Alumina Sol Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433399 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Alumina Sol Market Size

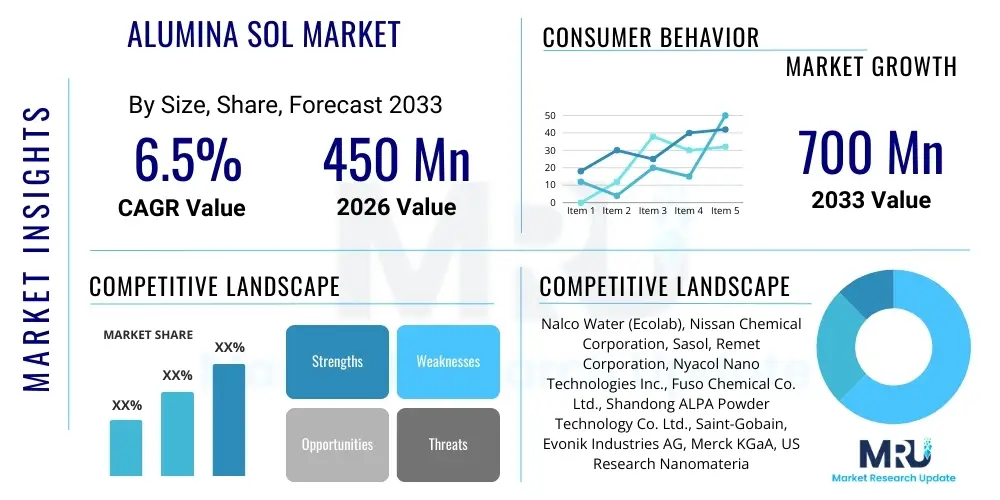

The Alumina Sol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $450 Million in 2026 and is projected to reach $700 Million by the end of the forecast period in 2033.

Alumina Sol Market introduction

Alumina sol, a colloidal dispersion of aluminum oxide (Al₂O₃) nanoparticles in a liquid medium, typically water, represents a highly versatile material critical for advanced industrial applications. These sols are characterized by their high surface area, excellent thermal stability, chemical inertness, and tunable particle size and morphology, making them indispensable in manufacturing processes requiring precision engineering and high-performance material characteristics. The colloidal nature allows for easy integration into various matrices, forming uniform thin films or serving as precursors for complex ceramic structures. Key industrial sectors driving demand include advanced ceramics manufacturing, catalytic systems design, and the development of specialized coatings, where the unique properties of alumina sols contribute significantly to product performance and longevity.

The product portfolio within the alumina sol market spans several grades, differentiated primarily by their particle size (ranging from a few nanometers to tens of nanometers), concentration, pH level, and stabilization mechanism. High-purity alumina sols are particularly valued in applications sensitive to contaminants, such as semiconductor processing and specialized optical coatings, ensuring stringent quality standards are met. The inherent stability of these sols, often achieved through electrostatic or steric hindrance mechanisms, guarantees long shelf life and consistent performance during industrial scale-up. Furthermore, the ability to control the surface chemistry allows manufacturers to tailor the sol for specific end-use environments, enhancing adhesion, dispersibility, or catalytic activity based on the required function.

Major applications of alumina sol include serving as a binder in refractory materials, a polishing agent for precision optics and silicon wafers (Chemical Mechanical Planarization - CMP), an active component or support material in catalytic converters, and as a raw material for transparent ceramic production. The significant benefits derived from using alumina sol encompass improved mechanical strength, superior thermal shock resistance, enhanced abrasive performance, and efficient control over porosity in filter and membrane applications. The market is fundamentally driven by the escalating demand for high-performance materials in the electronics and automotive sectors, coupled with increasing governmental mandates for environmentally friendly catalytic solutions requiring robust catalyst support structures.

Alumina Sol Market Executive Summary

The Alumina Sol Market is experiencing robust growth driven by accelerated technological advancements in materials science, particularly the focus on developing nanoscale components for high-efficiency systems. Business trends indicate a strong move toward functional customization, where manufacturers are increasingly offering tailored sol formulations optimized for specific application requirements, such as high-temperature stability in refractories or specific particle morphology for advanced polishing slurries. Strategic partnerships between alumina sol producers and end-use manufacturers, especially in the semiconductor and advanced ceramics industries, are becoming central to innovation and supply chain security. Furthermore, sustainability considerations are prompting manufacturers to refine synthesis processes, reducing energy consumption and minimizing waste, thereby aligning with global green manufacturing initiatives and creating a competitive advantage for firms prioritizing environmental, social, and governance (ESG) factors.

Regionally, the Asia Pacific (APAC) stands out as the dominant market, characterized by rapid industrialization, massive expansion in the electronics manufacturing base, and substantial governmental investment in infrastructure and catalytic technologies, particularly in China, Japan, and South Korea. North America and Europe also maintain significant market shares, primarily due to the stringent regulatory landscape driving demand for high-quality catalytic materials and the mature presence of sophisticated aerospace and automotive industries requiring advanced coatings and precision materials. The market dynamics in these developed regions emphasize R&D, focusing on integrating alumina sol into emerging applications like solid oxide fuel cells (SOFCs) and advanced battery components, demanding ultra-high purity and precise specifications.

Segment trends highlight the dominance of the colloidal aluminum oxide segment based on type, favored for its stability and broad applicability, while the catalyst and refractory applications segments continue to command the largest share based on end-use. The fastest-growing application segment is anticipated to be Chemical Mechanical Planarization (CMP) in electronics, fueled by the relentless miniaturization and increasing complexity of integrated circuits, which requires high-precision planarization techniques utilizing advanced alumina-based slurries. Investment trends are heavily skewed toward improving synthesis techniques—specifically, precipitation and hydrothermal methods—to achieve narrower particle size distribution and enhanced control over surface properties, ensuring superior performance across demanding industrial scenarios.

AI Impact Analysis on Alumina Sol Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Alumina Sol Market typically revolve around optimizing synthesis processes, predicting material performance under varying conditions, and streamlining quality control. Users frequently inquire: "How can AI optimize the hydrothermal synthesis of alumina sols to achieve uniform particle size?", "Can machine learning predict the long-term stability or aggregation behavior of a specific alumina sol formulation?", and "What role does AI play in simulating the performance of alumina sol-derived catalysts or coatings?". The core theme emerging from these inquiries is the expectation that AI and machine learning (ML) will revolutionize R&D and manufacturing by enabling faster iteration cycles, higher consistency, and significantly reduced material waste. Users anticipate AI assisting in complex multivariate analysis required to manage parameters like precursor concentration, temperature profiles, and pH during complex synthesis reactions.

The practical application of AI in the alumina sol production pipeline focuses heavily on process control and formulation design. AI algorithms are utilized to analyze vast datasets generated during production, identifying correlations between synthesis parameters and final product attributes, such as viscosity, particle size distribution (PSD), and surface charge. This data-driven approach moves away from traditional trial-and-error methods, allowing manufacturers to quickly zero in on optimal operating windows for achieving highly specialized sol specifications required by high-tech sectors like aerospace or medical devices. Furthermore, AI-powered predictive maintenance models are being deployed to monitor equipment condition, reducing downtime and maintaining the continuous, contaminant-free environment essential for producing high-purity sols.

Beyond manufacturing efficiency, AI is critical in accelerating the deployment and customization of alumina sol-based products, particularly in catalysis. Machine learning models are being trained on spectroscopic and reactivity data of various catalyst compositions to predict the most effective alumina support structure, porosity, and loading for a specific chemical reaction, drastically cutting down the time required for catalyst discovery. This predictive capability ensures that new alumina sol formulations meet stringent performance targets for efficiency and durability in critical applications like automotive exhaust treatment, directly impacting speed-to-market for novel materials. The integration of AI tools thus transforms alumina sol production from a specialized chemical process into a highly optimized, data-intensive manufacturing operation, enhancing quality and adaptability across the supply chain.

- AI-driven optimization of hydrothermal synthesis parameters for precise particle size control (AEO Focus: Precision Manufacturing).

- Machine learning algorithms predict sol stability, aggregation kinetics, and shelf life, reducing batch failure rates.

- AI facilitates high-throughput screening of catalyst support structures derived from alumina sol for specific chemical reactions.

- Implementation of digital twins powered by AI for real-time monitoring and anomaly detection in large-scale reactor systems.

- Automated quality control systems using computer vision and ML for immediate assessment of sol uniformity and purity.

DRO & Impact Forces Of Alumina Sol Market

The Alumina Sol Market is shaped by a strong interplay of compelling drivers, inherent restraints, and attractive opportunities, collectively defining its trajectory. The primary driver is the accelerating demand for advanced materials in high-growth industries, notably semiconductors, where alumina sol is irreplaceable in CMP slurries for planarizing silicon wafers, and in the automotive sector, driven by stringent emission standards mandating high-performance catalytic converters that rely on alumina as a support. Coupled with this is the versatility of alumina sol as a high-temperature binder in advanced refractory and ceramic applications, essential for infrastructure projects and industrial furnaces, ensuring operational resilience and longevity. The continuous innovation in nanotechnology further provides a foundational pull, as smaller, more uniform alumina particles unlock superior functional characteristics in coatings and composites.

However, the market faces significant restraints that temper its explosive growth potential. A major challenge is the complex, energy-intensive synthesis process required to achieve highly uniform, high-purity alumina sols, which results in high production costs compared to traditional micron-sized aluminum oxide powders. Furthermore, maintaining colloidal stability, preventing aggregation (flocculation), and ensuring consistent quality during long-distance transportation and storage remain technical hurdles, especially for ultra-fine particle grades. Regulatory complexity regarding nanoparticle handling and waste disposal, particularly in environmentally conscious jurisdictions, also adds operational constraints, necessitating specialized handling protocols and capital investment in advanced environmental safety systems, creating barriers to entry for smaller players.

Conversely, vast opportunities exist for strategic market expansion. The nascent but rapidly developing field of transparent ceramics, utilized in protective windows, sensors, and lasers, offers a high-value application area where alumina sol serves as a critical precursor. The rise of green energy technologies, including solid oxide fuel cells (SOFCs) and advanced battery separators (specifically lithium-ion), presents a significant growth avenue, as these applications require highly porous and thermally stable electrolyte or separator materials often derived from alumina sol precursors. Furthermore, market participants can capitalize on the growing industrial shift towards surface engineering, offering customized, high-performance alumina sol-based coatings for wear resistance, corrosion protection, and thermal insulation across various sectors, creating specialized niche markets with high profitability.

Segmentation Analysis

The Alumina Sol Market is systematically segmented based on Type, Application, and Region, enabling a granular understanding of market dynamics and targeted strategic investment opportunities. Segmentation by Type differentiates the market based on the physical and chemical characteristics of the sol, primarily particle morphology and stabilization mechanism, influencing its suitability for specific industrial processes. Segmentation by Application reveals the dominant end-use sectors, such as catalysis, polishing, and ceramics, highlighting where technological demand is concentrated. The structural diversity of alumina sol grades allows manufacturers to cater to stringent performance requirements across various high-value industries, ensuring material optimization for specialized functional requirements.

Based on Type, the market is broadly classified into Colloidal Aluminum Oxide and Pseudoboehmite Sol. Colloidal aluminum oxide is characterized by its crystalline structure and excellent stability, making it ideal for applications requiring robust mechanical properties, such as advanced abrasives and specialized coatings. Pseudoboehmite sol, an intermediate phase, is often used as a precursor for gamma-alumina, which is highly porous and serves as the most widely used catalyst support material globally, driving significant demand from the petrochemical and environmental remediation sectors. The choice between these types is critical, depending on whether the end-use requires high density and hardness (Colloidal) or high surface area and porosity (Pseudoboehmite-derived).

Application-wise, the market is dominated by three main segments: Catalysis, Refractories and Ceramics, and Polishing and Abrasives. The Catalysis segment is paramount, utilizing alumina sol for producing high-surface-area catalyst supports essential for reducing automotive emissions and processing petrochemical feedstock. The Refractories and Ceramics segment uses alumina sol as a high-purity binder, enhancing the thermal stability and mechanical strength of high-performance technical ceramics used in extreme environments. The Polishing and Abrasives segment, particularly in CMP for electronics, requires extremely fine and uniform particle size distributions to achieve the smooth surfaces necessary for advanced integrated circuit fabrication, representing a high-growth, high-value niche.

- Segmentation by Type:

- Colloidal Aluminum Oxide Sol

- Pseudoboehmite Sol

- Segmentation by Application:

- Catalysis (Including catalyst supports and washcoats for environmental and petrochemical sectors)

- Refractories and Ceramics (Binders, matrices, and precursors for technical ceramics)

- Polishing and Abrasives (Chemical Mechanical Planarization - CMP, precision optics polishing)

- Coatings (Thermal barrier coatings, corrosion-resistant films)

- Binders and Additives (Paints, textiles, paper)

- Segmentation by Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Alumina Sol Market

The value chain for the Alumina Sol Market begins with the upstream procurement of high-purity aluminum precursors, primarily aluminum metal, aluminum salts (like aluminum chloride or aluminum sulfate), or high-grade aluminum hydroxide. The quality and cost of these raw materials directly influence the purity and subsequent production cost of the final sol product. Key suppliers in the upstream segment focus on chemical refinement and consistency to meet the stringent purity requirements of nanochemical synthesis, particularly important for applications in electronics and medical devices. Efficiency in precursor sourcing and preparation is paramount, as variations in chemical composition can significantly impair the colloidal stability and particle size distribution achieved during the synthesis phase, which is the most critical and complex part of the value chain.

The midstream stage involves the specialized manufacturing of the alumina sol itself, utilizing sophisticated chemical processes such as precipitation, peptization, hydrothermal synthesis, or sol-gel techniques. This stage is highly capital-intensive and requires substantial intellectual property regarding process control (temperature, pressure, pH) and stabilization chemistry. Manufacturers in this segment, who are the core market players, invest heavily in R&D to tailor particle size, surface charge, and concentration according to specific client needs. Output purification, concentration, and stabilization are complex steps that ensure the product's quality, stability, and suitability for high-performance industrial applications, transforming basic precursors into value-added nano-colloids.

Downstream activities involve the distribution channel and the final application. Distribution is often a blend of direct sales to large end-users (e.g., major catalyst producers or semiconductor fabrication plants) and indirect sales through specialized chemical distributors who handle smaller orders and manage inventory for diverse clientele across various geographical locations. The end-use sectors, including automotive, electronics, aerospace, and general industrial manufacturing, integrate the sol into their specific processes, whether for forming catalyst washcoats, creating protective ceramic coatings, or formulating high-precision polishing slurries. The effectiveness of the product is ultimately realized at this final stage, where the tailored properties of the alumina sol directly contribute to the performance, efficiency, and durability of the final manufactured goods, solidifying the market's reliance on consistent, high-quality material supply.

Alumina Sol Market Potential Customers

The potential customer base for the Alumina Sol Market is highly diversified yet primarily concentrated within sectors that require materials exhibiting superior thermal, mechanical, and surface properties. Major potential customers include companies operating in the Catalyst Manufacturing industry, particularly those specializing in automotive catalytic converters and industrial environmental control systems. These firms are heavy consumers of pseudoboehmite-derived sols, which serve as the high-surface-area gamma-alumina support essential for maximizing catalytic efficiency and meeting stringent global emission regulations. The increasing pressure for cleaner energy and transport solutions guarantees sustained demand from this sector, making catalyst producers foundational clients.

Another crucial customer segment is the Advanced Ceramics and Refractories industry. Manufacturers producing high-performance components, such as furnace linings, insulation materials for high-temperature environments, and technical ceramics for mechanical seals or cutting tools, rely on the binding strength and high-temperature stability offered by high-purity colloidal aluminum oxide sols. These customers value the sol’s ability to create highly dense, uniform green bodies and enhance the overall structural integrity and thermal resistance of the final ceramic product. As industrial processes increasingly move toward higher operating temperatures and harsher chemical environments, the demand for alumina sol as a specialized binder in this sector continues to expand, driven by requirements for efficiency and longer product lifecycles.

Furthermore, the Electronics and Semiconductor Fabrication industry represents a high-growth, high-value customer group. Semiconductor companies, particularly those involved in wafer manufacturing and polishing (CMP), require ultra-pure, precisely sized alumina sol slurries to achieve the nanometer-scale surface flatness critical for multi-layered integrated circuits. Optical manufacturers, producing lenses, mirrors, and precision glass components, also utilize alumina sol for final-stage polishing due to its controlled abrasive action and ability to deliver superior surface finish without defects. These customers prioritize consistency, zero contamination, and narrow particle size distribution, demonstrating a willingness to pay a premium for high-specification products that directly impact the yield and performance of their sensitive electronic and optical components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million |

| Market Forecast in 2033 | $700 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nalco Water (Ecolab), Nissan Chemical Corporation, Sasol, Remet Corporation, Nyacol Nano Technologies Inc., Fuso Chemical Co. Ltd., Shandong ALPA Powder Technology Co. Ltd., Saint-Gobain, Evonik Industries AG, Merck KGaA, US Research Nanomaterials, Inc., KC Corporation, Jiangsu Sanmu Group Co. Ltd., Wuxi Yueda Chemical Co. Ltd., Suzhou Huirong Technology Co. Ltd., Hangzhou Jingyou Chemical Co. Ltd., DuPont, BASF SE, Fuji Silysia Chemical Ltd., Sumitomo Chemical Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Alumina Sol Market Key Technology Landscape

The technological landscape of the Alumina Sol Market is dominated by advanced synthesis and processing methods aimed at achieving precise control over nanoparticle characteristics, which is paramount for high-performance applications. The prevalent synthesis technologies include the hydrothermal method, the precipitation-peptization route, and the sol-gel process. The hydrothermal method is favored for producing highly crystalline alumina nanoparticles with narrow size distribution under elevated temperature and pressure, ensuring superior purity essential for electronic applications. The precipitation-peptization route is widely used for producing pseudoboehmite sols, offering a cost-effective route to high surface area materials used in catalysis, although optimizing the peptization step to maintain stability against premature flocculation requires careful control over pH and stabilizer selection.

Beyond synthesis, a critical technological focus lies in stabilization and dispersion techniques. Alumina sols are often stabilized electrostatically (by controlling the zeta potential, usually through pH adjustment) or sterically (using polymers or surfactants). Recent advancements involve the use of novel polymer coatings and surface functionalization techniques to enhance the compatibility of the alumina nanoparticles with non-aqueous media or specific organic matrices, expanding their use in composite materials and specialized solvent-based coatings. Furthermore, filtration and centrifugation technologies, such as ultrafiltration and dialysis, are essential processes used post-synthesis to purify the sol by removing residual ions and unwanted chemical byproducts, ensuring the stringent purity levels required by the CMP and medical industries are consistently met.

Innovation is also concentrated on scalable, continuous flow reactor systems replacing traditional batch processing. These continuous systems offer better heat and mass transfer control, leading to improved consistency, reduced synthesis time, and enhanced energy efficiency, which is crucial for lowering the overall production cost of high-volume commercial grades. The integration of Process Analytical Technology (PAT) tools, including in-situ dynamic light scattering (DLS) and small-angle X-ray scattering (SAXS), allows for real-time monitoring of particle growth and agglomeration during the synthesis stage. This real-time feedback loop is a technological cornerstone for maintaining batch-to-batch consistency and ensuring that the manufactured alumina sols meet the exacting specifications demanded by global manufacturers relying on predictable material performance for their advanced product lines.

Regional Highlights

The global Alumina Sol Market exhibits distinct consumption and production patterns across major geographical regions, influenced by localized industrial maturity, regulatory frameworks, and technological adoption rates. Asia Pacific (APAC) holds the dominant market share and is projected to experience the fastest growth throughout the forecast period. This dominance is attributed to the presence of large-scale manufacturing hubs for electronics (particularly semiconductor fabrication and display technology in countries like Taiwan, South Korea, and China) and the rapidly expanding automotive industry, driving massive demand for high-performance CMP slurries and catalytic converters. Government investments in infrastructure and R&D focused on next-generation energy and material science also solidify APAC's leading position, with Chinese manufacturers increasingly becoming key global suppliers of diverse alumina sol grades.

North America represents a mature and technologically advanced market, focusing predominantly on high-value, specialized applications such as aerospace components, defense, and high-purity materials for advanced research and medical technology. The demand in this region is less volume-driven and more performance-driven, emphasizing ultra-high purity alumina sols for highly critical applications. Stringent environmental regulations in the US and Canada bolster the demand for efficient catalytic systems, ensuring continuous innovation and adoption of the most advanced alumina sol-based catalyst supports. The region also hosts major players and academic institutions driving cutting-edge research in nanofluidics and advanced composite materials, securing its position as a primary innovation center for new alumina sol applications.

Europe maintains a substantial market presence, characterized by a strong emphasis on sustainability and circular economy principles, significantly impacting the demand for efficient and durable alumina sol products. The European automotive industry, driven by the EU’s strict Euro 7 emission standards, necessitates the rapid integration of highly efficient catalyst materials derived from alumina sol. Furthermore, the robust European chemicals and advanced materials sectors utilize alumina sol extensively in the production of high-performance refractories, specialized coatings, and as binders in functional pigments and textiles. While facing high production costs compared to APAC, European manufacturers often differentiate themselves through superior quality, traceability, and adherence to rigorous environmental and safety standards, particularly in specialized niches.

- Asia Pacific (APAC): Market leader due to semiconductor manufacturing growth (CMP demand) and expansive automotive and petrochemical industries. China and South Korea are key consumption and production centers.

- North America: Focused on high-purity, specialized applications in aerospace, defense, and advanced electronics; driven by stringent regulatory demand for high-efficiency catalysts.

- Europe: High demand from the automotive sector for compliance with stringent emission standards; strong utilization in advanced ceramics, refractories, and high-performance industrial coatings.

- Latin America: Emerging market characterized by increasing industrialization, particularly in Brazil and Mexico, leading to rising demand for refractories and catalyst materials in the local energy sector.

- Middle East and Africa (MEA): Growth driven by massive investments in the oil and gas sector (requiring advanced catalysts and refractories) and ongoing infrastructure development projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Alumina Sol Market.- Nalco Water (Ecolab)

- Nissan Chemical Corporation

- Sasol

- Remet Corporation

- Nyacol Nano Technologies Inc.

- Fuso Chemical Co. Ltd.

- Shandong ALPA Powder Technology Co. Ltd.

- Saint-Gobain

- Evonik Industries AG

- Merck KGaA

- US Research Nanomaterials, Inc.

- KC Corporation

- Jiangsu Sanmu Group Co. Ltd.

- Wuxi Yueda Chemical Co. Ltd.

- Suzhou Huirong Technology Co. Ltd.

- Hangzhou Jingyou Chemical Co. Ltd.

- DuPont

- BASF SE

- Fuji Silysia Chemical Ltd.

- Sumitomo Chemical Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Alumina Sol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between colloidal aluminum oxide sol and pseudoboehmite sol, and their respective main applications?

Colloidal aluminum oxide sol typically features crystalline, high-density nanoparticles, offering superior mechanical strength and stability, making it ideal for precision polishing (CMP) and high-performance coatings. Pseudoboehmite sol is an amorphous, highly porous precursor commonly used to manufacture high-surface-area gamma-alumina, which is the foundational support material for the vast majority of industrial catalysts, particularly in petrochemical processing and automotive emission control systems. The key differentiator is the end-use required: hardness and density versus porosity and catalytic surface area.

How significant is the role of alumina sol in the semiconductor industry, specifically in Chemical Mechanical Planarization (CMP)?

Alumina sol is critical to the semiconductor industry as a primary component in advanced CMP slurries. Its role is to provide the necessary mechanical abrasion required to achieve ultra-flat surfaces on silicon wafers during the fabrication of integrated circuits. The small, highly uniform particle size and controlled surface chemistry of high-purity alumina sols are essential for achieving the nanometer-scale precision and low defect rates necessary for the production of advanced, multi-layered microprocessors and memory chips, directly influencing manufacturing yield and device performance.

What are the key technical challenges faced by manufacturers in producing high-purity, stable alumina sols?

The primary technical challenges include maintaining long-term colloidal stability to prevent nanoparticle aggregation (flocculation), ensuring batch-to-batch consistency in particle size distribution (PSD), and minimizing contaminant levels during the synthesis and purification phases. Achieving ultra-high purity is difficult due to the requirement for highly refined precursors and specialized, contamination-free handling environments. Additionally, scaling up production from laboratory methods to commercial volumes while maintaining consistency requires significant process control and specialized reactor technology.

Which regional market shows the highest growth potential for alumina sol, and what factors are driving this acceleration?

The Asia Pacific (APAC) region exhibits the highest growth potential, largely driven by the explosive growth in its electronics manufacturing sector, particularly in countries like China, South Korea, and Taiwan. The increasing demand for advanced consumer electronics and data center infrastructure fuels the need for high-quality CMP slurries. Furthermore, rapid urbanization and industrial expansion across APAC are accelerating the deployment of new infrastructure and automotive technologies, increasing the demand for alumina sol-based catalysts and advanced refractory materials.

How are environmental regulations influencing the demand and technological development of alumina sol products?

Environmental regulations, particularly stringent global emission standards (e.g., Euro 7 in Europe, EPA standards in North America), significantly influence the market by driving demand for highly efficient catalyst supports. Alumina sol, utilized to create high-surface-area gamma-alumina supports, is essential for maximizing the performance of catalytic converters used to mitigate pollutants. This regulatory pressure encourages continuous technological development toward higher purity, more thermally stable alumina sols that enhance catalyst durability and efficiency, supporting cleaner industrial processes and automotive exhaust treatment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager