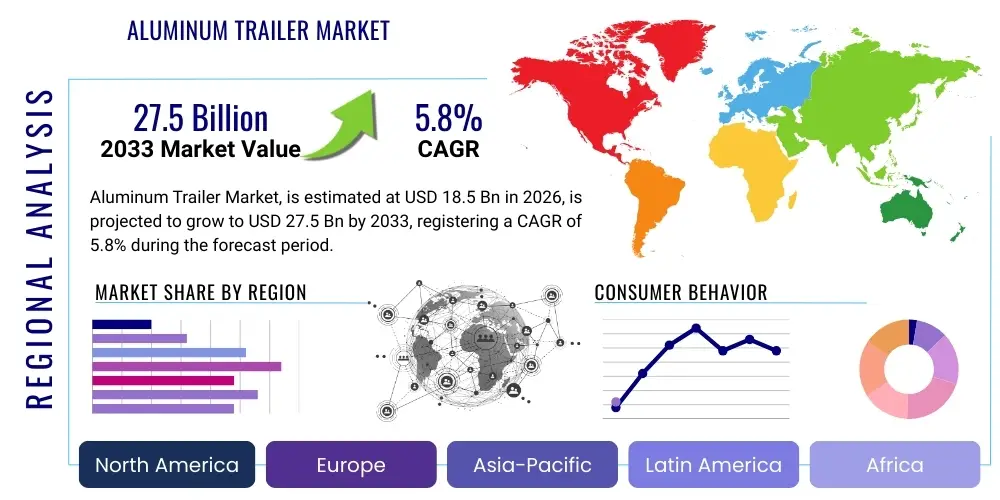

Aluminum Trailer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438459 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Aluminum Trailer Market Size

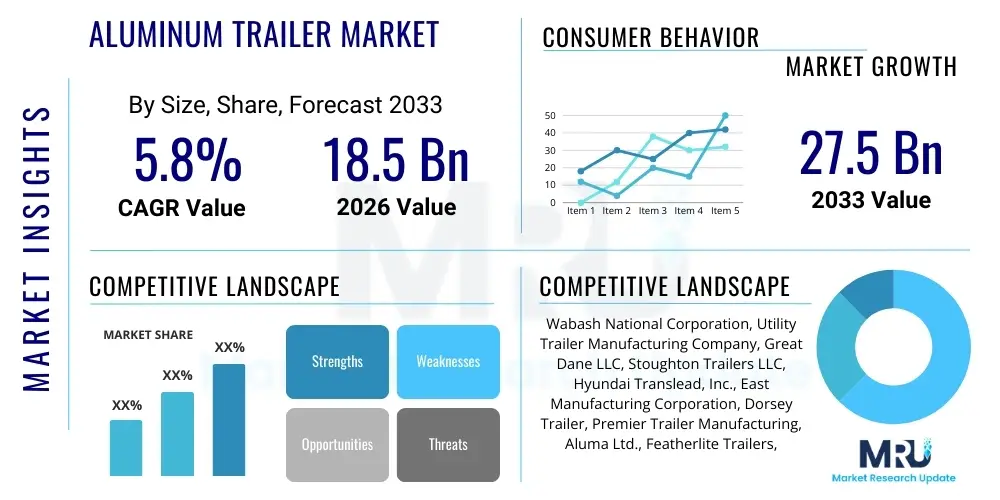

The Aluminum Trailer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 27.5 Billion by the end of the forecast period in 2033. This robust expansion is fueled primarily by the increasing demand for lightweight transportation solutions across various industries, including construction, logistics, and recreation, driven by stringent fuel efficiency standards and a growing focus on sustainability. Aluminum trailers offer superior payload capacity and durability compared to traditional steel variants, justifying the initial higher material cost through long-term operational savings and reduced maintenance needs, which significantly contributes to their overall market uptake across developed and emerging economies.

Aluminum Trailer Market introduction

The Aluminum Trailer Market encompasses the design, manufacturing, and distribution of transport units constructed predominantly from aluminum alloys, utilized for hauling goods, equipment, vehicles, and livestock. Aluminum trailers are highly valued for their exceptional strength-to-weight ratio, which directly translates into reduced fuel consumption for the towing vehicle, decreased wear and tear on components, and increased payload capacity compared to heavier steel alternatives. This product segment includes various types such as flatbed trailers, utility trailers, dump trailers, cargo trailers, and specialized trailers like horse trailers or tanker trailers, serving diverse end-user requirements across commercial and consumer sectors.

Major applications of aluminum trailers span several high-growth sectors. In the commercial logistics and freight industry, aluminum dry vans and reefers are preferred due to their longevity and operational efficiency. The construction and infrastructure sectors rely on aluminum dump and equipment trailers for moving heavy machinery and bulk materials, benefitting from the corrosion resistance of aluminum in harsh working environments. Furthermore, the robust recreational vehicle (RV) and automotive sports segments drive significant demand for aluminum car haulers and enclosed recreational trailers, where weight savings are critical for performance and ease of handling. The intrinsic benefits, including corrosion resistance, enhanced recyclability, and improved safety due to better braking performance and reduced overall weight, are primary driving factors propelling market expansion globally.

The market is predominantly driven by increasing regulatory pressures aimed at improving truck fuel efficiency and reducing greenhouse gas emissions, particularly in North America and Europe. Consumer awareness regarding the total cost of ownership (TCO), where reduced fuel costs outweigh the increased initial investment, further stimulates adoption. Additionally, technological advancements in aluminum welding, fabrication techniques, and the development of stronger, more specialized aluminum alloys suitable for heavy-duty applications ensure that aluminum trailers can meet the structural integrity demands previously monopolized by steel products. This convergence of environmental mandates, economic operational benefits, and material science innovation positions the Aluminum Trailer Market for sustained growth.

Aluminum Trailer Market Executive Summary

The Aluminum Trailer Market is characterized by robust business trends focusing on lightweighting initiatives and enhanced connectivity solutions. Key industry players are increasingly investing in advanced manufacturing processes, such as friction stir welding and modular designs, to optimize production costs and improve the structural integrity of trailers. There is a discernible shift towards specialized, high-performance trailers tailored for specific niche applications, such as high-capacity construction haulers and refrigerated transport units optimized for last-mile logistics. Furthermore, the integration of smart technologies, including telematics for real-time monitoring of temperature, tire pressure, and location, represents a crucial trend enhancing operational safety and efficiency across the commercial fleet segment.

Regionally, North America maintains its dominance due to a highly developed logistics infrastructure, stringent government regulations prioritizing fuel efficiency, and a large consumer base driving the demand for recreational and utility trailers. Asia Pacific, particularly China and India, is emerging as the fastest-growing region, fueled by rapid industrialization, expanding construction activities, and increasing investment in road infrastructure development. European countries show mature market penetration, driven primarily by the replacement cycle of aging fleets and strict emission standards mandated by the European Union, fostering innovation in aerodynamic and lightweight trailer designs. The Middle East and Africa (MEA) and Latin America are experiencing steady growth, supported by investments in mining, agriculture, and transportation sectors, favoring the durability and corrosion resistance of aluminum in challenging climatic conditions.

Segment-wise, the market is highly influenced by the Type and Application categories. Flatbed and Dump trailers are projected to hold substantial market share within the Type segment due to sustained demand from the construction and agricultural industries. Conversely, the Enclosed/Cargo segment is showing dynamic growth driven by the burgeoning e-commerce and logistics sectors requiring secure, lightweight transport solutions. From an Application perspective, the Commercial segment, encompassing heavy-duty logistics and construction, remains the largest revenue generator. However, the Recreational segment is experiencing accelerated growth, spurred by increased consumer spending on outdoor activities and the popularity of lightweight towing options for travel and leisure purposes, indicating diversification in market demand across both B2B and B2C channels.

AI Impact Analysis on Aluminum Trailer Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Aluminum Trailer Market predominantly revolve around three core themes: predictive maintenance, optimization of load distribution, and enhancing trailer manufacturing processes. Users frequently question how AI algorithms can monitor trailer component health (tires, axles, braking systems) in real-time to prevent costly failures, specifically leveraging sensor data integrated into smart aluminum chassis designs. Another major area of interest is the use of machine learning to calculate optimal trailer payload configurations dynamically, ensuring adherence to weight limits while maximizing fuel efficiency. Finally, users seek clarification on how AI-driven simulation and robotic automation are transforming complex aluminum welding and fabrication, reducing material waste, and accelerating production cycles, moving the industry toward 'smart factory' models.

The application of AI in the aluminum trailer sector is primarily focused on transforming operational efficiency and improving product lifespan through data intelligence. AI systems, coupled with advanced telematics embedded within aluminum trailer frames, can analyze vast streams of operational data—including vibration levels, temperature fluctuations, and route complexity—to generate highly accurate predictive maintenance alerts. This shift from reactive to proactive servicing minimizes downtime and significantly reduces the total cost of ownership for fleet operators. Furthermore, AI contributes to optimizing supply chain logistics related to trailer manufacturing, predicting material price volatility, and managing inventory of specialized aluminum alloys, ensuring a streamlined and resilient production flow.

As the industry moves toward autonomous trucking, the aluminum trailer becomes a critical data node in the overall ecosystem. AI plays a crucial role in validating the structural integrity of lightweight aluminum components under dynamic loads, using digital twins and simulation models before physical prototyping. This reduces the development cycle time for new, specialized trailer designs. Moreover, AI-powered quality control systems, utilizing computer vision, can inspect complex aluminum welds and structural connections post-fabrication with precision far exceeding manual checks, guaranteeing higher product quality and safety standards compliant with evolving industry regulations across different global jurisdictions.

- AI-driven Predictive Maintenance: Monitoring aluminum structure fatigue and component wear (e.g., brakes, suspensions) in real-time using embedded sensors.

- Optimized Payload Management: Machine learning algorithms determining ideal weight distribution for maximized fuel efficiency and safety compliance.

- Manufacturing Automation: AI-controlled robotic welding and material handling to ensure precise, high-strength aluminum fabrication and reduce waste.

- Supply Chain Optimization: Predictive analytics for managing aluminum alloy sourcing, pricing forecasts, and inventory control.

- Autonomous Trailer Integration: Enabling seamless communication and data exchange between the autonomous tractor unit and the smart aluminum trailer structure.

- Digital Prototyping: Using AI simulation tools to validate aerodynamic and structural designs before physical production, accelerating innovation.

DRO & Impact Forces Of Aluminum Trailer Market

The Aluminum Trailer Market dynamics are defined by a complex interplay of Drivers, Restraints, and Opportunities, collectively influenced by competitive and environmental impact forces. Key drivers include stringent regulatory demands for improved fuel efficiency and reduced carbon emissions, which inherently favor lightweight aluminum over traditional steel. The growing logistics sector globally, fueled by e-commerce expansion, requires trailers with higher payload capacities and lower maintenance needs. However, the primary restraint is the significantly higher initial cost of aluminum material and specialized fabrication techniques (e.g., advanced welding), which can deter smaller operators. Opportunities lie in the increasing adoption of smart trailer technologies and the expansion into emerging markets where infrastructure investment is accelerating. These forces collectively shape the competitive landscape, pushing manufacturers toward innovation in material science and operational efficiency to maximize market penetration and profitability.

Drivers: The most significant driver is the operational economics offered by aluminum trailers. Reduced tare weight allows fleet operators to haul more freight per trip, directly increasing revenue while simultaneously lowering fuel consumption—a crucial factor given volatile global energy prices. Furthermore, the inherent corrosion resistance of aluminum greatly extends the lifespan of the trailer, leading to superior residual value and reduced long-term maintenance expenditure, especially in regions exposed to corrosive elements like road salt or humid climates. Government incentives and mandates aimed at greening the transportation sector, such as those promoting lower carbon footprint logistics, further solidify the business case for adopting aluminum solutions over conventional heavier materials.

Restraints: Despite the long-term benefits, the high upfront investment remains a substantial barrier, particularly in price-sensitive markets or for independent owner-operators who struggle to secure financing for high-cost assets. Specialized knowledge and equipment are mandatory for repairing or manufacturing aluminum trailers, limiting the pool of qualified service providers and potentially increasing repair costs compared to widely available steel welding services. Additionally, fluctuations in global aluminum commodity prices, influenced by geopolitical events and energy costs, introduce supply chain volatility and pricing uncertainty for manufacturers, complicating long-term strategic planning and market stability.

Opportunities: Significant market opportunities exist in the development of modular and specialized aluminum trailer designs catering to niche industrial applications, such as high-pressure tank trailers or cryogenic transport units, where material performance is paramount. The convergence of aluminum structures with advanced telematics and IoT devices—creating "smart trailers"—offers substantial growth potential by providing value-added services like remote diagnostics and cargo monitoring. Furthermore, targeting emerging economies, where rapid infrastructure build-out necessitates durable, high-capacity construction and agricultural trailers, provides untapped avenues for geographical expansion and new market penetration, leveraging aluminum's proven robustness and efficiency.

- Drivers: Fuel efficiency mandates; Increased payload requirements; Superior corrosion resistance; Favorable total cost of ownership (TCO).

- Restraints: High initial purchase price; Volatility in aluminum commodity prices; Requirement for specialized manufacturing and repair expertise; Structural integrity concerns under extreme, localized stress (compared to certain steel alloys).

- Opportunities: Integration of smart trailer technology (IoT/Telematics); Expansion into specialized high-performance segments (e.g., defense, aerospace logistics); Development of novel, lighter aluminum alloys; Growth in emerging market infrastructure spending.

- Impact Forces: Environmental regulations prioritizing lightweighting; Technological innovation in welding and bonding; Substitution risk from high-strength composites; Consolidation among large fleet operators driving bulk purchasing demands.

Segmentation Analysis

The Aluminum Trailer Market segmentation provides a granular view of demand distribution across different product types, end-user applications, axle configurations, and weight capacities, critical for targeted marketing and strategic planning. The market is primarily segmented based on the structural function of the trailer, such as enclosed cargo versus open flatbeds, reflecting the diverse logistical needs of commercial and consumer end-users. Analyzing these segments helps identify high-growth niches, such as the rapidly expanding market for recreational aluminum trailers driven by consumer leisure spending, distinct from the steady, high-volume demand originating from the commercial logistics sector.

The Type segment is crucial as it dictates material usage, fabrication complexity, and pricing structure. Enclosed trailers typically command higher prices due to greater material use and the incorporation of features like insulation and advanced locking systems, appealing to high-value cargo transport. Conversely, utility and dump trailers, while simpler in structure, are high-volume sellers tied directly to the health of the construction and agricultural economies. Understanding the shift in demand toward multi-purpose or modular trailer designs within these types is essential for manufacturers seeking to optimize their product portfolio and respond quickly to cyclical market demand fluctuations across the regions.

Furthermore, segmentation by Axle Type (e.g., single axle, tandem axle, multi-axle) directly impacts the maximum permissible gross vehicle weight (GVW) and, consequently, the primary application. Heavy-duty tandem and tri-axle aluminum trailers dominate the commercial logistics and heavy equipment hauling segments, emphasizing structural rigidity and braking performance. Meanwhile, single-axle units are predominant in the consumer and light-utility markets where maneuverability and lower towing capacity are key requirements. Manufacturers strategically align their alloy selection and frame design based on these segmentation criteria to ensure regulatory compliance and optimal performance for the intended load capacity and road conditions.

- By Type:

- Enclosed/Cargo Trailers

- Flatbed Trailers

- Dump Trailers

- Utility Trailers

- Tank Trailers (e.g., Chemical, Petroleum)

- Specialized Trailers (e.g., Livestock, Car Haulers, Recreational)

- By Application:

- Commercial Logistics & Freight

- Construction & Infrastructure

- Agriculture & Farming

- Recreational & Consumer Use (RVs, ATV/Snowmobile transport)

- Mining & Oil/Gas

- By Axle Configuration:

- Single Axle

- Tandem Axle

- Multi-Axle (Tri-Axle and above)

- By Weight Capacity:

- Light Duty (Below 5,000 lbs GVWR)

- Medium Duty (5,000 lbs to 15,000 lbs GVWR)

- Heavy Duty (Above 15,000 lbs GVWR)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Aluminum Trailer Market

The value chain for the Aluminum Trailer Market begins with upstream activities centered around the sourcing and processing of raw materials, primarily high-grade aluminum alloys (such as 6061-T6 and 5083), supplied by major global aluminum producers and specialized metal processors. This phase is highly susceptible to commodity price volatility and requires robust contracts to ensure stable supply. Upstream differentiation is achieved through metallurgical innovation, focusing on lighter yet stronger alloys optimized for welding and fatigue resistance. Manufacturers often integrate partial aluminum processing capabilities (e.g., extrusion, rolling) to better control quality and cost, mitigating risks associated with external material suppliers. The logistics of transporting large aluminum sheets and extrusions also form a crucial, cost-intensive component of this initial stage.

The core manufacturing stage involves specialized fabrication, including precise cutting, forming, and advanced welding (TIG/MIG) of the aluminum components into the final trailer structure. This stage demands skilled labor and capital-intensive machinery optimized for handling aluminum, which is more challenging to work with than steel. Key activities here include integrating components like axles, suspension systems, brakes, and lighting, often sourced from specialized third-party suppliers. Efficiency in this midstream segment is determined by the adoption of automation, lean manufacturing principles, and stringent quality control protocols to maintain the structural integrity and aesthetic finish required by fleet buyers and consumers. Innovation in modular assembly techniques is accelerating to reduce time-to-market for customizable trailer configurations.

Downstream activities involve distribution, sales, and post-sale services. Aluminum trailers are distributed through a mix of direct sales channels, primarily for large fleet orders managed by internal sales teams, and indirect channels relying on extensive dealer networks. Dealer networks offer local sales support, financing options, and crucial repair and maintenance services, especially important due to the specialized nature of aluminum repair. Direct sales channels are often favored for complex, highly customized commercial trailers, while indirect distribution dominates the recreational and utility trailer segments. Aftermarket services, including parts replacement and specialized repair, are increasingly becoming a competitive differentiator, ensuring customer loyalty and supporting the long service life characteristic of aluminum products.

Aluminum Trailer Market Potential Customers

Potential customers for the Aluminum Trailer Market span a broad spectrum, categorized mainly into high-volume commercial fleet operators and specialized industrial users, alongside the fast-growing consumer and recreational segments. Commercial customers, such as third-party logistics (3PL) providers, dedicated freight carriers, and large retail chains with internal transportation fleets, prioritize trailers based on total cost of ownership (TCO), fuel savings, payload maximization, and durability. Their purchasing decisions are highly analytical, focusing on optimizing asset utilization and minimizing downtime, making the lightweight and corrosion-resistant attributes of aluminum highly appealing for long-haul and regional transport applications where operational continuity is paramount.

The construction, infrastructure, and mining sectors represent another critical segment, demanding heavy-duty aluminum dump trailers, low-boys, and equipment haulers. These customers require robust, impact-resistant structures capable of operating reliably in harsh environments. The non-corrosive nature of aluminum is a significant advantage in handling abrasive or moisture-laden materials like sand, gravel, and chemicals. In contrast, specialized industrial clients, including chemical processing companies and food and beverage producers, require custom aluminum tank trailers and refrigerated (reefer) trailers, where hygiene, insulation efficiency, and regulatory compliance (e.g., food-grade standards) drive purchasing choices, often favoring specialized alloy constructions.

Finally, the consumer and recreational market constitutes a significant and dynamic customer base. This segment includes individual owners, RV enthusiasts, motorsport teams, and small business owners needing utility and enclosed trailers for personal or light commercial use. These buyers prioritize ease of towing (due to lightweight construction), visual appeal, and long-term maintenance simplicity. Growth in this segment is strongly correlated with disposable income and interest in outdoor leisure activities, making customized, high-quality aluminum car haulers, boat trailers, and camping trailers high-demand items, often purchased through established dealer networks rather than direct fleet contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wabash National Corporation, Utility Trailer Manufacturing Company, Great Dane LLC, Stoughton Trailers LLC, Hyundai Translead, Inc., East Manufacturing Corporation, Dorsey Trailer, Premier Trailer Manufacturing, Aluma Ltd., Featherlite Trailers, Travalong, Cornhusker Trailer Manufacturing, Felling Trailers Inc., MAC Trailer Manufacturing, Kaufman Trailers, Load Trail, LLC, RGN Trailer Group, ATC Trailers, Legend Manufacturing, LLC, Wilson Trailer Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminum Trailer Market Key Technology Landscape

The technological landscape of the Aluminum Trailer Market is rapidly evolving, driven primarily by material science innovations and the integration of digital capabilities. A cornerstone technology is advanced aluminum alloy development, specifically focusing on high-strength 5XXX and 6XXX series alloys which offer enhanced weldability and superior resistance to metal fatigue and stress corrosion cracking. Manufacturers are utilizing specialized extrusion techniques to create complex aluminum profiles that maximize strength while minimizing weight, allowing for thinner walls and lighter overall frames without compromising structural integrity or longevity. Furthermore, surface treatment technologies, such as anodizing and specialized coatings, are deployed to enhance the inherent corrosion resistance of aluminum, particularly in regions where trailers face severe environmental exposure, extending the asset lifespan and maintaining residual value.

Fabrication technology represents another critical area of innovation. Traditional MIG welding is increasingly being supplemented or replaced by advanced techniques like Friction Stir Welding (FSW), particularly for joining large panels and structural components. FSW creates joints with superior mechanical properties, minimal heat distortion, and reduced reliance on consumables, leading to stronger, lighter, and more aesthetically pleasing trailers. Beyond welding, the use of structural adhesives and advanced mechanical fasteners (riveting systems designed for mixed materials) is gaining traction, especially in hybrid aluminum-steel trailer constructions, optimizing the benefits of both materials while addressing galvanic corrosion challenges at the interface points. These advancements reduce manufacturing time and enhance the durability required for heavy-duty applications.

In addition to structural technologies, the rise of the "Smart Trailer" is fundamentally reshaping the market. This involves integrating IoT sensors, telematics units, and connectivity platforms directly into the aluminum chassis. Key technologies include tire pressure monitoring systems (TPMS), brake health monitoring, load sensor systems, and GPS tracking, all powered by miniaturized electronics. These systems transmit real-time data to fleet managers, facilitating predictive maintenance, ensuring cargo integrity (especially in refrigerated aluminum trailers), and improving regulatory compliance. This digital integration maximizes operational uptime and provides significant data analytics capabilities, marking a crucial technological leap beyond purely mechanical design improvements and enhancing the trailer's value proposition as a sophisticated logistical asset.

Regional Highlights

Regional analysis underscores the heterogeneous nature of demand and regulatory influences shaping the global Aluminum Trailer Market.

- North America: This region holds the largest market share, driven by a mature logistics industry, stringent government mandates (e.g., EPA and NHTSA regulations encouraging lightweighting), and a high demand for recreational vehicles (RVs) and related haulers. The US and Canada benefit from extensive highway networks and a substantial fleet replacement cycle, strongly favoring high-capacity, lightweight aluminum dry vans and flatbeds. Key relevance: Dominant market size, high technology adoption, and strong consumer segment for recreational aluminum products.

- Europe: Characterized by strict emission standards (Euro VI) and complex road toll systems that often penalize heavier vehicles, Europe shows high penetration of innovative, aerodynamic aluminum trailer designs. Countries like Germany, France, and the UK focus heavily on refrigerated and intermodal aluminum trailers, emphasizing efficiency in densely populated corridors. Key relevance: High regulatory pressure driving lightweight innovation and specialized use in cold chain logistics and intermodal freight.

- Asia Pacific (APAC): Expected to be the fastest-growing region, driven by rapid urbanization, massive infrastructure projects (especially in China and India), and the expansion of the e-commerce supply chain. While steel trailers still dominate in price-sensitive segments, growing awareness of long-term operational costs and increasing investment in fleet modernization are accelerating the adoption of aluminum trailers, particularly in high-volume, long-haul corridors. Key relevance: High growth trajectory, large population base driving logistics demand, and increasing foreign investment in advanced manufacturing facilities.

- Latin America (LATAM): Market growth is steady, linked primarily to commodity transport (mining and agriculture) in countries like Brazil and Mexico. The need for durable, corrosion-resistant trailers capable of handling rough terrain and harsh climates makes aluminum a viable choice, particularly for dump and bulk transport applications, despite economic volatility restraining rapid capital investment. Key relevance: Demand centered on resource extraction and agricultural transport, favorable to corrosion resistance properties.

- Middle East & Africa (MEA): This region sees growth driven by infrastructure projects, oil and gas sector logistics, and agricultural expansion. Aluminum tankers for chemical and petroleum transport, benefiting from aluminum's inertness and non-sparking properties, are a key segment. Extreme temperatures necessitate specialized insulation techniques, making high-performance aluminum reefers critical in hot climates. Key relevance: Strong demand for specialized tankers and construction trailers, high growth potential tied to large-scale government investment projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminum Trailer Market.- Wabash National Corporation

- Utility Trailer Manufacturing Company

- Great Dane LLC

- Stoughton Trailers LLC

- Hyundai Translead, Inc.

- East Manufacturing Corporation

- Dorsey Trailer

- Premier Trailer Manufacturing

- Aluma Ltd.

- Featherlite Trailers

- Travalong

- Cornhusker Trailer Manufacturing

- Felling Trailers Inc.

- MAC Trailer Manufacturing

- Kaufman Trailers

- Load Trail, LLC

- RGN Trailer Group

- ATC Trailers

- Legend Manufacturing, LLC

- Wilson Trailer Company

Frequently Asked Questions

Analyze common user questions about the Aluminum Trailer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary operational advantage of using aluminum trailers over steel trailers?

The primary advantage is the superior strength-to-weight ratio of aluminum, which results in reduced tare weight, allowing for significantly higher payload capacity and achieving substantial fuel cost savings over the asset's lifespan. Aluminum also offers exceptional corrosion resistance, reducing long-term maintenance costs.

How do aluminum trailer material costs impact the final purchase price?

Aluminum trailers typically have a higher initial purchase price (upfront cost) compared to steel counterparts due to the higher commodity cost of specialized aluminum alloys and the complexity of specialized fabrication techniques like advanced welding. However, this is usually offset by lower operating expenses and higher residual value.

Which applications drive the largest demand in the Aluminum Trailer Market?

The largest demand is driven by the Commercial Logistics and Freight sector, specifically for high-volume dry van, refrigerated (reefer), and flatbed trailers. The Construction industry, requiring durable dump and equipment trailers, also represents a major segment driving consistent high-capacity demand.

What technological trends are currently influencing aluminum trailer design?

Key trends include the integration of 'Smart Trailer' technology, utilizing IoT sensors and telematics for predictive maintenance and cargo monitoring, along with the adoption of advanced fabrication methods like Friction Stir Welding (FSW) to enhance structural integrity and accelerate production efficiency.

Is the Aluminum Trailer Market facing major environmental regulations?

Yes, the market is highly influenced by regulatory mandates, particularly in North America and Europe, focusing on fleet fuel efficiency improvements and the reduction of greenhouse gas emissions. The lightweight nature of aluminum directly supports compliance with these stringent environmental targets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager