Alnico Magnets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434880 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Alnico Magnets Market Size

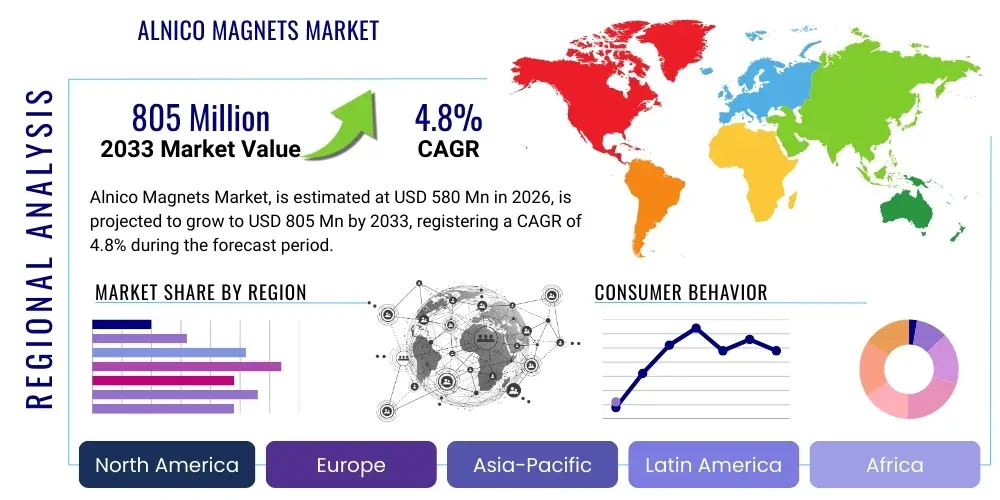

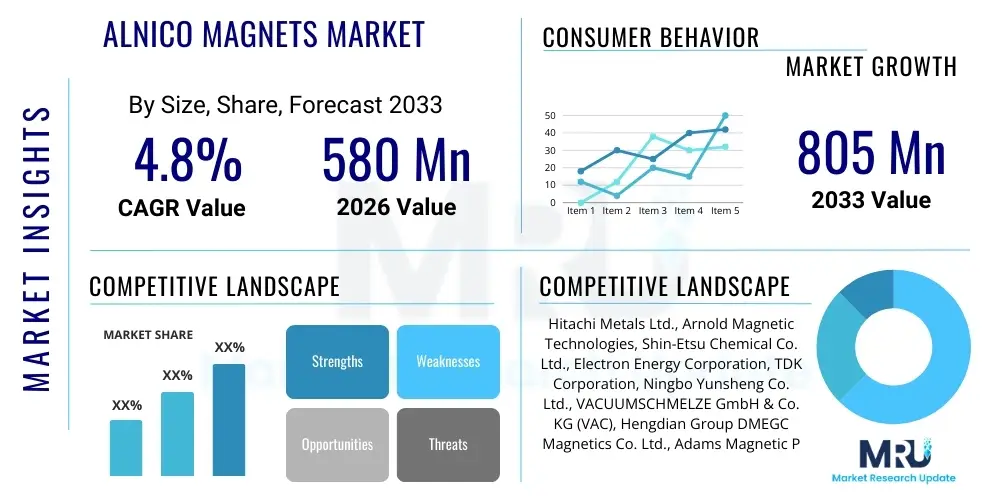

The Alnico Magnets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 580 Million in 2026 and is projected to reach USD 805 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the material's unparalleled stability across extreme temperature ranges, making it indispensable in legacy industrial applications and emerging high-reliability sectors such as aerospace and defense. While Alnico faces persistent competition from high-strength rare earth magnets, its superior resistance to demagnetization from high temperatures secures its niche, particularly in applications where operational heat is a critical factor and long-term magnetic stability is paramount for safety and performance.

The market expansion is not uniform across all application areas. Traditional segments, such as measuring instruments and guitar pickups, demonstrate steady demand, but the primary impetus for growth stems from sophisticated industrial motor systems and advanced sensing technologies. Ongoing research focused on refining Alnico alloys, specifically targeting enhanced coercivity through improved grain alignment and metallurgical processing, is contributing to its sustained relevance. Furthermore, the global drive towards electrification, although primarily relying on NdFeB magnets for propulsion motors, utilizes Alnico heavily in specialized auxiliary systems, sensors, and actuators that operate under demanding thermal conditions within electric and hybrid vehicles.

Geographically, the Asia Pacific region is expected to remain the largest consumer and producer, driven by expansive growth in automotive electronics manufacturing and heavy industrial machinery output, especially in China and Japan. Investment in R&D aimed at mitigating the dependency on volatile raw material supply chains, particularly cobalt, is a key strategic element for major market players. The overall market size increase reflects a balance between steady replacement demand in mature markets and escalating requirements from specialized, high-growth industries demanding reliability over absolute magnetic strength, solidifying Alnico's position as a premium, niche material.

Alnico Magnets Market introduction

Alnico magnets, an acronym derived from their primary constituents—Aluminum (Al), Nickel (Ni), and Cobalt (Co)—along with iron and minor additives like copper and titanium, represent one of the oldest and most versatile families of permanent magnet materials. Recognized for their excellent thermal stability and high residual induction, Alnico magnets maintain their magnetic properties effectively at temperatures up to 550°C, significantly outperforming most competing materials like ferrites or rare-earth magnets in high-temperature environments. Historically prominent in applications requiring strong magnetic fields and robustness, Alnico is manufactured either through casting or sintering processes, each yielding distinct magnetic properties and mechanical characteristics, catering to different performance needs across various industries.

The primary applications of Alnico magnets span a wide range of industrial and consumer electronics sectors. In the industrial domain, they are critical components in high-performance sensors, specialized electric motors, magnetic chucks, and sophisticated communication devices such like traveling wave tubes (TWTs). Their magnetic stability makes them ideal for scientific instrumentation and calibration standards where fluctuations in temperature must not compromise measurement accuracy. Moreover, their relatively high resistance to corrosion compared to rare earth magnets offers longevity in humid or challenging operational conditions. Although generally possessing lower coercive force than NdFeB or SmCo magnets, their superior residual induction (Br) and energy product (BHmax) when compared to ceramic magnets ensure continued utility in applications prioritizing flux density and thermal resilience.

The market driving factors for Alnico include the enduring demand for reliable magnetic components in extreme environments, the revitalization of the aerospace and defense sectors requiring high-temperature components, and the burgeoning use of complex sensor arrays in industrial automation and monitoring systems. Benefits derived from utilizing Alnico materials include exceptional long-term stability, resistance to oxidation, and compatibility with challenging thermal profiles, securing their essential role in mission-critical equipment. The ongoing technological evolution in material processing aims to improve the coercivity of Alnico alloys, allowing them to compete more effectively in size-constrained applications without sacrificing their inherent thermal advantages, thereby sustaining their niche market vitality.

Alnico Magnets Market Executive Summary

The Alnico Magnets Market is characterized by stable demand driven primarily by replacement cycles in mature industrial infrastructure and specialized requirements in high-reliability sectors. The overall market growth rate, while moderate, reflects strategic value creation in niche applications where thermal stability is a non-negotiable performance criterion, overriding the competition based purely on magnetic strength (as offered by rare earth magnets). Key business trends include consolidation among raw material suppliers and magnet fabricators, aiming to secure stable access to critical elements like cobalt and nickel, which are subject to significant price volatility. Furthermore, manufacturers are focusing on advanced forming techniques, such as directional solidification in casting, to maximize the magnetic alignment and improve overall energy product, thereby optimizing the performance-to-cost ratio for end-users in demanding fields like metrology and instrumentation.

Regional trends indicate that the Asia Pacific region maintains its dominance, primarily due to robust manufacturing bases in China and the specialized high-tech industrial complex in Japan, which heavily utilizes Alnico in robotics and precision electronics. North America and Europe, while seeing slower volume growth, remain crucial markets focused on high-margin, bespoke Alnico products for aerospace, medical devices, and high-fidelity audio equipment. European trends are additionally influenced by stringent environmental and recycling mandates, prompting research into closed-loop systems for cobalt recovery. Segmentation trends reveal that cast Alnico magnets, offering higher flux density, continue to command the largest market share, though sintered Alnico is gaining traction in applications requiring tighter dimensional tolerances and mechanical strength, such as small actuators and rotors.

Segments trends highlight the increasing specialization within application categories. The automotive sector's demand is shifting towards sensors (e.g., speed and proximity sensors) that must operate near hot engine parts, offering a secure niche for Alnico despite the overall shift to NdFeB in traction motors. Similarly, the energy sector, specifically older-generation wind turbines and specialized generators, relies on the intrinsic robustness of Alnico. These trends underscore a market pivot: Alnico is less utilized for pure power generation and more for high-precision, enduring magnetic field control in systems where operational longevity and temperature resilience are valued above all else. This strategic positioning ensures the market's resilience against substitution threats, maintaining its critical role across industrial hardware platforms globally.

AI Impact Analysis on Alnico Magnets Market

User queries regarding AI's influence on the Alnico Magnets Market center primarily around optimizing high-cost manufacturing processes, predicting performance degradation over time, and accelerating the discovery of novel alloys with reduced reliance on volatile materials like cobalt. Key themes emerging from this analysis include the potential for AI-driven material science platforms to model complex magnetic structures and predict the properties of substitute alloys before costly physical experimentation. Users are keenly interested in how machine learning can enhance quality control in both casting and sintering processes, particularly in detecting microstructural defects that compromise long-term magnetic stability. Furthermore, there is significant focus on leveraging AI to manage the volatility of raw material costs by optimizing purchasing strategies and predicting geopolitical impacts on supply chains, critical for materials containing expensive elements like cobalt.

The application of Artificial Intelligence and Machine Learning (ML) algorithms is expected to revolutionize the efficiency and quality control aspects of Alnico production. By implementing sophisticated predictive maintenance models driven by sensor data, manufacturers can anticipate equipment failure in high-temperature furnaces and improve the consistency of the heat treatment cycles essential for establishing Alnico's magnetic properties. AI is particularly effective in processing vast datasets generated during the sintering process, allowing for real-time adjustments to temperature profiles and atmospheric composition, leading to reduced scrap rates and superior batch consistency. This translates directly into higher yield rates and lower manufacturing costs, making Alnico more competitive relative to alternative magnetic materials.

In the long term, AI's most significant impact lies in expediting the development of next-generation, high-performance Alnico variants. Computational materials science, powered by deep learning, can explore millions of potential alloy compositions and processing parameters, targeting improved coercivity and energy density without sacrificing thermal stability. This capability is vital for mitigating the strategic risk associated with cobalt price fluctuations and supply concentration. Through AI-driven simulations, researchers can design alloys with superior grain boundary engineering and optimized phase compositions, thereby extending the viable application envelope for Alnico magnets into more demanding, high-efficiency systems currently dominated by rare earth materials.

- AI optimizes casting and sintering process parameters, reducing energy consumption and material waste.

- Machine Learning enhances quality control by predicting microstructural defects in real-time.

- AI accelerates the discovery of cobalt-reduced or cobalt-free high-performance Alnico variants.

- Predictive modeling helps manufacturers manage supply chain volatility and raw material inventory, especially cobalt and nickel.

- AI-driven simulation tools optimize magnet geometry designs for specific high-temperature sensor applications.

DRO & Impact Forces Of Alnico Magnets Market

The market dynamics of Alnico magnets are governed by a complex interplay of inherent material advantages, economic pressures, and technological substitution threats. The primary Drivers include Alnico's exceptional thermal stability and high magnetic flux density at elevated temperatures, securing its position in critical aerospace, military, and legacy industrial applications where other magnets fail. The growing need for precision control and sensing in industrial automation, where sensors are often located in high-heat environments, further propels demand. Conversely, the market faces significant Restraints, most notably the high cost and volatility associated with key raw materials, especially cobalt, which is geographically concentrated and politically sensitive. Furthermore, the lower coercivity compared to NdFeB means Alnico magnets require large physical volumes to resist demagnetization, limiting their use in miniaturized or highly integrated electronic devices where size and weight are severely constrained.

The primary Opportunities for market growth reside in the renewable energy sector, particularly specialized magnetos and generators that benefit from Alnico's robustness and longevity, despite the sector's general reliance on higher-energy-density magnets. Another substantial opportunity lies in the development of recycling technologies to recover cobalt and nickel from end-of-life magnets, mitigating reliance on primary sourcing and stabilizing the supply chain. Technological advancements in grain refinement and doping techniques aimed at enhancing coercivity represent a critical path for market expansion. Addressing the material cost issue through sustainable sourcing and processing improvements will unlock new application fields currently deemed too cost-prohibitive for Alnico components.

The Impact Forces significantly shaping the Alnico market include the ever-present and accelerating threat of substitution from rare earth magnets, particularly SmCo, which offers better temperature stability than NdFeB and higher coercivity than Alnico, though often at a higher cost. Furthermore, government regulations regarding critical mineral sourcing and environmental standards influence manufacturing strategies and costs globally. The bargaining power of suppliers remains high due to the concentrated nature of cobalt mining, impacting profit margins for magnet manufacturers. However, the unique combination of high residual induction and thermal tolerance acts as a powerful barrier to entry for many potential substitute materials, ensuring Alnico retains a dedicated, high-value segment within the broader permanent magnet landscape.

Segmentation Analysis

The Alnico Magnets Market is strategically segmented based on factors including manufacturing process, product type, end-use industry, and geographic region. Understanding these segmentations is critical for market participants to tailor product offerings and investment strategies. The core differentiation lies between cast and sintered Alnico, which dictates the magnet's final properties and suitability for specific applications. Cast Alnico typically offers superior magnetic performance, specifically higher residual induction and energy product, making it suitable for larger, high-flux applications such as motor components and complex meters. Sintered Alnico, processed using powder metallurgy, provides better mechanical strength and tighter dimensional tolerances, favoring smaller components like sensors, relays, and actuators where precise fitting is essential. These distinctions allow the market to serve both heavy industrial and precision instrumentation requirements effectively.

- By Manufacturing Process:

- Cast Alnico Magnets

- Sintered Alnico Magnets

- By Product Type:

- Alnico 5 (Most Common, High Residual Induction)

- Alnico 8 (Higher Coercivity, often containing Titanium)

- Alnico 9 (Anisotropic, highest magnetic properties)

- Others (Alnico 2, 3, 6)

- By End-Use Industry:

- Automotive (Sensors, Ignitions)

- Aerospace and Defense (Actuators, Guidance Systems)

- Industrial Manufacturing (Motors, Generators, Magnetic Chucks)

- Instrumentation and Metrology (Calibration, Measuring Devices)

- Consumer Electronics and Audio (Guitar Pickups, Loudspeakers)

- Healthcare and Medical Devices (Specialized imaging equipment)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Alnico Magnets Market

The value chain for Alnico magnets commences with the upstream sourcing of critical raw materials, primarily nickel, cobalt, and aluminum, alongside iron and various alloying additives like titanium and copper. This phase is characterized by significant vulnerability to geopolitical risks and commodity price volatility, particularly for cobalt, which necessitates rigorous inventory management and strategic long-term procurement agreements. Upstream analysis focuses heavily on the geographical concentration of mining operations and the subsequent refining processes that prepare these metallic elements into high-purity forms suitable for magnet fabrication. Efficiency at this stage is crucial, as raw material costs constitute a substantial portion of the final magnet price, driving manufacturers to seek diverse and secure sourcing channels.

The subsequent phase involves manufacturing, split between casting and sintering. Casting involves melting the alloy components and pouring them into molds, followed by critical heat treatment and cooling processes to establish the desired magnetic anisotropy and metallurgical structure. Sintering involves powder metallurgy, pressing fine alloy powders into shape and heating them just below the melting point. Both processes require extremely precise temperature control and atmospheric management to achieve optimal magnetic properties. After manufacturing, the magnets undergo rigorous finishing processes, including grinding, machining (often challenging due to the hard and brittle nature of Alnico), plating, and final magnetization and testing, adding significant value and ensuring they meet exacting customer specifications.

The downstream analysis focuses on distribution and end-user integration. Distribution channels can be direct, particularly for large Original Equipment Manufacturers (OEMs) in aerospace and heavy machinery, or indirect, utilizing specialized industrial distributors who provide value-added services such as machining, assembly, and kitting for smaller specialized users like audio equipment manufacturers or instrumentation companies. The final consumers integrate these magnets into mission-critical systems where the material’s thermal resilience is paramount. Effective logistics and technical support are crucial in the downstream segment, ensuring the proper handling, assembly, and calibration of Alnico magnets within complex end-products, thereby maximizing the lifetime performance and justifying the premium cost of these specialized magnetic components.

Alnico Magnets Market Potential Customers

The potential customer base for Alnico magnets is predominantly comprised of Original Equipment Manufacturers (OEMs) operating within highly technical and demanding industrial sectors that prioritize thermal stability and magnetic longevity over the absolute highest energy density. These end-users are typically sophisticated purchasers who understand the trade-offs between Alnico, Ferrite, and Rare Earth materials. The aerospace and defense sector represents a cornerstone of potential customers, relying on Alnico for essential components in inertial navigation systems, specialized radar equipment, and critical actuators that must function reliably under the severe thermal stresses encountered during flight or military operations. These customers demand extremely high quality, traceability, and often require compliance with stringent military and industrial standards, making long-term contractual relationships common.

Another major segment of buyers includes manufacturers of specialized electrical machinery and industrial automation equipment. This encompasses companies producing high-reliability generators, variable speed motors, and magnetic separation equipment utilized in mining or recycling. For these applications, Alnico’s resistance to demagnetization from high temperatures caused by continuous operation is invaluable, securing long product lifetimes and reducing maintenance downtime. Furthermore, the metrology and calibration industry forms a niche but crucial customer group, as Alnico’s exceptional stability makes it the material of choice for precise laboratory standards, flow meters, and measuring instruments where any deviation due to temperature fluctuation is unacceptable and would compromise measurement integrity.

Lastly, high-fidelity audio equipment manufacturers, particularly those specializing in professional loudspeakers and premium guitar pickups, represent a stable segment of potential customers. In these applications, Alnico's unique magnetic characteristics contribute to specific acoustic qualities that are highly valued by audiophiles and musicians, creating a persistent, albeit volume-constrained, demand. Given the premium nature of the products across all major end-use sectors, potential customers are typically willing to absorb the higher initial material cost of Alnico in exchange for the guaranteed performance, durability, and operational stability it provides in extreme or critical operating environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Million |

| Market Forecast in 2033 | USD 805 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi Metals Ltd., Arnold Magnetic Technologies, Shin-Etsu Chemical Co. Ltd., Electron Energy Corporation, TDK Corporation, Ningbo Yunsheng Co. Ltd., VACUUMSCHMELZE GmbH & Co. KG (VAC), Hengdian Group DMEGC Magnetics Co. Ltd., Adams Magnetic Products Co., Dexter Magnetic Technologies, Tengam Engineering Inc., Goudsmit Magnetics Groep, Bunting Magnetics Co., Hangzhou Permanent Magnet Group, Ningbo Ketian Magnet Co. Ltd., MS-Schramberg GmbH & Co. KG, Magnetfabrik Bonn GmbH, China Rare Earth Holdings Limited, Sanji Technology Group, Molycorp Magnequench. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Alnico Magnets Market Key Technology Landscape

The technological landscape of the Alnico Magnets Market is defined by continuous efforts to refine existing manufacturing processes—namely casting and sintering—and advancements in material composition and post-processing treatments. Casting technology remains predominant for producing magnets with high residual induction (Br), particularly the anisotropic grades like Alnico 5 and 9. Recent technological advancements in casting focus on directional solidification techniques, which meticulously control the grain growth and alignment during the cooling phase. This control minimizes grain boundary resistance and maximizes the degree of anisotropy, leading to higher energy products and superior performance in applications requiring maximum flux density. Furthermore, manufacturers are employing vacuum induction melting to ensure alloy purity, which is critical for achieving consistent magnetic characteristics across large production batches, directly addressing quality and reliability concerns from aerospace clients.

Sintering technology is advancing through the adoption of advanced powder metallurgy techniques, allowing for the fabrication of complex shapes and smaller components with tight dimensional tolerances, often required for miniature sensors and precision motors. Key innovations here involve ultra-fine powder preparation and optimized pressing methods to achieve higher density green bodies before sintering, minimizing porosity and improving mechanical strength. Efforts are also being directed toward low-oxygen sintering environments and the use of specialized binders to prevent oxidation of the reactive alloy components. These sintering refinements enhance the magnet’s structural integrity and make it more amenable to precise machining, expanding Alnico’s utility in complex, space-constrained assemblies.

Material science innovation centers on increasing the intrinsic coercivity (Hci) of Alnico alloys, traditionally its weakest point compared to rare earth alternatives. This is achieved through the strategic introduction of minor alloying elements, such as titanium (leading to Alnico 8), which aids in pinning the domain walls and resists demagnetization. Current research is exploring nanotechnology and surface modification techniques to improve the surface magnetic properties, particularly in anisotropic Alnico grades. Simultaneously, the focus on recycling technologies, including hydrometallurgical and pyrometallurgical routes for efficient recovery of nickel and cobalt from scrap magnets, is rapidly gaining technological prominence, driven by both economic necessity due to raw material costs and increasing regulatory pressure for sustainable production practices across the magnetic materials industry.

Regional Highlights

The Asia Pacific (APAC) region stands as the dominant force in the Alnico Magnets Market, both in terms of production volume and consumption. This dominance is intrinsically linked to the region’s expansive, high-volume manufacturing capabilities across major end-use industries, particularly automotive component production, general industrial machinery, and consumer electronics in countries like China, Japan, and South Korea. Japan, in particular, holds significant historical and technological leadership in specialized Alnico manufacturing, focusing on high-precision instrumentation and advanced robotics where quality and thermal stability are non-negotiable. China's contribution is driven by high production capacity and growing domestic consumption in industrial automation and electric motor manufacturing, making APAC the engine of market supply and sustained primary demand.

North America represents a mature, high-value market characterized by robust demand from the aerospace and defense sectors, which rely heavily on Alnico for mission-critical guidance systems, communication equipment, and sensors operating in thermally stressful environments. Strict regulatory requirements and stringent performance standards in the U.S. and Canada drive demand for premium, custom-engineered Alnico products, often sourced from highly specialized domestic fabricators who focus on low-volume, high-specification magnets. Furthermore, the region's strong presence in metrology and scientific instrumentation ensures a steady demand flow for stable magnetic standards, compensating for the slower volume growth seen in general industrial applications compared to APAC.

Europe maintains a strong, technology-driven market position, especially within Germany and the UK, fueled by sophisticated industrial automation, specialized medical equipment, and high-end audio engineering. The European market emphasizes energy efficiency and long-term product durability, favoring Alnico for applications in generators and specialized motor controls within its advanced manufacturing base. While the overall volume is smaller than APAC, European consumption is highly concentrated in high-margin sectors. Recent strategic focus includes investment in advanced recycling technologies to address the environmental impact and dependency on non-European cobalt sources, aligning the regional market with broader sustainability objectives and securing the long-term viability of Alnico components within the European industrial ecosystem.

- Asia Pacific (APAC): Dominates production and consumption; driven by automotive, industrial machinery, and precision electronics in China and Japan.

- North America: High-value market focused on aerospace, defense, scientific instrumentation, and demanding customized, high-specification magnets.

- Europe: Strong demand from advanced industrial automation, high-end audio, and specialized medical device manufacturing, prioritizing product longevity and efficiency.

- Latin America (LATAM) & Middle East and Africa (MEA): Emerging growth markets, driven primarily by infrastructure projects, oil and gas sensor needs (MEA), and slow adoption in general industrial machinery.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Alnico Magnets Market.- Hitachi Metals Ltd.

- Arnold Magnetic Technologies

- Shin-Etsu Chemical Co. Ltd.

- Electron Energy Corporation

- TDK Corporation

- Ningbo Yunsheng Co. Ltd.

- VACUUMSCHMELZE GmbH & Co. KG (VAC)

- Hengdian Group DMEGC Magnetics Co. Ltd.

- Adams Magnetic Products Co.

- Dexter Magnetic Technologies

- Tengam Engineering Inc.

- Goudsmit Magnetics Groep

- Bunting Magnetics Co.

- Hangzhou Permanent Magnet Group

- Ningbo Ketian Magnet Co. Ltd.

- MS-Schramberg GmbH & Co. KG

- Magnetfabrik Bonn GmbH

- China Rare Earth Holdings Limited

- Sanji Technology Group

- Molycorp Magnequench

Frequently Asked Questions

Analyze common user questions about the Alnico Magnets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Alnico magnets over rare earth magnets like NdFeB?

The primary advantage of Alnico magnets is their exceptional thermal stability, allowing them to maintain high magnetic flux density and stability at elevated temperatures, often up to 550°C, significantly higher than standard rare earth magnets. This thermal resilience makes them critical for high-heat industrial and aerospace applications.

In which key industries are Alnico magnets most commonly used?

Alnico magnets are predominantly used in the aerospace and defense sectors for sensors and guidance systems, industrial manufacturing for specialized motors and magnetic chucks, instrumentation for calibration and measurement devices, and in the audio industry for high-fidelity guitar pickups and professional loudspeakers.

What are the main types of Alnico magnets and how do they differ?

The main types are Cast Alnico and Sintered Alnico. Cast Alnico offers superior magnetic properties (higher residual induction) and is ideal for large components, while Sintered Alnico provides better mechanical strength and precise dimensional tolerances, suitable for smaller, complex geometries like sensors and actuators.

How does the volatile price of cobalt impact the Alnico Magnets Market?

Cobalt is a critical and expensive component of Alnico alloys, meaning its price volatility directly increases the cost of goods sold and introduces supply chain risk. This financial pressure drives manufacturers to seek advanced recycling solutions and develop lower-cobalt or titanium-doped Alnico grades (like Alnico 8) to mitigate cost exposure and maintain competitiveness.

Is Alnico still relevant given the dominance of Rare Earth magnets?

Yes, Alnico remains highly relevant. While rare earth magnets offer higher energy density for compact designs, they suffer from significant demagnetization at high temperatures. Alnico maintains its critical niche due to its superior thermal stability, corrosion resistance, and stable magnetic output over extreme temperature ranges, securing its essential role in high-reliability, long-life systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager