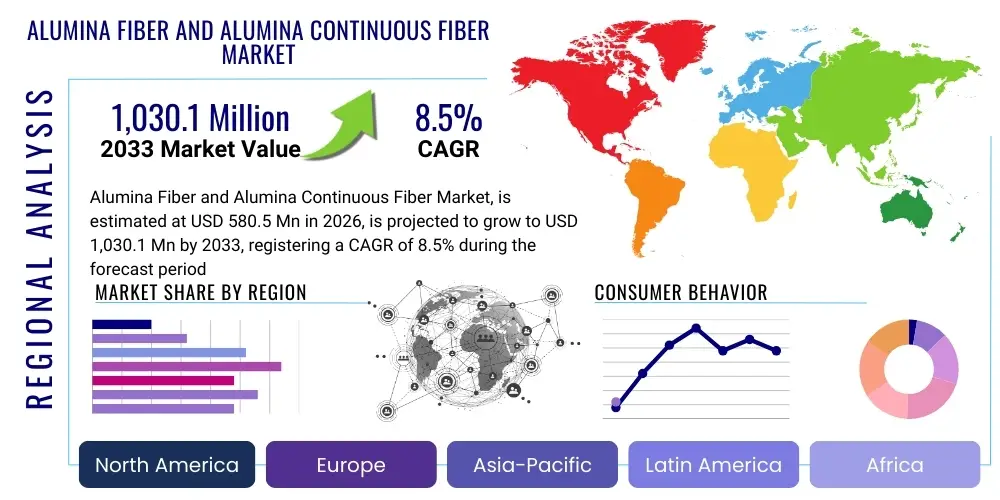

Alumina Fiber and Alumina Continuous Fiber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438194 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Alumina Fiber and Alumina Continuous Fiber Market Size

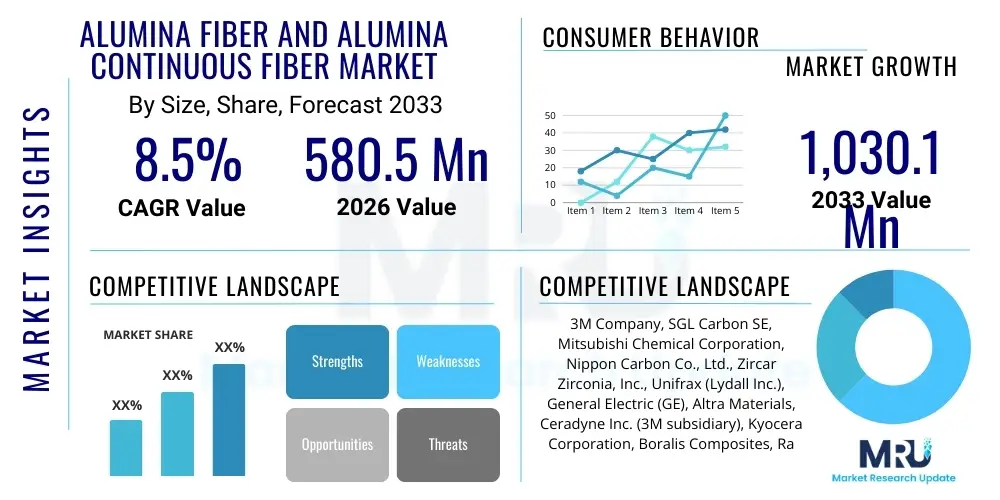

The Alumina Fiber and Alumina Continuous Fiber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $580.5 Million in 2026 and is projected to reach $1,030.1 Million by the end of the forecast period in 2033.

Alumina Fiber and Alumina Continuous Fiber Market introduction

Alumina fiber and alumina continuous fiber represent a critical class of advanced ceramic materials known for their exceptional thermal stability, chemical resistance, and high mechanical strength at elevated temperatures. These fibers, often manufactured through sophisticated sol-gel or chemical vapor deposition (CVD) processes, serve as essential reinforcement materials in demanding applications. Their unique combination of properties makes them indispensable in the production of high-performance ceramic matrix composites (CMCs) and metal matrix composites (MMCs), particularly where traditional materials, such as metals or standard glass fibers, fail due to intense heat or corrosive environments. The purity and crystalline structure of these fibers determine their final performance characteristics, with continuous fibers offering superior load-bearing capacity and structural integrity over chopped or short fibers.

Major applications for alumina fibers span several high-tech industries, most notably aerospace, defense, industrial furnaces, and filtration systems. In aerospace, alumina continuous fibers are pivotal for manufacturing engine components like shrouds, combustors, and exhaust nozzles, enhancing fuel efficiency and reducing weight compared to superalloys. The industrial sector utilizes these fibers heavily in refractory insulation, high-temperature filtration media for hot gas cleanup, and thermal barrier coatings (TBCs) in kilns and reformers. The growing focus on energy efficiency and operational safety in extreme conditions further drives the adoption of these specialized ceramic fibers.

Key driving factors accelerating market expansion include the burgeoning demand for lightweight materials in aircraft and automotive industries to meet stringent emission standards, coupled with continuous technological advancements in fiber manufacturing that improve scalability and reduce production costs. The inherent benefits, such as resistance to oxidation, creep resistance, and non-conductive properties, ensure that alumina fibers remain a preferred choice for materials engineers designing systems exposed to temperatures exceeding 1,000°C. Investment in advanced manufacturing techniques, such as additive manufacturing utilizing ceramic filaments, also contributes to novel application development and market penetration.

Alumina Fiber and Alumina Continuous Fiber Market Executive Summary

The Alumina Fiber and Alumina Continuous Fiber Market demonstrates robust growth, primarily fueled by the accelerating adoption of Ceramic Matrix Composites (CMCs) in the aerospace and defense sectors. Business trends indicate a strong emphasis on strategic partnerships between fiber manufacturers and composite fabricators to secure supply chains and co-develop next-generation materials tailored for extreme operational environments. Key market participants are heavily investing in R&D to improve fiber diameter uniformity, crystallinity, and purity, which directly impacts the performance ceiling of resulting composites. Furthermore, sustainability initiatives are driving demand for highly durable, long-lifespan refractory materials, benefiting high-performance alumina fibers over conventional alternatives. Price stability and consistent quality remain competitive differentiators in this technologically intensive market.

Regional trends highlight the Asia Pacific (APAC) region, led by China and Japan, as the dominant consumer and producer, driven by massive industrial infrastructure expansion and significant governmental investment in advanced defense programs. North America and Europe, however, maintain their leadership in high-value, niche applications, particularly in the commercial aviation and high-temperature filtration segments, demanding premium continuous fibers. The regional disparity in growth rates is influenced by differing regulatory environments concerning aerospace materials usage and the maturity levels of local industrial refractory markets. Emerging economies are increasingly adopting these fibers for specialized applications in chemical processing and power generation.

Segment trends reveal that the Continuous Alumina Fiber segment is experiencing faster growth than the Short/Chopped Fiber segment due to its essential role in structural CMCs for jet engines. The application segment dominated by Aerospace and Defense continues to provide the highest revenue, largely supported by long-term contracts for commercial aircraft engine manufacturing and maintenance. However, the Industrial segment, encompassing high-temperature furnace lining, thermal insulation, and petrochemical catalysts support, is expanding rapidly, offering diversification opportunities for manufacturers. Material innovation focusing on lower-cost precursors and scalable sol-gel techniques is crucial for penetrating price-sensitive industrial applications.

AI Impact Analysis on Alumina Fiber and Alumina Continuous Fiber Market

User inquiries frequently center on how Artificial Intelligence (AI) can optimize the notoriously complex and precise manufacturing processes of high-purity ceramic fibers, such as sol-gel routes, and whether AI can accelerate the discovery of novel fiber compositions. Key concerns revolve around integrating predictive maintenance in production lines to minimize downtime caused by process variations, and using machine learning to simulate material performance under extreme stress, thus reducing expensive and time-consuming physical testing. Users also seek clarity on how AI-driven supply chain management can handle the volatile pricing and sourcing of raw materials like aluminum hydroxide and silica precursors. The consensus expectation is that AI will primarily enhance process efficiency, quality control, and accelerated material design, rather than directly influencing end-user application demand.

AI's influence is anticipated to be profound in optimizing the complex firing and sintering steps, where minor temperature variations can drastically affect the fiber's microstructure and tensile strength. By utilizing sensors and real-time data analysis, machine learning algorithms can predict optimal heating curves and solvent removal rates, ensuring uniform quality across large batches. Furthermore, Generative AI models are being trained on vast material science databases to suggest novel dopants or precursor combinations that might yield fibers with even higher thermal stability or improved creep resistance, accelerating the material qualification timeline required for critical aerospace certification.

Beyond manufacturing, AI is also enhancing the inspection and quality assurance phases. Computer vision systems powered by deep learning are capable of identifying microscopic defects, such as voids or cracks, in continuous fiber tows at speeds far exceeding human capability. This rigorous quality control is non-negotiable for aerospace-grade materials. Overall, the integration of AI is transforming the alumina fiber industry from a traditional materials domain into a high-tech manufacturing sector characterized by precision engineering and data-driven quality metrics, ultimately lowering the cost of high-performance materials.

- AI-driven optimization of sol-gel and sintering process parameters for enhanced fiber uniformity and quality.

- Predictive maintenance analytics for continuous fiber production lines, reducing unplanned downtime and waste.

- Accelerated material discovery using machine learning to identify optimal chemical compositions and processing conditions.

- Computer vision systems utilizing deep learning for high-speed, accurate defect detection and quality control.

- Enhanced supply chain forecasting and logistics management for critical raw material procurement.

DRO & Impact Forces Of Alumina Fiber and Alumina Continuous Fiber Market

The market expansion is strongly driven by the unwavering global demand for lightweight, high-temperature resistant materials, particularly in the rapidly evolving aerospace industry where Ceramic Matrix Composites (CMCs) offer unparalleled performance benefits over traditional superalloys. Technological innovation, specifically advances in manufacturing techniques that allow for greater purity and consistency in continuous fibers, further acts as a primary driver, making these materials more reliable for structural applications. However, the market faces significant restraints, chiefly the extremely high manufacturing costs associated with sol-gel processing and the difficulty in scaling production while maintaining stringent quality control, which limits accessibility for more price-sensitive industrial users. Furthermore, processing challenges related to the brittle nature of ceramic fibers and the complexity of composite fabrication also restrict widespread adoption.

Opportunities for market growth lie in the burgeoning adoption of alumina fibers in energy production (e.g., concentrated solar power receivers and high-efficiency gas turbines) and in environmental applications such as advanced hot gas filtration for industrial emissions control. The defense sector, with its continuous requirement for enhanced missile systems and hypersonic vehicle components, also presents a lucrative niche. Furthermore, advancements in 3D printing technologies utilizing ceramic filaments could unlock new fabrication methodologies, reducing waste and customizing geometric components, thereby opening up novel design possibilities for composite parts.

The impact forces shaping the market are complex, centered primarily on substitution risk and technological momentum. While competition exists from other high-performance fibers (e.g., carbon fibers in certain temperature ranges or silicon carbide fibers), alumina fibers maintain a unique advantage in oxygen-rich, high-temperature oxidizing environments. The intense capital expenditure required for production creates high barriers to entry, concentrating market power among a few key players. The long qualification cycles inherent in aerospace material certification further stabilize demand for established, qualified fiber products, creating a powerful inertial force that favors incumbent suppliers and high-quality continuous fibers.

Segmentation Analysis

The Alumina Fiber and Alumina Continuous Fiber market is rigorously segmented based on product type, application, and end-use industry, reflecting the diverse requirements these advanced materials fulfill. Product differentiation focuses mainly on fiber format—continuous fibers, which provide superior structural reinforcement, versus short/chopped fibers, used primarily for thermal insulation and non-structural reinforcement. Application segmentation highlights the material's critical roles in high-temperature domains, particularly in refractory insulation, composite reinforcement, and specialized filtration. Analyzing these segments is essential for understanding where technological investment is most required and identifying the fastest-growing market niches.

Geographic segmentation is also pivotal, with North America and Asia Pacific being the dominant regions due to their established aerospace and industrial manufacturing bases, respectively. The distinct requirements of each end-use sector—from the stringent safety standards of aerospace to the cost-efficiency demands of the petrochemical industry—drive variations in fiber specifications, purity levels, and diameter requirements. For instance, continuous fibers used in CMCs for turbine engines demand near-perfect homogeneity and strength, justifying their higher cost, while insulation applications prioritize bulk density and thermal resistance.

This structured segmentation allows market participants to tailor their offerings, focusing either on high-volume industrial products or low-volume, high-value aerospace components. The rapid advancements in composite manufacturing techniques further blur the lines between traditional refractory insulation and advanced structural applications, necessitating fiber producers to maintain a broad portfolio capable of meeting evolving engineering demands across all key segments.

- Product Type:

- Alumina Continuous Fiber (High-performance CMCs, structural reinforcement)

- Alumina Short/Chopped Fiber (Thermal insulation, filler materials, filter media)

- Application:

- Refractory Insulation

- Composite Reinforcement (CMCs and MMCs)

- Filtration Media (Hot gas cleanup, molten metal filtration)

- Catalyst Support

- End-Use Industry:

- Aerospace and Defense (Jet engine components, thermal protection systems)

- Industrial Furnaces and Kilns (High-temperature linings, process heaters)

- Automotive (Brake systems, exhaust components)

- Petrochemical and Chemical Processing

- Power Generation (Gas turbines, incinerators)

Value Chain Analysis For Alumina Fiber and Alumina Continuous Fiber Market

The value chain for alumina fiber production is highly concentrated and technologically complex, beginning with the upstream supply of specialized, high-purity raw materials. Upstream analysis focuses on the procurement of high-grade aluminum precursors, typically aluminum hydroxide or aluminum salts, which must meet exacting purity standards for the sol-gel process. Chemical suppliers and mineral processors constitute this segment, where material quality directly dictates the mechanical and thermal properties of the final fiber product. Maintaining a stable, high-quality precursor supply chain is a critical competitive advantage, as inconsistencies at this stage severely impact downstream yields and performance, underscoring the necessity for robust supplier relationships and qualification protocols.

The core manufacturing stage involves specialized fiber producers utilizing sophisticated technologies like sol-gel spinning, heat treatment, and sintering, demanding significant capital investment and proprietary technological expertise. This stage is responsible for transforming precursors into high-strength, thermally stable continuous or chopped fibers. Given the high barriers to entry, this segment is dominated by a few global players who have mastered the complex process kinetics and quality control necessary for aerospace and industrial certification. Distribution channels are typically direct for high-value continuous fibers sold to composite manufacturers (direct B2B model) or via specialized distributors for industrial refractory products (indirect model), depending on the required technical support and volume.

Downstream analysis highlights the critical role of composite fabricators (for CMCs and MMCs) and system integrators (for industrial insulation and filtration) who transform the raw fibers into functional components. End-users in aerospace, defense, and power generation place extremely high demands on performance and reliability, making material qualification a lengthy and costly process. The final profitability within the value chain is increasingly captured by those players who can integrate vertically, offering both fiber production and composite component manufacturing, thus optimizing material design specifically for the intended structural or thermal application.

Alumina Fiber and Alumina Continuous Fiber Market Potential Customers

The primary potential customers for alumina fiber and alumina continuous fiber are organizations that operate or manufacture equipment requiring exceptional material performance under extreme thermal and chemical duress. These include major aerospace original equipment manufacturers (OEMs) such as Rolls-Royce, General Electric (GE) Aviation, and Pratt & Whitney, which utilize continuous alumina fibers extensively in the production of high-performance Ceramic Matrix Composite (CMC) components for turbine engines, including combustor liners, shrouds, and nozzles, aiming for lighter, more fuel-efficient aircraft.

Beyond aerospace, key industrial customers include global refractory material suppliers, furnace builders, and specialized thermal management companies serving the metals, glass, and ceramics industries. Companies operating high-temperature processing units, such as petrochemical refineries, steel mills, and power generation plants, are significant buyers of short/chopped alumina fibers for advanced refractory insulation and sealing applications where conventional materials break down. Furthermore, defense contractors require these materials for thermal protection systems, missile components, and specialized armor due to their lightweight properties and resilience to high-energy impacts and temperatures.

A rapidly growing customer base includes manufacturers specializing in high-efficiency filtration systems, particularly those involved in hot gas filtration for environmental emission control in coal-fired power plants or waste incinerators. These customers require fibers that maintain structural integrity and filtration efficacy at temperatures exceeding 800°C. In all sectors, the purchasing decision is heavily influenced not just by price, but predominantly by certified quality, consistent fiber properties (diameter, strength), and the supplier's ability to meet rigorous technical specifications and long-term supply contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580.5 Million |

| Market Forecast in 2033 | $1,030.1 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, SGL Carbon SE, Mitsubishi Chemical Corporation, Nippon Carbon Co., Ltd., Zircar Zirconia, Inc., Unifrax (Lydall Inc.), General Electric (GE), Altra Materials, Ceradyne Inc. (3M subsidiary), Kyocera Corporation, Boralis Composites, Rauschert GmbH, Isolite Insulating Products Co., Ltd., IBIDEN Co., Ltd., Shandong Luyang Energy-Saving Materials Co., Ltd., China National Building Material Group (CNBM), Morgan Advanced Materials, Saint-Gobain S.A., Beijing Composites Science & Technology Development Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Alumina Fiber and Alumina Continuous Fiber Market Key Technology Landscape

The manufacturing technology for high-performance alumina fibers is dominated by two highly specialized processes: the Sol-Gel process and, less commonly for continuous fibers, Chemical Vapor Deposition (CVD). The Sol-Gel route is the predominant method, involving synthesizing a colloidal suspension (sol) of aluminum precursors, spinning this mixture into fibers, and subsequently drying and sintering (gel). This process allows precise control over the stoichiometry, purity, and microstructure, which are essential for achieving the high tensile strength and thermal stability required for demanding applications like Ceramic Matrix Composites (CMCs). Continuous advancements focus on refining precursor chemistry to reduce manufacturing time and energy consumption, while enhancing crystallinity and reducing fiber diameter variation, directly influencing the performance consistency of the final composite.

Current technological innovations are also concentrated on the development of multi-component fibers, often incorporating silica (Alumina-Silica fibers) or trace elements like Yttria or Zirconia as stabilizers or grain growth inhibitors. The primary goal is to extend the operating temperature limit and improve creep resistance, a critical factor for turbine engine components operating under continuous high stress. Furthermore, surface treatment technologies are gaining importance; applying specialized coatings (e.g., boron nitride or silicon carbide) on the fiber surface is necessary to create a suitable interphase layer between the fiber and the ceramic matrix, crucial for ensuring effective load transfer and enhancing the composite's fracture toughness and lifespan.

A nascent, yet significant, technological trend involves integrating alumina fiber manufacturing with advanced fabrication techniques such as Additive Manufacturing (AM). Researchers are exploring methods to produce high-viscosity, printable ceramic slurries incorporating short or continuous alumina fibers, allowing for the rapid prototyping and production of complex geometric parts with integrated reinforcement. Success in this area would drastically change composite production economics, enabling on-demand, customized production and potentially lowering material waste compared to traditional lay-up methods. Furthermore, process automation, heavily reliant on sophisticated sensor technology and data analytics, is key to maintaining the ultra-high quality standards demanded by the aerospace industry.

Regional Highlights

Regional analysis confirms that the demand for alumina fiber is geographically concentrated, correlating strongly with global centers of advanced manufacturing, aerospace production, and heavy industrial infrastructure. The market dynamics are largely defined by three major regions: North America, Asia Pacific, and Europe, each presenting distinct growth drivers and technological capabilities.

- Asia Pacific (APAC): APAC holds a significant market share and is projected to be the fastest-growing region. This acceleration is driven by massive infrastructure expansion, particularly in China and India, increasing demand for high-temperature insulation in industrial furnaces (steel, glass, ceramics), and robust government investments in domestic aerospace and defense capabilities. Japan, a key technological hub, continues to lead in the development and production of high-purity continuous alumina-silica fibers for export and advanced domestic industrial use. The focus here is balanced between high-volume refractory products and strategic continuous fiber production.

- North America: North America represents a mature and high-value market, primarily driven by the dominating presence of global aerospace and defense primes (e.g., Boeing, Lockheed Martin, GE Aviation). The region is the largest consumer of premium, high-strength alumina continuous fibers due to the extensive use of CMCs in commercial and military jet engines. Strict regulatory standards concerning fuel efficiency and emissions further stimulate the demand for lightweight, high-temperature components, securing the region's position as the primary adopter of cutting-edge fiber technologies.

- Europe: The European market demonstrates steady growth, driven by stringent environmental regulations necessitating efficient industrial processes and the presence of major automotive and aerospace manufacturers (e.g., Airbus). Demand is robust in advanced thermal insulation for industrial kilns and high-end automotive applications (e.g., brake pads, exhaust systems). Technological development in Europe often focuses on sustainability and lifecycle assessment of high-temperature materials.

- Latin America, Middle East, and Africa (LAMEA): This collective region is currently a smaller, yet emerging market. Growth is primarily linked to investments in petrochemical processing, power generation infrastructure, and defense modernization programs in countries like Brazil and the UAE. Demand is predominantly for industrial insulation and refractory linings, with continuous fiber adoption limited to specialized energy and defense projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Alumina Fiber and Alumina Continuous Fiber Market.- 3M Company

- SGL Carbon SE

- Mitsubishi Chemical Corporation

- Nippon Carbon Co., Ltd.

- Zircar Zirconia, Inc.

- Unifrax (Lydall Inc.)

- General Electric (GE)

- Altra Materials

- Ceradyne Inc. (3M subsidiary)

- Kyocera Corporation

- Boralis Composites

- Rauschert GmbH

- Isolite Insulating Products Co., Ltd.

- IBIDEN Co., Ltd.

- Shandong Luyang Energy-Saving Materials Co., Ltd.

- China National Building Material Group (CNBM)

- Morgan Advanced Materials

- Saint-Gobain S.A.

- Beijing Composites Science & Technology Development Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Alumina Fiber and Alumina Continuous Fiber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Alumina Continuous Fiber?

The primary driver is the growing adoption of Ceramic Matrix Composites (CMCs) in the aerospace industry, specifically for manufacturing lightweight, ultra-high-temperature components (like turbine engine shrouds and combustor liners) that significantly improve fuel efficiency and performance over traditional metallic superalloys.

How do Alumina Fibers differ from traditional ceramic fibers like standard fiberglass?

Alumina fibers are characterized by vastly superior high-temperature performance (often stable above 1,200°C), exceptional chemical stability, and lower creep under stress compared to traditional fiberglass or mineral wool. They are produced via high-purity sol-gel methods, ensuring uniform microstructure necessary for structural composite applications.

Which manufacturing process is most commonly used for high-performance continuous alumina fibers?

The Sol-Gel spinning process is the most common technique. It involves creating a colloidal solution of aluminum precursors, spinning the gel into green fibers, and then subjecting them to precise drying and high-temperature sintering (firing) to form the final crystalline alumina structure.

What are the main restraints impacting the growth of the Alumina Fiber market?

The major restraints include the extremely high capital investment required for specialized manufacturing facilities, the high cost of raw material precursors, and the technical complexity of scaling up production while maintaining the stringent quality and consistency demanded by critical end-use applications like aerospace.

Which geographical region is expected to demonstrate the highest growth rate for alumina fiber products?

The Asia Pacific (APAC) region, driven by extensive industrialization, growing investment in domestic defense technology, and increased demand for advanced refractory and thermal insulation materials in countries like China and India, is forecasted to exhibit the highest CAGR during the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager