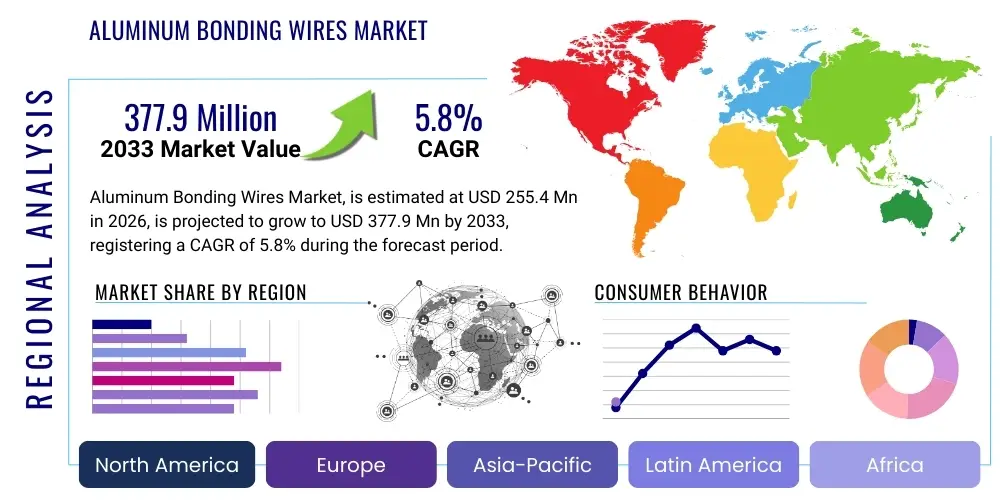

Aluminum Bonding Wires Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435676 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Aluminum Bonding Wires Market Size

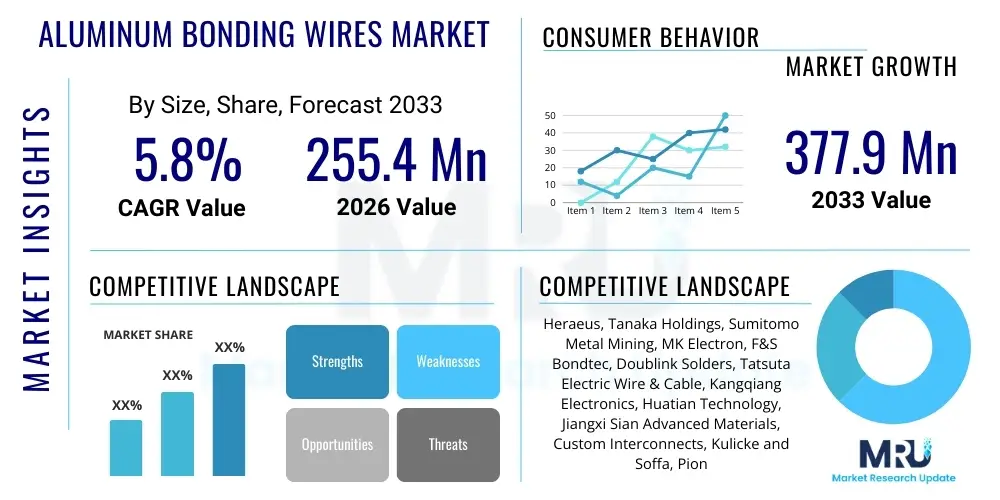

The Aluminum Bonding Wires Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 255.4 Million in 2026 and is projected to reach USD 377.9 Million by the end of the forecast period in 2033.

Aluminum Bonding Wires Market introduction

The Aluminum Bonding Wires Market encompasses specialized, fine-diameter wires used primarily in semiconductor assembly to create electrical interconnections between the integrated circuit (IC) chip and the lead frame or substrate. These wires are crucial components in microelectronic packaging, ensuring reliable electrical conductivity and structural integrity within devices ranging from standard ICs to high-power modules. Aluminum bonding wires, often alloyed with silicon (e.g., Al-1%Si), are selected due to their cost-effectiveness, high shear strength, and suitable performance in specific packaging applications, particularly those requiring lower current density or large diameter wires for power electronics.

Aluminum bonding wires differ from traditional gold or emerging copper wires by offering a distinct balance of material properties and economic viability. They are widely utilized in applications such as discrete devices, power transistors, LED lighting, and large-scale ICs where high temperature stability and cost constraints are critical considerations. The inherent material properties of aluminum, including its light weight and low resistivity (though higher than gold or copper), make it essential for manufacturing robust, reliable, and standardized semiconductor packages. The manufacturing process involves sophisticated drawing and annealing techniques to achieve the required mechanical properties and precise diameters, often ranging from 20 micrometers up to several hundred micrometers for power applications.

Major applications driving the demand for aluminum bonding wires include automotive electronics, where robust interconnection is necessary for engine control units and power management modules, and industrial power devices, such as IGBTs and MOSFETs, used in renewable energy systems and electric vehicle charging infrastructure. The primary benefits of utilizing aluminum bonding wires include lower material costs compared to precious metal alternatives, superior resistance to creep in certain high-temperature environments, and ease of handling during the wire bonding process, particularly for large diameter wires. Driving factors include the continuous expansion of the power semiconductor market and the persistent need for cost reduction in high-volume electronic manufacturing.

Aluminum Bonding Wires Market Executive Summary

The global Aluminum Bonding Wires Market is positioned for stable growth, propelled by robust expansion in the power electronics sector and increasing demand for cost-effective packaging solutions in standard semiconductor manufacturing. Business trends indicate a shift towards advanced alloys incorporating controlled percentages of silicon (e.g., Al-1%Si, Al-2%Si) to enhance mechanical reliability and bond integrity, addressing the stringent requirements of modern automotive and industrial applications. Furthermore, manufacturers are focusing on optimization of wire diameter distributions, specifically targeting the 50-100 µm segment, which is highly utilized in medium-power and high-reliability modules, necessitating stricter quality control and tighter tolerances in production processes.

Regional trends highlight Asia Pacific (APAC) as the undisputed leader, driven by the massive concentration of semiconductor assembly, testing, and packaging (OSAT) facilities in countries like China, Taiwan, South Korea, and Japan. The rapid adoption of electric vehicles (EVs) and the proliferation of advanced manufacturing infrastructure in APAC are creating sustained high demand for large-diameter aluminum wires used in power modules. While North America and Europe maintain technological leadership, their consumption is primarily concentrated in specialized high-reliability applications and proprietary defense or aerospace systems, necessitating premium, highly certified products.

Segment trends underscore the dominance of the Application segment related to Power Devices, which consistently mandates aluminum or copper wires due to thermal management and current handling requirements—a segment projected to exhibit the fastest growth over the forecast period. By Type, the 1% Si alloy remains the industry standard, offering an optimal balance of hardness and ductility for mass production. Concurrently, the increasing complexity of semiconductor geometry is pushing the demand for both smaller diameter wires in certain discrete applications and extremely large diameter wires (>100 µm) for high-power modules, emphasizing the market’s bifurcation based on end-use power requirements and packaging technology.

AI Impact Analysis on Aluminum Bonding Wires Market

User queries regarding AI's influence on the Aluminum Bonding Wires Market predominantly center on how Artificial Intelligence and machine learning (ML) optimize the manufacturing process, enhance quality control, and predict material performance under operational stress. Users seek confirmation on whether AI adoption leads to the rapid replacement of aluminum wires with newer materials or if it primarily acts as an optimization tool within existing production lines. Key themes include the use of AI for predictive maintenance of wire bonding machinery, real-time defect detection during wire drawing, and leveraging ML algorithms to fine-tune alloy compositions for superior bond strength and longevity in harsh environments, particularly in automotive applications where component failure is highly critical.

The immediate and tangible impact of AI is observed not in the material specification itself—aluminum wires remain crucial for cost-sensitive power applications—but rather in the efficiency and quality assurance phases of the value chain. AI-driven vision systems and deep learning algorithms are revolutionizing automated optical inspection (AOI) of bonding loops, dramatically reducing inspection time and improving the detection rate of subtle structural defects like wire sweep, short circuits, or poor bond pad coverage. Furthermore, simulation tools integrated with AI are accelerating the design cycle for new semiconductor packages, allowing manufacturers to model thermal cycling and mechanical stress on aluminum interconnections before physical prototyping, thereby ensuring greater reliability and faster time-to-market for high-power modules.

In the future, AI-powered materials informatics could potentially lead to the discovery of novel aluminum alloys or composite wires tailored precisely for extreme operating conditions. AI is crucial for managing the immense data generated by high-speed wire bonding machines (operating at thousands of bonds per hour), transforming raw process parameters into actionable insights that optimize machine parameters, minimize material waste, and ensure the consistent quality required for high-reliability applications like IGBT modules, thus solidifying aluminum bonding wires' position in cost-effective power electronics.

- AI-powered Predictive Maintenance: Minimizing downtime of wire bonding equipment, optimizing throughput, and reducing operational costs.

- Enhanced Quality Control (QC): Utilizing machine learning for real-time automated optical inspection (AOI) of bond geometry and wire defects (e.g., stitch integrity, loop height).

- Material Optimization: Employing AI/ML to simulate and predict the performance of new aluminum alloy compositions under varying thermal and mechanical stresses.

- Process Parameter Optimization: Dynamically adjusting bonding machine settings (e.g., ultrasonic energy, bonding force, temperature) based on sensor data and historical performance metrics.

- Supply Chain Forecasting: AI models assist in predicting demand fluctuations for specific wire diameters and managing inventory efficiently, mitigating risks associated with metal price volatility.

DRO & Impact Forces Of Aluminum Bonding Wires Market

The market dynamics for aluminum bonding wires are shaped by a complex interplay of cost sensitivity, technological limitations, and expanding end-user demands, particularly within power and automotive sectors. Driving forces include the relentless global push toward vehicle electrification (EVs, hybrid vehicles), which necessitates large-diameter, high-current carrying bonding wires, a domain where aluminum excels due to its economic advantage over gold and large-diameter copper. Opportunities are concentrated in emerging technologies such as Silicon Carbide (SiC) and Gallium Nitride (GaN) based power semiconductors, where aluminum wires are being adapted, often in conjunction with advanced coating technologies, to handle extremely high operating temperatures and faster switching speeds required by next-generation power modules, presenting significant avenues for alloy innovation and market penetration.

However, the market faces notable restraints, primarily the pervasive competition from copper bonding wires. Copper offers superior electrical conductivity and mechanical hardness, leading to its widespread adoption in mainstream IC packaging (e.g., memory and logic chips). Aluminum wires are typically restricted to power applications where their specific properties are preferred or where cost dictates the material choice. Fluctuations in the global price of aluminum and silicon (the primary alloying element) also introduce volatility, impacting manufacturing margins and procurement strategies for downstream OSAT providers. The inherent limitations of aluminum, such as susceptibility to oxidation and challenges in ultra-fine pitch bonding compared to gold, also constrain its use in advanced, high-density packaging formats, pushing R&D towards hybrid solutions.

The impact forces driving growth are primarily external, emanating from global macroeconomic trends like industrial automation and the energy transition, ensuring sustained demand for power devices. Conversely, technological internal forces, such as the continuous improvement in copper wire bonding reliability and the development of cost-effective gold plating alternatives, exert counter-pressure on aluminum market share, especially in smaller diameter segments. Success in this market hinges on manufacturers' ability to maintain stringent quality standards, provide customized large-diameter solutions for SiC/GaN modules, and effectively manage the delicate balance between cost leadership and performance reliability in high-stakes applications.

- Drivers

- Accelerated adoption of Electric Vehicles (EVs) and hybrid vehicles requiring robust power modules (IGBTs, MOSFETs).

- Cost-effectiveness of aluminum compared to traditional gold bonding wires, driving adoption in high-volume, cost-sensitive power applications.

- Increasing deployment of renewable energy infrastructure (solar inverters, wind power) which relies heavily on power semiconductors utilizing large-diameter aluminum wires.

- Restraints

- Intense competitive pressure from high-performance copper bonding wires in mainstream IC and memory packaging.

- Susceptibility of aluminum to oxidation, potentially complicating bonding processes and reducing long-term reliability compared to inert metals like gold.

- Market volatility associated with the fluctuating global price of raw aluminum material.

- Opportunity

- Growth in the High-Temperature and High-Power Semiconductor Market (SiC and GaN), necessitating customized large-diameter aluminum alloys.

- Development of advanced aluminum alloys and surface coatings to improve bond reliability and resistance to intermetallic compound formation.

- Expansion into emerging markets in Asia Pacific and Latin America driving localized demand for automotive and industrial electronics.

- Impact Forces Analysis

- Supplier Bargaining Power: Moderate, due to high entry barriers requiring specialized manufacturing technology but offset by the availability of substitutes (Cu, Au).

- Buyer Bargaining Power: High, driven by large-scale purchases by major OSATs and semiconductor companies demanding stringent specifications and competitive pricing.

- Threat of Substitutes: High, given the maturity and technological advancement of copper bonding wires, which continuously erode aluminum's potential market share in finer pitch applications.

Segmentation Analysis

The Aluminum Bonding Wires Market is comprehensively segmented based on Type, Diameter, and Application, reflecting the diverse technical requirements of the semiconductor industry. Segmentation by Type primarily involves the percentage of silicon used as an alloy, which dictates the wire's mechanical properties, hardness, and suitability for various bonding processes. Al-1%Si is the historical and current dominant segment, prized for its optimal balance of workability and strength, while higher Si content alloys (2%Si, 3%Si) cater to specific high-reliability or large-diameter requirements. Diameter segmentation is critical as it directly correlates with current carrying capacity; the 50-100 µm range dominates general power and discrete device packaging, whereas the >100 µm segment is crucial for high-power modules like IGBTs.

Application segmentation reveals the true demand drivers, with Power Devices emerging as the most significant and rapidly expanding consumer base. Aluminum wires are essential here due to the need for larger diameters to handle high currents and manage thermal stress effectively, especially in traction inverters and industrial motors. In contrast, IC Packaging, once a dominant segment, has largely transitioned to copper or advanced copper/palladium wires for finer pitch requirements, leaving aluminum to focus on larger IC packages or less performance-intensive chips. Optoelectronics, primarily driven by high-power LED arrays, also constitutes a vital, growth-oriented application segment, valuing the material's thermal properties and cost-efficiency.

This structured segmentation allows market participants to strategically focus their R&D and manufacturing capabilities. Manufacturers targeting high-growth areas must invest in producing high-purity aluminum wire alloys tailored for large diameter applications in extreme temperature environments, aligning with the stringent reliability standards of the automotive and industrial sectors. The shift toward higher diameter specifications in the Application segment emphasizes the need for robust handling and bonding technologies that can accommodate the increased stiffness and size of these critical interconnections.

- By Type

- Aluminum-1% Silicon (Al-1%Si)

- Aluminum-2% Silicon (Al-2%Si)

- Aluminum-3% Silicon (Al-3%Si)

- Other Aluminum Alloys (e.g., Al-Mg, High Purity Al)

- By Diameter

- <50 micrometers (µm)

- 50–100 micrometers (µm)

- >100 micrometers (µm)

- By Application

- IC Packaging (Standard & Large Dies)

- Discrete Devices (Transistors, Diodes)

- Optoelectronics (High-Power LEDs, Laser Diodes)

- Automotive Electronics (ECUs, Sensors, Power Systems)

- Power Devices (IGBTs, MOSFETs, Rectifiers, Inverters)

Value Chain Analysis For Aluminum Bonding Wires Market

The value chain for aluminum bonding wires begins with the upstream procurement and processing of high-purity aluminum and alloying elements, primarily silicon. Upstream activities involve specialized smelting and refining processes to ensure metal purity well above 99.99%, as minute contaminants can severely affect the electrical and mechanical properties of the final bonding wire. Key players in this phase are global metal suppliers and specialized chemical companies. The subsequent stage involves wire drawing, a highly technical process where specialized machinery reduces the diameter of the aluminum rod down to the micron level. This stage requires significant capital investment in precision equipment and process control to maintain tight dimensional tolerances and achieve optimal crystalline structure through precise annealing and heat treatments.

The midstream phase is dominated by the bonding wire manufacturers themselves, who perform the drawing, annealing, and final winding onto spools. Quality control and packaging are paramount, as the wire must be contamination-free and precisely tensioned to prevent damage during transport and high-speed bonding. The distribution channel is bifurcated: Direct sales are common for large-volume purchases by major integrated device manufacturers (IDMs) or large Outsourced Semiconductor Assembly and Test (OSAT) companies, allowing for customized specifications and technical support. Indirect distribution utilizes specialized regional distributors or sales agents who manage inventory, logistics, and technical support for smaller or geographically dispersed end-users, ensuring quick supply chain response times across key manufacturing hubs in Asia.

Downstream activities involve the final end-users—primarily OSATs and IDMs—who integrate the wires into semiconductor packages using high-speed ultrasonic wire bonding machines. This phase includes the rigorous testing and qualification of the packaged device. The performance of the aluminum bonding wire directly impacts the final product’s reliability and yield. The strong growth in the automotive sector means downstream demand is increasingly stringent, demanding higher reliability certifications and full traceability for every spool. Optimization of the value chain is therefore focused on reducing lead times, minimizing material waste during drawing, and improving collaboration between material suppliers and wire bonding machine manufacturers to ensure smooth integration into high-speed assembly lines.

Aluminum Bonding Wires Market Potential Customers

The primary customers for aluminum bonding wires are large-scale enterprises engaged in the assembly, testing, and packaging of semiconductor devices. These customers fall mainly into two categories: Outsourced Semiconductor Assembly and Test (OSAT) providers and Integrated Device Manufacturers (IDMs). OSAT companies, such as ASE, Amkor, and Jiangsu Changjiang Electronics Technology (JCET), are major volume consumers, utilizing vast quantities of aluminum wires for packaging a wide variety of discrete devices, power components, and certain large ICs where cost efficiency is prioritized. Their procurement decisions are heavily influenced by cost, consistency, and the supplier's ability to provide high-reliability products in high volume.

Beyond OSATs, IDMs that retain in-house packaging capabilities for strategic or specialized components—particularly those focused on automotive power (e.g., Infineon, ON Semiconductor) or industrial applications (e.g., Mitsubishi Electric)—constitute a critical segment. These companies require aluminum wires with highly specific alloy compositions and diameters, often custom-engineered to meet stringent proprietary thermal and mechanical specifications for high-power modules like IGBTs and advanced SiC devices. Their focus is less on absolute minimum cost and more on verifiable performance, long-term reliability under thermal cycling, and compliance with automotive quality standards (AEC-Q100/101).

A rapidly growing customer segment is specialized manufacturers of LED components and high-power optoelectronics, who utilize aluminum wires for robust heat dissipation and current delivery in lighting applications. Furthermore, defense and aerospace contractors, while representing smaller volume, are essential end-users, requiring extremely high-purity, certified aluminum wires that adhere to military specifications, emphasizing traceability and performance in extreme temperature and vibration environments. Therefore, suppliers must tailor their sales strategies to address the distinct technical and logistical demands of these diverse high-volume (OSAT) and high-specification (IDM/Automotive) buyer groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 255.4 Million |

| Market Forecast in 2033 | USD 377.9 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Heraeus, Tanaka Holdings, Sumitomo Metal Mining, MK Electron, F&S Bondtec, Doublink Solders, Tatsuta Electric Wire & Cable, Kangqiang Electronics, Huatian Technology, Jiangxi Sian Advanced Materials, Custom Interconnects, Kulicke and Soffa, Pioneer Material Precision, QPL Limited, Wuxi Xinming Micro-Wire. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminum Bonding Wires Market Key Technology Landscape

The technology landscape in the Aluminum Bonding Wires Market is characterized by continuous refinement in alloy composition and advances in wire drawing precision, ensuring wires meet increasingly demanding reliability standards. A primary technological focus involves the controlled inclusion of alloying elements, predominantly silicon, to manage the hardness, loop stability, and intermetallic compound formation at the bond interface. Advanced manufacturers utilize proprietary vacuum casting and homogenization techniques to ensure uniform distribution of the silicon content (often 1% to 3% by weight), which is vital for achieving consistent bonding behavior, especially in high-speed automated bonding processes where variability can significantly impact yield and throughput.

Furthermore, technology related to large-diameter aluminum wire processing is gaining prominence, driven by the power semiconductor segment. This involves specialized heavy wire bonding equipment and corresponding wire metallurgy designed to handle the high ultrasonic energy required to form reliable bonds with large die pads (sometimes exceeding 300 µm in diameter) while mitigating heel cracking and wire fatigue under extreme thermal cycling. The development of specialized surface treatments or temporary protective coatings on the aluminum wire is also a key technological area, aiming to reduce oxidation during storage and facilitate improved adhesion and robustness during the actual bonding process, thereby enhancing long-term operational reliability in modules subjected to high power loads.

Process technologies, particularly Continuous Casting and Drawing (CCD), combined with advanced in-line monitoring and tension control systems, are essential for maintaining the ultra-fine tolerance required for micron-scale wire production. The integration of advanced annealing furnaces allows for precise control over the grain structure, which is crucial for balancing the wire’s necessary stiffness (for automated handling) and required ductility (for reliable bond formation). The adoption of automated vision systems and advanced metrology tools throughout the manufacturing lifecycle ensures that the physical dimensions and metallurgical characteristics of the aluminum wires meet the stringent qualification standards demanded by automotive (AEC-Q) and industrial electronics customers.

Regional Highlights

The regional dynamics of the Aluminum Bonding Wires Market are heavily skewed toward Asia Pacific (APAC), which serves as the global epicenter for semiconductor packaging and automotive component manufacturing. This dominance is attributed to the presence of the world's largest OSAT companies and major fabrication facilities concentrated in China, Taiwan, South Korea, and Japan. The intense local competition and high production volumes necessitate the use of cost-effective materials, making aluminum bonding wires essential, particularly in high-volume discrete and power device packaging. The rapid deployment of 5G infrastructure and massive investments in localized EV manufacturing capabilities in countries like China are further cementing APAC's lead in consumption, especially for large-diameter wires used in power train inverters.

North America and Europe represent mature markets characterized by higher demand for specialty and high-reliability aluminum wires, primarily utilized in aerospace, defense, medical devices, and high-end industrial power applications. While the overall volume is lower than in APAC, these regions drive innovation in proprietary alloys and demand the highest levels of material certification and performance traceability. European markets, in particular, are witnessing accelerated adoption due to their strong presence in the high-power industrial segment, including renewable energy inverters and heavy machinery control systems. Regulatory pressures around reliability and environmental standards also influence material choice and procurement in these regions.

Latin America and the Middle East and Africa (MEA) currently hold smaller market shares but are exhibiting promising growth, driven by expanding local assembly capabilities and increasing industrialization. MEA's growth is often linked to localized investments in power generation and infrastructure projects, requiring robust power management modules. While these regions rely heavily on imported finished wires, the trend towards establishing regional electronic manufacturing hubs suggests a steady increase in localized demand for core semiconductor components, including aluminum bonding wires, albeit starting from a relatively low base compared to the established markets of East Asia.

- Asia Pacific (APAC): Dominates the market share due to high concentration of OSAT facilities, major electronics manufacturing bases, and rapid EV adoption in countries like China, South Korea, and Taiwan. Highest volume consumer of both standard and large-diameter aluminum bonding wires.

- North America: Focuses on high-reliability, specialty applications (defense, aerospace, high-end industrial), demanding premium certified wires and driving innovation in advanced alloy materials.

- Europe: Strong demand driven by the robust industrial power sector, including automotive suppliers and renewable energy component manufacturers, ensuring significant consumption of high-power, large-diameter aluminum wires.

- Latin America & MEA: Emerging markets with increasing industrialization and infrastructure investment, leading to gradual growth in localized electronic assembly and consumption of discrete and power device packaging materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminum Bonding Wires Market.- Heraeus

- Tanaka Holdings Co., Ltd.

- Sumitomo Metal Mining Co., Ltd.

- MK Electron Co., Ltd.

- F&S Bondtec Semiconductor GmbH

- Doublink Solders

- Tatsuta Electric Wire & Cable Co., Ltd.

- Kangqiang Electronics Co., Ltd.

- Huatian Technology (Kunshan) Electronics Co., Ltd.

- Jiangxi Sian Advanced Materials Co., Ltd.

- Custom Interconnects Inc.

- Kulicke and Soffa Industries, Inc. (Equipment and Materials)

- Pioneer Material Precision Co., Ltd.

- QPL Limited

- Wuxi Xinming Micro-Wire Co., Ltd.

- Nippon Micrometal Corporation

- Advanced Interconnect Technologies

- Microbond Technologies

Frequently Asked Questions

Analyze common user questions about the Aluminum Bonding Wires market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of using aluminum bonding wires over gold or copper in semiconductor packaging?

The primary advantage of aluminum bonding wires is their significant cost-effectiveness compared to gold and their superior performance in certain large-diameter, high-power applications, such as IGBT modules. Aluminum wires are often preferred when handling high currents and managing heat dissipation in cost-sensitive power electronic devices, as they minimize material expenses without compromising essential reliability standards for robust power cycling.

Which market segment is currently the largest consumer of aluminum bonding wires?

The Power Devices segment, which includes the packaging of high-current components like Insulated Gate Bipolar Transistors (IGBTs) and high-power MOSFETs, is the largest consumer. These devices require robust, large-diameter wires to handle substantial electrical loads and thermal stress, a requirement perfectly met by aluminum bonding wire specifications, especially the Al-1%Si alloy.

How does the increasing adoption of Silicon Carbide (SiC) technology influence the demand for aluminum bonding wires?

The shift towards Silicon Carbide (SiC) and Gallium Nitride (GaN) power devices positively influences the demand for specialized, high-reliability aluminum bonding wires. SiC modules operate at higher temperatures and frequencies, necessitating advanced aluminum alloys or coated wires that can withstand extreme thermal cycling and provide stable interconnection, driving innovation in the >100 µm diameter segment.

What is the most common alloy used in the aluminum bonding wires market?

The most common and widely utilized alloy is Aluminum-1% Silicon (Al-1%Si). The addition of 1% silicon is critical as it hardens the pure aluminum, improving the mechanical strength and loop stability required for high-speed automated wire bonding processes, ensuring reliable and robust interconnections across various semiconductor applications.

What role does the Asia Pacific region play in the global aluminum bonding wires supply chain?

Asia Pacific (APAC) holds the dominant market share and is the primary manufacturing hub for aluminum bonding wires. The region is home to the largest volume of OSAT (Outsourced Semiconductor Assembly and Test) providers and semiconductor fabrication plants, resulting in both the highest consumption rates and the largest production capacity globally, making it critical for supply chain logistics and pricing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager