Almond Drinks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432836 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Almond Drinks Market Size

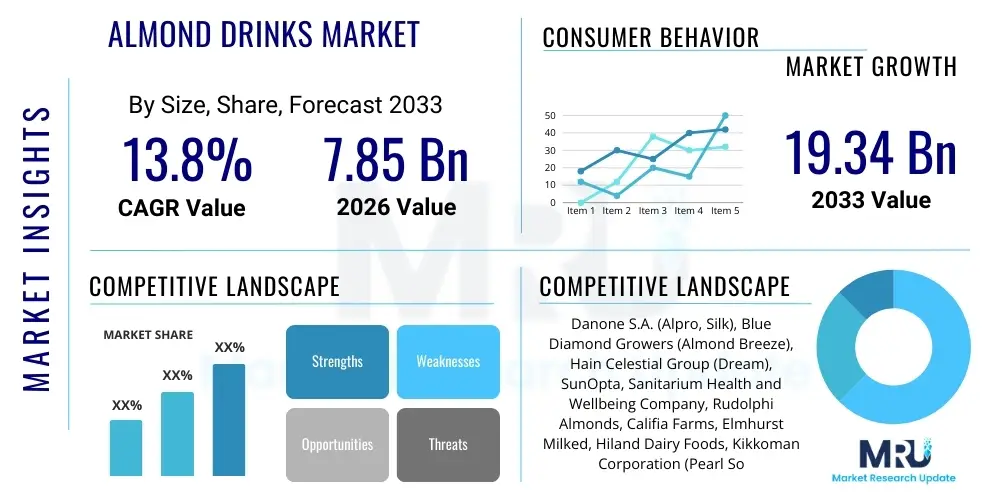

The Almond Drinks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.8% between 2026 and 2033. The market is estimated at USD 7.85 Billion in 2026 and is projected to reach USD 19.34 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by the accelerating global shift towards plant-based diets, a macroeconomic trend driven equally by increasing health consciousness among affluent consumers and pervasive ethical consumerism advocating for sustainable food systems. Consumers are progressively seeking dairy alternatives that offer tangible nutritional advantages, such as inherently lower caloric intake, zero cholesterol, and reduced saturated fat content, juxtaposed against a smaller overall environmental impact compared to traditional intensive dairy production methods. The consistent diversification of almond drink formats, moving beyond basic substitutions to specialized products like barista blends and high-protein variants, ensures continuous market relevance and penetration across diverse end-use applications, thus solidifying its indispensable role in the modern functional beverage category.

The sustained market growth is further underpinned by significant investments in optimizing the supply chain and enhancing product longevity. Technological advancements in Ultra-High Temperature (UHT) processing and aseptic packaging have critically enabled manufacturers to extend the shelf life of almond drinks substantially, facilitating wider global distribution, particularly into emerging economies in Asia Pacific and Latin America where cold chain logistics remain fragmented or costly. This improved accessibility, combined with strategic pricing models designed to bridge the gap between premium plant-based products and conventional milk, makes almond drinks an attractive daily staple for a growing global middle class. Furthermore, the persistent rise in diagnosed lactose intolerance and dairy allergies worldwide acts as a fundamental, non-negotiable driver, ensuring a captive consumer base relies on almond beverages as a necessity, thereby insulating a core segment of the market from volatile consumer preference trends and guaranteeing stable, long-term demand growth for the foreseeable future across all major consumption geographies, necessitating continuous research into novel flavor profiles and specialized functional additives to capture varied consumer segments globally.

Almond Drinks Market introduction

The Almond Drinks Market encompasses a sophisticated range of liquid consumables formulated from filtered water and pulverized raw almonds, meticulously processed to achieve a milk-like consistency and mouthfeel. These beverages are inherently lactose-free, gluten-free, and cholesterol-free, distinguishing them as a versatile and hypoallergenic substitute for dairy milk across various dietary regimes, including vegan, paleo, and ketogenic diets. The manufacturing process typically involves proprietary grinding and emulsification techniques, often incorporating nutritional fortifiers such as Calcium Carbonate, Vitamin D2, and Vitamin E, strategically compensating for nutrients commonly derived from dairy. Their flavor profile—mild, slightly nutty, and clean—lends itself exceptionally well to broad application, ranging from a base for breakfast cereals and smoothies to an essential component in complex professional coffee preparations, thereby integrating seamlessly into the daily consumption patterns of millions globally and cementing its mainstream status beyond niche health food stores, demanding precise quality control measures throughout the production cycle.

Major applications of almond drinks are diversified across both the retail and commercial sectors. In the retail sector, Ready-to-Drink (RTD) variants, available in various packaging formats (e.g., Tetra Pak cartons, PET bottles), satisfy immediate consumption needs. Commercially, the foodservice sector, particularly specialty coffee houses and fast-casual dining, represents a crucial demand vector. The rise of the barista blend category—formulations optimized with specific fat and protein compositions to ensure superior microfoam creation and stability under high heat—exemplifies the market's responsiveness to specialized B2B requirements. The benefits driving this accelerated adoption are multifaceted: health benefits (low sugar options, nutrient fortification), ethical benefits (perceived reduced environmental strain compared to livestock farming), and culinary versatility. These factors collectively position almond drinks not merely as an alternative but as a preferred choice for modern, conscious consumption, stimulating further investment in product enhancement and supply chain resilience to maintain market dominance against emerging plant-based competitors like oat and potato milk derivatives by emphasizing unique formulation stability.

Crucially, the driving factors extending market penetration include significant socio-demographic shifts, such as increasing urbanization, which facilitates greater access to supermarkets stocking diversified product ranges, and the exponential growth of digital platforms that streamline the direct-to-consumer distribution of specialty brands. Marketing efforts heavily leverage digital channels to educate consumers on the nutritional advantages and diverse usage occasions, effectively transforming almond milk from a functional ingredient into a lifestyle product. Regulatory support, particularly in regions like the EU and US, defining acceptable labeling standards for plant-based milk nomenclature, provides necessary clarity and builds consumer trust. This combination of strong product attributes, effective distribution, favorable demographics, and a supportive regulatory climate ensures the Almond Drinks Market maintains a trajectory of robust and sustained expansion across all core geographic segments, reinforcing its strategic importance within the global non-alcoholic beverage industry and requiring continuous monitoring of consumer sentiment regarding sourcing ethics.

Almond Drinks Market Executive Summary

The global Almond Drinks Market is navigating a period of intense structural evolution, characterized by fierce competition and a strong focus on strategic mergers and acquisitions (M&A) activities designed to secure control over raw material sourcing and consolidate distribution networks. Current business trends heavily emphasize clean-label formulation, with strong consumer preference for products free from artificial stabilizers, excessive sugar, and GMO ingredients, compelling manufacturers to invest in natural alternatives for emulsification and preservation. A major operational trend involves sophisticated supply chain optimization utilizing predictive analytics to manage the inherent volatility of almond commodity pricing and address the critical issue of regional water scarcity. Brands are increasingly differentiating themselves not just through flavor innovation but through verifiable sustainability certifications, providing an essential competitive edge in saturated Western markets and catering to the discerning ethical consumer base globally, ensuring that environmental impact reports become standard consumer-facing documentation.

Regional trends highlight a bipolar growth strategy: maintaining profitability and innovation supremacy in the mature markets of North America and Europe, while simultaneously deploying aggressive market penetration tactics in high-potential, high-growth regions, particularly the Asia Pacific (APAC). In North America, the focus is on premiumization—introducing high-end barista blends and nutritionally enhanced options (e.g., protein-boosted). Europe continues to lead in organic and ecological product integrity, often through strict government standards and consumer-led demands for transparency. The forecasted engine of growth, APAC, demands tailored localization strategies, focusing on shelf-stable (UHT) formats to overcome logistical constraints and introducing unique flavor profiles adapted to regional culinary preferences. The Middle East and Africa (MEA) remain nascent but promise substantial long-term potential, contingent on improved cold chain infrastructure development and aggressive consumer education regarding the nutritional parity and lifestyle benefits of switching from conventional dairy products, requiring precise market entry strategies.

Regarding segment trends, the Unsweetened and Original flavor categories maintain the largest volume market share globally, reflecting a widespread health trend favoring low-sugar intake for daily consumption purposes, such as in smoothies and cooking. However, the fastest growth is observed in highly specialized segments: the Barista Blend segment, driven by the professional foodservice demand for high-performance non-dairy products that perform optimally in heated applications, and the Functional Fortified segment, responding directly to consumer desires for proactive health management via added ingredients like specialized proteins, adaptogens, and omega fatty acids. Furthermore, the shift in distribution dynamics shows online retail experiencing significant exponential growth, supplementing the traditional strength of Supermarkets and Hypermarkets, particularly as consumers increasingly seek convenience, personalized subscription models, and access to a wider variety of niche and import brands not readily available through traditional brick-and-mortar channels, making omnichannel retailing a prerequisite for market leadership and maximized sales efficacy across all product categories.

AI Impact Analysis on Almond Drinks Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is fundamentally transforming the operational efficiency, sustainability footprint, and personalized product development within the Almond Drinks Market. Stakeholder analysis reveals that common user questions regarding AI’s influence primarily focus on optimizing almond sourcing to mitigate water scarcity—the market's most significant environmental challenge—and leveraging data to rapidly develop new, highly targeted functional products. Users and industry observers are keenly interested in how predictive models can stabilize volatile commodity pricing and ensure consistency in raw material quality, directly impacting the profitability and final sensory attributes of the packaged product. The overarching expectation is that AI will be the crucial technological catalyst enabling the industry to achieve ambitious sustainability targets while simultaneously meeting the rapidly diversifying demands for flavor and nutritional personalization, thereby future-proofing the value chain against environmental and competitive pressures.

In the agricultural and manufacturing realms, AI delivers critical efficiencies. Upstream, predictive analytics models are integrating real-time weather data, soil moisture levels, and historical crop performance to provide hyper-localized irrigation recommendations, resulting in documented water usage reductions in almond orchards. This not only addresses sustainability concerns but also lowers operational costs significantly for growers, ensuring a more stable, environmentally responsible supply chain for manufacturers. Midstream, in the processing facilities, AI-driven quality assurance systems, often utilizing computer vision, monitor the emulsification and homogenization processes. These systems can instantly detect deviations in viscosity, color, or particle size, ensuring superior product uniformity and texture, which is paramount for the performance of specialty products like barista blends, where precise formulation is non-negotiable for professional acceptability and mitigating expensive production errors.

Downstream, AI drastically sharpens market strategy and logistics execution. Machine learning algorithms analyze vast consumer behavioral datasets, spanning purchase history, loyalty program data, social media sentiment, and demographic indicators, to identify nuanced consumer micro-segments and predict future demand for specific product variations with high accuracy. This capability allows manufacturers to optimize inventory levels for both refrigerated and shelf-stable products, minimizing costly spoilage due to overstocking and preventing revenue loss from stock-outs during peak demand periods—a critical advantage in the short-shelf-life beverage industry. Furthermore, AI facilitates highly optimized, dynamic digital marketing campaigns that automatically tailor product messaging and promotions to individual consumer preferences, significantly enhancing conversion rates and maximizing lifetime customer value, transforming generic marketing efforts into precise, measurable strategic investments.

- AI-driven optimization of irrigation and resource management in almond orchards, reducing water footprint significantly through predictive modeling based on soil moisture and microclimate data, enhancing sustainable sourcing practices.

- Predictive maintenance analytics deployed on high-speed processing machinery (homogenizers, aseptic fillers) to anticipate mechanical failures, minimize unscheduled downtime, and enhance overall equipment effectiveness (OEE) and continuous manufacturing efficiency.

- Machine learning utilized for highly granular, SKU-specific demand forecasting across diverse distribution channels and geographies, optimizing cold chain inventory management and substantially reducing product spoilage and food waste.

- Natural Language Processing (NLP) employed to analyze vast datasets of consumer feedback, reviews, and social media sentiment for rapid identification of emerging flavor trends, product pain points, and assessment of marketing campaign efficacy and resonance.

- AI-enabled computer vision systems used in quality control lines to ensure micron-level consistency of viscosity, color, and flawless packaging integrity, thereby maintaining superior brand quality standards and regulatory compliance at scale.

- Algorithmic formulation tools aiding R&D teams in formulating novel, nutritionally balanced, and highly sensorially acceptable flavor profiles and functional blends, drastically cutting development time and material costs associated with traditional trial-and-error processes.

DRO & Impact Forces Of Almond Drinks Market

The Almond Drinks Market is powerfully driven by the undeniable global migration toward health-focused and ethically sourced food choices, encapsulated by the exponential rise of flexitarian and plant-based dietary preferences. This primary driver is strongly supported by the inherent health attributes of almond milk—it is naturally lactose-free, low in calories, and fortified with essential micronutrients like Vitamin D and Calcium, making it a medical necessity for those with intolerances and a preferred choice for weight-conscious and proactive health consumers. The increasing prominence of specialty coffee culture globally further accelerates this demand, as baristas and consumers alike require high-quality, reliable, non-dairy alternatives that can functionally integrate into espresso-based beverages, cementing almond milk's role as a staple ingredient in the burgeoning foodservice ecosystem and continuously expanding its consumption occasions far beyond the breakfast table and into specialized retail formats.

However, the market faces critical restraining factors that pose substantial structural challenges to sustained growth. Foremost among these is the escalating socio-environmental critique centered on the substantial water resources mandated by intensive almond monoculture, particularly concentrated in climatically sensitive regions like California, which risks potential regulatory backlash and significant negative public relations crises that can erode consumer trust, especially among highly engaged ethical buyers. Secondly, the market faces acute, disruptive competition from emerging non-dairy alternatives, particularly oat milk, which is often perceived as having a more favorable environmental footprint (lower water usage) and superior functional performance (creaminess, frothing ability) in coffee applications, compelling almond milk brands to either lower prices or dramatically improve functional attributes through technological innovation to maintain their competitive relevance and secure premium positioning in the rapidly evolving non-dairy category.

These constraints simultaneously pave the way for distinct strategic opportunities. Key among these is the opportunity for high-value functional fortification, whereby standard almond drinks are upgraded with high-demand ingredients such as specialized plant proteins (pea, rice), adaptogens (e.g., ashwagandha, medicinal mushrooms), or gut-health ingredients (probiotics, high-fiber complexes), transforming them into premium, wellness-focused beverages commanding higher margins and targeting specific consumer health needs. Furthermore, strategic geographic expansion into underserved markets, notably Southeast Asia and Latin America, represents a vast potential revenue stream, provided manufacturers effectively manage the logistics of distribution (e.g., UHT dependence) and localize product offerings to align with regional taste profiles and cultural culinary practices. The resulting impact forces demonstrate a highly competitive environment characterized by continuous, rapid product innovation and a compulsory focus on demonstrable supply chain sustainability and traceability, meaning long-term success hinges on effectively balancing aggressive global growth strategies with transparent, ethically sound sourcing practices and technological superiority in processing and formulation.

Segmentation Analysis

Market segmentation in the Almond Drinks sector is crucial for defining targeted marketing strategies and optimizing production capabilities to meet the highly diversified global consumer base. The segmentation matrix allows for a granular analysis of consumer behavior, differentiating between buyers seeking basic substitutions (Original, Unsweetened) and those desiring enhanced, indulgent, or functional attributes (Flavored, Barista Blends). Analyzing these segments reveals that while the Unsweetened category drives volume due to its appeal to health-conscious users, diabetics, and those seeking zero added sugar alternatives, the Flavored segment, particularly seasonal and indulgence-focused options (e.g., pumpkin spice, mocha), is highly profitable, capturing impulse purchases and catering to younger demographics seeking palatable, non-dairy treats. Understanding these specific segment nuances is vital for accurate capacity planning, inventory forecasting, and efficient resource allocation across the manufacturing footprint, ensuring maximized market penetration.

- By Type:

- Sweetened (Contains added caloric or non-caloric sweeteners, often targeting indulgence or taste familiarity)

- Unsweetened (Zero added sugar, appealing to core health-conscious consumers, low-carb dieters, and those prioritizing low-calorie intake)

- By Flavor:

- Original (The standard, unflavored base formulation for general daily use and cooking applications)

- Vanilla (A common, popular flavoring that provides enhanced palatability, often complementing coffee and cereal consumption)

- Chocolate (Targets younger demographics and indulgence categories, often featuring higher sugar content or specialized cocoa blends)

- Other Flavors (e.g., seasonal, spiced, honey, coconut blends, mocha – driving niche market growth and seasonal sales spikes)

- By Packaging:

- Cartons (Tetra Pak – dominant for high-volume UHT/shelf-stable and chilled formats, prioritizing efficiency and sustainability)

- Bottles (PET/Glass – often used for single-serve, premium, specialty cold-brew blends, or high-pressure processed (HPP) products)

- Cans (Emerging format for high-convenience, single-serving, ready-to-drink functional shots or specialized carbonated beverage mixes)

- By Distribution Channel:

- Supermarkets and Hypermarkets (Largest volume sales channel, providing broad consumer access and promotional negotiation leverage through modern trade networks)

- Convenience Stores (Focus on smaller, immediate consumption formats and high-traffic impulse purchases)

- Online Retail (Fastest growing channel, catering to niche brands, bulk buying, specialized subscription models, and comprehensive home delivery convenience)

- Foodservice (Cafes, Restaurants, Institutional Catering – demanding specialized, high-performance barista products and bulk supply solutions)

- By Application:

- Direct Consumption (Drinking straight or as part of everyday meals and snacks)

- Dairy Free Formulations (Used as functional ingredients in secondary products like plant-based yogurts, ice creams, and desserts)

- Cereal and Smoothies (Everyday application demonstrating core product utility and versatility)

- Barista/Coffee Applications (Specialized high-performance requirement demanding specific fat/protein content for frothing and stability)

Value Chain Analysis For Almond Drinks Market

The value chain for almond drinks commences with the rigorous upstream activities of agricultural sourcing and processing, predominantly located in the climatically favorable but water-stressed Central Valley of California, which dictates global supply dynamics and price stability. Upstream analysis involves efficient orchard management, sophisticated water conservation techniques (driven by regulatory necessity and consumer pressure), and efficient mechanical harvesting and shelling. Key players seek to secure long-term, ethical sourcing contracts with growers to mitigate extreme price volatility and guarantee consistent quality (e.g., specific almond types for flavor). The challenge at this stage is managing the immense environmental scrutiny regarding sustainability and ensuring compliance with stringent safety standards for pest management and chemical residue, compelling the use of highly traceable digital monitoring systems and blockchain technologies throughout the cultivation process to maintain supply chain transparency and consumer trust in the product's origin and ethical credentials.

The midstream segment involves the transformation of raw shelled and processed almonds into finished, stable beverages. This manufacturing phase is technology-intensive, requiring significant capital expenditure in advanced grinding, high-pressure homogenization, and blending equipment to ensure a smooth, stable emulsion that resists phase separation. Crucially, the choice of sterilization—pasteurization for refrigerated goods or Ultra-High Temperature (UHT) for shelf-stable—determines the required packaging technology, with aseptic filling lines being essential for UHT products destined for global long-distance transport. Optimization at this stage focuses rigorously on maximizing extract yield (extracting the maximum soluble almond content while minimizing processing waste) and enhancing energy efficiency in high-temperature treatment processes. The finished, packaged product then enters the downstream distribution network, categorized predominantly as direct or indirect, depending on the volume and market segment being strategically targeted.

Downstream analysis details the complex path to the end consumer, emphasizing logistical precision and channel differentiation. Direct distribution channels are predominantly utilized for the high-value B2B foodservice sector, where manufacturers maintain direct sales and service relationships with major national and global coffee chains to supply specialized barista products, often requiring dedicated, bespoke cold-chain management logistics to ensure optimal performance. Indirect channels rely heavily on collaboration with major retail distributors and 3PL partners to stock Supermarkets, Hypermarkets, and Convenience Stores, which collectively account for the vast majority of consumer volume sales. The exponential expansion of e-commerce, facilitated by sophisticated automated warehouse management systems and precise last-mile delivery networks, represents a highly effective indirect channel for reaching premium and niche brand customers. Success across all downstream segments requires precise real-time inventory control, dynamic pricing strategies responsive to local competition, and compelling in-store and digital merchandising to secure favorable visibility amidst intense competition from both dairy and rival plant-based alternatives, necessitating that the entire value chain is synchronized to deliver optimal product freshness and aggressively minimize costly product expiration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.85 Billion |

| Market Forecast in 2033 | USD 19.34 Billion |

| Growth Rate | 13.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Danone S.A. (Alpro, Silk), Blue Diamond Growers (Almond Breeze), Hain Celestial Group (Dream), SunOpta, Sanitarium Health and Wellbeing Company, Rudolphi Almonds, Califia Farms, Elmhurst Milked, Hiland Dairy Foods, Kikkoman Corporation (Pearl Soymilk), Earth’s Own Food Company, Vitasoy International Holdings, Oatly Group AB (diversification), Natura Foods, Ripple Foods (as a competitor context), The Hershey Company, Pacific Foods (Campbell Soup Co.), Trader Joe's, Pureharvest, Borges Agricultural & Industrial Nuts, Tofutti Brands, WhiteWave Foods. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Almond Drinks Market Key Technology Landscape

The core technological backbone of the Almond Drinks Market lies in achieving optimal product stability, extended shelf life, and superior sensory attributes, mirroring the performance of dairy milk without the reliance on animal fats or proteins. Ultra-High Temperature (UHT) processing remains the dominant sterilization method, enabling the mass production of shelf-stable almond milk packaged in aseptic containers (predominantly Tetra Pak). This technology is transformative, as it eliminates the logistical dependency on continuous refrigeration, drastically cutting distribution costs and making global penetration into temperature-sensitive and remote markets feasible. Continuous innovation in UHT technology focuses on minimizing thermal impact, ensuring that the sterilization process reduces microbial load effectively while preserving maximum micronutrient integrity and avoiding the development of off-flavors associated with excessive heat exposure, thus maintaining the clean-label promise and superior taste profile increasingly demanded by sophisticated consumers worldwide.

Beyond sterilization, specialized ingredient technology, specifically in emulsification and stabilization, is critical for superior product performance, particularly in the high-value barista segment. Manufacturers utilize sophisticated food science to develop highly effective, often natural, hydrocolloids (e.g., gellan gum, locust bean gum) and protein complexes that prevent the natural phase separation of almond solids and water, providing the desired creamy texture and, critically, ensuring the product does not curdle when mixed with hot, acidic coffee. Advanced techniques such as high-pressure homogenization (HPH) are employed to reduce the particle size of the almond solids to an extremely fine, uniform level, dramatically improving mouthfeel, reducing chalkiness, and ensuring emulsion stability over extended storage periods, providing a functional edge over less technologically sophisticated competitors and reinforcing brand quality perception in competitive retail spaces.

Furthermore, the digitalization of manufacturing and quality control constitutes a pivotal technological advancement. Modern processing plants utilize Internet of Things (IoT) sensors throughout the production line to monitor critical control points—from ingredient mixing ratios and precise temperature curves to packaging seal integrity—in real time. This vast data stream is fed into centralized Manufacturing Execution Systems (MES) and analyzed instantly by AI/ML algorithms to predict maintenance needs, flag subtle deviations in quality immediately, and ensure precise traceability from the specific raw almond batch to the final consumer product. This comprehensive, integrated technological approach significantly enhances safety compliance, maximizes operational yield, minimizes costly waste associated with quality defects, and provides the essential foundation for robust regulatory adherence and proactive quality management demanded by global food safety authorities, solidifying the industry's commitment to verifiable high standards and operational excellence.

Regional Highlights

The Almond Drinks Market exhibits distinct regional maturity levels and growth trajectories, reflecting fundamental differences in consumer acceptance, regulatory frameworks, and distribution infrastructure sophistication across continents. North America stands as the historical vanguard, characterized by the highest per capita consumption rates and the earliest mass adoption of plant-based alternatives. The market here is driven by relentless innovation in functional products, specialized dairy substitutes targeting niche dietary requirements (Keto, Paleo, protein-enriched), and robust competitive pricing. Key success factors in North America include securing exclusive partnerships with leading national and regional coffee chains to capture the highly profitable barista segment, continuous investment in flavor diversification beyond the core original and vanilla varieties, and leveraging influential digital marketing campaigns to sustain high consumer engagement and defend brand loyalty in a highly saturated retail environment against aggressive competitors.

Europe represents a highly dynamic and environmentally sensitive market environment, where robust growth is strongly coupled with demonstrable sustainability credentials, organic certification, and clean-label integrity. Western European countries, particularly the UK, Germany, and the Nordic countries, demonstrate exceptionally high penetration rates, often seeing plant-based milk consumption surpassing traditional dairy consumption in progressive urban demographics. Manufacturers operating in Europe must navigate complex, stringent regulations regarding labeling and sourcing, prioritizing local or regional almond sources whenever feasible to reduce transportation emissions and appeal to the strong European consumer preference for locally or ethically sourced ingredients. The rapid mainstreaming of veganism and flexitarianism, supported by powerful consumer advocacy and regulatory backing, ensures steady, high-value demand, with growth accelerating in Southern and Eastern European economies as modern retail infrastructure expands and consumer affluence increases across these geographies, requiring customized market entry strategies for nuanced consumer bases.

Asia Pacific (APAC) is unequivocally positioned as the future growth epicenter of the global almond drinks market, forecasted to achieve the highest CAGR throughout the period. The region’s trajectory is bolstered by a potent mix of macroeconomic factors: burgeoning middle-class populations with significantly higher disposable income, the rapid Westernization and modernization of dietary habits, and the widespread, clinically relevant factor of high lactose intolerance prevalence across Asian demographics. Shelf-stable UHT almond milk formats overwhelmingly dominate distribution across massive markets like China and India due to logistical challenges inherent in extensive, high-cost cold chain infrastructure requirements, facilitating broad access to consumers in non-metropolitan areas. Successful penetration strategies involve strategic joint ventures with established local beverage giants, tailoring sweetness levels and flavor profiles to align specifically with regional palates (e.g., incorporating less sugar than Western counterparts), and effective digital marketing through local platforms to build awareness among first-time plant-based consumers, ensuring APAC leads global volume growth through the forecast period and drives global manufacturing capacity increases.

- North America: Dominant global market share, high per capita consumption, established infrastructure. Focus on premiumization, functional fortification, and specialized barista applications to drive innovation and maintain category leadership.

- Europe: Second-largest market, emphasizing clean label, organic certification, and sustainable, transparent supply chains. Strong current growth in Western Europe, with rapidly emerging potential in Central and Eastern regions driven by expanding modern retail trade networks.

- Asia Pacific (APAC): Highest projected growth (CAGR), fueled by rapid urbanization, rising middle-class incomes, and critical lactose intolerance prevalence. Market dominance relies heavily on shelf-stable (UHT) product formats and precise flavor localization strategies.

- Latin America: Emerging market with increasing penetration, particularly in urban centers of Brazil, Mexico, and Chile. Growth is highly dependent on achieving economic stability and effective consumer education regarding the substantial health benefits of dairy substitution.

- Middle East and Africa (MEA): Nascent market primarily concentrated in high-income Gulf Cooperation Council (GCC) countries. Market maturity requires substantial infrastructural investment in cold chain logistics, aggressive efforts to lower product pricing, and targeted nutritional advocacy campaigns to shift traditional cultural preferences for dairy products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Almond Drinks Market.- Danone S.A. (Alpro, Silk)

- Blue Diamond Growers (Almond Breeze)

- Hain Celestial Group (Dream)

- SunOpta Inc.

- Califia Farms LLC

- Elmhurst Milked

- Tribe Foods Inc.

- Sanitarium Health and Wellbeing Company

- Rudolphi Almonds

- Kikkoman Corporation (Pearl Soymilk)

- Earth’s Own Food Company Inc.

- Vitasoy International Holdings Ltd.

- Oatly Group AB

- Nutriops SL (Ecomil)

- AlmondCo Australia

- Goya Foods Inc.

- Nestlé S.A.

- Campbell Soup Company (Pacific Foods)

- The Hershey Company

- Pureharvest

- Borges Agricultural & Industrial Nuts

- Trader Joe's (Private Label Dominance)

- Hiland Dairy Foods

Frequently Asked Questions

Analyze common user questions about the Almond Drinks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Almond Drinks Market?

The Almond Drinks Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 13.8% between 2026 and 2033, driven primarily by global consumer shifts towards plant-based nutrition and lactose-free dietary options, particularly in the rapidly expanding Asia Pacific region where health consciousness is rising exponentially.

What are the primary sustainability concerns regarding almond drinks production?

The foremost sustainability concern is the high volume of water required for almond cultivation, especially in drought-prone regions like California. Manufacturers are mitigating this through AI-driven precision irrigation technologies, ethical sourcing standards, and prioritizing regenerative agricultural practices to reduce the overall environmental footprint and address consumer scrutiny effectively.

Which distribution channel holds the largest market share for almond drinks?

Supermarkets and Hypermarkets currently retain the largest market share globally due to high volume sales and widespread physical access for bulk purchases. However, the Online Retail segment is demonstrating the highest growth trajectory, rapidly gaining ground by offering unparalleled convenience and catering to specialized premium, niche, and fortified almond drink brand offerings.

How does oat milk competition affect the Almond Drinks Market?

Oat milk poses a significant competitive restraint due to its superior functional performance in hot coffee (better frothing/stability) and its perceived lower environmental water footprint. This pressure mandates that almond drink manufacturers focus on continuous innovation, particularly the refinement of specialized barista blends using advanced hydrocolloid technology, to maintain functional parity and defend market share in the B2B sector.

What is the role of AI in optimizing the almond drink supply chain?

AI is strategically utilized across the supply chain, from optimizing raw material sourcing via predictive crop yield analysis and efficient irrigation scheduling, to enhancing midstream processing quality control through computer vision systems, and finally, optimizing downstream logistics via accurate demand forecasting, minimizing waste and maximizing profitability across the entire value chain operations.

What are the key technological advancements driving extended shelf life?

Key advancements are centered on Ultra-High Temperature (UHT) sterilization combined with advanced aseptic packaging systems (e.g., Tetra Pak). These technologies enable the creation of shelf-stable almond drinks that can be distributed globally without continuous cold chain requirements, drastically reducing logistical complexity and costs for penetrating emerging markets effectively.

Which geographic region is expected to show the fastest growth rate?

The Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate during the forecast period. This rapid expansion is primarily driven by increasing consumer awareness, rising middle-class disposable incomes, and the widespread prevalence of lactose intolerance among the indigenous population, creating a vast untapped consumer base demanding convenient alternatives.

Why are barista blends a significant segment within almond drinks?

Barista blends represent a high-value, specialized segment responding to the massive demand from the professional foodservice sector, particularly coffee shops. These formulations are specifically engineered for enhanced foaming, stability, and texture under high heat conditions, ensuring they function as high-quality substitutes for dairy milk in complex espresso-based beverages, thus guaranteeing B2B sales volume and loyalty.

What major trend is defining new product development in this market?

The major trend is functional fortification. New product development focuses heavily on enriching almond drinks with high-value functional ingredients such as additional plant proteins (pea or soy), adaptogens (ashwagandha), vitamins (B12), and prebiotics, transforming the beverage from a simple milk alternative into a targeted health and wellness product tailored for specific dietary outcomes and demanding higher retail margins.

Who are the primary potential customers for almond drinks?

Primary customers include individuals with diagnosed lactose intolerance or dairy allergies, dedicated vegans and vegetarians seeking ethical alternatives, and a large, expanding demographic of flexitarians and health-conscious consumers who prioritize almond drinks for their lower calorie count, zero cholesterol, and perceived environmental benefits compared to conventional dairy products across all meal occasions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager