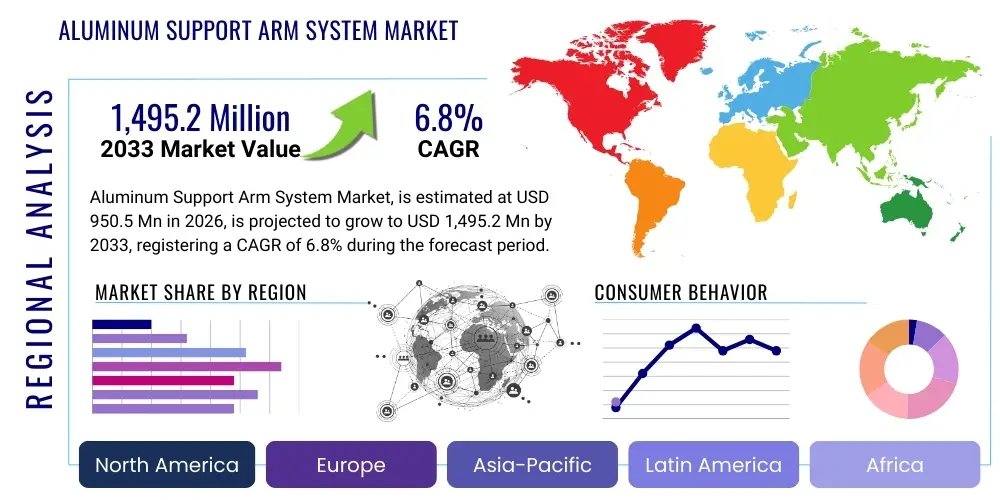

Aluminum Support Arm System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437486 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Aluminum Support Arm System Market Size

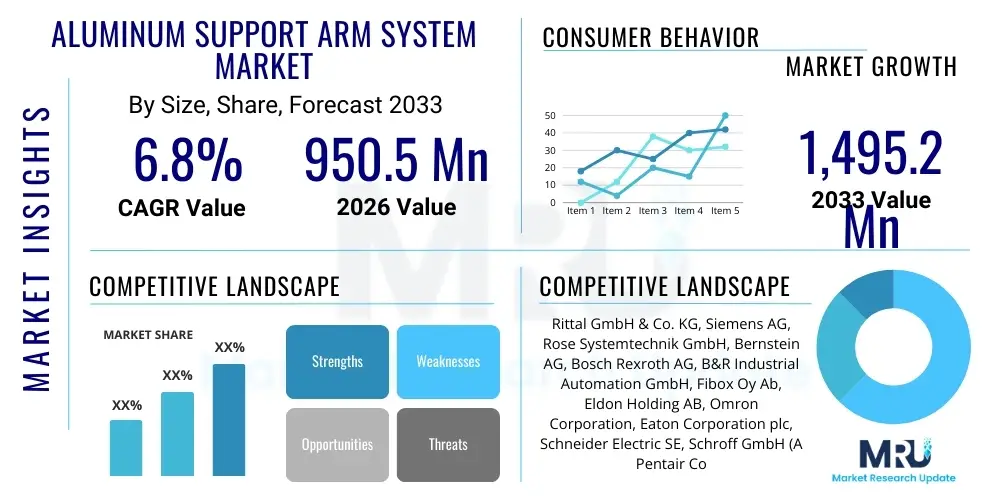

The Aluminum Support Arm System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 950.5 Million in 2026 and is projected to reach USD 1,495.2 Million by the end of the forecast period in 2033.

Aluminum Support Arm System Market introduction

The Aluminum Support Arm System Market encompasses specialized mechanical mounting solutions designed to securely hold and articulate Human Machine Interface (HMI) panels, control enclosures, and industrial monitors. These systems are predominantly utilized in sophisticated manufacturing environments where operator interfaces must be positioned precisely for optimal ergonomics and accessibility, ensuring efficient machine operation and monitoring. The inherent characteristics of aluminum, such as its high strength-to-weight ratio, excellent corrosion resistance, and aesthetic appeal, make it the material of choice over traditional steel counterparts, particularly in clean room environments or areas requiring lightweight maneuverability. This market is fundamentally driven by the global expansion of industrial automation and the increasing deployment of advanced visualization and control technology on the factory floor.

Aluminum support arm systems are modular assemblies comprising couplings, elbow joints, wall-mount bases, and connection adapters, allowing for highly flexible and customizable installations tailored to specific machine architectures. The primary applications span across diverse sectors, including machine tools, packaging machinery, food and beverage processing, and medical device manufacturing. These systems offer significant operational benefits, including improved worker safety through ergonomic positioning, reduced system downtime by ensuring stable display access, and enhanced modularity facilitating rapid reconfiguration of production lines. The integration of internal cable management pathways within the arm structures further streamlines installations and protects sensitive wiring from the harsh industrial environment, contributing significantly to system longevity and reliability.

Driving factors for sustained market growth include the pervasive trend of Industry 4.0, which mandates seamless connectivity and localized control points near complex machinery. As manufacturers globally invest heavily in digital transformation and intelligent manufacturing systems, the demand for robust, adjustable, and aesthetically integrated HMI support solutions escalates. Furthermore, stringent occupational safety standards and a growing focus on improving the operator experience are compelling industries to adopt ergonomic support systems. The continuous technological advancements in display panel sizes and weights also necessitate sophisticated, high-load-bearing yet maneuverable aluminum support arms, ensuring that the market trajectory remains positive throughout the forecast period.

Aluminum Support Arm System Market Executive Summary

The Aluminum Support Arm System Market is characterized by robust growth, primarily fueled by significant investments in industrial automation, especially across Asia Pacific and Europe. Key business trends indicate a shift towards highly modular and customizable systems that can accommodate varied load capacities, ranging from light-duty HMI displays to heavy-duty control panels used in complex machinery. Leading manufacturers are focusing on integrating features such as tool-free adjustments, specialized corrosion-resistant coatings, and seamless integration with proprietary enclosure systems to maintain a competitive edge. The emphasis on standardized component sizes also facilitates easier maintenance and inventory management for end-users, promoting greater adoption across large-scale manufacturing enterprises.

Regionally, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, driven by rapid industrialization, particularly in China, India, and Southeast Asian nations, where massive installations of new automated production lines are taking place. Europe remains a mature yet high-value market, anchored by Germany's advanced machine tool and automotive industries, prioritizing high-quality, durable, and aesthetically superior systems compliant with stringent EU machinery directives. North America’s growth is steady, largely spurred by the revitalization of domestic manufacturing and the expansion of the aerospace and medical device sectors, which require precision-engineered support solutions adhering to high regulatory standards.

Segment trends reveal that the medium-duty capacity segment (20 kg to 40 kg) holds the largest market share, catering to the most common sizes of industrial touchscreens and operator panels. However, the heavy-duty segment is experiencing accelerated growth due to the increasing adoption of larger, multi-functional control enclosures requiring greater structural integrity. Application-wise, the industrial automation segment dominates, reflecting the pervasive need for local control stations in fully automated factories. Furthermore, there is a pronounced segment trend towards integrated data transmission capabilities within the arm structure, allowing for Ethernet cables and power lines to run protected, enhancing the overall functionality and tidiness of the installation environment.

AI Impact Analysis on Aluminum Support Arm System Market

User queries regarding AI's influence on the Aluminum Support Arm System Market frequently center on whether intelligent systems will necessitate new mechanical requirements, how predictive maintenance will affect component lifespan, and if HMI centralization driven by AI will reduce the number of support arms needed. Users are concerned about the implications of real-time diagnostics, expecting the support arms themselves, or the enclosures they hold, to potentially house sophisticated sensor arrays for environmental monitoring (vibration, temperature) to inform AI-driven maintenance platforms. The consensus expectation is that while AI might centralize some control functions, the need for robust, decentralized HMI access points for localized monitoring and intervention will persist, potentially requiring smarter, more interconnected support arm systems capable of seamless data transmission.

AI's primary impact is enhancing the performance and efficiency of the machinery supported by these arms, which indirectly increases the demand for high-reliability components. Specifically, AI-driven predictive maintenance (PdM) relies on accurate, continuous data collection, often facilitated by sensors mounted directly or indirectly on the machine structure, sometimes leveraging the inherent stability of the support arm system. Furthermore, AI optimization of manufacturing layouts might lead to more dynamic and compact workstations, necessitating support arms with enhanced flexibility, shorter reach capabilities, and higher load precision. The future trend points towards 'smart' support arms that are pre-fitted with cabling, junction points, or even embedded chips to support edge computing requirements near the control panel.

In the design and manufacturing phase of the support arms themselves, AI is already being used to optimize material usage and structural design for weight reduction while maintaining necessary load ratings, leading to more efficient production processes. AI simulation tools enable manufacturers to predict the fatigue life of various joints and components under diverse operational stresses, thereby offering support systems with certified longevity tailored for specific high-stress industrial applications. This technological integration assures end-users of maximum uptime, aligning the support arm system's reliability with the high-availability demands of modern AI-managed production lines.

- AI-driven Predictive Maintenance (PdM) increases demand for high-reliability components and potentially integrated sensor housings within support arms.

- Optimization of factory floor layouts by AI leads to demand for highly flexible, modular, and compact support arm designs.

- AI simulations are utilized in design to optimize structural weight, improve fatigue life prediction, and reduce material waste during manufacturing.

- Potential integration of edge computing capabilities and data transmission pathways within the support arms to support decentralized, AI-enabled HMI panels.

- Enhanced personalization of operator interfaces driven by AI requires support systems with broader ergonomic adjustment capabilities and quicker reconfigurability.

DRO & Impact Forces Of Aluminum Support Arm System Market

The Aluminum Support Arm System Market is dynamically shaped by powerful drivers, notably the accelerating pace of global industrial automation and the resultant proliferation of advanced HMI and control technologies. This deployment mandates reliable, flexible mounting solutions, thereby directly translating into market growth. Simultaneously, opportunities abound in developing regions and in specialized niches such as explosion-proof environments (ATEX/IECEx zones), where aluminum's non-sparking properties combined with specialized coatings are highly valued. The overall impact forces are strongly positive, driven by long-term structural changes in manufacturing towards digital and intelligent operations, solidifying the support arm's role as a critical component of machine infrastructure rather than a mere accessory.

Key drivers include the global shift towards ergonomic workplace design and adherence to strict occupational health and safety regulations, forcing manufacturers to replace static, poorly positioned control interfaces with adjustable support arms. Furthermore, the modular nature and aesthetic qualities of aluminum systems appeal to machine builders (OEMs) who seek to provide a high-quality, professional finished look for their equipment. However, the market faces restraints, primarily the high initial investment cost compared to basic fixed mounting brackets, which can deter small and medium-sized enterprises (SMEs) with limited capital. Another restraint is the complexity in standardization across global markets, requiring manufacturers to maintain diverse product lines to comply with differing regional regulations and mechanical interface standards.

The primary opportunities lie in emerging application areas, such as logistics automation (e.g., automated guided vehicles or AGVs) and robotics, where lightweight, dynamic support arms are essential for integrating mobile HMI and tablet interfaces. Furthermore, there is a significant opportunity to develop systems with integrated Industrial Internet of Things (IIoT) readiness, offering pre-wired conduits for high-speed fiber optic or advanced Ethernet communication, minimizing installation complexity for end-users. The continuous effort to optimize supply chains and localize manufacturing capabilities presents an avenue for regional players to capitalize on reduced logistics costs and quicker delivery times, especially in high-growth areas like Southeast Asia, mitigating the global supply chain vulnerabilities experienced in recent years.

Segmentation Analysis

The Aluminum Support Arm System Market segmentation provides a granular view of demand based on capacity, application, and end-use industry, reflecting the diverse requirements of the modern industrial landscape. The segmentation by capacity—Light, Medium, and Heavy Duty—is crucial as it directly correlates with the size and weight of the HMI enclosures and control panels being mounted. The medium-duty segment historically dominates due to the prevalence of standard 10-inch to 21-inch industrial displays. However, market dynamics are pushing towards higher load-bearing systems as multi-touch, widescreen displays and larger, ruggedized enclosures become standard, driving growth in the heavy-duty sector.

Application-based segmentation highlights that industrial automation, encompassing automated machinery and production lines, is the principal revenue generator, given the imperative for localized control points in sophisticated manufacturing processes. Segments such as medical devices and food & beverage processing are niche but high-growth, demanding support systems that comply with strict hygiene standards, often requiring specialized IP ratings (Ingress Protection) and smooth, easy-to-clean aluminum surfaces. Understanding these segment-specific needs is vital for market players to tailor product features, such as stainless steel connection points for washdown areas or specialized electromagnetic compatibility (EMC) shielding for sensitive electronic equipment.

The future trajectory of the market suggests that customization and modularity will increasingly define success across all segments. End-users are increasingly demanding 'kit-based' solutions that allow them to mix and match components—such as different lengths, rotation limits, and mounting orientations—without compromising load integrity. This trend towards configurable products enables efficient inventory management for large manufacturing groups and allows machine builders to swiftly adapt their designs to various customer specifications, thus shortening time-to-market for final machinery solutions.

- By Capacity:

- Light Duty (Up to 20 kg)

- Medium Duty (20 kg to 40 kg)

- Heavy Duty (Above 40 kg)

- By Application:

- Industrial Automation

- Machine Tools and Metalworking

- Packaging and Processing Machinery

- Medical Devices and Healthcare Equipment

- Food & Beverage Processing

- HMI/Display Systems Integration

- By End-Use Industry:

- Automotive and Transportation

- Aerospace and Defense

- Electronics and Semiconductors

- General Manufacturing

- Pharmaceuticals and Biotechnology

Value Chain Analysis For Aluminum Support Arm System Market

The value chain for the Aluminum Support Arm System Market starts with upstream activities involving the sourcing and processing of raw aluminum, primarily high-grade aluminum alloys suitable for precision extrusion and casting. Key upstream suppliers include primary aluminum producers and specialized component manufacturers that supply standardized bearings, seals, and locking mechanisms necessary for articulation joints. Optimization at this stage focuses heavily on securing consistent material quality, managing volatility in aluminum commodity prices, and utilizing advanced manufacturing techniques like robotic welding and computerized numerical control (CNC) machining to achieve the necessary dimensional accuracy and surface finish required for aesthetic industrial products.

Midstream activities involve core manufacturing, including extrusion, surface treatment (anodizing or powder coating for enhanced durability and aesthetics), assembly of modular components, and quality assurance testing for load capacity and fatigue resistance. Manufacturers often invest heavily in design engineering to ensure systems meet international ergonomic standards and offer comprehensive cable management solutions. Distribution forms the critical link to the downstream market, predominantly relying on two channels: direct sales to major machine builders (OEMs) who integrate the arms into their machinery, and indirect sales through industrial distributors, system integrators, and electrical supply wholesalers who cater to maintenance, repair, and overhaul (MRO) demand and smaller end-user projects.

Downstream analysis focuses on the interaction with end-users and the provision of technical support. System integrators play a vital role in specifying the correct load-bearing capacity and reach requirements for complex factory setups. The indirect channel provides necessary local inventory and quick delivery, which is crucial for repair components. Direct relationships with major OEM clients are pivotal, enabling customized product development and large-volume contracts. A strong, responsive technical support network is essential post-sale, ensuring proper installation, addressing compatibility issues with various HMI enclosures, and providing long-term component availability, thereby solidifying brand loyalty and market position.

Aluminum Support Arm System Market Potential Customers

Potential customers for Aluminum Support Arm Systems are primarily categorized by their role in the industrial ecosystem: Machine Builders (OEMs) and End-Use Manufacturers. Machine builders represent the largest volume buyers, integrating these arms as standard components into their specialized machinery, such as CNC routers, injection molding machines, advanced inspection systems, and automated packaging lines. For these customers, key purchase criteria include reliability, compliance with international machine safety standards (e.g., ISO, CE), standardized mechanical interfaces for easy integration, and design continuity that aligns with their corporate branding and machine aesthetics.

End-Use Manufacturers, spanning industries like Automotive, Aerospace, and Food & Beverage, purchase these systems for retrofitting existing equipment or for new facility installations where control stations need optimal positioning. Their purchasing decisions are heavily influenced by ergonomic considerations, system robustness, ease of maintenance, and the ability of the support arm to protect sensitive control components in demanding industrial environments (e.g., high vibration, extreme temperatures, or corrosive agents). Customers in the medical and pharmaceutical sectors, in particular, require systems with specialized features such as antibacterial coatings and certified cleanroom compatibility, making material specifications and surface treatments critical purchasing factors.

A rapidly growing segment of potential customers includes specialized system integrators and electrical contractors who design and implement factory floor infrastructure. These buyers seek modularity, ease of assembly, and broad compatibility with multiple HMI vendor products (e.g., Siemens, Rockwell, B&R). Their procurement is often project-based, emphasizing product availability, technical documentation quality, and the supplier's ability to provide tailored configurations quickly. Catering to this segment requires manufacturers to offer comprehensive catalogues, detailed CAD models, and strong logistical support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950.5 Million |

| Market Forecast in 2033 | USD 1,495.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rittal GmbH & Co. KG, Siemens AG, Rose Systemtechnik GmbH, Bernstein AG, Bosch Rexroth AG, B&R Industrial Automation GmbH, Fibox Oy Ab, Eldon Holding AB, Omron Corporation, Eaton Corporation plc, Schneider Electric SE, Schroff GmbH (A Pentair Company), Hoffman Enclosures Inc., OKW Gehäusetechnik GmbH, Pfannenberg Group, ROLEC Gehäuse-Systeme GmbH, SICK AG, KUKA AG, ABB Ltd., TE Connectivity Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminum Support Arm System Market Key Technology Landscape

The technology landscape for the Aluminum Support Arm System Market is defined by innovations centered on modularity, load stability, and seamless integration with Industrial Internet of Things (IIoT) infrastructure. A dominant trend is the development of robust, adjustable joints utilizing specialized bearing technologies and internal friction elements to ensure precise, drift-free positioning of heavy HMI panels, even in environments subject to high vibration. Advanced surface treatments, such as specialized anodizing processes, are crucial, not only for corrosion resistance but also for providing anti-glare properties and ease of sterilization, catering specifically to the expanding cleanroom and hygienic processing sectors.

Furthermore, manufacturers are heavily investing in engineering modular systems that minimize the number of unique components required, simplifying configuration and reducing installation time. This modular approach leverages standardized interfaces (e.g., specific bore diameters and mounting hole patterns) compatible across various load classes, allowing end-users to easily upgrade or reconfigure their control stations. The integration of advanced cable management, including shielded internal compartments for high-frequency data cables (e.g., Profinet, Ethernet/IP) and dedicated pathways for power lines, addresses the growing complexity of modern control wiring while maintaining a tidy and protected external appearance.

The convergence with Industry 4.0 principles necessitates support systems capable of integrating digital elements. This includes offering enclosure designs that facilitate the mounting of peripheral sensors (e.g., RFID readers, light barriers) directly onto the arm structure, transforming the support arm from a passive fixture into an active part of the machine's data network. The use of lightweight aluminum alloys, often derived from aerospace standards, is paramount for systems intended for dynamic applications, such as large mobile control carts or robotic tending stations, where mass reduction directly translates into energy efficiency and improved maneuverability.

Regional Highlights

- Asia Pacific (APAC) Market Dominance and Growth: The APAC region is recognized as the fastest-growing market globally for Aluminum Support Arm Systems, driven by extensive government initiatives promoting domestic manufacturing and digital factory adoption, particularly in China, South Korea, and India. The rapid influx of foreign direct investment into manufacturing capacity across Southeast Asia necessitates modern, standardized control infrastructures. Local manufacturers are emerging, focusing on competitive pricing, though high-end demand still favors established European suppliers known for precision and durability. The market is characterized by mass adoption in the electronics assembly and automotive component manufacturing sectors, leading to volume-driven growth in the medium and light-duty segments.

- European Market Maturity and Quality Focus: Europe, led by Germany, Italy, and the Nordic countries, maintains a significant market share characterized by a strong demand for premium, highly durable, and ergonomically optimized systems. European OEMs prioritize adherence to stringent EU directives (Machinery Directive, EMC standards) and seek highly customized support solutions that integrate seamlessly with advanced machine tools and automated assembly lines. The focus is less on sheer volume growth and more on value-added features such as certified cleanroom capabilities, high IP ratings, and aesthetic design integration, reinforcing Europe’s position as a technological benchmark for quality and engineering excellence in the market.

- North American Market Resilience and Specialized Demand: North America presents a stable and resilient market, supported by substantial defense, aerospace, and high-tech manufacturing investments. Demand here is often bifurcated, with a strong requirement for heavy-duty systems in large industrial settings (e.g., oil and gas, heavy machinery) and specialized, FDA-compliant systems for the expanding medical device sector. The emphasis on local supply chains and quick turnaround times influences purchasing decisions. Furthermore, the increasing complexity of industrial controls in the US requires support arms capable of robustly handling sophisticated, multiple HMI configurations, driving steady demand for high-load capacity modular systems.

- Latin America and MEA Emerging Opportunities: Latin America and the Middle East and Africa (MEA) regions represent emerging markets where growth is highly correlated with infrastructure and energy sector investments. While still smaller than the primary markets, rapid industrialization, particularly in countries like Brazil, Saudi Arabia, and the UAE, is creating nascent demand. These regions often favor robust, cost-effective solutions capable of withstanding harsh environmental conditions. The oil and gas sector, in particular, drives demand for specialized, explosion-proof compatible support arm systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminum Support Arm System Market.- Rittal GmbH & Co. KG

- Siemens AG

- Rose Systemtechnik GmbH

- Bernstein AG

- Bosch Rexroth AG

- B&R Industrial Automation GmbH

- Fibox Oy Ab

- Eldon Holding AB

- Omron Corporation

- Eaton Corporation plc

- Schneider Electric SE

- Schroff GmbH (A Pentair Company)

- Hoffman Enclosures Inc.

- OKW Gehäusetechnik GmbH

- Pfannenberg Group

- ROLEC Gehäuse-Systeme GmbH

- SICK AG

- KUKA AG

- ABB Ltd.

- TE Connectivity Ltd.

Frequently Asked Questions

Analyze common user questions about the Aluminum Support Arm System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of choosing aluminum over steel for industrial support arm systems?

Aluminum support systems offer a superior strength-to-weight ratio, simplifying installation and maneuverability while maintaining high load capacity. They also provide enhanced corrosion resistance, better aesthetic appeal, and are typically easier to integrate with modular industrial enclosure systems, making them ideal for high-hygiene or cleanroom environments.

How does the Industry 4.0 trend specifically influence the design requirements for support arm systems?

Industry 4.0 drives the need for greater system modularity, enabling quick adjustments and reconfigurations to match dynamic production lines. Designs must incorporate improved internal cable management pathways for high-speed data transmission (IIoT connectivity) and offer greater structural stability to support increasingly complex and heavier HMI touchscreens and control enclosures.

What is the typical load capacity range for medium-duty aluminum support arms?

Medium-duty aluminum support arm systems are generally designed to handle static and dynamic loads ranging from 20 kg to 40 kg. This capacity is optimized to securely mount standard-sized industrial HMI panels, operator workstations, and mid-sized control enclosures frequently utilized across general manufacturing and automated processing lines.

Which regions are expected to drive the highest growth rate in the Aluminum Support Arm System Market?

The Asia Pacific (APAC) region, spearheaded by accelerated industrial automation and massive infrastructure investment in countries like China and India, is projected to exhibit the highest Compound Annual Growth Rate (CAGR). Europe, however, will maintain high market value due to its mature automotive and machine tool sectors prioritizing premium quality and technical compliance.

Are support arm systems compatible with various industrial HMI brands, or are they proprietary?

Modern aluminum support arm systems are designed for high compatibility, often utilizing standardized interfaces and adapters to mount enclosures from major HMI providers (e.g., Siemens, Rockwell, B&R). While some suppliers offer proprietary locking systems for aesthetic integration, modularity and interoperability remain core features to serve the diverse requirements of system integrators and OEMs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager