Aluminum Tubes and Aerosol Cans Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436099 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Aluminum Tubes and Aerosol Cans Market Size

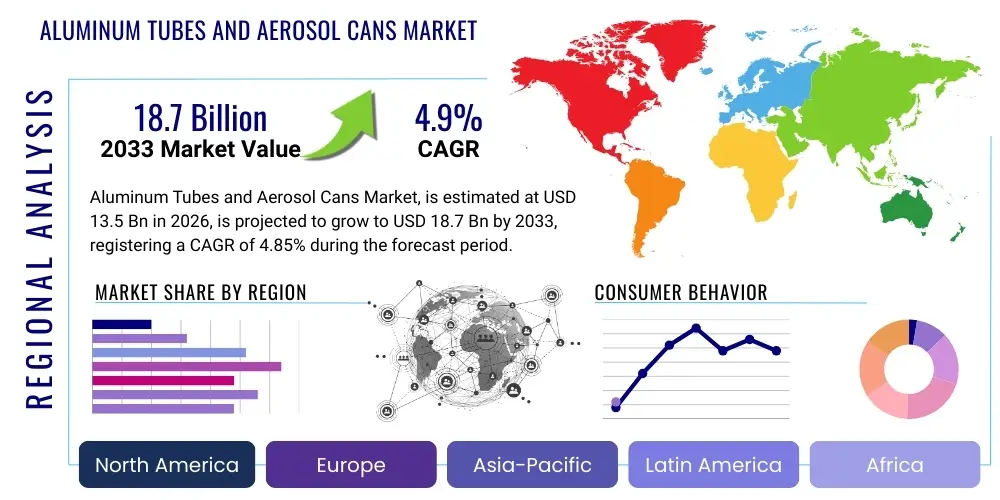

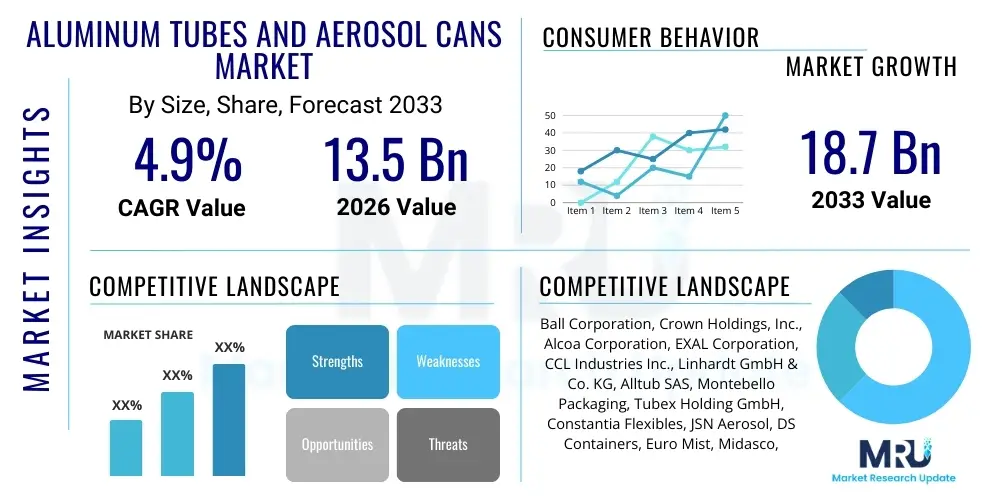

The Aluminum Tubes and Aerosol Cans Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.85% between 2026 and 2033. The market is estimated at USD 13.5 Billion in 2026 and is projected to reach USD 18.7 Billion by the end of the forecast period in 2033.

Aluminum Tubes and Aerosol Cans Market introduction

The Aluminum Tubes and Aerosol Cans Market encompasses the global production and distribution of specialized packaging solutions derived primarily from high-purity aluminum slugs. These containers are essential for industries requiring high barrier properties, non-reactivity, and effective product preservation, distinguishing them significantly from alternatives like plastics or glass in sensitive applications. Aluminum tubes, particularly, utilize the cold-extrusion process to achieve seamless walls, making them ideal for semi-solid products such as pharmaceuticals, dental creams, and high-end cosmetics. Their intrinsic barrier qualities prevent oxygen, moisture, and light transmission, crucial for maintaining product efficacy and extending shelf life, aligning perfectly with stringent regulatory requirements in healthcare sectors.

Aerosol cans, built typically using the drawing and ironing (D&I) process or impact extrusion, are characterized by their lightweight yet robust structure, designed to withstand high internal pressures necessary for dispensing fine mists or sprays. Major applications span personal care (deodorants, hairsprays), household products (air fresheners, cleaning agents), and industrial chemicals. The market growth is fundamentally driven by the rising global demand for convenience packaging, coupled with a powerful shift toward sustainable packaging materials, as aluminum is infinitely recyclable without loss of quality. This unique combination of functional superiority and environmental compatibility positions aluminum containers as a preferred choice across diverse end-user industries.

Key technological advancements, such as the development of advanced internal lacquer coatings and specialized surface treatments, continue to enhance the chemical resistance and compatibility of these containers with complex formulations. These innovations are pivotal in meeting the needs of modern, highly active pharmaceutical ingredients and corrosive household cleaners. Furthermore, the aesthetic flexibility offered by aluminum—allowing for high-definition printing and complex shaping—provides brand differentiation, especially important in the fiercely competitive consumer goods and cosmetics segments, thereby solidifying its market position against competitor materials.

Aluminum Tubes and Aerosol Cans Market Executive Summary

The Aluminum Tubes and Aerosol Cans market is experiencing sustained growth, primarily fueled by the accelerating shift toward sustainable packaging solutions, where aluminum’s closed-loop recyclability provides a significant competitive advantage over polymers. Key business trends include aggressive capacity expansion in emerging economies, particularly across Asia Pacific, driven by increasing disposable incomes and expanding domestic pharmaceutical manufacturing bases. Manufacturers are heavily investing in high-speed production lines incorporating advanced quality control systems, aiming to reduce manufacturing tolerances and material usage (lightweighting), which directly contributes to enhanced profitability and reduced environmental footprint across the supply chain. Consolidation among smaller regional producers is also notable, as larger multinational packaging conglomerates seek vertical integration and optimized global distribution networks.

Regionally, the market dynamics are polarized: Europe and North America emphasize regulatory compliance and premium, small-volume packaging for specialized medical and cosmetic applications, driving demand for high-value tubes. Conversely, Asia Pacific is the powerhouse of volume growth, characterized by massive consumption in personal care and household aerosol sectors. Latin America and the Middle East and Africa (MEA) present emerging market opportunities, supported by urbanization and subsequent rising consumption of packaged goods, although supply chain complexities remain a limiting factor. The market for aerosol cans, specifically, is being revitalized by propellant innovations, moving away from high-Global Warming Potential (GWP) gases towards alternatives like nitrogen or highly purified hydrocarbons, ensuring compliance with evolving climate regulations globally.

Segment trends highlight the critical role of the pharmaceutical application segment, which demands the highest purity aluminum and most stringent coating specifications, offering premium margins and stable, long-term contracts. Within product types, monobloc aerosol cans dominate due to their structural integrity and cost efficiency in mass production, while aluminum squeeze tubes see substantial growth in niche, high-value cosmetic and dental applications. The material science segment is actively exploring ultra-thin wall technology to further reduce raw material costs and optimize transport efficiency, impacting both profitability and sustainability metrics across all major segments, positioning the industry for robust, environmentally conscious expansion over the forecast period.

AI Impact Analysis on Aluminum Tubes and Aerosol Cans Market

Users frequently inquire about how advanced technologies, particularly Artificial Intelligence and Machine Learning, can revolutionize the historically mechanical and material-intensive processes within aluminum packaging manufacturing. Key themes center around optimizing complex production lines, improving raw material utilization to minimize waste, and maintaining exceptionally high quality control standards crucial for pharmaceutical and food contact applications. Users anticipate AI driving significant efficiencies in predictive maintenance for high-speed drawing and ironing (D&I) lines, ensuring near-zero downtime, and optimizing coating thickness and curing processes. Furthermore, there is strong interest in utilizing AI-driven image recognition systems for defect detection, replacing manual or conventional automated visual inspection with more precise, high-speed, and consistent quality assurance mechanisms, ultimately leading to reduced operational costs and improved product reliability.

- AI-driven Predictive Maintenance: Utilizing sensor data from high-speed presses and coating machines to predict component failure, significantly reducing unplanned downtime and optimizing scheduled maintenance intervals.

- Optimized Resource Utilization: Machine Learning algorithms analyze real-time extrusion data to fine-tune material flow and pressure, minimizing scrap rates and optimizing the gauge of the aluminum walls for lightweighting.

- Enhanced Quality Control (QC): Implementing deep learning visual inspection systems (VIMS) capable of detecting subtle surface defects, printing inaccuracies, and structural weaknesses at production speeds exceeding 300 cans per minute.

- Demand Forecasting and Supply Chain Efficiency: AI models analyze historical sales data, seasonality, and end-user inventory levels to provide highly accurate production forecasts, leading to better raw material procurement and optimized logistics planning.

- Process Parameter Optimization: Using AI to analyze the correlation between lacquer curing oven temperature, chemical composition, and final barrier performance, ensuring consistent internal coating quality essential for product integrity.

DRO & Impact Forces Of Aluminum Tubes and Aerosol Cans Market

The market is predominantly driven by the pervasive need for sustainable packaging, as aluminum offers superior recyclability, appealing strongly to corporate Environmental, Social, and Governance (ESG) mandates and consumer preference for eco-friendly products. However, the market faces significant restraints, including the inherent volatility in the global price of primary aluminum, which forms a major portion of the operational expenditure, making long-term pricing stability challenging for manufacturers. Opportunities are abundant in the pharmaceutical and medical sectors, which require aseptic packaging solutions, driving demand for specialized, high-barrier tubes and small-format cans. The primary impact forces shaping this domain include stringent global regulatory standards (e.g., European aerosol dispenser directives and US FDA requirements for pharmaceutical packaging) that mandate specific container integrity and material compatibility, alongside continuous technological pressure to innovate thinner, lighter packaging formats without compromising structural integrity or barrier performance.

Segmentation Analysis

The Aluminum Tubes and Aerosol Cans Market is segmented based on product type, material composition, application, and end-user industry, offering a granular view of specific market dynamics. The segmentation is crucial for understanding the varying technological requirements—for instance, aerosol cans require robust pressure resistance while pharmaceutical tubes prioritize sterile internal coatings. Product type segmentation distinguishes between highly specialized collapsible tubes, often used for viscous materials requiring precise dispensing, and rigid aerosol cans designed for pressurized contents. Application segmentation highlights the divergence in demand and regulatory hurdles across segments like Personal Care, Food & Beverages, and Pharmaceuticals, each necessitating unique internal lacquers and external finishing technologies to ensure product safety and consumer appeal.

- Product Type:

- Collapsible Tubes (Squeeze Tubes)

- Monobloc Aerosol Cans

- Aluminum Bottles

- Deep Drawn Cans (Two-piece and Three-piece constructions)

- Application:

- Personal Care (Deodorants, Shaving Foams, Hair Products, Toothpaste)

- Pharmaceuticals (Ointments, Creams, Inhalers)

- Food & Beverages (Whipped Cream, Specialty Oils, Beverages)

- Household Products (Air Fresheners, Insecticides, Cleaners)

- Industrial & Technical (Lubricants, Paints, Adhesives)

- End-User Industry:

- Cosmetic and Beauty Industry

- Healthcare and Pharmaceutical Industry

- Consumer Goods Manufacturing

- Automotive and Industrial Sector

- Closure Type:

- Screw Caps

- Stand-Up Caps (Dose Control)

- Valve Systems (Aerosols)

- Luer Lock Closures

Value Chain Analysis For Aluminum Tubes and Aerosol Cans Market

The value chain for aluminum tubes and aerosol cans begins with the upstream segment, dominated by raw material providers supplying high-purity aluminum slugs (typically 99.7% purity). This upstream phase is highly capital intensive, relying on primary aluminum smelting or, increasingly, advanced secondary recycling processes to source high-quality feedstock suitable for impact extrusion or drawing and ironing. Key considerations at this stage involve energy costs, which heavily influence the final pricing of the slug, and the logistics associated with global metal commodity trading. Efficiency in sourcing recycled content is a significant competitive differentiator, directly impacting the environmental profile of the final product and aligning with sustainability goals.

The core manufacturing process, the midstream segment, involves specialized packaging converters who transform the slugs into finished tubes or cans. This stage requires significant investment in precision machinery—such as high-speed impact extrusion presses, printing lines, internal coating application systems, and specialized curing ovens. Value addition is generated through technical expertise in applying food-grade or pharmaceutical-grade internal lacquers, ensuring compatibility and safety. Quality control is paramount here, utilizing sophisticated inspection technologies to verify structural integrity and prevent leakage, often involving proprietary processes related to surface treatment and necking optimization.

The downstream segment focuses on distribution and logistics, connecting converters to the diverse end-user industries. Distribution channels are predominantly B2B (Business-to-Business), relying on specialized freight and warehousing to deliver bulk orders directly to pharmaceutical filling plants, cosmetic contract manufacturers, or consumer goods factories. Direct distribution is common for large, long-term contracts, ensuring seamless inventory integration. Indirect channels utilize specialized industrial packaging distributors who manage smaller volumes or serve niche regional markets. The final application stage involves the filling and sealing of the containers by the end-users, requiring careful integration with high-speed filling machinery specific to the physical characteristics of the aluminum tubes (crimp sealing) or aerosol cans (valve crimping and propellant charging).

Aluminum Tubes and Aerosol Cans Market Potential Customers

The primary customers and buyers of aluminum tubes and aerosol cans are large multinational corporations and specialized contract manufacturers operating within industries where product integrity, high barrier protection, and precise dispensing are non-negotiable requirements. Pharmaceutical companies represent the highest-value customer base, purchasing tubes for topical medications (creams, gels) and specific aerosol cans for inhalation products, prioritizing material certifications, batch traceability, and sterility over cost sensitivity. The strict regulatory environment governing these end-users necessitates robust quality assurance from the packaging suppliers, making long-term supply relationships critical.

Secondly, the Personal Care and Cosmetics industries are major volume customers, utilizing aluminum tubes for premium products like concentrated face creams, dental care formulations, and hair dyes, where the aesthetic appeal and tactile quality of aluminum contribute significantly to brand image. Aerosol cans are indispensable for deodorants, antiperspirants, and styling products. These customers demand sophisticated exterior decoration capabilities, including high-resolution printing, metallic finishes, and specialized cap designs, pushing innovation in graphic technologies within the packaging sector. The third key customer group is the household and industrial segment, using aerosol cans for cleaning products, lubricants, and paints, driven by cost-efficiency and reliable performance under pressure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 13.5 Billion |

| Market Forecast in 2033 | USD 18.7 Billion |

| Growth Rate | 4.85% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ball Corporation, Crown Holdings, Inc., Alcoa Corporation, EXAL Corporation, CCL Industries Inc., Linhardt GmbH & Co. KG, Alltub SAS, Montebello Packaging, Tubex Holding GmbH, Constantia Flexibles, JSN Aerosol, DS Containers, Euro Mist, Midasco, Tecnocap S.p.A., Universal Can Corporation, China Aluminum Cans, Hindustan Tin Works Ltd., Nampak Ltd., Guangzhou Aluminum Can Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminum Tubes and Aerosol Cans Market Key Technology Landscape

The core technological landscape in aluminum tubes and aerosol cans manufacturing revolves around perfecting the impact extrusion and drawing & ironing (D&I) processes to achieve optimal wall thickness and structural integrity at high speeds, minimizing material usage (lightweighting). A critical area of focus is internal coating technology, specifically the development and application of advanced lacquers and epoxy-phenolic liners. These coatings must provide an inert barrier to prevent chemical interaction between the aluminum substrate and the product contents, particularly crucial for acidic or highly reactive substances found in pharmaceuticals and certain personal care products. Innovations here include the shift toward safer, non-Bisphenol A (BPA) compliant coatings that still offer robust chemical resistance and high flexibility required during the crimping or necking process without cracking or compromising the seal.

Furthermore, digital decoration and high-resolution printing represent a major technological investment area. Traditional offset printing on cylindrical surfaces is being augmented and, in some cases, replaced by sophisticated digital printing techniques that allow for variable data printing, faster setup times, and superior graphic fidelity, enabling highly complex designs and shorter production runs necessary for boutique cosmetic brands. This flexibility allows manufacturers to meet the growing consumer demand for personalized and aesthetically unique packaging. The integration of advanced visual inspection systems (VIMS) using high-speed cameras and machine vision algorithms ensures that print registration, color consistency, and surface finish meet rigorous quality standards before the containers proceed to the filling stage.

Sustainability-focused technological advancements are also driving substantial change. This includes sophisticated sorting and pre-treatment technologies for post-consumer recycled (PCR) aluminum to ensure the purity levels required for food and pharmaceutical contact grades. Manufacturers are actively developing new methods for applying and curing internal coatings using UV light or Electron Beam (EB) curing, which significantly reduces the energy footprint associated with traditional thermal curing ovens. Moreover, optimizing the valve and actuator systems for aerosol cans, ensuring minimal product retention and efficient dispersal with lower-GWP propellants, is a crucial ongoing technological development necessary for long-term regulatory compliance and market viability.

Regional Highlights

- North America:

The North American market, comprising the United States and Canada, is characterized by a mature regulatory environment and a high consumption rate of specialized aerosol products in the personal care and household segments. Demand for aluminum tubes is particularly robust in the pharmaceutical sector, driven by stringent FDA guidelines that favor barrier packaging to ensure drug stability and efficacy. Manufacturers here focus heavily on incorporating recycled aluminum content, often setting the benchmark for regional sustainability initiatives. The market emphasizes premium packaging solutions, including high-definition graphics and specialized valve systems for controlled dispensing, reflecting a willingness among consumers to pay more for high-quality, recyclable packaging.

Growth in this region is stable, fueled primarily by innovation in specialized products, such as pharmaceutical metered-dose inhalers (MDIs) and specialized topical treatments. The trend toward domestic manufacturing stability and security, particularly in healthcare supplies, further strengthens the aluminum tube segment. However, the region faces cost pressures from cheaper imports, necessitating continuous investment in automation and operational excellence to maintain competitiveness and meet the high labor cost structure inherent to the region.

- Europe:

Europe stands as a powerhouse for aluminum packaging innovation, driven fundamentally by the European Green Deal and highly ambitious recycling targets. The continent has a well-established infrastructure for aluminum recycling, making the use of high Post-Consumer Recycled (PCR) content standard practice. Regulatory bodies like the European Aerosol Federation (FEA) heavily influence product design, especially regarding sustainability, propellant choice, and safety standards (e.g., REACH compliance for internal coatings). The high-end cosmetics and personal care markets, particularly in France, Germany, and Italy, are significant consumers of premium aluminum tubes and specialty aerosol cans, leveraging aluminum’s aesthetic and sustainable attributes.

The European market is marked by stringent quality controls, especially for tubes used in pharmaceutical products requiring CE marking. There is a palpable trend towards lightweighting and advanced material substitution, exploring alternatives for internal liners to meet future regulatory challenges concerning food contact materials. The region's manufacturing is highly automated, focusing on precision engineering and short production runs tailored for diverse European markets, reflecting fragmented demand across numerous linguistic and regulatory landscapes.

- Asia Pacific (APAC):

APAC is projected to be the fastest-growing region, driven by explosive population growth, rapid urbanization, and rising disposable incomes leading to greater consumption of packaged goods across all sectors—personal care, household, and food & beverages. China and India are the dominant manufacturing hubs, witnessing massive investment in new production capacities for both tubes and aerosol cans, often focused on cost-efficient, high-volume production to serve local and export markets. The demand for standard and large-format aerosol cans for household cleaners and mass-market deodorants is especially high.

While the regulatory environment in APAC is diverse, there is a clear trend toward convergence with international quality standards, especially driven by multinational companies operating in the region. Sustainability concerns are accelerating, particularly in countries like Japan and South Korea, which are rapidly adopting highly recyclable packaging formats. The challenge for this region lies in establishing robust and consistent supply chains for high-quality recycled aluminum and managing complex logistics across vast geographical distances, making the establishment of localized manufacturing clusters crucial for efficiency.

- Latin America (LATAM) and Middle East & Africa (MEA):

LATAM and MEA represent important emerging markets characterized by increasing modernization and a growing consumer class. Brazil and Mexico lead the LATAM market, driven by personal care consumption and localized cosmetic brand expansion, generating steady demand for tubes and aerosol cans. Economic stability is a primary factor influencing market penetration. In MEA, the demand is concentrated in rapidly growing urban centers and industrial areas, primarily driven by household and industrial applications, alongside the unique demands of localized fragrance and personal hygiene products.

These regions often rely on imports or localized assembly operations, creating opportunities for international manufacturers. Investment in local manufacturing capacity is slowly increasing, aimed at circumventing high import duties and reducing lead times. Future growth is strongly linked to advancements in consumer education regarding packaging recyclability and the implementation of standardized waste management systems, which currently lag behind developed markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminum Tubes and Aerosol Cans Market.- Ball Corporation

- Crown Holdings, Inc.

- Alcoa Corporation

- EXAL Corporation (Nampak)

- CCL Industries Inc.

- Linhardt GmbH & Co. KG

- Alltub SAS

- Montebello Packaging

- Tubex Holding GmbH

- Constantia Flexibles

- JSN Aerosol

- DS Containers

- Euro Mist

- Midasco

- Tecnocap S.p.A.

- Universal Can Corporation

- China Aluminum Cans

- Hindustan Tin Works Ltd.

- Nampak Ltd.

- Guangzhou Aluminum Can Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Aluminum Tubes and Aerosol Cans market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the aluminum packaging market?

The primary driver is the global emphasis on sustainability and circular economy models. Aluminum is infinitely recyclable without degradation, offering significant environmental advantages over single-use plastics and directly meeting stringent corporate ESG (Environmental, Social, and Governance) targets and consumer demand for eco-friendly packaging solutions.

How do aluminum tubes compare to plastic tubes in terms of barrier properties?

Aluminum tubes offer intrinsically superior barrier properties, providing a complete and impermeable defense against moisture, oxygen, light, and contaminants. This protection is critical for preserving the efficacy of sensitive products, such as pharmaceuticals and high-active cosmetic ingredients, far surpassing the barrier capabilities of standard multilayer plastic tubes.

What role does the pharmaceutical industry play in the demand for aluminum tubes?

The pharmaceutical industry is a high-value consumer, relying on aluminum tubes for aseptic packaging of topical medications, ointments, and dental products. The demand is driven by regulatory requirements for long shelf life and guaranteed product integrity, making the aluminum’s inert nature and excellent barrier function indispensable for patient safety and drug stability.

What are the key technological challenges in aluminum aerosol can manufacturing?

Key challenges include achieving uniform, ultra-thin wall thickness (lightweighting) without compromising the can’s ability to withstand high internal pressure, and developing non-BPA internal coatings that are universally compatible with complex, aggressive chemical formulations and new, low-GWP propellants.

Which geographical region exhibits the highest growth potential for this market?

The Asia Pacific (APAC) region, led by emerging economies like China and India, shows the highest growth potential due to rapid industrialization, expanding domestic consumption of personal care and household goods, and substantial ongoing investment in localized, high-volume manufacturing capacity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager