Aluminium Coated Glass Cloth Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433147 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Aluminium Coated Glass Cloth Market Size

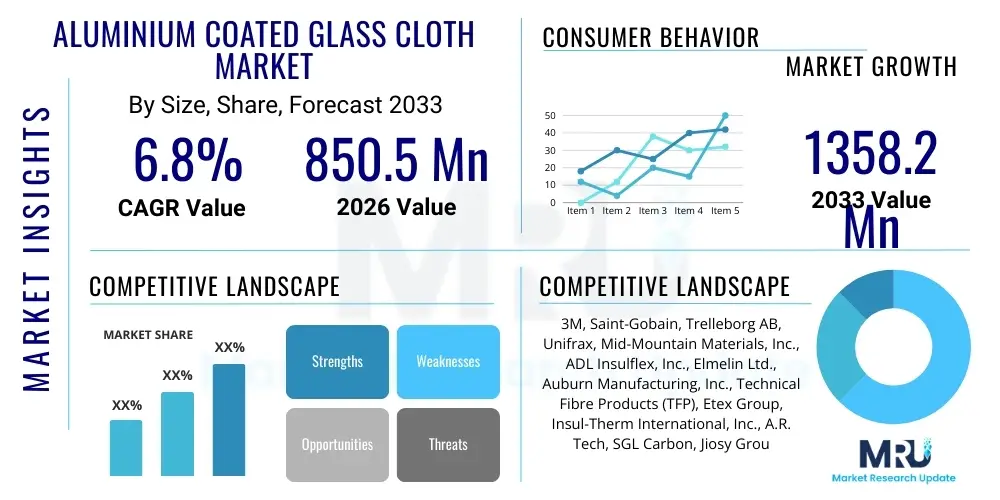

The Aluminium Coated Glass Cloth Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1358.2 Million by the end of the forecast period in 2033.

Aluminium Coated Glass Cloth Market introduction

The Aluminium Coated Glass Cloth market encompasses advanced textile materials engineered for high-temperature insulation, radiant heat shielding, and protective jacketing across diverse industrial and commercial applications. This specialized material combines the structural integrity and high thermal resistance of woven fiberglass fabric with the superior reflectivity and vapor barrier properties of a metallic aluminum layer. The coating process, often involving lamination or vapor deposition, ensures strong adhesion and durability, resulting in a flexible yet robust thermal barrier capable of withstanding continuous operating temperatures and short bursts of extreme heat.

The product is fundamentally utilized where passive fire protection and energy efficiency are paramount. Major applications span critical infrastructure, including aviation, where lightweight fire barriers are mandatory; automotive manufacturing, particularly in engine compartments and exhaust systems for heat management; and heavy industries such as petrochemical and power generation for insulating pipes, equipment, and personnel protection. The inherent benefits of aluminium coated glass cloth, such including low thermal conductivity, excellent dimensional stability, and resistance to chemicals and abrasion, position it as an indispensable material in environments demanding stringent safety standards and longevity.

The market growth is primarily propelled by stringent global regulatory frameworks mandating superior fire safety standards in building and transportation sectors, particularly in developed economies. Furthermore, the increasing global focus on energy conservation drives demand for high-performance insulation materials to minimize heat loss in industrial processes. The continuous expansion of complex manufacturing sectors and rapid urbanization, particularly in the Asia Pacific region, necessitate resilient and durable insulation solutions, thereby serving as core driving factors for market expansion and technological refinement in coating techniques.

Aluminium Coated Glass Cloth Market Executive Summary

The Aluminium Coated Glass Cloth Market is poised for substantial growth, driven significantly by escalating demand from the automotive and aerospace sectors for lightweight thermal management solutions and fire protection systems. Current business trends indicate a strong industry focus on developing environmentally friendly, solvent-free coating technologies to comply with evolving environmental regulations, alongside an increasing preference for customized products tailored to specific temperature profiles and mechanical stress requirements in complex industrial setups. Key market participants are investing heavily in improving the flexibility and tear resistance of the final composite material to enhance ease of installation and product longevity in demanding operational environments, leading to a surge in specialized product offerings catering to niche applications like cryogenic insulation jacketing and high-frequency noise dampening, thus broadening the market scope beyond traditional thermal barriers.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by unprecedented infrastructure development, rapid industrialization, and massive investment in automotive and electric vehicle (EV) manufacturing facilities across countries like China, India, and South Korea, which inherently require robust thermal insulation for battery packs and critical components. North America and Europe, while mature markets, continue to demonstrate stable demand, focusing on replacement cycles and the adoption of high-specification, premium-grade materials driven by stringent domestic fire codes and energy efficiency mandates, particularly in the industrial processing and oil and gas sectors, where material failure risk is acutely sensitive to operational continuity. This dual-speed market dynamic—high volume growth in APAC and high-value stability in the West—defines the overall global landscape.

Segmentation trends show that the application segment dominated by industrial insulation remains the largest contributor to revenue, primarily due to the vast installed base of piping, boilers, and turbine equipment requiring constant thermal protection and maintenance. However, the automotive segment, spurred by the electrification trend and the need to thermally isolate high-voltage components and battery systems, is projected to register the fastest growth rate throughout the forecast period. Furthermore, within the product type segmentation, the adhesive-backed variants are gaining significant traction, particularly in HVAC and construction applications, owing to their enhanced ease of application, reduced installation time, and improved sealing capabilities, which collectively lower the total cost of ownership for end-users implementing comprehensive insulation strategies across large-scale projects.

AI Impact Analysis on Aluminium Coated Glass Cloth Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Aluminium Coated Glass Cloth Market primarily revolve around optimizing manufacturing efficiency, predicting material performance under stress, and enhancing supply chain resilience. Users are keen to understand how AI-driven predictive maintenance models can utilize sensor data collected from insulated systems to anticipate material degradation or failure points in the coated glass cloth, ensuring timely replacement and reducing costly downtime in critical industrial applications such as high-pressure steam lines or chemical reactors. Furthermore, there is significant interest in applying machine learning algorithms to rapidly analyze material composition variations and coating thickness consistency during production, aiming to achieve zero-defect manufacturing and ultra-precise quality control for aerospace and defense-grade products, which require exceptional consistency and reliability. The key concerns center on the initial investment required for digitalization and the potential data privacy risks associated with integrating smart manufacturing systems across globally dispersed production sites, alongside expectations that AI will ultimately streamline inventory management by forecasting demand fluctuations more accurately based on real-time construction and manufacturing project timelines.

The implementation of AI and related technologies, such as advanced data analytics and the Industrial Internet of Things (IIoT), is fundamentally shifting the operational paradigm within the specialized textiles industry. For the Aluminium Coated Glass Cloth sector, AI algorithms are now being deployed to analyze complex variables—including furnace temperature stability, aluminum particle dispersion, and curing times—to optimize the lamination or vapor deposition processes, leading to reduced material wastage and improved product uniformity. This advanced process control minimizes batches that might fall outside stringent performance specifications, such as radiant heat reflectivity thresholds or adhesion strength limits, directly impacting profitability and material consistency, which is crucial for safety-critical applications.

Beyond the manufacturing floor, AI is playing an increasingly vital role in product development and R&D. Machine learning models are being utilized to simulate the thermal performance of new composite structures before physical prototyping, allowing manufacturers to quickly iterate on designs involving varied glass cloth weaves, coating thicknesses, and binding agents. This accelerated simulation capability drastically cuts down the time-to-market for specialized heat shields designed for emerging technologies, such as high-temperature environments found in new generation jet engines or concentrated solar power (CSP) facilities. Moreover, the integration of AI-powered demand forecasting tools helps producers manage highly volatile raw material pricing for aluminum and fiberglass, providing a crucial competitive edge through optimized procurement strategies and reduced holding costs.

- AI-Driven Quality Control: Enhancing consistency of aluminum coating thickness and adhesion strength via real-time data monitoring and corrective process adjustments.

- Predictive Maintenance Integration: Utilizing sensor data from end-user installations to forecast material degradation and optimize replacement schedules for industrial insulation systems.

- Supply Chain Optimization: Machine learning algorithms forecasting raw material demand (fiberglass, aluminum foil, adhesives) and logistics planning, mitigating price volatility and inventory risk.

- Accelerated R&D: AI simulation of thermal and mechanical performance of new composite material compositions, reducing physical prototyping cycles for niche applications.

- Smart Manufacturing: Deployment of IIoT sensors on coating lines to enable autonomous optimization of curing temperatures and line speeds for maximizing throughput and energy efficiency.

- Enhanced Customization: AI analysis of specific end-user environmental requirements (e.g., chemical exposure, continuous temperature) to suggest optimal material formulations.

DRO & Impact Forces Of Aluminium Coated Glass Cloth Market

The market for Aluminium Coated Glass Cloth is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the core Impact Forces shaping its trajectory. Key drivers include the global push for enhanced fire safety regulations in construction and transportation sectors, particularly the adoption of mandatory non-combustible materials in public spaces and high-rise buildings, coupled with the rapid growth of the electric vehicle (EV) market, which necessitates advanced, lightweight thermal barriers for battery protection and heat management. These legislative and technological drivers create persistent underlying demand for high-performance thermal insulation solutions that only specialized coated glass cloth can effectively meet. Simultaneously, the market faces restraints, primarily stemming from the volatility in the pricing of key raw materials, namely aluminum and high-grade fiberglass yarn, which can compress profit margins and complicate long-term pricing strategies for manufacturers, alongside increasing pressure from sustainable material alternatives that challenge traditional fiberglass composites in certain less-critical applications, pushing manufacturers to continuously innovate their coating and bonding techniques.

Opportunities for market expansion are largely centered on untapped application areas and geographical penetration. The burgeoning hydrogen economy presents a significant opportunity, as the production, storage, and transport of hydrogen gas require extremely rigorous thermal insulation and containment systems, which mandate specialized, non-permeable thermal jacketing materials capable of withstanding ultra-low temperatures and preventing thermal bridging. Furthermore, emerging markets in Southeast Asia and Africa, characterized by rapid industrialization and nascent infrastructure investment, represent significant geographical opportunities for scaling up distribution networks and establishing localized manufacturing facilities to cater to regional safety and energy efficiency needs. The strategic exploitation of these opportunities, alongside managing the fluctuating raw material costs, is paramount for sustainable long-term market leadership.

The impact forces driving the market are dominated by stringent regulatory standards and technological evolution. Regulations such as ISO 15540/15541 in the marine sector or specific FAA/EASA standards for aviation fire barriers compel continuous material upgrades and certification, thereby pushing up the quality threshold for all market participants. The overall impact force is strongly positive, underpinned by the fundamental requirement for energy efficiency (insulation reduces energy consumption) and safety (fire protection saves lives and assets). These dual mandates ensure that demand for reliable thermal and radiant barriers, such as aluminium coated glass cloth, remains structurally embedded in global industrial and infrastructural development cycles, mitigating the effects of periodic economic downturns and justifying premium pricing for certified, high-performance product variants.

Segmentation Analysis

The Aluminium Coated Glass Cloth Market is comprehensively segmented based on fundamental material characteristics, manufacturing methods, and diverse end-use applications, offering a detailed view of the market dynamics within specialized industrial niches. Analyzing the market through these segments reveals critical differences in demand drivers, pricing power, and technological requirements across various applications. The segmentation by thickness, for instance, highlights the trade-off between thermal performance (thicker materials) and flexibility/weight (thinner materials), directly impacting their suitability for different sectors, such as heavy industrial piping versus lightweight aerospace components.

Segmentation by coating method, specifically differentiating between lamination and vacuum deposition techniques, speaks to varying quality standards and production costs. Laminated products often dominate high-volume, cost-sensitive industrial applications, while vacuum deposition (or sputtering) yields superior, highly reflective, and ultra-thin films required for high-precision, demanding environments like certain defense or cleanroom applications, demanding a premium price point. Understanding these technological nuances is crucial for manufacturers tailoring their production capabilities and targeting specific customer needs with high precision and efficacy.

Finally, the application segmentation remains the most critical axis for revenue generation analysis, confirming that the automotive and industrial sectors are the primary consumers, but also revealing rapid growth opportunities in specialized areas such as data center cooling insulation and advanced marine exhaust jacketing. This granular segmentation allows market stakeholders to identify high-growth pockets, allocate R&D resources effectively toward emerging needs, and structure their sales channels to optimally serve distinct groups of end-users with highly specialized technical requirements and purchasing cycles.

- By Thickness

- 0.1mm – 0.3mm (Lightweight thermal barriers, flexible ducts)

- 0.3mm – 0.5mm (Standard insulation jackets, automotive heat shields)

- Above 0.5mm (Heavy-duty industrial blankets, furnace curtains)

- By Application

- Automotive (Engine heat shields, exhaust system wraps, battery thermal isolation)

- Aerospace & Defense (Fire barriers, thermal containment, aircraft insulation blankets)

- Industrial Insulation (Piping, valves, turbines, equipment jacketing)

- Marine (Engine room insulation, exhaust lagging, bulkhead fire protection)

- Construction (HVAC ducting, expansion joint covers, passive fire protection)

- Petrochemical & Oil and Gas (Insulation for processing units and storage tanks)

- By Product Type

- Adhesive-backed (Easy installation, HVAC sealing)

- Non-adhesive (Removable blankets, high-temperature applications)

- By Coating Method

- Lamination (Cost-effective, high volume)

- Vapor Deposition/Sputtering (High reflectivity, precision coating)

Value Chain Analysis For Aluminium Coated Glass Cloth Market

The value chain of the Aluminium Coated Glass Cloth Market begins with the upstream sourcing of raw materials, primarily high-silica fiberglass yarn (E-glass or S-glass) and aluminum foil or vaporized aluminum pellets, alongside specialized high-temperature adhesive systems. The quality and stability of these inputs are critical, as they directly dictate the final product’s thermal and mechanical properties. Manufacturers in this upstream segment are highly fragmented but specialized, focusing on achieving precise weave patterns and purity levels in the glass fiber. Price volatility, particularly in energy-intensive fiberglass production, poses a significant risk at this stage, compelling downstream manufacturers to enter into long-term procurement agreements or vertically integrate to secure a stable supply chain and mitigate cost fluctuations, focusing heavily on sustainability and energy efficiency in fiber production.

The core manufacturing process, or the conversion stage, involves weaving the fiberglass cloth and subsequently applying the aluminum coating, primarily through lamination using specialized binders or through more advanced vacuum deposition techniques for superior reflectivity. This stage is dominated by specialized technical textile producers who possess proprietary coating technologies and deep expertise in achieving durable adhesion and consistent reflectivity across large surface areas. Distribution channels vary significantly: high-volume, standardized products (like HVAC duct wraps) often utilize indirect channels through large industrial distributors and general construction suppliers, leveraging their extensive inventory and logistical networks to reach decentralized construction sites efficiently.

Conversely, customized and high-specification products targeted at aerospace, automotive OEM, or power generation projects typically rely on direct sales models. This direct approach enables technical consultation, joint product development, and precise quality assurance required by highly regulated end-users, ensuring that the material meets specific certification criteria. The downstream activities involve secondary processing, such as cutting, sewing, and fabricating the cloth into finished insulation blankets, jackets, or removable covers, often performed by specialized fabricators before installation by mechanical contractors or specialized insulation service providers at the end-user site, marking the final critical step in the value delivery process and determining installation efficiency and product lifespan in application.

Aluminium Coated Glass Cloth Market Potential Customers

Potential customers for Aluminium Coated Glass Cloth are deeply embedded in sectors that prioritize safety, thermal efficiency, and asset protection against extreme heat and fire hazards. The primary end-users are concentrated within heavy manufacturing, transportation, and infrastructure development projects. These buyers typically include procurement managers at automotive Original Equipment Manufacturers (OEMs) who require compliant materials for firewall insulation and battery thermal management in both traditional and electric vehicles, emphasizing lightweight performance and durability to meet aggressive crash safety standards and thermal runoff mitigation goals, driving high-volume recurring orders based on vehicle production volumes.

Another crucial customer segment involves engineering, procurement, and construction (EPC) firms working on large-scale industrial projects, such as power plants (coal, gas, nuclear), petrochemical refineries, and chemical processing facilities. These customers utilize the coated glass cloth extensively for insulating complex piping networks, turbine exhaust systems, and high-temperature equipment to prevent heat loss, maintain process efficiency, and protect personnel from severe burn risks. Their purchasing decisions are highly influenced by compliance with industry standards (e.g., ASTM, NFPA) and the material's certified long-term resistance to harsh chemical and moisture exposure, making material traceability and certification documentation key purchasing criteria for these highly risk-averse organizations.

Furthermore, specialized fabricators and insulation contractors serve as indirect customers, purchasing the raw coated cloth in bulk rolls and converting it into customized, reusable insulation jackets, flexible duct connectors, and welding curtains for diverse projects, ranging from marine vessels to commercial HVAC systems. Direct end-users also include military and defense organizations requiring highly specified, durable, and fire-resistant materials for naval vessels and specialized ground equipment. These customers are characterized by complex tender processes, extremely rigorous technical specifications, and a significant reliance on materials that offer verified performance data regarding thermal reflectivity and non-combustibility characteristics, driving demand for premium, high-specification products often requiring proprietary formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1358.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M, Saint-Gobain, Trelleborg AB, Unifrax, Mid-Mountain Materials, Inc., ADL Insulflex, Inc., Elmelin Ltd., Auburn Manufacturing, Inc., Technical Fibre Products (TFP), Etex Group, Insul-Therm International, Inc., A.R. Tech, SGL Carbon, Jiosy Group, Industrial Textiles and Plastics (ITP), Thermal Systems Kft, Skellerup, TenCate Protective Fabrics, China Beihai Fiberglass Co., Ltd., Zotefoams plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminium Coated Glass Cloth Market Key Technology Landscape

The technological landscape of the Aluminium Coated Glass Cloth market is defined by continuous innovation focused on enhancing three primary characteristics: reflectivity, durability, and flexibility, alongside a strong drive toward optimizing the coating process for environmental compliance. The lamination technique, while mature and cost-effective for standard industrial grades, is continuously refined through the development of advanced adhesive systems, specifically high-temperature silicone or acrylic-based binders that maintain integrity and adhesion even under sustained exposure to elevated temperatures and moisture, preventing delamination which is a common failure point in conventional coatings. Manufacturers are focused on solvent-free processes to meet stringent VOC emission standards, pushing R&D toward advanced hot-melt and reactive polyurethane adhesive technologies, which offer superior performance without the associated environmental drawbacks of traditional solvent-based systems.

A significant technological shift is observed in the adoption of advanced metallic deposition techniques, such as vacuum sputtering or chemical vapor deposition (CVD), particularly for high-specification products used in aerospace or critical electronics manufacturing. These methods apply a microscopically thin, yet extremely uniform layer of pure aluminum onto the glass fiber surface, resulting in vastly superior radiant heat reflection (often exceeding 95%) and a highly effective vapor barrier. This precision coating minimizes material weight while maximizing thermal performance, making it indispensable for applications where every gram counts, such as aircraft insulation blankets or next-generation rocket engine components, although these processes involve higher capital expenditure and energy consumption compared to simple lamination methods.

Furthermore, research into developing composite structures involves incorporating multilayer designs. This includes sandwiching the aluminium coated cloth with internal layers of ceramic fiber or aerogel-based matting to create ultra-high performance thermal insulation blankets with significantly reduced thickness and improved insulation R-value for confined spaces, such as those found in marine engine rooms or EV battery enclosures. The integration of specialty treatments, such as anti-abrasion coatings and UV stabilizers, is also gaining traction to extend the lifespan of the material when exposed to external environmental factors, ensuring that the critical aluminum reflective layer remains intact and functional throughout the material's service life in highly dynamic and corrosive environments.

Regional Highlights

The market dynamics of Aluminium Coated Glass Cloth vary significantly across key geographical regions, reflecting differences in industrial development, regulatory frameworks, and infrastructural investment patterns. Asia Pacific (APAC) dominates the market in terms of volume and growth rate, primarily driven by expansive urbanization and heavy investment in manufacturing sectors, notably automotive, shipbuilding, and construction, particularly in economic powerhouses like China and India. The immense scale of new infrastructure projects, coupled with a growing awareness and regulatory enforcement of fire safety standards, generates unprecedented demand for both standard and specialized thermal insulation materials for power generation, petrochemical facilities, and commercial buildings.

North America maintains a strong position, characterized by a mature market focused heavily on compliance, quality, and technological innovation. Demand here is stable, largely fueled by replacement cycles in industrial facilities, stringent environmental regulations requiring high-efficiency insulation in oil and gas operations, and robust growth in the aerospace and defense sectors. The U.S. remains the largest consumer in the region, demanding premium, certified materials that meet rigorous FAA and ASTM standards, especially concerning smoke density and non-flammability characteristics for aircraft and specialized military vehicle applications, fostering a market environment where high-value products command premium pricing and certified performance is non-negotiable.

Europe represents another key region, driven by the EU’s ambitious energy efficiency targets (e.g., Energy Performance of Buildings Directive) and stringent fire safety norms, necessitating the widespread adoption of high-performance thermal barriers in renovation and new build projects. The automotive industry in Germany and France, alongside specialized marine construction in Scandinavia, remains a significant consumer base. Moreover, the Middle East and Africa (MEA) exhibit emerging potential, particularly linked to massive investment in oil and gas processing facilities and power generation capacity expansion in the Gulf Cooperation Council (GCC) countries, where extreme ambient temperatures necessitate superior thermal insulation performance to ensure operational efficiency and asset protection.

- Asia Pacific (APAC): Highest growth rate fueled by rapid industrialization, massive automotive production (especially EVs), and large-scale infrastructure development in China, India, and Southeast Asia. Focus on high-volume production and cost-effective solutions.

- North America: Stable, high-value market driven by strict regulatory mandates in aerospace, defense, and high-specification industrial insulation (oil and gas, power generation). Strong demand for materials meeting stringent FAA and ASTM fire safety certifications.

- Europe: Driven by EU energy efficiency mandates and mandatory passive fire protection standards in construction and marine sectors. Focus on sustainable manufacturing processes and highly certified products for advanced industrial applications.

- Latin America (LATAM): Moderate growth supported by fluctuating investment in manufacturing and localized construction booms, particularly in Brazil and Mexico, though regulatory enforcement and quality standards can vary significantly across sub-regions.

- Middle East and Africa (MEA): Emerging demand concentrated in GCC states due to massive investment in petrochemical refineries, power plants, and utilities expansion, where extreme climate conditions mandate superior thermal reflectivity and long-term durability for outdoor applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminium Coated Glass Cloth Market.- 3M

- Saint-Gobain

- Trelleborg AB

- Unifrax

- Mid-Mountain Materials, Inc.

- ADL Insulflex, Inc.

- Elmelin Ltd.

- Auburn Manufacturing, Inc.

- Technical Fibre Products (TFP)

- Etex Group

- Insul-Therm International, Inc.

- A.R. Tech

- SGL Carbon

- Jiosy Group

- Industrial Textiles and Plastics (ITP)

- Thermal Systems Kft

- Skellerup

- TenCate Protective Fabrics

- China Beihai Fiberglass Co., Ltd.

- Zotefoams plc.

Frequently Asked Questions

Analyze common user questions about the Aluminium Coated Glass Cloth market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of aluminium coated glass cloth in industrial applications?

The primary function is to provide highly effective thermal and radiant heat shielding. The fiberglass core offers structural integrity and heat resistance, while the outer aluminum coating reflects up to 95% of radiant heat, serving as a crucial passive fire barrier and energy-efficient insulation jacket for pipes, equipment, and sensitive components in high-temperature environments.

How does the adoption of electric vehicles (EVs) impact the demand for this material?

EV adoption significantly increases demand, particularly for lightweight, high-performance variants. Aluminium coated glass cloth is essential for creating robust thermal barriers and fire containment systems around high-voltage battery packs, mitigating the risk of thermal runaway and ensuring passenger safety under extreme conditions, driving market growth in the automotive sector.

What are the key technical differences between laminated and vacuum-deposited aluminium coatings?

Laminated coatings use high-temperature adhesives to bond aluminum foil to the cloth, offering cost-effectiveness and durability for standard industrial use. Vacuum deposition (sputtering) applies a pure, ultra-thin aluminum film, resulting in superior reflectivity, minimal weight gain, and higher precision suitable for high-specification applications like aerospace and defense, typically commanding a premium price point.

Which region currently represents the largest market share for Aluminium Coated Glass Cloth and why?

Asia Pacific (APAC), particularly driven by China and India, holds the largest market share due to unprecedented growth in industrial infrastructure development, massive automotive production (including EV manufacturing), and increasing government enforcement of enhanced fire safety regulations in large commercial and residential construction projects across the region.

What are the major challenges facing manufacturers in the Aluminium Coated Glass Cloth market?

Major challenges include managing the high volatility and unpredictable pricing of key raw materials, specifically fiberglass yarn and aluminum. Additionally, manufacturers face pressure to continually innovate coating technologies to improve durability and flexibility while adhering to increasingly stringent global environmental regulations regarding VOC emissions from adhesive systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager