Allergy Rhinitis Drugs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431934 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Allergy Rhinitis Drugs Market Size

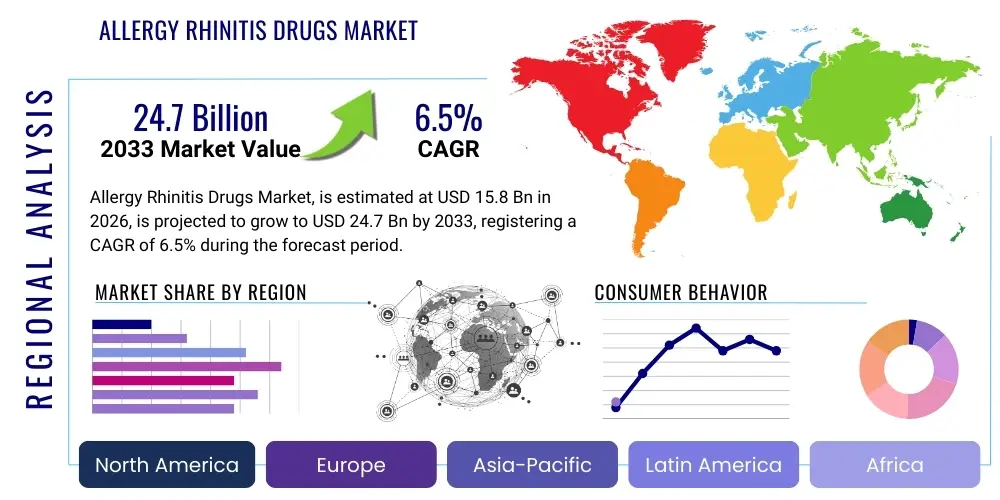

The Allergy Rhinitis Drugs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $15.8 Billion in 2026 and is projected to reach $24.7 Billion by the end of the forecast period in 2033.

Allergy Rhinitis Drugs Market introduction

The Allergy Rhinitis Drugs Market encompasses pharmaceutical products designed to manage and treat allergic rhinitis, a chronic inflammatory condition of the nasal mucosa triggered by exposure to airborne allergens such as pollen, dust mites, molds, and animal dander. This condition, often referred to as hay fever, significantly impacts the quality of life globally, leading to substantial healthcare expenditure and productivity loss. The primary product categories include antihistamines, nasal and oral corticosteroids, decongestants, leukotriene inhibitors, and specific forms of immunotherapy. The market is driven by several critical factors, including the increasing global prevalence of allergies due to heightened pollution levels, climate change influencing pollen seasons, and improvements in diagnostic accuracy leading to earlier patient identification and prescription adherence.

Allergy rhinitis drugs function by targeting the inflammatory cascade initiated upon allergen exposure. Antihistamines block the action of histamine at H1 receptors, reducing symptoms like sneezing, itching, and rhinorrhea. Corticosteroids, particularly administered nasally, are the cornerstone of treatment for moderate-to-severe persistent rhinitis due to their potent anti-inflammatory effects. The rising demand for second-generation antihistamines and advanced nasal sprays that minimize systemic side effects is propelling innovation within the segment. Furthermore, the market benefits significantly from the growing acceptance of specific allergen immunotherapy (SIT), which offers a potential long-term cure by modifying the underlying immunological response, moving beyond mere symptomatic relief.

Major applications of these drugs span across seasonal allergic rhinitis (SAR), perennial allergic rhinitis (PAR), and occupational rhinitis. The clinical benefits derived from effective treatment include improved sleep quality, enhanced cognitive function, reduced incidence of co-morbid conditions such as asthma and sinusitis, and overall enhancement of patient productivity. Driving factors further include favorable reimbursement policies in developed economies, increased patient awareness regarding self-care, and the continuous introduction of combination therapies that address multiple symptoms simultaneously, providing convenience and improved patient compliance.

Allergy Rhinitis Drugs Market Executive Summary

The global Allergy Rhinitis Drugs Market is exhibiting robust growth, primarily fueled by environmental factors exacerbating allergy incidence and a sustained push towards sophisticated, low side-effect treatment options. Business trends indicate a strong move toward biosimilars and generics in mature drug classes, pressuring pricing structures, while simultaneously witnessing significant investment in novel delivery systems (e.g., advanced nasal formulation technology) and personalized medicine approaches, particularly in allergen immunotherapy. Pharmaceutical companies are focusing on lifecycle management, extending patents through combination products and optimizing existing drugs for pediatric and geriatric populations. The transition of certain second-generation antihistamines from prescription-only status to over-the-counter (OTC) availability in key markets is significantly expanding market access and volume growth.

Regionally, North America maintains market dominance, attributed to high allergy prevalence, advanced healthcare infrastructure, and favorable early adoption rates of expensive biologics and immunotherapies. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, driven by rapid urbanization leading to increased exposure to indoor and outdoor pollutants, coupled with improving economic conditions that allow greater access to branded and high-quality medication. European markets show stable growth, focusing heavily on guidelines-based treatments and maintaining a high uptake of allergen-specific immunotherapies. Regulatory harmonization efforts across regions are streamlining product approval processes, aiding global market expansion.

Segment-wise, the Corticosteroids segment, particularly nasal formulations, remains the largest revenue generator due to their established efficacy as first-line therapy for persistent symptoms. Nonetheless, the Immunotherapy segment (Sublingual Immunotherapy - SLIT and Subcutaneous Immunotherapy - SCIT) is anticipated to demonstrate the highest CAGR, reflecting the shift in clinical paradigm towards disease modification rather than just symptom control. In terms of distribution, Retail and Online Pharmacies are rapidly gaining share over traditional hospital pharmacies, spurred by the OTC transition and the convenience of direct-to-consumer digital channels, a trend accelerated significantly by recent global shifts in consumer purchasing behavior.

AI Impact Analysis on Allergy Rhinitis Drugs Market

Common user questions regarding AI's impact on the Allergy Rhinitis Drugs Market frequently center on its potential for personalized diagnostics, improving drug discovery timelines, and optimizing patient treatment protocols. Users are primarily concerned about how AI can refine the identification of specific allergens and predict individual patient responses to various drug classes (e.g., predicting efficacy of a specific corticosteroid dose versus initiating immunotherapy). Key themes identified include the acceleration of R&D for novel small molecules and biologics, the use of machine learning to analyze large-scale electronic health records (EHRs) for better disease mapping and epidemiological insights, and the development of AI-powered digital health tools to monitor symptoms and enhance adherence, moving the market toward highly precision-driven allergy care.

- AI accelerates target identification and validation in drug discovery by analyzing genomic and proteomic data related to allergic inflammation.

- Machine learning algorithms optimize clinical trial design, identifying suitable patient cohorts rapidly and predicting potential drug efficacy and side effects.

- Natural Language Processing (NLP) enhances pharmacovigilance by analyzing unstructured adverse event reports, improving drug safety monitoring.

- AI-powered diagnostic tools integrate environmental data (pollen counts, pollution) with patient biometric inputs for highly accurate, real-time allergy forecasts.

- Personalized medicine benefits from AI models predicting optimal dosing and drug choice (e.g., distinguishing responders from non-responders to immunotherapy).

- Digital health platforms leverage AI for remote symptom tracking, improving patient compliance and allowing clinicians to adjust treatment proactively.

DRO & Impact Forces Of Allergy Rhinitis Drugs Market

The market for allergy rhinitis drugs is significantly influenced by a complex interplay of internal market dynamics and external macro-environmental forces. The primary driving forces stem from the escalating worldwide prevalence of allergic diseases, intrinsically linked to lifestyle changes, increased global pollution levels, and climate change-induced extensions of pollen seasons. Furthermore, advancements in clinical guidelines increasingly advocate for early and sustained therapeutic intervention, often favoring higher-cost, highly effective treatments like nasal steroids and specific immunotherapy, thereby bolstering market revenue. The rising awareness among consumers, coupled with increased accessibility to diagnostic testing, ensures a consistent pipeline of newly diagnosed patients entering the treatment funnel. However, market growth faces substantial restraints, primarily revolving around the financial burdens associated with chronic medication use and the pervasive availability of generic alternatives for established drug classes, which intensifies price erosion. Safety concerns, specifically related to the long-term use of corticosteroids in vulnerable populations, also act as a constraint, prompting a search for safer, non-steroidal alternatives. The cyclical nature of seasonal allergies can also lead to inconsistent patient adherence, momentarily depressing sales volumes outside peak seasons.

Opportunities for sustained market expansion are concentrated in two key areas: technological innovation and geographic expansion. The development of novel therapeutic modalities, especially in the realm of biological drugs targeting specific inflammatory pathways (e.g., anti-IgE or anti-IL-5 therapies, although mostly used for severe asthma, their potential in severe rhinitis is being explored) and highly efficient immunotherapy formulations (e.g., mucosal patch delivery or combination vaccines), represents a significant growth avenue. The untapped potential of emerging economies in Asia Pacific and Latin America, characterized by rapidly developing healthcare infrastructure and a growing middle class capable of affording chronic disease management, presents a robust opportunity for market penetration. Strategic partnerships between pharmaceutical giants and specialized biotech firms focusing on allergy solutions further accelerate the commercialization of pipeline products. The shift towards preventive care and lifestyle management integrated with pharmacological treatment also opens doors for digital health solutions that complement drug sales.

The impact forces influencing the competitive landscape are multifaceted. Product substitution is a constant threat, driven by the shift of effective medications from prescription to OTC status, providing consumers with numerous non-prescription options. Supplier power is generally moderate, as the manufacturing of key active pharmaceutical ingredients (APIs) is dispersed globally, yet specialized raw materials for advanced biologics or immunotherapy kits confer higher supplier leverage in niche areas. Buyer power remains high due to insurance companies and government agencies negotiating bulk pricing and mandating the use of low-cost generics where available. Technological shifts, particularly in diagnostics and personalized medicine, exert a strong transformative force, pushing manufacturers to invest heavily in R&D to maintain competitive differentiation and achieve premium pricing for truly innovative products.

Segmentation Analysis

The Allergy Rhinitis Drugs Market is intricately segmented based on drug class, route of administration, distribution channel, and end-user, reflecting the diverse clinical needs and commercial pathways in allergy management. Understanding these segments is crucial for strategic planning, as distinct classes of drugs cater to varying degrees of disease severity and patient preferences. The segmentation by drug class highlights the therapeutic breadth, ranging from quick-acting symptom relievers (antihistamines) to long-term disease controllers (corticosteroids and immunotherapy). The segmentation also reflects the evolution of treatment paradigms, where targeted therapies are gaining prominence over broad-spectrum drugs, offering higher efficacy with improved safety profiles. Geographical segmentation remains pivotal, dictating market access, regulatory strategy, and pricing power due to regional variations in allergy prevalence and healthcare infrastructure maturity.

The market analysis reveals clear trends within sub-segments. Nasal administration continues to be favored for local, high-concentration delivery, minimizing systemic exposure, which is a major concern for chronic use, particularly with steroids. However, oral medications maintain a significant share due to ease of use and high patient convenience. The distribution channel landscape is undergoing transformation, with online pharmacies capturing an increasing share of OTC and maintenance medication sales, driven by digital accessibility and competitive pricing, challenging the traditional dominance of retail and hospital pharmacies. Furthermore, the segmentation by end-user demonstrates that while clinics and outpatient settings are the primary points of diagnosis and initial prescription, the long-term management of chronic rhinitis heavily relies on homecare settings, emphasizing the importance of user-friendly drug formulations.

The complex regulatory environment, especially concerning the approval of combination drug products and the rigorous requirements for demonstrating the long-term safety and efficacy of immunotherapy products, fundamentally shapes segmentation growth. Manufacturers often leverage combination products (e.g., fixed-dose combination of an antihistamine and a nasal corticosteroid) to enhance compliance and capture a broader patient population suffering from moderate-to- severe symptoms. Analyzing these segmentation dynamics provides crucial insights for investors regarding areas of high growth (Immunotherapy) versus areas of high volume (Antihistamines and Corticosteroids).

- By Drug Class:

- Antihistamines (Second-generation, First-generation)

- Corticosteroids (Nasal, Oral)

- Decongestants

- Immunotherapy (Subcutaneous Immunotherapy - SCIT, Sublingual Immunotherapy - SLIT)

- Leukotriene Inhibitors

- Mast Cell Stabilizers

- Biologics (Emerging)

- By Route of Administration:

- Oral

- Nasal

- Ocular

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- By End-User:

- Clinics

- Hospitals

- Homecare Settings

- Allergy Centers

Value Chain Analysis For Allergy Rhinitis Drugs Market

The value chain for the Allergy Rhinitis Drugs Market begins with research and development (R&D), where significant capital is deployed to identify novel molecular targets, optimize drug delivery systems, and conduct extensive clinical trials. Upstream activities primarily involve the procurement and synthesis of active pharmaceutical ingredients (APIs) and excipients. API manufacturing is highly specialized, particularly for complex drugs like nasal corticosteroids and newer biologicals, demanding strict adherence to Good Manufacturing Practices (GMP) and stringent quality control. Key suppliers hold moderate bargaining power, especially in the proprietary immunotherapy and biologic segments where intellectual property rights limit sourcing alternatives. The manufacturing stage converts these raw materials into finished dosage forms—tablets, capsules, nasal sprays, and injectable solutions—requiring specialized sterile facilities and high-speed packaging lines to meet global demand efficiently.

The midstream segment is dominated by distribution channels, which are critical for market access. Direct distribution involves large pharmaceutical companies supplying directly to major hospital systems, specialized allergy centers, or government procurement agencies. Indirect distribution, which accounts for the majority of sales volume, relies heavily on a complex network of wholesalers, distributors, and logistics providers who ensure efficient storage and timely delivery to retail and online pharmacies. Retail pharmacies are the most critical point of sale, facilitating both prescription fulfillment and high-volume OTC purchases. The rise of digital platforms and online pharmacies has streamlined the supply chain, offering consumers greater convenience and often lower prices, thereby increasing the efficiency of medication delivery directly to the end-user. Regulatory compliance across all logistics stages, including cold chain requirements for immunotherapies, adds complexity and cost to the distribution process.

Downstream activities center on marketing, sales, and post-market surveillance. Marketing efforts are targeted towards both healthcare professionals (HCPs) and consumers, emphasizing product efficacy, safety profiles, and ease of use. For prescription drugs, pharmaceutical representatives educate physicians and specialists, while OTC drugs benefit from broad-based consumer advertising to drive self-selection. Post-market surveillance and pharmacovigilance ensure ongoing safety monitoring, a crucial component for maintaining regulatory approval and public trust. The final consumption stage involves the patient or end-user; the purchasing behavior is heavily influenced by insurance coverage, co-pay amounts, physician recommendations, and the general accessibility of the medication. The efficiency of the entire value chain is constantly being optimized to reduce turnaround times and minimize supply chain waste, particularly in high-volume generic segments.

Allergy Rhinitis Drugs Market Potential Customers

The primary consumers and end-users of allergy rhinitis drugs are individuals diagnosed with seasonal, perennial, or occupational allergic rhinitis, spanning all age groups from pediatric patients to the geriatric population. Due to the chronic nature of the condition, customers typically require continuous or intermittent therapeutic management, making them loyal, repeat purchasers of maintenance medications. Pediatric patients, who often exhibit heightened sensitivity to environmental allergens, represent a significant customer base, driving demand for child-friendly formulations such as liquid suspensions or specific nasal sprays designed for smaller nasal passages. Adult patients, particularly those with severe symptoms impacting work productivity, seek highly effective prescription therapies, including combination drugs and, increasingly, long-term disease-modifying options like immunotherapy.

Institutional buyers represent another critical customer segment. These include public and private hospitals, specialized allergy clinics, and outpatient care centers that utilize these drugs both for acute management and for dispensing initial prescriptions. Managed care organizations and government health agencies act as major indirect buyers, influencing purchasing decisions through formulary control and reimbursement policies, essentially determining which drugs are accessible and affordable to large patient populations. Furthermore, the burgeoning segment of consumers focused on self-care constitutes a massive customer base for Over-the-Counter (OTC) antihistamines and decongestants, reflecting a global trend towards managing mild-to-moderate symptoms without immediate physician consultation. Targeted marketing efforts are therefore tailored to address the distinct needs of each buyer group, ranging from clinical efficacy data for specialists to convenience and price points for the general consumer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $15.8 Billion |

| Market Forecast in 2033 | $24.7 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pfizer Inc., Johnson & Johnson, GlaxoSmithKline plc, Merck & Co., Inc., Sanofi S.A., Novartis AG, Bayer AG, Takeda Pharmaceutical Company Limited, AstraZeneca plc, Abbott Laboratories, Teva Pharmaceutical Industries Ltd., Hikma Pharmaceuticals PLC, Cipla Limited, Dr. Reddy's Laboratories Ltd., Glenmark Pharmaceuticals Ltd., Mylan N.V. (Viatris), Regeneron Pharmaceuticals, Inc., Allergopharma GmbH & Co. KG, Stallergenes Greer, ALK-Abelló A/S |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Allergy Rhinitis Drugs Market Key Technology Landscape

The technology landscape for the Allergy Rhinitis Drugs Market is rapidly evolving, driven by the need for enhanced drug efficacy, reduced side effects, and superior patient adherence. A primary area of technological advancement is in novel drug delivery systems, particularly nasal spray technology. This includes metered-dose pumps, sophisticated suspension formulations that ensure uniform droplet size for optimal deposition in the nasal cavity, and preservative-free systems to minimize mucosal irritation. Fixed-dose combination therapies, incorporating two active ingredients (like a nasal steroid and an antihistamine) in a single device, represent a pharmaceutical technology approach aimed at simplifying complex dosing regimens and maximizing therapeutic outcomes. This technological focus ensures that the local drug concentration is maximized while systemic absorption is minimized, addressing critical safety concerns associated with long-term use, especially in chronic rhinitis management.

Immunotherapy manufacturing and formulation technologies are witnessing groundbreaking innovation. Sublingual Immunotherapy (SLIT), utilizing highly purified allergen extracts in tablet form, has been a key technological shift, moving away from the traditional, inconvenient, and often riskier subcutaneous injections (SCIT). Advanced manufacturing techniques are now focused on producing standardized, high-potency allergen extracts, ensuring consistent therapeutic results across batches, a historical challenge for this segment. Furthermore, the development of novel adjuvants and liposomal encapsulation technologies for allergy vaccines aims to enhance the immune response rapidly, potentially shortening the duration of immunotherapy treatment required for sustained tolerance. The integration of digital technologies, such as smart inhalers and connected nasal devices, allows for objective tracking of medication usage and technique, providing valuable feedback to both patients and healthcare providers.

Beyond drug formulation, the technological infrastructure supporting the market is increasingly reliant on bioinformatics and personalized medicine tools. Genomics and proteomics are being employed to identify specific biomarkers that can predict a patient’s response to different treatments, guiding clinicians towards personalized drug selection, which is particularly relevant for expensive biologicals. The incorporation of advanced materials science is also evident in the development of biodegradable microspheres and nanosystems designed for sustained release of active compounds, potentially reducing the frequency of administration. Overall, the technological trajectory is moving towards highly specific, patient-centric, and minimally invasive treatment modalities that maximize efficacy while prioritizing user convenience and safety across all demographics.

Regional Highlights

The regional dynamics of the Allergy Rhinitis Drugs Market are dictated by factors such as allergy prevalence rates, healthcare spending patterns, regulatory environment maturity, and consumer preference for prescription versus OTC treatments.

- North America (U.S. and Canada)

- Market Dominance: Holds the largest market share due to high prevalence of allergic rhinitis, robust adoption of advanced therapeutics (including biologics and high-cost immunotherapy), and significant healthcare expenditure.

- Key Drivers: Favorable reimbursement policies, strong presence of major pharmaceutical innovators, and high consumer awareness driving demand for branded and combination nasal sprays.

- Regulatory Environment: Mature and efficient system facilitates faster adoption of novel drug delivery technologies and high uptake of advanced treatment protocols.

- Europe (Germany, UK, France, Italy, Spain)

- Growth Trajectory: Stable and mature market characterized by stringent clinical guidelines emphasizing the use of corticosteroids as first-line therapy.

- Immunotherapy Focus: Europe exhibits the highest penetration rate of standardized specific allergen immunotherapy (SLIT and SCIT), driven by strong historical research and local specialty manufacturers (e.g., in Germany and Denmark).

- Pricing Pressure: Government control over drug pricing, particularly in key markets like the UK and Germany, necessitates strong generic competition and efficiency in marketing established brands.

- Asia Pacific (APAC) (China, Japan, India, South Korea)

- Highest CAGR: Projected to be the fastest-growing region owing to rapid urbanization, increasing air pollution, and rising disposable incomes enhancing access to prescription drugs.

- Market Dynamics: Japan and South Korea represent mature segments with high adoption of advanced nasal therapies, while China and India are emerging markets driven by volume sales and increasing shift from traditional medicines to modern pharmaceuticals.

- Challenges: Diverse regulatory frameworks and significant disparity in healthcare accessibility across different countries pose commercial challenges requiring localized strategies.

- Latin America (LATAM)

- Emerging Potential: Characterized by fragmented healthcare systems and high out-of-pocket expenditure, limiting access to high-cost prescription drugs, but steady growth is observed.

- Preference: Strong market for affordable generics and OTC antihistamines. Focus on expanding access to essential medication.

- Middle East and Africa (MEA)

- Market Development: Nascent market showing growth tied to infrastructure development and rising expatriate populations importing higher healthcare standards.

- Regional Influence: Political stability and oil-based wealth in the GCC countries allow for the adoption of premium branded products and specialized clinics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Allergy Rhinitis Drugs Market.- Pfizer Inc.

- Johnson & Johnson

- GlaxoSmithKline plc

- Merck & Co., Inc.

- Sanofi S.A.

- Novartis AG

- Bayer AG

- Takeda Pharmaceutical Company Limited

- AstraZeneca plc

- Abbott Laboratories

- Teva Pharmaceutical Industries Ltd.

- Hikma Pharmaceuticals PLC

- Cipla Limited

- Dr. Reddy's Laboratories Ltd.

- Glenmark Pharmaceuticals Ltd.

- Mylan N.V. (Viatris)

- Regeneron Pharmaceuticals, Inc.

- Allergopharma GmbH & Co. KG

- Stallergenes Greer

- ALK-Abelló A/S

Frequently Asked Questions

Analyze common user questions about the Allergy Rhinitis Drugs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Allergy Rhinitis Drugs Market?

The increasing global prevalence of allergic rhinitis, primarily driven by rising levels of pollution, climate change extending pollen seasons, and enhanced diagnostic capabilities leading to earlier patient identification, is the core market driver.

Which drug class is expected to show the highest growth rate during the forecast period?

The Immunotherapy segment (both SCIT and SLIT) is anticipated to exhibit the highest CAGR, reflecting a strategic shift in clinical practice towards disease modification and achieving long-term tolerance rather than merely managing acute symptoms.

How does the shift to OTC status affect the market for Allergy Rhinitis Drugs?

The transition of effective second-generation antihistamines and certain nasal sprays to Over-the-Counter (OTC) status significantly expands market accessibility, drives volume sales through retail and online channels, and intensifies price competition among generics.

Which region currently holds the largest share in the Allergy Rhinitis Drugs Market?

North America maintains the largest market share, driven by a high allergy burden, advanced healthcare infrastructure, high consumer spending on healthcare, and rapid adoption of high-cost, innovative prescription therapies and biologics.

What are the key technological advancements influencing drug delivery systems in this market?

Key technological advancements include fixed-dose combination nasal sprays, metered-dose pump technology ensuring optimal deposition, and the development of high-potency, standardized sublingual tablets for allergen immunotherapy (SLIT).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager