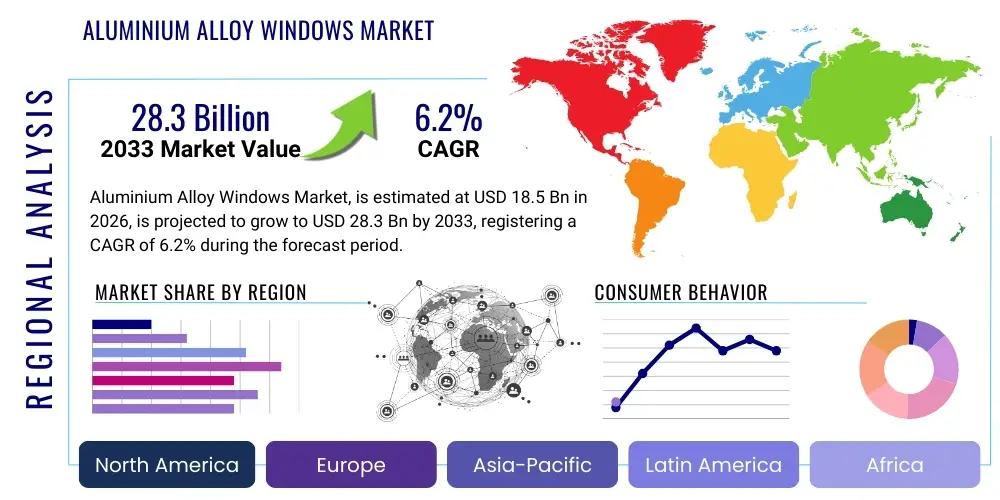

Aluminium Alloy Windows Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434944 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Aluminium Alloy Windows Market Size

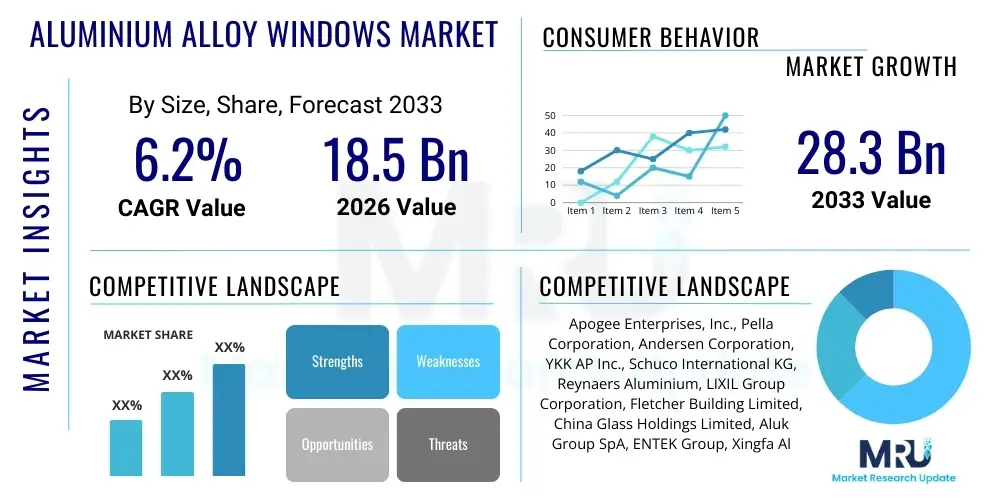

The Aluminium Alloy Windows Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 18.5 billion in 2026 and is projected to reach USD 28.3 billion by the end of the forecast period in 2033.

Aluminium Alloy Windows Market introduction

The Aluminium Alloy Windows Market encompasses the manufacturing, distribution, and sale of window systems primarily fabricated from aluminum alloys, valued for their durability, light weight, design versatility, and corrosion resistance. These products are critical components in both residential and commercial construction, offering superior structural integrity compared to traditional materials, enabling the creation of large, aesthetically modern apertures that maximize natural light penetration. Contemporary market demand is increasingly focused on high-performance solutions, requiring advanced glazing and integral thermal break technologies to significantly enhance insulation properties. This focus ensures compliance with evolving global mandates aimed at reducing carbon footprints in the built environment, positioning aluminum windows as a premium, sustainable choice for modern architecture globally. The foundational appeal of aluminum lies in its high strength-to-weight ratio, which allows for slender frame profiles and expansive glass areas, highly sought after in contemporary urban design, making them ideal for high-rise applications where weight reduction is crucial without sacrificing wind load resistance or overall stability.

The primary applications of aluminum alloy windows span across the entire construction sector, ranging from iconic high-rise commercial buildings and modern, dense residential complexes to essential institutional facilities such, as advanced educational campuses and healthcare centers, alongside substantial involvement in refurbishment projects. Key benefits driving widespread adoption include exceptional longevity, resistance to weathering and corrosion, and minimal maintenance requirements over the product lifecycle, which offers substantial cost advantages compared to materials requiring frequent treatment or replacement. Crucially, aluminum is infinitely recyclable without loss of quality, contributing directly to the circular economy and aligning with strict corporate sustainability goals and international green building standards. The durability profile makes these windows particularly suitable for harsh climates, including regions with high humidity, seismic activity, or extreme temperature fluctuations, guaranteeing reliability and minimizing the need for premature replacement, thereby reducing lifecycle costs for building owners and managers significantly.

Driving factors for sustained market expansion include the accelerating pace of global urbanization, particularly across emerging economies in Asia and Africa, which generates immense demand for new building infrastructure. Furthermore, significant governmental investment in infrastructure renewal and sustainable housing initiatives worldwide provides a reliable stimulus, often accompanied by favorable tax incentives for energy-efficient upgrades. Favorable regulatory frameworks, especially those mandating higher levels of energy efficiency in new and renovated buildings (such as tightening U-value requirements across Europe and North America), compel developers to specify high-performance window systems, thereby fueling the demand for advanced thermal break aluminium solutions. Technological innovations, including precision CNC machining, optimized extrusion techniques, and automated assembly processes, are continuously enhancing product quality while driving down long-term manufacturing costs, making sophisticated aluminum window systems accessible to a broader range of construction projects globally, further strengthening market penetration against competing materials like PVC and wood by offering a superior balance of performance, aesthetics, and structural longevity, especially in large-format applications.

Aluminium Alloy Windows Market Executive Summary

The Aluminium Alloy Windows Market is strategically repositioning itself, moving away from simple commodity production toward specialized, high-performance architectural solutions. Current business trends are marked by intensified merger and acquisition activities, where larger manufacturers are acquiring specialized component suppliers, particularly those proficient in high-end thermal insulation materials and proprietary hardware systems. This strategy aims to secure intellectual property, enhance vertical integration, and ensure control over crucial supply chains, thereby mitigating risks associated with component sourcing and guaranteeing product quality consistency necessary for achieving top-tier environmental certifications like LEED Platinum or equivalent regional standards. Manufacturers are also increasingly investing in digitalization, leveraging Building Information Modeling (BIM) compatibility and advanced quotation software to streamline complex project specifications and accelerate time-to-market for customized orders, focusing on offering end-to-end solutions including technical design consultation and certified installation services rather than just basic product supply, fostering deeper relationships with architectural firms and large-scale property developers seeking integrated solutions.

From a geographical perspective, the market displays significant regional polarization regarding performance requirements and growth momentum. The Asia Pacific region retains its lead in overall volume due to relentless construction growth, with market players focused on scalability and cost-efficiency in volume production. Conversely, mature markets like Europe and select parts of North America prioritize product sophistication, demanding multi-chambered thermal break systems, triple glazing, and exceptional airtightness capabilities to satisfy ambitious net-zero energy targets. This regional divergence necessitates highly flexible manufacturing footprints, enabling companies to quickly adapt product lines to meet varying local climate needs, safety codes (e.g., impact resistance, seismic ratings), and aesthetic preferences, making localized R&D, product testing, and regional certification compliance a critical competitive factor for global players seeking balanced market presence across diverse economies, ensuring their portfolio addresses both high-volume standardized needs and specialized custom orders.

Segmentation analysis highlights sustained and accelerating growth in the renovation and replacement sector across developed economies, driven heavily by regulatory mandates and financial incentives for improving the thermal performance of existing housing and commercial building stock, providing a stable long-term revenue stream independent of volatile new construction cycles. In product terms, specialized sliding and lift-and-slide door systems, often incorporating large aluminium profiles to support expansive glass, are gaining significant traction in high-end residential and hospitality segments due to their exceptional operational smoothness and ability to create vast, unobstructed views and seamless indoor-outdoor transitions. The commercial segment continues its trajectory toward custom curtain wall and strip window systems utilizing robust aluminum alloys, primarily driven by the corporate desire for visually striking, light-filled office environments that meet high standards of environmental sustainability. Sustainability remains a powerful underlying segment trend, with procurement increasingly favoring manufacturers who can reliably demonstrate low embodied carbon through the utilization of high percentages of certified recycled aluminum content in their final products, influencing large institutional and corporate buying decisions through formalized supply chain vetting and reporting requirements.

AI Impact Analysis on Aluminium Alloy Windows Market

Common user questions regarding AI's influence consistently investigate its capacity to redefine manufacturing precision, predict material requirements, and fundamentally alter the architectural design process in the Aluminium Alloy Windows sector. Users are particularly interested in how Artificial Intelligence can move quality control from batch sampling to 100% continuous inspection, ensuring every window frame meets stringent thermal and structural specifications while simultaneously minimizing costly rework and material waste. A core theme is the expectation that AI will optimize the inherently complex supply chain—forecasting demand fluctuations based on real-time construction activity indicators and adjusting inventory levels of specialized components like thermal break strips and unique hardware, thereby protecting against unexpected price spikes and delivery delays in a highly competitive and material-intensive industry environment.

The introduction of AI algorithms into the production environment promises to significantly enhance operational efficiencies, starting with the complex extrusion process. AI-powered software analyzes sensor feedback from the presses to fine-tune temperature, speed, and pressure parameters in real-time, ensuring optimal material flow and profile consistency, which is crucial for achieving high-tolerance fits required for effective thermal breaks. Furthermore, sophisticated machine learning models can process vast amounts of historical fabrication data to identify patterns leading to material defects or premature equipment wear, implementing predictive maintenance schedules that drastically reduce unplanned downtime and extend the lifecycle of expensive production machinery, translating directly into lower unit manufacturing costs and faster fulfillment cycles for developers who depend on reliable delivery timelines for large projects, securing a substantial competitive advantage for early AI adopters.

AI also serves as a transformative tool in the pre-construction phase. Generative design platforms, utilizing complex machine learning to analyze factors such as regional climate data, building orientation, energy consumption modeling, and regulatory compliance standards, can rapidly iterate and suggest optimized window frame geometries, glass specifications, and shading solutions. This capability allows architects and engineers to quickly move toward the highest performing solution for a given project, minimizing the need for extensive manual simulation and testing. For the end customer, AI-driven digital configurators use immersive technologies like Augmented Reality (AR) to overlay bespoke aluminum window designs onto existing or planned structures, providing immediate visual confirmation and precise costing, thereby dramatically improving the accuracy and speed of the sales quotation process for highly customized, high-value installations, enhancing customer engagement and satisfaction.

- AI-driven Predictive Maintenance: Minimizing machinery downtime in extrusion plants through early detection of mechanical anomalies, resulting in maximal machine uptime and stable production schedules.

- Generative Design Optimization: Utilizing machine learning to rapidly simulate and create highly energy-efficient window profiles and material combinations based on micro-climate data and specific structural requirements, optimizing material usage.

- Automated Quality Control: Implementing high-speed, vision-based AI systems capable of 100% inspection of frame welds, surface finishes, and gasket seating for dimensional accuracy and flaw detection far surpassing manual capabilities, ensuring consistent quality.

- Supply Chain Forecasting: Optimizing aluminum billet procurement and complex component inventory management by analyzing regional construction project pipelines, weather forecasts, and historical market volatility trends, improving cost control.

- Enhanced Customer Configuration: Leveraging AI/AR interfaces to provide immersive, personalized visualization and instant, accurate quoting for complex, custom window solutions, significantly shortening the sales cycle and reducing order errors.

- Robotics Integration: Implementing AI to govern advanced robotic systems for precise, high-volume handling, assembly, and secure glazing processes, enhancing both worker safety and product consistency and speeding up fabrication time.

- Energy Performance Simulation: AI models accelerating the simulation of thermal performance (U-values and SHGC) for new designs, ensuring compliance before expensive physical prototyping is initiated, reducing R&D costs.

DRO & Impact Forces Of Aluminium Alloy Windows Market

The operational landscape of the Aluminium Alloy Windows Market is intensely governed by a dynamic interaction between influential Drivers, restrictive Restraints, and latent Opportunities, collectively shaping the strategic direction and investment priorities of market players. The principal drivers are centered on global regulatory tailwinds promoting sustainable construction—namely, stricter government mandates on building energy performance that necessitate the use of high-efficiency framing and glazing systems, particularly in mature economies. The inherent material advantages of aluminum, including its exceptional durability, minimal lifetime maintenance requirements, and full recyclability, strongly position it as the preferred material for long-term construction investments, favored by lifecycle assessment models. Furthermore, demographic shifts, particularly rapid global urbanization and the rising middle class in APAC, sustain substantial demand for modern, architecturally impressive, and structurally sound window solutions in both new and existing infrastructure projects, requiring vast manufacturing scale and reliable supply chains to meet the sheer volume of demand in these rapidly expanding regions.

Despite strong underlying demand, the market faces formidable restraints that challenge profitability and market access. The most significant financial constraint is the acute volatility and elevated cost of primary aluminum feedstock, which is often tied to global energy prices and geopolitical stability, making accurate cost projection difficult for manufacturers and impacting final product pricing competitiveness. Secondly, the market is constrained by intense price competition from low-cost substitute materials, particularly high-volume PVC (vinyl) windows, which often satisfy baseline performance requirements at a significantly lower initial cost, capturing a substantial share of the economy and mid-range residential sectors, particularly in cost-sensitive markets. Additionally, the technical complexity and specialized capital investment required to implement the most advanced multi-chamber thermal break technologies necessary for top-tier energy performance can create high barriers to entry and limit production scalability for smaller regional players who cannot afford the specialized equipment and intellectual property licenses required for top performance systems.

Opportunities for exponential market growth reside primarily in the technological realm and expansion into underserved segments. The burgeoning smart windows market, integrating IoT capabilities for environmental control and security, represents a significant premiumization opportunity, allowing manufacturers to capture higher margins by offering added value beyond basic protection and integrating seamlessly into modern building management systems. The vast market potential in retrofitting and renovation projects across mature economies, particularly those targeting historical or underperforming commercial and residential buildings, provides a consistent, recession-resistant revenue stream focused on energy performance upgrades, often backed by attractive government subsidies or mandates. Companies focusing on R&D to develop innovative, cost-effective thermal break materials and streamlining automated fabrication processes to absorb raw material price increases are best poised to capitalize on these opportunities and consolidate market leadership, navigating the competitive and regulatory pressures effectively by offering superior certified performance.

Analyzing the impact forces through a modified Porter’s lens reveals the high bargaining power of key raw material suppliers (primary aluminum producers), due to the oligopolistic structure of the global aluminum market, exerting upward pressure on manufacturing costs and influencing long-term contractual obligations. Buyer power is moderate but highly influential; large real estate developers leverage high volume requirements for competitive pricing and stringent performance guarantees, while individual consumers wield lower influence but demand high customization and robust warranties. The threat of substitutes, dominated by high-performance vinyl and wood composites, remains substantial, particularly in segments where thermal performance parity can be achieved at lower cost. Competitive rivalry among existing players is intense, characterized by continuous product feature enhancement, strategic pricing, and aggressive expansion into high-growth regions like APAC and the Middle East, necessitating continuous innovation in thermal efficiency and aesthetic design to maintain differentiation and market relevance against both high-end and low-cost competitors.

Segmentation Analysis

The Aluminium Alloy Windows Market is highly segmented, allowing for precise market targeting based on product characteristics, end-user applications, and operational requirements. The fundamental segmentation provides a granular view of demand distribution, helping stakeholders tailor their manufacturing and marketing strategies to specific regional and consumer needs. Key segmentation criteria include the type of window (casement, sliding, fixed), the type of material finish (anodized, powder coated), the installation type (new construction vs. replacement), and crucially, the end-use sector, which defines performance criteria such as thermal insulation, sound dampening, and wind load resistance. The shift towards higher performance categories across all segments reflects the global drive for energy efficiency in both commercial and residential buildings, pushing even standard segment products towards adopting improved thermal separation techniques.

The dominance of the residential segment in volume terms is being challenged by the rapid growth of the commercial segment, particularly in high-density urban areas requiring sophisticated, large-format window wall systems for modern offices and hotels. Within the product type segmentation, the popularity of sliding and bi-fold configurations continues to surge, driven by modern architectural preferences that seek to maximize natural light and usable space, often integrating these large openings with outdoor living areas. The renovation segment, specifically, demands highly adaptable and customizable products that can fit varied existing structural openings while delivering modern energy performance, driving innovation in adjustable frame systems and modular installation techniques.

- By Product Type:

- Sliding Windows

- Casement Windows

- Fixed Windows

- Tilt-and-Turn Windows

- Bi-fold Windows

- By Application:

- Residential (Single-family, Multi-family)

- Commercial (Office Buildings, Retail, Hospitality)

- Industrial

- By End-Use Sector:

- New Construction

- Renovation and Replacement

- By Frame Finish:

- Anodized (Natural, Colored)

- Powder Coated (Standard, High-performance PVDF)

- Other (E.g., Wood Grain Sublimation)

Value Chain Analysis For Aluminium Alloy Windows Market

The value chain for the Aluminium Alloy Windows Market begins with upstream activities focused on raw material sourcing, primarily bauxite mining, aluminum smelting (an extremely energy-intensive process), and the subsequent alloying process to create extrusion billets. This initial stage is heavily influenced by global commodity markets and energy prices and is dominated by large-scale global commodity producers, giving them significant pricing power over midstream manufacturers. Midstream operations involve the intricate extrusion of aluminum profiles using precision dies, mandatory surface treatments (anodizing, powder coating to prevent corrosion), and the integration of critical components like high-performance glass panels (glazing), hardware, and essential thermal break materials. Efficiency and precision in profile extrusion are paramount value drivers at this stage, as dimensional accuracy directly influences the structural integrity and thermal performance rating of the final product system.

Downstream activities include the final fabrication, assembly, distribution, and critical on-site installation of the fully configured window systems. Fabrication often involves highly customized cutting, machining, and assembly based on specific architectural drawings provided by clients, requiring specialized CNC machinery and a highly skilled technical workforce to manage the complex joining processes, especially for thermally broken systems. Distribution channels are highly varied: large manufacturers often employ direct sales teams for large commercial developers and institutional clients, ensuring tight specification control. In contrast, indirect channels rely on regional wholesalers, specialized building material distributors, and local fabricators who cater effectively to smaller contractors and the high-volume renovation market, managing inventory closer to the point of use.

Direct channels, favored for large-scale, architecturally specific commercial projects, allow manufacturers tighter control over product pricing, quality assurance, and installation compliance, fostering direct relationships with influential architects and specifiers who drive material selection. Indirect channels, essential for maximizing reach in the high-volume residential and dispersed renovation markets, rely heavily on the established logistical efficiency and installation expertise of intermediaries who can manage localized inventory, offer credit terms, and provide necessary post-sale support. Given the complexity and performance criticality of modern fenestration (especially high-performance thermally broken systems), rigorous training across all distribution and installation points is paramount to ensure correct assembly and field installation, which is absolutely crucial for achieving the intended energy performance ratings and minimizing costly warranty claims post-occupancy.

Aluminium Alloy Windows Market Potential Customers

Potential customers for Aluminium Alloy Windows are fundamentally segmented based on the scale and complexity of the construction activity, ranging from massive multinational real estate conglomerates and institutional developers to individual homeowners undertaking personalized renovation projects. Large-scale property developers, particularly those focused on high-rise commercial offices, luxury residential towers, mixed-use developments, and institutional complexes (e.g., corporate headquarters, cutting-edge hospitals), constitute the primary high-volume buyers. These sophisticated customers prioritize verified performance specifications, adherence to strict project deadlines, and the ability to source bespoke, architecturally integrated window systems that comply with global sustainability standards like LEED, BREEAM, or regional equivalents, often making procurement decisions based on documented long-term lifecycle costs and superior aesthetic integration over initial unit price.

The second major segment encompasses general contractors, project management firms, and specialized glazing contractors, who procure aluminium windows as part of broader construction packages and are responsible for the execution and integration on site. These intermediary buyers prioritize reliable, just-in-time supply chains, ease of physical installation, and competitive bulk pricing, acting as the critical link between the manufacturer and the end-client's architect or property owner. Furthermore, public sector organizations—including governmental agencies responsible for affordable housing, public schools, military facilities, and transportation infrastructure—represent a substantial and stable customer base. Procurement in this sector is characterized by a focus on standardized specifications, strict compliance with local safety and environmental codes, competitive tendering, and robust long-term performance guarantees, often favoring manufacturers who demonstrate a stable track record and local content fulfillment capabilities.

Finally, the rapidly expanding renovation and retrofitting market targets individual homeowners, small builders, and property management companies seeking to upgrade existing structures for significantly improved energy efficiency, modern aesthetics, and enhanced acoustic performance. This segment, primarily serviced through retail channels, authorized distributors, and small to medium-sized local fabricators, requires product flexibility, strong technical support for measurement and custom fitting, and accessible financing options for home improvements. Demand here is often directly influenced by regional energy efficiency rebate programs and increasing consumer awareness regarding the potential long-term utility savings and improved comfort associated with replacing single-pane or poorly insulated legacy window systems with modern thermal break aluminum units.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 28.3 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Apogee Enterprises, Inc., Pella Corporation, Andersen Corporation, YKK AP Inc., Schuco International KG, Reynaers Aluminium, LIXIL Group Corporation, Fletcher Building Limited, China Glass Holdings Limited, Aluk Group SpA, ENTEK Group, Xingfa Aluminium Holdings Limited, SAPA Building Systems, Kawneer Company, Alsco Metals Corporation, Veka AG, Rehau AG + Co, Guangdong Kin Long Hardware Products Co. Ltd., Aluprof S.A., Technal (Hydro Building Systems) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminium Alloy Windows Market Key Technology Landscape

The technological landscape underpinning the Aluminium Alloy Windows Market is undergoing rapid transformation, largely driven by the imperative for enhanced energy efficiency and seamless architectural integration. The central pillar of this evolution is the sophisticated engineering of the "thermal break," which involves using advanced, low-conductivity polymers, such as reinforced polyamides or specialized structural resins, precisely inserted into the hollow cavities of the aluminum frame profiles. Innovations here focus on developing multi-chambered and labyrinthine thermal breaks that maximize the air gap and minimize conductive heat transfer, thereby achieving industry-leading U-values (thermal transmittance coefficients) essential for compliance with stringent standards like Passive House or Net-Zero Energy requirements. Ongoing research explores the integration of composite materials directly within the frame structure to further reduce thermal bridging without compromising the structural integrity that aluminum is known for, pushing the envelope of material science in fenestration and offering designers new material combinations.

Complementary technological advancements are concentrated in glazing systems and surface durability. Modern aluminum windows universally employ advanced glazing options, including triple-pane insulation units utilizing low-emissivity (Low-E) coatings tailored to specific climate zones (optimizing either solar heat gain or heat retention) and filled with inert gases like argon or krypton. Breakthrough technologies such as Vacuum Insulated Glazing (VIG) are emerging, offering thermal performance comparable to a solid wall within a slim profile, although high production costs currently limit VIG to specialized, high-premium applications where maximum insulation with minimal frame depth is required. Simultaneously, surface treatment processes have advanced dramatically: while anodizing remains crucial for high corrosion resistance, high-performance powder coating utilizes multi-layer application techniques and specialized fluoropolymer resins (like PVDF) to ensure colorfastness and exceptional resistance to UV degradation, scratching, and industrial pollutants, guaranteeing aesthetic longevity in demanding urban or coastal environments and minimizing lifetime maintenance costs.

Furthermore, digital technologies and automated manufacturing are revolutionizing the production floor. The adoption of advanced Computer Numerical Control (CNC) machining centers allows for micron-level precision in profile cutting, drilling, and drainage hole creation, which is vital for perfect frame assembly and long-term water resistance, particularly for high-volume orders. Robotics are increasingly used for high-throughput, repetitive tasks such as sealant application, gasket insertion, and heavy glass unit lifting and placement, significantly improving production speed and consistency while mitigating workplace safety risks associated with handling heavy, large-format glass. Crucially, the integration of Building Information Modeling (BIM) software tools enables seamless collaboration; manufacturers provide detailed BIM objects of their window systems, allowing architects to integrate precise thermal and structural data directly into their models, minimizing design clashes, improving accuracy of energy performance projections, and streamlining the entire construction documentation process from initial specification to final installation, enhancing project efficiency across the entire construction lifecycle.

Regional Highlights

- Asia Pacific (APAC): Dominates the market both in production capacity and consumption volume, fueled by unprecedented rates of urbanization and massive government investments in infrastructure and smart city development across China, India, and Indonesia. While the base market historically prioritized cost over high thermal performance, there is a distinct, rapid shift in tier-one cities towards high-end, thermally improved aluminum systems driven by rising quality expectations and the proliferation of international corporate headquarters and luxury residential projects. Regional market strategies focus on establishing vast, localized supply chains and adapting product lines to handle the diverse climate requirements, ranging from the humid, tropical conditions of Southeast Asia to the cold, continental climate of Northern China, requiring versatile and adaptable manufacturing processes.

- Europe: The most technologically mature market segment, characterized by extremely high regulatory pressure centered on achieving near-zero energy building standards (NZEB). Key markets such as Germany, the Nordic countries, and the UK exhibit overwhelming demand for advanced aluminum systems featuring deep thermal breaks, multiple sealing levels, and triple-glazing to minimize heat loss and maximize airtightness. The market's vitality is significantly driven by the substantial renovation and retrofitting sector, where stringent government incentives and penalties compel building owners to upgrade inefficient legacy window systems, guaranteeing stable, high-value demand. Competition here is based on sophisticated certifications, system integration complexity, and providing comprehensive technical consultancy services.

- North America: Presents a highly demanding market where product performance must satisfy extreme variations in climate, ranging from harsh northern winters to severe coastal weather events. The market emphasis is strongly placed on energy performance (measured via NFRC standards) and structural resilience, particularly high-impact and hurricane-resistant glazing required in the Southeast and Gulf Coast regions. Market growth is stable, underpinned by a robust single-family and multi-family residential sector and continuous investment in high-performance commercial and institutional buildings. Key strategies involve optimizing distribution logistics and providing strong, extended warranties reflecting the high quality and performance demands of the local consumer base, particularly against weather-related failures.

- Latin America (LAMEA): Showing consistent, moderate growth tied to economic stability and new urban development, particularly in economic hubs like São Paulo, Santiago, and Mexico City. The market is highly sensitive to pricing, often leading to preference for standard aluminum profiles without complex thermal breaks, especially in regions with milder climates where insulation is less critical. However, the premium segment—luxury residential and international commercial construction—is rapidly adopting advanced European and North American specifications, creating a tiered market where high efficiency solutions coexist alongside high-volume, standardized products. Improving regulatory focus on local building codes is expected to gradually elevate minimum required performance standards across the board, driving long-term change.

- Middle East and Africa (MEA): This region is characterized by exceptionally high growth potential, fueled by large-scale sovereign wealth fund projects in the GCC states (Saudi Arabia, UAE, Qatar) focusing on ambitious developments like NEOM and new metropolitan centers. The primary technical requirement is the management of extreme solar heat gain and intense UV exposure, driving demand for specialized solar-control glazing and robust, highly durable frame finishes (like PVDF coatings) capable of withstanding desert conditions. Installation complexity and the need for systems that resist sand and dust ingress are also critical factors for success. Africa presents a nascent market, with growth concentrated in major economic capitals requiring basic to mid-range performance windows for commercial infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminium Alloy Windows Market.- Apogee Enterprises, Inc.

- Pella Corporation

- Andersen Corporation

- YKK AP Inc.

- Schuco International KG

- Reynaers Aluminium

- LIXIL Group Corporation

- Fletcher Building Limited

- China Glass Holdings Limited

- Aluk Group SpA

- ENTEK Group

- Xingfa Aluminium Holdings Limited

- SAPA Building Systems (part of Hydro Extrusion)

- Kawneer Company (part of Arconic)

- Alsco Metals Corporation

- Veka AG

- Rehau AG + Co

- Guangdong Kin Long Hardware Products Co. Ltd.

- Aluprof S.A.

- Technal (Hydro Building Systems)

Frequently Asked Questions

Analyze common user questions about the Aluminium Alloy Windows market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Aluminium Alloy Windows Market?

The Aluminium Alloy Windows Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033, driven primarily by increasing global construction activities, stringent energy efficiency mandates, and sustained demand for durable, low-maintenance building envelopes.

How do aluminum alloy windows contribute to energy efficiency?

Modern aluminum alloy windows significantly enhance energy efficiency through the integration of sophisticated thermal break technology—low-conductivity insulating strips inserted into the frame—combined with high-performance glazing systems featuring Low-E coatings and inert gas fills, which effectively minimize heat transfer and optimize the building’s thermal performance to meet regulatory standards.

Which region dominates the global market for aluminium alloy windows?

The Asia Pacific (APAC) region currently dominates the global market for aluminium alloy windows, both in terms of production capacity and volume consumption, a position primarily secured by the accelerated pace of urbanization and large-scale commercial and residential construction projects across major economies like China, India, and Southeast Asian nations.

What are the primary restraints affecting the growth of this market?

The primary restraints include the significant volatility and high cost of primary aluminum feedstock, which introduces financial uncertainty for manufacturers, and the persistent, intense price competition stemming from high-volume, lower-cost substitute materials, particularly PVC (vinyl) window systems, in the mass market segments.

What role does smart technology play in the future of aluminum windows?

Smart technology is critical for market evolution, involving the integration of automated features such as electrochromic (switchable) glass, integrated ventilation sensors, and security monitoring directly into the window system, positioning the product as an active, controllable component of comprehensive smart building management systems and achieving higher performance metrics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager