric alignment, reveals areas of concentrated industrial spending. Shaft alignment systems dominate the market share due to the ubiquitous nature of coupled rotating equipment across all manufacturing sectors. However, the fastest growth is observed in geometric alignment, driven by the increasing size and complexity of large industrial assets, requiring precise 3D measurement capabilities for foundations, roller beds, and machine tool flatness. End-use industry segmentation provides insight into where capital expenditure for alignment tools is highest, with Manufacturing (especially machine tools and robotics) and Oil & Gas (due to severe operating conditions and high reliability demands) being the most prominent consumers. This structured analysis is essential for identifying both mature revenue streams and emerging, high-growth sectors, informing resource allocation for R&D and sales channel development.

Moreover, the segmentation helps delineate the competitive landscape. Companies specializing in high-end, complex geometric alignment solutions (often utilizing laser trackers) operate in a different competitive sphere than those focused on entry-level, handheld shaft alignment tools. The component breakdown further assists in value chain analysis, particularly in understanding the dependency on high-quality sensors (e.g., CCD cameras, accelerometers) and specialized analytical software licenses. As the market matures, integration across these segments becomes vital; for example, modern systems must be capable of seamlessly switching between shaft and belt alignment measurements using the same core hardware and software platform, thereby offering enhanced value proposition to maintenance teams.

- By Product Type:

- Laser Alignment Systems

- Optical Alignment Systems

- Mechanical Alignment Systems (Dial Indicators, Straightedge)

- Vibration-Based Alignment Systems

- 3D Measurement and Geometric Alignment Systems

- By Component:

- Sensors and Transmitters (Detectors)

- Display and Processing Units

- Software and Data Analytics Platforms

- Accessories (Fixtures, Shims, Brackets)

- By Application:

- Shaft Alignment

- Belt/Pulley Alignment

- Bore Alignment

- Geometric Alignment (Flatness, Straightness, Perpendicularity)

- By End-Use Industry:

- Manufacturing and Process Industries

- Oil & Gas and Petrochemicals

- Power Generation (Thermal, Nuclear, Renewables)

- Aerospace and Defense

- Marine and Shipbuilding

- Mining and Metals

Value Chain Analysis For Alignment Systems Market

The value chain for the Alignment Systems Market begins with upstream activities focused heavily on the procurement and development of highly specialized components, primarily high-precision laser diodes, optical sensors (e.g., CMOS/CCD detectors), and sophisticated microprocessors required for rapid signal processing and data acquisition. Key upstream challenges include maintaining a stable supply of specific optical components and managing the intellectual property associated with proprietary measurement algorithms. Research and Development (R&D) forms the most critical upstream activity, driving innovation in sensor fusion, wireless communication protocols, and battery technology to enhance field portability and measurement accuracy. Manufacturers must also secure reliable software development teams to continually update firmware and application interfaces, ensuring the systems remain compatible with evolving industrial operating systems and cloud environments, thus maintaining a competitive technological edge.

Downstream activities involve system integration, robust quality control, calibration services, and extensive distribution networks. Once the systems are manufactured and assembled, they undergo rigorous metrological calibration to ensure precision and traceability, often requiring ISO 17025 certification. Distribution channels are typically bifurcated into direct sales and indirect channels. Direct sales are often preferred for high-value, complex systems requiring specialized installation support, particularly to large industrial conglomerates and aerospace clients. These direct channels allow manufacturers to maintain control over customer relationships and training quality. Indirect channels, comprising industrial distributors, value-added resellers (VARs), and regional sales agents, handle the majority of standard shaft and belt alignment tool sales, providing local inventory and immediate technical support to SMEs.

Service and support constitute a massive component of the downstream value proposition. Post-sale activities, including mandatory periodic recalibration, technical support hotlines, specialized application training, and software subscription management, are vital revenue generators and critical differentiators in this market. The transition towards Condition Monitoring Services (CMS) means that downstream value increasingly flows from data analytics and continuous remote support rather than just the initial hardware sale. Effective management of this service ecosystem—ensuring rapid field response and expert knowledge transfer—is paramount to customer satisfaction and loyalty, ultimately reinforcing brand reputation in a sector where reliability is non-negotiable.

Alignment Systems Market Potential Customers

The potential customers for Alignment Systems are primarily organizations that rely on large quantities of rotational machinery, fixed industrial assets, or precision manufacturing processes where dimensional accuracy is non-negotiable. The largest demographic comprises maintenance departments and engineering teams in heavy process industries such as Oil & Gas, Petrochemicals, and Power Generation (including nuclear, thermal, and hydropower), where machine uptime directly correlates with revenue and safety compliance. These customers require robust, explosion-proof, and highly reliable systems capable of measuring alignment under challenging ambient conditions and often prefer integrated solutions that provide both alignment and vibration diagnostics from a single vendor. The need for documented, traceable alignment reports is crucial for regulatory auditing and internal quality assurance protocols, making systems with robust data logging capabilities highly attractive.

A second major customer segment includes automotive and general manufacturing facilities, particularly those involved in automated assembly and high-speed production lines. In the automotive sector, customers utilize alignment systems not only for routine maintenance of plant machinery (pumps, fans, conveyors) but also for the highly precise calibration of robotic arms, jigs, fixtures, and machine tools, ensuring component quality and interchangeability. Furthermore, the aerospace and defense industries represent a niche but highly lucrative customer base, demanding the most accurate 3D and geometric alignment systems (like laser trackers) for wing assembly, fuselage alignment, and critical tooling calibration, where tolerances are measured in microns and system certification is mandatory.

Lastly, independent service providers, including industrial repair shops, third-party maintenance contractors, and specialized alignment consultants, form a growing customer base. These entities purchase alignment systems as core tools for their service delivery portfolio, catering to smaller industrial clients who cannot justify the capital outlay for their own dedicated equipment. This segment prioritizes portability, speed of measurement, and ease of use, as their technicians must operate effectively across a multitude of different plant environments daily. Targeted sales strategies must address the distinct purchasing drivers of each customer group—prioritizing reliability and compliance for the energy sector, speed and accuracy for manufacturing, and absolute precision and certification for aerospace.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fluke Corporation, SKF AB, Pruftechnik Dieter Busch AG, Easy-Laser AB, Hamar Laser Instruments Inc., Damalini AB, Ludeca Inc., ACOEM Group, Balmac Inc., Vibralign Inc., Seiffert Industrial, Laser-View Technologies, Fixturlaser, Optical Metrology Services, AMETEK, Inc., Gleason Corporation, Leica Geosystems (Hexagon AB), Status Pro, Rotalign, Lazer Alignment Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Alignment Systems Market Key Technology Landscape

The technological landscape of the Alignment Systems Market is dominated by the evolution of laser-based systems, which have dramatically replaced traditional mechanical dial indicators due to their speed, accuracy, and user-friendliness. Modern laser alignment systems utilize advanced semiconductor lasers and high-resolution digital sensors (CCD or CMOS) to achieve micron-level precision, even over substantial distances. The key technological advancement lies in the utilization of multiple measurement points, often four or more, taken across a full or partial shaft rotation, combined with sophisticated algorithms that compensate for environmental factors such as coupling backlash, thermal drift, and machine foundation settling. This shift from simple single-point measurement to continuous sweep mode measurement has significantly reduced the required technical skill level while improving diagnostic reliability. Furthermore, the integration of MEMS gyroscopes and accelerometers is increasingly prevalent, aiding in the determination of precise angular positions without needing perfect rotational movements.

Beyond laser technology, the market is characterized by the increasing maturity of 3D measurement and geometric alignment solutions, which leverage technologies like laser trackers, laser scanners, and total stations. These highly accurate, non-contact systems are essential for large-scale structural alignment in sectors such as civil engineering, aircraft manufacturing, and complex fixture fabrication. The continuous improvement in the portability and affordability of laser trackers is broadening their application beyond traditional metrology labs and onto the plant floor. Furthermore, software platforms have become a pivotal part of the technology landscape, providing features such as 3D visualization of misalignment, automated compliance reporting, and connectivity to enterprise asset management (EAM) systems. These software enhancements transform raw data into actionable insights, driving higher adoption rates among maintenance professionals who value intuitive, data-driven decision support.

The most compelling technological trend is the drive toward wireless connectivity and IIoT integration. Nearly all new high-end alignment systems incorporate Bluetooth or Wi-Fi to facilitate seamless data transfer to mobile devices (tablets/smartphones) and cloud-based platforms. This connectivity enables remote monitoring, immediate sharing of results with geographically dispersed teams, and the utilization of cloud computing for complex analysis, including AI processing. Furthermore, advancements in battery technology, enhancing the longevity of field units, and the development of robust, industrially hardened interfaces (IP67 ratings) ensure that these sensitive electronic devices can withstand the rigorous and often hazardous conditions found in heavy industry, thereby guaranteeing consistent performance and measurement reliability under stress.

Regional Highlights

Regional dynamics heavily influence the adoption and growth trajectory of the Alignment Systems Market, dictated by differing levels of industrial maturity, infrastructure investment, and regulatory pressures concerning operational efficiency and safety.

- North America: Characterized by high technological maturity and stringent industry standards (e.g., API standards in Oil & Gas). The region is a primary adopter of advanced, integrated alignment and condition monitoring solutions. Market growth is driven by the replacement cycle of older technology and a strong focus on predictive maintenance to reduce labor costs and maximize efficiency in mature manufacturing and energy sectors. The United States accounts for the largest share, emphasizing high-end laser and 3D geometric systems for aerospace and complex machining operations.

- Europe: Europe is a key innovation hub, particularly in Germany and Scandinavia, focusing on highly precise manufacturing and sustainable industrial practices. Demand is fueled by regulatory mandates promoting energy efficiency and the pervasive integration of Industry 4.0 principles. The market here prioritizes robust, modular systems that can easily integrate with existing plant digitalization efforts, resulting in strong growth for software-as-a-service (SaaS) offerings related to alignment data management.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR due to rapid industrial expansion, massive infrastructure projects (e.g., power plants, high-speed railways), and increasing foreign direct investment in manufacturing capabilities, particularly in China, India, and Southeast Asian nations. While the market initially utilized lower-cost solutions, the increasing emphasis on quality control and global competitiveness is rapidly driving demand for sophisticated laser alignment systems to ensure reliable high-volume production.

- Latin America (LATAM): Market growth in LATAM is steady but moderate, often correlated with investments in mining, oil extraction, and processing industries. Adoption is often driven by multinational corporations establishing standardized maintenance practices. The challenge remains the high initial cost, leading to a strong demand for cost-effective, durable, and easy-to-use entry-level and mid-range alignment products.

- Middle East and Africa (MEA): The MEA region is characterized by substantial investments in the Oil & Gas, petrochemicals, and utilities sectors. These sectors require extremely reliable alignment solutions due to the high operational temperatures and critical nature of the machinery. Saudi Arabia and the UAE are major spenders, focusing on premium, certified alignment systems that enhance safety and prevent catastrophic equipment failures in sensitive exploration and processing environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Alignment Systems Market.- Fluke Corporation

- SKF AB

- Pruftechnik Dieter Busch AG

- Easy-Laser AB

- Hamar Laser Instruments Inc.

- Damalini AB

- Ludeca Inc.

- ACOEM Group

- Balmac Inc.

- Vibralign Inc.

- Seiffert Industrial

- Laser-View Technologies

- Fixturlaser

- Optical Metrology Services

- AMETEK, Inc.

- Gleason Corporation

- Leica Geosystems (Hexagon AB)

- Status Pro

- Rotalign

- Lazer Alignment Inc.

Frequently Asked Questions

Analyze common user questions about the Alignment Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of transitioning from mechanical to laser alignment systems?

The primary benefit of switching to laser alignment systems is the significant improvement in accuracy, speed, and repeatability of measurements compared to traditional mechanical dial indicators. Laser systems drastically reduce human error, provide instant, high-resolution data displays, and facilitate automated report generation necessary for predictive maintenance compliance and enhanced operational energy efficiency.

How does Alignment Systems technology contribute to Industry 4.0 and Smart Manufacturing initiatives?

Alignment Systems contribute to Industry 4.0 by providing highly accurate, connected sensor data on machine health. Modern systems utilize IIoT connectivity (wireless communication) to feed real-time alignment status directly into centralized Condition Monitoring (CM) and Enterprise Asset Management (EAM) platforms, enabling automated diagnostics, predictive scheduling, and continuous asset performance optimization.

What are the key differences between shaft alignment and geometric alignment applications?

Shaft alignment focuses on correcting the coaxial position of coupled rotating shafts (motors, pumps) to eliminate angular and parallel offset misalignment. Geometric alignment, conversely, involves measuring and correcting the dimensional accuracy (flatness, straightness, parallelism) of large, non-rotating structures such as machine beds, turbine casings, and large assembly fixtures, often requiring 3D laser tracking technology.

Which end-use industry drives the highest demand for sophisticated 3D geometric alignment solutions?

The Aerospace and Defense industry, along with specialized Heavy Manufacturing (e.g., shipbuilding and large machine tool builders), drives the highest demand for sophisticated 3D geometric alignment solutions, such as laser trackers and total stations, due to the critical requirement for extreme precision (micron level) in assembling large, high-value components and tooling with tight regulatory tolerances.

What role does software play in the modern Alignment Systems Market?

Software is essential, transforming alignment hardware from simple measuring tools into diagnostic platforms. Modern software provides intuitive user guidance, analyzes thermal growth compensation, simulates correction scenarios (prescriptive maintenance), manages historical alignment records, generates mandatory compliance reports, and facilitates remote expert collaboration via cloud integration, enhancing overall user efficiency and reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Alignment Systems Market Size Report By Type (Shaft Alignment, Belt Alignment), By Application (Manufacturing Industry, Chemical Industry, Power Industry, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Alignment Systems Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Shaft Alignment, Belt Alignment), By Application (Manufacturing Industry, Chemical Industry, Power Industry, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager