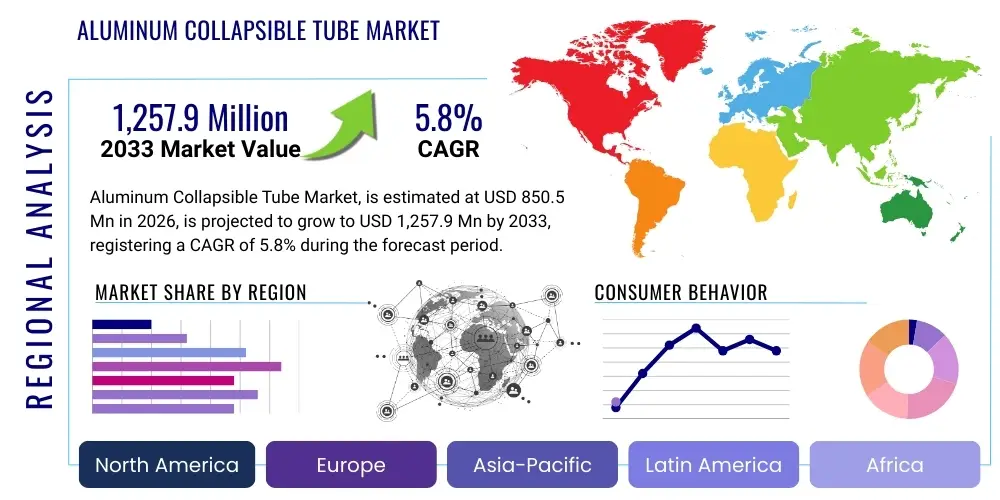

Aluminum Collapsible Tube Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435200 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Aluminum Collapsible Tube Market Size

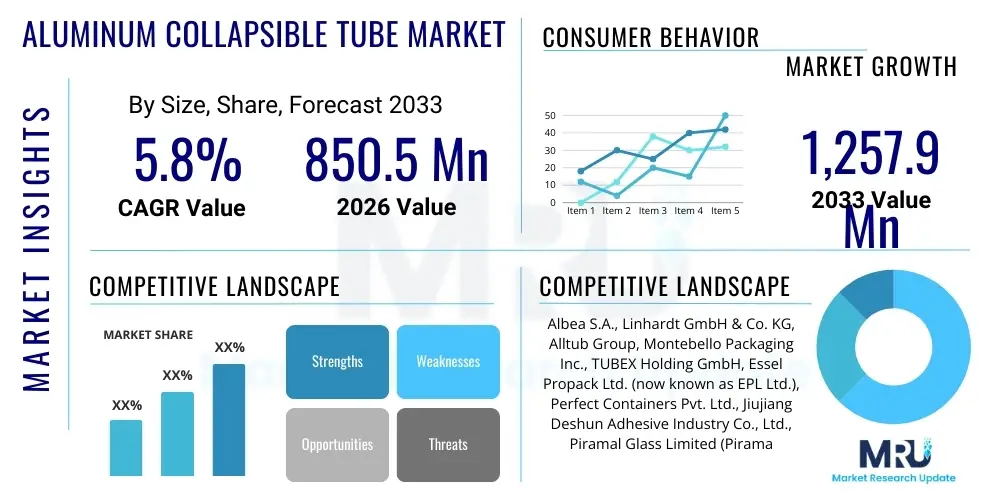

The Aluminum Collapsible Tube Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1,257.9 Million by the end of the forecast period in 2033.

Aluminum Collapsible Tube Market introduction

The Aluminum Collapsible Tube Market encompasses the production and distribution of flexible, non-pressurized aluminum containers primarily used for dispensing viscous or semi-solid products. These tubes are characterized by their excellent barrier properties, lightweight nature, and precise dosage capabilities. The intrinsic material properties of aluminum, particularly its impermeability to light, moisture, and air, make these tubes critical packaging solutions across highly sensitive industries, ensuring product integrity and extended shelf life for formulations such as pharmaceuticals, specialized cosmetics, and industrial adhesives. The market's growth trajectory is inextricably linked to the rising global demand for safe, hygienic, and convenient primary packaging formats, especially in rapidly expanding consumer healthcare sectors and specialized personal care markets where anti-contamination features are paramount.

Aluminum collapsible tubes offer significant advantages over alternative packaging materials like plastic or laminates, particularly regarding product preservation and sustainability. Once squeezed, the aluminum structure retains its shape, preventing air ingress, which is vital for preventing oxidation and maintaining the efficacy of active ingredients, especially in pharmaceutical ointments and sensitive cosmetic creams. Furthermore, aluminum is infinitely recyclable, aligning strongly with contemporary corporate sustainability goals and evolving global regulatory mandates focused on reducing plastic waste. This robust combination of superior barrier function and environmental responsibility underpins the steady adoption rate in high-value application segments.

Major applications driving the market include oral care, topical drugs, personal grooming products, and various industrial sealants. Key benefits driving market expansion include consumer convenience, product stability enhancement, effective brand communication through high-quality printing surfaces, and substantial cost efficiencies in logistics due to their light weight. Driving factors currently influencing the market involve accelerated urbanization, increasing consumer spending on healthcare and personal care products in emerging economies, stringent quality requirements imposed by regulatory bodies like the FDA and EMA for pharmaceutical packaging, and continuous technological advancements aimed at improving internal lacquer coatings to enhance compatibility with aggressive product formulations, thereby minimizing migration risks and maximizing product stability over the specified shelf life.

Aluminum Collapsible Tube Market Executive Summary

The Aluminum Collapsible Tube Market is poised for substantial expansion, driven by converging trends in sustainability, pharmaceutical packaging regulations, and evolving consumer preferences for convenient and secure product delivery systems. Business trends indicate a strong move toward lightweighting initiatives and enhanced aesthetic features, requiring manufacturers to invest in advanced printing technologies, such as dry offset printing and high-resolution varnishing, to meet sophisticated brand specifications. Furthermore, manufacturers are increasingly focusing on vertical integration, controlling the entire supply chain from aluminum slug production to finished tube manufacturing, which enhances cost control and quality consistency, thereby reinforcing competitive positions within the global marketplace.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market, largely fueled by booming pharmaceutical production, rapid growth in population-dense emerging economies, and increased disposable income leading to higher consumption of high-end cosmetic and oral care products. North America and Europe, while mature, remain dominant in terms of value, driven by strict regulatory frameworks necessitating high-barrier packaging for prescription and over-the-counter (OTC) drugs. These developed regions are also pioneering the adoption of tubes manufactured with recycled aluminum content (PCR—Post-Consumer Recycled), responding directly to strong governmental pressures and consumer demand for circular economy packaging solutions, setting a precedent for global sustainability standards.

Segment trends underscore the dominance of the pharmaceutical segment, which demands the highest quality standards, resulting in premium pricing and substantial market share. Within material and barrier technology, there is a distinct trend toward advanced internal protective lacquers, including epoxy-phenolic and polyamide-imide resins, designed to handle highly aggressive or alkaline formulations without leaching or reacting with the metal substrate. In terms of closure mechanisms, consumer-friendly options such as tamper-evident seals and specialized nozzle applicators for precision dosing in ophthalmic or dermatological applications are gaining traction, further optimizing the tube structure to maximize both functionality and consumer safety across diverse product categories.

AI Impact Analysis on Aluminum Collapsible Tube Market

User inquiries regarding AI's influence in the Aluminum Collapsible Tube Market frequently center on themes of operational efficiency, quality control, predictive maintenance, and supply chain resilience. Key questions address how AI can optimize the deep drawing and impact extrusion processes to minimize material waste (slug usage), whether machine vision systems powered by AI can detect microscopic defects in internal lacquer coatings better than human inspectors, and how predictive analytics can forecast fluctuations in primary aluminum commodity prices or manage complex, multi-regional logistics networks efficiently. Users are particularly keen on understanding AI's role in maintaining the zero-defect standard required by the pharmaceutical sector and improving energy efficiency during the high-temperature curing stages of tube finishing.

The application of Artificial Intelligence within the aluminum tube manufacturing ecosystem is rapidly progressing beyond basic automation into sophisticated cognitive processing. AI-driven systems are deployed to analyze vast datasets collected from high-speed production lines, identifying correlations between machine parameters (e.g., pressure, temperature, tooling alignment) and final product quality. This level of optimization minimizes material defects such as pinholes, uneven wall thickness, or poor shoulder formation, significantly reducing scrap rates which directly impacts profitability. By leveraging machine learning models, manufacturers can achieve superior process control, leading to greater yield, faster changeovers, and a reduction in energy consumption per unit produced, which is vital in a highly competitive, capital-intensive manufacturing environment seeking operational excellence.

Furthermore, AI plays a crucial role in enhancing supply chain visibility and demand forecasting. Given the volatile nature of primary aluminum pricing and the stringent delivery schedules required by pharmaceutical clients, predictive AI models allow for more accurate raw material procurement strategies, hedging against market risks. AI is also integral to implementing advanced visual inspection systems on quality control conveyor belts. These systems utilize deep learning algorithms to instantaneously compare high-resolution images of every tube produced against ideal specifications, autonomously flagging and rejecting tubes with minute printing misalignments, critical lacquer inconsistencies, or structural flaws undetectable by conventional sensors, thereby guaranteeing compliance with stringent industry standards globally.

- AI optimizes machine setup and process parameters during impact extrusion, minimizing material waste.

- Predictive maintenance schedules equipment upkeep, reducing unexpected downtime and maximizing operational throughput.

- Machine Vision (Deep Learning) systems ensure 100% inspection of lacquer integrity and print quality at high speeds.

- AI models enhance demand forecasting for specific tube formats and volumes, improving inventory management.

- Automation and robotic handling, guided by AI, reduce human contamination risk, particularly in cleanroom environments required for pharma grade packaging.

- Algorithmic control over drying and curing ovens improves energy efficiency and coating uniformity.

DRO & Impact Forces Of Aluminum Collapsible Tube Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively influenced by various internal and external impact forces. A primary driver is the unparalleled barrier protection aluminum offers, which is non-negotiable for sensitive pharmaceutical formulations like specialized dermatological creams and ophthalmic gels, demanding a non-reactive and hermetic seal against environmental contaminants. This requirement is reinforced by growing global healthcare expenditure and aging populations, which continuously increases demand for stable topical medications. Alongside this, the robust push for sustainable packaging solutions globally elevates aluminum's profile, as it offers a genuinely recyclable option compared to complex multi-layer plastics, fitting perfectly into extended producer responsibility (EPR) schemes in major developed economies.

However, the market faces significant restraints, notably the fluctuating and generally high cost of primary aluminum, which exposes manufacturers to considerable raw material price volatility, compressing profit margins. Furthermore, the specialized manufacturing process required, including precise internal coating application and sophisticated printing, necessitates high capital investment and technical expertise, creating barriers to entry for new players. Competition from flexible laminates and barrier plastic tubes, which sometimes offer cost advantages or specific aesthetic/haptic qualities desired by certain cosmetic brands, also exerts downward pressure on pricing in less regulated segments. Maintaining lacquer integrity, especially for highly acidic or aggressive product chemistries, remains a persistent technical challenge requiring continuous R&D investment.

Opportunities for growth are abundant, particularly in emerging markets where modernization of packaging is a key objective, replacing lower-quality, non-barrier materials. Significant opportunity exists in developing tubes utilizing increased Post-Consumer Recycled (PCR) aluminum content, appealing to eco-conscious brands and consumers. Moreover, innovation in anti-counterfeiting features—such as integrated holographic seals or sophisticated micro-printing for brand protection—offers premiumization opportunities, especially for high-value pharmaceutical and luxury cosmetic brands. The deployment of advanced manufacturing technologies, including highly integrated digital printing systems and automated quality inspection, promises to reduce operational costs and enhance product consistency, fueling competitive differentiation and long-term market penetration.

- Drivers: Superior barrier protection (impermeability), rising demand for topical pharmaceuticals, high recyclability of aluminum, increasing focus on product shelf life and integrity.

- Restraints: Volatile prices of primary aluminum slugs, high capital expenditure for precision manufacturing, technical challenges in achieving perfect internal coating compatibility with aggressive formulations.

- Opportunities: Expansion into high-growth pharmaceutical markets in APAC, development of tubes with higher PCR aluminum content, integration of advanced anti-counterfeiting packaging technologies, optimizing manufacturing processes through AI/Industry 4.0 adoption.

- Impact Forces: Strict regulatory mandates (FDA, EMA) driving quality standards, global consumer shift towards sustainable packaging materials, volatility in global commodity markets, increasing competition from hybrid packaging formats.

Segmentation Analysis

The Aluminum Collapsible Tube Market is meticulously segmented based on end-use application, product type, and closure mechanism, allowing for a precise understanding of market dynamics and targeted strategic planning. The application segment remains the most crucial determinant of market quality and price, with pharmaceutical and healthcare use commanding the highest standards due to regulatory requirements concerning sterilization, inertness, and barrier performance. Product categorization often revolves around tube dimensions (diameter and length) and specialized features like tamper-evident seals or enhanced internal coatings necessary for product stability. Analyzing these segments helps manufacturers tailor their production capabilities—such as specialized internal lacquering processes (e.g., polyamide-imide) or unique nozzle designs—to meet the exacting standards of specific vertical markets, ensuring compliance and maximizing customer value.

Segmentation by product type typically differentiates between standard open-end tubes, which are crimped and sealed by the end-user (filler), and pre-sealed tubes used for specific cleanroom or pharmaceutical applications. The closure mechanism segment is also vital, distinguishing between standard screw caps, child-resistant closures (CRC), stand-up caps (which offer better shelf appeal), and specialized dispensing nozzles (e.g., cannula tips for precise application). As consumer preferences shift towards convenience and safety, the demand for innovative closure mechanisms that prevent accidental spills or ensure controlled dosage is significantly driving growth in the high-value closure sub-segment.

- By Application:

- Pharmaceuticals (Ointments, Gels, Creams)

- Cosmetics and Personal Care (Toothpaste, Hair Dyes, Moisturizers)

- Food Products (Concentrates, Mustards, Spreads)

- Chemical and Industrial (Adhesives, Sealants, Lubricants, Paints)

- By Cap Type:

- Standard Screw Caps

- Stand-Up/Flip-Top Caps

- Child-Resistant Closures (CRC)

- Specialized Applicator Nozzles

- By Internal Coating:

- Epoxy Phenolic

- Polyamide Imide

- Wax/Polyethylene Liner

Value Chain Analysis For Aluminum Collapsible Tube Market

The value chain for the Aluminum Collapsible Tube Market is highly integrated and commences with the upstream supply of primary aluminum, primarily in the form of slugs—small, high-purity cylindrical discs that serve as the fundamental raw material. Upstream analysis involves assessing the procurement dynamics of these aluminum slugs, which are subject to global commodity market pricing and energy costs associated with primary smelting. Key success factors at this stage include negotiating long-term supply contracts, establishing robust quality checks for slug purity and dimensional tolerance, and increasingly, securing supplies of certified Post-Consumer Recycled (PCR) aluminum feedstocks to meet sustainability mandates, creating a competitive advantage for manufacturers with robust sourcing strategies.

The core manufacturing phase involves sophisticated processes: impact extrusion (where the slug is forced into the tube shape), trimming, internal lacquering, external base coating, high-resolution printing (using techniques like dry offset), capping, and quality control. Midstream efficiency is paramount, requiring substantial investment in high-speed, precision manufacturing equipment capable of maintaining cleanroom standards, particularly for pharmaceutical grade tubes. The subsequent downstream activities focus on distribution, where tubes are sold directly to the filling companies (end-users). Distribution channels are predominantly direct, characterized by highly customized orders regarding tube dimensions, printing specifications, and specialized internal lacquer chemistries. Indirect channels involve distributors or specialized packaging brokers who aggregate smaller orders or manage supply to localized regional fillers.

The market relies heavily on a direct distribution model because tube specifications are often proprietary and highly sensitive to the product formulation being filled. For pharmaceutical clients, the relationship between the tube manufacturer and the filler is critical, involving extensive validation and documentation. The shift toward specialized tubes and reduced lead times necessitates a streamlined logistics network, optimized through digital platforms that manage complex inventory and global shipment requirements. Effective collaboration between the tube maker and filler minimizes risks associated with tube-filling equipment compatibility and ensures the integrity of the barrier properties are maintained up until the point of sealing and final use by the consumer.

Aluminum Collapsible Tube Market Potential Customers

The primary customers for aluminum collapsible tubes are the large-scale industrial companies that utilize these containers for primary packaging of semi-solid or viscous goods. The largest and most demanding customer segment originates from the pharmaceutical industry, including multinational corporations and generic drug manufacturers specializing in topical medications, ophthalmic preparations, and veterinary products. These customers prioritize quality assurance, regulatory compliance (e.g., DMF filing support), strict quality control documentation, and consistent supply reliability, making them the most profitable segment but also the most challenging to serve due to zero-defect requirements and specialized audit protocols.

Another major segment encompasses the cosmetic and personal care industry, particularly oral care (toothpaste manufacturers) and specialized beauty brands (hair dyes, high-end face creams). These buyers value aesthetics, demanding superior print quality, customized finishes (matte or glossy), and innovative closure designs that enhance brand recognition and consumer experience. While slightly less regulated than pharmaceuticals, the cosmetic segment requires high levels of flexibility in order specifications and design complexity, focusing heavily on market responsiveness and fast turnaround times for promotional cycles and product launches in competitive consumer markets.

Industrial and food sector companies also constitute a significant customer base. Industrial buyers include manufacturers of adhesives, silicon sealants, high-performance lubricants, and chemical compounds that require packaging inertness and robust structural integrity to contain often corrosive or highly viscous substances. Food customers, although a smaller volume segment, require tubes for products like condensed milk, purees, and specialized gourmet pastes, where the aluminum barrier is essential for maintaining freshness and preventing oxidation over long distribution periods, emphasizing food-grade safety certification and non-toxic internal coatings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1,257.9 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Albea S.A., Linhardt GmbH & Co. KG, Alltub Group, Montebello Packaging Inc., TUBEX Holding GmbH, Essel Propack Ltd. (now known as EPL Ltd.), Perfect Containers Pvt. Ltd., Jiujiang Deshun Adhesive Industry Co., Ltd., Piramal Glass Limited (Piramal Enterprises), R. N. Industries, Guangzhou Junyue Aluminum Tube Co., Ltd., Huhtamaki Oyj, CCL Industries Inc., K. S. Enterprises, Pouch Makers Canada. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminum Collapsible Tube Market Key Technology Landscape

The manufacturing technology for aluminum collapsible tubes is dominated by the impact extrusion process, a high-speed, precision cold-forming technique that transforms an aluminum slug into a seamless tube body. This core technology requires highly specialized tooling and hydraulic presses capable of exerting significant force to ensure uniform wall thickness and structural integrity, preventing defects such as pinholes which would compromise barrier performance. Recent technological advancements focus on optimizing the extrusion speed and precision through integration of servo-driven machinery and sophisticated sensor arrays that monitor pressure and temperature in real-time, thereby reducing material stress and enhancing the quality consistency required for demanding pharmaceutical applications.

A secondary, but equally critical, technological area involves the application of internal lacquers and external coatings. Internal coatings are essential to prevent direct contact between the aluminum and the product formulation, which could lead to corrosion or chemical reaction. Technological innovations are geared towards developing advanced, compliant internal lacquers, such as high-solids epoxy or specialized phenolic formulations, that offer superior chemical inertness and enhanced heat resistance for post-filling sterilization processes. Automated, high-speed spraying systems equipped with robotic vision systems ensure consistent film weight and complete coverage, especially critical around the tube neck and shoulder area, while UV-curing technology is increasingly adopted to improve efficiency and reduce the environmental footprint compared to traditional thermal curing methods.

Furthermore, digital printing technology is rapidly transforming the external presentation of aluminum tubes. Traditionally relying on dry offset printing, which is highly efficient but limits graphic complexity, the industry is increasingly exploring hybrid or full digital printing solutions. These advanced systems allow for photographic-quality imagery, variable data printing (VDP) for personalization or serialization (a growing requirement in pharma), and shorter run lengths with minimal setup waste. Combining these high-fidelity printing capabilities with specialized surface treatments, such as metallic inks and selective varnishes, allows brands to achieve premium shelf appeal while maintaining the functional benefits of the aluminum substrate, representing a major technological leap in brand differentiation within the packaging sector.

Regional Highlights

Regional dynamics play a crucial role in shaping the Aluminum Collapsible Tube Market, with diverse growth rates and regulatory environments influencing adoption across continents. The Asia Pacific (APAC) region is projected to exhibit the fastest growth, primarily driven by demographic shifts, expanding middle-class populations, and significant investment in healthcare infrastructure, particularly in countries like China and India. The robust expansion of the domestic pharmaceutical and oral care manufacturing base in APAC necessitates large volumes of high-quality, cost-effective packaging solutions. Local manufacturers are rapidly scaling up production capacities and adopting advanced technologies to meet both domestic demand and increasing export requirements, positioning the region as a global manufacturing hub for aluminum tubes, although often focused on high volume rather than niche, premium applications.

Europe and North America represent the mature markets, characterized by high-value consumption, stringent regulatory requirements, and a strong emphasis on sustainability. European nations, in particular, lead in the adoption of tubes with high Post-Consumer Recycled (PCR) content and are actively exploring bio-based lacquer alternatives to further enhance environmental performance. The demand in these regions is heavily concentrated in the pharmaceutical and specialty cosmetic segments, where compliance with quality standards (like pharmacopeial monographs) outweighs cost considerations. Manufacturers in these regions invest heavily in cleanroom facilities and sophisticated quality management systems to maintain their competitive edge based on product quality and technical support rather than pure pricing competition.

Latin America (LATAM) and the Middle East & Africa (MEA) markets are displaying moderate yet accelerating growth. In LATAM, growth is spurred by recovering economies and increasing consumer access to modern pharmaceutical and personal care products, often displacing traditional packaging formats. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, shows strong demand fueled by sophisticated cosmetic brands and local pharmaceutical ventures aiming to reduce reliance on imports. However, these regions often face challenges related to logistical complexities and the need for localized technical expertise, meaning foreign imports still play a significant role, though regional players are starting to emerge to capitalize on proximity and localized supply chain management opportunities.

- Asia Pacific (APAC): Dominates volume growth due to rapid industrialization, expanding healthcare systems, and booming oral care consumption; focused on capacity expansion and cost efficiency.

- Europe: High-value market segment driven by stringent sustainability directives (PCR integration) and demanding pharmaceutical quality standards; technological leaders in advanced coating and printing.

- North America: Stable market characterized by high consumption of OTC and prescription topical drugs; strong focus on regulatory compliance and specialized high-barrier tube formats.

- Latin America (LATAM): Emerging growth market benefiting from economic recovery and expanding local pharmaceutical manufacturing base; increasing adoption of international packaging standards.

- Middle East and Africa (MEA): Growing demand fueled by increasing urbanization and localized production of cosmetics and personal care items; potential for niche growth in high-end cosmetic packaging.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminum Collapsible Tube Market.- Albea S.A.

- Linhardt GmbH & Co. KG

- Alltub Group

- Montebello Packaging Inc.

- TUBEX Holding GmbH

- Essel Propack Ltd. (now known as EPL Ltd.)

- Perfect Containers Pvt. Ltd.

- Jiujiang Deshun Adhesive Industry Co., Ltd.

- Piramal Glass Limited (Piramal Enterprises)

- R. N. Industries

- Guangzhou Junyue Aluminum Tube Co., Ltd.

- Huhtamaki Oyj

- CCL Industries Inc.

- K. S. Enterprises

- Xingfei Packaging (Jiangsu) Co., Ltd.

- JSN Aluminium Tubes

- Guangdong Nanxin Printing & Packaging Co., Ltd.

- Antilla S.A.

Frequently Asked Questions

Analyze common user questions about the Aluminum Collapsible Tube market and generate a concise list of summarized FAQs reflecting key topics and concerns.Why are aluminum collapsible tubes preferred over plastic tubes for pharmaceutical products?

Aluminum tubes offer superior barrier properties, providing an absolute seal against gas, light, and moisture ingress. This impermeability is essential for maintaining the stability and efficacy of sensitive pharmaceutical formulations, preventing oxidation and contamination, which plastic tubes cannot match entirely without complex, costly barrier layers.

What major sustainability advantage does aluminum tube packaging offer?

Aluminum is infinitely recyclable without loss of quality. Aluminum tubes contribute positively to the circular economy and corporate sustainability metrics, especially as manufacturers increasingly incorporate high levels of Post-Consumer Recycled (PCR) aluminum content into production, minimizing reliance on virgin resources.

How does raw material price volatility affect the aluminum tube manufacturing sector?

The primary raw material, aluminum slugs, are traded commodities subject to global market price fluctuations. Volatility directly impacts production costs, requiring manufacturers to employ sophisticated hedging strategies and long-term procurement agreements to mitigate the risk of margin compression and ensure stable pricing for long-term customer contracts.

What is the purpose of the internal lacquer coating in aluminum collapsible tubes?

The internal lacquer acts as a protective barrier between the aluminum substrate and the product formulation. It prevents chemical interaction (corrosion or leaching) that could affect the product's safety, flavor, or efficacy, ensuring the tube remains inert and compliant with food-grade or pharmaceutical regulations throughout the product's lifespan.

Which application segment holds the largest market share for aluminum collapsible tubes?

The Pharmaceutical segment consistently holds the largest share in terms of value, driven by the non-negotiable requirement for high-barrier, non-reactive packaging for topical drugs, ointments, and specialty medications. This segment adheres to the strictest quality and regulatory standards globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager