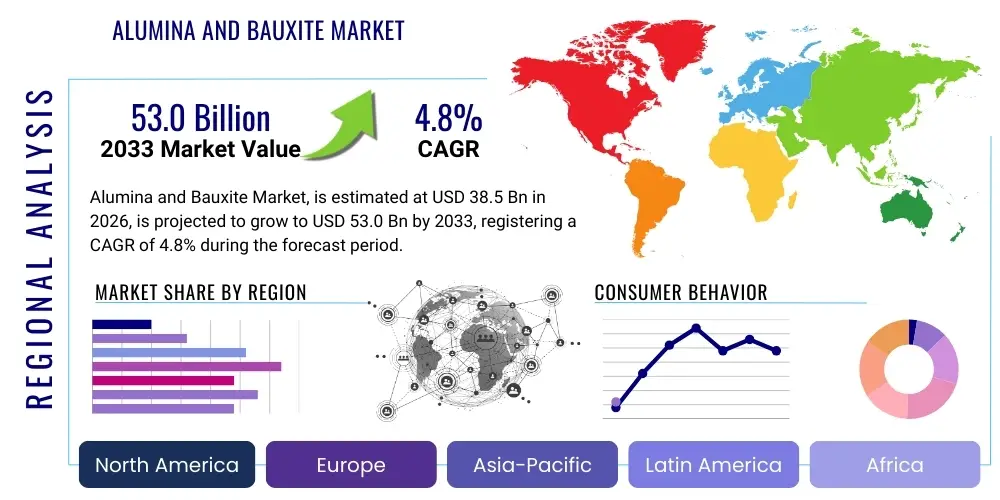

Alumina and Bauxite Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437613 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Alumina and Bauxite Market Size

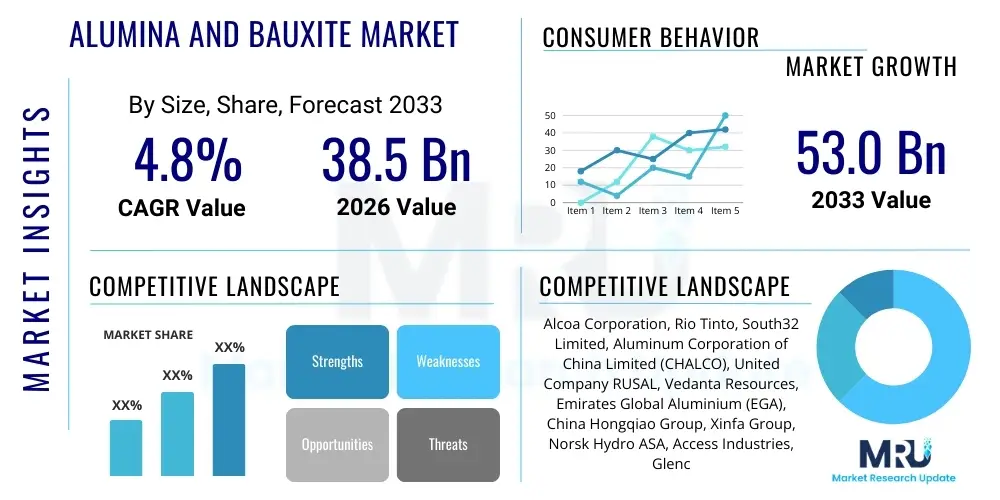

The Alumina and Bauxite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $38.5 Billion in 2026 and is projected to reach $53.0 Billion by the end of the forecast period in 2033.

Alumina and Bauxite Market introduction

The Alumina and Bauxite Market encompasses the extraction of bauxite, the primary ore for aluminum, and its subsequent refining into alumina (aluminum oxide) through the energy-intensive Bayer process. Bauxite is a naturally occurring heterogeneous material, predominantly found in tropical and subtropical regions, crucial for the global supply chain of aluminum, which is essential across numerous industrial sectors. Market dynamics are heavily influenced by global aluminum demand, energy prices, and geopolitical factors affecting mining and refining operations. The fundamental importance of these materials lies in their role as precursors for producing aluminum metal, alongside niche applications in refractories, abrasives, chemicals, and ceramics, where high purity and specific material characteristics are required.

Current market expansion is primarily driven by the escalating demand from the construction, automotive, and packaging sectors, all of which rely on aluminum for lightweighting, durability, and recyclable properties. In the automotive industry, the drive toward electric vehicles (EVs) and enhanced fuel efficiency mandates the increased use of lightweight materials, positioning aluminum, and consequently alumina and bauxite, as strategic raw materials. Furthermore, the global infrastructure push, particularly in emerging economies of the Asia Pacific, necessitates substantial quantities of aluminum for new construction and industrial machinery, reinforcing the upstream demand for bauxite and alumina.

Key technological advancements are centered on optimizing the Bayer process to reduce energy consumption and manage the massive waste product known as red mud (bauxite residue). Innovations include calcination optimization, utilization of low-grade bauxite, and developing specialized processes for converting red mud into useful products, such as iron recovery or construction materials. These process efficiencies are critical for maintaining competitive pricing and addressing increasingly stringent environmental regulations, ensuring the sustainable long-term viability of the alumina and bauxite supply chain.

Alumina and Bauxite Market Executive Summary

The global Alumina and Bauxite Market is poised for stable growth, fueled primarily by robust global demand for aluminum metal driven by urbanization and the energy transition. Major business trends include significant investment in high-quality bauxite deposits, particularly in Guinea and Australia, aimed at securing long-term supply stability amidst fluctuating global trade dynamics. Furthermore, market players are focused on vertical integration and technological innovation to enhance the efficiency of alumina refining processes, especially concerning energy usage and reducing the environmental footprint associated with red mud disposal. Strategic mergers and acquisitions are common as companies seek to consolidate reserves and achieve economies of scale, thereby controlling cost structures across the value chain from mining to metal production.

Regionally, the Asia Pacific (APAC) dominates the market, largely due to China's immense aluminum production capacity and growing domestic demand across construction and manufacturing industries. While Australia remains the world leader in bauxite production and refining, the emergence of Africa, particularly Guinea, as a powerhouse for high-grade bauxite exports is reshaping trade routes and global supply distribution. North America and Europe, characterized by mature industrial bases, focus intensely on the sustainable sourcing of alumina and prioritize advanced, energy-efficient refining technologies, often importing substantial volumes of bauxite to feed domestic refineries.

Segment trends highlight the dominance of the metallurgical grade alumina segment, which accounts for the vast majority of demand, directly tied to primary aluminum smelting. However, non-metallurgical grades, utilized in ceramics, chemicals, and refractories, exhibit faster growth rates due to their high-value, specialized applications in emerging high-tech sectors, including lithium-ion batteries and advanced thermal insulation. The market is increasingly competitive, requiring players to not only optimize operational costs but also to demonstrate compliance with rigorous ESG (Environmental, Social, and Governance) standards to secure financing and market access in developed regions.

AI Impact Analysis on Alumina and Bauxite Market

User interest regarding the influence of Artificial Intelligence (AI) in the Alumina and Bauxite sector centers predominantly on operational efficiency, resource optimization, and mitigating environmental risks. Key user questions revolve around how AI and machine learning (ML) can improve bauxite exploration success rates, optimize the highly complex and energy-intensive Bayer process, and provide predictive maintenance for heavy mining and refining equipment. There is significant concern regarding the potential for AI to enhance ore grade selectivity, minimize waste generation (specifically red mud), and streamline supply chain logistics, thereby offering substantial cost reductions and compliance improvements in an inherently high-volume, low-margin commodity industry. Users anticipate that AI implementation will lead to smarter resource management, decreased unforeseen downtime, and substantial improvements in energy efficiency, driving the next wave of productivity gains in mining and refining operations globally.

- AI-Driven Exploration: Utilizing machine learning algorithms to analyze geological, seismic, and satellite data, dramatically improving the accuracy and speed of identifying new bauxite deposits, reducing exploration costs, and optimizing drilling plans.

- Bayer Process Optimization: Implementing real-time predictive models to control temperature, pressure, and chemical dosages within the alumina refining process, leading to reduced energy consumption, increased yield, and optimized reagent usage (e.g., caustic soda).

- Predictive Maintenance: Deployment of AI sensors and analytics on mining trucks, crushers, pumps, and digestors to anticipate equipment failure, minimizing unplanned downtime and extending the lifespan of critical capital assets in harsh operating environments.

- Supply Chain and Logistics Automation: Using AI for dynamic routing of bauxite shipments (rail, conveyor, sea), optimizing inventory levels at ports and refineries, and providing real-time demand forecasting to align production with fluctuating global aluminum markets.

- Environmental Monitoring and Red Mud Management: AI systems analyze monitoring data to predict stability risks in red mud containment areas (tailings dams) and optimize the drying and neutralization processes, reducing environmental liability and accelerating the adoption of dry stacking techniques.

- Ore Grade Control: Machine vision and spectroscopic analysis integrated with AI classifiers to sort bauxite ore instantly after extraction, ensuring precise blending for refinery input, which is crucial for maximizing efficiency when processing varying ore grades.

DRO & Impact Forces Of Alumina and Bauxite Market

The market for alumina and bauxite is shaped by a powerful confluence of driving forces, significant restraints, and emerging opportunities, collectively defining the competitive landscape and growth trajectory. Primary market drivers include the accelerating global demand for aluminum, particularly spurred by the electric vehicle revolution and infrastructure modernization projects in developing nations. The necessity for lightweighting across transportation and construction sectors places consistent upward pressure on aluminum production, directly impacting the demand for its primary raw materials. Furthermore, the high recyclability of aluminum metal makes it attractive under circular economy initiatives, ensuring sustained long-term demand for the virgin material required to maintain global stock levels.

However, significant restraints temper this growth. The most prominent challenges involve the energy intensity and high capital cost of the Bayer refining process, which makes profitability highly susceptible to volatile energy prices (natural gas and electricity). Environmental regulations are becoming increasingly stringent, particularly regarding the safe disposal and management of red mud, imposing substantial compliance costs and potential operational risks on refiners. Additionally, geopolitical risks, including trade disputes, export bans, and political instability in major bauxite-producing regions like West Africa, pose persistent threats to the stability and predictability of the global supply chain.

Opportunities within the sector are primarily centered on innovation in sustainability and technology. This includes developing and commercializing low-carbon alumina production methods, exploring alternative sources of aluminum (e.g., utilizing non-bauxite resources), and improving methods for extracting valuable elements from red mud, effectively transforming waste into commercial assets. Furthermore, the rising demand for specialty, non-metallurgical alumina in advanced electronics, high-performance ceramics, and catalyst production presents lucrative avenues for market diversification and achieving higher profit margins compared to the bulk commodity metallurgical segment.

Segmentation Analysis

The Alumina and Bauxite Market is highly differentiated based on product type, end-use application, and source of bauxite ore, providing a granular view of market dynamics. Segmentation by product type primarily divides the market into metallurgical grade alumina (used for aluminum smelting) and non-metallurgical grade alumina (used in specialty chemicals, refractories, and ceramics). Metallurgical alumina holds the dominant market share due to the sheer volume of aluminum production globally, while non-metallurgical grades command premium pricing and demonstrate specialized growth tied to technological advancements in niche industries. The market’s complexity necessitates a detailed analysis of these segments to accurately forecast material consumption patterns and investment potential across the value chain, from mining output to finished product application.

By application, the market is heavily weighted toward the aluminum production industry, which consumes over 90% of global alumina supply. However, the non-metallurgical segments, including refractories (critical for high-temperature industrial processes), abrasives (used in manufacturing and finishing), and chemicals (water treatment, catalysts), are gaining importance due to the high-performance attributes of specialized aluminum compounds. Analyzing the growth of these smaller segments offers insights into material science innovation and industrial diversification beyond the volatile primary aluminum commodity market.

Furthermore, segmentation by bauxite source, often categorized by ore quality (high-grade trihydrate vs. low-grade monohydrate) or geographical origin, is crucial as the composition dictates the efficiency and cost of the subsequent Bayer refining process. Different regional sources, such as Guinea, Australia, and Brazil, provide bauxite with unique impurity profiles, which directly influence refinery technology selection and operational expenditure. This level of segmentation allows stakeholders to strategize optimal sourcing and processing pathways based on accessibility, geopolitical stability, and processing economics.

- By Product Type:

- Metallurgical Grade Alumina (Standard smelting input)

- Non-Metallurgical Grade Alumina

- Calcined Alumina (Refractories, Ceramics)

- Tabular Alumina (High-performance refractories)

- Activated Alumina (Desiccants, Catalysts)

- Fused Alumina (Abrasives)

- Chemical Alumina

- Bauxite Ore

- By Application:

- Aluminum Production (Primary Smelting)

- Refractories

- Abrasives

- Ceramics

- Chemicals

- Others (e.g., Fluxing agents, Proppants)

- By Source/Region:

- Australia

- Guinea

- Brazil

- China

- India

- Rest of the World

Value Chain Analysis For Alumina and Bauxite Market

The value chain of the Alumina and Bauxite Market is linear and highly integrated, starting with upstream mining operations and culminating in the fabrication of finished aluminum products. The upstream segment involves the geological exploration, extraction, crushing, and washing of bauxite ore. This phase is capital-intensive and subject to stringent regulatory oversight regarding land use and environmental remediation. Key players in this stage are concentrated in regions with vast, high-grade deposits, focusing heavily on optimizing extraction logistics and maintaining operational stability against geopolitical volatility. Technological focus here includes improved remote sensing, autonomous haulage, and ore beneficiation techniques to prepare the raw material for refining.

The midstream phase, centered on the conversion of bauxite into alumina via the Bayer process, is the most energy-intensive link in the chain. Refineries require massive inputs of energy (heat and power) and caustic chemicals (sodium hydroxide). Efficiency gains in this stage, such as waste heat recovery and optimized residue management (red mud), directly translate to cost competitiveness. The distribution channel for alumina primarily involves long-term contracts and bulk shipping to primary aluminum smelters located globally, often near sources of cheap, renewable energy. Direct sales are common between integrated producers (who own both the mine and the refinery) and independent smelters.

The downstream sector focuses on the electrolytic smelting of alumina into primary aluminum metal (P1020). This highly electricity-dependent process dictates the final cost structure of the metal. Following smelting, aluminum is cast, alloyed, and fabricated into semi-finished products (sheets, extrusions, billets) and ultimately delivered to end-user industries such as automotive, construction, and packaging. The indirect distribution channels involve traders, brokers, and specialized distributors who handle non-metallurgical grades of alumina and fabricated aluminum products, ensuring market access to smaller, specialized end-users who require precise material specifications.

Alumina and Bauxite Market Potential Customers

The primary customers for alumina and bauxite are large-scale industrial consumers whose core business relies on the properties of aluminum and its compounds. The overwhelming majority of metallurgical grade alumina is purchased by aluminum smelting companies that operate reduction plants globally. These customers are highly sensitive to price fluctuations, purity levels, and long-term supply security, often engaging in complex hedging strategies and long-term supply agreements to mitigate risk. They seek suppliers capable of consistently delivering high volumes that meet stringent P1020 standard specifications required for efficient electrolysis.

Secondary, yet rapidly growing, customer segments are focused on non-metallurgical applications. These include manufacturers of technical ceramics that require high-purity, calcined alumina for applications demanding extreme hardness, thermal resistance, and electrical insulation (e.g., semiconductor components, armor). Refractory manufacturers are significant buyers, utilizing tabular and fused alumina to produce furnace linings capable of withstanding corrosive and high-temperature environments in steel, glass, and cement production. Chemical companies represent another critical segment, purchasing activated alumina for use in water treatment filtration, catalyst supports, and specialized chemical syntheses, prioritizing specific surface area and pore structure characteristics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $38.5 Billion |

| Market Forecast in 2033 | $53.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alcoa Corporation, Rio Tinto, South32 Limited, Aluminum Corporation of China Limited (CHALCO), United Company RUSAL, Vedanta Resources, Emirates Global Aluminium (EGA), China Hongqiao Group, Xinfa Group, Norsk Hydro ASA, Access Industries, Glencore PLC, National Aluminium Company (NALCO), CVG Bauxilum, China Power Investment (CPI). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Alumina and Bauxite Market Key Technology Landscape

The technology landscape in the Alumina and Bauxite market is characterized by ongoing efforts to refine and enhance the core process—the Bayer method—while simultaneously exploring disruptive alternative technologies. The primary focus for incumbent technologies is on enhancing energy efficiency through improved heat exchange systems, optimizing crystallization processes to increase yield and reduce impurity carryover, and implementing advanced calcination techniques that require less thermal energy. Furthermore, substantial research is directed toward developing effective and economically viable methods for processing low-grade or high-silica bauxite, which expands the available resource base and reduces reliance on premium, high-grade ores, thereby improving resource sustainability globally.

Beyond process optimization, two critical areas of technological advancement are Red Mud (Bauxite Residue) management and low-carbon aluminum initiatives. Regarding red mud, technologies involve dry stacking, which minimizes land use and water consumption, and innovative processes to extract valuable elements like iron, titanium, and Rare Earth Elements (REEs), transforming the waste product into a co-product. In the pursuit of decarbonization, the ELYSIS inert anode technology, backed by major industry players, is a significant disruptive innovation aiming to eliminate direct greenhouse gas emissions from the smelting process, which, while downstream, directly influences the required specifications and sustainable sourcing expectations for alumina.

Digital transformation, including the adoption of the Industrial Internet of Things (IIoT), advanced sensors, and digital twin technology, is becoming central to maintaining operational excellence. These digital tools enable real-time monitoring and control across the entire operation, from autonomous mining equipment navigation to complex refinery diagnostics. Such integration is essential for implementing predictive maintenance protocols and achieving the highly precise process control necessary for low-carbon and high-efficiency operations, ensuring the sector remains competitive and compliant with future environmental performance metrics.

Regional Highlights

Regional dynamics heavily dictate the global supply and demand equilibrium in the Alumina and Bauxite Market, reflecting differing resource endowments, refining capacities, energy costs, and regulatory environments. Asia Pacific (APAC) holds the largest market share, driven primarily by China, which is both the largest producer of aluminum globally and a massive consumer of bauxite and alumina. Australia, Brazil, and Guinea are dominant suppliers of raw bauxite, establishing critical trade corridors that feed the high-demand refining centers in APAC and the Middle East. The region’s rapid industrialization and significant investment in infrastructure continue to underpin robust, high-volume demand.

North America and Europe represent mature markets characterized by stable, high-value demand for finished aluminum products and highly specialized non-metallurgical alumina. While domestic bauxite reserves and refining capacity have diminished in many European countries due to high energy costs, the emphasis here is on securing sustainable, low-carbon sources of alumina imports. These regions are leaders in the implementation of advanced processing technologies, prioritizing circular economy principles, and driving the demand for high-purity, environmentally compliant materials essential for aerospace, precision engineering, and green energy technologies.

The Middle East and Africa (MEA) region, particularly the Gulf Cooperation Council (GCC) states, have emerged as major global players due to their strategic advantage in low-cost energy (natural gas and solar), which facilitates large-scale, cost-competitive aluminum smelting. The region, exemplified by the UAE’s Emirates Global Aluminium (EGA), focuses on integrating the value chain from mining (often in Africa, like Guinea) to primary smelting, positioning itself as a key exporter of high-quality aluminum metal. Africa, specifically Guinea, is critically important as it possesses the world’s largest high-quality bauxite reserves, driving substantial foreign investment and reshaping the upstream supply dynamics globally.

- Asia Pacific (APAC): Dominates consumption and production, spearheaded by China and India. Growth is fueled by massive infrastructure, construction, and automotive manufacturing expansion. The region also hosts leading integrated players and refining hubs that process imported bauxite, relying heavily on cost-efficient operations.

- North America: Characterized by high domestic demand, especially from the aerospace, automotive (EVs), and defense sectors. Focuses on advanced, specialized aluminum products and emphasizes material sustainability and traceability in the supply chain. Import reliance for raw bauxite is high.

- Europe: High regulatory pressure mandates process efficiency and low-carbon footprint. Demand is stable for high-specification alloys and non-metallurgical alumina in ceramics and chemicals. Active in R&D for red mud utilization and next-generation refining technologies.

- Latin America (LAMEA): Brazil is a major global producer and exporter of high-quality bauxite and alumina. Market growth is often tied to commodity price cycles and internal infrastructure development. The region maintains significant refining capacity, often linked to large, diversified mining conglomerates.

- Middle East and Africa (MEA): Key growth engine due to energy advantage (smelting) in the Gulf states and massive bauxite reserves in West Africa (Guinea). This region acts as a crucial hub connecting raw material supply (Africa) to low-cost processing (Middle East).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Alumina and Bauxite Market.- Alcoa Corporation

- Rio Tinto

- South32 Limited

- Aluminum Corporation of China Limited (CHALCO)

- United Company RUSAL

- Vedanta Resources

- Emirates Global Aluminium (EGA)

- China Hongqiao Group

- Xinfa Group

- Norsk Hydro ASA

- Access Industries

- Glencore PLC

- National Aluminium Company (NALCO)

- CVG Bauxilum

- China Power Investment (CPI)

- Sichuan Guangwang International Aluminum Co., Ltd.

- Hindalco Industries Limited

- Dubal Holding LLC

- Gove Aluminium Finance Limited

- Tajik Aluminum Company (TALCO)

Frequently Asked Questions

Analyze common user questions about the Alumina and Bauxite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand growth in the Alumina and Bauxite Market?

The primary factor is the accelerating global demand for primary aluminum, which is essential for lightweighting vehicles (especially Electric Vehicles or EVs), urbanization, and renewable energy infrastructure projects worldwide. Aluminum’s use in transportation and construction sectors directly dictates the consumption rates of metallurgical alumina and bauxite.

How does the Bayer process efficiency affect market profitability?

The Bayer process is highly energy-intensive, meaning efficiency directly impacts operational costs. Optimization efforts—such as improved heat recovery and reduced caustic soda consumption—are critical. High energy prices significantly restrain profitability, pushing producers toward regions with access to stable, low-cost energy sources.

Which region holds the largest market share for Bauxite and Alumina globally?

The Asia Pacific (APAC) region currently holds the largest market share, driven primarily by China’s massive production capacity for primary aluminum and immense domestic demand for aluminum products across its growing manufacturing and construction industries.

What are the main environmental challenges associated with alumina refining?

The main environmental challenge is the safe and sustainable management of Bauxite Residue (red mud), a highly alkaline waste product generated during the Bayer process. Disposal requires large containment areas, and increasing regulatory pressure necessitates research into red mud utilization (e.g., resource extraction) and dry stacking technologies.

How is AI being applied to improve bauxite mining operations?

AI is being utilized to optimize operational efficiency through predictive maintenance for heavy machinery, real-time sensor data analysis for better ore grade control, and machine learning models for more precise geological exploration, reducing cost and improving resource recovery rates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager