Aluminum Foil Fiberglass Cloth Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436379 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Aluminum Foil Fiberglass Cloth Market Size

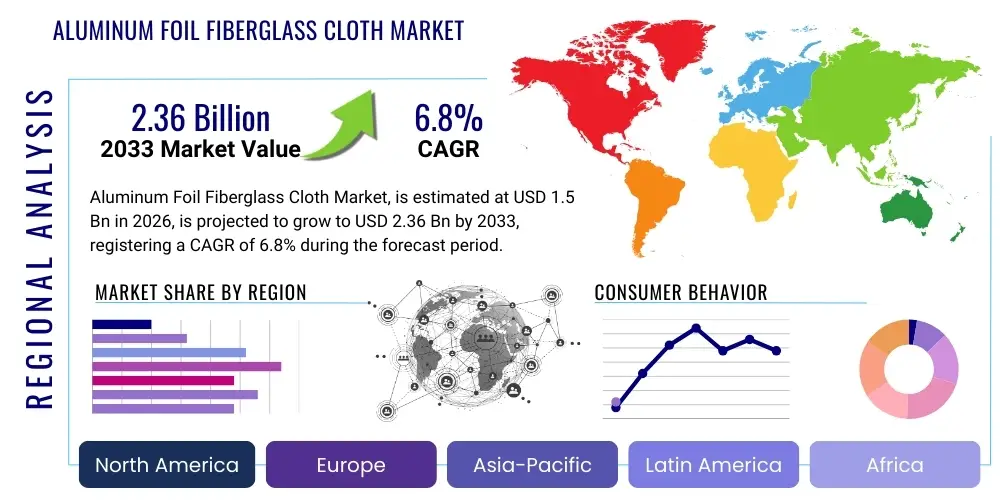

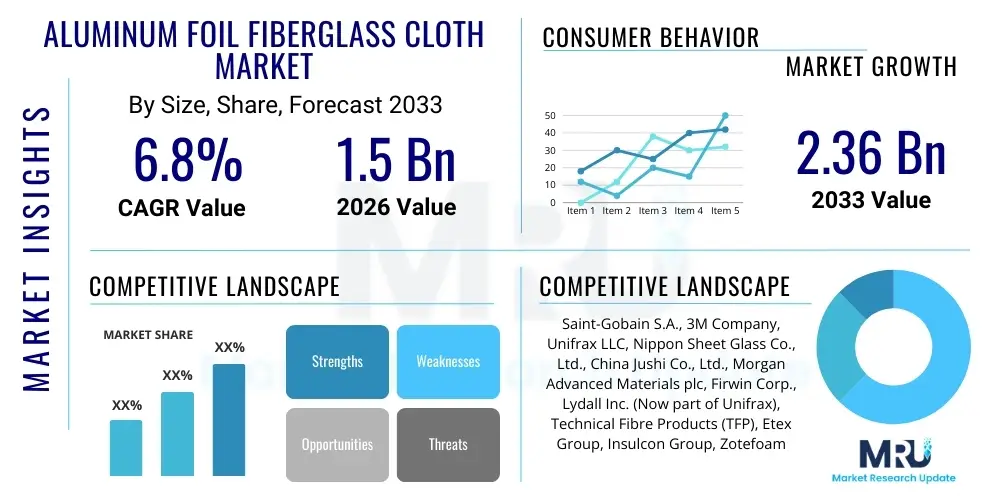

The Aluminum Foil Fiberglass Cloth Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.36 Billion by the end of the forecast period in 2033.

Aluminum Foil Fiberglass Cloth Market introduction

The Aluminum Foil Fiberglass Cloth market encompasses materials engineered by laminating or bonding aluminum foil to woven fiberglass fabric, creating a highly durable, fire-resistant, and thermally insulating composite. This material, often utilizing specialized adhesives such as silicone or pressure-sensitive acrylics, is primarily designed to maximize heat reflection and vapor barrier performance. The core product finds extensive utility across severe thermal environments where standard materials fail to provide adequate protection, such as industrial insulation, protective jacketing, and fire safety systems. Its robust mechanical strength derived from the fiberglass weave, combined with the excellent reflectivity and low emissivity of the aluminum surface, makes it indispensable for energy efficiency applications and personnel safety.

The primary applications of aluminum foil fiberglass cloth span several critical industries including Heating, Ventilation, and Air Conditioning (HVAC) duct insulation, petrochemical pipelines, aerospace components, and automotive heat shields. The material offers superior benefits, particularly its non-combustible nature, high tensile strength, resistance to moisture and corrosion, and exceptional thermal performance. These features translate directly into reduced energy costs for businesses and increased safety standards in infrastructure. Furthermore, the material’s lightweight characteristic relative to its insulation capabilities promotes ease of installation and reduced structural load, contributing significantly to its commercial viability in large-scale construction and manufacturing projects.

Market growth is predominantly driven by stringent governmental regulations mandating energy conservation and fire safety standards in commercial and residential construction globally. Increasing urbanization, coupled with significant infrastructure investments in emerging economies, fuels the demand for high-performance insulation materials. Moreover, the accelerating adoption of electric vehicles (EVs) and high-efficiency HVAC systems, which require specialized thermal management solutions to ensure operational stability and battery longevity, acts as a crucial propellant for sustained market expansion over the forecast period.

Aluminum Foil Fiberglass Cloth Market Executive Summary

The Aluminum Foil Fiberglass Cloth Market is undergoing a rapid transition driven by global mandates focused on energy efficiency and fire safety, positioning it for robust expansion, especially within the construction and industrial sectors. Key business trends include the increasing focus on sustainable production practices, utilizing low-VOC adhesives and recyclable materials, and the development of higher-temperature resistance grades suitable for specialized applications like aerospace and high-performance automotive parts. Manufacturers are actively investing in automated lamination technology to improve product consistency and scale up production capabilities, meeting the escalating demand from infrastructural development projects worldwide. Strategic partnerships between fiberglass weavers and specialized coating companies are becoming essential to innovate complex, multi-layered insulation solutions.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive construction booms in China, India, and Southeast Asian nations, alongside significant investments in industrial manufacturing facilities and complex energy infrastructure. North America and Europe maintain strong market shares, predominantly due to stringent regulatory frameworks governing building codes and industrial emissions, which necessitate the consistent use of premium, certified fire-retardant materials. Segment-wise, the HVAC and duct insulation application category retains the largest market share owing to the material's superior vapor barrier and thermal reflection properties essential for optimizing air distribution systems. The fire and safety segment, including protective clothing and welding blankets, is projected to exhibit the fastest growth, driven by enhanced occupational safety standards globally.

Major segment trends indicate a shift towards advanced composite materials, specifically those utilizing aluminized fiberglass cloth that incorporates flexible silicone coatings or specialized polymer films to enhance durability and environmental resistance against UV radiation and harsh chemicals. Furthermore, the thickness and density segment is seeing increased demand for thicker, multi-ply cloths (e.g., 20 oz/sq yd and above) for heavy industrial applications requiring extreme heat protection. Pricing pressure remains moderate but constant, necessitating cost optimization in raw material sourcing—particularly fiberglass yarn and aluminum foil—while maintaining compliance with high international quality and safety certifications (e.g., UL listings, IMO standards).

AI Impact Analysis on Aluminum Foil Fiberglass Cloth Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) within the Aluminum Foil Fiberglass Cloth market is fundamentally reshaping production efficiency, supply chain resilience, and quality assurance processes. Common user questions frequently revolve around how AI can optimize the complex lamination process, predict raw material price fluctuations (aluminum and glass fibers), and ensure flawless product quality, especially concerning pinholes in the foil layer or inconsistencies in adhesive application. Users are keen to understand if AI can facilitate the customization of product specifications, such as optimizing the precise thickness and adhesive formulation for specific end-user environments (e.g., high-humidity versus extreme-temperature industrial settings). Concerns also focus on the upfront investment required for integrating vision systems and predictive maintenance algorithms into existing, often older, manufacturing lines. The consensus expectation is that AI will significantly reduce material waste, increase line speed, and create highly responsive and adaptive manufacturing environments capable of handling diverse order specifications swiftly and accurately, fundamentally lowering operational expenditure and elevating competitive advantage.

- AI-Powered Predictive Maintenance: Reduces equipment downtime on lamination and weaving machines by analyzing sensor data to anticipate mechanical failures.

- Optimized Quality Control: Utilizes machine vision systems and deep learning algorithms to detect micro-defects (pinholes, coating gaps) in real-time during high-speed production, ensuring adherence to strict safety standards.

- Supply Chain and Inventory Management: ML models predict demand fluctuations for raw materials (fiberglass yarn, aluminum coils), optimizing procurement timing and reducing inventory holding costs while mitigating geopolitical supply risks.

- Process Parameter Optimization: AI algorithms fine-tune variables such as oven temperature, adhesive spread rate, and line tension during the lamination process, maximizing bond strength and minimizing energy consumption.

- Advanced Material Formulation: Generative AI assists in rapidly testing and formulating new, high-performance adhesive systems (e.g., silicone or acrylic polymers) that enhance flame retardancy and resistance to extreme temperatures.

DRO & Impact Forces Of Aluminum Foil Fiberglass Cloth Market

The market dynamics are primarily shaped by robust driving factors related to global infrastructure development and stringent regulatory mandates for fire protection and energy conservation, while simultaneously contending with inherent industry restraints such as volatile input costs and competition from alternative insulation technologies. The principal driver remains the accelerated growth in the construction sector, particularly commercial and institutional buildings globally, necessitating vast quantities of high-specification insulation for HVAC ductwork and exterior jacketing. Opportunities lie significantly in developing specialized composites for emerging high-growth applications, including thermal runway protection in electric vehicle battery packs, and high-temperature filtration media, which require non-standard material compositions and certification.

The restraint factor primarily revolves around the fluctuation in prices of key raw materials, namely aluminum ingot and fiberglass raw materials (silica sand and soda ash), which are commodity-dependent and susceptible to geopolitical instability and energy cost volatility. This variability complicates long-term cost estimation and contract bidding for manufacturers, often squeezing profit margins. Furthermore, the industry faces competition from high-performance synthetic materials, such as aerogels and advanced ceramic fiber blankets, which, despite their higher cost, offer superior performance in niche ultra-high temperature or vacuum applications, potentially limiting market penetration in certain high-end industrial segments. Successfully navigating these restraints requires sophisticated risk management strategies and diversification of sourcing channels.

The overall impact forces are strongly positive, indicating that the cumulative weight of drivers significantly outweighs the restraints. The non-negotiable nature of fire safety regulations and the sustained global commitment to reducing carbon footprints through energy efficiency ensure that the demand for certified, high-quality aluminum foil fiberglass cloth will continue to rise. Market participants must leverage opportunities by investing in product innovation focused on sustainability (e.g., bio-based adhesives, recycled aluminum content) and improving manufacturing efficiency through automation. The critical impact force driving future market expansion is the continuous tightening of international building codes, particularly in rapidly urbanizing regions, making fire-rated thermal barriers like this cloth a standard rather than optional requirement.

Segmentation Analysis

The Aluminum Foil Fiberglass Cloth market is segmented based on key structural and functional parameters, allowing manufacturers to target specific end-use applications that capitalize on the material's unique thermal and mechanical properties. The primary segmentation criteria include material type (covering the weave structure and foil thickness), product thickness/weight (which directly correlates with insulation performance), and most crucially, the specific end-use application, which dictates the required certification and performance characteristics. Understanding these segments is vital for strategic market positioning and product development, enabling companies to meet the stringent demands of industries ranging from construction and marine to high-tech automotive manufacturing.

Segmentation by material structure generally differentiates between plain weave, twill weave, and satin weave fiberglass, each offering distinct levels of tensile strength, flexibility, and fray resistance. Simultaneously, the type of adhesive used—such as silicone-based, which offers superior thermal stability, or acrylic-based, used for low-temperature applications—creates significant sub-segments. The trend in segmentation is shifting towards performance-based categorization, where composite materials are classified not just by their physical composition but by their certified temperature rating and flame spread index, making procurement easier for engineering firms requiring compliance with standards like NFPA or ASTM E84.

The application segment dominates strategic decisions, with HVAC & Duct Insulation, Pipe & Vessel Insulation, Protective Clothing, and Welding & Fire Blankets forming the largest categories. The growth rate differential across these applications is notable; while HVAC remains the volume driver, the smaller, specialized segments like fire barriers for transportation (rail and aerospace) are experiencing faster growth due to higher safety standards and the integration of lightweight materials. This detailed segmentation highlights the material's versatility, proving its essential nature across varied industrial landscapes demanding certified non-combustible thermal and vapor barriers.

- By Material Type:

- Fiberglass Weave (Plain, Twill, Satin)

- Foil Thickness (Light Gauge, Heavy Gauge)

- Adhesive Type (Silicone, Acrylic, Asphalt-based)

- By Product Weight (g/sqm):

- Lightweight (Under 400 g/sqm)

- Medium Weight (400 - 800 g/sqm)

- Heavyweight (Above 800 g/sqm)

- By Application:

- HVAC & Duct Insulation

- Pipe & Vessel Insulation (Petrochemical, Marine)

- Welding & Fire Blankets

- Protective Clothing (Aprons, Gloves)

- Aerospace and Automotive Heat Shields

- By End-User Industry:

- Construction & Infrastructure

- Industrial Manufacturing

- Marine & Shipbuilding

- Automotive & Transportation

Value Chain Analysis For Aluminum Foil Fiberglass Cloth Market

The value chain for Aluminum Foil Fiberglass Cloth is complex, starting with highly capitalized upstream suppliers and concluding with diverse downstream end-users in specialized sectors. The upstream segment is dominated by primary producers of E-glass fiberglass yarn, which requires significant energy input and capital investment, and manufacturers of high-purity aluminum foil, where pricing volatility is a major concern. Key raw material procurement involves securing consistent supply contracts for high-quality woven glass fiber cloth and specialized high-temperature resistant adhesives (e.g., silicone or advanced polymers). Efficiency at this stage is critical, as the cost of raw inputs constitutes a significant portion of the final product price, driving the need for long-term strategic sourcing agreements.

Midstream operations involve the core manufacturing processes: weaving the fiberglass cloth, preparing the aluminum foil, and the lamination or bonding process. This phase includes sophisticated coating techniques to ensure a uniform and durable bond, along with quality control testing for tensile strength, flame retardancy, and vapor transmission rates. Manufacturers must invest heavily in specialized lamination equipment and thermal ovens. Direct channels involve manufacturers selling high-volume, standard products directly to large industrial consumers or major HVAC contractors. Indirect channels utilize distributors, specialized material dealers, and regional wholesalers who provide local inventory, cutting services, and technical support to smaller contractors and fabrication shops, ensuring wider market penetration.

The downstream segment involves final processing and installation within key end-user markets. Distributors often act as a critical intermediary, providing tailored dimensions and logistical solutions, which adds value, particularly in the construction and shipbuilding industries where just-in-time delivery is paramount. Demand is highly driven by specifications issued by engineering firms and adherence to international regulatory certifications. This reliance on certification bodies emphasizes the importance of product quality and traceability throughout the entire value chain, from the chemical composition of the adhesive to the weaving structure of the fiberglass, ensuring that the final product meets the intended safety and performance standards demanded by complex infrastructure projects.

Aluminum Foil Fiberglass Cloth Market Potential Customers

The primary potential customers for Aluminum Foil Fiberglass Cloth are diverse industrial entities and contractors who require certified, high-performance thermal barriers and fire safety materials. The largest segment of customers includes HVAC installation companies and large construction contractors who utilize the material extensively for wrapping rigid and flexible air ducts, ensuring minimal heat loss or gain and acting as a crucial vapor barrier to prevent condensation and mold growth in commercial buildings. These customers prioritize adherence to building codes (e.g., UL 723, NFPA standards) and seek materials that offer a long lifespan and easy application, making pre-laminated, self-adhesive versions highly desirable.

Another significant customer base comprises manufacturers in heavy industries such as petrochemicals, power generation (especially gas and coal plants), and marine shipbuilding. These end-users purchase the material, often in heavier weights and silicone-coated variants, for insulating large pipes, vessels, and reactors to maintain process temperature and provide personnel protection from extreme heat exposure. For marine applications, specific compliance with International Maritime Organization (IMO) standards is mandatory, focusing on low smoke and toxicity output, differentiating the purchasing criteria compared to standard construction buyers.

A rapidly expanding segment of potential customers includes specialized manufacturers in the transportation sector, specifically those focused on electric vehicle battery manufacturing and aerospace component production. In the EV sector, the cloth is integrated as a critical fire barrier layer around battery modules to prevent thermal runaway propagation, demanding materials with ultra-high thermal stability and lightweight characteristics. Aerospace customers require highly specialized, certified materials for engine insulation, cabin fire barriers, and protective blankets, where failure is not an option, leading these customers to prioritize technical performance and comprehensive material data sheets over simple cost considerations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.36 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Saint-Gobain S.A., 3M Company, Unifrax LLC, Nippon Sheet Glass Co., Ltd., China Jushi Co., Ltd., Morgan Advanced Materials plc, Firwin Corp., Lydall Inc. (Now part of Unifrax), Technical Fibre Products (TFP), Etex Group, Insulcon Group, Zotefoams plc, GuangZhou Laili Co., Ltd., Henan Lingrui Industry Co., Ltd., Haining Qicheng Composites Co., Ltd., Thermal Composites, Hefei Xinghai Refractories Co., Ltd., Darco Industrial Supply Inc., SGL Carbon, Owens Corning. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminum Foil Fiberglass Cloth Market Key Technology Landscape

The manufacturing process of Aluminum Foil Fiberglass Cloth relies on several sophisticated technologies, primarily centered around achieving superior bond strength, fire resistance, and material consistency under high-speed production conditions. A critical technology involves advanced lamination and coating techniques. Hot-melt lamination, utilizing specialized polymers and thermal curing processes, ensures the aluminum foil and fiberglass base cloth are permanently bonded without compromising the integrity of either material. The focus is increasingly on precision coating technologies, such as doctor blade coating or gravure coating, to apply adhesives uniformly across the wide surface area, minimizing defects like air pockets or uneven adhesive thickness, which can compromise the vapor barrier performance.

Another significant technological advancement lies in the development of specialized adhesive chemistries. Traditional asphalt-based adhesives are being phased out in favor of high-performance, environmentally compliant alternatives, such as solvent-free, fire-retardant silicone and acrylic adhesives. Silicone-based adhesives are crucial for products designed for extreme temperature applications (up to 500°C or higher), offering flexibility and maintaining bond strength under thermal cycling. Simultaneously, the integration of nanotechnologies is being explored to enhance the fire-retardant properties of the polymer layer, providing superior resistance to flame spread and smoke generation, which is highly valued in regulated sectors like aerospace and marine safety.

Furthermore, technology related to fiberglass weaving and finishing is constantly evolving. Manufacturers are employing higher-speed rapier and air-jet weaving machines to produce large volumes of densely woven glass cloth with enhanced uniformity and reduced yarn breakage. Post-weaving treatment technologies, including heat setting and chemical finishing, are essential to remove sizing agents and improve the material’s receptivity to the lamination adhesive. These processes are increasingly monitored and controlled through automated systems and real-time sensor feedback loops, which are vital for maintaining the rigorous quality standards required for certified fire protection and industrial insulation products sold globally.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market region, projected to register the fastest growth due to rapid urbanization, massive infrastructure spending, and the expansion of industrial manufacturing bases, particularly in China, India, and ASEAN countries. Strict enforcement of energy conservation policies in commercial construction drives high demand for thermal insulation materials.

- North America: Characterized by stringent building codes (e.g., U.S. and Canadian fire safety standards) and a mature HVAC industry, North America represents a substantial market share. Demand is consistently high for premium, UL-certified products used in large-scale commercial retrofitting and new construction projects, emphasizing low smoke and toxicity performance.

- Europe: The European market is highly mature and focuses heavily on sustainability and energy efficiency targets (e.g., Net Zero mandates). Regulatory drivers, such as the Energy Performance of Buildings Directive (EPBD), necessitate the continuous upgrading of insulation standards in existing structures, fueling demand for high-performance, fire-rated materials.

- Latin America (LATAM): Growth in LATAM is concentrated in key developing economies like Brazil and Mexico, driven by foreign direct investment in manufacturing and energy infrastructure. The market is moderately fragmented, with increasing awareness and adoption of international safety standards gradually replacing lower-quality, non-certified materials.

- Middle East and Africa (MEA): The MEA region is witnessing significant demand, particularly from the Gulf Cooperation Council (GCC) countries. Extreme climate conditions necessitate high-efficiency HVAC insulation, and substantial ongoing investments in petrochemical and oil and gas infrastructure require certified industrial insulation for pipelines and storage vessels.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminum Foil Fiberglass Cloth Market.- Saint-Gobain S.A.

- 3M Company

- Unifrax LLC

- Nippon Sheet Glass Co., Ltd.

- China Jushi Co., Ltd.

- Morgan Advanced Materials plc

- Firwin Corp.

- Lydall Inc. (Now part of Unifrax)

- Technical Fibre Products (TFP)

- Etex Group

- Insulcon Group

- Zotefoams plc

- GuangZhou Laili Co., Ltd.

- Henan Lingrui Industry Co., Ltd.

- Haining Qicheng Composites Co., Ltd.

- Thermal Composites

- Hefei Xinghai Refractories Co., Ltd.

- Darco Industrial Supply Inc.

- SGL Carbon

- Owens Corning

Frequently Asked Questions

Analyze common user questions about the Aluminum Foil Fiberglass Cloth market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of aluminum foil in fiberglass cloth composites?

The aluminum foil layer acts as a highly effective vapor barrier, preventing moisture penetration into the insulation material, and provides superior radiant heat reflectivity, enhancing the overall thermal insulation performance of the fiberglass cloth.

Which regulatory standards are critical for Aluminum Foil Fiberglass Cloth in construction applications?

Critical standards include UL 723 (Standard for Test for Surface Burning Characteristics of Building Materials), ASTM E84, and NFPA standards, which govern the flame spread and smoke density ratings essential for code compliance in HVAC and building insulation.

How does the thickness or weight of the fiberglass cloth impact product performance?

Heavier weight fiberglass cloths (e.g., 800 g/sqm+) typically offer enhanced mechanical strength, better durability against abrasion, and often greater thermal stability, making them preferred for heavy industrial use like welding blankets or high-temperature vessel jacketing.

What are the key drivers for market growth in the Asia Pacific region?

Key drivers include rapid urbanization, massive governmental investments in commercial and residential infrastructure, and increasingly stringent national and regional regulations mandating energy-efficient and fire-safe building materials in high-density areas.

Is Aluminum Foil Fiberglass Cloth suitable for extreme high-temperature environments?

Yes, especially when bonded with silicone or high-performance thermoset adhesives, the material is highly suitable for extreme temperatures, offering continuous operation at elevated temperatures and crucial short-term resistance against thermal shock and direct flame exposure.

Deep Dive Analysis: Application Segmentation and Performance Benchmarks

The performance requirements for Aluminum Foil Fiberglass Cloth vary drastically depending on the specific application, necessitating different material configurations for segments such as HVAC, industrial pipe insulation, and fire safety products. In HVAC applications, the primary focus is on achieving a low permeance rating (excellent vapor barrier) and a high reflectivity index (low emissivity), thereby minimizing condensation risks and maximizing the efficiency of conditioned air distribution. Standard construction utilizes lightweight, often acrylic-bonded cloth that balances cost-effectiveness with necessary thermal performance. The crucial performance benchmark here is the material's ability to maintain its integrity and barrier function over decades without delamination or degradation due to moisture cycling.

Conversely, industrial insulation for high-temperature piping and vessels, particularly in petrochemical and power generation facilities, demands cloth components that can withstand constant operational temperatures exceeding 350°C. For these segments, manufacturers use heavy-duty fiberglass weaves (such as satin or 8 Harness weaves) combined with highly stable silicone-based adhesives and thick aluminum foil layers, often incorporating a protective outer coating for chemical splash resistance. The benchmark for these applications is sustained thermal stability, low thermal conductivity, and chemical inertness, ensuring material reliability during prolonged exposure to steam, oil, or aggressive environments, thus preventing catastrophic failures and ensuring operational safety for personnel.

Furthermore, the fire safety segment, which includes welding blankets, protective screens, and smoke curtains, prioritizes non-combustibility and mechanical resilience. These products are often required to be stand-alone fire barriers, not just insulation aids. Certification under specific standards like ISO 11612 (for protective clothing) or specialized marine fire ratings (IMO FTP Code) is mandatory. The performance benchmark here is the ability to resist burn-through for specified time periods, effectively block radiant heat transmission, and maintain structural integrity when subjected to molten splatter or direct flame, which dictates the use of highly treated, heavily coated (often vermiculite or silicone) fiberglass fabrics before the aluminum foil is applied.

Critical Market Challenges and Mitigation Strategies

One of the persistent challenges facing the Aluminum Foil Fiberglass Cloth market is the intense price volatility associated with key raw materials. Fiberglass yarn production is energy-intensive, meaning its cost is highly sensitive to global energy prices, while aluminum is a globally traded commodity subject to geopolitical factors, mining constraints, and trade tariffs. This unpredictability creates significant hedging difficulties for manufacturers and complicates fixed-price contracting with large construction or industrial clients. Mitigation strategies increasingly involve vertical integration where feasible, and, more commonly, entering into long-term strategic supply agreements with tiered pricing structures that allow for shared risk management between the material producer and the raw commodity supplier. Furthermore, optimizing inventory management using AI-driven predictive modeling helps manufacturers purchase materials at optimal times, buffering against short-term price spikes.

Another significant challenge relates to the pervasive issue of product substitution and the proliferation of low-quality, non-certified materials, especially in developing markets. Non-compliant products, often utilizing inferior adhesives or low-gauge foil, fail to meet critical fire safety or vapor barrier standards, leading to premature insulation failure and potential building code violations. This dilutes brand reputation and creates an uneven competitive landscape. Addressing this requires robust industry self-regulation, aggressive enforcement of intellectual property rights, and concerted educational efforts aimed at end-users and building inspectors to highlight the long-term cost of utilizing non-certified materials compared to the superior lifespan and safety of compliant products.

Technological limitations surrounding ultra-high temperature performance also present a hurdle. While the material performs well up to moderate industrial temperatures, achieving sustained performance in applications exceeding 600°C requires complex and expensive specialized treatments or alternative base materials, such as ceramic fibers, which challenges the economic viability of the standard product range. Future mitigation relies on continuous R&D into next-generation high-temperature polymer adhesives that can maintain bond strength near the melting point of aluminum, pushing the material’s operational envelope without resorting to significantly higher-cost ceramic alternatives. Successful innovation in this area would unlock access to niche high-performance industrial segments currently dominated by competing materials.

Future Growth Opportunities and Strategic Recommendations

The most compelling growth avenue for the Aluminum Foil Fiberglass Cloth market is centered on the rapid transformation occurring in the electric vehicle (EV) sector. As global EV adoption accelerates, there is a corresponding, non-negotiable demand for specialized thermal and fire protection materials designed to isolate and mitigate the risk of thermal runaway in lithium-ion battery packs. Aluminum foil fiberglass cloth, especially when modified with high-performance silicone coatings, is ideally suited for creating lightweight, flexible, and certified fire barriers between battery cells or modules. Manufacturers must strategically pivot R&D efforts to develop specific product grades that meet strict automotive quality standards (e.g., IATF 16949) and address the unique thermal cycling and vibration demands of mobile applications.

A second major opportunity lies in the expansion of advanced modular and prefabricated construction techniques. These methods rely on precise, factory-applied insulation solutions that demand flexible, pre-cut, and self-adhesive aluminum foil fiberglass products ready for immediate installation. By providing materials in kit form tailored to specific modular designs, manufacturers can significantly reduce on-site labor costs and installation time, creating a strong value proposition for high-volume modular builders. Strategic recommendations involve investing in sophisticated cutting and kitting automation technologies to serve this growing, efficiency-driven construction niche effectively.

Finally, leveraging sustainability as a competitive differentiator presents a long-term opportunity. While fiberglass itself is inert, focusing on reducing the environmental footprint of the adhesive system and integrating recycled aluminum foil components can appeal strongly to environmentally conscious European and North American markets. Manufacturers should seek certifications for low-VOC (Volatile Organic Compounds) adhesives and promote the long-term energy savings provided by the material. Strategic recommendations include collaborating with green building councils and certification bodies to establish recognized metrics for the material's lifecycle environmental impact, thereby justifying premium pricing in sustainability-focused tenders.

Geopolitical Risk Assessment and Mitigation

The Aluminum Foil Fiberglass Cloth market, like many industrial composite sectors, is inherently exposed to geopolitical risks, primarily stemming from the global concentration of fiberglass production and the international trading of aluminum. A significant portion of the world's fiberglass yarn production is concentrated in Asia, particularly China, creating potential vulnerabilities related to trade disputes, export restrictions, and regional operational disruptions (e.g., energy shortages or environmental shutdowns). Any imposed tariffs or trade barriers between major consuming regions (North America, Europe) and major producing regions can drastically inflate the cost of the base cloth, leading to market distortion and pricing instability for manufacturers outside the primary production zone.

Mitigation of these geopolitical risks requires a sophisticated dual-sourcing strategy. Manufacturers should actively seek qualified suppliers outside the dominant geographical cluster, diversifying their supply chain to include certified weavers in regions like India, Turkey, or Eastern Europe, even if initial costs are marginally higher. Furthermore, the development of robust localized processing capabilities within consuming regions (e.g., establishing lamination and finishing plants in North America or Europe) reduces reliance on fully finished imports and provides a hedge against abrupt international trade policy changes. Establishing buffer stocks of critical raw materials at regional distribution hubs is also essential to maintain continuity of supply during short-term geopolitical turbulence.

Beyond raw materials, the geopolitical environment also impacts demand through infrastructure sanctions or altered bilateral trade agreements, particularly concerning large oil and gas projects or major governmental construction initiatives. A professional risk assessment mandates continuous monitoring of political stability and economic policies in key emerging markets that drive industrial insulation demand. Strategic planning must incorporate flexible market entry and exit strategies, allowing manufacturers to rapidly adjust distribution networks or capacity allocation in response to changing geopolitical realities, ensuring that capital is not over-committed in high-risk, unstable operating environments, thereby preserving corporate resilience and financial stability.

Technology Advances and R&D Focus Areas

Research and Development (R&D) in the Aluminum Foil Fiberglass Cloth sector is primarily focused on enhancing two core attributes: extreme temperature resistance and superior bonding performance. A key area of innovation is the development of non-halogenated, fire-retardant (FR) adhesive systems. As regulations increasingly restrict the use of halogenated chemicals due to environmental and health concerns, the industry is shifting towards phosphorus-based or intumescent chemistries that provide equivalent or better flame suppression capabilities while maintaining high thermal stability and bond strength, especially critical during the thermal expansion of the materials.

Another focal point for R&D is the creation of multi-functional laminates. This involves integrating secondary layers or coatings to provide additional performance benefits beyond basic thermal insulation and vapor barrier properties. Examples include anti-microbial coatings for use in sensitive HVAC environments (hospitals, clean rooms) or highly abrasion-resistant coatings for external jacketing applications in harsh industrial outdoor settings. These advanced composites command higher margins and allow manufacturers to penetrate niche markets where standard foil cloth is inadequate, driving high-value segmentation.

The long-term R&D outlook also includes leveraging automation and data analytics in the production environment. Future factories will utilize sophisticated sensor arrays to measure material characteristics (e.g., surface tension, adhesive viscosity, fiber alignment) in real-time, feeding data into ML models. This capability will enable closed-loop manufacturing controls, allowing the production line to self-correct process variables dynamically, leading to near-zero defect rates, minimized material waste, and significantly reduced energy consumption during the curing and lamination phases, positioning manufacturers for leadership in both efficiency and product consistency.

Sustainability Metrics and Green Initiatives

Sustainability is rapidly transforming from a niche consideration to a core competitive requirement within the Aluminum Foil Fiberglass Cloth market, driven by consumer demand and stricter global environmental policies. Key sustainability metrics focus on reducing the embodied energy of the product, primarily related to the production of both fiberglass and aluminum. Initiatives are centered on optimizing fiberglass production techniques to utilize recycled glass content (cullet) and transitioning manufacturing facilities to renewable energy sources to reduce the massive carbon footprint associated with high-temperature glass melting.

A second critical metric involves the formulation of the adhesive layer. Traditional adhesives often contain high levels of volatile organic compounds (VOCs), contributing to poor indoor air quality during installation and operation. Green initiatives emphasize the switch to 100% solids, water-based, or UV-cured low-VOC adhesives. Manufacturers who achieve stringent certifications like GREENGUARD or relevant European eco-labels gain a substantial competitive edge, particularly when bidding on large governmental or commercial green building projects, where material health and environmental impact are weighted heavily.

Furthermore, attention is being paid to the recyclability and end-of-life management of the composite material. While fiberglass itself is chemically stable, separating the aluminum foil and the adhesive polymer presents recycling challenges. Future sustainability success hinges on developing easily de-bondable adhesive systems or designing products where the components can be efficiently separated for material recovery. Promoting the material’s extreme longevity—its ability to function effectively for over 50 years—is a strong sustainability argument, as it reduces the frequency of replacement and associated waste generation compared to less durable insulation alternatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager