Aluminum Idler Rollers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431615 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Aluminum Idler Rollers Market Size

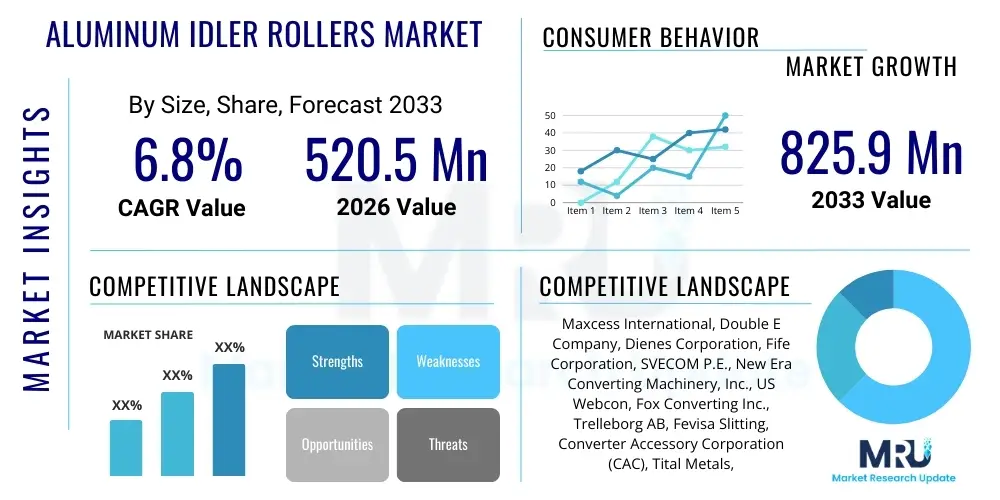

The Aluminum Idler Rollers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $520.5 Million in 2026 and is projected to reach $825.9 Million by the end of the forecast period in 2033.

Aluminum Idler Rollers Market introduction

Aluminum Idler Rollers are crucial components utilized in web handling equipment across various industries, including printing, packaging, and converting. These rollers are designed specifically to guide, support, and stabilize thin, flexible materials (webs) such as paper, film, foil, and textiles as they move rapidly through processing machinery. Aluminum is the preferred material due to its exceptional strength-to-weight ratio, allowing for the manufacturing of low-inertia rollers that are essential for high-speed operations. Low inertia minimizes the torque required to start and stop the web, enhancing precision and reducing energy consumption.

The core function of an idler roller is to provide smooth, frictionless movement while maintaining proper web tension and alignment. Aluminum construction offers superior thermal conductivity compared to steel, aiding in heat dissipation and preventing potential warping or material degradation during extended high-speed runs. These rollers often feature specialized surface treatments, such as hard anodizing or ceramic coatings, to improve durability, resistance to wear, and specific friction characteristics tailored to the material being processed. Their widespread adoption is intrinsically linked to the increasing global demand for sophisticated packaging and high-quality printing, necessitating faster, more reliable web processing systems.

Major applications for aluminum idler rollers include flexographic and rotogravure printing presses, slitting and rewinding machines, laminators, coating lines, and textile processing equipment. The primary benefits driving market demand include improved process efficiency, reduced web breaks, minimized vibration at high speeds, and enhanced product quality control. Furthermore, the push towards factory automation and the integration of precision manufacturing techniques mandates the use of lightweight, dynamically balanced components, positioning aluminum idler rollers as indispensable elements in modern industrial machinery.

Aluminum Idler Rollers Market Executive Summary

The Aluminum Idler Rollers Market is characterized by robust growth, driven primarily by the rapid expansion of the flexible packaging and high-speed converting industries, particularly within the Asia Pacific (APAC) region. Business trends indicate a strong shift towards highly customized and dynamically balanced rollers capable of operating reliably at speeds exceeding 1,500 meters per minute. Manufacturers are heavily investing in advanced lightweighting techniques, utilizing specialized aluminum alloys and proprietary internal rib structures to further reduce rotational inertia, which is a key competitive differentiator in performance-sensitive markets.

Regionally, APAC currently dominates the market share due to massive investments in manufacturing infrastructure, especially in China, India, and Southeast Asian nations, catering to global consumer goods demand. North America and Europe, while mature, remain strong markets, focusing on the replacement and upgrade of older machinery with precision-engineered, energy-efficient aluminum roller systems. These developed regions exhibit a higher propensity for adopting premium products featuring advanced surface treatments like plasma coatings for maximum longevity and specialized grip properties.

Segmentation trends highlight the increasing prominence of smaller diameter (less than 100 mm) rollers, driven by the compact design requirements of modern printing and coating equipment. Furthermore, the demand for dynamically balanced rollers, regardless of size, is accelerating, emphasizing quality over cost in industrial purchasing decisions. The competitive landscape is moderately fragmented, with specialized component suppliers focusing on vertical market expertise, while larger industrial machinery suppliers integrate roller manufacturing capabilities internally or through strategic partnerships to ensure component quality and availability.

AI Impact Analysis on Aluminum Idler Rollers Market

Common user questions regarding AI's influence center on how artificial intelligence can enhance roller operational performance, predict maintenance requirements, and optimize manufacturing quality. Users frequently ask about AI-driven design tools for lightweighting, the effectiveness of machine learning algorithms in dynamic balancing processes, and the integration of predictive analytics to prevent catastrophic web handling failures. The core expectations revolve around achieving "zero downtime" web handling systems and leveraging AI to move beyond traditional reactive maintenance schedules.

The primary impact of AI in the Aluminum Idler Rollers market is observed in the optimization of the entire product lifecycle, from initial design to end-use maintenance. AI-powered generative design tools are being used by manufacturers to simulate stress distribution and rotational physics, leading to the creation of ultra-lightweight roller geometries that were previously impossible to calculate manually. Furthermore, during the manufacturing phase, machine learning algorithms analyze real-time vibration data during dynamic balancing, significantly reducing calibration time and achieving higher precision balancing tolerances. This move towards intelligent manufacturing ensures that idler rollers can reliably meet the extreme demands of next-generation, high-speed converting machinery.

In operational settings, embedded sensors (IoT) on aluminum idler rollers, combined with AI/ML platforms, monitor temperature, vibration signature, and bearing health in real-time. This continuous analysis allows for the development of highly accurate predictive maintenance models, alerting operators to potential failure risks hours or days before component failure occurs. This proactive approach minimizes unexpected downtime, optimizes resource allocation for MRO (Maintenance, Repair, and Operations), and extends the operational lifespan of the rollers, thereby significantly improving the overall efficiency and cost-effectiveness of web handling systems across all end-user sectors.

- AI-driven generative design optimizes roller geometry for maximum inertia reduction and lightweighting.

- Machine learning enhances dynamic balancing precision, reducing manufacturing lead times and improving high-speed performance.

- Predictive maintenance using AI minimizes unexpected web handling machinery downtime by analyzing real-time sensor data (vibration, temperature).

- AI systems analyze web tension data to recommend optimal roller surface treatments and configurations for specific material processing.

- Automated quality control systems utilize computer vision and AI to inspect surface finish and structural integrity during production, ensuring superior product quality.

DRO & Impact Forces Of Aluminum Idler Rollers Market

The market dynamics are governed by a complex interplay of demand for operational efficiency and constraints related to material costs and competitive alternatives. High-speed automation in industries like flexible packaging, label printing, and converting acts as the primary driver, demanding components that ensure maximum web stability and minimum energy consumption, areas where lightweight aluminum excels. Simultaneously, the persistent fluctuations in global aluminum prices and the emergence of advanced composite materials (like carbon fiber) for ultra-high-performance applications pose significant restraints. Opportunities lie in the integration of smart features (sensorization) into idler rollers for real-time diagnostics and the geographic expansion into rapidly industrializing economies in Southeast Asia and Africa, which are transitioning from manual to automated processes.

The impact forces currently shaping the market are characterized by high-intensity competition based on precision engineering and customization. Forward integration by specialized roller manufacturers into value-added services, such as dynamic balancing consultancy and advanced surface coating applications, is increasing differentiation. The influence of regulatory standards related to food safety and hygiene, particularly in the packaging sector, also pushes demand toward corrosion-resistant, easily cleanable anodized aluminum rollers. These forces necessitate continuous innovation in bearing technology and surface science to maintain competitive edge and meet increasingly stringent performance specifications required by modern converting equipment.

Another major impact force stems from the rapid obsolescence cycle of manufacturing machinery. As OEMs introduce faster, wider, and more complex web handling machines, the demand for compatible, high-precision aluminum idler rollers rises proportionately. This reliance on capital equipment cycles ensures a steady replacement and upgrade market. The industry faces an ongoing challenge in balancing the need for customization—as every application often requires specific dimensions, treatments, and inertia characteristics—with the need for scalable and efficient mass production. Successfully navigating this trade-off between customization complexity and manufacturing scale will be vital for market leaders over the forecast period.

Segmentation Analysis

The Aluminum Idler Rollers market is comprehensively segmented based on three primary characteristics: Roller Type (dead shaft, live shaft), Application (Printing, Packaging, Converting, Textiles), and Diameter. Diameter segmentation is critical as it dictates the moment of inertia and suitability for specific web widths and speeds, with the small diameter category generally catering to high-speed, narrow-web operations. Application segmentation reflects the varying technical requirements across different end-use sectors, such as the need for anti-static coatings in film converting versus abrasion resistance in heavy textile processing. Furthermore, segmentation by surface treatment (anodized, non-anodized, ceramic coated) reveals trends in material protection and functional requirements like specific friction coefficients and chemical resistance.

- By Roller Type:

- Dead Shaft Idler Rollers

- Live Shaft Idler Rollers

- By Application:

- Printing Industry (Flexographic, Gravure, Digital)

- Packaging Industry (Film, Foil, Laminates)

- Converting Industry (Slitting, Rewinding, Coating)

- Textile and Non-Woven Industry

- Other Industrial Applications

- By Diameter:

- Less than 100 mm

- 100 mm – 200 mm

- Above 200 mm

- By Surface Treatment:

- Hard Anodized

- Non-Anodized/Polished

- Ceramic Coated

- Rubber Covered

Value Chain Analysis For Aluminum Idler Rollers Market

The value chain for Aluminum Idler Rollers begins with upstream activities involving the sourcing and processing of high-grade aluminum billets and specialized alloys, a segment dominated by large global metal providers. This raw material phase is critical, as the purity and properties of the aluminum directly influence the roller's final weight and structural integrity. Following sourcing, primary manufacturing involves precision extrusion or casting of the roller shell, followed by specialized machining operations such as turning, grinding, and, most importantly, achieving ultra-precise dynamic balancing to meet high rotational speed requirements. The value addition in this phase is driven by advanced manufacturing tolerances and proprietary internal geometries designed for lightweighting.

Midstream activities involve the application of value-added surface treatments, including hard anodizing for corrosion and abrasion resistance, or specialized coatings (e.g., plasma, ceramic) to achieve specific coefficients of friction required by end-users. Bearing integration is another key step, where high-precision, low-friction bearings are fitted to minimize rotational resistance. The distribution channel is bifurcated: direct sales primarily target large Original Equipment Manufacturers (OEMs) who integrate the rollers into new web handling machinery, requiring high-volume customization and technical collaboration during machine design. Indirect sales, facilitated through specialized industrial distributors and MRO (Maintenance, Repair, and Operations) suppliers, serve the replacement and aftermarket segment, focusing on quick availability and standardized dimensions.

Downstream analysis focuses on the end-users, mainly large industrial printing houses, flexible packaging converters, and material processors. The market exhibits high interdependence, as the performance of the idler roller directly impacts the end-user's productivity and product quality. OEM relationships are crucial for sustained revenue, while the aftermarket MRO segment offers higher margins but requires extensive inventory management across diverse specifications. Successful companies strategically manage both direct and indirect channels, leveraging technical expertise to support OEMs while utilizing distributors to maintain broad geographic coverage for replacement part supply.

Aluminum Idler Rollers Market Potential Customers

The primary consumers of aluminum idler rollers are specialized industrial processors requiring high-precision web conveyance systems. Key potential customers include large-scale flexible packaging manufacturers who process plastic films, foils, and paper into various consumer packaging formats. These buyers demand rollers that can handle high web tension and speed without inducing wrinkles or tears, often necessitating anti-static properties and chemical resistance due to solvents used in printing and coating. Their purchasing decisions are heavily influenced by the guaranteed performance metrics, such as dynamic balance certification and bearing life expectancy, to maximize continuous production uptime.

Another major customer cluster resides within the global printing industry, specifically commercial printing houses utilizing wide-format rotogravure and flexographic presses, as well as digital printing system integrators. For these customers, idler rollers must provide exceptionally uniform web transport to ensure perfect registration and color consistency across long runs. The textile industry, particularly manufacturers of non-woven materials (e.g., medical supplies, hygienic products), also represents a growing segment, requiring wide-format rollers capable of gentle handling of delicate or abrasive fabrics, often incorporating specific rubber or specialized coatings for optimum grip and release properties.

Furthermore, specialized converting companies focused on tasks like slitting, rewinding, laminating, and adhesive coating are significant end-users. These companies prioritize customized roller solutions that minimize inertial drag during rapid acceleration and deceleration cycles. The purchasing process for these sophisticated customers often involves rigorous testing and performance validation, favoring suppliers who offer advanced technical consultation, quick turnaround for custom dimensions, and demonstrated expertise in vibration dampening and thermal management across various operational speeds and environmental conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $520.5 Million |

| Market Forecast in 2033 | $825.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Maxcess International, Double E Company, Dienes Corporation, Fife Corporation, SVECOM P.E., New Era Converting Machinery, Inc., US Webcon, Fox Converting Inc., Trelleborg AB, Fevisa Slitting, Converter Accessory Corporation (CAC), Tital Metals, Alpha Rollers, Roller Specialists Inc., Nidec Corporation, Bosch Rexroth AG, SMC Corporation, Mitsubishi Heavy Industries, Componex Inc., Toray Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminum Idler Rollers Market Key Technology Landscape

The technology landscape in the aluminum idler rollers market is heavily focused on achieving superior rotational precision and enhancing surface functionalization to meet the demands of high-throughput machinery. A primary technological area is the refinement of dynamic balancing techniques. Modern manufacturers utilize multi-plane, high-frequency balancing machines, often employing proprietary software and algorithms, to certify rollers for speeds up to 5,000 meters per minute (or higher) with minimal runout and vibration. This precision minimizes the risk of web fluttering and ensures superior print registration, driving the adoption of premium, certified components in high-end applications. Furthermore, advancements in specialized bearing assemblies, utilizing low-friction ceramic or hybrid materials, are critical for reducing rotational drag and heat generation in non-driven applications.

Another pivotal technological development involves surface engineering and advanced coatings. Hard anodizing remains standard for durability, but market growth is increasingly driven by specialized applications leveraging thermal spray coatings, such as ceramic or tungsten carbide, which provide extreme wear resistance and controlled friction characteristics. These coatings are essential when handling abrasive materials or when precise traction is required without damaging delicate films. Innovations also extend to proprietary surface texturing techniques, including micro-grooving or laser etching, designed to control the air boundary layer that forms around the web at high speeds, thus preventing air entrapment and maintaining stable web contact.

The integration of smart manufacturing capabilities represents the future technology landscape. This includes embedding miniature IoT sensors directly within the roller assembly (or its shaft) to monitor parameters such as internal temperature, vibration magnitude, and rotational frequency in real-time. These sensors connect to centralized monitoring systems, enabling predictive maintenance models driven by AI, as detailed previously. This shift transforms the roller from a passive mechanical component into an active, data-generating asset, allowing end-users to optimize machine settings proactively and significantly improve overall equipment effectiveness (OEE) across their production lines.

Regional Highlights

The global market for aluminum idler rollers demonstrates significant regional disparities in terms of growth rates, demand drivers, and technological adoption profiles. The Asia Pacific (APAC) region is currently the dominant and fastest-growing market, primarily fueled by the massive expansion of the consumer goods, e-commerce, and food processing sectors. Countries like China, India, and Vietnam are witnessing rapid industrialization, leading to substantial investments in new, high-speed converting and packaging machinery, thus creating high volume demand for standardized and semi-custom aluminum rollers. The region benefits from lower manufacturing costs, making it a critical hub for both consumption and production.

North America and Europe represent mature markets characterized by replacement demand, strict quality requirements, and a high focus on sustainable and energy-efficient solutions. European manufacturers, particularly in Germany and Italy, prioritize highly specialized, precision-engineered rollers with certification for the highest speeds and tightest tolerances. The demand here is less volume-driven and more value-driven, centered on proprietary surface treatments, specialized alloys, and adherence to stringent industrial safety and environmental regulations. These regions are also early adopters of AI-integrated, sensor-enabled smart rollers.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions offering high growth potential, albeit from a smaller base. Growth in MEA is largely concentrated in industrialized Gulf Cooperation Council (GCC) states and South Africa, driven by packaging requirements for domestic consumer markets and construction materials. LATAM sees steady demand tied to local food processing and printing industries. These regions are generally more cost-sensitive but are rapidly moving towards adopting technologically superior aluminum rollers as opposed to heavier, less efficient alternatives, mirroring the global trend towards enhanced operational efficiency.

- Asia Pacific (APAC): Dominates market share due to unparalleled growth in flexible packaging, textile, and printing sectors; highest volume demand globally.

- North America: Focus on technology upgrades, replacement of legacy systems, and early adoption of smart (sensorized) aluminum rollers; mature, high-value market.

- Europe: Driven by demand for ultra-precision, customized components and adherence to strict energy efficiency and environmental standards; strong presence of specialized component manufacturers.

- Latin America (LATAM): Emerging market characterized by increasing automation in food and beverage processing and localized printing industries.

- Middle East and Africa (MEA): Growth stimulated by new infrastructure development and localized manufacturing investments, driving demand for packaging solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminum Idler Rollers Market.- Maxcess International

- Double E Company

- Dienes Corporation

- Fife Corporation

- SVECOM P.E.

- New Era Converting Machinery, Inc.

- US Webcon

- Fox Converting Inc.

- Trelleborg AB

- Fevisa Slitting

- Converter Accessory Corporation (CAC)

- Tital Metals

- Alpha Rollers

- Roller Specialists Inc.

- Nidec Corporation

- Bosch Rexroth AG

- SMC Corporation

- Mitsubishi Heavy Industries

- Componex Inc.

- Toray Industries

Frequently Asked Questions

Analyze common user questions about the Aluminum Idler Rollers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using aluminum for idler rollers over steel or composites?

Aluminum offers a significantly higher strength-to-weight ratio compared to steel, resulting in lower rotational inertia. This low inertia is critical for high-speed web handling, reducing energy consumption, minimizing web tension fluctuations, and allowing for faster acceleration and deceleration, leading to less product waste and higher overall machine efficiency.

How important is dynamic balancing in the aluminum idler roller manufacturing process?

Dynamic balancing is paramount. It ensures the roller spins without excessive vibration or runout, especially at high rotational speeds (common in modern converting machinery). Poor balancing leads to web defects, premature bearing failure, and machinery damage. High-precision balancing is a non-negotiable requirement for high-performance applications.

Which end-user application drives the highest demand for aluminum idler rollers globally?

The flexible packaging industry drives the highest global demand. This sector, encompassing film, foil, and laminate processing, requires continuous, high-speed web movement for printing, coating, and slitting operations, necessitating the low-inertia, precision guiding capabilities provided by advanced aluminum rollers.

What technological advancements are enhancing the lifespan and performance of idler rollers?

Key advancements include sophisticated surface treatments like hard anodizing, ceramic, or plasma coatings for enhanced abrasion resistance and specific friction control. Furthermore, the integration of advanced low-friction ceramic hybrid bearings and embedded IoT sensors for predictive maintenance significantly extends operational lifespan and improves system reliability.

How is the market influenced by the increasing trend of lightweighting in industrial machinery?

The lightweighting trend directly boosts the aluminum idler roller market. As machinery OEMs aim for faster operational speeds and reduced energy footprints, lightweight aluminum components are essential. Manufacturers are continuously innovating roller internal structures (e.g., ribbed or honeycomb designs) to achieve minimum weight while maintaining maximum stiffness and dimensional stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager