Alpaca Fiber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432833 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Alpaca Fiber Market Size

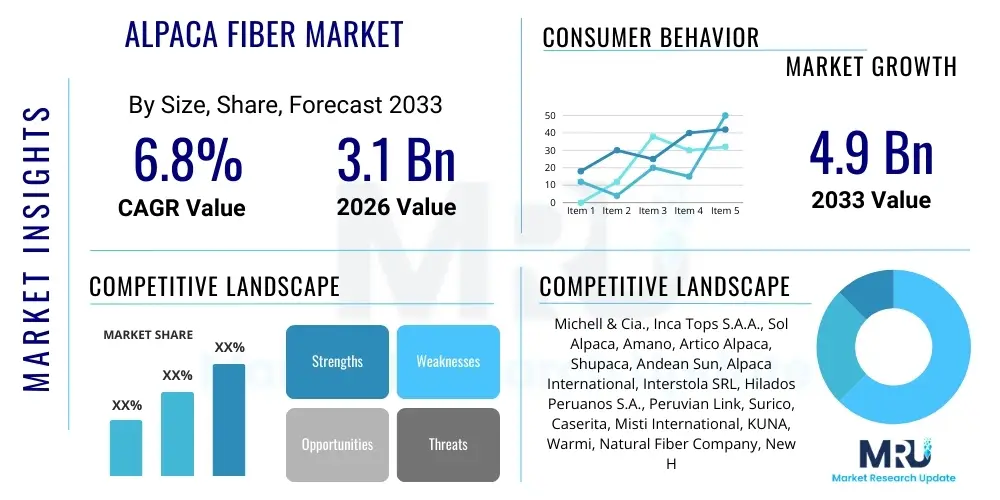

The Alpaca Fiber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033.

Alpaca Fiber Market introduction

The Alpaca Fiber Market encompasses the global trade and utilization of fleece derived from the two main alpaca types, Huacaya and Suri, renowned for their softness, thermal properties, and hypoallergenic qualities. Alpaca fiber is classified as a specialty animal fiber, competing primarily with cashmere, merino wool, and mohair, yet offering superior insulation without the prickly texture often associated with coarser wools. This inherent high quality, coupled with a strong emphasis on ethical sourcing and sustainability, positions alpaca fiber as a premium commodity, primarily serving the high-end apparel, luxury textiles, and home furnishings sectors. Key applications include sophisticated knitwear, woven garments, outer protective wear, and high-performance technical textiles where warmth and lightweight design are paramount considerations.

Product descriptions vary significantly based on the fiber's micron count, which determines its classification ranging from Royal Alpaca (below 19 microns) to coarser grades used in carpets and industrial felts. Major applications are concentrated in the fashion industry, driven by consumer demand for sustainable and natural fibers that offer exceptional comfort and durability. The benefits derived from alpaca fiber—including superior moisture-wicking capabilities, inherent flame resistance, and unparalleled softness—are strong contributors to its market expansion. Furthermore, the fiber’s diversity in natural colors reduces the need for extensive chemical dyeing processes, aligning with contemporary environmental, social, and governance (ESG) standards, thereby bolstering its appeal among environmentally conscious brands.

Driving factors for this specialized market include the increasing disposable income in developed economies, enabling consumers to invest in high-cost luxury goods, and the growing global awareness regarding sustainable fashion practices. Furthermore, technological advancements in processing and spinning techniques, particularly micro-fiber separation and blending with other premium materials, enhance the fiber's versatility and application scope. Demand is also catalyzed by strategic promotional efforts by producing nations, such as Peru and Bolivia, focusing on branding alpaca fiber as a high-value, traceable, and ethically sourced material. These combined elements underscore a robust growth trajectory for the market, despite inherent supply limitations related to animal husbandry and geographical constraints.

Alpaca Fiber Market Executive Summary

The global Alpaca Fiber Market demonstrates dynamic growth fueled by strong demand for luxury, natural, and sustainable textiles, particularly in North America and Western Europe. Key business trends indicate a vertical integration push by major Peruvian and international companies to control the supply chain from animal breeding to finished garment production, ensuring traceability and quality consistency. This strategic maneuver mitigates risks associated with fluctuating raw material costs and bolsters brand reputation based on ethical sourcing. Furthermore, there is a pronounced shift towards technical innovation in fiber blending, allowing alpaca fibers to penetrate emerging markets like performance outerwear and medical textiles, traditionally dominated by synthetic materials. Investment in sustainable processing technologies, specifically waterless dyeing and waste reduction methods, is becoming a prerequisite for market entry, reflecting stringent consumer and regulatory demands.

Regional trends reveal the dominance of Latin America, particularly Peru, as the primary source of raw fiber supply, leveraging its climatic advantage and established infrastructure for herd management. However, consumption is overwhelmingly concentrated in developed regions. North America showcases robust demand driven by a strong luxury consumer base and an early adoption of sustainable fashion criteria. Europe, particularly Italy and Germany, remains the epicenter for high-end manufacturing and design, dictating global fashion trends that incorporate alpaca fiber. The Asia Pacific (APAC) region is emerging as a significant growth area, led by China's growing affluent class and its expanding domestic textile manufacturing capacity, shifting its role from solely an exporter to a major consumer of premium natural fibers.

Segmentation trends highlight the increasing importance of the Royal Alpaca and Baby Alpaca segments (fibers under 22 microns) due to escalating demand for ultra-soft, next-to-skin apparel. While these finer grades command a substantial price premium, their application in high-value products ensures profitability. Conversely, the coarser grades maintain a stable market share in the home furnishings and industrial textile segments, supported by their inherent durability and superior insulation properties. The processing segmentation shows a clear preference for specialty yarns and rovings, driven by small to medium-sized boutique textile producers seeking customized input materials. Overall, the market remains highly segmented by quality, where brand reputation and fiber certification significantly influence pricing and consumer trust across all application areas.

AI Impact Analysis on Alpaca Fiber Market

Analysis of common user questions related to the impact of AI on the Alpaca Fiber Market reveals key themes centered around supply chain efficiency, predictive demand forecasting, and sustainable innovation. Users frequently inquire about how AI can optimize the complex logistics of fiber collection and sorting across vast geographic areas, particularly in the Andean highlands. A major concern is the potential for AI-driven genetic selection to enhance fiber quality and yield without compromising the welfare or biodiversity of alpaca herds. Furthermore, there is significant interest in how machine learning can be leveraged for non-invasive, high-speed automated grading of fiber quality, reducing reliance on slow, manual inspection methods. Expectations are high that AI will transform inventory management, minimizing waste and improving market responsiveness by accurately predicting seasonal shifts in luxury consumer demand and material preferences, thereby driving both profitability and sustainability within this niche market.

AI's influence is already being felt in the initial stages of the value chain through precision animal husbandry. Machine learning algorithms are analyzing biometric data from alpaca herds—tracking health, nutrition, and environmental factors—to optimize breeding programs and improve fleece quality consistency. This data-driven approach allows for rapid identification of superior fiber-producing animals, accelerating genetic improvement cycles and ultimately increasing the supply of highly sought-after fine micron grades. Downstream, AI is crucial for optimizing manufacturing processes; computer vision systems are being integrated into spinning mills to detect microscopic flaws in yarn production, ensuring flawless output quality critical for luxury goods. This not only reduces material wastage but also significantly cuts down on processing time and operational costs, providing a substantial competitive edge.

The implementation of AI-driven platforms is transforming market intelligence and consumer interaction. Natural Language Processing (NLP) tools are employed to analyze social media trends and global fashion reporting, enabling producers to quickly adapt their product lines to emerging aesthetic demands and color palettes. For retail, AI-powered chatbots and recommendation engines are enhancing the personalized shopping experience for high-value alpaca products, offering detailed provenance and sustainability information tailored to the conscientious luxury buyer. The net effect of these AI applications is the creation of a more transparent, efficient, and responsive supply chain, addressing the core consumer need for verifiable ethical sourcing and premium product quality in the alpaca fiber domain.

- AI optimizes genetic selection in alpaca breeding for finer micron counts and higher yield.

- Machine learning algorithms enhance traceability by tracking fiber origin and processing history across the supply chain.

- Computer vision systems enable rapid, automated quality grading of raw fiber and finished yarn, surpassing manual inspection efficiency.

- Predictive analytics forecasts luxury textile demand, optimizing inventory management and reducing overproduction waste.

- AI supports sustainable practices by optimizing resource use (water, energy) in fiber processing and dyeing facilities.

DRO & Impact Forces Of Alpaca Fiber Market

The dynamics of the Alpaca Fiber Market are heavily influenced by a delicate balance of inherent product qualities, ethical considerations, and market access limitations. Drivers include the rising global demand for sustainable, natural, and luxury apparel, benefiting from alpaca fiber's superior attributes like softness, warmth, and inherent hypoallergenicity. Opportunities stem primarily from expanding applications into technical textiles and niche medical fabrics, alongside strategic branding initiatives that emphasize the fiber's unique provenance and ethical production methods. However, the market faces significant restraints, most notably the highly limited and geographically concentrated raw material supply, which subjects prices to high volatility and hinders large-scale industrial expansion. The overall impact forces suggest a market characterized by high barriers to entry and intense competition among specialized producers focusing on quality differentiation rather than volume.

Major drivers sustaining market momentum include the strong consumer preference shift away from synthetic fibers toward natural, biodegradable alternatives. Alpaca fiber is intrinsically positioned well within this sustainability movement due to its minimal environmental footprint compared to conventional sheep wool or cashmere production, especially regarding land use and methane emissions. Furthermore, continuous innovation in textile manufacturing allows for the efficient processing of finer alpaca grades, enhancing the luxury appeal and expanding the functional scope of the resultant fabrics. Marketing efforts focusing on traceability—often leveraging blockchain technology—appeal strongly to the modern luxury consumer who demands transparency regarding the ethical treatment of animals and the fair compensation of local farmers in source countries like Peru and Bolivia.

Restraints fundamentally revolve around supply chain rigidity. Alpaca farming is highly dependent on specific high-altitude ecosystems, making rapid scaling impractical and susceptible to localized climatic shifts. This inelastic supply curve results in significant price sensitivity to slight demand increases, making long-term cost planning challenging for manufacturers. Moreover, processing capabilities, particularly for the ultra-fine grades, are technologically demanding and geographically sparse, creating bottlenecks outside established production hubs. The market opportunity lies in developing new regional processing centers closer to major consuming markets (e.g., in Europe or Asia) to reduce transportation costs and lead times, as well as increasing efforts in fiber blending to extend the use of available raw materials across a wider product spectrum while maintaining high perceived value.

Segmentation Analysis

The Alpaca Fiber Market is primarily segmented based on the fiber type (distinguishing quality by micron count), the color variation (natural colors versus dyed), the end-use application (apparel, home textiles, industrial), and the processing stage (raw fiber, processed yarn, finished garments). The micron count segmentation is critical, as it directly correlates with price, performance, and application, with categories such as Royal Alpaca (ultrafine) and Baby Alpaca driving the highest revenue share in the luxury segment. Geographic segmentation emphasizes the divergence between fiber-producing regions (Latin America) and major consumption/manufacturing hubs (North America and Europe), reflecting the global nature of this specialized supply chain.

- By Fiber Type:

- Royal Alpaca (Below 19 Microns)

- Baby Alpaca (19 to 22 Microns)

- Superfine Alpaca (22 to 25 Microns)

- Huarizo/Coarse Alpaca (Above 25 Microns)

- By Color:

- Natural (White, Fawn, Brown, Black, Grey)

- Dyed

- By Application:

- Apparel (Knitwear, Outerwear, Accessories)

- Home Textiles (Blankets, Carpets, Upholstery)

- Industrial & Technical Textiles (Felting, Insulation)

- By Processing Stage:

- Raw Fiber/Fleece

- Processed Fiber (Sliver, Roving, Tops)

- Finished Yarn

Value Chain Analysis For Alpaca Fiber Market

The value chain for Alpaca Fiber is characterized by its high degree of specialization and geographical concentration, beginning with the upstream sector centered in the high Andes mountains of South America. Upstream activities involve alpaca breeding, rearing, and annual shearing, primarily conducted by small-scale indigenous farmers and cooperatives. The critical step here is the initial sorting and grading of raw fleece based on micron count, length, and color, which determines the fiber’s market value. Direct relationships between large international mills and these farming cooperatives are increasingly common to ensure sustainable practices, quality control, and ethical pricing, often bypassing numerous intermediaries common in traditional agricultural commodity markets.

Midstream processing involves scouring, carding, spinning, and sometimes dyeing. This stage is dominated by specialized mills, largely concentrated in Peru, which possess the necessary sophisticated machinery required to handle the delicate nature of alpaca fiber, particularly the superfine grades. These mills transform raw fleece into processed tops, roving, or finished yarn. Distribution channels at this stage are bifurcated: direct distribution to major international luxury textile manufacturers (e.g., Italian fashion houses) for exclusive use, and indirect distribution through specialized fiber brokers and trading houses that cater to smaller, boutique designers globally. Efficiency in this midstream segment is paramount, as mishandling can severely degrade the value of the final product.

Downstream analysis focuses on the manufacturing of final products, primarily high-end apparel and luxury home goods, which often takes place in major consumer regions like Italy, the US, and China. Finished garments are then distributed through highly selective channels, predominantly luxury retail boutiques, high-end department stores, and increasingly, direct-to-consumer (D2C) e-commerce platforms that leverage the fiber’s narrative of sustainability and exclusivity. The indirect distribution network also includes global textile fairs and specialized B2B marketplaces. The profitability across the entire chain is significantly influenced by the level of value addition; finished garments command the highest margins, driving incentive for vertical integration among key market players seeking greater control over branding and pricing.

Alpaca Fiber Market Potential Customers

The primary end-users and buyers of Alpaca Fiber fall predominantly into the luxury and specialized textile sectors, driven by the demand for high-quality, sustainable materials. Major customers include high-end fashion designers and luxury apparel brands (e.g., Loro Piana, Brunello Cucinelli) who utilize premium alpaca fibers (Royal and Baby grades) for signature knitwear, tailored coats, and sophisticated accessories. These buyers require consistent supply, stringent quality verification, and often demand detailed traceability documentation confirming ethical sourcing and minimal environmental impact. The purchasing decisions of these large manufacturers are heavily influenced by the fiber's micron quality, color uniformity, and the supplier's capacity to meet customized processing requirements, such as specialized yarn counts or unique blends.

Another significant customer base exists within the home furnishings and interior design sector. This includes manufacturers specializing in luxury blankets, throws, high-end carpets, and upholstery materials. While these applications may utilize a broader range of fiber grades, including the coarser types for durability, the inherent thermal regulation and aesthetic appeal of alpaca fiber maintain its premium positioning. Institutional buyers, such as boutique hotels and exclusive residential developers, also represent a segment of potential customers seeking durable, hypo-allergenic, and visually appealing textile solutions for upscale environments. Reliability of supply and adherence to specific fire safety standards or durability metrics are critical factors for these buyers.

Emerging potential customers are found in the technical textile and niche medical device sectors. Due to alpaca fiber's lightweight nature, exceptional thermal regulation, and superior moisture management capabilities, it is increasingly being explored for performance wear, specialized military textiles, and orthopaedic supports. These buyers, often R&D departments in advanced textile firms, focus less on aesthetic appeal and more on measurable functional properties, such as tensile strength, insulation capacity per unit weight, and bacterial resistance. The growth in this segment suggests a diversification of the customer portfolio beyond traditional fashion, opening opportunities for suppliers able to provide technically processed and certified industrial-grade alpaca materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Michell & Cia., Inca Tops S.A.A., Sol Alpaca, Amano, Artico Alpaca, Shupaca, Andean Sun, Alpaca International, Interstola SRL, Hilados Peruanos S.A., Peruvian Link, Surico, Caserita, Misti International, KUNA, Warmi, Natural Fiber Company, New House Textiles, The Alpaca Yarn Company, Alpacas del Peru. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Alpaca Fiber Market Key Technology Landscape

The technological landscape in the Alpaca Fiber Market is focused intensely on enhancing fiber quality analysis, improving efficiency in delicate processing, and ensuring sustainability throughout the production lifecycle. A critical technology involves advanced automated fiber analysis systems, such as Optical Fiber Diameter Analyzer (OFDA) and Laserscan, which provide rapid, precise measurement of micron count and uniformity. These tools are indispensable for classifying and pricing raw fiber accurately, replacing older, slower manual methods, thereby enabling higher throughput for large mills. Furthermore, sophisticated scouring and carding machines are engineered specifically to handle the extremely fine and delicate structure of baby and royal alpaca fibers, minimizing breakage and waste during the crucial cleaning and preparation phases before spinning, ensuring maximum retention of the fiber's inherent softness.

In the yarn production stage, high-speed, precision spinning technologies, including Ring Spinning and specialized Worsted Spinning processes, are essential for creating high-quality, durable yarns suitable for luxury knitwear and weaving. Significant innovation is also directed toward fiber blending technology. Modern mills utilize advanced blending machinery and computer-controlled systems to seamlessly combine alpaca fiber with other luxury materials like silk, cashmere, or Tencel, producing novel textiles that leverage alpaca's benefits while optimizing cost and performance. This technological integration allows producers to achieve specific functional requirements, such as increased drape, tensile strength, or luster, catering to diversified fashion demands.

Sustainability technologies represent another major area of investment. Leading companies are adopting eco-friendly processing techniques, including advanced biological enzyme washes that reduce harsh chemical usage in scouring. Waterless dyeing or low-water usage dyeing systems (e.g., supercritical CO2 dyeing) are being explored and implemented to mitigate the significant water consumption traditionally associated with textile processing. Additionally, the adoption of blockchain technology is gaining traction to provide immutable records of fiber provenance, ensuring traceability from the specific farm or cooperative to the final garment. This technological assurance of ethical and sustainable practices is a key competitive differentiator, satisfying the increasing transparency demands of the global luxury consumer base.

Regional Highlights

The Alpaca Fiber Market exhibits a highly polarized regional structure, with production concentrated primarily in Latin America and consumption/high-value manufacturing heavily weighted towards North America and Europe. Latin America, particularly Peru and Bolivia, dominates the global supply chain due to geographical and heritage advantages, producing over 85% of the world's commercial alpaca fiber. Peru, benefiting from long-established industry infrastructure and large, specialized mills, serves as the global benchmark for processing and export of high-grade alpaca yarn and tops. The region’s market relevance is defined not just by volume, but by its control over the quality parameters, especially for the rare and high-priced Royal Alpaca fiber. Continued investment in farmer training and genetic improvement programs in this region ensures its long-term supremacy in raw material supply.

North America (predominantly the US and Canada) represents a critical consumption market, characterized by high disposable incomes and a robust appetite for luxury, sustainable fashion. Demand here is driven by affluent consumers who prioritize ethical sourcing and the inherent quality of natural fibers. This region is a major end-market for finished alpaca garments and accessories. Market growth is further stimulated by an increasing number of independent designers and textile startups focusing on natural, traceable materials, often sourcing directly from Peruvian suppliers or specialized importers, thereby influencing global style trends favoring hypoallergenic and highly insulating fabrics. The US domestic production, though minimal compared to South America, serves niche, localized markets focused on direct-to-consumer sales and handcrafted goods.

Europe, led by nations such as Italy, Germany, and the UK, serves as the global manufacturing hub for high-end textiles. Italy, in particular, leverages its historical expertise in luxury textile processing to transform imported alpaca yarns and tops into prestigious garments for global distribution. European consumer demand mirrors North America's emphasis on sustainability and quality, yet the region’s market is characterized by a high degree of integration between fiber processing, design innovation, and final garment manufacturing. The Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, primarily driven by expanding middle and upper classes in China and Japan, countries that have traditionally valued fine, natural fibers. China is increasingly important not just as a manufacturing base, but as a substantial end-user market, challenging established regional distribution patterns and opening new avenues for premium fiber exports.

- Latin America (Peru & Bolivia): Global epicenter of raw fiber production; controls over 85% of the world's supply; critical for quality control and ethical sourcing initiatives.

- North America (USA & Canada): Major consumption market driven by luxury demand and strong emphasis on sustainable and traceable textiles.

- Europe (Italy & Germany): Key manufacturing and design hub for high-end alpaca garments; dictates global fashion trends; strong focus on technical processing expertise.

- Asia Pacific (China & Japan): Fastest growing consumption market; increasing domestic demand for luxury natural fibers; China emerging as a significant manufacturing and consumer power.

- Middle East & Africa (MEA): Nascent market, primarily focused on imported high-end finished goods catering to niche luxury retail segments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Alpaca Fiber Market.- Michell & Cia.

- Inca Tops S.A.A.

- Sol Alpaca

- Amano

- Artico Alpaca

- Shupaca

- Andean Sun

- Alpaca International

- Interstola SRL

- Hilados Peruanos S.A.

- Peruvian Link

- Surico

- Caserita

- Misti International

- KUNA

- Warmi

- Natural Fiber Company

- New House Textiles

- The Alpaca Yarn Company

- Alpacas del Peru

Frequently Asked Questions

Analyze common user questions about the Alpaca Fiber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the premium pricing and demand for Alpaca Fiber?

Premium pricing is primarily driven by the fiber's unique attributes—superior softness, thermal insulation, and hypoallergenicity—combined with the inherent scarcity and geographical limitations of supply. Demand is amplified by the global trend toward sustainable, natural luxury textiles, supported by verifiable ethical sourcing and environmental claims.

How does the micron count impact the application and value of Alpaca Fiber?

Micron count is the central determinant of fiber quality and value. Ultra-fine grades (Royal Alpaca, 18-19 microns) command the highest prices and are exclusively used for luxury, next-to-skin apparel. Coarser grades (above 25 microns) are valued for durability and insulation in home textiles, carpets, and industrial felting, possessing a significantly lower market price point.

Which geographical region dominates the production and supply of raw Alpaca Fiber?

Latin America, specifically Peru and Bolivia, dominates raw fiber production, accounting for over 85% of the world's commercial supply. This region holds the climatic advantage and established infrastructure necessary for large-scale, high-quality alpaca husbandry, making it the central hub of the upstream value chain.

What are the primary restraints hindering rapid growth in the Alpaca Fiber Market?

The main restraints are the inelastic supply curve, which limits volume expansion and results in significant price volatility due to the specialized nature of alpaca farming. Processing bottlenecks outside of primary production regions and intense competition from other premium specialty fibers like cashmere also challenge market penetration.

How is technology being utilized to ensure traceability and sustainability in the Alpaca Fiber supply chain?

Advanced technologies, including Optical Fiber Diameter Analysis (OFDA) for quality grading and precision processing machinery, improve efficiency. Crucially, blockchain technology is increasingly being adopted by leading producers to provide immutable records, ensuring transparency regarding fiber provenance and verifiable ethical sourcing for consumers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Alpaca Fiber Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Huacaya Fiber, Suri Fiber), By Application (Apparels, Interior Textiles, Industrial Felting, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Alpaca Fiber Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Huacaya, Suri), By Application (Clothing Application, Rugs Application, Toys Application, Other Applications), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager