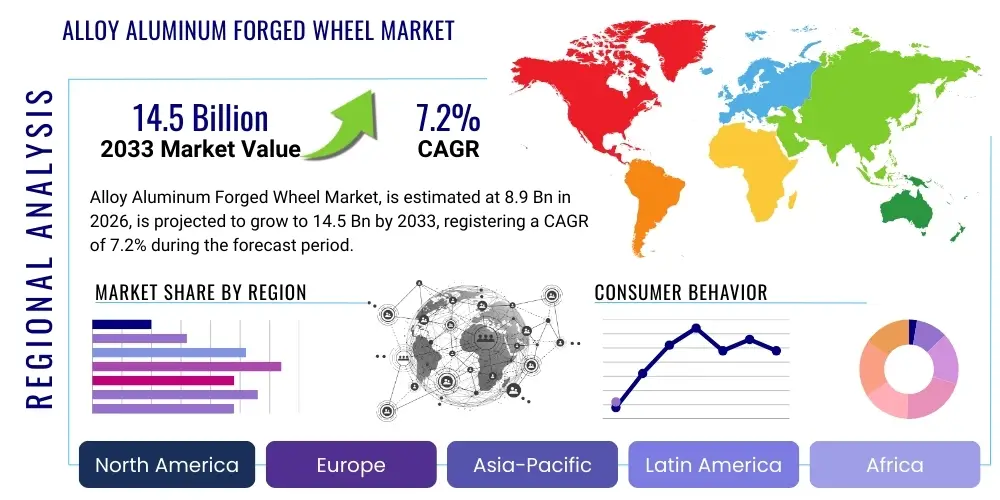

Alloy Aluminum Forged Wheel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440094 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Alloy Aluminum Forged Wheel Market Size

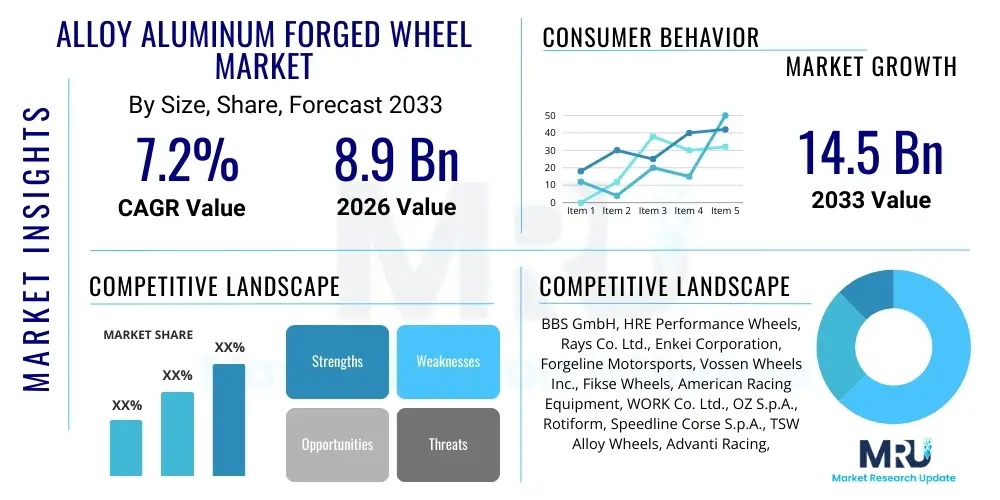

The Alloy Aluminum Forged Wheel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 8.9 billion in 2026 and is projected to reach USD 14.5 billion by the end of the forecast period in 2033.

Alloy Aluminum Forged Wheel Market introduction

The Alloy Aluminum Forged Wheel Market encompasses the global industry involved in the design, manufacturing, and distribution of wheels produced through a forging process using aluminum alloys. These wheels are distinguished by their superior strength-to-weight ratio, enhanced durability, and aesthetic appeal compared to traditional cast wheels. Forging involves subjecting a solid billet of aluminum alloy to extreme pressure and heat, which rearranges the metal's grain structure, eliminating porosity and creating a denser, stronger, and more resilient component. This process significantly improves the mechanical properties of the wheel, making it ideal for applications where performance, safety, and longevity are paramount.

Major applications for alloy aluminum forged wheels span across a wide array of vehicle types, including high-performance sports cars, luxury vehicles, electric vehicles (EVs), light commercial vehicles, and heavy-duty trucks, as well as specialized motorsport applications. In passenger vehicles, forged wheels contribute to improved handling, better braking performance, reduced unsprung mass, and enhanced fuel efficiency due due to their lighter weight. For commercial vehicles, the increased durability and load-bearing capacity make them a preferred choice, reducing maintenance costs and improving operational efficiency over the long term. The market also sees significant traction in the aftermarket segment, where enthusiasts seek performance upgrades and aesthetic customization.

The primary benefits of alloy aluminum forged wheels include significant weight reduction, which directly translates to improved fuel economy and reduced emissions, aligning with global environmental regulations. Their superior strength and fatigue resistance enhance vehicle safety and driver confidence, especially during aggressive driving or under heavy loads. Aesthetically, the forging process allows for more intricate and refined designs, contributing to the premium look and feel of vehicles. Key driving factors for this market's growth include the increasing global demand for high-performance and luxury vehicles, stringent fuel efficiency and emission standards, the expanding electric vehicle market, and a rising consumer preference for vehicle customization and premium accessories that offer both style and substance.

Alloy Aluminum Forged Wheel Market Executive Summary

The Alloy Aluminum Forged Wheel Market is currently experiencing robust growth, driven by an accelerating shift towards lightweighting in the automotive industry and a sustained demand for enhanced vehicle performance and aesthetics. Business trends indicate a heightened focus on advanced manufacturing techniques, including precision CNC machining and innovative surface treatments, to cater to diverse OEM specifications and sophisticated aftermarket consumer preferences. Collaborations between wheel manufacturers and automotive design houses are becoming more prevalent, fostering innovation in wheel architecture and material science. Furthermore, the emphasis on sustainable manufacturing practices and the recyclability of aluminum are gaining importance, influencing supply chain decisions and product development strategies within the market. The competitive landscape is characterized by both established global players and niche performance wheel manufacturers vying for market share through product differentiation and technological leadership.

Regional trends reveal Asia-Pacific as a leading and rapidly expanding market, primarily due to the burgeoning automotive production in countries like China, Japan, and India, coupled with increasing disposable incomes and a growing appetite for luxury and performance vehicles. North America and Europe, while mature, continue to demonstrate strong demand, particularly within the premium, sports, and electric vehicle segments, driven by a culture of vehicle customization and a continuous push for technological innovation. Emerging markets in Latin America and the Middle East & Africa are also showing promising growth, albeit from a smaller base, as urbanization, economic development, and increasing infrastructure investments drive vehicle sales and subsequent demand for higher quality components like forged wheels. The electrification of the automotive industry is a significant regional accelerator, with major EV manufacturers often opting for forged wheels to maximize range and performance.

In terms of segment trends, the passenger vehicle segment continues to dominate the market, propelled by the expanding sales of SUVs, luxury sedans, and high-performance coupes where forged wheels are often standard or a highly sought-after option. The electric vehicle segment is emerging as a critical growth engine, as forged wheels help mitigate battery weight and extend driving range through reduced unsprung mass. The aftermarket segment is witnessing substantial expansion, fueled by vehicle enthusiasts seeking to upgrade their vehicles with lighter, stronger, and more visually appealing wheels, often driven by social media trends and motorsports influence. Rim size preferences are evolving, with a noticeable trend towards larger diameter wheels (19-inch and above) becoming increasingly popular across various vehicle categories, impacting manufacturing capabilities and design considerations for market participants.

AI Impact Analysis on Alloy Aluminum Forged Wheel Market

User questions regarding AI's impact on the Alloy Aluminum Forged Wheel Market frequently revolve around how artificial intelligence can optimize design, streamline manufacturing processes, enhance quality control, and contribute to supply chain efficiency. Key themes consistently emerging include the potential for AI-driven generative design to create lighter yet stronger wheel structures, the role of machine learning in predictive maintenance for forging equipment, and the application of computer vision for defect detection. Users are also keen to understand how AI can personalize design options for the aftermarket, manage complex production schedules, and forecast demand more accurately in a dynamic automotive landscape. Concerns often touch upon the initial investment costs for AI integration, the need for specialized skills, and the ethical implications of autonomous decision-making in production. However, the overarching expectation is that AI will be a transformative force, leading to significant advancements in product performance, manufacturing efficiency, and market responsiveness.

- Generative Design for Optimization: AI algorithms can explore thousands of design iterations for wheel structures, optimizing for minimal weight, maximum strength, and improved airflow, reducing the need for extensive physical prototyping and accelerating product development cycles.

- Predictive Maintenance in Forging: Machine learning models analyze sensor data from forging presses, heat treatment ovens, and CNC machines to predict equipment failures before they occur, minimizing downtime, reducing maintenance costs, and ensuring consistent production quality.

- Enhanced Quality Control: AI-powered computer vision systems can rapidly scan finished wheels for microscopic defects, surface imperfections, or structural anomalies with far greater accuracy and consistency than human inspection, ensuring higher quality standards and reducing material waste.

- Supply Chain Optimization: AI can analyze vast datasets to optimize raw material procurement, manage inventory levels, predict demand fluctuations, and streamline logistics for alloy aluminum billets and finished wheels, leading to cost savings and improved delivery times.

- Manufacturing Process Automation: AI can control and optimize various stages of the forging process, including temperature regulation, pressure application, and robotic handling, leading to greater consistency, reduced human error, and improved energy efficiency.

- Personalized Aftermarket Design: AI-driven platforms can enable customers to visualize and customize wheel designs virtually, providing personalized recommendations based on vehicle type, driving style, and aesthetic preferences, enhancing customer engagement and market reach.

- Material Property Prediction: Machine learning models can predict the optimal alloying compositions and heat treatment parameters required to achieve specific mechanical properties in aluminum alloys, leading to the development of superior performing and specialized forged wheels.

- Energy Efficiency Monitoring: AI systems can monitor energy consumption across the entire manufacturing process, identifying inefficiencies and suggesting optimizations to reduce the carbon footprint and operational costs associated with forged wheel production.

- Market Trend Analysis and Forecasting: AI can process vast amounts of market data, including sales figures, social media trends, and economic indicators, to provide highly accurate forecasts for demand, popular designs, and emerging market segments, guiding strategic decisions.

- Robotics and Automation Integration: AI acts as the "brain" for advanced robotics in the factory, enabling more complex and adaptive automation for tasks such as material handling, precision machining, and automated finishing processes, increasing production throughput and safety.

DRO & Impact Forces Of Alloy Aluminum Forged Wheel Market

The Alloy Aluminum Forged Wheel Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, alongside various impact forces that shape its trajectory. A primary driver is the automotive industry's relentless pursuit of lightweighting to improve fuel efficiency, reduce emissions, and enhance vehicle performance, particularly critical for the burgeoning electric vehicle segment where battery weight is a major concern. The escalating demand for luxury and high-performance vehicles, which often feature forged wheels as standard equipment or a premium upgrade, further fuels market expansion. Additionally, the growing trend of vehicle customization in the aftermarket, driven by a desire for unique aesthetics and performance upgrades, consistently contributes to the demand for superior quality forged wheels. Stricter global safety standards and regulatory pushes for lower carbon footprints also indirectly bolster the adoption of these lightweight, durable components.

However, the market faces significant restraints that temper its growth. The most prominent restraint is the relatively high manufacturing cost associated with the forging process, which involves complex machinery, high energy consumption, and specialized skilled labor, making forged wheels considerably more expensive than their cast counterparts. This higher price point can limit adoption in budget-sensitive vehicle segments and among cost-conscious consumers. Furthermore, the availability of alternative wheel materials, such as various cast aluminum alloys and steel, which offer a lower cost entry point, creates competitive pressure. The complex and time-consuming production process for forged wheels, often involving multiple stages of heating, pressing, and precision machining, can also lead to longer lead times and less flexible production schedules compared to casting, posing a challenge for rapid market response.

Despite these restraints, numerous opportunities are poised to drive the market forward. The rapid global expansion of the electric vehicle (EV) market presents a colossal opportunity, as the weight reduction offered by forged wheels directly translates to increased range and improved driving dynamics for EVs. The growing adoption of forged wheels in commercial vehicles, including heavy-duty trucks and buses, driven by the need for enhanced durability, payload capacity, and fuel savings, represents another significant avenue for growth. Moreover, continuous advancements in forging technologies, material science, and computational design (e.g., generative design with AI) are enabling the production of even lighter, stronger, and more intricate wheel designs at potentially reduced costs. The increasing disposable income in emerging economies and the rising preference for premium automotive components are also opening new geographical markets for forged wheel manufacturers, broadening the customer base beyond traditional luxury and performance segments.

Segmentation Analysis

The Alloy Aluminum Forged Wheel Market is meticulously segmented based on various critical parameters to provide a granular understanding of market dynamics, consumer preferences, and growth opportunities. These segmentation criteria include vehicle type, rim size, sales channel, and end-use application, each offering unique insights into demand patterns and competitive landscapes across different market verticals. Analyzing these segments helps stakeholders, from manufacturers to investors, to identify lucrative niches, tailor product offerings, and devise effective market penetration strategies, ensuring that product development and marketing efforts are aligned with specific customer needs and market trends. This detailed breakdown facilitates strategic planning and resource allocation in a highly competitive and evolving industry.

- By Vehicle Type

- Passenger Cars (Sedans, Hatchbacks, SUVs, Crossovers)

- Luxury & Sports Cars (High-performance sedans, supercars, hypercars)

- Electric Vehicles (BEVs, PHEVs)

- Commercial Vehicles (Light Commercial Vehicles, Heavy-Duty Trucks, Buses)

- Motorcycles

- By Rim Size

- Below 18-inch

- 18-inch to 20-inch

- Above 20-inch (21-inch, 22-inch, 23-inch, and larger)

- By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket (Independent Distributors, Specialty Retailers, Online Sales)

- By End-Use Application

- Automotive (Passenger & Commercial)

- Motorsports (Formula 1, Le Mans, Rally, Drifting)

- Aerospace (Specialized applications where ultra-lightweight and strength are critical)

- Defense (Military vehicles requiring robust and durable wheels)

- By Manufacturing Process

- Single-Piece Forged Wheels

- Multi-Piece Forged Wheels (2-piece, 3-piece)

Value Chain Analysis For Alloy Aluminum Forged Wheel Market

The value chain for the Alloy Aluminum Forged Wheel Market is a sophisticated network encompassing several critical stages, beginning with raw material sourcing and culminating in the final delivery to end-users. The upstream segment of the value chain is dominated by the procurement of high-grade aluminum alloys, primarily 6061 and 7075 series, which are selected for their excellent strength-to-weight ratio and suitability for forging. Key players at this stage include global aluminum producers and alloy suppliers who transform bauxite ore into aluminum ingots and billets. These suppliers must ensure consistent quality and purity, as the integrity of the raw material directly impacts the performance and safety of the final forged wheel. Relationships with these suppliers are crucial for maintaining a stable and cost-effective material flow, often involving long-term contracts and quality assurance partnerships to meet stringent industry standards.

Midstream activities involve the core manufacturing processes of the forged wheel itself. This includes the initial forging of the aluminum billet under immense pressure and high temperatures, followed by heat treatment to achieve desired mechanical properties. Post-forging, the wheels undergo precision CNC machining to create the intricate designs, bolt patterns, and hub bores. This stage also encompasses surface finishing, which can include powder coating, anodizing, polishing, or painting, to enhance durability and aesthetic appeal. Wheel manufacturers, ranging from large-scale global corporations to specialized boutique firms, invest heavily in advanced machinery and skilled labor for these processes. The efficiency and technological sophistication at this stage directly influence production costs, quality, and the ability to innovate with new designs and performance features, making it a highly competitive segment of the value chain.

The downstream segment of the value chain focuses on distribution and sales, connecting the finished forged wheels with their diverse customer base. Distribution channels are typically categorized into direct and indirect methods. Direct distribution primarily involves supplying original equipment manufacturers (OEMs) for integration into new vehicle production lines. This requires robust logistics, just-in-time delivery capabilities, and stringent quality compliance. Indirect distribution channels cater to the aftermarket, reaching individual consumers, tuning shops, and performance enthusiasts through a network of independent distributors, specialty retailers, and increasingly, online e-commerce platforms. The effectiveness of these channels is crucial for market penetration and brand visibility. Strong relationships with aftermarket distributors and a robust online presence are vital for reaching the broad spectrum of potential buyers who seek performance upgrades, aesthetic customization, and premium quality for their vehicles.

Alloy Aluminum Forged Wheel Market Potential Customers

The Alloy Aluminum Forged Wheel Market caters to a diverse range of potential customers, each driven by specific needs for performance, aesthetics, durability, and safety. The largest segment of potential customers comprises Original Equipment Manufacturers (OEMs) in the automotive industry. These include manufacturers of luxury cars, high-performance sports cars, and premium SUVs, where forged wheels are often standard or a highly desirable option due to their weight-saving benefits, contribution to driving dynamics, and sophisticated appearance. As the electric vehicle (EV) market expands rapidly, EV manufacturers are increasingly becoming key customers, leveraging forged wheels to optimize battery range and handling by reducing unsprung mass, thereby enhancing the overall efficiency and performance of their electric models.

Another significant group of potential customers lies within the automotive aftermarket, consisting of individual vehicle owners and automotive enthusiasts. These buyers are typically looking to upgrade their vehicles, seeking improved performance, better handling, enhanced fuel efficiency, and a distinctive aesthetic appeal that sets their vehicle apart. The aftermarket customer base includes owners of everyday passenger cars seeking performance or visual upgrades, as well as dedicated car tuners and motorsports participants who demand the ultimate in strength, lightness, and precision for competitive driving. This segment is highly influenced by trends in vehicle customization, social media, and the prestige associated with high-quality forged wheels, often prioritizing brand reputation and design innovation.

Beyond passenger cars, commercial vehicle operators, including trucking companies and logistics firms, represent a growing segment of potential customers. Forged aluminum wheels for heavy-duty trucks and buses offer significant advantages such as increased payload capacity due to their lighter weight, improved fuel economy over long hauls, and enhanced durability leading to reduced tire wear and maintenance costs. The robust nature of forged wheels makes them highly suitable for the demanding conditions faced by commercial fleets, translating into lower operational expenses and improved safety over the lifecycle of the vehicle. Additionally, niche markets like motorsports teams and defense contractors also constitute potential customers, where the extreme demands for performance, reliability, and lightweight construction make forged wheels an indispensable component.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.9 billion |

| Market Forecast in 2033 | USD 14.5 billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BBS GmbH, HRE Performance Wheels, Rays Co. Ltd., Enkei Corporation, Forgeline Motorsports, Vossen Wheels Inc., Fikse Wheels, American Racing Equipment, WORK Co. Ltd., OZ S.p.A., Rotiform, Speedline Corse S.p.A., TSW Alloy Wheels, Advanti Racing, Konig Wheels, Washi Beam Co., LTD., Alcoa Corporation (Howmet Aerospace), Maxion Wheels (division of Iochpe-Maxion S.A.), CITIC Dicastal Co., Ltd., Superior Industries International, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Alloy Aluminum Forged Wheel Market Key Technology Landscape

The Alloy Aluminum Forged Wheel Market is characterized by a sophisticated and continuously evolving technology landscape, with advancements focused on improving material properties, optimizing manufacturing efficiency, and enhancing design capabilities. Central to this landscape are advanced forging techniques, which have progressed beyond traditional hydraulic presses to include multi-directional presses and hot-forging processes that allow for greater control over grain structure and material flow. Flow forming, a hybrid process combining forging and casting, is also gaining traction, enabling the creation of lighter and stronger barrel sections for wheels. These techniques require precise temperature control and immense pressure to reshape aluminum billets into the desired wheel profile, ensuring maximum material density and minimal imperfections. Research into new aluminum alloys, particularly those with higher strength-to-weight ratios and improved fatigue resistance, is also a critical area of technological development, pushing the boundaries of what is possible in wheel design and performance.

Beyond the primary forging process, precision CNC (Computer Numerical Control) machining is indispensable in the production of alloy aluminum forged wheels. Modern multi-axis CNC machines are utilized to meticulously carve out intricate designs, precise bolt patterns, and hub bores from the forged blank, achieving tolerances that are critical for balance, fitment, and safety. The integration of CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) software is crucial, allowing designers to create complex 3D models and simulate manufacturing processes, ensuring design integrity and optimizing tool paths for machining efficiency. This digital precision minimizes material waste, reduces production time, and enables rapid prototyping of new designs, offering manufacturers a competitive edge in catering to diverse aesthetic and performance requirements from both OEMs and aftermarket consumers. The shift towards automation and robotics in these machining centers further enhances consistency and throughput.

The technology landscape also encompasses a range of post-processing and finishing techniques that significantly contribute to the final product's durability, aesthetics, and market appeal. Advanced heat treatment processes, such as solution treatment and artificial aging, are applied to further enhance the mechanical properties of the forged aluminum, increasing its strength and hardness. Surface finishing technologies include sophisticated powder coating, liquid painting, anodizing, and polishing systems, which provide protection against corrosion, wear, and environmental elements, while also offering a wide array of visual options. Innovations in these finishing processes focus on achieving greater durability, better adhesion, and a wider spectrum of colors and textures, allowing for extensive customization. Furthermore, non-destructive testing (NDT) methods like X-ray inspection and ultrasonic testing are vital quality control technologies, ensuring that each forged wheel meets the rigorous safety and performance standards demanded by the automotive and motorsports industries before it reaches the customer.

Regional Highlights

North America: The North American market for alloy aluminum forged wheels is characterized by robust demand, particularly from the luxury, performance, and truck segments. The region exhibits a strong culture of vehicle customization and a high disposable income, driving significant aftermarket sales. Stringent fuel efficiency standards and a growing interest in electric vehicles also contribute to the adoption of lightweight forged wheels. Major automotive OEMs in the U.S., Canada, and Mexico integrate forged wheels into their premium vehicle offerings, ensuring a consistent OEM demand. Innovation in design and manufacturing technologies often originates from or finds early adoption in this region, influenced by a competitive landscape among established performance wheel manufacturers and a highly engaged consumer base that values both aesthetic appeal and superior driving dynamics.

Europe: Europe represents a mature yet highly innovative market for alloy aluminum forged wheels, driven by a strong luxury and sports car segment, particularly in Germany, Italy, and the UK. The region is at the forefront of automotive engineering, with an emphasis on performance, safety, and sophisticated design. European manufacturers are keen on reducing vehicle emissions and improving fuel economy, making forged wheels an attractive solution. The premium segment for passenger cars and the niche motorsports industry consistently demand high-quality, lightweight wheel solutions. Growth is also supported by the increasing penetration of electric vehicles and a regulatory environment that encourages sustainable and efficient automotive components. The aftermarket in Europe is vibrant, with consumers often seeking upgrades for performance and visual differentiation.

Asia Pacific (APAC): The Asia Pacific region is the largest and fastest-growing market for alloy aluminum forged wheels, primarily fueled by the massive automotive production bases in countries like China, Japan, India, and South Korea. Rising disposable incomes, rapid urbanization, and an expanding middle class are leading to increased sales of luxury, performance, and premium SUVs, where forged wheels are increasingly popular. Government initiatives promoting electric vehicles and stringent emission regulations further accelerate the demand for lightweight components. Japan and China, in particular, are key manufacturing hubs and also significant consumers. The region is witnessing substantial investments in automotive manufacturing capabilities, making it a critical market for global forged wheel suppliers and a hotbed for new market entrants.

Latin America: The Latin American market for alloy aluminum forged wheels is emerging, characterized by steady growth driven by increasing vehicle production, economic development, and improving infrastructure in key countries such as Brazil and Mexico. While smaller than other regions, the market shows potential due to rising demand for commercial vehicles requiring durable and efficient components, as well as a burgeoning middle class beginning to invest in higher-value automotive parts for passenger cars. Local manufacturing capabilities are developing, but the market largely relies on imports for high-end forged wheels. The growing presence of international automotive OEMs and a gradual shift in consumer preferences towards better quality and performance are expected to bolster the adoption of alloy aluminum forged wheels in the forecast period.

Middle East and Africa (MEA): The Middle East and Africa region presents unique growth opportunities for the alloy aluminum forged wheel market. The Middle East, particularly the GCC countries, is a significant consumer of luxury and high-performance vehicles, supported by high per capita incomes and a strong automotive enthusiast culture. This drives consistent demand for premium forged wheels both in OEM and aftermarket segments. In Africa, while the market is still nascent, economic diversification and improving infrastructure in countries like South Africa and Nigeria are leading to an uptick in vehicle sales, creating a gradual but growing demand for durable and efficient automotive components, including forged wheels for commercial fleets and premium passenger cars. Investment in local assembly plants by international manufacturers is also stimulating demand for quality components in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Alloy Aluminum Forged Wheel Market.- BBS GmbH

- HRE Performance Wheels

- Rays Co. Ltd.

- Enkei Corporation

- Forgeline Motorsports

- Vossen Wheels Inc.

- Fikse Wheels

- American Racing Equipment

- WORK Co. Ltd.

- OZ S.p.A.

- Rotiform

- Speedline Corse S.p.A.

- TSW Alloy Wheels

- Advanti Racing

- Konig Wheels

- Washi Beam Co., LTD.

- Alcoa Corporation (Howmet Aerospace)

- Maxion Wheels (division of Iochpe-Maxion S.A.)

- CITIC Dicastal Co., Ltd.

- Superior Industries International, Inc.

Frequently Asked Questions

What are the primary benefits of alloy aluminum forged wheels compared to cast wheels?

Alloy aluminum forged wheels offer several significant advantages over traditional cast wheels, primarily due to their superior manufacturing process. They are substantially lighter, reducing unsprung mass, which leads to improved vehicle handling, better braking performance, enhanced acceleration, and greater fuel efficiency. Forged wheels are also considerably stronger and more durable, with a denser, non-porous grain structure that results in higher resistance to bending, cracking, and fatigue. This increased strength directly contributes to enhanced safety and a longer lifespan, making them a preferred choice for high-performance, luxury, and commercial vehicles where reliability and reduced weight are paramount. Their aesthetic appeal, allowing for more intricate and refined designs, is another key benefit that attracts both OEMs and aftermarket consumers.

Why are alloy aluminum forged wheels typically more expensive than cast wheels?

The higher cost of alloy aluminum forged wheels stems from several factors inherent in their production process. First, the raw material used for forging, typically a high-grade aluminum billet, is more expensive than the molten aluminum used for casting. Second, the forging process itself requires sophisticated, high-pressure machinery, such as large hydraulic presses, which represent a significant capital investment. The multi-stage manufacturing process, involving precise heating, immense pressure, subsequent heat treatments, and extensive CNC machining to achieve the final intricate designs, is more time-consuming and energy-intensive than casting. Additionally, the specialized skills and expertise required for operating and maintaining this advanced equipment further contribute to higher labor costs. These combined factors result in a premium price point compared to the mass-produced, less labor-intensive cast wheels.

How does the production of forged wheels contribute to vehicle performance and fuel efficiency?

The production of forged wheels significantly contributes to vehicle performance and fuel efficiency primarily through weight reduction. By reducing the unsprung mass—the weight not supported by the suspension system—forged wheels allow the suspension to react more quickly and effectively to road conditions, leading to improved handling, better grip, and a smoother ride. The lighter weight also decreases rotational inertia, which enhances acceleration and reduces the energy required to stop the vehicle, resulting in shorter braking distances. From a fuel efficiency standpoint, less weight means the engine has to work less to move the vehicle, directly translating to lower fuel consumption and reduced carbon emissions. This benefit is particularly critical for electric vehicles, where weight reduction directly extends battery range.

What is the role of the aftermarket segment in the Alloy Aluminum Forged Wheel Market?

The aftermarket segment plays a crucial and dynamic role in the Alloy Aluminum Forged Wheel Market, serving as a significant driver of growth and innovation. This segment caters to individual vehicle owners and automotive enthusiasts who seek to upgrade their existing vehicles with forged wheels for enhanced performance, improved aesthetics, or both. Aftermarket demand is fueled by trends in vehicle customization, motorsports influence, and the desire for personalization. It provides manufacturers with an avenue to showcase cutting-edge designs and technological advancements, often testing new concepts before wider OEM adoption. The aftermarket segment also allows for greater design flexibility and specialization, offering a diverse range of rim sizes, finishes, and configurations to meet specific consumer preferences, thus expanding the overall market reach and fostering brand loyalty among enthusiasts.

How is the electric vehicle (EV) market impacting the demand for alloy aluminum forged wheels?

The electric vehicle (EV) market is profoundly impacting and significantly boosting the demand for alloy aluminum forged wheels. EVs typically carry substantial battery packs, making them considerably heavier than their internal combustion engine (ICE) counterparts. To counteract this added weight and maximize driving range, EV manufacturers are increasingly prioritizing lightweight components, with forged wheels being a prime choice. Reducing unsprung mass through lighter forged wheels directly improves an EV's energy efficiency, extending its range and enhancing its overall performance, including acceleration and handling dynamics. Furthermore, the sleek and often futuristic design language of many EVs pairs well with the premium aesthetics and precision achievable with forged wheels, making them a natural fit for the evolving EV landscape and a critical component in optimizing electric vehicle engineering.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager