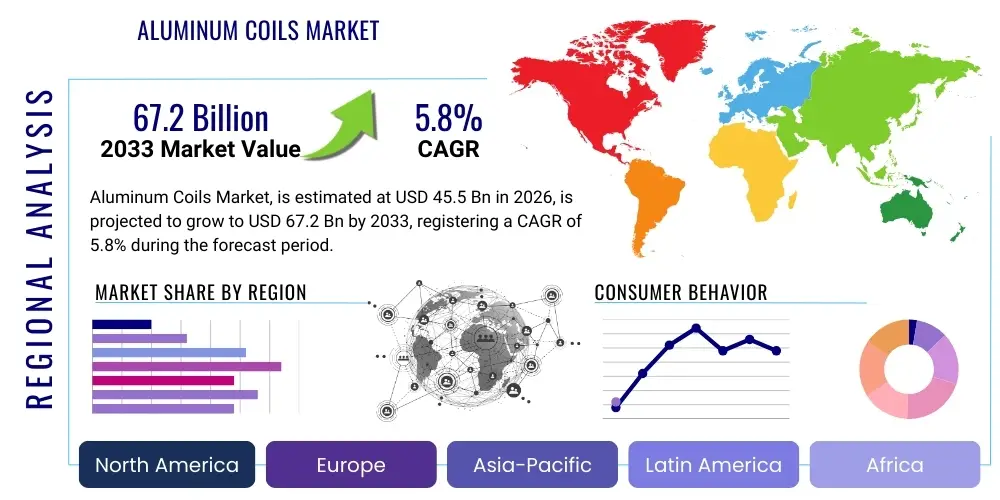

Aluminum Coils Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435198 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Aluminum Coils Market Size

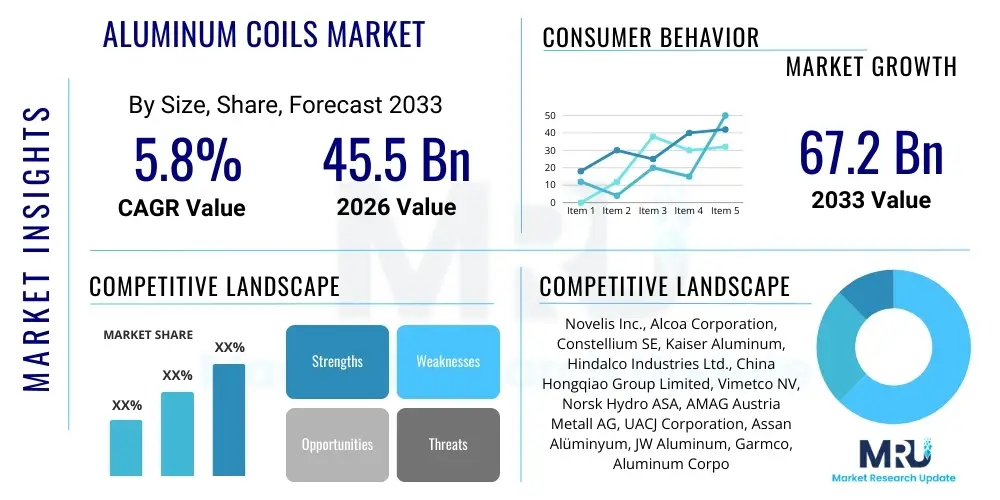

The Aluminum Coils Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 67.2 Billion by the end of the forecast period in 2033.

Aluminum Coils Market introduction

The Aluminum Coils Market encompasses the production, distribution, and consumption of thin, flat aluminum sheets that are rolled into coils for ease of transportation and subsequent processing. These coils serve as essential raw materials across numerous heavy and light industries due to aluminum’s inherent advantages, including low weight, high strength-to-density ratio, excellent corrosion resistance, superior thermal conductivity, and inherent recyclability. The versatility of aluminum coils allows them to be used in various finishes, such as mill finish, pre-painted, or anodized, tailoring them for specific application requirements in demanding environments like marine construction or high-performance automotive parts. The global shift toward sustainable and lightweight materials, driven by stringent environmental regulations and the need for enhanced energy efficiency in transportation and construction sectors, is fundamentally shaping the market dynamics.

Major applications of aluminum coils span the building and construction industry, particularly for roofing, siding, and curtain walls; the automotive sector for body panels, heat exchangers, and structural components aiming at vehicle lightweighting; and the HVACR (Heating, Ventilation, Air Conditioning, and Refrigeration) industry for condensers and evaporators. Furthermore, the packaging industry relies heavily on aluminum coils for beverage cans, foil packaging, and pharmaceutical strips due to the metal’s excellent barrier properties and hygiene characteristics. The product’s adaptability to various forming and joining techniques, combined with the increasing global infrastructure development expenditure, positions aluminum coils as a critical industrial commodity.

The primary benefits driving the market include superior malleability, allowing complex shapes to be achieved without compromising structural integrity, and resistance to environmental degradation, which extends product lifecycle, especially in outdoor applications. Key driving factors include the escalating demand for electric vehicles (EVs) where lightweight materials are crucial for maximizing battery range, robust growth in the residential and commercial construction markets globally, especially in emerging economies, and technological advancements in alloying and coating processes that enhance the performance and aesthetic appeal of the final coiled product. Continuous innovation in rolling technology is also enabling the production of thinner, higher-strength coils, further expanding their applicability.

Aluminum Coils Market Executive Summary

The Aluminum Coils Market demonstrates resilient growth, underpinned by fundamental shifts toward sustainable materials across key end-use industries. Current business trends highlight significant capacity expansion in Asia Pacific, driven by China and India, focusing on producing specialized, high-grade coils tailored for the automotive and aerospace sectors. Consolidation among major players is observed globally, emphasizing vertical integration to secure stable bauxite and alumina supply chains while investing heavily in advanced rolling mills to improve product quality and reduce energy intensity. The trend toward pre-painted and specialized alloy coils (like 5xxx and 6xxx series) is accelerating, driven by the construction sector’s demand for ready-to-install, highly durable, and aesthetically diverse external cladding materials. Furthermore, the increasing focus on circular economy principles has made recycled aluminum utilization a central competitive differentiator, influencing pricing strategies and supply contracts.

Regionally, Asia Pacific maintains its dominance, primarily due to large-scale infrastructure projects, rapid urbanization, and being the global hub for automotive and electronics manufacturing. North America and Europe, while mature markets, exhibit steady demand, predominantly driven by vehicle lightweighting initiatives and stringent energy efficiency standards in building codes, fueling the requirement for high-precision, thinner gauge coils for specialized applications like HVACR and advanced packaging. Emerging regions, including Latin America and the Middle East and Africa (MEA), are showing promising growth trajectories linked to industrialization efforts and increased investment in oil and gas infrastructure, where corrosion-resistant aluminum is preferred.

Segment trends reveal that the Coated Aluminum Coils segment is outpacing the Mill Finish segment in growth rate, reflecting the increased need for customized functional and protective surface treatments in construction and consumer goods. Among applications, the Automotive segment is expected to register the highest CAGR, primarily fueled by the accelerating production of electric and hybrid vehicles requiring lightweight chassis and battery casings. The Building and Construction segment remains the largest volume consumer, utilizing coils extensively for roofing, composite panels, and window frames. The continuous innovation in coil coatings, including solar-reflective paints and anti-microbial treatments, further solidifies the segment’s sustained value proposition across diverse industrial and commercial uses.

AI Impact Analysis on Aluminum Coils Market

User inquiries regarding AI's influence on the Aluminum Coils Market frequently center on three core themes: optimizing production efficiency, enhancing quality control through predictive maintenance, and streamlining complex supply chain logistics. Users are keen to understand how AI-driven process controls can reduce energy consumption in the highly power-intensive rolling process and minimize material waste (scrap rate) by optimizing cutting and finishing sequences. Key concerns revolve around the capital investment required for implementing sophisticated machine learning algorithms and integrating predictive quality assurance systems capable of identifying microscopic defects in coiled sheets in real-time. Expectations include AI standardizing alloy composition analysis, accelerating new product development (e.g., specialized high-strength automotive alloys), and creating more accurate demand forecasting models to synchronize production capacity with fluctuating global commodity prices and construction cycles.

- AI-powered predictive maintenance reduces downtime in high-speed rolling mills and coating lines.

- Machine Learning (ML) algorithms optimize furnace temperatures and rolling parameters, minimizing energy consumption during processing.

- Computer vision systems enhance quality control by automatically detecting surface defects (e.g., scratches, pitting) on coiled sheets in real-time.

- Advanced analytics facilitate precise raw material (bauxite, alumina) sourcing and inventory management, mitigating price volatility risks.

- AI-driven simulation tools accelerate the development and testing of new aluminum alloys for specific applications like electric vehicle battery enclosures.

- Demand forecasting models improve production scheduling, reducing excess inventory and mitigating stock-out situations across the supply chain.

- Robotics and AI integration optimize coil handling, packaging, and warehouse management, enhancing operational safety and speed.

DRO & Impact Forces Of Aluminum Coils Market

The Aluminum Coils Market is influenced by a dynamic set of Drivers, Restraints, and Opportunities (DRO), collectively defining the overall Impact Forces shaping its trajectory. The primary driver is the pervasive trend of lightweighting across the transportation sector, necessitated by regulatory demands for fuel efficiency and the operational requirements of electric vehicles, where aluminum is indispensable. This is powerfully augmented by robust global urbanization and infrastructure spending, especially in Asia, which demands durable, low-maintenance building envelopes and structural components. However, the market faces significant restraints, chiefly the high volatility of primary aluminum prices, which are linked to global energy costs and geopolitical stability, making long-term procurement and stable pricing challenging for mid-sized manufacturers. Furthermore, intense competition from alternative materials, such as advanced plastics and composite fibers in niche automotive applications, necessitates continuous innovation in aluminum performance.

Opportunities for market expansion are substantial, particularly through the development of highly specialized alloys—such as high-strength 7xxx series for aerospace and high-formability 5xxx series for complex automotive stamping—and the expansion of recycling infrastructure. Increased investment in closed-loop recycling systems offers manufacturers a pathway to enhanced sustainability credentials and a less volatile cost structure compared to primary aluminum production. The growing application of pre-coated and pre-treated coils, which reduce downstream processing costs for end-users, represents a strong avenue for value addition. The impact forces are generally positive, favoring expansion, but they are significantly tempered by the reliance on energy-intensive smelting processes and the resulting requirement for high capital expenditure to meet stringent environmental standards.

The overall impact force leans towards moderate growth driven by technological substitution (replacing steel with aluminum) and strong consumer and regulatory preference for lighter, recyclable products. Geopolitical risks related to trade tariffs on imported aluminum and the concentration of primary production capacity in specific regions pose systemic risks. The market’s resilience is tied to its ability to absorb cost fluctuations through efficiency gains, process optimization via Industry 4.0 technologies, and robust forward contracting mechanisms to hedge against price volatility, ensuring stable supply to high-volume consuming sectors like construction and automotive production.

Segmentation Analysis

The Aluminum Coils Market is extensively segmented based on key differentiators including product type, application, and end-use industry, allowing manufacturers to tailor production strategies to specific industry demands. This granular segmentation provides critical insights into market penetration and growth potential across various value chains. The segmentation by product type, differentiating between coils with surface treatments (coated/painted) and those in their natural state (mill finish), highlights the increasing demand for value-added products that offer enhanced durability, aesthetic versatility, and reduced processing steps for the end-user. Application segmentation clarifies the diverse utilization across major industrial categories, with automotive and construction dominating volume demand but packaging and HVACR contributing significantly to specialized product requirements.

- By Product Type:

- Coated Aluminum Coils (Pre-Painted, Anodized, Laminated)

- Mill Finish Aluminum Coils (Bare Aluminum)

- By Application:

- Automotive (Body panels, Heat Exchangers, Structural components)

- Construction (Roofing, Siding, Composite Panels, Window Frames)

- HVACR (Fin Stock, Ducts, Heat Exchanger Components)

- Packaging (Cans, Foils, Containers)

- Electrical & Electronics (Capacitor Foil, Conductors)

- Industrial & Others (Machinery parts, Consumer Durables)

- By End-Use Industry:

- Building and Construction (Residential, Commercial, Industrial)

- Transportation (Automotive, Aerospace, Marine, Rail)

- Consumer Durables (Appliances, Furniture)

- Industrial (Machinery, Equipment)

- By Alloy Series:

- 1xxx Series (Pure Aluminum)

- 3xxx Series (Mn-Alloys, General Purpose)

- 5xxx Series (Mg-Alloys, Marine, Automotive)

- 6xxx Series (MgSi-Alloys, Structural, Automotive)

- 7xxx Series (Zn-Alloys, High Strength, Aerospace)

Value Chain Analysis For Aluminum Coils Market

The Aluminum Coils market value chain begins with upstream activities involving the mining of bauxite, refinement into alumina, and the energy-intensive smelting process to produce primary aluminum ingots, or the collection and processing of aluminum scrap for secondary production. The reliance on primary production renders the upstream segment highly sensitive to energy prices and geopolitical factors influencing raw material extraction. Key players often seek control over upstream resources to secure consistent feedstock supply and mitigate commodity price volatility. Innovations in recycling technologies (secondary production) are crucial as they offer significant cost advantages and reduced carbon footprint, moving manufacturers toward a more sustainable and economically stable supply base.

Midstream processing involves melting, casting, and hot and cold rolling of aluminum ingots into thin sheets, which are then coiled. This stage requires high capital investment in sophisticated rolling mills and advanced gauge control systems to ensure product precision, particularly for high-demand applications like automotive closures and aerospace skins. Downstream activities focus on value addition, including surface treatments such as pre-painting, anodizing, or lamination, transforming mill-finish coils into specialized products demanded by construction and consumer goods sectors. This value-added stage is where product differentiation and higher margins are typically realized, often involving closer collaboration between the coil manufacturer and the final fabricator or OEM.

Distribution channels for aluminum coils are multifaceted, involving both direct and indirect sales. Major multinational coil producers often employ direct sales teams and dedicated logistics networks to supply high-volume customers, such as large automotive OEMs or massive construction projects, ensuring timely delivery and stringent quality adherence. Indirect channels involve distributors, service centers, and specialized metal brokers who purchase coils in bulk, perform minor processing (slitting, cut-to-length), and supply smaller fabricators or regional contractors. Service centers play a crucial role in maintaining local inventories, managing shorter lead times, and providing just-in-time delivery, thereby optimizing the working capital cycles for smaller end-users who cannot handle full coil loads or specialized inventory requirements.

Aluminum Coils Market Potential Customers

The aluminum coils market targets a diverse range of high-volume industrial consumers, primarily categorized by their specific utilization of the material’s key attributes—lightweight strength, corrosion resistance, and thermal efficiency. The Building and Construction sector represents the largest single pool of potential customers, encompassing developers, structural engineers, facade manufacturers, and roofing contractors who utilize aluminum coils for durable, maintenance-light exterior applications like curtain walls, composite panels, and standing seam roofing systems. This customer base is highly focused on longevity, compliance with fire and structural codes, and aesthetic variety, driving demand for pre-painted and architectural-grade anodized coils.

Another critical customer segment is the Transportation industry, including major automotive OEMs (Original Equipment Manufacturers) and Tier 1 suppliers specializing in body structures, thermal management systems, and battery casings for EVs. These customers prioritize lightweighting and high-strength alloys (e.g., 5xxx and 6xxx series) to meet regulatory emissions standards and enhance vehicle performance and range. Their requirements often involve customized coil specifications and complex contractual relationships focused on quality traceability and sustained supply volume.

Furthermore, the Packaging industry, particularly manufacturers of beverage cans and flexible packaging solutions, constitutes a steady and substantial customer base, valuing aluminum’s barrier properties and infinite recyclability. Appliance manufacturers (Consumer Durables) and specialized HVACR equipment producers form specialized customer groups, requiring coils with precise thickness tolerances and high thermal conductivity for applications like refrigerator liners and air conditioner fins, highlighting the technical diversity of the customer landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 67.2 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Novelis Inc., Alcoa Corporation, Constellium SE, Kaiser Aluminum, Hindalco Industries Ltd., China Hongqiao Group Limited, Vimetco NV, Norsk Hydro ASA, AMAG Austria Metall AG, UACJ Corporation, Assan Alüminyum, JW Aluminum, Garmco, Aluminum Corporation of China Limited (CHALCO), Kobe Steel Ltd., Gränges AB, RUSAL, Arconic Corporation, Aleris (now part of Novelis), Zhenjiang Dingsheng Aluminum Industries Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminum Coils Market Key Technology Landscape

The technological landscape of the Aluminum Coils Market is defined by advanced manufacturing processes aimed at achieving higher precision, improved material properties, and greater sustainability. Central to the market is the development of continuous casting and rolling (CC&R) technology, which significantly increases production efficiency and material yield compared to conventional ingot casting, reducing overall energy usage per ton of finished coil. Modern rolling mills incorporate sophisticated automatic gauge control (AGC) systems and flatness control systems using advanced sensor feedback loops to maintain extremely tight thickness tolerances across the entire coil length and width, crucial for high-performance applications like aerospace and high-speed canning lines. These technological advancements reduce waste and improve the reliability of the final product.

Another crucial area is the metallurgy and alloying process. Research focuses heavily on developing specialized heat-treatable alloys, particularly from the 6xxx and 7xxx series, optimized for specific automotive and structural requirements. This includes alloys that exhibit superior post-forming strength (bake hardening) or enhanced resistance to stress corrosion cracking. Advanced homogenization techniques are employed to ensure uniform distribution of alloying elements, minimizing internal stresses and maximizing mechanical properties. The capability to consistently produce large, flawless coils of high-strength alloys is a primary technological differentiator among leading market players.

Furthermore, surface treatment and coating technology represent a major area of innovation. Manufacturers are increasingly utilizing environmentally friendly pre-treatment chemicals (chrome-free alternatives) and high-performance coil coatings, including fluorocarbon (PVDF) and silicone modified polyester (SMP) paints, offering exceptional color retention, gloss stability, and resistance to harsh weather and industrial environments. The adoption of PVD (Physical Vapor Deposition) and PVD (Plasma Vapor Deposition) processes is emerging for ultra-thin, highly functional protective layers. These technologies not only extend the lifespan of the aluminum coils but also fulfill the rising architectural demand for sophisticated, durable exterior finishes, securing higher value per unit volume.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for aluminum coil consumption and production, driven primarily by China and India. The region benefits from massive governmental investment in infrastructure, high urbanization rates, and its position as the world’s leading manufacturing hub for automotive, electronics, and construction materials. Southeast Asian countries, including Vietnam and Thailand, are rapidly expanding their fabrication capacity, utilizing aluminum coils for increasing local residential construction and as export components for global supply chains. The market growth here is volume-driven, focusing on 3xxx and 5xxx series for general construction and packaging.

- North America: The North American market is characterized by high demand for specialized, high-performance alloys, particularly for the automotive sector (driven by mandatory CAFE standards and the EV transition) and the aerospace industry. While construction remains a core consumer, the emphasis is on premium, pre-coated architectural products and highly efficient HVACR components. Investments are focused on enhancing recycling infrastructure to secure domestic supply and reduce reliance on imported primary aluminum.

- Europe: Europe exhibits strong demand fueled by stringent environmental regulations, pushing for circular economy models and lightweighting in transportation. Germany, Italy, and France are key consumers, utilizing aluminum coils for high-end automotive parts, sustainable building facades, and advanced packaging solutions. The European market prioritizes sustainability credentials, leading to a higher penetration rate of recycled content coils and specialized, low-carbon aluminum products.

- Latin America (LAMEA): This region is an emerging market with growth tied to industrialization and commodity price cycles. Brazil and Mexico lead the demand, primarily driven by domestic automotive assembly plants and growing consumption in the beverage canning and basic construction sectors. Market expansion is moderate but stable, focusing on localized production capacity and fulfilling regional infrastructure needs.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in Gulf Cooperation Council (GCC) countries, driven by mega-construction projects, especially in Saudi Arabia and UAE. The region is a significant global producer of primary aluminum (due to low energy costs), influencing local coil manufacturing. Demand is characterized by the need for extremely durable, corrosion-resistant coated coils suitable for high temperatures and harsh marine environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminum Coils Market.- Novelis Inc.

- Alcoa Corporation

- Constellium SE

- Kaiser Aluminum

- Hindalco Industries Ltd.

- China Hongqiao Group Limited

- Vimetco NV

- Norsk Hydro ASA

- AMAG Austria Metall AG

- UACJ Corporation

- Assan Alüminyum

- JW Aluminum

- Garmco

- Aluminum Corporation of China Limited (CHALCO)

- Kobe Steel Ltd.

- Gränges AB

- RUSAL

- Arconic Corporation

- Alvance Aluminium Group

- Zhenjiang Dingsheng Aluminum Industries Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Aluminum Coils market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Aluminum Coils Market?

The primary drivers include the accelerating global shift toward electric vehicle production, which demands lightweight aluminum components to maximize battery range, and intensive governmental and private investment in sustainable infrastructure and construction worldwide, particularly in the Asia Pacific region.

How does the volatility of aluminum prices affect manufacturers?

Volatile aluminum prices, often influenced by energy costs and LME (London Metal Exchange) trading, create uncertainty regarding procurement costs. Manufacturers mitigate this risk through long-term hedging contracts, vertical integration into primary production, and maximizing the use of stable, cost-efficient secondary (recycled) aluminum.

Which application segment holds the largest share of the Aluminum Coils Market?

The Building and Construction industry holds the largest volume share of the Aluminum Coils Market, utilizing coils extensively for roofing, siding, composite panels, and architectural facades due to aluminum's durability and corrosion resistance.

What is the significance of Coated Aluminum Coils versus Mill Finish Aluminum Coils?

Coated Aluminum Coils, including pre-painted and anodized variations, offer enhanced aesthetics, superior protection against corrosion, and functionality, often eliminating the need for further processing by the end-user. Mill Finish coils are bare and typically used for general industrial purposes or where subsequent processing like specialized forming is required.

How is the focus on sustainability impacting the production of aluminum coils?

Sustainability mandates are driving manufacturers to invest heavily in advanced recycling technologies to increase recycled content (secondary aluminum), which requires significantly less energy than primary smelting, resulting in low-carbon aluminum coils that meet growing regulatory and consumer demand for environmentally friendly materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager