Almandine Garnet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435327 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Almandine Garnet Market Size

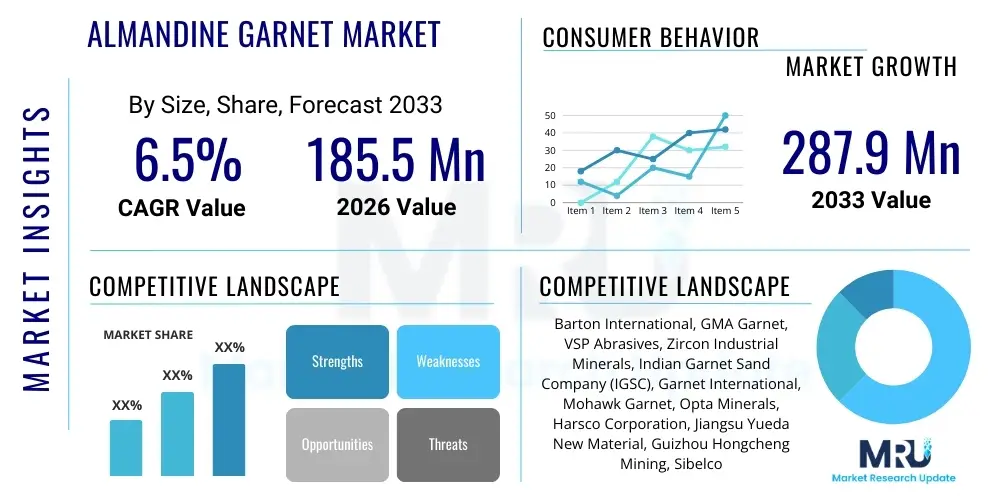

The Almandine Garnet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 185.5 Million in 2026 and is projected to reach USD 287.9 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global demand for high-performance, environmentally friendly abrasive materials, particularly within the waterjet cutting and abrasive blasting industries, which prize Almandine Garnet for its hardness, density, and non-toxic properties.

Almandine Garnet Market introduction

The Almandine Garnet Market encompasses the sourcing, processing, and distribution of the ferrous aluminum silicate mineral known for its distinctive dodecahedral structure and exceptional physical characteristics. This material, categorized primarily as a natural abrasive, finds widespread application across various industrial sectors due to its superior cutting efficiency, low dust generation, and recyclability. Historically, Almandine Garnet has been crucial in the preparation and finishing of surfaces in high-specification engineering and manufacturing processes, offering an effective and safer alternative to traditional silica sand and metallic abrasives, thereby aligning with stringent global occupational health standards and environmental regulations.

Major applications of Almandine Garnet include waterjet cutting, where its sharp, angular grains provide clean, precise cuts in thick materials; abrasive blasting for preparing substrates in infrastructure and marine industries; and as a filtration media in industrial water treatment systems due to its high specific gravity and chemical inertness. The primary benefits driving market adoption are its hardness (Mohs scale 7.5–8.5), which ensures rapid material removal and longevity, its low friability, and its classification as a non-hazardous material, contrasting sharply with carcinogenic crystalline silica. These technical advantages translate into enhanced operational efficiency and reduced waste disposal costs for end-users.

The market expansion is fundamentally driven by robust growth in end-use sectors such as aerospace, automotive manufacturing, and shipbuilding, which require flawless surface preparation for painting and coating applications. Additionally, increasing environmental scrutiny globally, particularly regarding airborne dust emissions and the safe handling of abrasive materials, acts as a significant catalyst, favoring the adoption of inert and recyclable minerals like Almandine Garnet. Technological advancements in mineral processing and purification techniques further ensure the availability of high-grade, application-specific garnet products, bolstering its competitive edge against synthetic abrasives.

Almandine Garnet Market Executive Summary

The Almandine Garnet market is experiencing sustained growth, underpinned by significant shifts in industrial abrasive usage towards safer and more efficient materials, driven by global regulatory pressures emphasizing worker safety and environmental stewardship. Business trends indicate a focus on supply chain optimization and vertical integration among key players to secure access to high-quality raw ore deposits, primarily in regions like India, Australia, and the US, ensuring consistent product quality and mitigating volatility in pricing. Furthermore, there is an increasing trend in developing specialized, finer-grade garnet powders tailored for precision finishing and advanced filtration applications, moving beyond traditional coarse blasting uses, indicating market maturity and diversification.

Regional trends highlight the Asia Pacific (APAC) region as the primary growth engine, driven by massive investments in infrastructure development, burgeoning shipbuilding activities, and expanding manufacturing bases, particularly in China and India, creating immense demand for abrasive blasting media. North America and Europe, characterized by mature markets, exhibit strong demand primarily in high-precision applications like aerospace and high-end automotive component manufacturing, focusing heavily on recyclable and sustainable garnet usage. Regulatory alignment, such as REACH compliance in Europe, continues to shape product specifications and market entry barriers, favoring suppliers who can provide certified, low-dust products.

Segmentation trends confirm that the Application segment dominated by Waterjet Cutting and Abrasive Blasting collectively accounts for the largest market share, though Filtration Media applications are projected to witness the highest CAGR due to intensifying industrial water recycling efforts globally. In terms of Grade, Industrial Grade garnet remains predominant, but the specialized Gemstone Grade segment maintains niche stability, providing high value per unit volume. The focus across all segments is on achieving optimal purity and consistent mesh size distribution, critical performance indicators for industrial users demanding predictable results in high-stakes manufacturing environments.

AI Impact Analysis on Almandine Garnet Market

Common user questions regarding AI's impact on the Almandine Garnet Market revolve primarily around improving operational efficiency, optimizing mineral processing, and predicting future demand cycles. Users frequently inquire how AI can enhance the sorting and grading of raw garnet ore to achieve higher purity levels and consistent particle size distribution, which are critical quality parameters for industrial applications like waterjet cutting. There is also significant interest in leveraging predictive maintenance models for large processing equipment, thereby minimizing costly downtime and improving resource utilization in mining and milling operations. Furthermore, users seek to understand how AI-driven demand forecasting can stabilize volatile supply chains and allow suppliers to strategically manage inventory based on real-time global industrial indicators, ensuring that high-specification garnet grades are available precisely when and where needed across diverse end-use sectors like shipbuilding and petrochemicals.

The implementation of AI and machine learning algorithms is set to revolutionize several stages of the garnet value chain, offering unprecedented precision and efficiency. In the exploration phase, AI algorithms analyze geological data to identify high-yield deposits, reducing exploratory costs and time. During processing, smart vision systems equipped with machine learning capabilities are being deployed to automate the sorting process, accurately distinguishing high-quality almandine from contaminants and low-grade material based on spectral analysis and morphological features, which significantly increases the overall recovery rate and final product quality, pushing the standards for industrial-grade abrasives higher.

Looking forward, AI is expected to play a crucial role in enhancing the sustainability profile of the garnet industry. Optimization algorithms can model and minimize energy consumption during crushing, screening, and washing stages, contributing to lower operational carbon footprints. Moreover, in the downstream market, AI systems analyze operational feedback from end-users, especially in complex waterjet cutting installations, providing data that helps manufacturers customize and refine particle size distributions (mesh sizes) for specific material requirements, such as titanium alloys or composite materials, ensuring the garnet product delivers maximum cutting speed and minimal kerf width, thus solidifying its competitive advantage over alternatives.

- AI-driven automation enhances ore sorting and grading, ensuring higher final product purity and consistency.

- Predictive maintenance using machine learning minimizes downtime of high-throughput processing machinery in mining operations.

- Advanced statistical modeling forecasts global demand fluctuations, optimizing inventory management and reducing supply chain risk.

- AI assists in geological surveying and resource identification, improving the efficiency of mineral exploration.

- Machine vision systems rapidly detect and classify foreign material contamination, guaranteeing specialized industrial grades meet stringent quality controls.

- Optimization algorithms reduce energy consumption during milling and classification processes, improving environmental sustainability.

DRO & Impact Forces Of Almandine Garnet Market

The Almandine Garnet market dynamics are governed by a robust balance of intrinsic performance advantages and external economic and regulatory pressures. The primary driver is the accelerating shift away from hazardous abrasive materials like silica sand, driven by stringent occupational safety regulations enforced globally by bodies like OSHA and the EU's HSE, which mandate safer alternatives in blasting environments. This regulatory push directly elevates the appeal of non-toxic, low-dust, and reusable garnet. Simultaneously, rapid industrialization, particularly in Asian economies, fuels massive infrastructure projects and manufacturing outputs, creating relentless demand for efficient surface preparation media. However, growth is tempered by restraints such as price volatility influenced by high energy costs for processing and transportation, alongside the geographical concentration of premium raw materials, creating potential geopolitical supply chain vulnerabilities. The core impact forces include regulatory shifts, technological innovations in abrasive delivery systems, and macro-economic stability influencing global infrastructure spending.

Key opportunities for market expansion lie in the development of specialized micro-grades for emerging applications, such as high-precision lapping and polishing in electronics and optics manufacturing, which require ultra-fine, highly purified abrasive particles. Furthermore, the growing global focus on water scarcity and industrial water recycling presents a significant avenue for growth, as Almandine Garnet is highly effective and durable as a dense filtration medium, displacing traditional filter sands due to superior performance characteristics. Addressing the challenges posed by high initial capital investment required for new processing plants and establishing efficient recycling loops for spent garnet abrasive are crucial for long-term sustainable market penetration and mitigating cost restraints, which currently act as a barrier to entry for smaller market players.

The market faces significant impact forces from substitutes. While garnet holds a strong position, synthetic alternatives like aluminum oxide and silicon carbide offer higher hardness and consistency in some niche applications, forcing garnet suppliers to continuously improve purity and particle shape through advanced processing techniques. Economic downturns affecting global construction and shipbuilding sectors can temporarily depress demand, yet the essential nature of garnet in maintenance and fabrication processes ensures resilience. The most substantial enduring impact force remains the ever-tightening regulatory framework surrounding abrasive use, positioning high-performance, environmentally safe materials like Almandine Garnet for inevitable long-term market dominance within specified industrial sectors.

Segmentation Analysis

The Almandine Garnet market is comprehensively segmented based on its application, the end-use industry utilizing the material, and the physical grade of the product, reflecting the highly diversified demand profiles across various industrial sectors. This segmentation highlights the functional versatility of the mineral, ranging from high-pressure cutting tools requiring extreme uniformity and hardness, to large-scale surface preparation operations, and finally, to chemical filtration systems demanding inertness and specific density. Understanding these divisions is crucial for market participants to tailor their processing methods, pricing strategies, and distribution channels, ensuring product specifications precisely match the demanding requirements of specific industrial processes, thereby maximizing market share in specialized niches. The distinction between Industrial Grade, predominantly used in bulk applications, and the higher-value Gemstone Grade, dictates the necessary purification and processing complexity required by miners and distributors.

The Application segment, which includes Waterjet Cutting and Abrasive Blasting, represents the volumetric core of the market, driven by infrastructural projects, equipment maintenance, and shipbuilding, which consume vast quantities of the material for preparing surfaces before coating. However, the rapidly expanding Filtration Media segment, although smaller in volume, exhibits robust growth due to global wastewater treatment mandates and industrial reuse requirements. End-use industries such as Aerospace and Automotive place a premium on extremely high purity and consistency for precision surface preparation, distinguishing their requirements from the higher volume, lower specification needs of the Construction and Shipbuilding sectors. These differences emphasize the need for producers to operate multiple processing lines capable of delivering materials tailored to unique particle size distributions, chemical purity levels, and packaging formats to address the entire spectrum of industrial demand.

- Application

- Waterjet Cutting

- Abrasive Blasting (Wet and Dry)

- Filtration Media

- Lapping and Polishing

- Anti-skid Coatings

- End-Use Industry

- Automotive

- Aerospace & Defense

- Oil & Gas (Petrochemical)

- Shipbuilding & Marine Coatings

- Construction & Infrastructure

- Electronics & Optics

- Water Treatment

- Grade Type

- Industrial Grade Garnet (Abrasive and Filtration)

- Gemstone Grade Garnet (High Purity)

Value Chain Analysis For Almandine Garnet Market

The Almandine Garnet value chain begins with upstream analysis, involving the geological exploration and mining of raw garnet sand deposits, primarily found in coastal mineral sands (heavy mineral concentrates) or hard rock formations. The efficiency of this stage, influenced heavily by geographical location and accessibility, determines the cost base for the entire market. Mining operations, often involving dredging or open-pit methods, extract the ore which is then subjected to preliminary beneficiation, including physical separation techniques such as gravity separation and magnetic separation, to produce a marketable concentrate. The success in the upstream phase relies heavily on controlling extraction costs and managing environmental compliance related to mining site rehabilitation.

The midstream phase focuses on the rigorous processing and refinement of the garnet concentrate to meet strict industrial specifications. This involves crushing, drying, screening, and precise classification using advanced sieving technologies to achieve the required mesh sizes (e.g., 80 mesh for waterjet cutting, 30/60 mesh for blasting). Sophisticated producers also utilize specialized washing and purification steps to remove trace contaminants, critical for high-purity applications like electronics or high-pressure filtration. Quality control at this stage is paramount, as particle shape, hardness, and chemical purity directly dictate the product’s performance and pricing power in downstream markets.

Downstream distribution channels involve getting the finished, bagged product to the diverse end-users. Direct channels are typically utilized for large-volume customers, such as major shipbuilding yards or large-scale waterjet equipment manufacturers, allowing for customized supply contracts and just-in-time delivery. Indirect distribution relies heavily on a global network of specialized industrial abrasive distributors and filtration media suppliers who provide local stockholding, technical support, and smaller batch sizes to SMEs in sectors like automotive repair and local infrastructure maintenance. The logistical challenge involves minimizing transportation costs for a high-density, relatively low-value bulk commodity, making proximity to end-use markets or efficient bulk shipping routes vital for competitiveness.

Almandine Garnet Market Potential Customers

The primary customers for Almandine Garnet are industrial entities that require superior surface preparation, material cutting, or specialized filtration capabilities, prioritizing material performance, environmental safety, and cost efficiency over traditional alternatives. High-volume end-users include major shipyards and marine repair facilities globally, utilizing garnet extensively for abrasive blasting to remove old coatings and rust before applying new protective layers, demanding consistency in blast profile and low chloride content. Similarly, large-scale structural engineering and infrastructure construction companies are core buyers, using the material for surface preparation on bridges, pipelines, and steel structures where structural integrity depends on the quality of the protective coating applied.

A second crucial customer segment consists of precision engineering firms, notably those in the aerospace and advanced automotive industries, as well as job shops specializing in waterjet cutting. These buyers require the highest grades of garnet, characterized by extremely tight particle size distributions, low friability, and chemical inertness, to ensure clean, micron-level accurate cuts in expensive, difficult-to-machine materials like composites, titanium, and heat-treated steels. The investment in high-end waterjet machinery necessitates the use of premium, consistent abrasive input to maximize equipment lifespan and cutting efficiency, making these customers highly sensitive to product quality and supplier reliability.

Finally, the growing environmental sector represents a rapidly expanding customer base, specifically municipal and industrial water treatment plants. These facilities purchase medium-grade Almandine Garnet as a high-density filter media component in multi-media filtration systems, valued for its durability, chemical resistance, and ability to handle high flow rates while effectively removing suspended solids. As regulatory bodies worldwide enforce stricter standards on effluent quality and promote water reuse, the demand from this sector is projected to maintain strong momentum, shifting the purchasing focus from mere abrasive properties to chemical stability and filtration efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 Million |

| Market Forecast in 2033 | USD 287.9 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Barton International, GMA Garnet, VSP Abrasives, Zircon Industrial Minerals, Indian Garnet Sand Company (IGSC), Garnet International, Mohawk Garnet, Opta Minerals, Harsco Corporation, Jiangsu Yueda New Material, Guizhou Hongcheng Mining, Sibelco, R.A. Stone, A.T. Mineral, AGSCO Corporation, Guangxi Xinyuan, Premier Group, Star Garnet, Imerys, Shengping Minerals |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Almandine Garnet Market Key Technology Landscape

The technology landscape for the Almandine Garnet market is concentrated on enhancing extraction purity, optimizing particle morphology, and improving the efficiency of application systems. In the processing phase, magnetic separation techniques are continuously being refined, utilizing high-intensity, rare-earth magnets to achieve higher mineral purity by effectively removing trace ferrous contaminants, which is crucial for applications sensitive to rust or foreign matter like precision waterjet cutting. Furthermore, advanced dry milling technologies are being developed to minimize the environmental impact and energy expenditure associated with traditional wet processing methods, yielding cleaner, more consistently shaped grains that enhance abrasive performance and reduce dust generation during usage.

In terms of application technologies, the innovation surrounding waterjet cutting machinery is intrinsically linked to garnet demand. New ultra-high-pressure pumps (upwards of 90,000 psi) require abrasives that can withstand extreme kinetic energy transfer without shattering, driving demand for garnet with superior toughness and low friability. Simultaneously, recycling technology for spent garnet is advancing rapidly. Specialized pneumatic conveying systems and cleaning apparatuses are now being deployed in large industrial settings to recover used garnet from blast chambers, clean it of paint residue and contaminants, and re-classify it for reuse, which significantly lowers lifetime material costs for end-users and enhances the material’s overall economic viability and environmental appeal, securing its position over single-use alternatives.

Moreover, digitalization is increasingly influencing the market, moving beyond AI applications into real-time monitoring of quality control. Spectroscopic analysis techniques and automated particle size analyzers integrated into the production lines ensure every batch of processed garnet adheres to specified standards without human intervention, ensuring optimal material performance. This technological integration is key to maintaining market competitiveness, especially for suppliers targeting international markets where consistency and certification, such as ISO and military specifications (MIL-A-22262B), are mandatory requirements for high-stakes applications like defense and aerospace manufacturing, pushing industry standards towards zero-defect output and traceability.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing regional market, primarily driven by massive governmental investments in infrastructure (roads, ports, energy pipelines) and the dominant presence of global shipbuilding centers (China, South Korea, India). The high pace of industrial expansion and manufacturing output across automotive and general fabrication sectors creates relentless demand for high-volume, cost-effective blasting media. Furthermore, increasing regulatory focus on water conservation in densely populated industrial zones is boosting demand for Almandine Garnet as an efficient filtration media.

- North America: This region is characterized by high demand for premium, consistent quality garnet, driven mainly by the high-precision aerospace, defense, and high-end automotive manufacturing sectors, where waterjet cutting is a standard practice for complex part fabrication. Regulatory stability and a strong emphasis on worker safety (OSHA standards) ensure continued preference for non-toxic Almandine Garnet over silica alternatives. Technological adoption, especially in abrasive recycling and advanced processing, remains strong, focusing on minimizing operational costs and maximizing sustainability.

- Europe: The European market is highly regulated, with environmental compliance (e.g., REACH) being a major determinant of material usage. Demand is concentrated in specialized applications such as maintenance of offshore oil and gas structures, high-speed rail, and advanced machinery manufacturing. European buyers typically demand certified, low-dust, and highly recyclable garnet grades, placing a strong emphasis on supply chain transparency and sustainable sourcing practices. Germany, the UK, and Scandinavian countries are key consumers, often driving innovation in abrasive delivery systems.

- Middle East and Africa (MEA): Growth in MEA is strongly correlated with the volatility of the oil and gas sector and infrastructure development, particularly in the Gulf Cooperation Council (GCC) nations. Almandine Garnet is critically important for surface preparation in pipeline construction, refinery maintenance, and anticorrosion applications on specialized marine vessels. The rapid expansion of urbanization projects and the resulting need for enhanced water treatment facilities also contribute significantly to the demand for filtration-grade garnet.

- Latin America: This market offers considerable growth potential, although often hindered by economic volatility and underdeveloped supply chains. Key demand drivers include mining equipment maintenance, shipbuilding in Brazil, and burgeoning automotive manufacturing in Mexico. The adoption curve is slower than in APAC, but increasing awareness regarding workplace safety and the superior performance of garnet is slowly accelerating the substitution of older, less efficient abrasive technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Almandine Garnet Market.- Barton International

- GMA Garnet

- VSP Abrasives

- Zircon Industrial Minerals

- Indian Garnet Sand Company (IGSC)

- Garnet International

- Mohawk Garnet

- Opta Minerals

- Harsco Corporation

- Jiangsu Yueda New Material

- Guizhou Hongcheng Mining

- Sibelco

- R.A. Stone

- A.T. Mineral

- AGSCO Corporation

- Guangxi Xinyuan

- Premier Group

- Star Garnet

- Imerys

- Shengping Minerals

Frequently Asked Questions

Analyze common user questions about the Almandine Garnet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Almandine Garnet globally?

The primary driver is the accelerating global shift towards safer, non-toxic abrasive materials, driven by stringent occupational health regulations (e.g., OSHA, EU directives) that restrict the use of hazardous substances like crystalline silica. Almandine Garnet's non-toxic, low-dust, and recyclable nature makes it the preferred environmentally compliant alternative for abrasive blasting and waterjet cutting across high-value industrial sectors.

How does the quality of Almandine Garnet impact waterjet cutting performance?

The quality, defined by particle size consistency (mesh size), purity, and low friability, critically impacts waterjet cutting performance. Consistent particle size ensures uniform kinetic energy transfer for precise cuts and maximizes cutting speed, while high purity prevents nozzle clogging and premature wear of expensive waterjet equipment components, ensuring operational efficiency and reducing maintenance costs.

Which region currently holds the dominant market share for Almandine Garnet?

The Asia Pacific (APAC) region, primarily driven by China and India, holds the dominant market share. This dominance is due to robust economic growth fueling massive infrastructure construction, extensive shipbuilding activities, and expanding manufacturing bases that require high volumes of abrasive media for surface preparation and finishing applications, significantly outpacing demand in North America and Europe.

What are the main competitive alternatives to Almandine Garnet in industrial applications?

The main competitive alternatives vary by application. In high-hardness abrasive applications, synthetic materials like aluminum oxide (corundum) and silicon carbide offer greater hardness. For low-cost blasting, materials like coal slag and steel grit are used. However, Almandine Garnet maintains a crucial competitive edge due to its optimal balance of hardness, density, environmental safety, and recyclability, particularly in sensitive or specialized applications.

In addition to abrasive applications, what is the fastest-growing use segment for Almandine Garnet?

The Filtration Media segment is the fastest-growing application for Almandine Garnet. This growth is spurred by increasing global regulatory requirements for industrial water reuse and effluent purification. Garnet is valued as a dense, high-performance component in multi-media filtration beds, offering chemical inertness and superior physical stability compared to conventional sand filters, facilitating efficient wastewater treatment and recycling processes across industrial operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager