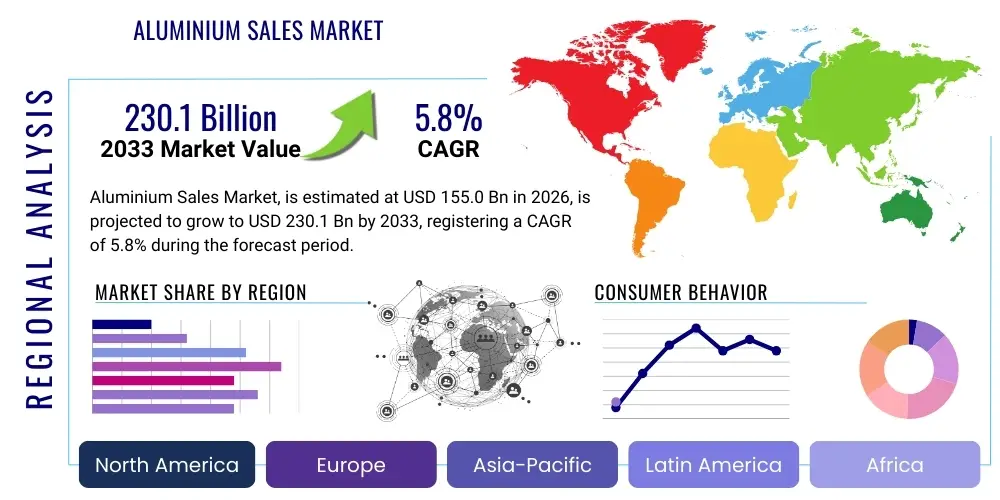

Aluminium Sales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435619 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Aluminium Sales Market Size

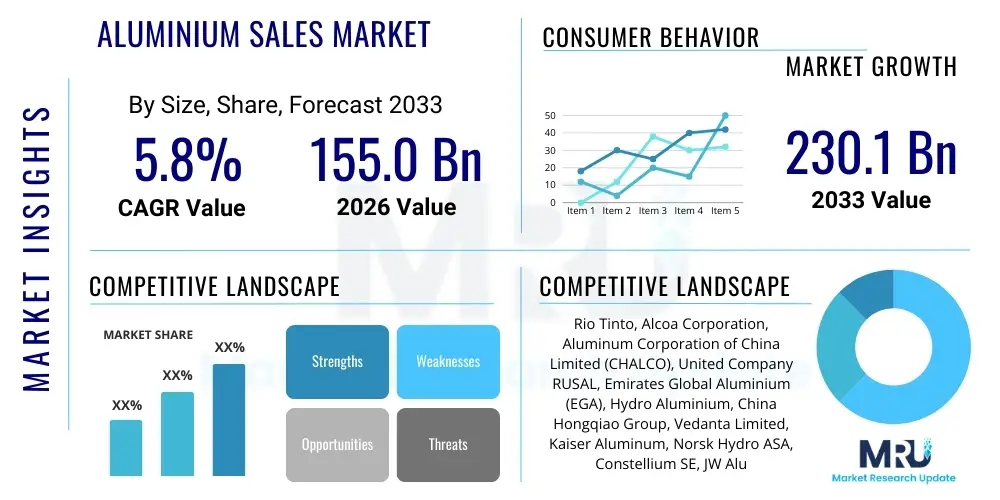

The Aluminium Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 155.0 Billion in 2026 and is projected to reach USD 230.1 Billion by the end of the forecast period in 2033.

Aluminium Sales Market introduction

The Aluminium Sales Market encompasses the global trade and distribution of various forms of aluminum, including primary aluminum, recycled secondary aluminum, and fabricated products such as sheets, foils, extrusions, and castings. Aluminum, renowned for its low density, high strength-to-weight ratio, excellent corrosion resistance, and high electrical and thermal conductivity, is a foundational material in modern industrial applications. Its versatility allows it to serve critical functions across key economic sectors, positioning its sales trajectory as a vital indicator of global manufacturing health and infrastructural investment. The ongoing shift toward lightweight materials in the transportation sector, coupled with robust demand from sustainable packaging solutions, forms the bedrock of current market expansion.

Major applications driving the market include the automotive industry, where aluminum is increasingly replacing steel to enhance fuel efficiency and facilitate the transition to electric vehicles (EVs). Furthermore, the construction and infrastructure sector relies heavily on aluminum for fenestration, structural components, and architectural systems due to its durability and aesthetic properties. The packaging industry utilizes aluminum foil and cans extensively, leveraging the metal’s recyclability and barrier properties to ensure product longevity and meet growing consumer demand for sustainable packaging formats. These diverse applications ensure sustained sales volume across various geographic regions and economic cycles.

Key benefits associated with aluminum, such as its infinite recyclability without loss of quality, strong performance in extreme temperatures, and malleable characteristics, serve as primary driving factors for market growth. Increased global focus on decarbonization and circular economy principles elevates the demand for sustainable materials, where secondary aluminum production—which requires significantly less energy than primary smelting—is becoming a competitive advantage. Furthermore, urbanization trends in developing economies fuel construction activity, securing the long-term outlook for high-volume aluminium sales.

Aluminium Sales Market Executive Summary

The Aluminium Sales Market demonstrates robust growth driven primarily by structural shifts in the transportation and sustainability sectors. Business trends indicate a strategic focus among major producers on expanding secondary aluminum capacity and integrating advanced digital tools to optimize supply chain resilience and procurement processes. The market faces moderate price volatility influenced by energy costs and geopolitical stability impacting major bauxite and alumina supply regions. Key players are investing heavily in innovative alloying techniques to meet stringent performance requirements from high-tech industries, particularly aerospace and advanced electric vehicle manufacturing.

Regionally, Asia Pacific (APAC) maintains its dominance in volume, fueled by rapid industrialization, massive infrastructure projects in China and India, and surging production of consumer electronics. North America and Europe exhibit mature market characteristics but show high growth potential in high-value segments like aerospace and specialized automotive castings, alongside a pronounced regulatory push favoring recycled content. Latin America and the Middle East and Africa (MEA) are emerging as crucial growth frontiers, driven by investments in renewable energy infrastructure (which utilizes significant amounts of aluminum) and domestic production capacity expansion aimed at regional self-sufficiency.

Segment trends reveal that the Transportation sector remains the largest consumer by value, while the Packaging segment is experiencing the fastest growth rate, propelled by single-serve beverage can demand globally. Among product types, rolled products (sheets and foils) command the largest market share, utilized extensively across packaging and automotive body panels. Fabricated components are seeing increasing complexity, reflecting the sophisticated requirements of modern end-use applications, emphasizing the market's trajectory towards value-added, customized sales rather than purely commodity-driven volume.

AI Impact Analysis on Aluminium Sales Market

Common user questions regarding AI's impact on the Aluminium Sales Market frequently center on themes such as predictive pricing models, optimizing energy-intensive smelting processes, enhancing supply chain visibility, and improving metal quality control. Users are keen to understand how AI can mitigate the inherent volatility in raw material and energy costs that characterize aluminum production. There is significant interest in how machine learning algorithms can analyze vast datasets concerning global demand, inventory levels, and geopolitical factors to provide more accurate sales forecasts, thereby enabling producers and distributors to manage inventories more efficiently and secure better contract pricing. Furthermore, the role of AI in reducing the substantial carbon footprint associated with primary aluminum production through process optimization is a major area of concern and expectation.

The implementation of Artificial Intelligence and Machine Learning (ML) is beginning to revolutionize operational efficiencies across the aluminium value chain, moving beyond simple automation to predictive analytics. In the upstream segment, AI algorithms are deployed to analyze bauxite quality, optimize alumina refining yields, and crucially, manage the complex, energy-intensive electrolysis process in smelters. By precisely controlling parameters such as temperature, current density, and electrolyte composition in real-time, AI minimizes energy consumption per ton of aluminum produced, leading directly to lower operational costs and a significant reduction in associated greenhouse gas emissions. This technological shift directly impacts sales competitiveness by offering lower-cost, greener aluminum products.

Downstream, AI enhances market responsiveness and product quality. ML models are used for defect detection during rolling and extrusion, far surpassing human capabilities in speed and accuracy, thereby reducing waste and improving product consistency crucial for demanding sectors like aerospace and medical devices. Additionally, AI-powered demand forecasting integrates data from various end-use sectors (e.g., new vehicle production schedules, construction permits) to generate highly accurate sales predictions for specific product forms and alloys. This precision minimizes lead times, optimizes stocking levels for distributors, and ultimately strengthens customer relationships through reliable supply, ensuring robust and sustained sales performance.

- AI optimizes energy consumption in primary smelters, reducing production costs by 5% to 15%.

- Machine learning improves predictive maintenance of casting and rolling equipment, minimizing unplanned downtime and securing consistent supply.

- AI-driven supply chain platforms enhance traceability and transparency, crucial for certifying sustainable and low-carbon aluminium sales.

- Natural Language Processing (NLP) is used to analyze market sentiment and geopolitical risks, refining short-term sales pricing strategies.

- Computer vision systems enable high-speed, non-destructive quality inspection of finished products, ensuring compliance with stringent industry specifications.

DRO & Impact Forces Of Aluminium Sales Market

The Aluminium Sales Market is fundamentally driven by the accelerating demand for lightweight materials in the automotive and aerospace industries, a trend amplified by global commitments to carbon neutrality and fuel efficiency standards. Simultaneously, significant restraints exist, primarily revolving around the extremely high capital expenditure and massive energy requirements necessary for primary aluminum smelting, leading to high exposure to volatile energy prices and complex geopolitical dependencies for raw materials like bauxite. Opportunities are abundant, specifically in the expansion of high-grade recycled aluminum capacity and the development of specialized aluminum alloys tailored for advanced manufacturing applications, such as additive manufacturing. These internal dynamics are further influenced by external impact forces, including stringent environmental regulations mandating circular economy practices and macroeconomic factors governing global infrastructure spending.

Key drivers include the transition towards electric vehicles (EVs), which necessitates lightweight materials to offset battery weight and extend driving range, substantially increasing the per-vehicle aluminum content. Furthermore, rapid urbanization, particularly in emerging markets, consistently boosts construction sector demand for durable and low-maintenance aluminum components. The exceptional recyclability of aluminum (requiring only about 5% of the energy needed for primary production) acts as a powerful driver, aligning the material perfectly with global sustainability targets and providing a long-term cost advantage over competing metals.

However, market growth is hampered by high barriers to entry for new primary aluminum producers due to regulatory complexities and the massive scale required for cost-effective operations. Moreover, the increasing cost of securing high-quality scrap aluminum for secondary production presents a bottleneck, as the supply of readily available scrap struggles to keep pace with the accelerating demand for recycled content. These constraints require strategic partnerships and significant investments in sorting and purification technologies to maintain the supply-demand equilibrium for high-grade material. External impact forces, such as fluctuating tariffs and trade disputes related to aluminum imports and exports, often introduce unpredictability into international sales contracts and pricing structures, complicating long-term investment planning.

Segmentation Analysis

The Aluminium Sales Market is comprehensively segmented based on product form, end-use application, and processing technology, allowing for granular analysis of demand patterns and strategic market positioning. The segmentation by product form—encompassing rolled products, extruded products, primary metal, and castings—highlights the varying levels of value addition and complexity required for specific end-user specifications. Rolled products, particularly sheets and foils, dominate the volume due to their pervasive use in automotive body parts, building envelopes, and consumer packaging. Analyzing end-use industries—Automotive & Transportation, Building & Construction, Packaging, Electrical & Electronics, and Industrial—provides clarity on the primary consumption drivers, with transportation currently undergoing the most significant transformation in material usage.

- By Product Form:

- Rolled Products (Plates, Sheets, Foils)

- Extruded Products (Profiles, Tubes, Bars)

- Castings (Engine Blocks, Wheels, Structural Parts)

- Primary Metal (Ingots, Billets, Slabs)

- By End-Use Industry:

- Automotive & Transportation (Automotive, Rail, Marine, Aerospace)

- Building & Construction (Architectural, Structural)

- Packaging (Cans, Foils, Closures)

- Electrical & Electronics (Cables, Conductors, Heat Sinks)

- Machinery & Industrial Equipment

- By Source:

- Primary Aluminum (Smelting)

- Secondary Aluminum (Recycled Scrap)

Value Chain Analysis For Aluminium Sales Market

The aluminium value chain is highly integrated and capital-intensive, starting with the upstream processes of bauxite mining and alumina refining. Bauxite, the raw ore, is processed into alumina (aluminum oxide) through the Bayer process. This white powder is then transferred to smelters, which constitute the most crucial and energy-intensive step—the reduction of alumina into primary aluminum metal via the Hall-Héroult electrolytic process. Upstream stability, particularly the predictable supply of bauxite and competitively priced, low-carbon electricity, directly dictates the cost and environmental footprint of the final sales product. Strategic control over high-quality bauxite deposits and access to abundant hydroelectric or renewable energy sources are significant competitive advantages for major integrated producers.

The midstream segment involves the processing of primary or secondary aluminum into semi-fabricated products, such as ingots, billets, slabs, and ultimately, rolled products, extrusions, and castings. This stage focuses on alloying (mixing aluminum with elements like silicon, magnesium, or zinc) to achieve specific performance characteristics required by downstream customers, such as higher tensile strength for aerospace applications or improved formability for automotive panels. The efficiency and technological maturity of these fabrication processes—including advanced continuous casting and hot rolling mills—are paramount to delivering value-added products and maintaining consistent quality demanded by highly technical end-users.

Downstream activities center on distribution, sales, and end-use application. Distribution channels are typically categorized into direct sales to large OEMs (Original Equipment Manufacturers) in the automotive and aerospace sectors, and indirect sales through a network of specialized service centers, distributors, and metal traders who provide customized cutting, finishing, and inventory management services to smaller fabricators and builders. Given aluminum's diverse applications, logistics and inventory management play a critical role; distributors must maintain wide inventories of various alloys and product forms to meet just-in-time delivery requirements. The final price and sales margin are influenced heavily by long-term commodity contracts, regional LME (London Metal Exchange) pricing, and the level of value-added processing performed.

Aluminium Sales Market Potential Customers

Potential customers for the Aluminium Sales Market are highly diverse, spanning major global industries that require materials offering a combination of lightweight performance, durability, and recyclability. The primary purchasers, or end-users, of aluminum products are large multinational corporations operating within the transportation, construction, and consumer goods sectors. These entities purchase vast quantities of specific alloys and product forms—such as 5xxx and 6xxx series alloys for automotive structure, or 3xxx series alloys for beverage packaging—based on stringent technical specifications, long-term procurement agreements, and sustainability metrics.

In the transportation segment, key buyers include automotive OEMs (Original Equipment Manufacturers) such as Tesla, Ford, and BMW, which require high-strength aluminum sheets for car bodies and specialized castings for engine components and chassis. Aerospace manufacturers like Boeing and Airbus are significant buyers of high-purity, fatigue-resistant alloys for aircraft structures. In the construction industry, large commercial builders, structural engineers, and fenestration system providers purchase extruded profiles and architectural sheets for cladding, windows, and curtain walls. These buyers prioritize lifespan, corrosion resistance, and thermal performance.

The packaging industry constitutes a massive, consistently growing customer base, including major beverage companies (e.g., Coca-Cola, PepsiCo) and food processors, who rely on aluminum for beverage cans, food trays, and pharmaceutical foils due to its exceptional barrier properties and infinite recyclability. Furthermore, the Electrical and Electronics sector, encompassing cable manufacturers and semiconductor producers, consumes highly conductive aluminum for high-voltage transmission lines and heat dissipation components (heat sinks). The purchasing criteria for these diverse customers are dictated by factors ranging from minimum order quantities and global logistics capabilities to verifiable proof of low-carbon production processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.0 Billion |

| Market Forecast in 2033 | USD 230.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rio Tinto, Alcoa Corporation, Aluminum Corporation of China Limited (CHALCO), United Company RUSAL, Emirates Global Aluminium (EGA), Hydro Aluminium, China Hongqiao Group, Vedanta Limited, Kaiser Aluminum, Norsk Hydro ASA, Constellium SE, JW Aluminum, Hindalco Industries Ltd., Ma'aden Aluminium, EGA Aluminium |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminium Sales Market Key Technology Landscape

The technology landscape in the Aluminium Sales Market is currently defined by innovations aimed at energy efficiency, enhanced alloy performance, and increased material recovery from scrap. A critical area of technological focus is the development and commercialization of inert anode technology for primary aluminum smelting. Traditional carbon anodes are consumed during the electrolysis process, producing significant CO2 emissions. Inert anodes, often ceramic- or metal-based, are designed to produce oxygen instead of CO2, offering a pathway toward near-zero-carbon primary aluminum production. While still facing hurdles related to lifespan and material stability, successful large-scale deployment of this technology, such as the ELYSIS process, will fundamentally reshape the sales dynamic by offering truly green aluminum at competitive production costs.

In the midstream and downstream segments, advanced processing technologies are crucial for meeting increasingly demanding end-user specifications, particularly in the aerospace and automotive sectors. This includes the widespread adoption of advanced continuous casting methods to produce defect-free rolling slabs and billets, improving yield and reducing waste. Furthermore, the development of high-strength, lightweight aluminum alloys (e.g., Al-Li alloys, 7xxx series alloys) specifically tailored for complex components is driving high-value sales. These alloys enable thinner materials without sacrificing structural integrity, essential for maximizing the efficiency gains sought by EV manufacturers and aircraft builders. Precision extrusion technologies also allow for the creation of intricate, multi-hollow profiles with tight tolerances, optimizing material usage in architectural and structural applications.

The recycling sector is being transformed by sensor-based sorting technologies, including X-ray transmission (XRT) and LIBS (Laser-Induced Breakdown Spectroscopy). These technologies significantly enhance the purity and efficiency of scrap segregation, allowing recyclers to effectively separate different aluminum alloy grades from mixed municipal and industrial scrap streams. High-purity recycled material is essential for closed-loop systems, particularly in the automotive industry, where contamination can compromise safety-critical components. The integration of digital twins and predictive modeling in rolling mills further optimizes production schedules and reduces scrap rates, ensuring that the sales volume is maximized while minimizing resource consumption and operational variability.

Regional Highlights

The regional dynamics of the Aluminium Sales Market are characterized by a significant divergence in demand drivers, production capacities, and regulatory environments, making a geographical segmentation crucial for strategic analysis. Asia Pacific (APAC) dominates global production and consumption, largely driven by the industrial and infrastructural expansion in China, which acts as both the world's largest producer and consumer of primary aluminum. India's burgeoning automotive sector and sustained construction growth are rapidly increasing its proportional market share. The APAC region’s strength is rooted in high volume, though often constrained by environmental pressures related to coal-fired power sources used for smelting in certain areas.

North America and Europe represent mature markets focused heavily on advanced, high-value applications and stringent sustainability mandates. Demand here is characterized by high consumption of specialized alloys for premium automotive, aerospace, and high-tech packaging. Both regions are witnessing a rapid shift towards secondary (recycled) aluminum to reduce embodied carbon. European regulations, such as those related to the EU Green Deal and carbon border adjustments, heavily influence sales decisions, promoting the purchase of verified low-carbon aluminum and compelling producers to invest in renewable energy sources for smelting operations.

The Middle East (specifically GCC countries) holds significant strategic importance due to its access to low-cost natural gas, which fuels large-scale, cost-efficient primary aluminum smelters (e.g., UAE, Bahrain). These regions are primarily export-focused, supplying primary metal globally. Latin America, particularly Brazil, is rich in bauxite reserves and possesses substantial hydroelectric power capacity, enabling domestic production growth and supplying both local construction demand and international markets. Africa, while offering large untapped bauxite resources, remains challenged by infrastructure limitations, though investment in refining and smelting capacity is rising, poised to significantly impact global supply in the long term.

- Asia Pacific (APAC): Dominates global volume; fueled by Chinese construction, Indian automotive growth, and high demand for electrical components. Focus on expanding capacity, though facing significant energy and emissions challenges.

- Europe: High-value market focused on advanced alloys for automotive lightweighting and aerospace. Driven by regulatory mandates favoring low-carbon primary and high recycled content aluminum. Strong emphasis on circular economy models.

- North America: Significant consumption across aerospace, automotive (especially trucks and SUVs), and packaging. High reliance on imports but increasing investment in domestic recycling infrastructure (secondary production).

- Middle East & Africa (MEA): Key global exporter of primary aluminum due to competitive energy costs (natural gas). Strategic expansion in downstream processing (e.g., rolling and extrusion) to capture higher value.

- Latin America: Stable supply of bauxite and access to hydropower supports domestic primary production, supplying regional infrastructural and beverage can markets, with Brazil leading consumption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminium Sales Market.- Rio Tinto

- Alcoa Corporation

- Aluminum Corporation of China Limited (CHALCO)

- United Company RUSAL

- Emirates Global Aluminium (EGA)

- Hydro Aluminium

- China Hongqiao Group

- Vedanta Limited

- Kaiser Aluminum

- Norsk Hydro ASA

- Constellium SE

- JW Aluminum

- Hindalco Industries Ltd.

- Ma'aden Aluminium

- EGA Aluminium

- BHP Group

- Shandong Xinfa Aluminium Group

- Aleris Corporation (now part of Novelis)

- Sapa Extrusions (now part of Hydro)

- Novelis Inc.

Frequently Asked Questions

Analyze common user questions about the Aluminium Sales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for growth in the Aluminium Sales Market?

The primary driver is the accelerating shift towards lightweight materials in the global transportation sector, particularly the mass production of electric vehicles (EVs), which utilizes significantly more aluminum per unit to compensate for battery weight and enhance energy efficiency.

How does the sustainability movement impact the sales of primary versus secondary aluminum?

The sustainability movement strongly favors secondary (recycled) aluminum sales because its production requires up to 95% less energy than primary aluminum. Increasing corporate and regulatory pressure for verifiable low-carbon materials is accelerating demand and pricing premiums for recycled content.

Which end-use industry holds the largest market share by volume for aluminum consumption?

The Building and Construction industry traditionally consumes a large volume of aluminum, but the Transportation (Automotive and Aerospace) sector currently represents the largest market share by value, driven by high-specification alloy demand and rapid adoption in vehicle structures.

What role does energy pricing play in the competitiveness of primary aluminum sales?

Energy pricing is critical, as electricity constitutes approximately 30% to 40% of the production cost for primary aluminum. Regions with access to competitive, stable, and low-carbon power sources (e.g., hydropower or natural gas) hold a significant competitive advantage in global sales.

What are the key technological advancements influencing future aluminium sales?

Key technological advancements include inert anode technology for near-zero-carbon smelting, advanced sensor-based scrap sorting for high-purity recycling, and the development of specialized, ultra-high-strength aluminum alloys required for cutting-edge aerospace and automotive applications.

What geopolitical factors most influence aluminum sales pricing?

Geopolitical factors such as trade tariffs (e.g., U.S. Section 232 duties), sanctions impacting major producers like RUSAL, and instability in key bauxite mining regions (like Guinea) introduce significant volatility in pricing and supply chain reliability, directly affecting global sales contracts.

How is the packaging segment evolving in the aluminum market?

The packaging segment is experiencing rapid growth, especially in beverage can sales, driven by aluminum's superior recyclability compared to plastics. Consumer preference and regulatory mandates for circular packaging solutions are strengthening the demand for aluminum foil and cans globally.

What is the main challenge faced by producers in the secondary aluminum market?

The main challenge is securing a consistent supply of high-quality, uncontaminated scrap metal, and effectively sorting different alloy grades. As demand for secondary aluminum rises, price competition for available scrap intensifies, impacting margins and availability for specific high-specification products.

Which region is expected to exhibit the fastest growth in aluminum consumption during the forecast period?

Asia Pacific (APAC), particularly Southeast Asian nations and India, is expected to exhibit the fastest consumption growth due to rapid urbanization, sustained infrastructural investment, and increasing penetration of electric two-wheelers and passenger vehicles.

What is the difference between primary and secondary aluminum in terms of market dynamics?

Primary aluminum sales are highly correlated with global commodity prices (LME) and are sensitive to energy costs, while secondary aluminum sales often command a "green premium" and are influenced more by scrap availability, processing technology costs, and regional recycling rates.

How are advancements in 3D printing affecting the demand for specific aluminum alloys?

Additive manufacturing (3D printing) is creating niche, high-value demand for specialized, atomized aluminum powders (e.g., AlSi10Mg) that possess exceptional flowability and mechanical properties suitable for producing complex, mission-critical components for aerospace and medical devices.

What are rolled products and what are their primary applications in sales?

Rolled products include plates, sheets, and foils, produced by passing ingots through rolling mills. Their primary sales applications are automotive body sheets (for structural and exterior panels), aerospace skins, and aluminum foil used extensively in food and pharmaceutical packaging.

How does the aluminium industry address the red mud waste generated during production?

The industry is focusing on improved disposal and utilization technologies for red mud (bauxite residue), including extracting valuable components like rare earth elements and developing novel applications for it as a building material or soil stabilizer, aiming to reduce environmental impact and regulatory friction.

What is the significance of the London Metal Exchange (LME) in aluminum sales?

The LME is the global benchmark for non-ferrous metal trading, and LME spot and futures prices are critical reference points for setting long-term supply contracts and hedging risk in the physical aluminum sales market worldwide.

Why is the construction industry shifting towards aluminum from traditional materials?

The shift is driven by aluminum's low weight, which eases installation; its exceptional resistance to corrosion, ensuring a long service life; and its thermal performance, contributing to energy-efficient buildings, alongside its modern aesthetic appeal in architectural applications.

What factors determine the premium paid for specific aluminum alloys?

Premiums are determined by the complexity of alloying, the strictness of the technical specifications (e.g., low impurity levels, specific strength requirements), certifications needed (e.g., aerospace quality), and the demand-supply balance for niche, high-performance alloys.

How are producers utilizing digital twins in their manufacturing processes?

Producers utilize digital twins—virtual replicas of physical smelting and rolling operations—to simulate process changes, optimize energy input, predict equipment failure, and test new alloy parameters before implementation, enhancing efficiency and reducing the cost of quality control in sales.

What impact do electric vehicles have on the type of aluminum products demanded?

EVs increase demand for high-integrity structural castings and complex extrusions for battery enclosures, chassis components, and crash management systems, requiring specialized 6xxx and 7xxx series high-strength alloys compared to traditional internal combustion engine vehicles.

How does the distribution channel structure impact the final price of aluminum products?

Distribution channels, including service centers and traders, add value through logistics, inventory financing, and custom processing (cutting, finishing). These services reduce lead times for smaller buyers but introduce an incremental cost, leading to higher final sales prices compared to direct OEM procurement.

What are the implications of capacity constraints in primary aluminum production?

Capacity constraints, often due to stringent environmental regulations forcing smelter closures or high energy costs, can lead to supply shortages, driving up global benchmark prices and increasing market reliance on existing capacity and secondary production sources to meet sales demand.

Which factors contribute to the high cost of starting a new primary aluminum smelter?

New primary smelters require immense initial capital investment for facility construction, reliable access to vast amounts of electricity (often requiring dedicated power plants), and compliance with complex international environmental and safety regulations, creating significant financial barriers to entry.

How is aluminum used in the renewable energy sector?

Aluminum is critical in the renewable energy sector for solar panel mounting structures and frames (due to its corrosion resistance and light weight) and for high-voltage transmission cables and conductors, leveraging its high electrical conductivity.

What is the typical lifespan of an aluminum product in a key application like construction?

In construction, aluminum products such as window frames, cladding, and structural elements are designed for extremely long lifespans, often exceeding 50 to 70 years, before they are systematically recycled, highlighting the metal's durability and high economic value retention.

How is the market responding to demand for traceable and certified sustainable aluminum?

The market is responding through the adoption of certification schemes like the Aluminium Stewardship Initiative (ASI) and by implementing blockchain technology to ensure verifiable traceability from bauxite mine through to the final fabricated product, meeting the rising demands of corporate buyers.

What distinguishes aluminum sales in the aerospace segment from the automotive segment?

Aerospace aluminum sales demand ultra-high purity, zero-defect quality standards, lower volume but extremely high pricing, and specialized heat-treatable alloys (e.g., 7xxx series) with exceptional fatigue resistance, whereas automotive sales prioritize high volume, lower cost, and advanced formability.

What are the main risks associated with relying on imported aluminum?

Relying on imported aluminum exposes end-users to risks including currency fluctuations, geopolitical trade restrictions (tariffs), extended lead times, and logistical disruptions, necessitating diversification of supply sources and regional inventory management strategies to maintain stable sales.

How is the trend of miniaturization in electronics affecting aluminum sales?

Miniaturization increases the demand for high-efficiency thermal management solutions. Aluminum's excellent thermal conductivity makes it essential for smaller, high-density heat sinks and cooling plates in devices, driving sales of thin-gauge foils and precision machined components.

What is the strategic focus of major aluminum producers regarding mergers and acquisitions?

The strategic focus centers on acquiring or investing in downstream fabrication and recycling assets (rolling mills, extrusion plants, advanced scrap processors) to secure market share in high-value-added products, diversify away from reliance on volatile primary metal prices, and secure access to high-quality scrap feedstock.

What is the impact of global inflation on aluminum sales prices?

Global inflation significantly raises the operational costs of aluminum production, particularly for energy, labor, and transportation. These increased input costs are typically passed on to the end consumer, resulting in higher sales prices for both primary metal and fabricated products.

Why is the 6xxx series alloy so popular in the construction and transportation sectors?

The 6xxx series (Aluminum-Magnesium-Silicon alloys) is popular due to its excellent combination of strength, weldability, corrosion resistance, and heat treatability, making it ideal for structural frames, railings, automotive chassis, and bicycle components, offering a balance of performance and processability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager