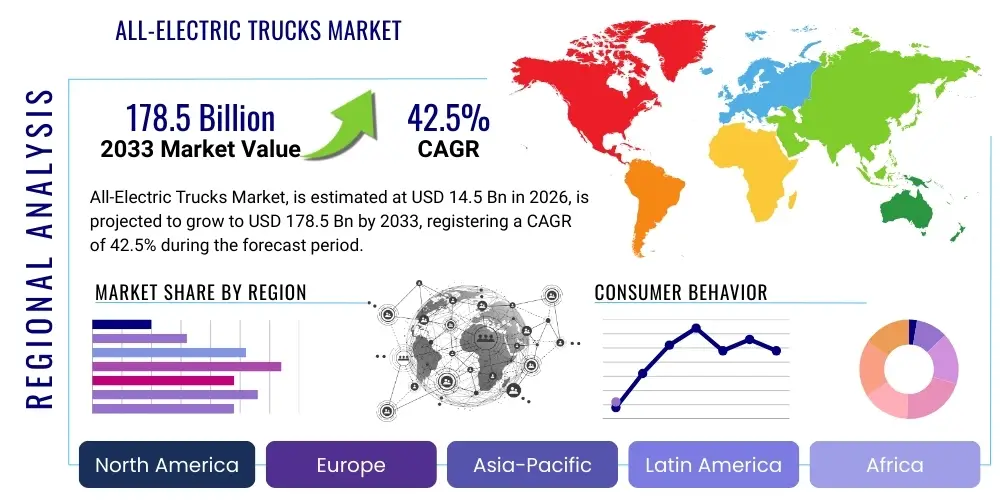

All-Electric Trucks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438072 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

All-Electric Trucks Market Size

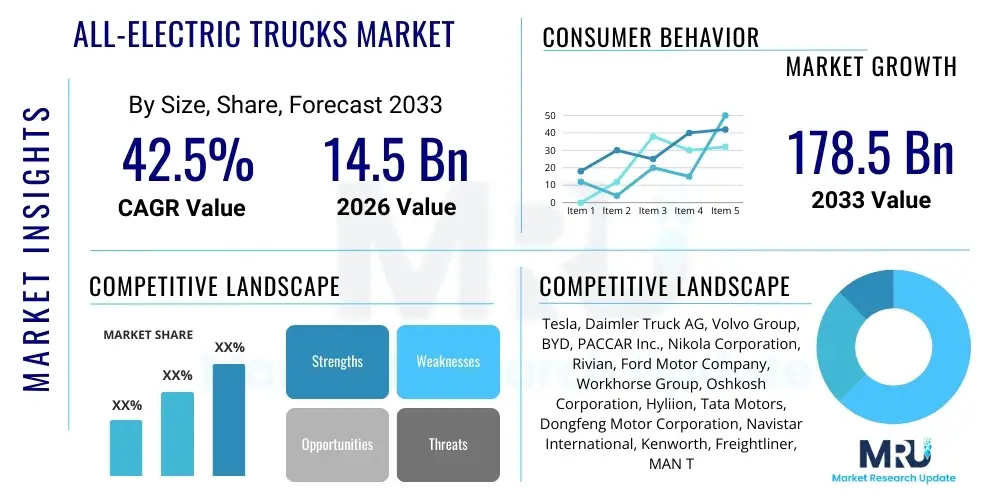

The All-Electric Trucks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 42.5% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $178.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by global regulatory pressures aimed at decarbonizing the logistics and transportation sectors, particularly in dense urban environments. The rising viability of lithium-ion battery technology, offering improved energy density and faster charging cycles, is making electric trucks a practical alternative to traditional diesel powertrains for specific duty cycles, especially within fleet operations focused on regional hauling and last-mile delivery.

All-Electric Trucks Market introduction

The All-Electric Trucks Market encompasses commercial vehicles, ranging from light-duty vans to heavy-duty Class 8 trucks, powered exclusively by battery packs, eliminating the reliance on internal combustion engines (ICE). These vehicles utilize electric powertrains for propulsion, offering zero tailpipe emissions and significantly reduced operational noise, making them ideal for urban centers and noise-sensitive operations. Major applications span critical sectors, including regional freight transport, urban logistics and last-mile delivery services, port operations, refuse collection, and specialized construction duties. The inherent benefits of these vehicles include lower running costs due to reduced fuel and maintenance needs, alongside substantial environmental compliance advantages, supporting corporate sustainability mandates across various industries globally.

Driving factors propelling market growth include stringent government mandates like those enforced by the European Union and specific states in the US, which necessitate the gradual phasing out of diesel trucks in favor of electric alternatives. Furthermore, increasing investments in charging infrastructure by both private enterprises and governmental bodies are mitigating historical range anxiety concerns. The decreasing cost of battery cells and the evolution of sophisticated battery management systems (BMS) are improving the total cost of ownership (TCO) calculation for fleet operators, making the transition to electric fleets economically compelling over the medium to long term, thereby reinforcing the market's robust trajectory toward widespread adoption.

All-Electric Trucks Market Executive Summary

The All-Electric Trucks Market is experiencing rapid commercialization, transitioning from niche pilot projects to large-scale fleet integration, driven by compelling business trends focusing on operational efficiency and environmental, social, and governance (ESG) compliance. Key business trends involve extensive partnerships between established automotive OEMs and specialized battery manufacturers, alongside the emergence of technology-focused startups introducing disruptive business models like battery-as-a-service (BaaS) to lower upfront acquisition costs for fleet managers. Regional trends indicate strong leadership from the Asia Pacific, specifically China, due to proactive government subsidies and high manufacturing capacity, while North America and Europe are witnessing accelerated deployment, focusing particularly on medium-duty logistics and regional haulage routes. Segment trends highlight the medium-duty electric truck segment as the primary growth catalyst, offering the optimal balance between battery requirements, payload capacity, and established operational routes, although the heavy-duty segment is poised for significant future growth as battery energy density continues to improve, addressing long-haul range limitations.

AI Impact Analysis on All-Electric Trucks Market

Analysis of common user inquiries regarding AI's influence on the All-Electric Trucks Market reveals consistent themes centered on operational efficiency, battery lifecycle management, and safety protocols. Users frequently ask about how AI can optimize charging schedules (Vehicle-to-Grid integration), predict battery degradation (health monitoring), and enhance route planning to maximize range and minimize energy consumption. There is a strong expectation that AI will move beyond basic telematics to provide predictive maintenance insights, thereby maximizing uptime and reducing TCO, a critical factor for fleet managers. Furthermore, concerns revolve around the cybersecurity implications of highly connected AI-driven electric fleets and the need for standardized data protocols to ensure interoperability and secure data sharing between vehicle systems, fleet management software, and public infrastructure providers. Overall, users anticipate that AI integration will be essential for realizing the full economic potential of electric truck deployment by solving complex logistical and energetic challenges.

- AI-driven Predictive Maintenance: Utilizing machine learning models to analyze vehicle performance data, predict component failures (especially battery and powertrain), and schedule maintenance proactively, significantly increasing vehicle uptime.

- Optimized Route Planning and Range Prediction: Integrating real-time traffic, weather, topography, and payload data with AI algorithms to calculate the most energy-efficient routes and provide highly accurate remaining range predictions, mitigating range anxiety.

- Smart Charging and Grid Management: Implementing AI systems to manage fleet charging schedules dynamically, leveraging low energy tariffs (peak shaving) and coordinating energy draw with the grid (V2G capability) to minimize costs and prevent infrastructure overload.

- Enhanced Fleet Telematics and Driver Assistance: Deploying computer vision and machine learning for advanced driver-assistance systems (ADAS), optimizing driving behavior for energy efficiency, and improving overall safety standards.

- Battery Health Monitoring and Lifecycle Management: Using AI to monitor cell-level performance, accurately gauge battery State of Health (SOH), extend lifespan, and facilitate effective second-life applications for retired battery packs.

DRO & Impact Forces Of All-Electric Trucks Market

The dynamics of the All-Electric Trucks Market are fundamentally shaped by a convergence of regulatory push factors and technological pull factors, creating substantial market momentum despite persistent infrastructural hurdles. Drivers, such as rigorous global mandates targeting reduced greenhouse gas emissions and the expansion of zero-emission zones in major cities, compel fleet operators to transition rapidly. These forces are amplified by corporate commitments to decarbonization, pushing major logistics companies toward sustainable fleet procurement. Restraints primarily center on the high initial acquisition cost of electric trucks compared to diesel equivalents and the critical lack of robust, high-power public charging infrastructure tailored for heavy commercial vehicles, which restricts long-haul applicability. Opportunities emerge from advancements in next-generation battery chemistries (e.g., solid-state, sodium-ion) that promise higher energy density and faster charging, alongside the growing potential for hydrogen fuel cell electric trucks (FCEVs) to complement battery-electric solutions, particularly in demanding long-range segments. The interplay of these factors defines the market's trajectory, requiring significant public and private collaboration to accelerate infrastructure development and standardize charging protocols.

Impact forces illustrate how these DRO factors interact. High initial cost remains a powerful constraining force, particularly for smaller fleet operators, but it is gradually being countered by supportive government incentives and subsidies (tax credits, purchase rebates) that lessen the financial burden. The environmental imperative acts as an undeniable driver, influencing consumer preferences and investor mandates, making electric truck adoption a non-negotiable strategic priority for public-facing companies. Technological advancements, specifically the continuous improvement in battery energy density and corresponding reduction in weight, directly amplify the opportunity by expanding the addressable market from urban delivery to regional and even medium-distance long-haul routes. The market's resilience against the existing infrastructure gaps is sustained by dedicated depot charging solutions and early adopters operating within defined, predictable routes, proving the operational viability even while public infrastructure scales up.

Ultimately, the market's acceleration hinges on the ability of manufacturers to achieve component standardization and economies of scale, thereby reducing production costs, combined with rapid infrastructure deployment, particularly mega-watt charging (MCS) solutions. Failure to address the scalability of high-speed charging for heavy-duty applications could severely restrain market growth beyond the medium-duty segment. However, the opportunity presented by regulatory alignment across major economic blocs ensures that the long-term trend remains strongly positive, compelling continuous investment in R&D and manufacturing capacity expansion globally, mitigating the persistent restraints over time as the technology matures and becomes universally cost-competitive.

Segmentation Analysis

The All-Electric Trucks Market is primarily segmented based on the vehicle type (duty classification), battery type, range, and end-user application, providing a granular view of deployment patterns and specific technological requirements. The duty classification—Light, Medium, and Heavy—is crucial, as it dictates the required payload capacity, operational range, and the necessary battery size, profoundly influencing vehicle design and cost. The medium-duty segment (Class 5-7) currently dominates the market share due to its suitability for last-mile and regional delivery operations where current battery technology provides sufficient range without significant payload compromise. Furthermore, segmentation by range is critical, separating vehicles suitable for short urban loops (<150 miles) from those targeting longer regional haulage (>300 miles), directly affecting customer choice and infrastructure needs. End-user applications, spanning logistics, construction, and waste management, each present unique operational demands that mandate specialized truck configurations and charging strategies.

Analyzing the segmentation highlights evolving competitive landscapes. Within the heavy-duty segment (Class 8), which represents the largest potential market volume in terms of revenue, technological advances are concentrated on achieving the highest energy efficiency and fast charging capabilities to maintain competitive transport logistics schedules. Regional variations in market penetration are starkly evident; Asia Pacific is characterized by high penetration of light and medium-duty electric trucks due to supportive policies and congested urban environments, while North America is intensely focusing on scaling up electric solutions for medium and heavy-duty regional freight. The technological sub-segmentation is increasingly relevant, with discussions moving beyond basic lithium-ion to include nickel-manganese-cobalt (NMC) and lithium-iron-phosphate (LFP) batteries, where LFP is favored in applications prioritizing safety and longevity over absolute energy density.

The strategic segmentation helps stakeholders, including manufacturers and infrastructure providers, tailor their offerings effectively. For instance, refuse collection services often require high-power takeoff (PTO) capabilities and regenerative braking efficiency, positioning them as ideal early adopters for electric powertrains, whereas construction applications require ruggedness and exceptional torque delivery. Understanding these nuanced needs across segments allows for targeted product development, addressing the specific TCO concerns and operational mandates of diverse end-users, thus streamlining the mass adoption of electric fleets across the entire commercial transportation ecosystem, maximizing efficiency and minimizing financial risk for early movers in each category.

- By Type:

- Light-Duty Trucks (Class 1-3)

- Medium-Duty Trucks (Class 4-7)

- Heavy-Duty Trucks (Class 8)

- By Battery Type:

- Lithium-Iron Phosphate (LFP)

- Nickel Manganese Cobalt (NMC)

- Other Chemistries (e.g., Solid-State, Sodium-Ion)

- By Range:

- Short Range (< 150 Miles)

- Medium Range (150-300 Miles)

- Long Range (> 300 Miles)

- By Application:

- Logistics and Last-Mile Delivery

- Municipal Services (Waste Management, Utility Maintenance)

- Construction and Mining

- Port and Terminal Operations

Value Chain Analysis For All-Electric Trucks Market

The value chain for the All-Electric Trucks Market is complex and highly integrated, starting from the upstream sourcing of critical raw materials for battery manufacturing and extending to the downstream operations involving fleet management and end-of-life battery recycling. The upstream analysis focuses heavily on the procurement and processing of key battery components, including lithium, cobalt, nickel, and graphite, where geopolitical risks and sustainable sourcing practices are major concerns influencing overall supply chain stability and cost volatility. Battery cell production, typically dominated by specialized Asian manufacturers, represents the highest value-add activity in the upstream segment. Midstream activities involve the assembly of cells into battery packs and the manufacturing of essential electric components (inverters, motors, power electronics), followed by the final assembly of the electric truck chassis and cabin by established or emerging OEMs.

Downstream analysis covers the distribution, sales, and aftermarket services crucial for fleet adoption. Distribution channels are evolving rapidly, moving beyond traditional dealership models to include direct sales and specialized fleet consultation services that address the unique requirements of transitioning to electric fleets, such as charging infrastructure planning and energy contract negotiation. Direct distribution, often favored by new entrants and technology companies, facilitates closer customer relationships and faster feedback loops. Indirect distribution, leveraging established dealer networks, remains critical for traditional OEMs, particularly for providing geographically dispersed service and maintenance support, a vital factor for high-utilization commercial vehicles. The aftermarket segment, encompassing vehicle servicing, software updates (OTA), and battery health management, is rapidly growing and requires specialized technical training and diagnostic tools.

Crucially, the sustainability loop within the value chain—specifically the handling of end-of-life batteries—is becoming a significant downstream factor. Effective second-life applications (e.g., stationary storage) and eventual high-efficiency material recycling are necessary to secure the long-term environmental and economic viability of the entire ecosystem. This requirement necessitates close collaboration between vehicle manufacturers, energy companies, and recycling specialists. Furthermore, the role of digital platforms for fleet management, maintenance scheduling, and optimizing charging infrastructure integration acts as an overarching digital layer across the entire downstream distribution and operational lifespan, maximizing the TCO benefits and operational efficacy of electric truck fleets.

All-Electric Trucks Market Potential Customers

The potential customers and primary end-users of All-Electric Trucks are diverse organizations characterized by high utilization rates, predictable routes, and strong sustainability mandates, enabling them to maximize the TCO advantage derived from reduced fuel and maintenance expenses. Major buyers include large-scale logistics and e-commerce companies, such as Amazon, FedEx, and DHL, who operate vast fleets for last-mile and regional hub-to-hub deliveries. These entities often have dedicated depots where charging infrastructure can be economically installed and managed, minimizing reliance on nascent public charging networks. The demand from these logistics giants is focused predominantly on light and medium-duty electric trucks designed for efficient, zero-emission urban operation, making them the primary demand driver in many developed markets.

Beyond the logistics sector, municipal and governmental service providers represent a substantial customer base, particularly for applications like refuse collection, public works maintenance, and utility services. These fleets typically operate within fixed boundaries and defined daily cycles, which perfectly align with the current range capabilities of electric trucks. The adoption in this segment is frequently driven by public policy and a commitment to air quality improvement in densely populated areas. Furthermore, specialized industrial sectors, including port authorities and large warehousing operators, are procuring electric terminal tractors and yard haulers to meet internal emission reduction targets and comply with local air quality regulations governing industrial zones, favoring heavy-duty electric models with high torque requirements for intermittent, high-load operations.

A rapidly emerging segment of potential customers includes construction companies and mining operators, particularly those involved in urban projects or regulated environments where noise and exhaust emissions are strictly controlled. While this segment requires the highest battery capacity and robustness, technological advancements are making specialized electric dump trucks and concrete mixers viable alternatives. Ultimately, the transition is being led by large corporate entities with centralized fleet management and access to capital for upfront investment, but the market is expected to broaden significantly to include smaller and medium-sized enterprises (SMEs) as truck prices decrease and centralized, public heavy-duty charging corridors become widely established along major freight routes globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $178.5 Billion |

| Growth Rate | 42.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tesla, Daimler Truck AG, Volvo Group, BYD, PACCAR Inc., Nikola Corporation, Rivian, Ford Motor Company, Workhorse Group, Oshkosh Corporation, Hyliion, Tata Motors, Dongfeng Motor Corporation, Navistar International, Kenworth, Freightliner, MAN Truck & Bus, Scania, Renault Trucks, Xos Trucks |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

All-Electric Trucks Market Key Technology Landscape

The technological landscape of the All-Electric Trucks Market is dominated by advancements in three critical areas: battery technology, charging infrastructure, and integrated vehicle software systems. Current market viability is highly dependent on lithium-ion batteries, predominantly NMC and LFP variants, with intense research focused on improving volumetric and gravimetric energy density to extend range without sacrificing payload capacity. The imminent commercialization of solid-state batteries represents the next major technological leap, promising enhanced safety, faster charging, and a potential doubling of current energy density, which would fundamentally unlock the heavy-duty long-haul segment. Simultaneously, optimization of thermal management systems (TMS) is essential to ensure battery longevity and performance consistency under varied operational conditions, particularly during high-speed charging or extreme weather exposure, safeguarding the significant upfront battery investment.

A parallel revolution is occurring in charging infrastructure, transitioning from standard high-voltage DC fast charging to Megawatt Charging System (MCS) solutions, which are indispensable for heavy-duty electric trucks requiring massive energy replenishment within logistics-friendly timeframes (e.g., during mandated driver breaks). This technological shift necessitates standardized connectors, sophisticated power management solutions at depots, and smart grid integration capabilities (V2G/V2X) to manage the enormous power demand spikes associated with simultaneously charging large electric fleets. The market is also seeing rapid integration of silicon carbide (SiC) and gallium nitride (GaN) semiconductors in power electronics (inverters and converters), significantly improving the efficiency of power transfer between the battery and the electric motor, thereby contributing to overall vehicle range extension and faster charging times.

Furthermore, the reliance on sophisticated software and connectivity is transforming the truck from a mechanical asset into a highly intelligent, integrated device. Key software technologies include advanced telematics platforms that leverage machine learning for predictive maintenance and route optimization, as well as over-the-air (OTA) update capabilities for powertrain and battery management software. These digital systems are crucial for managing the complex interplay of battery state-of-charge, driver behavior, and external logistics requirements, effectively maximizing payload efficiency and ensuring the vehicle operates within its optimal energy window. This holistic technological focus—spanning energy storage, power delivery, and intelligent control—is the foundation upon which scalable and economically viable electric truck fleets are being built globally.

Regional Highlights

The All-Electric Trucks Market exhibits significant regional variations influenced by local regulatory frameworks, infrastructure maturity, and specific regional logistics demands. Asia Pacific (APAC) holds the dominant market share, primarily driven by China, which has robust government policies, substantial subsidies, and a massive domestic manufacturing base for both batteries and electric commercial vehicles. The rapid urbanization and high density of logistics activities in Chinese cities have made electric light and medium-duty trucks the default choice for urban delivery, supported by widespread dedicated charging depots and rapid deployment strategies. India and Japan are also emerging, focusing on domestic manufacturing and public transport electrification, respectively, although China remains the powerhouse of electric commercial vehicle adoption in this region.

Europe represents the second-largest and fastest-growing region in terms of heavy-duty electric truck adoption. Driven by stringent EU carbon emission targets and the expansion of urban low-emission zones (LEZs), European OEMs like Volvo and Daimler are leading the deployment of heavy electric regional haulers and municipal trucks. The focus here is on developing cross-border Megawatt Charging Corridors (MCCs) to facilitate long-distance zero-emission freight transport. Governments across Western Europe are aggressively subsidizing procurement and investing heavily in high-power charging infrastructure along key transport routes, setting the stage for medium- to heavy-duty fleet electrification over the coming decade.

North America is characterized by high demand concentration in California and other mandated states that adhere to zero-emission vehicle (ZEV) requirements. While infrastructure deployment lags behind Europe and China, investments are ramping up significantly through federal programs like the Bipartisan Infrastructure Law. The North American market is unique due to the vast distances and the dominance of Class 8 trucks, requiring manufacturers to heavily focus on range extension technologies and MCS standardization to cater to heavy freight logistics across continental distances. Latin America and the Middle East and Africa (MEA) are currently nascent markets, primarily focused on pilot projects in specific high-density urban centers or specialized industrial applications (e.g., mining in Chile, specialized transport in the UAE), pending greater regulatory clarity and infrastructure stability.

- Asia Pacific (APAC): Dominates the global market, particularly in the light and medium-duty segments, anchored by extensive manufacturing capacity and aggressive governmental support in China, making it the primary volume market.

- Europe: High growth trajectory focused on heavy-duty electrification, driven by stringent EU climate targets, widespread adoption in municipal fleets, and focused investment in cross-border Megawatt Charging infrastructure.

- North America: Strong policy push from key states (California) and significant federal investment, focusing on transitioning Class 8 heavy-duty regional hauling, requiring rapid deployment of high-power charging solutions.

- Latin America and MEA: Emerging markets characterized by pilot programs in select commercial centers and industrial sectors, awaiting greater economic stability and foundational charging infrastructure investment before widespread adoption occurs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the All-Electric Trucks Market.- Tesla

- Daimler Truck AG

- Volvo Group

- BYD

- PACCAR Inc.

- Nikola Corporation

- Rivian

- Ford Motor Company

- Workhorse Group

- Oshkosh Corporation

- Hyliion

- Tata Motors

- Dongfeng Motor Corporation

- Navistar International

- Kenworth

- Freightliner

- MAN Truck & Bus

- Scania

- Renault Trucks

- Xos Trucks

Frequently Asked Questions

Analyze common user questions about the All-Electric Trucks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the total cost of ownership (TCO) advantage of electric trucks over diesel trucks?

Electric trucks typically achieve a lower TCO over their lifespan due to drastically reduced fuel costs (electricity vs. diesel) and substantially lower maintenance expenses resulting from fewer moving parts in the electric powertrain compared to complex internal combustion engines, offsetting the higher initial purchase price.

How is range anxiety being addressed in the heavy-duty electric truck segment?

Range anxiety is mitigated through continuous improvements in battery energy density, the development of specialized high-efficiency thermal management systems, and the strategic deployment of Megawatt Charging Systems (MCS) along major freight corridors, enabling rapid, high-power charging during mandatory driver rest periods.

Which geographical region leads the global adoption of all-electric commercial vehicles?

The Asia Pacific region, specifically China, currently leads global adoption due to aggressive government subsidies, extensive manufacturing capabilities, and early, widespread deployment of electric trucks, particularly in the light and medium-duty segments for urban logistics.

What role do hydrogen fuel cell electric trucks (FCEVs) play in the electric truck market?

FCEVs are anticipated to complement battery-electric trucks, primarily targeting the long-haul, heavy-duty segment where battery weight and range limitations are most pronounced. FCEVs offer faster refueling times and comparable range to diesel, positioning them as a viable zero-emission solution for demanding, long-distance freight operations.

What are the primary restraints hindering the mass adoption of electric trucks?

The key restraints include the significant high initial acquisition cost compared to traditional diesel vehicles, the persistent lack of standardized, high-capacity public charging infrastructure suitable for large commercial vehicles, and concerns regarding battery degradation and residual value management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- All-electric Trucks Market Size Report By Type (Light & Medium-duty Truck, Heavy-duty Truck), By Application (Logistics, Municipal), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- All-electric Trucks Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Light & Medium-duty Truck, Heavy-duty Truck), By Application (Logistics, Municipal, Construction, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager