Alumina Wafers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431954 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Alumina Wafers Market Size

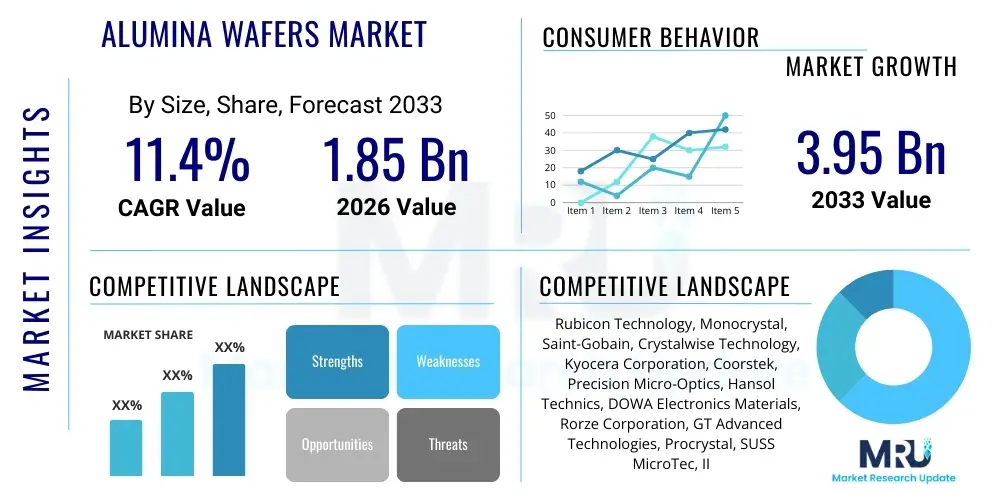

The Alumina Wafers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.4% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $3.95 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for high-performance electronic components, particularly in the rapidly evolving sectors of advanced optics, microelectronics, and solid-state lighting (SSL).

Alumina Wafers Market introduction

The Alumina Wafers Market encompasses specialized substrates primarily composed of aluminum oxide (Al2O3), engineered for high-temperature and high-frequency electronic applications. These wafers are crucial foundational components, especially in the manufacturing of light-emitting diodes (LEDs), high-power radio frequency (RF) devices, and specific types of sensors, leveraging alumina’s exceptional dielectric strength, thermal conductivity, and chemical resistance. The intrinsic material properties of alumina, such as its mechanical robustness and crystalline structure compatibility, make it an indispensable choice over silicon in applications requiring extreme thermal management and operating environments.

Major applications driving market adoption include advanced consumer electronics, automotive lighting systems, industrial power electronics, and sophisticated defense and aerospace technologies. In the LED sector, sapphire alumina wafers are the standard substrate for epitaxially growing Gallium Nitride (GaN) layers, crucial for high-efficiency blue and white LEDs. Beyond lighting, alumina wafers are increasingly used in micro-electromechanical systems (MEMS) and advanced packaging due to their superior hermetic sealing capabilities and dimensional stability across varied temperature profiles.

Key benefits associated with alumina wafers include their superior chemical inertness, which is essential for surviving harsh etching and deposition processes during semiconductor fabrication, and their high melting point, enabling manufacturing processes that are inaccessible to conventional substrates. The primary driving factors for market growth include the global transition towards energy-efficient SSL technology, the burgeoning deployment of 5G and 6G infrastructure requiring high-frequency RF components built on insulating substrates, and continuous advancements in electric vehicle (EV) power electronics demanding robust thermal dissipation materials.

Alumina Wafers Market Executive Summary

The Alumina Wafers Market is characterized by robust business trends centered on technological miniaturization and material optimization, primarily in the compound semiconductor segment. Manufacturers are aggressively investing in increasing wafer diameter sizes, moving from 2-inch and 4-inch towards 6-inch and 8-inch wafers, to enhance manufacturing efficiency and reduce per-chip costs, a direct response to the massive volume requirements of the global LED and RF filter markets. Strategic collaborations between wafer suppliers and epitaxial equipment providers are defining the competitive landscape, focusing on improving surface quality and reducing defect density to boost device yield rates.

Regionally, Asia Pacific (APAC) dominates the consumption and production landscape, led by substantial manufacturing capacities in China, Taiwan, South Korea, and Japan, which are global hubs for LED, consumer electronics, and automotive manufacturing. North America and Europe demonstrate significant growth momentum, particularly in high-value, specialized applications such as advanced photonics, satellite communication components, and high-reliability defense electronics, often leveraging proprietary crystal growth techniques. Government initiatives supporting energy efficiency and domestic semiconductor production further accelerate regional market differentiation and localized supply chain strengthening.

Segment trends highlight the critical importance of wafer purity and orientation. The semiconductor grade alumina wafers, often single-crystal sapphire, account for the largest revenue share due to their widespread use in GaN-based devices. Application segmentation indicates that solid-state lighting (SSL) remains the largest consumer, though the fastest growth is observed in high-frequency wireless communication components (e.g., filters and amplifiers for 5G), and specialized sensor applications, reflecting the market's evolving reliance on materials that provide superior insulation and heat dissipation properties simultaneously.

AI Impact Analysis on Alumina Wafers Market

Common user questions regarding AI's impact on the Alumina Wafers Market typically revolve around optimizing crystal growth processes, improving quality control, and automating highly technical manufacturing steps. Users are keen to understand how AI can predict and mitigate defects during high-temperature crystallization, thereby increasing yield rates and reducing material waste, which is critical given the high cost of raw materials and complex processing. Concerns also center on AI’s role in rapidly analyzing vast datasets generated during wafer polishing and surface preparation to achieve atomic-level flatness and purity required for subsequent epitaxial growth.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is poised to revolutionize the upstream manufacturing phase of alumina wafers. AI systems are being deployed for predictive maintenance of highly complex crystal pullers, optimizing temperature gradients, and adjusting pulling speed in real-time based on in-situ sensor data to ensure crystal homogeneity and minimize internal stress, leading directly to higher-quality, defect-free substrates. This shift moves wafer production from traditional empirical methods towards precision-guided, data-driven manufacturing, drastically enhancing throughput predictability.

Furthermore, AI is instrumental in the downstream quality assessment phases. Automated visual inspection (AVI) systems powered by deep learning algorithms can identify microscopic surface flaws, micro-scratches, and crystallographic defects far more reliably and quickly than human operators. By correlating specific fabrication parameters with observed wafer defects, AI provides actionable insights that allow manufacturers to continuously refine their processes, ensuring that alumina wafers meet the stringent uniformity and reliability standards demanded by advanced microelectronic applications, particularly those in mission-critical sectors.

- AI optimizes crystal growth parameters (temperature, pressure, speed) using predictive modeling to maximize yield.

- Machine Learning enhances Automated Visual Inspection (AVI) systems for high-speed, accurate defect detection and classification on wafer surfaces.

- AI-driven process control reduces material waste and energy consumption during high-temperature synthesis, improving overall cost efficiency.

- Predictive maintenance schedules for critical manufacturing equipment (e.g., furnaces, polishers) are optimized using ML, minimizing unplanned downtime.

- AI facilitates faster material characterization by analyzing complex X-ray diffraction and spectroscopic data, accelerating R&D cycles for novel alumina composites.

DRO & Impact Forces Of Alumina Wafers Market

The Alumina Wafers Market dynamics are profoundly shaped by a combination of high demand from compound semiconductor sectors (Driver), stringent material purity requirements coupled with high manufacturing costs (Restraint), and significant opportunities arising from emerging technologies like 5G and Electric Vehicles (Opportunity). These forces collectively dictate investment patterns, technological innovation strategies, and overall market expansion, resulting in a complex yet rapidly evolving industrial environment where material science breakthroughs are critical differentiators. The inherent high thermal stability of alumina acts as a persistent impact force, solidifying its irreplaceable role in high-power applications where silicon substrates fail due to thermal runaway or degradation.

Drivers: A primary driver is the accelerating global adoption of solid-state lighting (LEDs), particularly in emerging economies and for specialized industrial lighting, which fundamentally relies on alumina sapphire substrates for epitaxial growth. The second major impetus stems from the proliferation of high-frequency and high-power electronic devices, specifically those based on Gallium Nitride (GaN) and Silicon Carbide (SiC) heterostructures, where alumina’s excellent dielectric properties and thermal dissipation capabilities are mandatory. The increased focus on enhancing energy efficiency and miniaturization across consumer electronics and industrial machinery further fuels demand for reliable, thermally robust substrate materials.

Restraints: The market faces significant restraints, including the complex, time-consuming, and energy-intensive manufacturing process required for growing high-quality single-crystal alumina wafers, leading to high production costs. Furthermore, the mismatch in lattice parameters between sapphire (Al2O3) and deposited materials like GaN can lead to crystallographic defects, affecting device performance and yield, necessitating complex buffer layers and advanced processing techniques. Market profitability is also sensitive to the volatile pricing of raw material precursors and the specialized capital expenditure required for maintaining state-of-the-art crystal growth facilities.

Opportunities: Significant growth opportunities are emerging from the deployment of 5G and next-generation communication networks, which require enhanced RF filters and power amplifiers often utilizing alumina substrates for stability and high-frequency operation. The explosive growth of the Electric Vehicle (EV) market presents an avenue for high-power electronics and robust thermal management modules, where alumina wafers offer critical advantages. Additionally, advancements in micro-optics, flexible electronics (through thin-film deposition on alumina), and specialized UV-C LED applications are creating niche, high-margin opportunities for customized alumina substrate solutions.

Segmentation Analysis

The Alumina Wafers Market is primarily segmented based on material type, diameter size, and application, reflecting the diverse technical requirements across end-use industries. Segmentation by material type distinguishes between high-purity single-crystal sapphire wafers and polycrystalline alumina, with single-crystal sapphire dominating the high-performance semiconductor segment due to its superior structural integrity required for epitaxial growth. Diameter size segmentation reflects the maturity and scale of the manufacturing process, where larger diameters (e.g., 6-inch and 8-inch) are increasingly adopted for mass production economies of scale, while smaller sizes remain relevant for specialized defense and R&D applications.

Segmentation by application clearly delineates the market consumption landscape, with Solid State Lighting (SSL), driven by LEDs, constituting the largest user base, demanding specific wafer surface properties and high volume. Power Electronics and RF/Microwave components represent the fastest-growing segments, requiring ultra-high purity and specific crystallographic orientations to maximize device performance in high-frequency environments. This detailed categorization assists manufacturers in tailoring production capabilities and customizing surface preparation techniques, such as chemo-mechanical polishing (CMP) and specialized etching, to meet precise end-user specifications, driving product differentiation and market competitiveness.

- By Type:

- Sapphire Alumina Wafers (Single Crystal)

- Polycrystalline Alumina Wafers (Ceramic)

- Patterned Sapphire Substrate (PSS)

- By Diameter:

- 2-inch and 3-inch

- 4-inch

- 6-inch

- 8-inch and above

- By Application:

- Solid State Lighting (LED Manufacturing)

- Power Electronics and High-Frequency Devices (GaN/RF Components)

- Optoelectronics and Laser Diodes

- Microelectromechanical Systems (MEMS)

- Specialized Industrial Sensors

- Aerospace and Defense

Value Chain Analysis For Alumina Wafers Market

The value chain for the Alumina Wafers Market is complex, starting with the highly specialized upstream extraction and purification of raw materials, primarily high-purity aluminum oxide powder (Al2O3), which must meet extremely stringent purity standards (typically 5N or 6N). Key upstream suppliers focus on chemical synthesis and thermal treatment processes to produce precursors suitable for crystal growth, demanding substantial investment in quality control systems to prevent contaminants that could compromise the final wafer’s electrical or optical properties. The subsequent crystal growth phase, utilizing methods such as the Czochralski or Kyropoulos techniques, is the most capital-intensive and critical step, defining the physical and structural quality of the boules.

The midstream processing involves highly sophisticated techniques, including slicing, lapping, polishing (often using Chemical Mechanical Planarization - CMP), and cleaning, to transform raw crystal boules into precision wafers with near-perfect surface finish and specified crystallographic orientation (e.g., C-plane, A-plane). Midstream manufacturers focus intensely on minimizing surface damage and achieving exceptional flatness to ensure subsequent epitaxial growth is successful. Distribution channels are highly specialized, often involving direct sales contracts between wafer manufacturers and large-scale semiconductor fabricators (fabs) or original equipment manufacturers (OEMs).

Downstream analysis reveals that the primary end-users are integrated device manufacturers (IDMs) and specialized foundries focused on compound semiconductors, especially in the LED and RF segments. Direct distribution channels, characterized by rigorous technical support and long-term supply agreements, dominate high-volume transactions. Indirect channels, involving specialized technical distributors and agents, cater to smaller R&D organizations or niche industrial buyers. The success of the downstream component depends heavily on achieving zero-defect rates and consistency in wafer thickness and orientation, necessitating close collaboration throughout the entire chain, from powder sourcing to device integration.

Alumina Wafers Market Potential Customers

Potential customers for alumina wafers primarily encompass entities engaged in the manufacture of advanced electronic and photonic devices that require substrates offering superior thermal, electrical, and mechanical performance compared to conventional silicon. The largest segment of buyers includes global Solid State Lighting (SSL) manufacturers and LED chip makers, who require mass volumes of sapphire wafers for blue and white light emission technologies. These companies prioritize cost-effective, large-diameter wafers (6-inch) with Patterned Sapphire Substrate (PSS) technology to maximize light extraction efficiency and device yield.

A rapidly expanding customer base includes foundries specializing in Gallium Nitride (GaN) power electronics and high-frequency Radio Frequency (RF) devices used in 5G infrastructure, defense radars, and automotive applications. These buyers demand ultra-high purity, low-defect wafers suitable for high-electron mobility transistor (HEMT) fabrication. Furthermore, manufacturers of specialized optical components, high-power laser diodes, and advanced Microelectromechanical Systems (MEMS) also represent significant potential customers, seeking custom wafer specifications for optical transparency and precise physical dimensions necessary for complex sensor integration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $3.95 Billion |

| Growth Rate | 11.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rubicon Technology, Monocrystal, Saint-Gobain, Crystalwise Technology, Kyocera Corporation, Coorstek, Precision Micro-Optics, Hansol Technics, DOWA Electronics Materials, Rorze Corporation, GT Advanced Technologies, Procrystal, SUSS MicroTec, II-VI Incorporated (Coherent), Sumitomo Electric Industries, Namiki Precision Jewel Co., Ltd., Crysdot, Beijing Jite Intelligent Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Alumina Wafers Market Key Technology Landscape

The core technology landscape for alumina wafers is dominated by the crystal growth methods necessary to produce large, high-quality, single-crystal sapphire boules. Historically, the Czochralski (CZ) method and the Kyropoulos method have been widely used, but newer, more efficient techniques such as the Edge-defined Film-fed Growth (EFG) and Heat Exchanger Method (HEM) are gaining prominence. EFG allows for the creation of predefined shapes and larger rectangular crystals, improving material utilization, while HEM is highly valued for producing large-diameter boules with superior crystalline quality and reduced internal stress, essential for advanced semiconductor applications.

Beyond crystal growth, advancements in surface engineering and preparation technologies are critical differentiators. These include highly precise slicing techniques (e.g., wire sawing) to minimize material loss, followed by multi-stage lapping and chemical mechanical planarization (CMP). CMP technology is essential for achieving the required atomic-level flatness (nanometer-scale roughness) and scratch-free surface necessary for successful GaN epitaxial deposition. Furthermore, Patterned Sapphire Substrate (PSS) technology, which involves etching micro-scale geometric patterns onto the wafer surface prior to epitaxial growth, has become a standard requirement in LED manufacturing as it significantly enhances light extraction efficiency by mitigating total internal reflection.

The future technology landscape is focusing on improving the yield of larger diameter wafers (6-inch and 8-inch) while simultaneously reducing production time and energy consumption. Research is heavily invested in optimizing the control systems of high-temperature furnaces, often integrating AI for real-time process monitoring and adjustment to ensure crystal uniformity. Furthermore, hybrid substrate approaches, such as using specialized buffer layers or composite structures, are being investigated to mitigate the lattice mismatch challenges inherent when growing materials like GaN on sapphire, thereby paving the way for higher performance and more reliable next-generation devices.

Regional Highlights

The Asia Pacific (APAC) region stands as the undisputed market leader in the Alumina Wafers sector, commanding the largest market share in both consumption and production volumes. This dominance is directly attributable to the concentration of the world's largest LED manufacturing bases, particularly in China, Taiwan, South Korea, and Japan, which require massive supplies of sapphire substrates for general lighting, display backlights, and specialty applications. Furthermore, significant investments in 5G infrastructure development and the rapid expansion of the consumer electronics supply chain in countries like China and South Korea continue to cement APAC's role as the central engine of market growth. Localized supply chains allow for quicker adaptation to technological demands and cost-competitive production.

North America demonstrates substantial growth, focusing primarily on high-end, specialized applications rather than sheer volume. The region excels in R&D and manufacturing for high-reliability military and aerospace electronics, advanced RF components for satellite communication, and specialized GaN-on-Sapphire power devices. Strong government and private investment in next-generation wide bandgap semiconductors (WBG), driven by defense and high-performance computing needs, ensures sustained demand for ultra-premium, high-specification alumina wafers. Technological innovation, particularly in advanced crystal growth techniques and customized surface preparation, often originates from this region, setting global quality benchmarks.

Europe represents a mature yet growing market, heavily focused on automotive applications, industrial power electronics, and sophisticated sensor technologies. European countries, particularly Germany and France, are leaders in developing advanced automotive lighting systems and power control units for Electric Vehicles (EVs), where the thermal management capabilities of alumina wafers are critical. The region's regulatory environment favoring energy efficiency also spurs demand for high-performance LEDs and GaN devices built on alumina substrates. The European market emphasizes quality, long-term reliability, and compliance with stringent industrial standards, fostering demand for certified and traceable substrate sources.

- Asia Pacific (APAC): Dominates production and consumption; driven by massive LED manufacturing, 5G deployment, and consumer electronics hub activities in China, South Korea, and Taiwan.

- North America: High growth in specialized sectors, including aerospace, defense electronics, high-frequency RF components, and advanced GaN power systems; focus on R&D and high-purity substrates.

- Europe: Strong demand fueled by the automotive sector (EV power electronics, advanced lighting) and industrial machinery; emphasis on quality, reliability, and regulatory compliance.

- Latin America & MEA: Emerging markets with incremental growth, primarily supported by infrastructure development projects, including regional LED lighting adoption and basic communication infrastructure rollout.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Alumina Wafers Market.- Rubicon Technology

- Monocrystal

- Saint-Gobain

- Crystalwise Technology

- Kyocera Corporation

- Coorstek

- Precision Micro-Optics

- Hansol Technics

- DOWA Electronics Materials

- Rorze Corporation

- GT Advanced Technologies

- Procrystal

- SUSS MicroTec

- II-VI Incorporated (Coherent)

- Sumitomo Electric Industries

- Namiki Precision Jewel Co., Ltd.

- Crysdot

- Beijing Jite Intelligent Technology Co., Ltd.

- Wafer Works Corporation

- Müller Group

Frequently Asked Questions

Analyze common user questions about the Alumina Wafers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary material driving the growth of the Alumina Wafers Market?

The primary material fueling market growth is single-crystal sapphire (Al2O3), which is essential for manufacturing high-brightness Light Emitting Diodes (LEDs) and Gallium Nitride (GaN) based power and high-frequency electronic devices due to its superior thermal stability and electrical insulation properties.

Which application segment holds the largest share in the consumption of alumina wafers?

Solid State Lighting (SSL), encompassing the production of various LEDs for general illumination, automotive, and display backlights, currently represents the largest application segment consuming alumina (sapphire) wafers globally, demanding high volumes of 4-inch and 6-inch substrates.

How does the adoption of 5G technology specifically impact the demand for alumina wafers?

5G technology significantly increases the demand for alumina wafers because high-frequency Radio Frequency (RF) components and filters require robust, low-loss, and thermally stable substrates. Alumina’s excellent dielectric constant makes it the material of choice for fabricating these crucial high-performance components.

What technological advancement is most critical for improving LED efficiency on sapphire substrates?

The most critical advancement is Patterned Sapphire Substrate (PSS) technology. PSS involves etching microscopic patterns onto the wafer surface before epitaxial growth, which significantly enhances the light extraction efficiency of LEDs by reducing total internal reflection, thereby boosting overall device performance.

What is the main challenge faced by manufacturers in producing large-diameter alumina wafers?

The main challenge is maintaining high crystalline quality and minimizing defects (such as internal stress and dislocations) across larger diameter boules (6-inch and 8-inch). Achieving this requires significant capital investment in advanced crystal growth equipment like HEM or EFG and stringent process control to ensure consistent surface uniformity for subsequent epitaxial processing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager