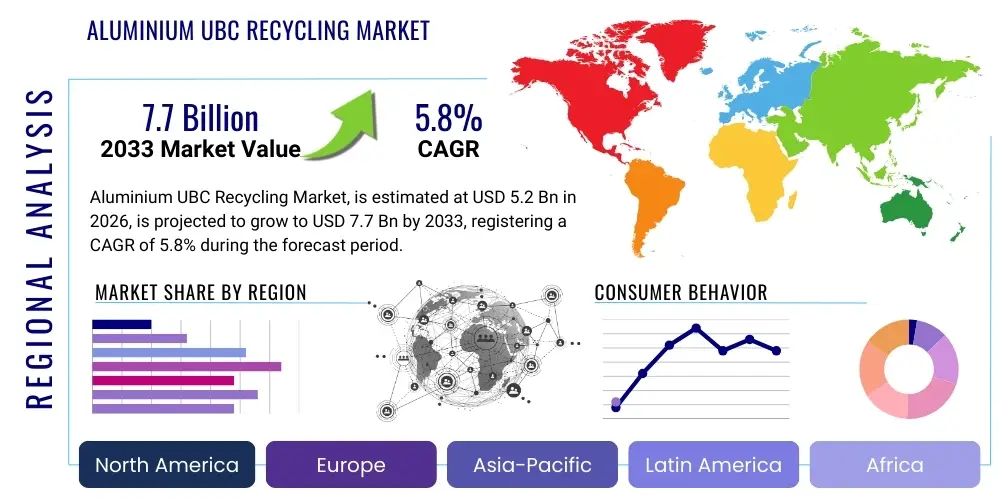

Aluminium UBC Recycling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435002 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Aluminium UBC Recycling Market Size

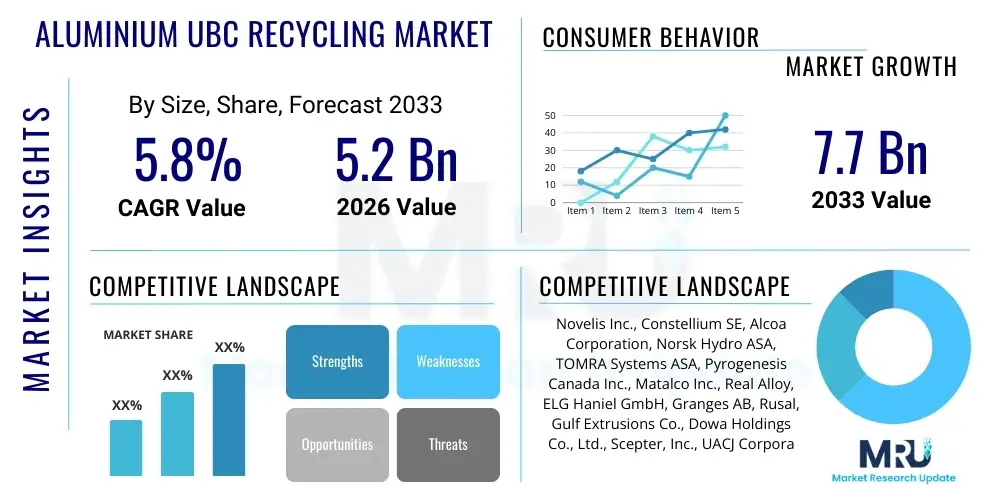

The Aluminium UBC Recycling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by increasing global regulatory mandates promoting closed-loop systems, coupled with the rising economic efficiency derived from using secondary aluminum over primary production. As major industrialized nations intensify their focus on sustainability goals and carbon footprint reduction, the demand for recycled Used Beverage Cans (UBCs) as a feedstock for new products continues to accelerate, making this sector pivotal to the circular economy within the metals industry. The intrinsic value of aluminum—its low density, high strength, and infinite recyclability without loss of quality—further solidifies its position as a preferred material, ensuring consistent market expansion.

Market expansion is also heavily influenced by fluctuating primary aluminum prices and the substantial energy savings realized through recycling. Recycling aluminum requires only about 5% of the energy needed to produce virgin aluminum, providing a compelling cost advantage, especially in regions facing high energy costs. Furthermore, technological improvements in sorting and processing, particularly advanced sensor-based sorting (SBS) and artificial intelligence integration, are enhancing recovery rates and the purity of the resulting scrap, thereby increasing the confidence of downstream users, such as automotive and packaging industries, in using recycled content. This improvement in material quality mitigates historical barriers related to contamination and inconsistency, driving higher utilization rates globally.

Geographically, Asia Pacific, led by China and India, is expected to emerge as the fastest-growing region, driven by massive population growth, increasing consumption of canned beverages, and recent governmental pushes toward waste management modernization and infrastructure investment. Concurrently, established markets in North America and Europe are focusing on improving consumer participation rates in collection schemes (like Deposit Return Systems, or DRS) and optimizing industrial processing capacities. The overall market size expansion reflects not only increased volumes of UBC collected but also the premium associated with certified, low-carbon secondary aluminum products, which is attracting significant investment in advanced recycling facilities worldwide.

Aluminium UBC Recycling Market introduction

The Aluminium UBC Recycling Market encompasses the entire industrial ecosystem dedicated to collecting, sorting, processing, and remelting discarded aluminum Used Beverage Cans (UBCs) to produce secondary aluminum ingots, billets, or slabs for manufacturing new products. This highly developed segment is a cornerstone of the global circular economy, minimizing reliance on bauxite mining and significantly reducing greenhouse gas emissions associated with primary aluminum smelting. The fundamental product is the recycled aluminum alloy, often designated as "can sheet stock," which retains the mechanical and physical properties necessary for high-speed can production. Key applications primarily include the fabrication of new beverage and food cans, but recycled aluminum is increasingly utilized in the automotive sector for lightweighting vehicles and in construction materials where sustainability credentials are valued. The inherent benefits of UBC recycling are threefold: significant energy savings (up to 95%), drastic reduction in landfill waste, and conservation of finite natural resources, positioning the market as essential for environmentally responsible industrial production.

Major applications for the recycled aluminum derived from UBCs extend beyond the closed-loop system of producing new cans. The purity and controlled alloying elements in UBC scrap make it suitable for high-specification casting and extrusion applications, particularly in the transportation industry. As Original Equipment Manufacturers (OEMs) in the automotive sector commit to lower carbon footprints, the demand for secondary aluminum, especially from readily available and clean sources like UBCs, has surged for components such as engine blocks, transmission housings, and structural parts. This diversification of applications buffers the market against fluctuations solely dependent on the beverage consumption cycle, ensuring stable demand. Furthermore, the push for lighter electric vehicles (EVs) mandates the increased use of lightweight materials like aluminum, solidifying the importance of a reliable, sustainable scrap supply chain.

The primary driving factors sustaining the growth of this market include stringent environmental regulations mandating Extended Producer Responsibility (EPR) schemes, favorable policy mechanisms such as carbon taxes and incentives for using recycled content, and profound consumer preference shifts toward sustainable packaging choices. Economically, the high market value of aluminum scrap, combined with sophisticated collection infrastructure in mature markets, ensures robust feedstock availability. The continuous innovation in recycling technology, specifically focused on improving the efficiency of sorting and reducing metal loss during the remelting process, further lowers operational costs and enhances profitability, attracting continued investment and encouraging widespread adoption of recycling programs globally.

Aluminium UBC Recycling Market Executive Summary

The Aluminium UBC Recycling Market exhibits strong resilience, driven by macroeconomic trends favoring decarbonization and resource efficiency. Key business trends indicate a movement toward vertical integration among major players, where collectors, processors, and secondary smelters are merging operations to control supply chains, ensure consistent quality, and capture higher margins. Furthermore, there is a distinct increase in cross-border investments aimed at establishing sophisticated recycling infrastructure in emerging economies, particularly across Southeast Asia and Latin America, where consumption rates are spiking but recycling rates remain suboptimal compared to North America and Europe. Financial modeling suggests that capital expenditure is increasingly focused on advanced technology adoption, specifically artificial intelligence (AI) and advanced spectroscopic sorting equipment, to improve material purity and throughput, which are critical factors influencing the final price and utility of the recycled product. Strategic partnerships between packaging manufacturers and waste management companies are becoming common to guarantee the supply of high-quality UBC feedstock for closed-loop manufacturing cycles.

Regionally, the market presents a dichotomy. North America and Europe maintain high maturity, characterized by established Deposit Return Systems (DRS) and stringent environmental reporting standards, leading to steady, high recycling rates (often exceeding 70%). Growth here is incremental, focused primarily on optimization and maximizing consumer participation. Conversely, the Asia Pacific region is the powerhouse of volume growth, spurred by rapid urbanization, massive industrialization, and consequential waste generation. Governments in APAC are now actively implementing regulatory frameworks and infrastructure projects to manage this volume, transforming the region from a major importer of scrap to a significant generator and domestic consumer of recycled metal. The Middle East and Africa (MEA) and Latin America are emerging areas, showing potential but requiring substantial foreign direct investment to overcome logistical and informal sector challenges related to collection and formal processing capacity.

Segment trends highlight the dominance of the aluminum beverage can sector as the primary end-user, ensuring the core market stability. However, the fastest growth within the end-user segment is observed in the automotive and transportation sectors, particularly in components requiring high strength-to-weight ratios, driven by the electric vehicle transition. Segmentation based on processing technology shows an increasing reliance on advanced metallurgical techniques, such as continuous rotary furnaces (CRFs) and specialized dross processing, to maximize metal recovery from the shredding and melting stages. The scrap quality segmentation emphasizes a market shift towards higher-purity, furnace-ready scrap, commanding premium pricing and incentivizing collectors to invest in advanced pre-processing and cleaning operations to meet stringent industrial specifications.

AI Impact Analysis on Aluminium UBC Recycling Market

User questions related to AI's impact on UBC recycling primarily revolve around optimizing operational efficiency, enhancing material purity, and improving supply chain predictability. Common concerns include: "How accurately can AI sort different alloy grades?", "Can AI predict scrap availability and pricing fluctuations?", and "What are the investment costs and ROI for integrating AI into existing sorting facilities?" Based on this analysis, the key themes summarize that users are highly optimistic about AI's potential to solve the industry's most persistent pain points—labor intensity, sorting error rates, and susceptibility to volatile supply. Expectations center on AI-driven vision systems and deep learning algorithms dramatically improving the precision of distinguishing aluminum cans from other contaminants (like steel or plastics) and identifying specific aluminum alloy grades at high speeds, which is crucial for producing high-quality secondary metal. Furthermore, there is significant interest in using predictive analytics to model regional collection rates based on seasonal consumption patterns, regulatory changes, and economic indicators, thereby stabilizing the highly fragmented scrap procurement process.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the traditional sorting process within the UBC recycling value chain. Conventional sensor-based sorting (SBS), which relies on near-infrared (NIR) or X-ray fluorescence (XRF), is limited in its ability to handle complex contamination or mixed polymer streams. AI-powered vision systems, combined with advanced robotics, utilize deep learning models trained on vast datasets of materials to classify objects with unprecedented speed and accuracy, even when materials are heavily soiled or damaged. This increase in purity directly translates into lower energy consumption during remelting (due to fewer impurities needing to be fluxed out) and higher value for the resulting aluminum ingot. The ability of AI to learn and adapt to changing waste stream characteristics ensures long-term operational relevance, addressing a major challenge faced by legacy mechanical recycling systems.

Beyond sorting, AI applications are extending into the operational management of the recycling facilities and the wider supply chain. Predictive maintenance, utilizing ML algorithms trained on sensor data from shredders, furnaces, and conveyors, allows operators to anticipate equipment failure, minimizing costly unplanned downtime. Furthermore, AI is being deployed for optimizing furnace loading and energy usage during the melting process. By simulating various operational scenarios and material inputs, AI determines the most efficient melting schedule, reducing cycle times and optimizing fuel consumption. In the supply chain, AI-driven logistics platforms optimize collection routes for UBC haulage, balancing fuel costs against volume collected, thereby lowering the overall cost of feedstock acquisition and improving the carbon efficiency of the entire recycling lifecycle.

- AI-powered Vision Systems: Enhances sorting accuracy of UBCs from mixed waste streams (plastics, paper, steel) and identifies subtle alloy variations.

- Predictive Maintenance: Uses machine learning to analyze operational sensor data, forecasting equipment failure in shredders and furnaces, thus reducing downtime.

- Optimized Furnace Operations: AI algorithms manage charging sequences and temperature control during remelting to minimize energy usage and maximize metal recovery.

- Supply Chain Forecasting: ML models analyze consumption data, regulatory shifts, and seasonal trends to predict scrap availability and stabilize procurement strategies.

- Quality Control Automation: Real-time assessment of recycled metal purity, ensuring consistent output quality that meets stringent downstream customer specifications.

DRO & Impact Forces Of Aluminium UBC Recycling Market

The Aluminium UBC Recycling Market is characterized by powerful Drivers (D), significant Restraints (R), and compelling Opportunities (O), which collectively shape the competitive landscape and investment decisions—these constitute the Impact Forces. The primary drivers are regulatory pressures, notably the global implementation of Deposit Return Schemes (DRS) and Extended Producer Responsibility (EPR) legislation, which guarantee a captive, high-volume feedstock supply. Simultaneously, corporate sustainability goals, pushing major beverage and automotive companies toward 100% recycled content targets, exert robust pull demand. However, the market faces significant restraints, chiefly the inconsistency in collection infrastructure across developing regions, contamination challenges in mixed waste streams that compromise secondary metal quality, and the high initial capital expenditure required for advanced sorting and smelting technologies. The key opportunities lie in capitalizing on technological breakthroughs like advanced spectroscopic sorting and digital traceability platforms, coupled with the massive potential for market penetration in underserved, high-growth consumer markets in Asia and Africa, where recycling rates are currently low. These forces combine to create a dynamic environment where sustained regulatory support acts as the primary accelerator, while technology adoption is the essential mechanism for overcoming logistical and quality-related hurdles, ensuring long-term profitability and sustainability.

Drivers are primarily environmental and economic. Economically, the immense energy savings (up to 95%) compared to primary production provide a decisive cost advantage, particularly as global carbon pricing mechanisms become more prevalent, penalizing high-emission primary production. Environmentally, the public and political emphasis on reducing landfill volumes and achieving climate targets makes UBC recycling a non-negotiable component of modern industrial policy. The restraint posed by scrap quality variability is significant; contaminated scrap requires extensive pre-treatment and results in lower metal yield, raising operational costs. Furthermore, the volatility of scrap commodity prices introduces financial risk, making long-term planning challenging for recyclers without robust hedging mechanisms. Logistical complexity, particularly the cost and effort of collecting lightweight UBCs over vast distances, remains a persistent challenge that necessitates continuous optimization of collection networks.

The current market trajectory is heavily influenced by the opportunity to integrate advanced Industry 4.0 technologies. The application of AI and robotics not only mitigates labor shortages but also fundamentally transforms the economic viability of recovering even slightly contaminated scrap streams. Another substantial opportunity is the premiumization of "low-carbon" aluminum; secondary aluminum derived from UBCs inherently carries a significantly lower carbon footprint, allowing recyclers to command higher prices from environmentally conscious buyers, especially in the automotive and aerospace sectors. The Impact Forces dictate that successful market participants must strategically manage regulatory compliance and technological investment while actively mitigating supply chain volatility through long-term contracts and efficient localized collection systems. The confluence of these factors indicates a market accelerating towards consolidation and technological sophistication, rewarding efficiency and purity in material recovery.

Segmentation Analysis

The Aluminium UBC Recycling Market is primarily segmented across three critical dimensions: End-Use Application, Processing Technology, and Collection Source. Understanding these segments is vital for strategic market engagement, as each segment dictates specific purity requirements and logistical demands. The End-Use Application segmentation clearly identifies the destination of the recycled metal, with the Closed-Loop (Can-to-Can) segment dominating due to its intrinsic circularity and high-quality demands. The Processing Technology segmentation differentiates facilities based on their metallurgical capabilities, ranging from basic remelting operations to advanced refining processes using fluxing agents and filtration systems designed to remove complex impurities like magnesium and silicon. Lastly, segmentation by Collection Source—which includes Deposit Return Schemes (DRS), Materials Recovery Facilities (MRFs), and industrial scrap—is crucial for assessing feedstock consistency and predictable volume flow, with DRS generally yielding the highest quality and most traceable UBC scrap.

The differentiation in processing technology is becoming increasingly critical due to evolving quality demands from end-users. While simple shredding and melting suffice for some lower-grade casting applications, producing certified high-purity coil stock for new cans or advanced automotive components requires sophisticated equipment such as specialized continuous rotary furnaces (CRFs) capable of handling volatile magnesium and highly effective dross recovery systems. The investment in these high-tech systems often separates market leaders from regional commodity players. Furthermore, the segmentation by Collection Source directly impacts operational costs. UBCs collected via MRFs often require intense pre-sorting and cleaning due to high contamination rates, whereas those sourced through organized schemes like DRS provide cleaner input material, leading to lower processing costs and higher recovery yields.

Strategic analysis must prioritize the intersection of these segments. For instance, a facility specializing in closed-loop manufacturing (End-Use Application) will inherently need to employ the most advanced refining technology (Processing Technology) and preferably secure feedstock from high-purity Collection Sources (DRS or dedicated industrial take-back programs). This integrated perspective allows businesses to optimize their capital allocation and focus on niches that command premium pricing based on certified sustainability and material quality. The increasing focus on carbon footprint reporting further drives segmentation, creating a new premium category for verified low-carbon recycled aluminum tailored for specific industrial clientele seeking verifiable Scope 3 emissions reductions.

- By End-Use Application:

- Can-to-Can (Closed-Loop) Recycling

- Automotive Components

- Construction and Building Materials

- Other Industrial Uses (e.g., Foundry Alloys)

- By Processing Technology:

- Shredding and Bailing

- Smelting and Remelting (Continuous Rotary Furnaces, Reverberatory Furnaces)

- Refining and Alloying

- Dross Processing and Recovery

- By Collection Source:

- Deposit Return Systems (DRS)

- Materials Recovery Facilities (MRFs)

- Industrial Scrap (Pre-consumer)

- Household/Curbside Collection Programs

Value Chain Analysis For Aluminium UBC Recycling Market

The value chain of the Aluminium UBC Recycling Market begins with upstream collection and aggregation, moves through highly specialized intermediate processing, and culminates in downstream secondary aluminum production and distribution. Upstream analysis focuses on the efficient collection of UBCs, primarily from public collection points, residential curbside programs, and commercial waste streams, where the initial sorting and densification (bailing or shredding) take place. The effectiveness of this initial stage, often involving numerous small-scale collection entities and large-scale MRFs, determines the purity and volume consistency of the primary feedstock. The challenge upstream is managing the high fragmentation and variability in material quality, especially in regions lacking standardized DRS. The main stakeholders upstream are municipalities, waste management companies, and individual scrap dealers.

The middle segment of the value chain is occupied by processors and secondary smelters who transform the loose or baled scrap into usable forms. This intermediate processing involves advanced cleaning, removal of lacquers and contaminants (de-coating), and melting in large-scale furnaces, typically continuous rotary furnaces (CRFs) for efficiency. Downstream analysis focuses on the output: the production of specialized secondary aluminum alloys, often in the form of T-ingots or sow ingots, which are tailored to the exact specifications of major end-users. The key downstream activities include quality assurance, alloying to precise chemical compositions, and subsequent distribution. Direct distribution channels involve long-term contracts between large secondary aluminum producers and major beverage can sheet manufacturers (e.g., Novelis, Constellium) or Tier 1 automotive suppliers. Indirect channels involve commodity brokers and metal exchanges, catering to smaller foundries or casting operations.

The efficiency of the overall value chain is highly dependent on logistics and technological integration between the collection and processing stages. Companies are increasingly moving towards vertically integrated models to exert control over the entire supply sequence, ensuring quality consistency and hedging against scrap price volatility. For instance, a major downstream smelter might invest directly in upstream MRF technology to ensure a consistent, clean supply of pre-sorted UBC. The critical point of value addition occurs during the high-tech processing stage, where contaminants are removed, and the metal is re-alloyed, fundamentally transforming low-value scrap into high-value industrial metal. Robust, transparent distribution channels, often leveraging digital platforms for traceability and certification, are essential for capturing the premium associated with low-carbon secondary aluminum.

Aluminium UBC Recycling Market Potential Customers

The primary potential customers and end-users of recycled aluminum derived from UBCs are concentrated in industries that prioritize lightweighting, material sustainability, and energy efficiency. The largest customer base remains the beverage and food packaging industry, requiring high volumes of consistent-quality secondary aluminum sheet for the production of new cans. These customers, driven by consumer demand for sustainable packaging and aggressive corporate commitments to circular economy models (e.g., 50% or 100% recycled content targets), demand material that meets stringent metallurgical standards for high-speed manufacturing processes. This need necessitates long-term procurement relationships with secondary smelters capable of closed-loop supply management and verifiable quality control. The stability and consistency of this demand segment make it the foundational pillar of the UBC recycling market.

The second major cohort of potential customers resides in the transportation sector, predominantly automotive OEMs and their Tier 1 suppliers. As the automotive industry rapidly pivots toward electric vehicles (EVs), the imperative to reduce vehicle weight to maximize battery range drives the increased use of aluminum structural components, body panels, and crash management systems. Since aluminum from UBCs often contains specific alloy components suitable for casting and high-strength applications, it is highly valued by this sector. These customers often require certified, low-carbon aluminum to meet their internal Scope 3 emissions reduction targets, making the traceable sustainability credentials of UBC-derived metal a significant buying criterion. The procurement process here is complex, involving strict quality audits and highly specific alloy formulation requirements.

Additionally, the construction and industrial manufacturing sectors represent substantial potential customers. Recycled aluminum is used in window frames, roofing materials, and specialized industrial equipment where corrosion resistance and longevity are paramount. While these segments may tolerate slightly broader alloy variations than the packaging or automotive industries, they are increasingly sensitive to the price of primary aluminum, making cost-competitive secondary aluminum an attractive alternative, particularly for large infrastructure projects seeking LEED certification or similar environmental performance indicators. Furthermore, smaller foundries and specialized die-casting operations constitute a continuous but fragmented customer base, relying on brokers and smaller distributors for customized aluminum alloy ingots tailored for specific small-batch components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Novelis Inc., Constellium SE, Alcoa Corporation, Norsk Hydro ASA, TOMRA Systems ASA, Pyrogenesis Canada Inc., Matalco Inc., Real Alloy, ELG Haniel GmbH, Granges AB, Rusal, Gulf Extrusions Co., Dowa Holdings Co., Ltd., Scepter, Inc., UACJ Corporation, China Hongqiao Group, Kaiser Aluminum, Spectro Analytical Instruments, Retech Systems LLC, A&L Recycling. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminium UBC Recycling Market Key Technology Landscape

The technological landscape of the Aluminium UBC Recycling Market is characterized by continuous innovation aimed at increasing recovery yields, enhancing material purity, and reducing the energy intensity of the remelting process. A foundational technology advancement is in automated pre-sorting. Traditional manual or eddy current separation methods are being rapidly supplemented by sophisticated sensor-based sorting (SBS) technologies, primarily utilizing X-ray Transmission (XRT) and Near-Infrared (NIR) spectroscopy. These systems can process high volumes of scrap while accurately identifying and separating aluminum from contaminants like steel, plastics, and even different grades of aluminum alloys, significantly improving the quality of furnace-ready scrap and drastically reducing downstream processing costs related to dross formation and fluxing. The latest generation of these sorters integrates AI algorithms to handle complex material overlaps and recognize highly deformed or soiled UBCs, pushing sorting efficiency to near-perfect levels.

In the processing and melting stage, critical technologies focus on thermal efficiency and metal recovery. Continuous Rotary Furnaces (CRFs) have largely replaced traditional reverberatory furnaces for UBC recycling due to their enhanced thermal efficiency, better heat transfer kinetics, and superior ability to handle high volumes of shredded, lightweight scrap with minimal oxidation loss. Furthermore, significant technological effort is being directed towards advanced de-coating technologies—processes that thermally remove external paint and internal liners from the UBCs prior to melting. Effective de-coating minimizes the introduction of organic contaminants into the melt, which, if left unchecked, can lead to hazardous emissions, lower metal quality, and increased dross formation. Specialized atmosphere control within the furnaces also helps minimize metal oxidation during melting, maximizing the final yield of usable secondary aluminum.

Finally, technology related to quality assurance and traceability is emerging as a market differentiator. Modern secondary smelters employ sophisticated melt treatment processes, including inline degassing and filtration systems, to remove non-metallic inclusions and hydrogen, which are detrimental to the final product's strength and formability (especially for high-speed rolling mill applications). Complementary to this, digital technologies like blockchain and integrated data platforms are being implemented to track the origin and processing history of UBC scrap. This digital traceability allows recyclers to certify the low-carbon status of their products, providing the necessary documentation for end-users committed to reporting Scope 3 emissions reductions, thereby capturing a premium in the high-end industrial segments like aerospace and automotive.

Regional Highlights

Regional dynamics play a crucial role in shaping the Aluminium UBC Recycling Market, driven by variances in consumer behavior, regulatory frameworks, and industrial demand concentration. North America and Europe represent mature markets characterized by established recycling infrastructure, high consumer awareness, and mandatory recycling mandates. In North America, particularly the US, the market is highly influenced by state-level DRS programs and substantial domestic demand from the beverage and automotive industries, pushing recovery rates above the global average. European growth is sustained by rigorous EU directives, including stringent landfill restrictions and circular economy action plans, compelling member states to achieve ambitious material recycling targets. Both regions benefit from technological leadership, hosting major secondary aluminum producers and advanced sorting equipment manufacturers, focusing on optimizing efficiency and material purity.

Asia Pacific (APAC) stands out as the epicenter of future market volume expansion. Countries like China, India, and rapidly developing nations in Southeast Asia (Vietnam, Indonesia) are witnessing explosive growth in beverage consumption coupled with increasing urbanization. Although recycling rates are currently inconsistent, often relying on informal sectors, governmental policy shifts—including bans on scrap imports and the establishment of domestic recycling targets—are forcing massive investments in formal, large-scale processing facilities. China, while traditionally a major scrap importer, is transitioning to self-sufficiency, driving regional capacity development. This region presents both the greatest opportunity for volume growth and the largest challenge regarding standardization and infrastructure development.

Latin America, and the Middle East and Africa (MEA), offer promising long-term growth potential, though they currently face unique challenges. Latin American nations, such as Brazil and Mexico, have historically high informal recycling rates for aluminum cans due to their commodity value, but this process often lacks the sophisticated industrial refinement needed for high-end applications. Investment is needed to formalize and scale up these operations. The MEA region is characterized by significant investment in primary aluminum production (due to low energy costs) but is rapidly recognizing the environmental and economic value of integrating secondary production, particularly in the UAE and Saudi Arabia. Regional growth will depend heavily on stable regulatory frameworks and sustained foreign direct investment in collection and high-tech sorting infrastructure to transition from localized, informal collection to standardized, industrial recycling operations.

- North America (US & Canada): Mature market defined by high recycling rates, robust DRS presence in many states/provinces, and strong demand integration with the automotive lightweighting trend. Focus on technology upgrades and maximizing residential participation.

- Europe (EU & UK): Highly regulated market driven by Circular Economy Action Plans and high EPR fees. Leadership in implementing digital traceability and certified low-carbon aluminum production processes. Germany, UK, and Nordic countries show exceptional recycling performance.

- Asia Pacific (APAC): Highest projected volume growth due to surging consumption and urbanization. Significant governmental investment in large-scale formal recycling infrastructure (China, India). Challenges include scaling collection networks and standardizing quality.

- Latin America: High inherent value recognition for aluminum scrap resulting in effective, though often informal, collection systems. Opportunity for industrial formalization and investment in high-tech processing to serve domestic and export markets (Brazil, Mexico).

- Middle East & Africa (MEA): Emerging market with increasing regulatory attention on waste management. Focus on establishing core infrastructure and leveraging regional energy advantages to support both primary and increasingly, secondary aluminum production capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminium UBC Recycling Market.- Novelis Inc. (A subsidiary of Hindalco Industries)

- Constellium SE

- Alcoa Corporation

- Norsk Hydro ASA

- TOMRA Systems ASA

- Matalco Inc.

- Real Alloy (A division of Real Industry, Inc.)

- ELG Haniel GmbH

- Granges AB

- Rusal

- UACJ Corporation

- Pyrogenesis Canada Inc.

- Dowa Holdings Co., Ltd.

- Kaiser Aluminum

- Scepter, Inc.

- China Hongqiao Group

- OmniSource Corporation

- Spectro Analytical Instruments

- Retech Systems LLC

- A&L Recycling

Frequently Asked Questions

Analyze common user questions about the Aluminium UBC Recycling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current global recycling rate for Used Beverage Cans (UBCs)?

The global recycling rate for UBCs typically averages around 70%, though this figure varies significantly by region. Mature markets like Europe and North America often exceed 80%, largely due to effective Deposit Return Systems (DRS) and strong public participation. The highest rates are generally observed where the scrap value incentive and regulatory structure are maximized, while rates remain lower in many developing regions due to inadequate collection infrastructure.

How does the energy consumption of secondary aluminum compare to primary aluminum production?

Recycling aluminum from UBCs requires significantly less energy—approximately 95% less—compared to producing primary aluminum from bauxite ore. This massive energy saving is the fundamental economic and environmental driver of the UBC recycling market, contributing directly to lower production costs and substantially reduced carbon emissions per ton of metal produced.

What are Deposit Return Schemes (DRS), and how do they impact UBC recycling volumes?

Deposit Return Schemes (DRS) are regulatory systems where consumers pay a small deposit when purchasing a beverage container, which is refunded upon returning the empty container. DRS systems have a profound positive impact on UBC recycling volumes and purity, as they create a powerful economic incentive for collection outside of traditional municipal waste streams, typically yielding higher recovery rates and cleaner, less contaminated feedstock.

Which technological advancements are most critical for future market growth?

The most critical technological advancements are centered on enhancing sorting accuracy and purity. Key technologies include AI-powered sensor-based sorting (SBS) utilizing XRT and NIR spectroscopy, which minimizes contamination. Additionally, advanced continuous rotary furnaces (CRFs) and specialized molten metal refining processes are crucial for maximizing metal recovery and meeting the stringent quality specifications required by the closed-loop packaging and automotive industries.

What role does the automotive industry play in driving demand for recycled UBC aluminum?

The automotive industry is a rapidly growing driver of demand, especially with the transition to electric vehicles (EVs). UBC-derived secondary aluminum is valued for its specific alloy characteristics suitable for lightweighting components, which is essential for improving EV battery range. Furthermore, automotive OEMs seek certified low-carbon aluminum to meet corporate sustainability goals and reduce their Scope 3 emissions footprint.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager